4.

INDONESIA

Success at Atlanta Fair

Indonesian furniture and home decoration products sold

well during the Atlanta Summer Market Exhibition at the

Americas Mart Convention Center, Atlanta and have the

potential to secure contracts for around US$2.4 million.

Didi Sumedi, Director General, National Export

Development, Ministry of Trade, said products that

attracted buyers were toys, cypress wood products,

wooden utensils and wine and cigarette storage boxes.

The Head of the Indonesian Trade Promotion Center,

Bayu Nugroho, said governments support for participants

at this event is one of the government's efforts to increase

the value of Indonesia's exports to the US market.

See:

https://www.neraca.co.id/article/166240/furnitur-indonesiaberpotensi-transaksi-usd-24-juta-atlanta-summer-market

Programme to increase GHG absorption

The Environment and Forestry ministry has reported the

programme to boost absorption of greenhouse gas

emissions from the forestry and land use sector is being

conducted on a massive scale throughout the country.

This programme has become one of the most reliable ways

to combat climate change according to Secretary of the

ministry's Directorate General of Forestry and

Environmental Planning, Dr Hanif Faisol. The FoLU Net

Sink 2030 programme has been running across all regions

in Indonesia. The ministry has also conducted public

awareness campaigns on emission reductions.

See:

https://en.antaranews.com/news/241909/program-toincrease-absorption-of-ghg-emissions-conducted-massively

Indonesia invites Japan to increase forestry

investment

The Indonesian Ambassador to Japan, Heri Akhmadi, said

that Indonesia/Japan trade cooperation is very close

especially for wood products. He added that the

transformation of the energy sector in Japan that focuses

on bio-energy sources, such as wood pellets, opens up

opportunities for Indonesia.

An Indonesian delegation visited japan for the Indonesia-

Japan Forestry Investment Dialogue in early August and

the dialogue involved a number of Japanese forestry

companies.

See:

https://forestinsights.id/2022/08/04/indonesia-undangjepang-tingkatkan-investasi-kehutanan-dukung-folu-net-sink-2030/

Government - economic growth above five percent

The government will continue to maintain the economy so

it grows above five percent until the third quarter of 2022

despite the global turmoil and uncertainty. The

Coordinating Minister for the Economy, Airlangga

Hartarto, said that if the economy is able to grow above

five percent by the third quarter then the annual growth

target of 5-5.2 percent for this year will be achieved.

Minister Hartarto said his optimism was in line with

current economic growth driven by consumption,

investment and exports. On the supply side almost all

sectors reported growth in the first half of 2022.

See:

https://en.antaranews.com/news/242481/governmentmaintains-indonesias-economic-growth-at-above-five-percent

5.

MYANMAR

Trade Department release timber

export data

According to a recent release from the Trade Department

the earnings from the export of wood products between

October 2021 and May 2022 were US$108 million. The

figures for 2019-20 and 2020-21 were US$150 million and

US$122 million. It has been suggested that exports to EU

and USA are likely to decline while those to countries that

have not sanctioned Myanmar, such as India and China,

will rise.

See:

https://www.commerce.gov.mm/my/content/).

Changes to exchange regulations

On 9 August the Central Bank raised its official exchange

rate from 1,850 Kyats per dollar to 2,100 Kyats. At the

same time the Central Bank lowered the percent of earned

hard currency that must be converted from 100% to 65%.

Previously exporters had to convert the entire amount of

export earning into Myanmar Kyats at the fixed rate of

1,850 Kyats per dollar. This change has been welcomed by

exporters and manufactures.

As a result of the previous regulations manufacturers and

sawmillers were unable to import necessary material and

equipment as they had no access to hard currency.

Log supplies a challenge

Millers are experiencing a shortage of teak logs which fall

outside the dates when sanctions on the Myanma Timber

Enterprise (MTE) were implemented (logs held by the

MTE before 21 June 2021 are regarded as being

exempted).

MTE appears to be facing a challenge in transporting teak

and hardwood logs from the extraction sites to Yangon

because of security concerns due to activities of resistance

groups.

In related news a new regulation, effective at the end of

this year, will ban the export of large sized sawn timber

(baulks) which are regarded as raw material. Export to the

EU and USA are expected to decline.

Inconsistency in financial regulations create

confusion

The Central Bank of Myanmar raised its official exchange

rate in August. The domestic press has said erratic policy

shifts by the Central Bank have made the situation worse

for Myanmar’s economy. Last month, the Central Bank

ordered borrowers to suspend repayment of foreign loans

in order to conserve foreign currency reserves.

In April this year it ordered all businesses to convert all

foreign currency earnings into kyats within one day at the

official rate of 1,850 kyats, well below the informal

market rate of over 2,200 kyats. These actions have eroded

confidence in the kyat according to the local press.

See-

https://www.irrawaddy.com/news/burma/myanmar-juntasmoves-to-ease-currency-rules-wont-help-in-long-runexperts.html)

Fund established to develop rural areas

The Ministry of Planning and Finance set up a fund of

K400 billion from the National Natural Disaster

Management Fund in order to develop state economies

and to improve the lives of the people from regions and

states as well as promoting their economies. This was

reported by the Chairman of the State Administration

Council, Prime Minister Senior General Min Aung Hlaing.

See -

https://www.gnlm.com.mm/foreign-exchange-earned-fromexportation-will-be-spent-on-the-import-of-agricultural-inputsand-other-necessary-goods-senior-general/#article-title

)

Illegal timbers seized

The Anti-Illegal Trade Steering Committee has taken

action. An inspection team led by Myanmar Police Force

conducted raids on 4 and 5 August under the instructions

of the Mon State Anti-Illicit Trade Task Force and a team

led by the Yangon Region Forest Department carried out

inspections under the supervision of the Yangon Region

Anti-Illegal Trade Task Force.

A total of 6.1 tonnes of illegal timber worth K311,822 was

seized in the Oakkan forest reserve in Taikkgyi Township

of Yangon North District. In addition 17.8 tonnes of

illegal teak, iron-wood and other timbers worth

K8,566,372 were confiscated in the Bago, Thayawady and

Pyi districts.

See:

https://www.gnlm.com.mm/illegal-timbers-restricted-goodsconsumer-goods-and-vehicles-confiscated/

Crimes against women and children

The Independent Investigative Mechanism for

Myanmar (IIMM) has gathered evidence, outlined in

its Annual Report, that indicates “sexual and gender-based

crimes, including rape and other forms of sexual violence

and crimes against children have been perpetrated by

members of the security forces and armed groups”.

Crimes against women and children are amongst the

gravest international crimes but they are also historically

underreported and under-investigated,” said Nicholas

Koumjian, Head of the IIMM.

Meanwhile, with the consent of its information sources,

“IIMM is sharing relevant evidence to support

international justice proceedings currently underway at

the International Court of Justice (ICJ) and International

Criminal Court (ICC)”.

The IIMM was created by the UN Human Rights

Council in 2018 to collect and analyse evidence of the

most serious international crimes and other violations of

international law committed in Myanmar since 2011. It

aims to facilitate justice and accountability by preserving

and organizing evidence and preparing case files for use in

future prosecutions of those responsible in national,

regional and international courts.

See:

https://news.un.org/en/story/2022/08/1124302

6.

INDIA

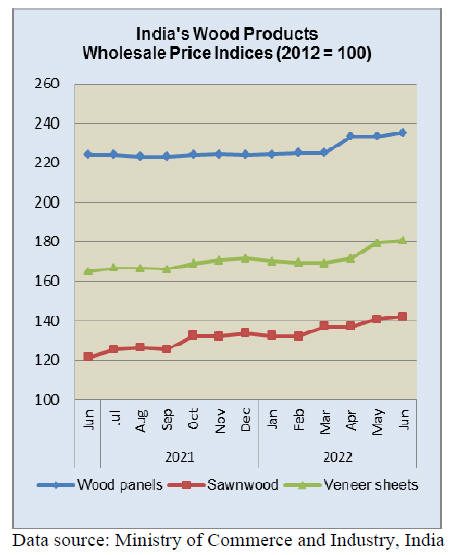

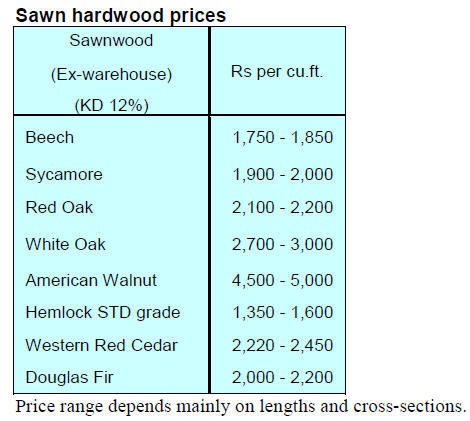

Wholesale price indices

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade has published

wholesale price indices for June 2022. The annual rate of

inflation, based on the Wholesale Price Index (WPI) was

up 15.2% year on year in June 2022.

The high rate of inflation was mainly due to a rise in

prices of oil, food, crude petroleum and natural gas, metals

and chemicals.

The index for manufactured products declined in June. Out

of the 22 NIC two-digit groups for manufactured products,

14 saw increases in prices while 8 groups saw declines.

Price increases were reported for most wood products,

however, weak consumer sentiment drove down furniture

prices.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Relief for coastal shipping companies

To provide respite to waterway transportation from high

fuel prices the Ministry of Ports, Shipping and

Waterways has directed all major ports to exempt coastal

shipping operators from port and vessel charges for 6

months.

This is being done to offset the high cost of fuel. The

Minister also commented the rising fuel costs which is

making domestic roll-on/roll-off ferries too expensive. All

13 major ports will exempt all berth and vessel related

charges currently levied on the roll-on/roll-off passenger

ferries for the next 6 months will immediate effect, the

ministry said.

See: https://www.business-standard.com/article/currentaffairs/

no-port-vessel-related-charges-on-coastal-shipping-for-6-

months-govt-122072400646_1.html

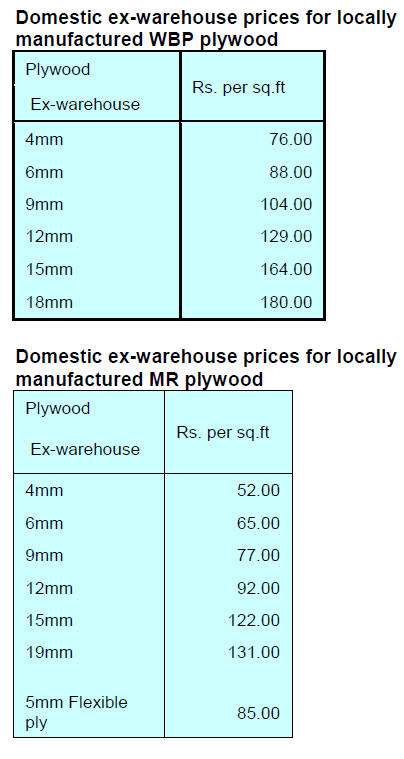

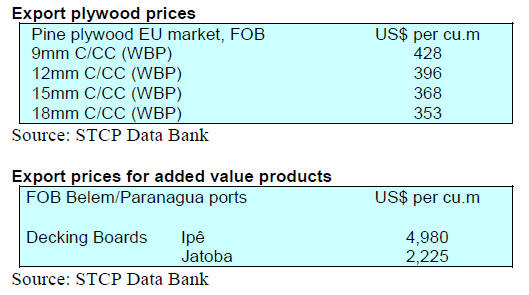

Plywood

In mid-July plywood manufacturers' associations in South

India unanimously agreed to raise plywood prices due to

the steep increase in resin prices but this has not been

adopted nationwide.

See:

https://www.plyreporter.com/article/93217/south-basedplywood-associations-raise-plywood-prices-by-50-paisa-per-sqftper-glue-line

Please note plywood prices are now shown below free of

local taxes.

Forests are forests –Supreme Court

A recent Supreme Court ruling on the Aravalli forests case

is a decisive win for forest conservation, environmental

wellbeing and sustainable development. The court made it

clear that the protection accorded to forests by law cannot

be limited to only those areas recognised in the Indian

Forest Act, 1927.

The implications of the ruling are far wider than protection

of one small forest. This ruling comes at a time when

biodiversity loss has emerged as a major challenge with

substantial economic implications.

The court rules that the Aravalli forests were legally

required to be regarded as forests and that central

government permission is required to allow any change of

uses.

Source:

https://economictimes.indiatimes.com/opinion/eteditorial/not-missing-thelaw-for-thetrees/articleshow/93060842.cms

7.

VIETNAM

Wood and Wood Products (W&WP) Trade Highlights

Vietnam's W&WP exports to South Korea in July 2022

reached US$76.4 million, down 5.8% compared to July

2021. In the first 7 months of 2022 W&WP exports to

Korean were estimated at US$606.6 million, up 13% over

the same period in 2021.

Vietnam's exports of office furniture in July 2022 reached

US$33.1 million, down 34% compared to June 2021. In

general, over the first 6 months of 2022, exports of office

furniture were worth US$190.1 million, down 28.3% over

the same period in 2021.

Vietnam's imports of padauk in July 2022 accounted to

8,800d cu.m, worth US$3.8 million, down 30% in volume

and 45% in value year on year.

Over the first 7 months of 2022 imports of padauk are

estimated at 79,600 cu.m, worth US$35.3 million, down

26% in volume and 21% in value over the same period in

2021.

Over the first 7 months of 2022 exports of handicrafts are

estimated at US$150.53 million, up 5.1% over the same

period in 2021.

Vietnam's wood industry urged to seek new

opportunities in UK

While many products exported to the UK enjoyed strong

increases thanks to the UK-Vietnam Free Trade

Agreement (UKVFTA), Vietnam’s timber industry is

facing difficulties in expanding in this market and this

requires manufacturers and exporters to change their

business strategies.

Vietnam’s wood industry is seeing declining international

sales.

Exports in July are estimated at US$1.41 billion, down

5.5% against June and down 1.6% year-on-year according

to a report of the General Department of Forestry under

the Ministry of Agriculture and Rural Development

(MARD). This was the second month that the export of

wood and timber products decelerated.

Earlier, figures from the General Department of Customs

showed exports of wood and wood products reached

US$1.4 billion in June, down nearly 11% year-on-year.

Declining export orders

According to market insiders the wood industry will face a

serious challenge due to a decrease in export orders in the

latter half of this year.

A quick survey of 52 timber businesses conducted by the

Vietnam Timber and Forest Products Association

(Vifores) in collaboration with Forest Trends showed that

most companies witnessed decreasing exports to the US,

EU and UK markets.

Thirty-three out of 45 firms exporting to the US said their

revenues decreased by nearly 40% compared to the first

months of this year. A similar trend is seen in the EU and

the UK with two-thirds of the surveyed enterprises

reporting revenue drops of over 41%.

Moreover, about 71% of businesses said that orders will

continue to decline towards the end of the year. Under the

current market situation, 44% of businesses expect their

revenues will fall by about 44% for the whole year.

Vietnam's wood industry is integrating deeply with

international markets so high inflation and tightening

credit policies in response to rising inflation in major

markets are driving down demand.

New opportunities in the UK

W&WP export to the UK enjoyed an increase of 14% to

US$72 million in the first three months of 2022 but sales

to this market are also declining as consumers are

tightening their spending.

In June the value of exports declined 38% year-on-year to

US$16.3 million and in the first half the rate of reduction

was 7.7% to US$135.5 million.

Like other parts of the world, inflation in the UK hit a 40-

year high in June as food and energy prices continued to

soar, worsening the country’s historic cost-of-living crisis.

The Bank of England has implemented five consecutive

25 basis point rate hikes to cool high inflation and is

considering a 50 basis point hike at its August policy

meeting.

According to David Hopkins, chief executive of ‘Timber

Development UK’, the UK’s imports of wood and wood

products rose in the first quarter as merchants start to

rebuild stocks after the winter.

The UK’s economy is now struggling with high inflation,

high interest rates and big logistics challenges due to

Brexit and the Russian invasion of Ukraine.

So far, Vietnam’s predominant timber export to the UK is

furniture but Hopkins sees another opportunity for

Vietnamese exporters in niche areas such as plywood.

On furniture products, Hopkins said demand is expected to

decline in the next two years after a boom in housing

repair and maintenance during the pandemic before it can

bounce back. This trend will likely happen in the US and

the EU which are also suffering from high costs of living.

To better compete and expand sales in the UK, Hopkins

suggested Vietnamese manufacturers and exporters invest

in marketing and promotion to enhance awareness among

UK consumers about Vietnamese products.

The concepts of legality and sustainability are important

for consumers in the UK and are backed up by legislation.

See:

https://en.vietnamplus.vn/vietnams-timber-industry-urgedto-seek-new-opportunities-in-uk/234961.vnp

Exports of wood and forest products down for 2nd

consecutive month

According to a report by the General Department of

Forestry, Ministry of Agriculture and Rural Development,

the country’s export value of wood and forest products in

July of 2022 was estimated at US$1.41 billion, the second

month that the value of exports of wood and forest

products fell.

In general, the export value of wood and forest products in

the first 7 months of 2022 was estimated at US$10.42

billion, up by 1.3% over the same period of 2021. Exports

of wood and wood products alone reached US$9.72

billion, an increase of 1.2%; of which, the exports of wood

chips reached US$1.4 billion, up by 30%, the exports of

wood pellets reached US$0.45 billion, up by 79%, the

exports of all kinds of panel products reached US$0.91

billion, up by 22%, the export of wood products reached

US$6.97 billion down by 7% and the exports of nontimber

forest products reached US$0.7 billion, up by

2.6%.

Regarding the markets, in the first 7 months of 2022,

timber and forest products were exported to 110 countries

and territories, of which, the US, Japan, China, EU and

South Korea continued to be the main export markets.

The total exports to those 5 markets were estimated at

US$9.38 billion accounting for 90% of the total export

value of the country.

Exports to the US market reached over US$5.84 billion,

down by 5% over the same period of 2021, of which, the

exports of wood and wood products reached US$5.58

billion, down by 51%. Exports of non-timber forest

products reached US$0.25 billion, down by 0.6%.

Exports to the Japanese market reached US$1.04 billion,

up by 19% over the same period of 2021 of which exports

of wood and wood products reached US$999 million, up

by 20% and the exports of non-timber forest products

reached US$36 million, down by 2%.

Exports to the Chinese market reached US$1.161 billion,

up by 24% over the same period of 2021.

The country’s exports of wood and wood products to

China reached US$1.15 billion, up by 23%; while the

exports of non-timber forest products reached US$15

million, up by 164.2 percent.

Exports to the EU market reached US$726 million, up by

1% over the same period of 2021, of which, exports of

wood and wood products reached US$549 million, down

by 2% and the exports of non-timber forest products

reached US$177 million, up by 11%.

According to the Import-Export Department, Ministry of

Industry and Trade, the United States was the largest

export market of Vietnam's wood and wood products.

However, the decrease in export value of wood and wood

products to this important market has affected the export

activities of the whole industry.

The US is the main export market for the wood industry so

the decrease in exports hinders the growth of wood and

wood products export sector.

Exports of wood and wood products in the second half of

2022 may face many challenges both in terms of the

market and the supply chain, when the world inflation is

high, causing the purchasing power to decrease and the

transportation costs to increase.

According to Vietnam Timber and Forest product

Association, exports of wood and forest products in the

last months of the year may continue to face difficulties

due to the high price of production materials and products;

countries tighten credit policies because inflation tends to

increase, leading to a sharp decrease in consumer demand.

In addition, the wood industry is also facing the US DOC's

initiation of an investigation into wooden cabinets and

dressing tables.

In the context that the imports of raw materials from

European markets decreased sharply, specifically the

imports from Germany decreased by 2.2%, from France

decreased by 6.9%, from Italy decreased by 10.1%, from

Sweden decreased by 42.1% due to the influence of the

Russian invasion of Ukrainian leading to transportation

difficulties.

Imports of raw materials from some countries increased

sharply such as from Russia, Finland, and Belgium due to

the need to find alternative sources of raw materials due

to reduced supply in other markets.

The supply of raw materials from domestically planted

forest wood is still sufficient to meet production needs.

Currently, due to the increased demand for woodchips and

pellets, prices have risen by over 30% so the forest owners

tend to cut young forests (3-4 years old plantations),

leading to the risk of shortage of wood materials for

processing all kinds of other wood products.

In order to deal with the challenges ahead the General

Department of Forestry has recommended enterprises

actively develop production and business plans; promptly

respond to market fluctuations; strictly comply with

regulations on records of forest product origin and other

relevant regulations in timber and forest product

production and trading activities.

International wood fair opens in Binh Duong

More than 100 Vietnamese and foreign firms showed

advanced wood processing technologies, machinery and

raw materials at the 2022 Vietnam Binh Duong Furniture

Association (BIFA) Wood exhibition which opened in

southern Binh Duong province on 8 August.

See:https://en.vietnamplus.vn/international-wood-fairopens-in-binh-duong/235276.vnp

This biennial trade show is expected to unlock possibilities

for local and foreign companies looking to tap into

Vietnam’s potential. With its plentiful labour and

entrepreneurs and excellent connectivity with key timber

areas in the southeastern and Central Highlands regions,

Binh Duong claims a favourable business environment.

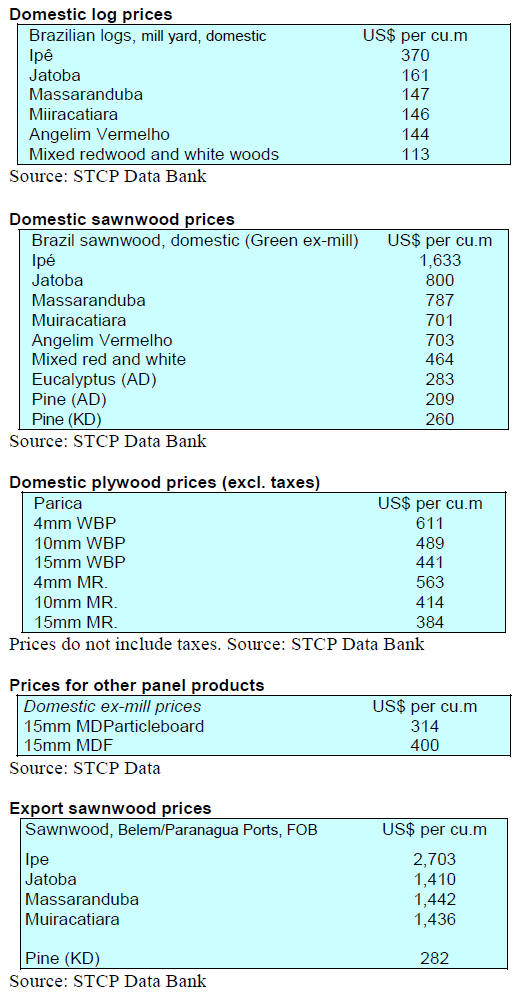

8. BRAZIL

Partnership boost for furniture

sector

The Project for Development, Competitiveness and

Integration of the Furniture Industry (Projeto de

Desenvolvimento, Competitividade e Integração da

Indústria do Mobiliário - PCDIMOB), a partnership

between the Brazilian Furniture Industry Association

(Abimóvel) and the Brazilian Micro and Small Business

Support Service (SEBRAE) intends to involve more than

200 small businesses in an initiative to combine efforts

and resources for the development of competitiveness,

productivity and integration of micro and small companies

in the furniture sector.

In eight states SEBRAE has confirmed particpants from

Pará, in the North, Piauí and Sergipe, in the Northeast, Rio

de Janeiro, in the Southeast Paraná, Santa Catarina and

Rio Grande do Sul, in the South and Distrito Federal, in

the Midwest.

PDCIMOB has identified five strategic objectives:

management excellence; strategic intelligence and trade

promotion; innovation; competitiveness and productivity

and networking.

In order to achieve the objectives strategies will be

developed on Sectoral and Digital Intelligence,

Competitiveness Improvement and Commercial closeness.

As a result it is expected that small businesses will

increase production and income and achieve a 30% jump

in innovation.

See:

https://www.moveisdevalor.com.br/portal/abimovel-esebrae-firmam-parceria-para-fortalecer--setor

Public hearing on forest concessions

The Ministry of Agriculture opened a public hearing in

July on concessions in the national forests of Jatuarana,

Pau Rosa and Gleba Castanho all within the Amazon

region and totalling 885,000 hectares.

The consultation aimed to gather information, feedback

and suggestions from the public and was coordinated by

the Brazilian Forest Service (SFB).

A forest concession allows sustainable harvesting of only

four to six trees per hectare and further harvesting can

only be undertaken after 25 to 35 years to allow for natural

regeneration.

See:

https://amazonia.org.br/consulta-publica-sobre-concessoesde-tres-florestas-vai-ate-sexta/

Abimad, US$8 million in business is possible

A furniture fair promoted by the Brazilian Associação

Brasileira das Indústrias de Móveis de Alta Decoração

(Abimad - Association of High Decoration Furniture

Industries) brought together a group of 60 foreign buyers

from countries such as Saudi Arabia, South Africa, the

United States, Panama, the Dominican Republic,

Argentina, Chile and Uruguay. It has been estimated that

Abimad may have generated about US$8 million in

business.

Brazilian furniture exports grew 42% in the past 12

months according to IEMI (Market Intelligence) in

partnership with the Brazilian Trade and Investment

Promotion Agency (Apex-Brazil).

In March alone Brazil exported about US$71.6 million in

furniture and mattresses. In the first quarter of the year the

performance was 8.8% higher compared to the same

period in 2021.

See:

https://valor.globo.com/patrocinado/imoveis-devalor/noticia/2022/07/29/estrangeiros-impulsionam-setormoveleiro-nacional.ghtml

Higher exports to the United States

The furniture trade between Brazil and the United States

registered a record in the first half of 2022. The US is

currently responsible for importing about 38% of Brazilian

furniture destined for the international market according to

the Brazilian Association of Furniture Industries

(ABIMÓVEL).

Furthermore, the trade between the two countries

registered US$42.7 billion in the first six months of 2022

according to the Brazilian-American Chamber of

Commerce.

This corresponds to an increase of 43% compared to the

first half of last year. Brazilian exports to the United States

increased by 32% this year.

The Brazilian Furniture Project, an initiative of

ABIMÓVEL and ApexBrasil (Brazilian Agency for the

Promotion of Exports and Investments), supported the

participation of 24 Brazilian companies in business rounds

in New York in May 2022.

Imports of American products to Brazil also increased and

the difference between imports and exports between the

countries resulted in a deficit of US$7.4 billion for Brazil,

the highest ever recorded.

See:

https://setormoveleiro.com.br/exportacoes-brasileiras-paraos-estados-unidos-crescem-em-niveis-historicos-em-2022/

9. PERU

Plantations to substitute for

imports

The Executive Director of the National Forest and

Wildlife Service (Serfor), Nelly Paredes, highlighted the

experience of the Agrarian Workers' Cooperative

Atahualpa Jerusalem, better known as "Granja Porcón",

which has successfully established plantations.

She explained that the aim of Serfor is to promote

commercial forest plantations and agroforestry systems. In

2021 Peru imported wood products valued at around

US$1.1 million and some of these products can be

substituted by domestic production using plantation

timbers as raw material.

Shipments of veneer and plywood recovering

Exports of veneers and plywood in the first five months of

this year totalled US$1.21 million, a rise of 5.2%

compared to the same period in 2021, however, the total

did not reach the level seen in earlier years according to

the Management of Services and Extractive Industries

division of the Association of Exporters (ADEX).

In the past ten years (January-May period) the best

performance was in 2015 when shipments amounted to

US$7.85 million. In subsequent years (January-May),

there were constant declines to US$4.65 million (2016),

US$3.98 million (2017), US$3.14 million(2018), US$1.15

million (2019) and US$0.8 million (2020). These latest

figures indicate recovery is possible.

The main destination in the January-May 2022 period was

Mexico (US$1.18 million), or about 97% of all shipments

and up 9% compared to the same period in 2021.The most

outstanding export product was plywood at US$0.95

million, followed by walnut wood veneers, container

floors and shihuahuaco wood profiles.

Of the total timber exports (US$66.5 million, in the first

five months of the year) veneers and plywood represented

just 2% being surpassed by semi-manufactured products,

sawn wood, construction products, furniture and parts and

firewood and charcoal.

Guidelines to extend validity of forest concessions

Serfor has approved guidelines for the extension of the

validity of forest concession contracts (including timber

and non-timber) and wildlife concessions for five-years.

Through these guidelines the procedures are disclosed

according to the provisions of the Forestry and Wildlife

Law and its regulations and its purpose is to provide a

broad planning horizon for the concessions; in the case of

forestry, 40 years and for wildlife, 25 years.

Concession contracts can be extended every five years if

one of two conditions are met:

If it is recommended by the five-yearly audit

report carried out by the Supervision Agency for

Forest Resources and Wild Fauna (OSINFOR) to

the concession.

The concession has a current voluntary forest or

wildlife certificate.

With the approval of these guidelines the aim is to

encourage concessions holders that perform well and to

demonstrate to others that efforts to achieve a good

performance will be recognised.

See guideline:

https://www.gob.pe/institucion/serfor/normaslegales/3328020-d000175-2022-midagri-serfor-de

Serfor and Hungarian Research Institute cooperation

In early August the Executive Director of the Serfor and

the Director General of the Hungarian Forest Research

Institute (ERTI), Attila Borovics, expressed their

commitment to work together for the forest management

of the Amazon forests.

The head of Serfor explained that they will seek to sign a

cooperation agreement where the main topics of interest of

both institutions will be established related to innovation,

research and management of the resources of the Amazon

forests in order to guarantee their conservation.

ERTI, home to Hungarian forestry research since 1898,

has experience in the fields of forest management and the

agroforestry sector as well as working with Latin

American countries.