|

Report from

North America

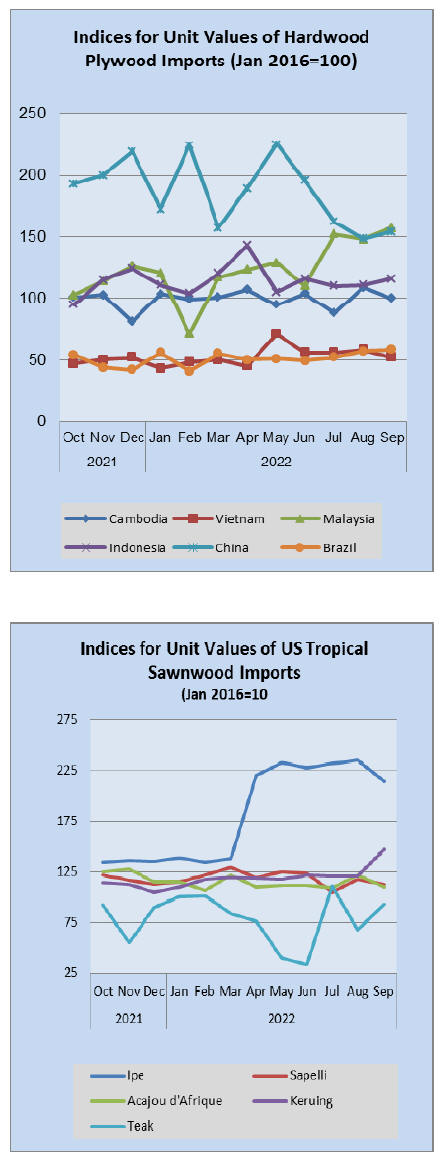

Tropical sawn hardwood imports rise

US imports of sawn tropical hardwood rose 15% in

September, rebounding from a yearly low in August. Still,

the 20,622 cubic metres in September imports fell below

that of all other months in 2022. Imports of Sapelli made

up the bulk of the gain, rising 51% over the previous

month’s total.

Imports of Sapelli were up 74% year to September.

Imports of Mahogany gained 37% in September and are

also up 37% year to date. Imports of Balsa were down

44% in September and are down more than 50% from

2021 year to date.

Imports from Cameroon and Congo (Brazzaville) were

both up sharply in September while imports from Brazil

recovered somewhat (up 16%) from a weak August

showing but were still well below the levels seen for most

of the year.

Canada’s imports of sawn tropical imports continued their

recent rally in September soaring 66% to return close to

the eight-year high set in June. Imports from Brazil

increased more than 20-fold in September to US$1.7

million—nearly twice the number of any month in the past

10 years.

Imports of Mahogany rose 79% to their highest level in

two years. Canada’s total imports of sawn tropical

hardwood are up 41% over last year through September.

Hardwood plywood imports decline

US imports of hardwood plywood fell to a yearly low in

September, declining 17% from the previous month. The

249,636 cubic metres imported was 18% below that of the

September 2021.

Imports from Russia fell 78% in September to a new low

as tensions continue between Russia and the West. Imports

also fell significantly from Malaysia, Indonesia and China.

Yet, imports remain up sharply for the year so far from

most trading partners except from Russia, which is down

19% in 2022. Total imports are up 21% over last year

through September.

Despite steep decline, US veneer imports remain

ahead

The run up of US imports of tropical hardwood veneer

over the summer made the annual autumn decline look

excessive as imports fell 81% by value in September from

the seven-year high set in August. However, even with

the steep drop, September imports still managed to

outpace the previous September numbers by 18.5%.

Imports from Italy and Cote d’Ivoire both fell more than

90% in September while imports from Cameroon took a

complete holiday. Yet, imports from Cameroon are more

than double that of last year so far this year and imports

from Italy and Cote d’Ivoire are both ahead more than

10%.

Imports from China were the only gainer in September, up

65% for the month. Total imports of hardwood veneer are

up 47% over last year through September.

Hardwood flooring imports down

US imports of hardwood flooring fell 9% by value in

September, declining for the second straight month and

falling to a level 12% lower than last September. Imports

from Brazil fell 57% for the month and imports from

Malaysia fell by 28%.

Imports from China, which dropped sharply in August,

declined an additional 7% in September to their lowest

level in at least 10 years. Despite the drop, for the year so

far overall imports of hardwood flooring are up 10% over

2021.

Strong imports from Thailand, Indonesia and Canada led

to a 14% rise in imports of assembled flooring panels in

September. Imports from Thailand jumped 58% while

imports from Indonesia and Canada both rose more than

20%. Through the first three quarters of the year, total

imports of assembled flooring panels are ahead of 2021 by

35%.

Moulding imports rally

After two months of declines US imports of hardwood

mouldings rallied to levels matching that of this summer.

A 22% rise in the value of moulding imports in September

over August lifted imports 23% higher than the previous

September. Imports from Brazil, which doubled from

August to September accounted for much of the gain.

Imports from Brazil are up 79% over last year through the

third quarter, while overall imports of hardwood moulding

are up 28% over 2021.

US wooden furniture imports continue to slide

US imports of wooden furniture fell for a fourth straight

month in September. At US$1.96 billion, September

imports were down 5% from the previous month but were

nearly 6% higher than September 2021.

Imports from China and Mexico both fell by more than

10% while imports from top-supplier Vietnam fell 2%.

Imports from India rose 22% after a weak August and

imports from Indonesia ticked upward for a second

straight month. Total imports of wooden furniture are up

6% year to year over 2021 through the first three quarters

of 2022.

Cabinet sales drop but continue to outpace last year

Cabinet sales dropped in September according to

participating members in the Kitchen Cabinet

Manufacturers Association's monthly Trend of Business

Survey.

Overall cabinet sales fell 4.8% in September compared to

August 2022. Custom sales were down 11.3%, semicustom

sales dropped 5.6%, and stock sales decreased

3.0%. Compared to August, the estimated cabinet quantity

was down 5.3%.

However, 2022 sales remain strong compared to last year.

Cabinet sales rose 23.8% in September 2022 compared to

September 2021 figures, continuing the trend of year-overyear

sales growth for the industry. Custom sales were up

8.4%, semi-custom rose 32.5% and stock sales increased

21.9%. The estimated cabinet quantity decreased 1.9%

compared to last year at this time.

The Trend of Business Survey shows overall cabinet sales

for the first nine months were up 17.6% when compared to

the same time period in 2021. Custom sales were up

16.0%, semi-custom sales increased 15.9% and stock sales

increased by 19.2%. The estimated cabinet quantity

decreased 0.6% according to the survey.

See:https://www.woodworkingnetwork.com/news/almanacmarket-data/cabinet-sales-remain-robust-september-kcma-trendbusiness

New residential furniture orders fell in August

New residential furniture orders dropped significantly in

August, down 34% compared to 2021 figures and marking

the eighth straight month of year-over-year double-digit

declines, according to the latest survey by Smith Leonard.

Orders were down for 84% of the survey participants.

Year-to-date new orders were down 29% from last year;

for comparison, 2021 year to date was up 29% over 2020.

"Remember that 2020 year to date included two months

where the industry was basically shut down. So as has

been the case, the numbers are difficult to compare," noted

Ken Smith, managing partner at Smith Leonard.

Approximately 91% of the survey participants reported

new orders were down for the year to date.

Shipments were up 9% over August 2021, with year to

date figures up 6% compared to the same period in 2021.

Year-to-date shipments were up for 70% of the

participants. Backlogs in August 11% compared to July,

and were down 35% from last year, the report stated.

"Hopefully, many participants are focusing on backlogs as

getting a good handle on them is really important as we go

through this recession or slow down and depend on

backlogs to keep business going from a shipping

perspective," Smith said.

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/new-residential-furniture-orders-fall-augustfurniture-insights

|