US Dollar Exchange Rates of

25th

Mar

2022

China Yuan 6.3642

Report from China

US remains largest market for China¡¯s wooden

furniture

According to China Customs the value of China¡¯s wooden

furniture exports rose 28% to US$25.62 billion in 2021.

The US was the largest accounting for 32% of the total

exports. The value of China¡¯s wooden furniture exports to

the US rose 32% to US$8.15 billion in 2021. Other

markets are very diverse but the top 10 destinations

accounted for 70% of exports.

Chinese furniture manufacturers have seen raw material

cost rising which puts pressure on their profit margins.

Despite this, overall exports still showed a good

performance in 2021.

The value of China¡¯s wooden furniture exports to the main

markets grew at different rates in 2021.

Increase in China¡¯s wooden furniture imports

from

Italy

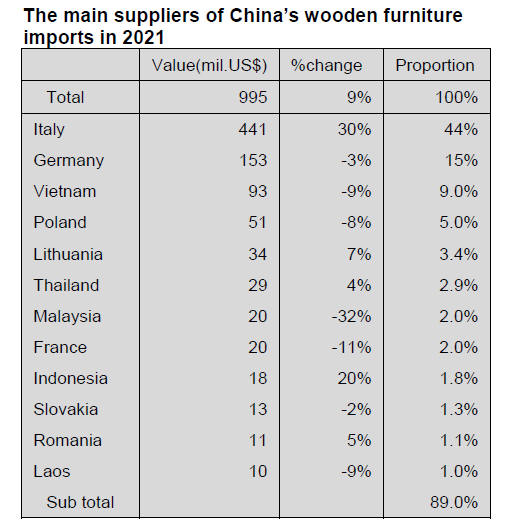

According to China Customs, the value of China¡¯s wooden

furniture imports rose 9% to US$995 million in 2021. Italy

was the largest supplier and accounted for 44% of the

2021 total. The value of China¡¯s wooden furniture imports

from Italy grew 30% to US$441 million in 2021.

The second largest supplier was Germany. In 2021

Germany provided 15% of the total value of imports.

Vietnam and Poland were significant shippers of wooden

furniture to China in 2021shipping US$93 million and

US$51 million respectively in 2021.

In addition, Lithuania, Thailand, Malaysia, France,

Indonesia, Slovakia, Romania and Laos shipped wooden

furniture valued at over US$10 million in 2021.

China¡¯s wooden furniture imports from the top 12

suppliers made up 89% of the national total.

Thailand the main supplier of sawn

rubberwood in

2021

According to China Customs, sawn rubberwood imports in

2021 rose 6% to 3.86 million cubic metres and of this total

over 95% came from Thailand.

Over 80% of imported sawn rubberwood is processed in

Shunde District of Foshan City in Guangdong Province.

The full utilisation of sawn rubberwood has played an

irreplaceable role in stabilising China¡¯s timber imports for

many years. Rubberwood imports are still remarkable

compared with other kinds of timber although domestic

demand for furniture has weakened in recent years.

China¡¯s plywood exports hit a record high

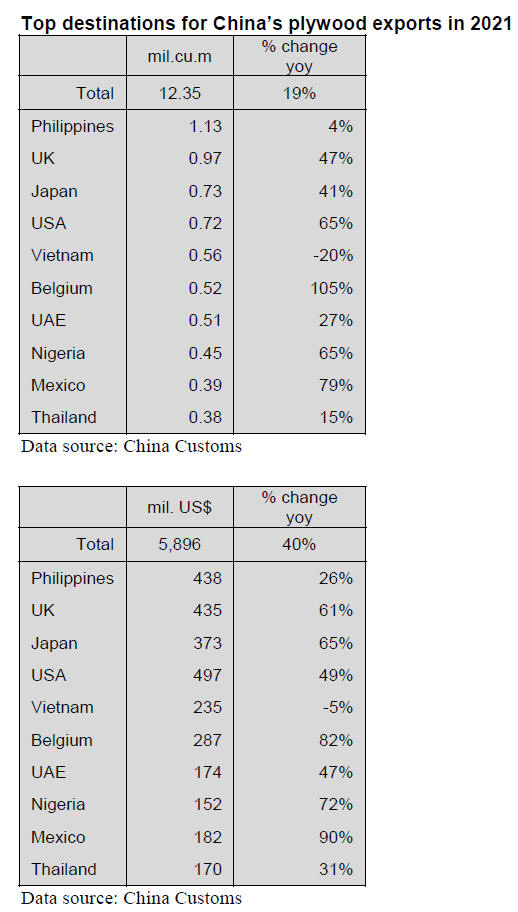

According to China Customs plywood exports were 12.35

million cubic metres valued at US$5.896 billion in 2021,

up 19% in volume and 40% in value year on year.

The volume of China¡¯s plywood exports hit a record high

in 2021. China's plywood exports have been more than 10

million cubic metres since 2012.

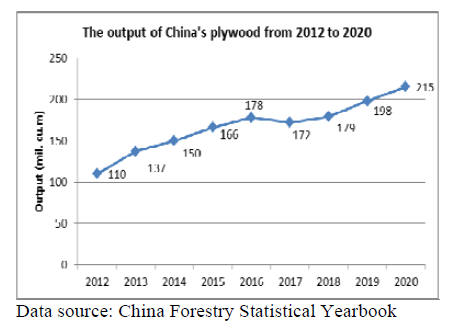

The output of China¡¯s plywood industries has been rising

since 2012 except for a dip at the end of 2019 due to the

covid pandemic. In 2020 output rose 9% to 215 million

cubic metres.

Plywood produced in China is mainly used domestically.

The proportion of China¡¯s plywood output to exports is

around 5%.

Philippines the largest destination for

China¡¯s plywood

exports

The Philippines was the largest market for China¡¯s

plywood exports in 2021 and accounted for 9% of the

national total. China¡¯s plywood export markets are very

diverse and the volume of the top 10 destination countries

made up of just 50% of the national total in 2021. China¡¯s

plywood exports to Vietnam fell 20% to 560,000 cubic

metres in 2021, the only country where there was a

decline.

Rise in China¡¯s plywood imports from Japan

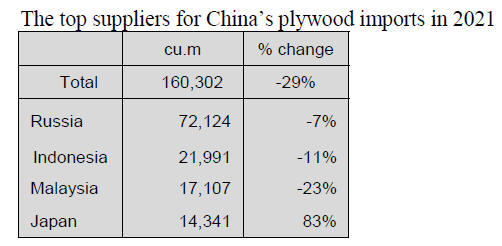

According to China Customs, plywood imports from

Japan were 160,302 cubic metres valued at US$153

million, down 29% in volume year on year. China no

longer imports large quantities of plywood because the

output capacity of plywood in China has been increasing

in recent years.

Russia, Indonesia, Malaysia and Japan were the top 4

suppliers of plywood to China in 2021 accounting for

nearly 80% of the national import. China¡¯s plywood

imports from Russia, Indonesia and Malaysia fell 7%,

11% and 23%in 2021. However, China¡¯s plywood imports

from Japan surged 83% to 14,341 cubic metres in 2021.

Change in China¡¯s 2022 HS code for wood products

Tariff codes for some commodities have been adjusted

according to China Customs. The following HS codes for

wood products have been deleted as of 1 January 2022.

Sawdust wood waste and scrap (4401.4000£©

Teak log£¨ 4403.4910£©

Teak sawnwood£¨ 4407.2910£©

Plywood (4412.9410, 4412.9491, 4412.9492,

4412.9499, 4412.9910, 4412.9991, 4412.9992,

4412.9999£©

Wooden frames for paintings, photos and mirrors

(4414.0010, 4414.0090)

Woodworking for construction, including doors and

windows, frames, thresholds, poles and beams

(4418.1010, 4418.1090, 4418.2000, 4418.6000£©

Wood or bamboo carvings (4420.1011, 4420.1012,

4420.1020, 4420.1090£©

Rattan, willow and Bamboo seats

(9401.4010¡¢9401.4090£©

Wood furniture parts (9403.9000£©

The following HS codes for wood products have been

added as of 1 January 2022.

Wood pellets or sawdust (4401.3200, 4401.4100,

4401.4900£©

Wood charcoal (4402.2000£©

Teak log£¨ 4403.4200£©

Teak sawnwood(4407.2300)

Sawnwood (4407.1300¡¢4407.1400£© £»

Plywood£¨ 4412.1093, 4412.1094, 4412.1095,

4412.4100, 4412.4200, 4412.4911, 4412.4919,

4412.4920, 412.4990, 4412.5100, 4412.5200,

4412.5911, 4412.5919, 412.5920, 4412.5990,

4412.9100, 412.9200, 4412.9920, 4412.9930,

412.9940, 4412.9990£©

Wooden frames for paintings, photos and mirrors

(4414.1000, 4414.9010, 4414.9090£©

Woodworking for construction, including doors and

windows, frames, thresholds, poles and beams

(4418.1100, 4418.1910, 4418.1990, 418.2100,

4418.2900, 4418.3000, 4418.8100, 4418.8200,

4418.8300, ¡¢4418.8900, 418.9200£©

Tropical wood tableware and kitchen utensils

(4419.2000£©

Tropical wood carving or bamboo carvings

(4420.1110, 4420.1120, 4420.1190, 4420.1911,

4420.1912, 4420.1920, 4420.1990£©

Coffins (4421.2000£©

Wooden seats (9401.3100, 9401.3900, 9401.4110,

9401.4190, 9401.4910, 401.4990, 401.9100,

9401.9910, 9401.9990£©

Wood furniture parts (9403.9100, 9403.9900£©

See:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202112/t20211215_3775137.htm

GGSC-CN Index Report (February 2022)

In February with the end of the Spring Festival

all workers have resumed work and production has

increased. China's PMI index registered 52.9% in

February, a slight increase from the January and has been

above 50 for 4 consecutive months indicating that the

macro economy has been stable.

In February timber production and manufacturing

continued its steady upward trend, industrial demand

rebounded, enterprise production was rising and prices for

the main raw materials fell making four consecutive

monthly declines.

The GGSC-CN comprehensive index

for February registered 52.9% ( 37.5% for last

February and 14.1% for February 2020) an increase of

2.7% from the previous month and has been above

50% for two months. See Figure below.

Challenges

Pinus sylvestris logs export was restricted by Russia and

forced a change other species.

Wood resources are scarce and the supply problem is

serious.

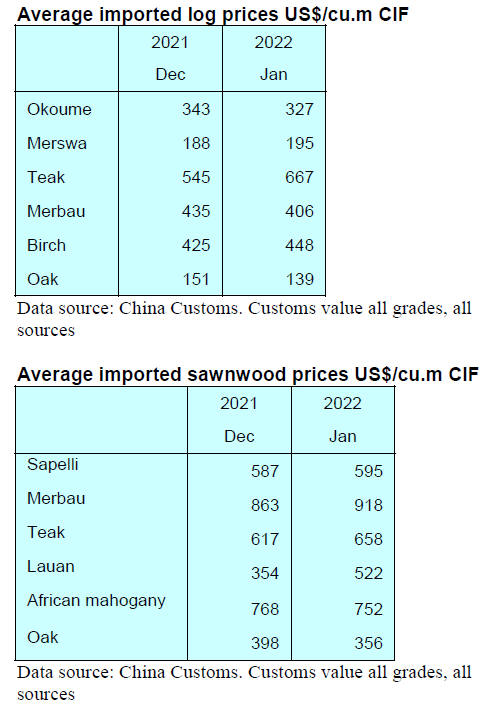

Products in short supply

Merbau, teak, base material, cumaru and oak

Commodity for which the price has increased

Teak, cumaru oak£¬panels£¬solid wood, leather, sponge,

paint, paperboard, glue, firewood, base material and

paraffin.

Commodity of which the price has decreased

Taun, fibreboard, cloth, glass, melamine, urea and

formaldehyde.

In February 2022 four GGSC-CN sub-indices increased

and one declined.

The production index registered 53.9%, an increase from

the previous month and above 50% after four months.

The new order index registered 57.7%, an increase from

the previous month, reflecting the ability of enterprises to

obtain orders is better than last month. Among them the

new export order index, reflecting international trade,

registered 46.2%, down from the previous month.

The main raw material inventory index registered 42.3%,

indicating that the raw material inventory of the forest

products enterprises surveyed is less than that of last

month.

The employment index registered 46.2% and the supplier

delivery time index was 57.7% indicating that the supply

time of raw material suppliers was much faster than the

previos month.

See:

http://www.itto-ggsc.org/site/article_detail/id/234

|