Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Oct

2022

Japan Yen 149.1

Reports From Japan

New economic

package to prevent economic downturn

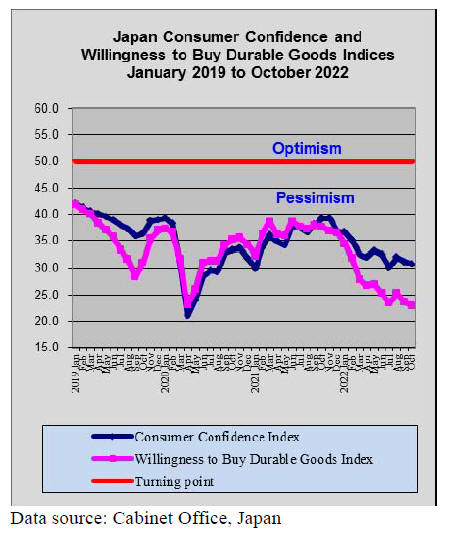

In an effort to help struggling households and companies,

especially small enterprises, cope with inflation the

government has arranged a new economic package worth

39 trillion yen (US$264 billion) focusing on steps to ease

the pain of higher prices passed on to households, spurring

wage growth and preventing any economic downturn after

the modest recovery from the pandemic.

Securing enough funding is a challenge for heavilyindebted

Japan whose debt has ballooned to more than

twice the size of the economy.

The recent surge in inflation is attributed to higher energy

and raw material costs, most of which are imported at

sharply higher prices because of the weak yen exchange

rate. Many commentators say the inflationary pressures

have been made worse by the Bank of Japan's (BoJ)

monetary easing policy. Core consumer inflation exceeded

3% in September, the sharpest gain since 1991 but still

well below that in other similar economies

See:

https://english.kyodonews.net/news/2022/10/dc19f0bc7937-japan-eyes-26-tril-yen-economic-package-to-fight-inflation.html

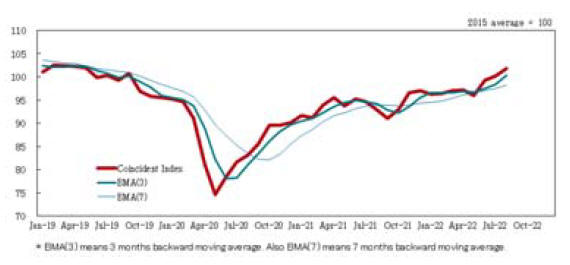

Inflation weighing on business confidence

The BoJ Tankan survey showed major manufacturers are

still much more upbeat than during the gloomiest days of

the Covid-19 pandemic. But inflation, including higher

energy prices fueled by the war in Ukraine, has weighed

on business confidence this year.

Japan Green Investment for Carbon Neutrality

The national broadcaster NHK has reported on the

establishment of the Japan Green Investment Corp. for

Carbon Neutrality (JICN). This is a joint initiative by the

Japanese government and private sector that will provide

investments and loans for decarbonisation projects.

Environment Minister Nishimura Akihiro attended its

inaugural general meeting and said he hopes the

organisation will actively and boldly provide funds for

decarbonisation projects without being bound by

precedents. The JICN will provide investment and debt

guarantees for projects such as renewable energy, plastic

recycling and forest conservation. The government,

financial institutions and businesses have invested a total

of 20.4 billion yen in JICN. The organisation is headed by

Tayoshi Yoshihiko.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20221028_39/

and

https://www.env.go.jp/en/press/press_00704.html

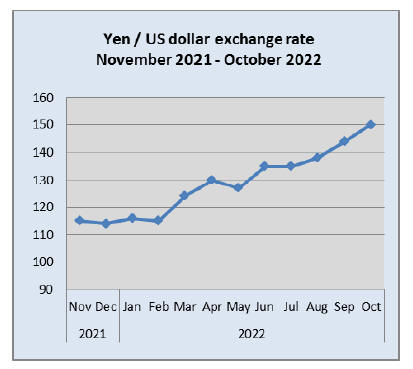

Yen in free fall

The BoJ remains committed to its ultra-low interest rates

arguing that raising interest rates under the current

economic conditions would only undermine the already

weak demand. This month the yen fell to a 32-year low

against the US dollar.

The BoJ governor, Haruhiko Kuroda, made it clear when

speaking to law makers that the bank has no plans to

change course.

See:

https://www.nytimes.com/2022/10/21/business/japaninterest-rates.html

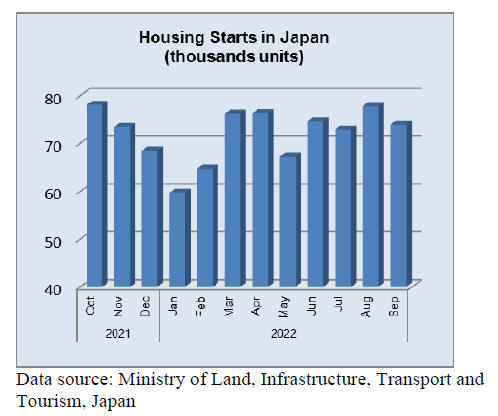

Real estate prices back to 20-year highs

The real estate market in Japan is seeing a surprising

upswing on the back of the cheap yen and a revival of

interest in investment in property. The yen has fallen 20%

against the US dollar which has lifted demand from

foreign real estate investors.

The country’s house price index peaked in the first quarter

of 1991, a prelude to the end of the Japanese asset price

bubble. This led to what became known as a “Lost

Decade” where the economy stagnated and prices

deflated.

This was in part caused by Japan’s decision to

raise interest rates above 6% which caused an evaporation

of liquidity from the market and prices to tumble. Today,

prices are back to 20-year highs.

See:

https://capital.com/japan-house-price-crash-foreigninvestment-weak-yen

Import update

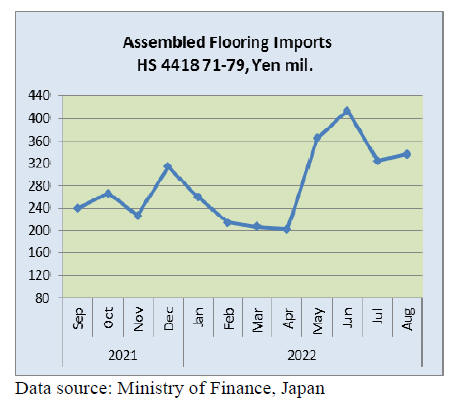

Assembled wooden flooring imports

Despite the drop in the value of imported assembled

wooden flooring (HS441271-79) in July and the only

modest 3% upswing in August, year on year up to August

2022 imports rose 17%.

HS441875 was the main category of flooring imported in

August (as it was in previous months) accounting for 78%

of the total. In August, China was the main supplier of

HS441875 at 50% followed by Vietnam 21% Austria 11%

and Malaysia 10%.

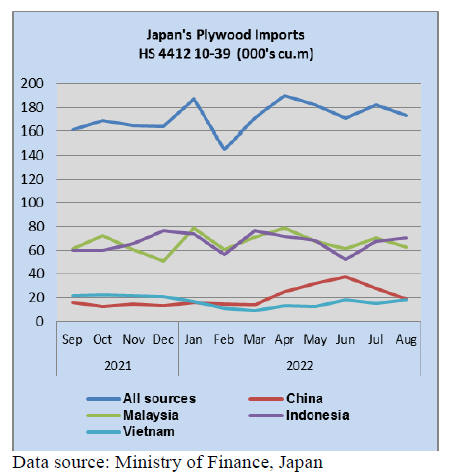

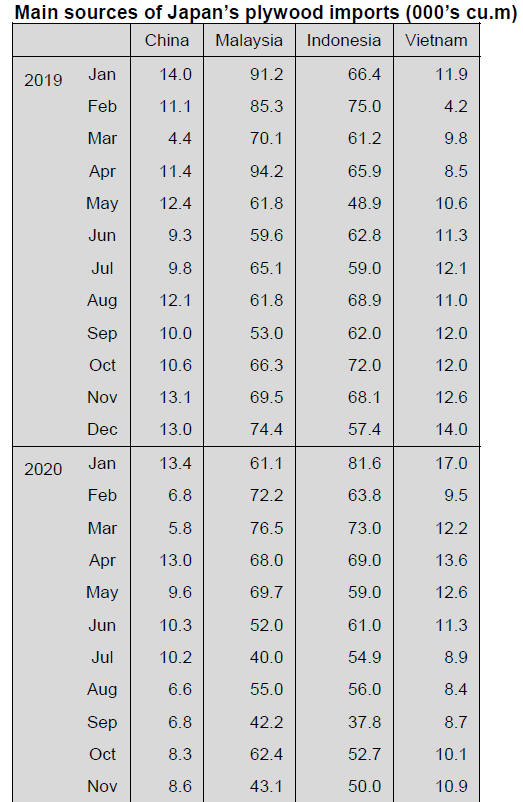

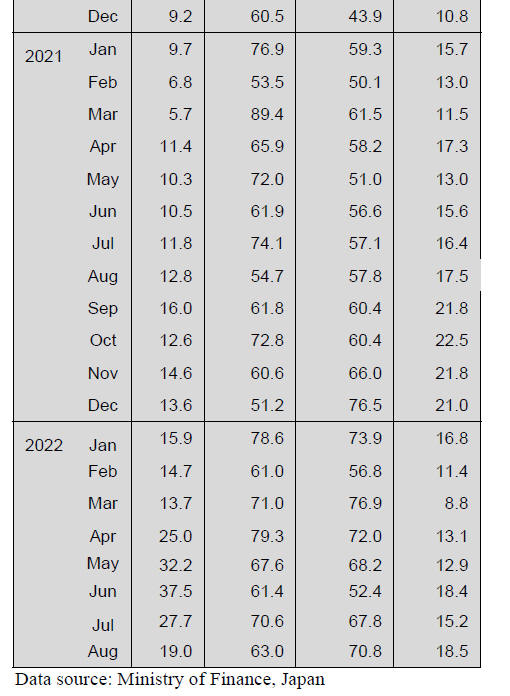

Plywood imports

August imports of plywood (HS441210-39) stood at 172.8

cu.m, down 5% from the previous month but up 20% on

August 2021. Indonesia and Malaysia are the main

suppliers of plywood to Japan and together they accounted

for around 77% of Japan’s August import volumes.

Shipments from Malaysia were down in August compared

to July but shipments from Indonesia were up month on

month. Compared to the volumes imported in August

2021 both Malaysia and Indonesia saw gains this year.

Plywood imports from China at 19,000 cu.m were down

compared to July but up on August 2021. In contrast,

plywood imports from Vietnam rose both month on month

and year on year in August this year.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Domestic softwood plywood

Domestic softwood plywood manufacturers start to adjust

production because there are not many inquires due to

excessive inventory. Volume of the inventory at the end of

August was 0.5 month, 0.4 month more than previous

month, against the volume of shipment.

This was low-level volume and manufacturers think that

0.7 month is a standard volume. Volume of softwood

plywood produced in August was 235,804 cbms, 8.6% less

than July due to the holidays in the middle of August.

Shipment was 223,652 cbms, 11% less than previous

month and inventory at the end of August was 111,495

cbms, 11.9% more than previous month.

This production was almost same volume as May’s

production but shipment was 7.2% less than May. This

was for the first time of a low-level shipment volume in

two years.

Inventory at the end of September will increase because

wholesalers and precutting plants do not get the softwood

plywood due to interim budget results in September.

Once, the inventory increased to 178,798 cbms at the

end

of May, 2020 due to the COVID -19 but it does not have

to reduce the inventory at this time.

Since Japanese government banned importing veneers

from Russia and there is a manufacturer which stopped

producing softwood plywood due to the fire broke out.

However, the prices of 12mm 3 x 6 are 2,000 yen,

delivered per sheet, and this is over double priced

compared to 2020.

Usually, demand for plywood is very lively during

September to the end of the year and a movement of

shipment is high-level. It might be a shortage of softwood

plywood by reducing production but manufacturers do

reduce production to keep the prices in same level.

It is unclear how much volume and what kind of plywood

would be reduced but manufacturers would shorten a time

of operations or working days. Most of manufacturers start

reducing production in October but some of them had

already started. There is no time limit and it depends on a

situation whether to increase production or not.

Wood demand and supply in 2021

A total volume of demand and supply in 2021 is

82,132,000 cbms, 10.3% more than 2020. This is the

increase for the first time in three years.

For domestic production, this is straight twelve years

increase. Volume of structural lumber including plywood

is stabilizing and of fuel wood increased a lot for the past

five years.

Volume of fuel wood increased by 39.1% from 2020 and a

rate of self -sufficiency in wood decreased 41.1%, 0.7

point lower than 2020 due to increased imported wood.

This is decrease for the first time in eleven years.

A total supply of structural lumber is 3,647,000 cbms,

8.8% higher than previous year and of non-structural

lumber is 45,660,000 cbms, 11.6% higher than previous

year. It is obvious that these results are on the rebound

from 2020 when the total starts decreased over 10% due to

the COVID-19.

Supply of domestic lumber is 33,720,000 cbms, 8.3%

higher than 2020 and this is straight twelve months

increase.

Imported lumber is 4,840 cbms, 11.8% higher than 2020

and this is for the first time in three years growing. This is

because imported wood fuel grew for 40% up from 2020.

Volume of imported lumber decreased due to the wood

shock in 2021 and a rate of self-sufficiency in structural

lumber is 48%, 0.8 point more than last year.

Average of supply volume during 2012 – 2016 was

75,000,000 cbms and the supply volume increased to

80,000,000 cbms during 2017-2021.

Domestic and imported lumber are levelling off since

2016. However, wood fuel in 2016 was 5,810,000 cbms

and increased to 14,740,000 cbms in 2021, 153% more

than 2016. Grand total of housing starts and wood fuel

after the Lehman shock in 2008 have been increasing.

The rate of self-sufficiency in wood grew to 41% in 2020

from 26.3% in 2010. Nevertheless, the imported wood fuel

in 2021 increased 40% from the previous year and the rate

of self-sufficiency in wood decreased by 0.7 point.

Domestic unused wood has been used for wood biomass

power generation plants since the FIT (Feed in Tariff) had

started in 2012. Volume of domestic wood fuel have been

increasing for twelve years continuously.

Now, the imported pellets are used for large wood biomass

power generation plants instead of domestic wood fuel, so

wood fuel in 2021 increased 1,520,000 cbms, 39.1% from

3,880,000 cbms in 2020.

Since housing starts decreased 10% in 2020 due to the

COVID- 19, all kinds of supply volume increased in 2021.

Starts of wooden house in 2019 were 520,000 units and

starts in 2021 were 500,000 units.

A rate of self-sufficiency in lumber in 2019 was 46.3%

and 48% in 2021. Plywood was 45.3%.

South Sea lumber

Demand for South Sea lumber is sluggish in Japan but the

prices in Japan are high because the export prices in South

Asia are high and the yen is continuing to fall against the

dollar.

Movement of lumber from Europe or Russia in Japan is

slow due to the excessive inventory. However, there is not

enough inventory of South Sea lumber for interior

finishing lumber. The weak yen is also a problem. It was

145 yen against the dollar at the end of September.

The Japanese government and the Bank of Japan intervene

in currency markets to stop the yen falling but the yen will

continue falling due to a large difference in interest rates

between the U.S.A. and Japan. That is why distribution

companies have to raise the prices even though the

movement is slow and they are not rush for selling.

Laminated lumber manufacturers in China and Indonesia

occasionally lower the prices a little bit.

|