US Dollar Exchange Rates of

25th

Feb

2022

China Yuan 6.3292

Report from China

Rise in house prices a relief for real estate companies

More mainland cities are trying to support the real estate

sector by easing the requirements on down payments and

mortgage financing to reverse the worst decline in home

sales in a decade which economists fear could threaten the

broader economy. Data from the China Real Estate

Information Corp shows the top 100 real estate developers

saw sales drop 40% year on year in January.

China¡¯s US$1.7 trillion housing market has begun to

unravel as the economy in the fourth quarter grew at the

slowest pace in 18 months.

A press release from China's National Bureau of Statistics

(NBS) suggests that house prices have started to recover, a

positive sign that a steep decline in the real estate sector is

beginning to be brought under control following the policy

adjustments in the fourth quarter of 2021.

See:

https://www.scmp.com/business/chinabusiness/article/3167946/chinas-housing-market-gets-lifelinescities-lenders-ease

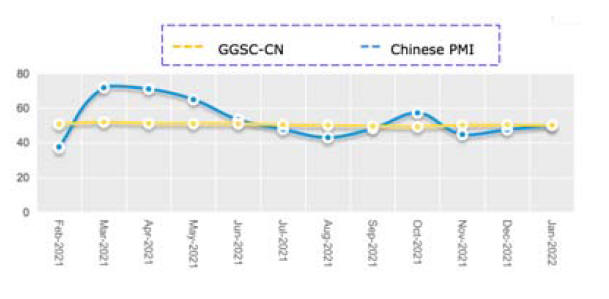

GGSC-CN Index, January 2022

In January 202, China's PMI index registered 50.1%,

a decrease of 0.2% from the previous month but still in

the expansion range (i.e. above 50%) for 3 consecutive

months. Howeverthe triple pressure of shrinking demand,

supply shock and weakening business expectation still

exists.

In January wood product manufacturing remained stable;

new orders increased but foreign demand was relatively

sluggish. The output on the supply side remained stable

and the prices of the main raw materials fell for the third

consecutive month.

The GGSC-CN comprehensive index for January

registered 50.2 (42.9 for Jan. 2021 and 48.4% for Jan

2020) an increase of 2.7% from the previous month and

above the critical value of 50. See fig below.

Challenges

Pinus sylvestris log export was banned by Russia's export

which forced Chinese companies to change alternative

species.

The price of chemical raw materials increased sharply,

resulting in a significant increase in production costs.

It has become difficult to purchase base materials.

Wood resources are scarce and the supply chain has been

disrupted.

Products in short supply

Merbau, teak, base material, cumaru oak.

Commodity for which the price has increased

Teak, cumaru, oak, panels, sawnwood, leather, paint and

paraffin.

Commodity of which the price has been decreased

Taun £¬ fibreboard, cloth, glass, melamine, urea,

formaldehyde

As for the GGSC-CN index, in January 2022, two subindexes

increased while three declined. The production

index registered 50%, an increase of 12.5% from the

previous month and above 50% after three months.

The new order index registered 53.6%, a decline of 2.7%

from the previous month reflecting the ability of

enterprises to obtain orders is better than last month. The

new export order index reflecting international trade

registered 35.7%, an increase of 4.5% from the previous

month showing that orders from abroad in January

improved.

The main raw material inventory index registered

39.3%, a

decrease of 4.5% from the previous month.

The employment index registered 42.9%, a decrease

of 13.4% from the previous month. It shows that the

employment of the forest products enterprises is less than

that of last month.

The supplier delivery time index was 60.7% an increase

of 23.2% from the previous month indicating the delivery

time for raw materials has improved.

Log imports

In the report on China¡¯s log imports published in the 1-15

February ITTO Market Report there were several

anomalies. Some were related to the data from China

Customs which shows temperate species HS codes

assigned to timbers from tropical countries. This would

only be possible if the countries in question trans-shipped

imported temperate species to China. It has been

determined that, for the countries involved, this was not

the case.

A revised report on China¡¯s log imports will be published

at a later date.

|