US Dollar Exchange Rates of

25th

Aug

2022

China Yuan 6.8596

Report from China

Decline in sawnwood imports

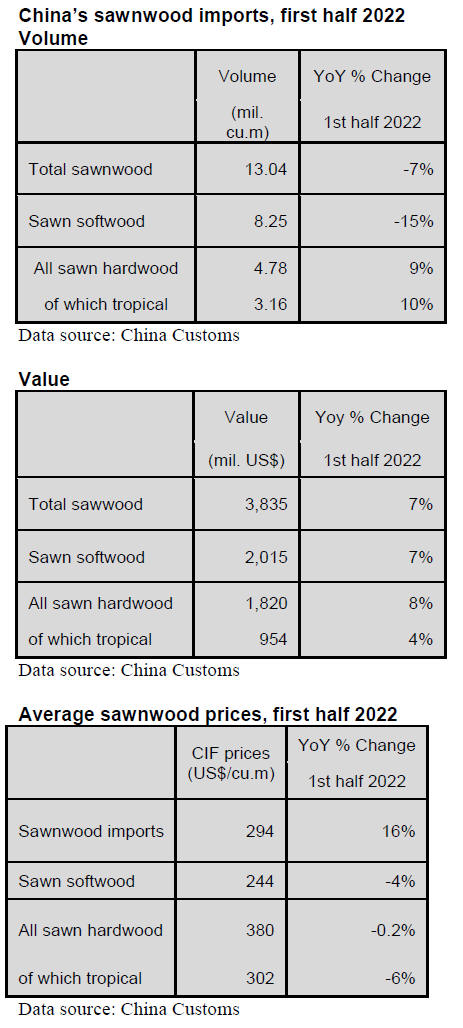

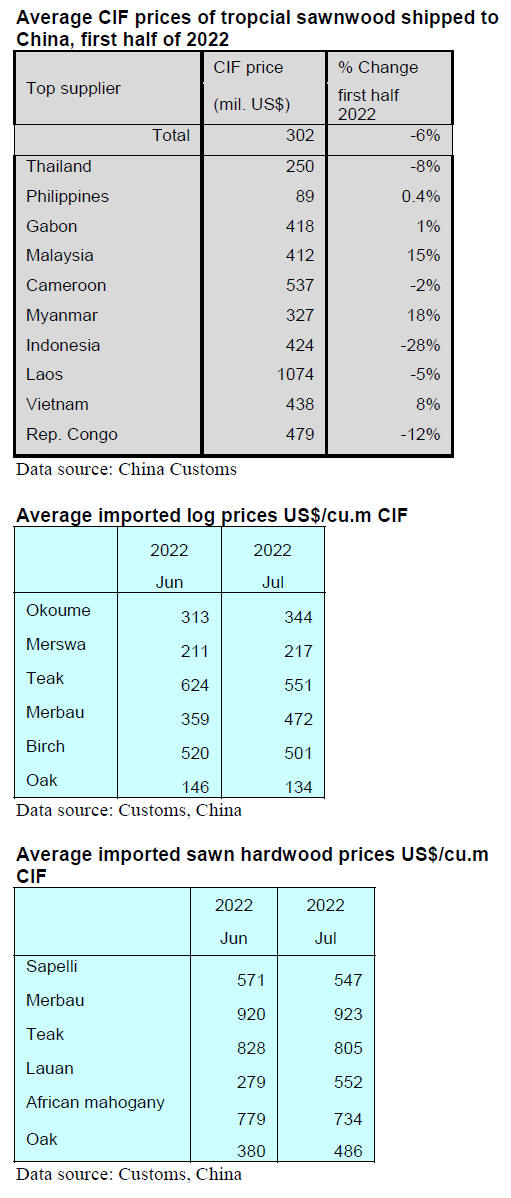

In the first half of 2022 China¡¯s sawnwood imports

totalled 13.04 million cubic metres valued at US$3.835

billion, down 7% in volume but up 7% in value. The

average CIF price for sawnwood rose 16% to US$294 per

cubic metre over the same period of 2021.

Of total sawnwood imports, sawn softwood imports fell

15% to 8.25 million cubic metres, accounting for 63% of

the national total, down 6% over the same period of 2021.

The average CIF price for sawn softwood fell 4% to

US$244 per cubic metre over the same period of 2021.

Sawn hardwood imports rose 9% to 4.78 million cubic

metres because China¡¯s sawn hardwood imports from the

top sources Thailand, Russia, the Philippines and Gabon

rose 13%, 20%, 14% and 11% respectively.

Imports from Austria surged. The average CIF price

for

sawn hardwood fell slightly to US$380 per cubic metre

over the same period of 2021.

Of total sawn hardwood imports, tropical sawn hardwood

imports were 3.16 million cubic metres valued at US$954

million, up 10% in volume and 4% in value and accounted

for about 24% of the national total. The average CIF price

for tropical sawn hardwood declined 6% to US$302 per

cubic metre over the same period of 2021.

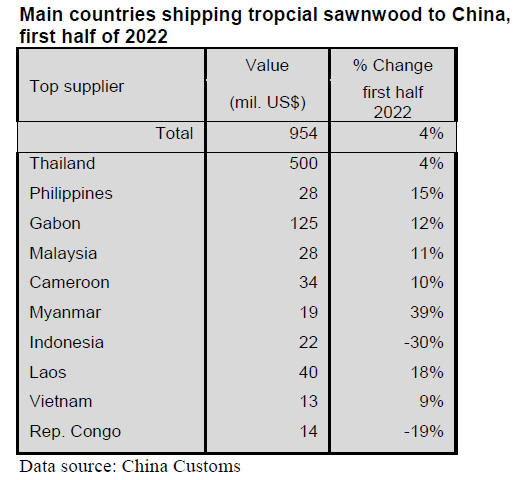

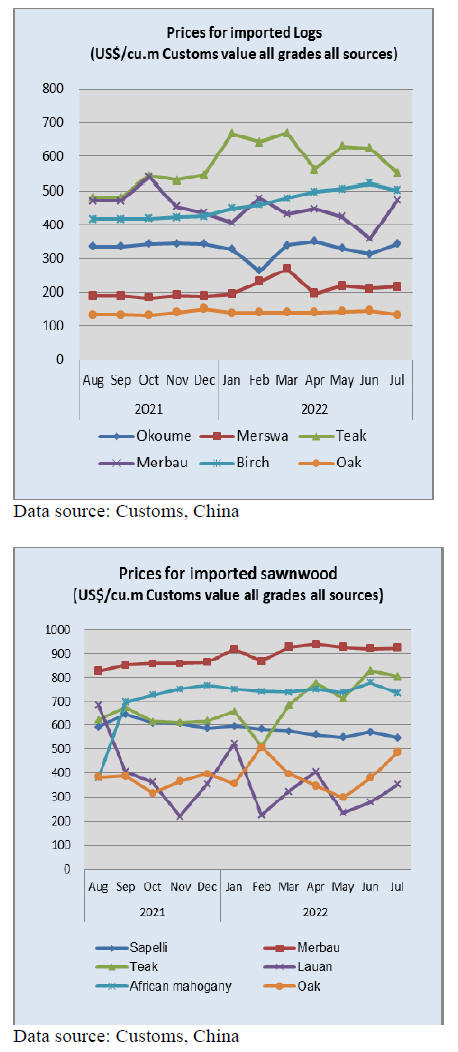

CIF prices for sawnwood imports

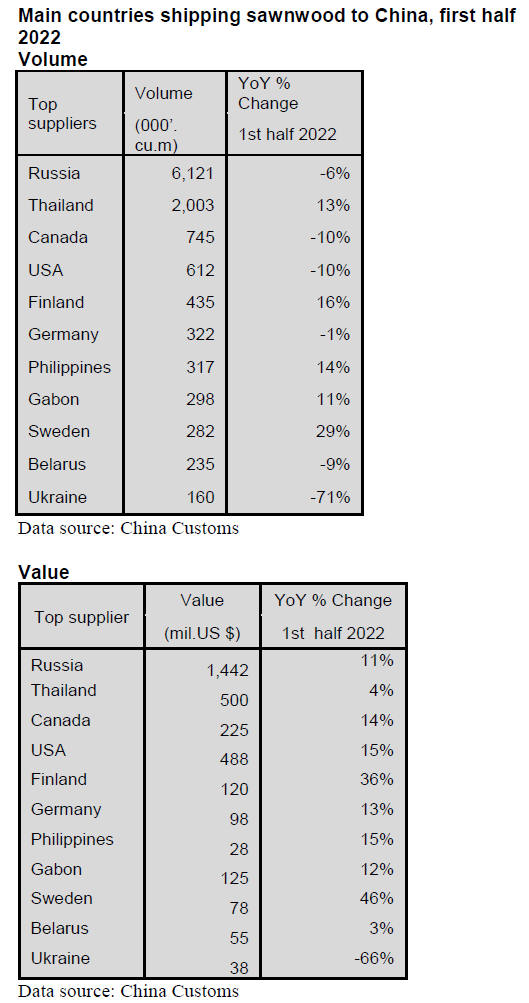

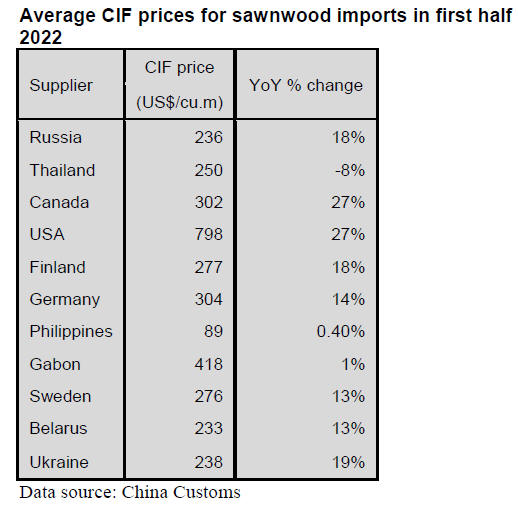

CIF prices for China¡¯s sawnwood imports from most

suppliers rose in the first half of 2022, except for Thailand.

Prices for sawnwood imports from Thailand alone fell 8%

to US$250 per cubic metre in the first half of the year.

The CIF prices for China¡¯s sawnwood imports from

Russia, Canada, USA and Finland increased 18%, 27%,

27% and 18% respectively. Other countries where prices

increased were Germany, Sweden, Belarus and Ukraine.

The main reasons for the rise in CIF sawnwood prices in

the first half of 2022 were: a shortage of sawnwood supply

because some producing countries have reduced harvests;

disrupted global logistics and container turn-around was

not smooth during lockdowns and strong domestic demand

in China where there is a ban on domestic harvesting of

natural forests.

Decline in the major sawn softwood suppliers

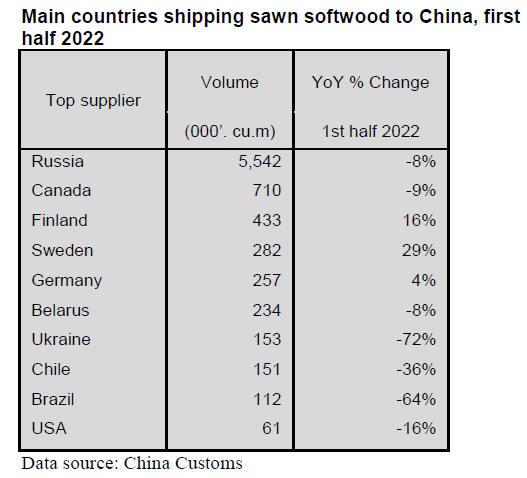

In the first half of 2022 China¡¯s sawn softwood imports

came to 8.25 million cubic metres, down 15% year on year

and accounted for 63% of the total national sawnwood

imports, down 6% over the same period of 2021.

Russia was the top sawn softwood supplier to China in the

first half of 2022. 67% of China¡¯s sawn softwood was

imported from Russia. However, China¡¯s sawn softwood

imports from Russia fell 8% to 5.542 million cubic metres.

Canada, the second largest sawn softwood supplier to

China, saw its exports of sawn softwoods fall 9% which

drove down the overall import figure.

China¡¯s sawn softwood imports from Ukraine and Brazil

plunged 72% and 64% respectively. This also resulted in

the decrease in the total volume of China¡¯s sawn softwood

imports in the first half of 2022.

Thailand, the main country shipping sawnwood

to

China

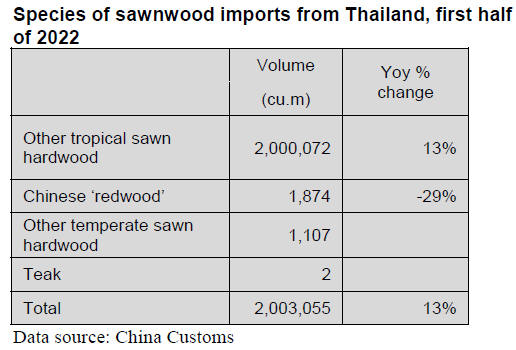

China¡¯s sawnwood imports from Thailand rose 13% to 2

million cubic metres in the first half of 2022. Thailand has

long been the main country shipping sawnwood to China

exceeding that from Canada, USA and Finland. In

addition, most of the imported sawnwood from Thailand is

sawn rubberwood which is included in ¡®Other¡¯ tropical

sawn hardwood (HS code 44072990), rubberwood does

not have a dedicated HS code.

China¡¯s redwood imports from Thailand were just 1,874

cubic metres, down 29% from the same period last year.

Teak imports from Thailand amounted to only 2 cubic

metres in the first half of 2022.

Rubberwood products are very popular in China. The

annual consumption of sawn rubberwood is about 6

million cubic metres of which 80% is imported from

Thailand. Imported sawn rubberwood is used in furniture

manufacturing (45%), wood doors (24%), bathroom

cabinets (26%), wood floors and other woodwork (5%).

Due to Thailand's investment policies Chinese enterprises

are attracted to establish sawmills in Thailand to produce

for the home market.The CIF price for sawnwood from

Thailand declined 8% during the first quarter which

boosted imports.

Rise in China¡¯s tropical sawn hardwood

imports

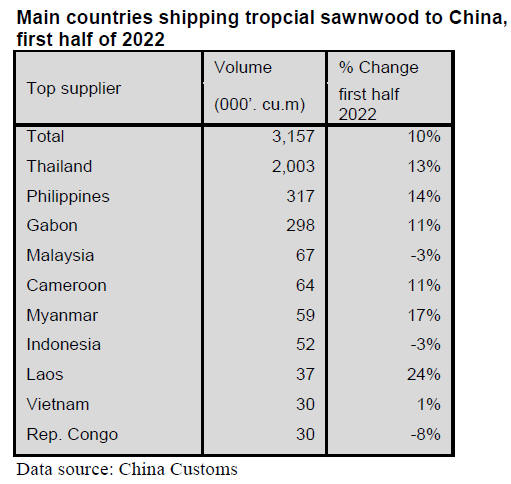

Of total sawn hardwood imports, tropical sawn hardwood

imports were 3.16 million cubic metres valued at US$954

million, up 10% in volume and 4% in value and accounted

for about 24% of the national total.

The Philippines and Gabon are the second and third largest

suppliers of tropical sawnwood imports after Thailand

accounting for 10% and 9% of the total tropical sawnwood

imports respectively in the first half of 2022. China¡¯s

tropical sawn hardwood imports from the Philippines and

Gabon came to 317,000 cubic meters and 298,000 cubic

metere, up 14% and 11% respectively in the first half of

2022.

The top 10 countries supplied 94% of China¡¯s tropical

sawnwood requirements in the first half of 2022, namely

Thailand (63%), the Philippines (10%), Gabon (9%),

Malaysia (2.1%), Cameroon (2.0%), Myanmar (1.9%),

Indonesia (1.7%), Laos (1.2%), Vietnam (1.0%) and the

Republic of Congo (0.9%).

|