Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Dec

2021

Japan Yen 113.38

Reports From Japan

Win the race against Omicron to

secure growth

In its latest report on Japan's economic and financial

situation the OECD noted that "losing the race against new

variants could result in renewed states of emergency being

declared delaying the recovery," despite progress in the

government's vaccine rollouts. The OECD projected in its

latest economic outlook that the Japanese economy will

grow 1.8 percent in 2021 and 3.4 percent in 2022.

Under virus emergencies, people in Japan had been asked

to refrain from making nonessential outings although the

requests were nonbinding. The OECD added that the

Omicron variant could "aggravate" the employment

prospects of young people after graduating.

See:

https://www.oecd.org/newsroom/japan-broaden-the-digitaltransition-to-strengthen-economic-recovery-from-covid-19-saysoecd.htm

Economy declined 3.6% in the third quarter

The Japanese government says the country's latest

economic downturn bottomed out in May 2020 during the

first wave of the pandemic. A Cabinet Office expert group

said Japan's economy took a turn for the worse on the back

of trade disputes between China and the United States at

the same time a state of emergency was in place for much

of the country, hurting employment and manufacturing.

The group said the downturn extended for 19 months

making it the fourth longest recession since the end of

World War Two.

The economy began to show signs of recovery picking up

in June 2020 but the recovery remains weak with GDP

dropping for three consecutive months to September 2021

and even in comparison with past recovery periods the

current upturn appears to be stalling.

Japan's economy shrank slightly faster than initially

reported in the third quarter, as a sharp rise in local Covid-

19 cases hit private consumption and a global chip supply

shortage hurt corporate sentiment. The economy declined

an annualised 3.6% in the third quarter of this year mainly

due to a larger than expected fall in private consumption

which makes up more than half of GDP.

See:

https://www5.cao.go.jp/keizai3/chiiki/chiiki.html

and

https://www.businesstimes.com.sg/government-economy/japandowngrades-q3-gdp-on-deeper-hit-to-consumer-spending

¡®Shrinkflation¡¯ ¨C Japan¡¯s contribution to economic

jargon

Because consumer prices and wages in Japan have

remained remarkably unchanged for the last 20 years

companies now do all they can to avoid increasing prices

for fear of losing out to competitors. A Japanese website

(www.neage.jp) tracks price changes and hidden price

hikes whereby the product is reduced in size the price

stays the same and has introduced the term ¡®shrinkflation.

In Japan, the impact of deflation means it is difficult to

raise prices directly and that is a headache for the

government which wants to see modest inflation, an

essential component to a virtuous spending cycle to drive

economic growth.

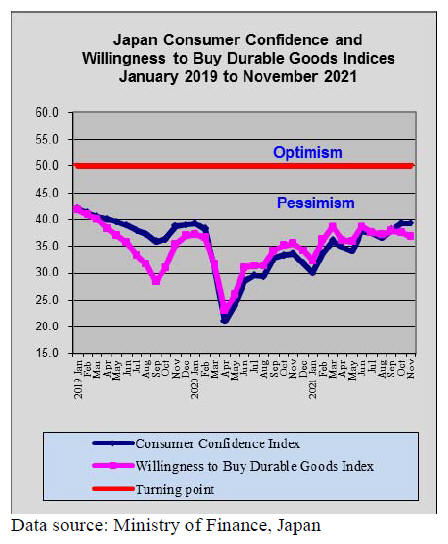

Good news on covid ¨C bad news on energy prices

Despite the rapid decline in the number of Covid-19

infections across the country November consumer

confidence, as recorded by the Japanese Cabinet Office,

was unchanged compared to a month earlier. The main

concern of consumers, it appears, is rising electricity and

gasoline prices.

Of the four component indicators, that for overall

livelihood and willingness to buy durable goods fell for

the second consecutive month. Indicators for income

growth and employment improved for the third straight

month in November.

See:

https://www.japantimes.co.jp/news/2021/12/04/business/economy-business/japan-shrinkflation-economy/

Wage increases or else companies told

In an effort to boost wages and drive domestic

consumption the government has threatened to deny some

tax breaks to big companies that do not hike wages while

boosting deductions for those that do. This proposal is

included in the final draft of the government¡¯s annual tax

reform plan.

Wages in Japan have stayed largely flat over the past 30

years aggravating deflation. The tax plan is part of the

Prime Minister¡¯s focus on distributing wealth to

households.

Large companies that raise wages by 4% from the

previous year will get deductions of up to 30% of taxable

income, up from the current maximum of 20%.

Small firms that raise wages by 2.5% will qualify

for a tax

deduction of up to 40% up from the current 25%.

Companies that do not raise wages will not be able to

claim tax deductions a wide range of expenditure.

See:

https://www.reuters.com/world/asia-pacific/japan-givemassive-tax-breaks-companies-that-lift-wages-draft-plan-2021-12-08/

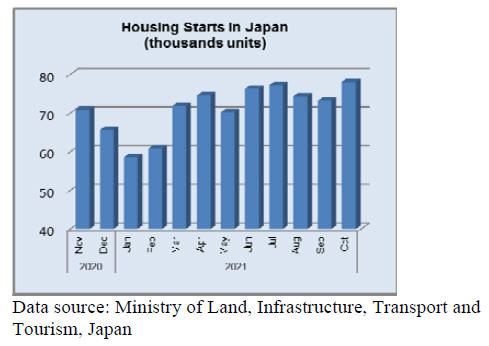

Title

Housing in Japan is cheap relative to that in other

developed economies because of the country's almost

deregulated housing policies which has allowed the

number of houses to grow such that never has housing

demand overtaken supply which has kept prices low.

Housing starts are a barometer of the overall health of an

economy; if starts rise then it means developers and their

bankers are confident enough to build houses and assume

there will be buyers.

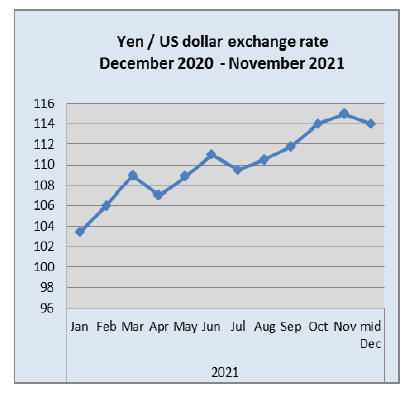

Prices rising as weak yen pushes up import

costs

For most of 2021 the yen has weakened against the US

dollar mainly because of Japan¡¯s continued stuggle with

Covid-19, rising commodity prices and higher US

Treasury yields which pushed the dollar higher. The weak

yen is behind the 9% rise in wholesale prices in

November, the steepest advance for years.

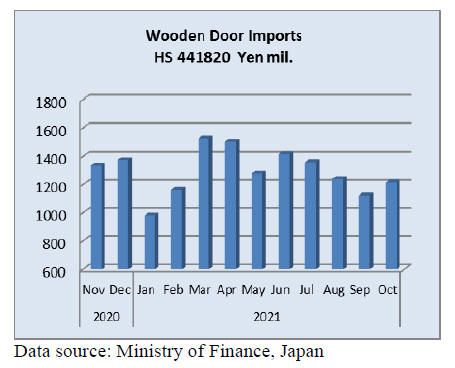

Import update

Wooden door Imports (HS441820)

As was the case in September China accounted for 53% of

Japan¡¯s October 2021 imports of wooden doors. The other

top shippers to Japan were; the Philippines (14%), the US

(17%) and Sweden (11%). There were very few shipments

of wooden doors from SE Asian producers.

Year on year, October wooden door imports (HS441820)

were 6% lower than in than in 2020 and still below the

value of October 2019 imports. After three consecutive

monthly declines the value of Japan¡¯s wooden door

imports rose in October. Theree was only a slight

difference between the value of September and October

2021 imports of wooden doors.

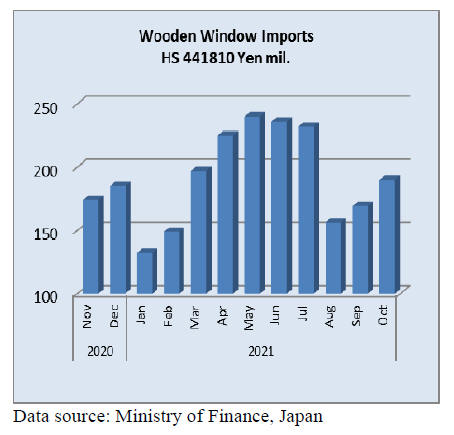

Wooden window imports (HS441810)

After the dramatic decline in the value of August imports

of wooden windows (HS441810) there was a modest

recovery in September and this extended into October.

Month on month there was a 12% rise in the value of

October imports.

Year on year there was little change in the value of

October imports. Despite the rise in October the value of

imports of wooden windows is still well below the levels

seen in October 2019.

Over 80% of Japan¡¯s imports of wooden windows in

October came from shippers in just two countries, China

(58%) (42% in Sept..) and the Philippines 26% (18% in

Sept.). Shippers in these two countries continue to

dominate Japan¡¯s imports of wooden windows.

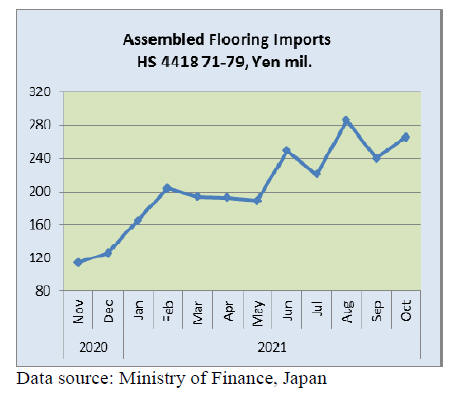

Assembled wooden flooring imports

The value of assembled flooring (HS441471-79) imports

has been erractic since mid-2021 but there is an underlying

upward trend in the value of imports. Year on year, the

value of Japan¡¯s imports of assembled wooden flooring in

October rose a massive 72% (c.f. 22% in September and

the value of imports had recovered to the level reported for

October 2019.

Imports of HS441875 was the main category (77% Oct.

c.f. 72% in Sep.) with most coming from China (46%) and

Vietnam (24%). Shipments from Thailand and Malaysia

were small.

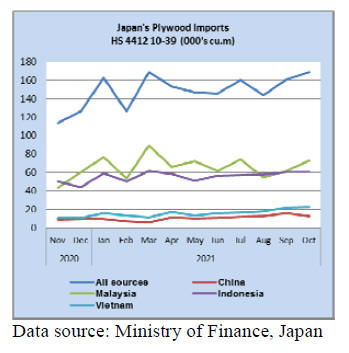

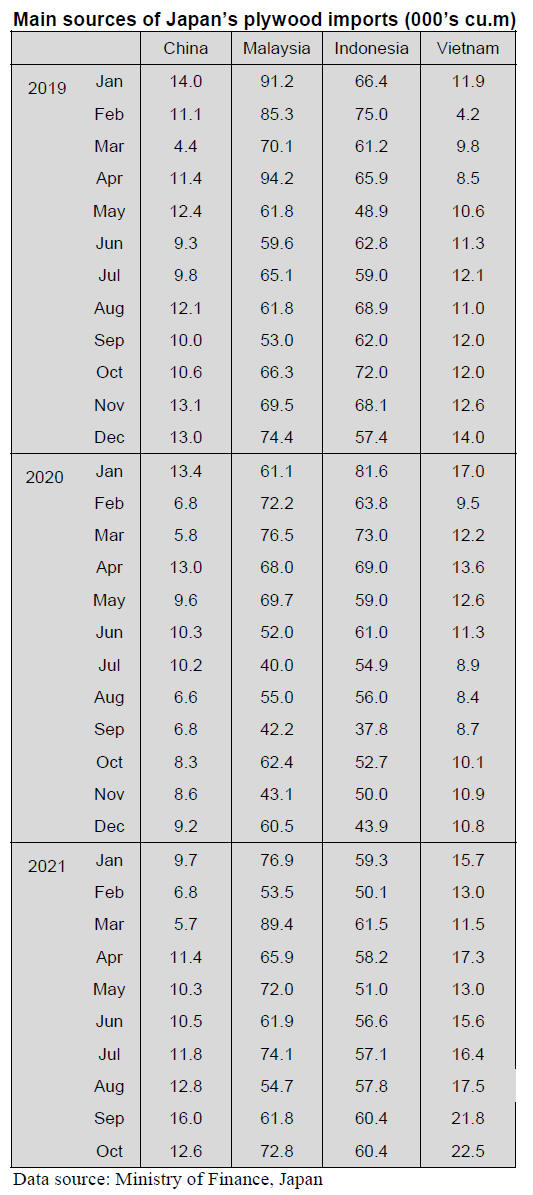

Plywood imports

The volumes of Japan¡¯s plywood imports rose 25% in

October compared to a month earlier and at 169,163 cu.m,

were higher than in both 2020 and 2019. In October all

four shippers of plywood, Malaysia, Indonesia, China and

Vietnam posted year on year gains but compared to the

volume of shipments in September shippers in China and

Indonesia saw a slight decline while imports from

Malaysia and Vietnam rose.

From mid 2021, except for the dip in August, the

volume

of Japan¡¯s plywood imports has shown an upward trend.

Shipments from Malaysia have risen for two consecutive

months and there has been a steady increase in the volume

of plywood imported from Vietnam.

In October 2021 it was only China that saw a drop in the

volume of plywood shipments to Japan.

Of all shipments in October HS441231 accounted for over

87% while imports of HS441234 and HS441239 acounted

for around 4% each.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

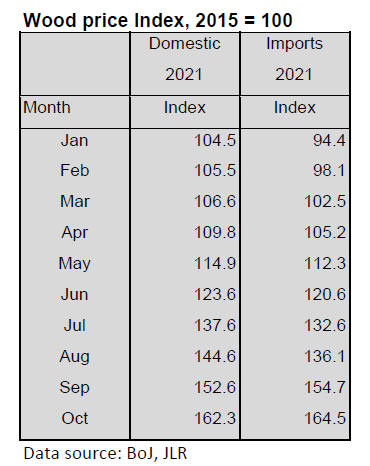

Price index trend by the bank of Japan

Soaring wood products¡¯ since last spring pushed total cost.

In August, wood products are number one item of inflation

among other items then in September, imported wood

products are number one so escalated prices of wood

products are conspicuous. After spiraling wood products

prices in producing regions of Europe and North America

simmered down, which lasted for six months, imported

cost of wood products continue high because of

weakening yen¡¯s exchange rate.

It is too early to judge if this is new era of wood market

but one favorable thing is that high cost imported wood

products stimulated demand of domestic wood products.

The bank of Japan disclosed price index of domestic

businesses in October based on average of 2015 is 100.

October index is 107.8, 8.0% up from October last year.

This increase is first time since January 1981, 40 years and

nine months. 1981 is peak year of second oil shock.

Escalation of prices is brought by confusion of geopolitics

like soaring oil prices.

In this year, the prices increased by confusion of supply

chain by COVID 19 epidemic, unstable supply of

materials as a result of confusion of container cargo

handlings. This collapsed balance of supply and demand

and the prices soared. Wood products are not listed as

inflation factor until last March then it started impacting

price increase since last April.

In August, overall price increase is zero but wood

products¡¯ contribution factor is 0.06% together with steel

products, which exceeded metal and plastic. Meantime,

prices of imported wood products surpassed 2015 level

since last March and in July, it is 132.6 and 164.5 in

October. By items, European laminated products and

lumber and North American lumber.

Price escalation this year is brought by demand explosion

in North America, Europe and China. Wood demand in

Japan is not so bad with new housing starts of level of

800,000 units, which is more than 2020.

Higher materials¡¯ cost contributed higher corporate profit.

Wood products prices are now decided by international

factors and Japanese domestic wood is now becoming

international since Japan exports over one million cubic

meters a year, which is the largest exporting country in

Asia, surpassing Malaysia.

Following chart shows trend of index month by month

through October. Index of wood products compared to

overall price index is getting higher in the second half of

the year. Rank shows how wood products contribute

among other products.

Second quarter performance of housing

companies

Major house builders recorded higher sales and higher

profit despite inflation of building materials. Number of

new starts in the same quarter last year dropped by

COVID 19 epidemic then housing starts recovered. For

major builders of order made houses, result is better than

2020 but lower than 2019.

Orders for builders of unit built for sale did not drop in

2020 and many gained more. In 2021, wood and steel

products prices soared but many absorbed inflated portion

by themselves and recoded higher profit yet.

It is rough estimate but for Sekisui house, wood prices for

detached and rental units are about five billion yen more

and steel prices are about two billion yen more up until

last July and it started passing higher cost onto sales

prices. Sekisui Chemical Housing¡¯s steel prices increased

by five billion yen but it has not passed to the sales prices

yet. Daiwa House says steel prices increased by almost

three times and it will put it onto sales prices from now on.

Since last year, people¡¯s sense or standard of value for

living and working has changed by COVID 19 pandemic.

By increase of remote works, people started moving out of

populated areas and demand for housing in suburban areas

increased.

In Tokyo region, demand for units built for sale started

increasing since May 2020. Builders of units built for sale

could sell already built units without any discount and the

inventory rapidly decreased.

Plywood

Supply shortage of domestic softwood plywood continues

through the year and precutting plants are forced tight rope

operation and very cautious of taking new orders. Other

structural wooden board has no extra supply to replace

plywood so there is no substitution.

The manufacturers struggle to secure material logs and

imported logs like North American Douglas fir are also

hard to have. Also adhesive prices are escalating so major

manufacturers decided to raise the prices of 12 mm 3x6

panel by 200 yen per sheet.

Market prices of imported hardwood plywood continue

climbing because the suppliers¡¯ export prices keep

escalating and the yen¡¯s exchange rate is weakening. In

supplying regions, rainy season started. Local plywood

mills didn¡¯t have time to build up log inventory before

rainy season started. Higher adhesive prices are another

factor to increase the prices. Container shortage increases

transportation cost.

Domestic logs and lumber

Demand of domestic lumber is weakening so the prices are

declining but compared to the same period of last year, the

prices are high and sawmills can make money so sawmills

are anxious to produce and many mills are running fully.

Lumber supply is so much that the prices are softening day

after day.

This impacts log prices and A class log prices for lumber

are declining while B class logs for plywood are tight in

supply nationwide. B class logs are also used by laminated

lumber mills, crating lumber mills and wood chip plants

for power generating plants so they compete with each

other to scramble necessary logs and the prices are firm.

Prices of stud and cross beam are particularly weak among

lumber because supply of imported lumber increased. 3

meter KD cedar post prices were more than 100,000 yen

per cbm up until last summer and in Kanto region the

prices were as high as 120,000 yen but now they are down

to about 90,000 yen. Post and sill are weak but the prices

drop in small degree. 3 meter KD cedar 105 mm square

prices are unchanged at level of 100,000 yen. 4 meter KD

cypress sill 105 mm square prices are 130,000-150,000

yen.

Supply of logs is steady as it is full harvest season and

November has favorable weather. Sawmills are actively

purchasing but the prices of logs for lumber, which

climbed sharply in last spring and summer, are weakening

in the Western Japan. Since last June, cypress log prices

are less than 40,000 yen, which were 40,000-50,000 yen

and in November, they are 30,000-35,000 yen with some

low prices of less than 30,000 yen.

Meantime, tight supplied plywood log prices are 20,000

yen on larch in the North East and 30,000 yen on cypress

in Western Japan.

Panasonic developed recycled wood board

Panasonic¡¯s housing division announced that it succeeded

to develop manufacturing reproduction quality of wood

board by using abandoned oil palm trees. In Malaysia,

waste oil palm trees are granulated then collaborated board

plant in Japan makes MDF. It is called Panasonic Board

and will be marketed to furniture manufacturers since

2022. After 2023, it will market it to building materials

market then develop the market in Europe and North

America as raw material of particleboard.

Oil palm trees are planted in large scale in South East

Asian countries like Indonesia, Malaysia and Thailand.

Palm oil is used for cooking and detergent. Shell is used

for fuel as PKS (palm kernel shell) for wood biomass

power generation plants. After 25-30 years of crop period,

palm trees are abandoned in the farm and it emits methane

gas when they rot.

Panasonic has started developing reproduced wood board

from waste palm trees since 2017.

Since wasted palm trees have heavy moisture and easy to

rot so reuse is hard. Panasonic came up with measures to

remove impurities in process of rinsing and extract long

fibers, which is pressed to form base material board.

Since 2022, it will supply MDF (3x6 with thickness of 2.5

mm) for domestic furniture manufacturers. It is said that

methane gas is 25 times more for global warming factor

compared to carbon dioxide so utilization of waste palm

trees contributes reduction of green-house gas. Also using

waste palm trees helps when worldwide wood resources

are decreasing.

|