4.

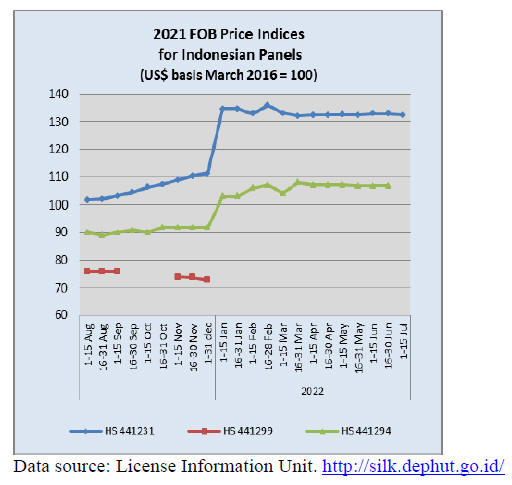

INDONESIA

APHI Calls on EU to Promote SVLK

The Association of Indonesian Forest Concession Holders

(APHI) has called on the European Union to jointly

promote the Legality and Sustainability Verification

System (SVLK) to further strengthen Indonesia’s efforts to

improve forest governance in support of climate change

action.

Chairman of APHI, Indroyono Soesilo said that Indonesia

and the EU have had a Voluntary Partnership Agreement

(VPA) for Forest Law Enforcement, Governance and

Trade (FLEGT-VPA) since 2013. He commented that

under the Agreement the EU has an obligation to promote

FLEGT licenses in accordance with article 13 of the

FLEGT VPA.

Indroyono said during a meeting with the EU Ambassador

to Indonesia at the APHI office that Article 13 must be

implemented to support FLEGT licensing. Indroyono said,

despite being one of the main markets, exports of

Indonesian wood products to the EU are still relatively

small and that Indonesia needs support to expand its

market share.

In response the Ambassador explained that EU consumers’

awareness of green products that are environmentally

friendly is getting stronger, therefore fulfilling the

elements of legality and sustainability is important.

Regarding Article 13 the Ambassador said this could be

one of the points of discussion at the high-level meeting of

the EU and Indonesia later in the year.

See:

https://forestinsights.id/2022/07/04/aphi-calls-on-eu-topromote-svlk-to-strengthen-indonesian-forest-governance/

Forestry sector should be contributing more to GDP

The contribution of the forestry and wood processing

sectors to national gross domestic product (GDP) was only

Rp112 trillion or 0.66% according to the Minister of

Finance, Sri Mulyani Indrawati.

She added that the government needs to make

improvements since Indonesia is home to vast tropical

forests so the sector should be contributing significantly

more.

See:

https://www.kemenkeu.go.id/publikasi/berita/menkeuungkap-perlunya-tingkatkan-kontribusi-sektor-kehutanan/

and

https://economy.okezone.com/read/2022/06/28/320/2619901/srimulyani-ungkap-kontribusi-hutan-ke-pnbp-hanya-rp5-6-triliun?page=2

Realising a ‘multi-business’ forestry sector requires

investment

Development of a multi-business forestry model is a

business opportunity that can help address climate change

as well as improving the welfare of the people living close

to the forest.

The Deputy Chairman of the Chamber of Commerce and

Industry (Kadin) for Environment and Forestry, Silverius

Oscar Unggul, said that Kadin and APHI continue to look

for the marketing models and the products and services to

be developed in multi business forestry operations.

The Deputy Chairman of APHI, Soewarso, said the

challenge in the plantation forestry business is the long

investment period and if a viable multi-business model can

be found prospects will be more attractive.

Soewarso proposed that banks and financial institutions

implement innovative blended financing for wood, nontimber

forest products and carbon trading. As security

Soewarso suggested that a Certificate of Emissions

Reduction (CER) issued by an authorised institution could

be used as a guarantee to obtain financing.

See:

https://forestinsights.id/2022/07/09/implementasi-multiusaha-kehutanan-perlu-dukungan-pembiayaan/

A huge investment needed to meet forestry NDC target

The cost of reaching the Nationally Determined

Contribution (NDC) target for the forestry sector is

estimated at Rp77.82 trillion according to the Minister of

Finance, Sri Mulyani Indrawati. According to the Minister

the forestry sector could have the biggest contribution to

greenhouse gas emission reductions compared to other

sectors.

See:

https://en.antaranews.com/news/236569/need-rp7782-trillion-to-meet-forestry-ndc-target-minister

Forestry Congress reaffirms role of forestry sector in

National Development

At the opening of the 7th Indonesian Forestry Congress

themed "Managed Forests, Protected Earth and an

Empowered Nation” the Minister of Environment and

Forestry, Siti Nurbaya, called upon forestry sector

stakeholders to strengthen their commitment in

encouraging the progress in Indonesia's forestry

development and to actively participate in international

efforts to achieve sustainable development and address

climate change.

The Congress aimed to play a role in the national agenda

on climate change as formulated in the 2030 FoLU Net

Sink.

The Minister was reported as saying “In responding to

these global challenges, breakthrough steps, innovation

and collaboration are needed to accelerate the

implementation of climate change mitigation actions, as

well as optimize scientific resources in earth management

for completion and efforts for sustainability and prosperity

as a legacy for our future generations".

See:

https://www.menlhk.go.id/site/single_post/4837/kongreskehutanan-indonesia-vii-meneguhkan-kembali-pengelolaansektor-kehutanan-pada-pembangunan-bangsa

5.

MYANMAR

MTE Tender bids to be in local

currency

According to log buyers/exporters, without notice, the

Myanma Timber Enterprise (MTE) changed the currency

in which tender bids should be made from US dollars to

the local currency kyat (MMK). Millers now have to bid in

MMK.

This is a major change at MTE which has required bids in

US dollars for past decades. After the government required

conversion of incoming US dollars to MMK within one

day in April this year payments to MTE for logs had been

stalled for about three months.

It is unclear if this is a permanent change and it is too early

to say that it is the end of the US$ dominated payment

system by MTE.

The MTE is sanctioned by EU and US and is denied

international swift transfers. Although the change to MMK

is a consequence of the intensified monetary control

measures by the government by coincidence now MTE is

not recipient of US$. The earnings of hard currencies is a

main cause of sanctioned by EU and USA introduced after

the military took control in February 2021.

Yuan-denominated China border trade back to dollars

Yuan-denominated settlement in China-Myanmar border

trade hit over 500 million yuan (US$74.44 million) in the

first half of 2022 despite the closure of most border

crossings due to covid prevention and control measures.

The Myanmar government accepted the yuan as an official

settlement currency for border trade with China, its biggest

trading partner in December last year. The Global Times

reported earlier that the estimated settlement scale in the

pilot phase is about 2 billion yuan, which is equivalent to

about 30 percent of the value of bilateral border trade via

inland routes.

According to a report on a Chinese-language website in

Myanmar on July 3, the authorities in Myanmar informed

traders in Muse, one of Myanmar's main border trade

points with China, that payments should be switched back

to US dollars.

According to the media this change applies to local

enterprises but not to financial institutions which provides

the opportunity for banks to still settle the border trade in

yuan.

See:

https://www.globaltimes.cn/page/202207/1270273.shtml )

6.

INDIA

House prices down loan rates up

Housing sales have fallen by 15% in the top seven Indian

cities driven down by increased prices and rising rates for

home loans. The Mumbai Metropolitan Region (MMR)

recorded the highest sales of apartments between April

and June according to a report released by ANAROCK

Property Consultants.

Anuj Puri, Chairman of the ANAROCK Group, is quoted

in the Times of India as saying inflationary pressures on

input costs compelled developers to increase property

prices in the past few months and RBI unleashed two rate

hikes that pushed up home loan interest rates.

See:

https://realty.economictimes.indiatimes.com/news/residential/housing-sales-in-delhi-ncr-fell-19-in-apr-jun-anarock/92642941

Improving turn-around time at ports

A recent meeting of the Ministry of Ports, Shipping and

Waterways chaired by Sarbananda Sonowal, Union

Minister for Ports, Shipping and Waterways concluded

with some notable decisions. Sonowal suggested that all

ports should prepare a master plan to become Mega Ports

by 2047. The meeting also discussed the application of

automated technologies that could improve the

performance at Indian Ports.

The Minister specifically called for layover times at

india’s major ports to be reduced. He said “There should

be zero waiting time for inbound and outbound cargo”.

This will require reducing current wait time of around a

day for berthing at major ports. The media quote the

average time before a cargo ship was berthed at a major

port in 2021 was around 0.95 days.

According to official estimates the container turn-around

time at major Indian ports is about 26.5 hours. This has

come down from around 45 hours in 2013-14. Sonowal

said that a Master Plan to enable ports to identify and

resolve bottlenecks in multi-modal connectivity in vital.

See:

https://nenow.in/north-east-news/assam/sarbanandasonowal-asks-all-ports-to-prepare-master-plan-to-becomemega.html

Rupee tumbles – pain for importers

Indian importers will be feeling pain as the rupee fell to a

record low of 79.38 to the US dollar recently as news

emerged that the country's trade deficit hit an all-time high

in June due mainly to the surge in crude oil

and coal imports. The Reserve Bank of India (RBI) has

intervened but has not been able to stem the sharp decline.

The government has introduced a tax on gold imports and

the RBI has intervened in the foreign exchange markets by

selling dollars. The central bank also announced a series of

measures to increase foreign exchange inflows to boost the

rupee.

7.

VIETNAM

Vietnam: Wood and wood product (W&WP) trade

highlights

According to the Vietnam General Department of

Customs, the W&WP exports to the US in June 2022 were

estimated at US$826.3 million, down 19% compared to

June 2021. In the first half of 2022 exports of W&WPs to

the US totaled US$4.92 billion down 2.5% compared to

the same period in 2021.

Vietnam's exports of office furniture in June 2022 reached

US$30.3 million, down 32% compared to June 2021. In

general, in the first 5 months of 2022 exports of office

furniture were valued at US$156.8 million, down 27%

compared to the same period in 2021.

Imports of raw wood in June 2022 have been estimated at

602,000 cu.m, worth US$237.8 million, up 4.6% in

volume and 3% in value.

In June Vietnam's exports of timber and wood products

decreased due to the impact of high inflation in export

markets according to the Ministry of Industry and Trade.

In the first six months of this year the value of wood and

wood product exports rose 2.8% year on year to US$8.5

billion. But exports of wood products declined almost 5%

to US$6 billion.

Wooden furniture was the main export item but exports

earning dropped as the economies in importing countries

suffered rising inflation and declining consumer

confidence. High US inflation has caused low- and

middle-income groups to tighten their spending, creating a

significant impact on Vietnam's wood product exports.

In addition, the decline in export earnings in the first half

of this year were affected by very high logistics costs.

Exporters say that in some cases the value of wood

products in a containers shipped to the US is lower than

the shipping cost. Because of high shipping costs some US

buyers are switching to suppliers in countries that are

closer such as Mexico to keep shipping costs down.

Vietnam wood product manufacturers have started to

report weaker order book positions due to reduced orders

from the US as well as South Korea and the EU.

The declining orders in the first half of 2022 has worried

the wood industry as they fear they may not achieve the

export growth target this year. For 2022 export turnover

growth for wood and wood products is forecasted to reach

only 5-7% in contrast to the 9% growth in 2021.

In the light of high inflation that is not shown any signs of

cooling globally businesses are also reviewing orders to

achieve the most efficiency in production and management

in order to keep their customers.

Do Xuan Lap, Chairman of the Vietnam Timber and

Forest Products Association, said the issue for the wood

industry today is that Vietnam needs to develop highquality

domestic wood raw material sources to maintain its

competitive advantage.

See:

https://en.vietnamplus.vn/vietnams-wood-exports-decreaseas-inflation-increases/233562.vnp

A special contribution from Dr. Hoang Lien Son,

Director of the Forest Economics Research Centre,

Vietnamese Academy of Forest Science

Current Situation of Vietnam’s Timber Imports and

Policy Solutions - Towards Timber Legality Assurance

Over the last two decades Vietnam has been emerging as a

top producer of wood and wood products (W&WP). At

present, W&WP from Vietnam are shipped out to over

140 overseas markets, and Vietnamese wood operators

must comply with increasing requirements on timber

legality assurance imposed by importers.

The US Lacey Act, the Korea Act on Sustainable Use of

Timbers, the Japan Clean Wood Act, the Australia Illegal

Logging Prohibition Act, the EU and UK Timber

Regulations along with the VPA/FLEGT Vietnam has

concluded with the EU in 2018 have been tightening the

control over imported W&WPs.

In response on the internationally reinforced regulations

on timber legality, the Prime Minister of Vietnam issued

Decision 102. Dated 1st September 2021, to specify the

implementation of VPA/FLEGT and operate VNTLAS.

According to VNFOREST, around 30% of wood imported

into Vietnam comes from countries classified as high-risk

of timber legality.

Careful investigation of recent development of timber

imports and identification of possibilities for improving

domestic regulatory framework becomes imperative. With

in-depth analysis of collected data collection and inclusive

interviews of relevant stakeholder groups, this paper

provides an overview of Vietnam’s timber imports 2015 -

2020, and presents recommendations for improving

policies and regulations related to the VNTLAS.

Of great implication is the proposed adjustment of criteria

for risk-classification and clarification of global timber

certification schemes. The authors also call for

strengthening bilateral ties with low-risk countries, using

IT to support compliance mechanisms and identify

additional low-risk suppliers to secure timber imports.

Introduction

Vietnam has been pursuing an intensive integration into

the global economy. As of January 2022, Vietnam has

signed 15 bilateral and multilateral Free Trade Agreements

(FTA) covering 53 trade partners, and all of these FTAs

are currently effective and significantly account for the

country’s international trade (Handbook “Rules of origin

in FTAs to which Vietnam is a signatory”, 2022).

In line with these FTAs, Vietnam’s wood industry has

been pro-actively integrating into the global supply chain

of wood and wood products. Vietnam has been importing

large volumes of timber from over 100 source countries.

In the period 2016 – 2020, the volume of imported timber

amounted to 7 - 9 million cu.m of round wood equivalent

with the value of 2.2 – 2.5 billion US$.

However, the share of locally sourced wood has been

gradually taking over the imports. The imports contributed

70% of raw material input used in Vietnam’s wood

industry in 2010, the rest of 30% was covered by imports.

In 2022 the imported wood is expected to share 25% of the

total wood consumption in Vietnam (Viet Nam

Administration of Forestry, 2022).

The top 5 markets of wood and wood products exported

from Vietnam, including the US, Japan, China, EU and

Korea, have all put in place timber legality regulations. To

respond on the requirements imposed by major customers,

Vietnam has promulgated Decree No. 102/2020/NĐ-CP

dated 1 September 2020 by the Government to specify the

implimentation of Vietnam Timber Legality Assurance

System (VNTLAS).

In accordance with this Decree (Clause 1, Article 3), legal

timber is defined as “timber or timber products that are

harvested, imported, confiscated, transported, traded,

processed, exported in accordance with Vietnamese legal

regulations and regulations under international treaties to

which Viet Nam is a signatory and relevant legal

regulation of the country in which timber is harvested”.

Moreover, the VPA/FLEGT between Viet Nam and the

European Union (EU), which entered into force since June

2019, is a legally binding agreement aimed at

strengthening forest governance and promoting trade in

legal wood and wood products exported from Vietnam to

the EU markets.

Along with opportunities, the agreement also presents

challenges for the timber industry of Vietnam, including

(i) higher competition (there are 53 economic partners

within the scope of the signed agreements), and (ii) more

strict regulations for controlling the legality of timber

origin (Ministry of Agriculture and Rural Development,

2022). To cope with this development, Vietnam has

applied policies to achieve better control and management

of imported timber.

According to Decision No. 4832/QĐ-BNN-TCLN, issued

in 2020 by the Ministry of Agriculture and Rural

Development, countries from where Viet Nam imports

timber can be classified as either of active (low-risk) or

non-active (high-risk) geographical areas with respect to

timber legality concerns.

Of the over 100 countries which are exporting wood to

Vietnam, 51 countries are classified as of active, the rest

are of non-active geographical areas.

Following this classification, importers have to submit

additional documents and evidences to prove timber

legality while importing timber from countries of nonactive

geographical areas.

The objective of this paper is to assess the situation of

imported timber 2015 - 2020, focusing on the risk-based

control and management mechanisms instituted by

VNTLAS. The authors provide an overview of imported

timber in Vietnam, and recommend solutions to support

Vietnam’s timber legality requirements.

These recommendations include adjusting the criteria for

classifying low-risk countries, providing more details on

requirements for conducting due diligence on timber

legality, and clarification of forest certification schemes

applicable in Vietnam.

The authors also call for strengthening bilateral relations

with low-risk countries, promoting the application of IT to

faster the identification of timber origin, and furthering

market studies to identify new low-risk countries for

legally sourced timber procurement.

This paper summarises the results of a research project

titled “Research on development of domestic markets of

wood and wood products for restructuring of Viet Nam’s

forestry sector”.

Collection of secondary information and data

Data and information were compiled from reports on

import and export of timber and timber products published

by the Viet Nam Timber and Forest Products Association

(VIFOREST); statistical data on import and export

announced by Vietnam General Department of Customs

2015 – 2020; and comprehensive reports prepared by

Forest Trends, VIFOREST and local associations.

In addition, data was collected and analyzed through a

careful overview of scientific reports and other materials

related to imported timber and policies on management of

legal timber.

Lastly, extensive consultations with a large range of

experts in multiple fields (incl. agro-forestry and fishery

market management, agro-forestry and fishery processing,

customs, forest protection) to identify and verify solutions

towards proper management of imported timber with

special attention to timber legality assurance.

Data processing

Excel software is used to process and analyse data and

calculate volume, value, proportion of imported timber.

Moreover, attempts have been made by the authors to

investigate the key timber suppliers/exporters which are

classified by risk geographical areas as follows:

Major timber exporters (round timber and sawn

timber) who have the largest volume of timber

exported to Vietnam 2015 – 2020.

Major timber exporters which are listed in

active/nonactive geographical areas and the risk

of timber species they are exporting to Vietnam

in accordance with Decision No. 4832/QĐ-BNNTCLN

in 2020 by the Ministry of Agriculture and

Rural Development.

This Decision defined the list of timber species that have

been imported into Vietnam and the list of countries

belonging to active or nonactive geographical areas.

Accordingly, 51 countries which are exporting wood to

Vietnam have been listed as of active geographical areas.

The categorisation of risk geographical areas helps assess

the risk levels of timber raw materials imported into

Vietnam and suggest solutions to strengthen the control

and management of the timber inputs.

The current situation of imported timber raw materials:

Round wood imports

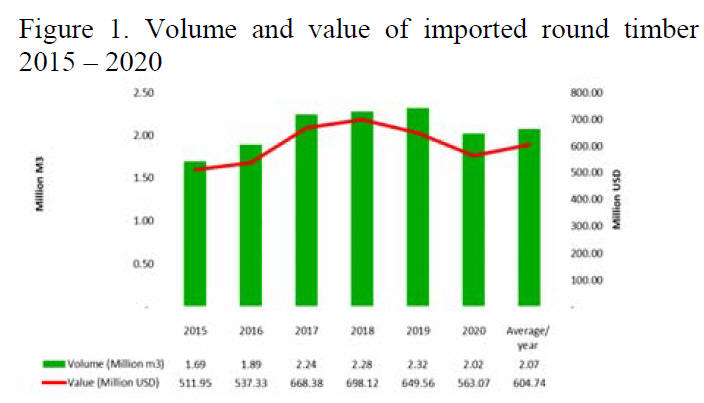

The volume of imported round timber has increased from

1.69 million cu.m in 2015 to 2.32 million cu.m in 2019,

equivalent to an increase of 37% compared to 2015. The

value of imported round timber has also increased from

511 million US$ in 2015 to 698 million US$ in 2018.

In 2020, due to impacts of the Covid-19 pandemic, volume

of imported round timber slightly decreased, reaching 2.02

million cu.m, equivalent to a value of 563 million US$.

The average annual volume of imported round timber is

about 2.07 million cu.m, equivalent to 604.7 million US$.

The volume and value of imported round timber are shown

in Figure 1.

Main countries exporting round timber to

Viet Nam

Round timber is imported into Vietnam from more than

100 countries and territories. However, only few countries

have large volume of round timber exported to Viet Nam.

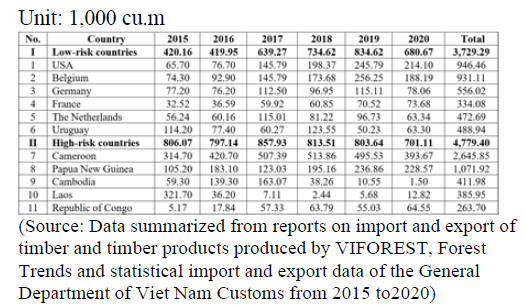

Table 1 below lists countries which are exporting large

volume of round timber to Vietnam. These countries share

about 65 – 70% of total import of round timber and are

classified into two categories, namely low-risk and highrisk

geographical areas.

Countries of active or low-risk geographical areas

include

the US, Belgium, Germany, the Netherlands and Uruguay

etc. The US is the largest round timber exporter to Viet

Nam with an average of 157,000 cu.m per year and about

946,460 cu.m for in the whole 2015 – 2020 period.

Countries of non-active or high-risk geographical includes

Cameroon, Papua New Guinea, Cambodia, Laos and

Republic of Congo etc.

Cameroon is the largest round timber exporter to Vietnam

with an average of 0.4 – 0.5 million cu.m per year and 2.6

million cu.m for the whole period.

The volume of round timber imported from Laos and

Cambodia has sharply decreased over the investigated

period 2016 – 2020. In the recent past, before 2015, Laos

and Cambodia used to be largest exporters for Vietnam.

Figure 2. Proportion (%) of round timber imported into

Vietnam from major sourcing countries of high-risk

geographical areas 2015 - 2020

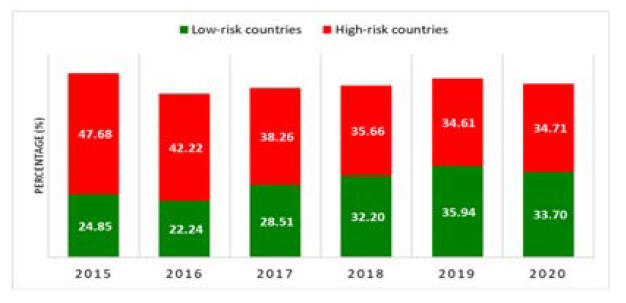

Table 1 and Figure 2 show that in 2015 the volume of

timber imported from major sourcing countries

categorized as high-risk geographical regions totaled

806,070 cu.m, nearly double the volume of timber

imported from low-risk geographical countries, accounting

for 47.68% of total round timber supplies of Viet Nam.

However, by 2020, the volume of timber imported from

high-risk geographical countries decreased to about

701,110 cu.m, accounting for 34,71% of total volume of

imported timber, while the volume of timber imported

from low-risk geographical countries increased to 680,670

cu.m, accounting for 33.7%.

The volume of round timber imported from USA and

Belgium has rapidly increased over the years.

The volume of round timber imported from USA alone

increased from 65,700 cu.m in 2015 to 214,100 cu.m in

2020. In contrast, the volume of round timber imported

from some countries such as Laos and Cambodia has

rapidly decreased as these countries have implemented

policies to restrict the export of round timber. The volume

of round timber imported from Laos decreased from

321,700 cu.m in 2015 to 12,820 cu.m in 2020, down 96%

compared to 2015.

Table 2 summarizes the value of round timber imported

from low-risk and high-risk geographical countries.

Cameroon, USA, Belgium, Papua New Guinea are leading

with respect to the value of round timber exported to Viet

Nam. Particularly, Cameroon has high export value with

an average of 150-200 million US$ per year, reaching over

1 million US$ during in the 2015 – 2020 period.

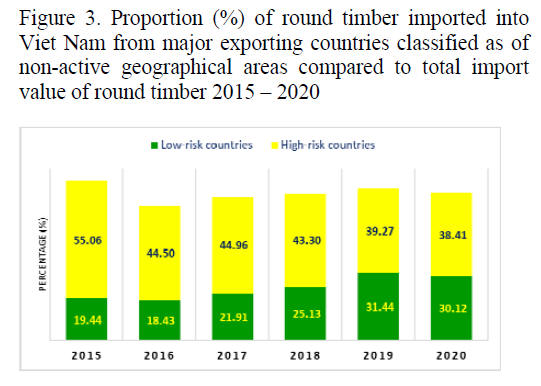

The value of timber imported from these countries’

accounts for 65-75% of total import value of round timber.

Moreover, in this period, the value of round timber

imported from low-risk geographical countries has

increased whereas the value of round timber imported

from high-risk geographical countries has decreased from

55.06% in 2015 to 38.41% in 2020 (Figure 3). This is

considered as a positive signal of the implementation of

VPA/FLEGT and policies to control and manage timber

imported into Viet Nam.

The current situation of imported sawn

timber

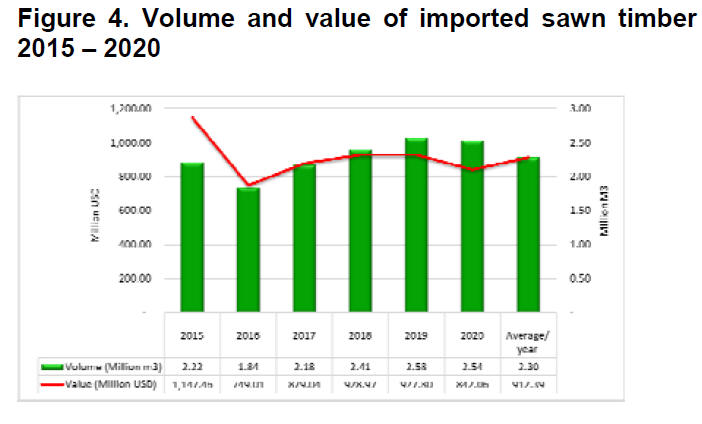

The import volume of sawn timber increased from 2.22

million cu.m in 2015 to 2.54 million cu.m in 2020 (the

annual average import volume is about 2.3 million cu.m).

However, the import value of sawn timber decreased from

1,147 million US$ in 2015 to 749.01 million US$ in 2016.

The average import value is about 912 million US$ with

minor fluctuations likely influenced by the decline of rare

and precious timber species imported from Laos and

Cambodia. The change in volume and value of imported

sawn timber is summarised in Figure 4 below.

Major countries supplying sawn timber to

Viet Nam

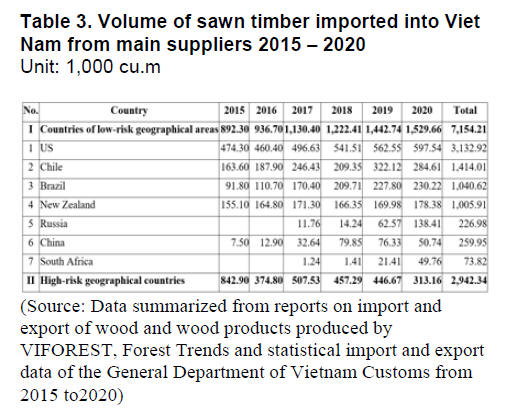

Viet Nam imports sawn timber from various countries

including USA, Chile, Brazil, New Zealand, Cambodia

etc. (hereinafter referred to a “main supplier”). The US is

the largest supplier with volumes increasing from 474,000

cu.m in 2015 to 597,000 cu.m in 2020.

Between 2015 - 2020, the total volume of sawn timber

imported from the main suppliers account for 75-80% of

the total import volume of sawn timber, equivalent to

about 7.74 million cu.m.

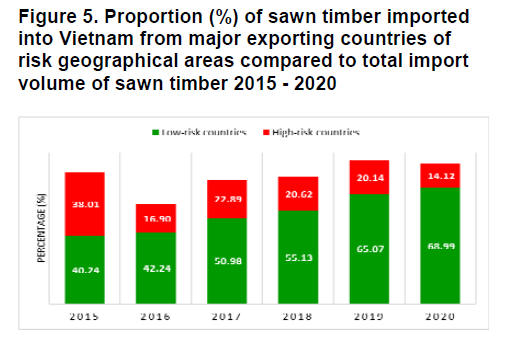

As observed in Table 3, the volume of sawn timber

imported from low-risk suppliers has been increasing fast.

In 2015, the volume of sawn timber imported from the

main suppliers of low-risk and high-risk geographical

areas amounted to approximately 850,000 cu.m,

accounting for 38% and 40% for the low-risk and highrisk

categories.

However, these proportions have changed in recent years.

In 2020, the volume of sawn timber from main suppliers

of low-risk geographical areas increased by 1.53 million

cu.m, nearly double the import volume in 2015,

accounting for 68.99% of total import volume of sawn

timber.

Meanwhile, the volume of sawn timber imported from

main suppliers in high-risk geographical areas contributes

just 14.12% of total import volume of sawn timber in

2020.

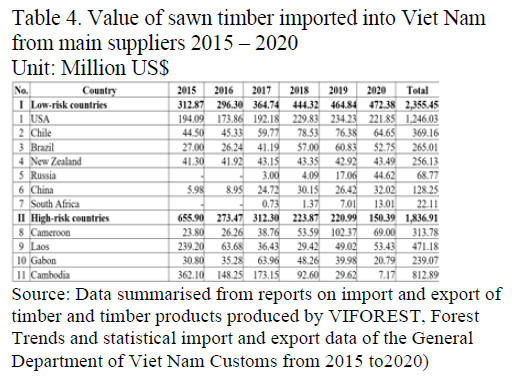

Table 4 presents the value of imported sawn timber

from

main suppliers which account for 75 - 85% of the total

import value of sawn timber. The import value of sawn

timber from the US amounts to 200 - 250 million US$ per

year. Of special attention is the decrease of import value of

sawn timber from Laos and Cambodia (e.g. from

Cambodia the value decreased from US$ 362 million in

2015 down to US$ 7.17 million in 2020).

The total import value of sawn timber from countries of

high-risk geographical areas significantly decreased from

655.9 million US$ in 2015 to around 150.4 million US$ in

2020.

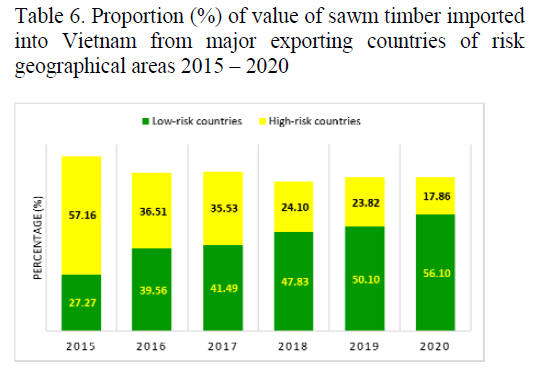

Thus, as of 2020, the import value of sawn timber from

high-risk geographical areas accounted for just 17.86%,

while the import value of sawn timber from countries of

low-risk geographical areas (472 million US$) accounted

for 56.1% of total import value of timber in 2020.

Promulgation and implementation of policies

on

managing imported timber to ensure timber legality

The regulatory framework applicable for timber legality

assurance covers the following legal documents:

Decision No. 1624/QĐ-TTg dated 14 November 2019 of

the Prime Minister to approve the plan for implementation

of the Voluntary Partnership Agreement between the

Socialist Republic of Viet Nam and the European Union

on Forest Law Enforcement, Governance and Trade

(VPA/FLEGT). This Decision specified tasks and

responsibilities of relevant agencies and organizations in

VPA/FLEGT implementation.

Decree No. 102/2020/NĐ-CP dated 1 September 2020 of

the Government to promulgate Vietnam Timber Legality

Assurance System (VNTLAS). The Decree has specified

the main contents of the VPA/FLEGT, including

management of imported timber and supply chain control

in the Vietnamese context. Accordingly, enterprises

importing timber into Viet Nam from high-risk

geographical areas are subject to due diligence practice

and submission of additional evidences to prove the

legality of imported timber.

Decision No. 4832/QĐ-BNN-TCLN dated 27 November

2020 of the Minister of Agriculture and Rural

Development to announce the list of timber species which

have been imported into Viet Nam and the list of countries

attributed to active/non-active geographical areas.

According to this Decision, the number of timber species

which have been entered Vietnam has been recorded 322

species and 51 countries have been classified as of active

or low-risk geographical areas. Those imported timber

species and timber exporting countries that are not listed in

this Decision will be considered as risk timber species and

countries of high-risk geographical areas.

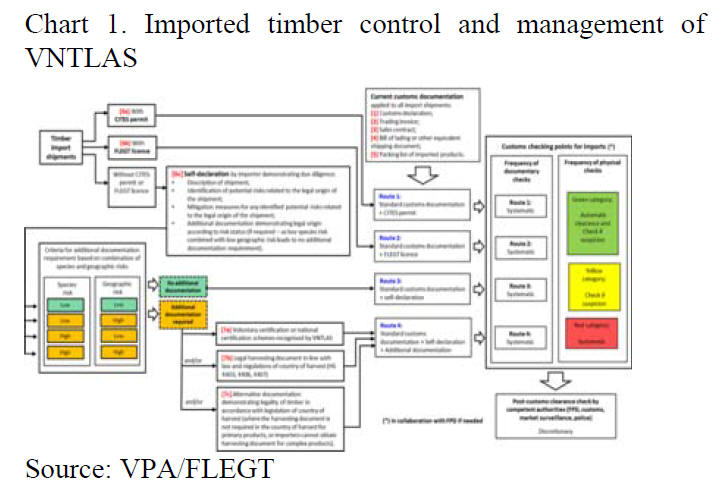

Control and management of imported timber

Chart 1 outlines the procedure of imported timber control

and defined responsibilities of relevant stakeholders to

ensure timber legality requirements applicable for

imported timber.

In addition to the existing legal framework to

regulate

timber imports, under VNTLAS new regulations have

been promulgated. For example, in accordance with the

Decree No. 102/2020/NĐ-CP specifying the operation of

VNTLAS, risk mitigation measures must be applied by

importers to prevent possible violation.

This Decree also aims to create favorable conditions for

operators to comply with relevant laws. Imported timber

is, therefore, controlled and managed in accordance with

criteria of active/non-active geographical areas with

low/high risk treatment. Importers must comply with

regulations on provision of dossiers, declaration of origin

of imported timber, and take responsibilities for the

accuracy of provided dossiers and declared information

(Clause 4, Article 4, Decree No. 102/2020/NĐ-CP).

Decree 102 assigned the Ministry of Agriculture and Rural

Development to collaborate with relevant agencies (the

General Department of Customs, Ministry of Industry and

Trade, Ministry of Natural Resources and Environment,

Ministry of Foreign Affairs) to define the list of countries

classified as of active geographical areas which are

exporting timber to Viet Nam in accordance with the

international treaties to which Viet Nam is a signatory.

The Decree also stipulates the responsibility of customs

authorities and forest protection agencies in management

of imported timber as well as verification of the legality of

each shipment of imported timber.

Success and challenges in timber legality control and

assurance

One of the most important benefits of the extant timber

legality system is the increase of imported timber from

low-risk countries in the 2015 – 2020 period.

This reduction is likely associated to the system’s

capability to support the adaptability and competitiveness

of the timber industry and institutionalizes the correct

regulations. These policies specified in the aforementioned

legal documents have reduced numerous administrative

procedures for enterprises to help improve the

effectiveness of control and management of imported

timber to meet the VNTLAS requirements.

Moreover, timber processing and trading enterprises have

actively sourced timber raw materials from low-risk

geographical regions while reducing volume and value of

timber imported from high-risk geographical regions.

Challenges

Some challenges remain with respect to the legality of

imported timber. First, the proportion of imported from

non-positive or high-risk geographical regions remains

high, accounting from 14% to 38.4% of total volume of

timber imported into Viet Nam, especially with respect to

imported round timber. Second, the standardization and

synchronization of the national.

TLASs in different countries are complex because these

systems are developed on the basis of independent

national legal systems. Lastly, many countries have not

developed legal regulations for the whole supply chain,

especially the supply chain in which timber is transported

or traded through middlemen.

Recommendations for managing imported timber to

ensure legality of timber

Further clarifying criteria of active geographical

areas/countries which are exporting timber to facilitate the

compliance with timber legality requirements.

The classification of countries/regions based on criteria

defined in Decree No. 102/2020/NĐ-CP and Decision No.

4832/QĐ-BNN-TCLN leads to limited number of low-risk

countries. The authors suggest that those countries that

have signed VPA, but have not reached the stage of

FLEGT licensing and or countries that have been

negotiating with EU to conclude VPA, can also be

considered as of low-risk.

Due diligence practice to avoid illegally sourced timber

along the entire supply chain is complex and resource

consuming. The authors recommend to simplify and due

diligence requirements and take due diligence

performance as a key criterion for imported timber control

under VNTLAS.

Regarding the criterion on national regulatory timber

certification scheme recognised by Viet Nam (under

VNTLAS requirements) there is often a lack of

information to verify the availability of national

timber/forest certification schemes.

The operators from sourcing countries should submit

accurate documents to validate the schemes applicable in

their countries.

Controlling and managing the compliance with legality

requirements applicable for timber imported into Viet

Nam

In accordance to VNTLAS, Viet Nam needs to strengthen

bilateral relations with low-risk countries to stabilize the

supply of imported timber and satisfy wood processing

demands for export.

The national legal framework for each risk geographical

category needs to be finalized in order to facilitate the

management of imported timber.

Strengthen the application of information and technology

for better sharing data between relevant agencies (e.g.

forest protection agencies and customs authorities),

facilitating one-door procedure processing, and optimizing

the fast clearance of import and export procedures.

To satisfy the VNTLAS requirements, enterprises

importing timber from risk markets need to comply with

additional due diligence requirement as specified in the

Decree No. 102/2020/NĐ-CP. Along with due diligence

practice, new market studies should be conducted to select

additional low-risk countries from where to import timber.

These studies should provide necessary evidences for

verification of legal timber origin.

Conclusion

Imported timber plays an important role in the

development of Vietnam’s wood processing industry. The

results of this study indicate positive signals for the growth

of volume and value of timber imports from low-risk

countries.

The authors argue that the national regulatory framework

supporting VNTLAS is key driver of these changes and

facilitating the implementation of the VPA/FLEGT.

Although the timber imported from high-risk geographical

areas is on decline, its share of annual import volume is

still high. Yet, there is a significant proportion of imported

timber coming from natural forests and meeting local

demand in housing and furnishing.

To assure the legal origin of timber Viet Nam needs to

adjust the criteria for categorisation of low-risk countries

and introduce mechanisms to effectively control and

manage the timber and application of information and

technology for the traceability of timber origin.

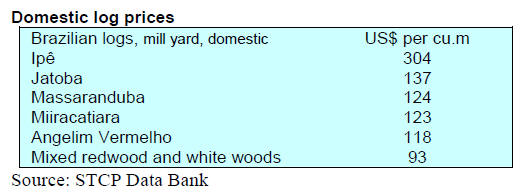

8. BRAZIL

Furniture production increases

According to Abimóvel (Brazilian Furniture Industry

Association) furniture consumption in March 2022 was

28.1 million pieces out of the 29.3 million pieces produced

and this represented an increase of almost 12% over the

previous month.

However, the accumulated consumption January to March

2022 was down 28% compared to the same period in 2021

when the furniture market was influenced by COVID-19

pandemic control measures. Brazilian furniture exports in

March amounted to US$71.6 million, a 4% growth over

the previous month. In April 2022, however, there was a

8% drop over March. In the first quarter of 2022 imports

of furniture manufacturing machinery dropped over 20%

year on year.

See:

https://forestnews.com.br/abimovel-consumo-de-moveisfoi-de-281-milhoes-de-pecas-em-marco/

Combating forest fires

The Ministry of Justice has announced that it will send a

task-force to combat forest fires and unauthorised burning

in Brazilian biomes.

This initiative is part of the’ Operations Guardians of the

Biome’ which will focus this year on regions of the

Amazon, Cerrado, Pantanal, Atlantic Forest and Caatinga

biomes including operations in 9 states of the Amazon

region (Acre, Amazonas, Amapá, Maranhão, Mato Grosso

do Sul, Mato Grosso, Pará, Rondônia, Roraima). The

estimated cost of the task-force is R$77 million.

More than 6,000 staff will work in the task-force including

representatives from the Chico Mendes Institute for

Biodiversity Conservation (ICMbio), the National Public

Security Force and the Brazilian Institute for the

Environment and Renewable Natural Resources

(IBAMA).

The security staff will monitor and implement actions in

places where there are large fire as well as investigate

crimes. The Federal Government expects that the task

force will continue until January 2023 when the critical

drought season should end.

The first phase of the ‘Operations Guardians of the Biome’

against forest fires and wildfires was launched in July

2021 and ended in late January 2022. According to the

government, during that period the professionals of the

task-force tackled 18,000 forest fires and reported 7,000

environmental crimes.

See:

https://forestnews.com.br/ministerio-da-justica-lanca-planode-combate-a-queimadas-florestais-no-brasil/

Brazil-Sweden collaboration to promote sustainability

Brazil and Sweden have established a cooperation

mechanism that can generate proposals for the

development of technologies applied to bio-products and

sustainable forest management. This was announced

during the 3rd Brazil-Sweden Innovation Week when the

Executive Committee of the Brazil-Sweden Working

Group on Innovative Industrial High Technology met.

During the event Brazilian bio-economy specialists visited

the Swedish Research Institute (RISE) to identify

convergence of interests in the development of

technologies for bio-products, bio-materials and SFM.

In November 2022 Swedish specialists will visit to be

briefed on infrastructure of bio-economy research and

innovation in Brazil.

According to the Ministry of Science, Technology and

Innovations (MCTI) the idea is to take advantage of the

knowledge and experience of each country. Brazilians

have experience with the use of biodiversity while Sweden

has extensive forestry skills.

Brazil is currently Sweden's largest trading partner in

Latin America. More than 200 Swedish companies operate

in Brazil generating 70,000 jobs and revenues of R$85

billion according to the Swedish Embassy in Brasilia.

See:

https://summitagro.estadao.com.br/noticias-docampo/brasil-e-suecia-vao-colaborar-em-projetos-desustentabilidade/

Furniture exports disappoint

Furniture exports from Rio Grande do Sul State, one of the

main furniture production clusters in the country, fell 4%

in the first five months of 2022 according to Movergs

(Association of Furniture Industries of the State of Rio

Grande do Sul).

Never-the-less, the performance of furniture sector in the

State remains well-above what was recorded in the same

period in 2020 and 2019 (about 81% and 40% higher,

respectively).

The United States, Chile, Peru, Uruguay, the United

Kingdom, Paraguay, Bolivia and Colombia are the main

export destinations but imports by Peru have fallen.

See:

https://forestnews.com.br/exportacoes-de-moveis-gauchoscaem-42-nos-primeiros-cinco-meses/

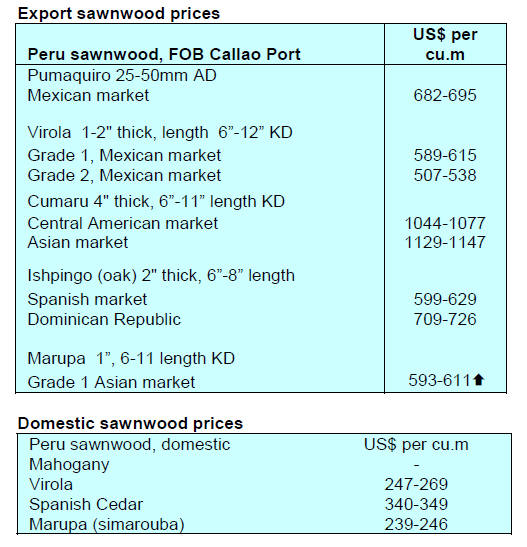

9. PERU

Rising shipments of manufactured

wood products

Exports of manufactured wood products in the first 4

months of the year totalled US$1.1 million, a growth of

140% compared to the same period in 2021 according to

the Extractive Industries Management of the Association

of Exporters (ADEX). This was the highest amount

between January and April over the past five years.

The increase is explained by higher demand from its two

main markets, the US (US$0.33 million) and the United

Arab Emirates (US$0.32 million), with increases of 49%

and 162%, respectively.

These two markets accounted for around 64% of the total.

Spain, Chile, Singapore, Belgium, Colombia, Panama,

France and Italy completed the list of top ten destinations.

The main items exported were chests and cases for jewelry

(US$0.53 million), statuettes and other adornments

(US$0.16 million), pallets, boxes and other cargo

platforms (US$0.12 million). ). The main exporting

regions for these products were Lima (US$0.97 million),

followed by Arequipa, Callao, Áncash and Piura.

These goods were shipped mainly through the Jorge

Chávez airport (US$0.58 million) and by sea (US$0.34

million) through the ports of Callao and Paita (Piura).

In 2021 shipments of manufactured wood products

reached US$1.4 million down 6% compared to 2020 and

down 21% compared to 2019. Last year they represented

just 1.1% of the total wood shipments. It should be noted

that it was in 2018 when these exports had their best

performance reaching US$2.8 million.

Initiatives on commercial forest plantations

The National Forest and Wildlife Service (Serfor) and the

World Bank have announced they will work together to

develop initiatives that promote reforestation and the

establishment of forest plantations.

The General Manager of Serfor, German Jaimes,

confirmed Serfor’s interest in working with the World

Bank on joint action to promote the reactivation of the

forestry sector.

He indicated that Serfor has a new management model that

has three very important pillars: the Forest Investment

Plan by 2050, the Quality and Integrity Management

System and the Investment Project of the National Forest

and Fauna Information System.

The Forest Investment Plan will optimise the

competitiveness of the forest, forest governance, forestry

and wildlife research and the efficient zoning of all the

departments of Peru.

Modifications to the ‘Operations Book provide to

Loreto

In order to improve the registration of information from

Primary Transformation Centers (CTP), the National

Forestry and Wildlife Service (SERFOR) and the Ministry

of Economy and Finance (MEF) have presented a proposal

to modify the so-called ‘Operations Book’ to the forestry

authorities of Loreto.

The proposal has ben prepared with the technical

assistance from USAID Pro-Bosques and modifies the

format in order to improve the way improving transpareny

in traceability of forest products.

According to SERFOR the main contribution in the

proposal is to link the sawnwood with the log’s of origin.

This proposal will allow better traceability and record

much more real information.

After the tests, the regional forestry authorities of Loreto,

Ucayali and Madre de Dios, where this proposal is

presented, will monitor and accompany the sawmills to

obtain the results of this pilot, which will be presented to

SERFOR for approval. Trials will be conducted before it

is introduced.

Exports from Amazon areas

Exports from the Amazonregions (Amazonas, Loreto,

Madre de Dios, San Martín and Ucayali) totalled more

than US$221.1 million between January and April of this

year an increase of 58% compared to the same period in

2021 according to ADEX. This was the highest in recent

years.

According to the ADEX Data Trade Commercial

Intelligence System traditional shipments (US$117.8

million) increased 52% and accounted for 53% of the total

due to the large shipments of hydrocarbons (+31%).

Others were mining (61%) and agriculture (100%).

Added value product exports were value at US$103.2

million and included agricultural products (US$78.6

million) followed by wood (US$23.1 million).

The main market for Amazon products was Brazil with

US$47.3 million. Other markets were India, Mexico, the

US and the Netherlands.

The Madre de Dios region ranked first and exports were of

raw gold, Brazil nuts, molded wood, slats and friezes for

parquet flooring and tropical sawnwood.