Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Mar

2022

Japan Yen 124.0

Reports From Japan

All restrictions lifted

The government has lifted all covid restrictions in the

remaining 18 prefectures where they were in place. This

decision comes as daily cases are around half the number

at the peak of the sixth wave and the hospital bed

occupancy rate for covid continues to decline.

See:

https://www.japantimes.co.jp/news/2022/03/16/national/coronavirus-emergency-travel-cases/

In related news, the government will raise the limit on

daily international arrivals in Japan to 10,000 from April

from the current 7,000 as strict border regulations have

been criticised by the private sector.

Economy faces downside risks

The March Cabinet Office report says country¡¯s economy

¡°continues to show movements of picking up, although

some weaknesses are seen¡±. This assessment is unchanged

from the February report in which the government lowered

its basic economic view for the first time in five months,

citing weakness in private consumption. However, the

report warns there are downside risks arising from the

Russian invasion of Ukraine.

See:

https://www.japantimes.co.jp/news/2022/03/25/business/economy-business/japan-economy-view-unchanged/

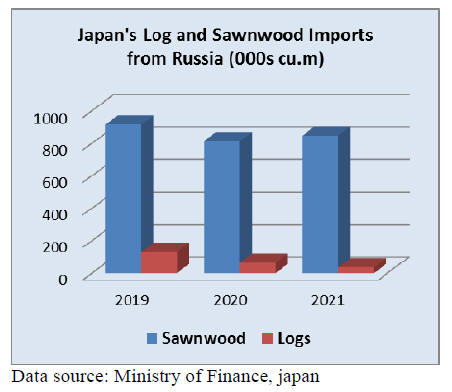

Russia bans wood product exports to Japan

The Russian government announced on 10 March that it

has stopped exporting logs, wood chip and veneer to

unfriendly countries in retaliation for the imposition of

sanction. Japan is one of the countries deemed ¡®unfriendly¡¯

by Russia.

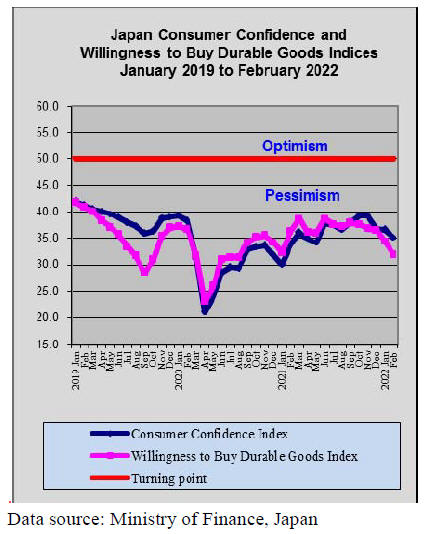

Risng prices drives down confidence

Government data showed that consumer prices rose for the

sixth straight month in February as households paid more

for gasoline and electricity.

The data indicated that energy prices surged 20%, the

biggest rise in over 40 years. Petrol prices surged 22% and

food prices rose by around 3%. If this continues consumer

confidence will be driven lower.

Serious earthquake rocks eastern Japan

A very strong earthquake shook Japan mid-month

damaging a large number of homes and leaving 3 people

dead. The quake also disrupted transportation systems and

supply chains in northeast of the country.

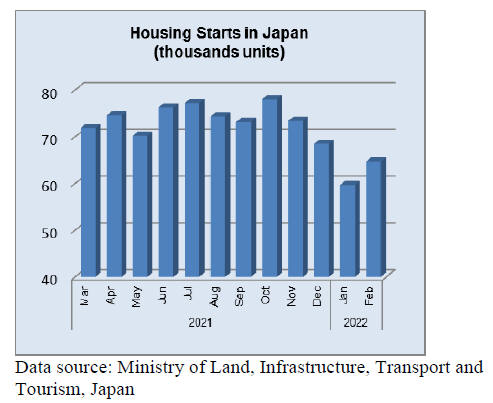

Marriages drop to post war low

The Ministry of Health, Labor and Welfare has released

population statistics showing a further decline in the birth

rate in 2021, the sixth consecutive year of decline. The

number of marriages also declined to a postwar low.

The decline in births is bound to continue as the marriage

rate drops and this will have an impact on demand for new

homes.

See:

https://www.nippon.com/en/japandata/h01267/?cx_recs_click=true

February 2022 housing starts rose 8% year on year and jumped

11% compared to January. As the weather improves building

activity picks up.

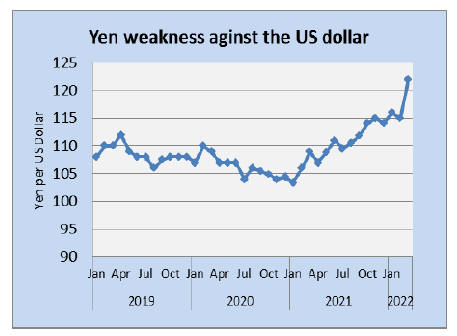

Yen at 5 year low

The yen is facing strong downward pressure against the

US dollar raising the risk to the Japanese economy as the

cost of imports will rise, a situation aggravated by the

Russian invasion of Ukraine.

A recent decision by the Bank of Japan (BoJ) to extend the

loose monetary policy while other developed countries are

scaling back economic stimulus to dampen inflation drove

the yen to its lowest in five years. Mid March the yen was

trading at 119 to the US dollar.

See:

https://www.nippon.com/en/news/yjj2022031501080/

Import update

Wooden door and window imports

The Ministry of Finance has not published January 2022

import data for either wooden doors (HS441820) or

wooden windows (HS441810).

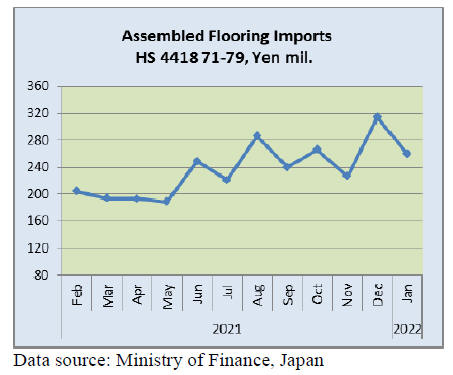

Assembled wooden flooring imports

Despite the dip in the value of assembled flooring

(HS441871-79) imports in January this year there has been

a steady upward trend in the import value since May 2021.

Year on year, assembled wooden flooring imports were up

56% in January 2022 but the January figure was down by

17% compared to that in December 2021.

The main category of assembled flooring imported by

Japan is HS441875 accounting for around 70% of January

2022 imports with the main suppliers being China and

Vietnam and Malaysia. The second ranked category in

terms of value of imports was HS441879 shipped mainly

from China, Thailand and Vietnam.

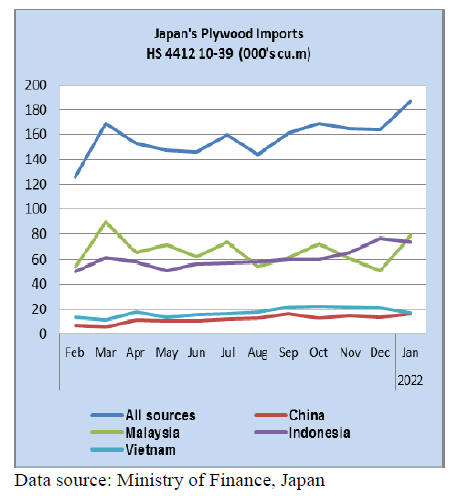

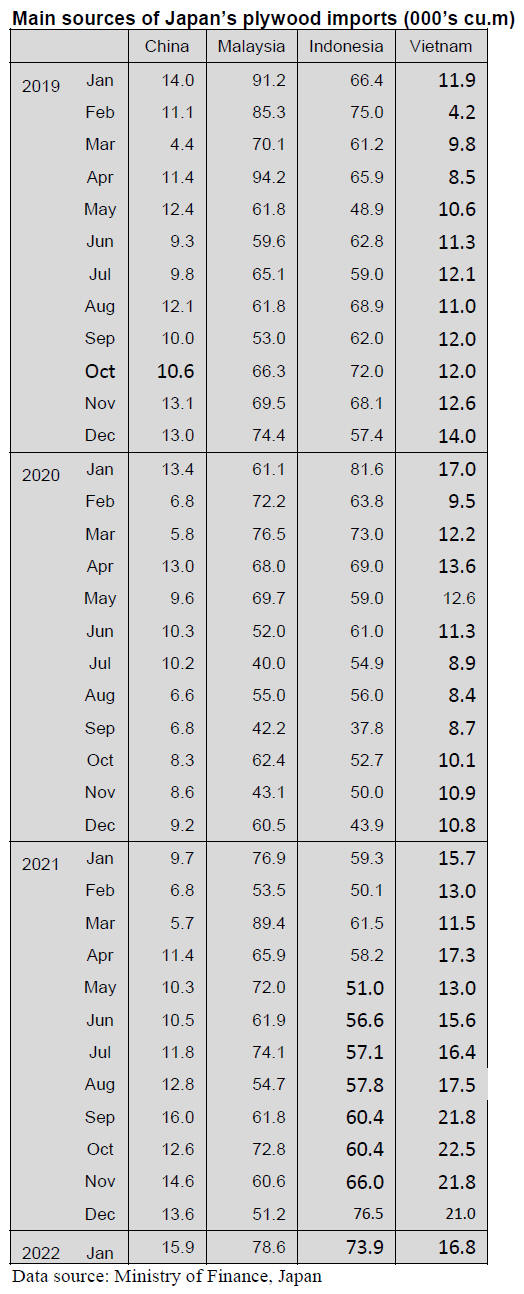

Plywood imports

There was a surge in imports of plywood (HS441210-39)

in January this year due to rising demand and a drop in the

availability of plywood manufactured from domestic raw

materials. Year on year, January 2022 plywood import

volumes rose 14% and compared to a month earlier

January import volumes were also 14% higher.

Malaysia and Indonesia are the main plywood shippers

to

Japan and in January 2022 shipments from Malaysia rose

sharply to a level not seen since March 2021. In contrast

shipments from Indonesia eased slightly in January.

The other significant shippers of plywood to Japan are

China and Vietnam and in January shipments from China

were up month on month while those from Vietnam fell

slightly.

Of the various categories of plywood imported in

January

2022 (as in other months) HS441231 was the most

common accounting for almost 90% of imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Russia bans export of wood products

The Russian government announced on March 10 that it

stops exporting logs, wood chip and veneer to unfriendly

countries for retaliation of the sanctions the Western

nations taken for the invasion of Russia to Ukraine.

Log export has been banned already so there is no damage

but users of wood chip and veneer will suffer greatly.

Particularly veneer is important material to maintain

quality of plywood so the Japanese plywood

manufacturers need to find substituting sources in a hurry.

Lumber is not included in this measure.

For Japan, larch KD veneer from Terneiles, Plastin,

Primorski Krai and RFP, Khabarovsk are immediate

product. Both exports about 250,000 cbms a year from

these two sources. Larch veneer has high strength and it is

kiln dried so plywood mills in Japan do not have to dry it,

which makes operations efficiently.

Since plywood mills struggle to secure enough raw

material like domestic cedar logs, stop of Russian veneer

supply is really hard blow. Plywood mills are now looking

for substitutions such as eucalyptus, beech, birch, Douglas

fir, radiate pine but immediate supply is difficult.

Actually target of this measure is European countries,

where Russian wood chip is consumed in large volume for

fuel and paper manufacturing. In Europe, wood products

supply from Russia, Ukraine and Belarus are significantly

important.

It is said that lumber export from Russia to the European

countries is 5.2 million cbms so once such supply is

disrupted export of European wood products for the North

America and Japan would drop down and the prices would

soar. This could be another wood shock.

Plywood supply

The shipping of domestic plywood has been exceeding

production. The volume of imported plywood was over

250,000 cbms for the first time in three years. About

80,000 cbms of plywood were imported from Malaysia,

same volume as Indonesia. Volume of over 80,000 cbms

continued from Indonesia for straight two months.

The volume of imported plywood from Malaysia and

Indonesia increased because there was a delay of arrival

by a Japanese New Year¡¯s holiday.

There was another reason that a busy exporting plywood

to North America from Malaysia or Indonesia peaked out

and they shipped more for Japan.

Shortage of imported South Sea hardwood plywood had

slightly solved. However, since one of major plywood

companies in Malaysia stopped accepting new orders in

November, 2021, the imported volume would be low in

February 2022. This situation would continue until March.

Some plywood companies in Malaysia and Indonesia are

suffering a lack of logs. They have a very few orders

which are a half of usual amount of orders.

There is not enough supply of softwood plywood in Japan

due to a New Year¡¯s holiday and a heavy snow covered in

North Eastern Japan. There were not enough domestic logs

and larch laminated veneer from Russia. Plywood mills

are not able to increase the production despite active

orders.

On the other hand, the shipping was firm. According to

Japan Plywood Manufacturers¡¯ Association, a final

inventory at the end of January was 77,000 cbms, which

was 1,400 cbms less than December, 2021. This is only

0.3 month supply based on shipping volume. Some

plywood manufacturers in Japan say that shipping will be

more than production in February and March.

South Sea logs and lumber

Malaysia and Indonesia are in the middle of rainy season

so log production is extremely low since late February.

Local plywood mills in Malaysia continue struggling to

secure logs then labor shortage continues after Indonesian

workers are not able to work in Malaysia because of

corona epidemic.

PNG is also in rainy season so log production is way down

and arranging ship¡¯s space become difficult after volume

for Japan becomes minimal.

South Sea lumber manufacturers secure ample logs to cut

but truck body lumber demand is inactive because truck

manufacturing is delayed by shortage of semi-conductor.

South Sea hardwood veneer started arriving after it

delayed by container shortage.

Dealers of Chinese made laminated free board in Japan

have ample inventory and contract balance so they are in

no hurry to make future contract. Chinese manufacturers

maintain present prices with high cost of Russian red pine

lumber and adhesive.

There is no influence of Russian invasion to Ukraine but it

may be good reason to maintain the prices.

Indonesian mercusii pine lumber is arriving much

smoothly after container shortage problem eased but there

is no excessive import. After all, supply and demand

balance well by tight supply during rainy season and

stagnating demand in Japan.

Sumitomo Forestry¡¯s business plan

Sumitomo Forestry Co., Ltd., announced a mid- to-long

term business plan. The plan is about aiming carbon zero

society by expanding forest and using wood in the future.

The company sets the goal at 2,500 billion yen of

recurring profit in 2030.

Reducing CO2 by maintaining and expanding forest is one

of the goals and logging and reforestation at aged manmade

forest in Japan is as well. For details, Sumitomo

keeps a total of 279,000 hectares in Indonesia, Papua New

Guinea, NZ and including 48,000 ha in Japan. Then it will

expand the forest land to 500,000 hectares by adding the

area in Australia, North America and South America.

10,000 billion yen will be used for managing plan of

global forest fund.

The company also launches a new section which involves

a management of forest business and a weather satellite for

controlling the forest growing. It will build wooden

industrial complex in Japan by investing 200 billion yen

for three years. Target is about 1,000,000 cbms of

domestic logs will be consumed as of 2030.

As the first step, Sumitomo will build a new biomass

energy plant at Shibu city in Kyusyu area and starts

operating it in 2025. In this area, majority of logs are

exported but Sumitomo plans to make value added

products from local logs and export will be four locations

of wood processing complex, which are medium size

wood processing plant with consumption of 200,000-

300,000 cbms of logs.

In section of construction department, Sumitomo will

promote decarbonizing and LCCM housing as standard on

the process of planning. Sumitomo will build a six-story

building in London, the United Kingdom with calculating

the volume of CO2. Sumitomo has built 11,230 units in

the United States, 3,169 units in Australia and 2,534 units

in other countries. They will build 23,000 units in the

United States and 5,500 units in Australia and 11,500 units

in other countries. 10,000 units will be built in Japan as

well. The total units will be 50,000 units in 2030.

Sumitomo¡¯s target figure for sales of building materials in

2024 is 2,640 billion yen, 21.7% more than December,

2021. Housing in overseas and the real estate business is

9,540 billion yen, which will be 48% more from

December, 2021.

Housing and construction in Japan are 5,470 billion yen,

7.1% increasing. Resource and environment are 265

billion yen, 18.8% more than December, 2021. The total

sales will be 1 trillion and 7,700 billion yen, 27.7% more

than December 2021 and the recurring profit will be 1,730

billion yen, 25.6% increasing.

Sumitomo plans for building 9,750 units in Japan, 0.4%

increasing from December, 2021. 16,000 units in the

United States. This is 42.5% more than before. 4,000 units

in Australia. This is 26.2% increasing.

|