|

Report from

North America

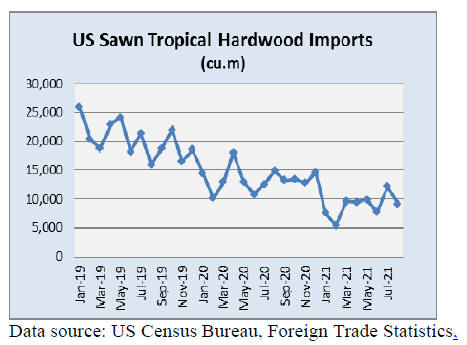

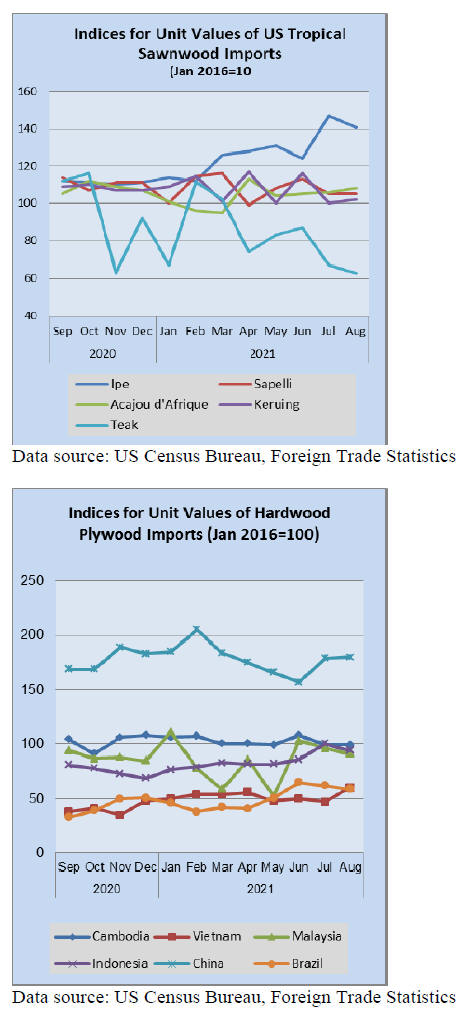

Tropical hardwood imports fell back in August

After spiking in July imports of sawn tropical hardwood

fell by 25% in August, returning to the levels seen this

spring. The 9,190 cubic metres imported is up 10% from

that of August 2020 and about 5% below the volume we

saw in March and April.

After smashing monthly records with 5,425 cubic metres

imported in July, imports fell to 783 cubic metres for

August, more in line with historic levels and about the

same level seen last August. Imports of Mahogany rose

sharply for a second straight month and are now ahead

146% year to date. Virola imports are up 47% for the year

so far after also gaining strongly in August.

Imports from Malaysia fell by 90% in August, due to

Keruing, but remain ahead 14% year to date. Imports from

Brazil rose 51% in August but are down 83% year to date,

although that may be more due to how the U.S. is now

measuring this import category than to actual imports.

Total tropical hardwood imports are down 33% for the

year so far, but that number is due to the removal of Ipe

and Jatoba totals from the category beginning this year.

When the two woods are included, US imports of sawn

tropical hardwood are up 21% so far this year versus last

year.

Meanwhile, Canadian imports of sawn tropical hardwood

fell for the fourth straight month in August. Monthly

imports dropped 5% as imports from Ghana, Brazil, and

the United States all fell sharply.

Despite the continued decline total imports for the year are

ahead 16% over last year through August.

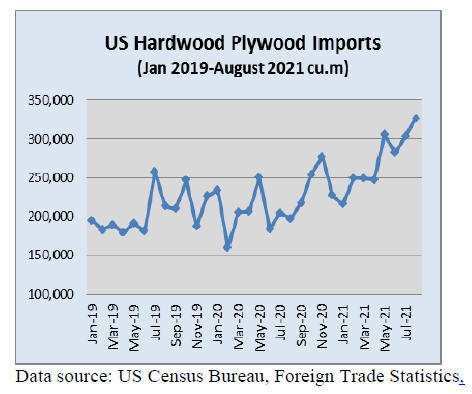

Hardwood plywood imports rise to four year high

Imports of hardwood plywood continued their rise in

August. Import volumes were up 7% in August to

326,682 cubic metres, the highest level since January

2017. Imports from Indonesia accounted for nearly onethird

of the volume, rising 72% in August.

Imports from Indonesia are ahead of last year¡¯s volume by

54% through August. Imports from Malaysia rose sharply

in August (up 204%), while imports from Vietnam fell by

34%.

Total US imports of hardwood plywood are ahead 33%

from 2020 year to date with all major trading countries

seeing improvement over last year¡¯s volume.

Veneer imports down 12%

Imports of tropical hardwood veneer fell for a second

straight month, dropping 12% in August. Very weak

imports from India fueled the decline. Imports from India

fell by 89% in August and were only at about 10% of the

level from August 2020.

Imports from China and Cameroon were also down for the

month and imports from all three countries are behind

2020 year-to-date numbers by more than 10%. However,

imports from Cote d¡¯Ivoire and Ghana have nearly made

up for the losses.

Imports from Cote d¡¯Ivoire nearly quadrupled in August

and are ahead 26% year to date while imports from Ghana

were up 41% in August and up 37% year to date. Overall

imports for the year are down 2% versus 2020 year to date

through August.

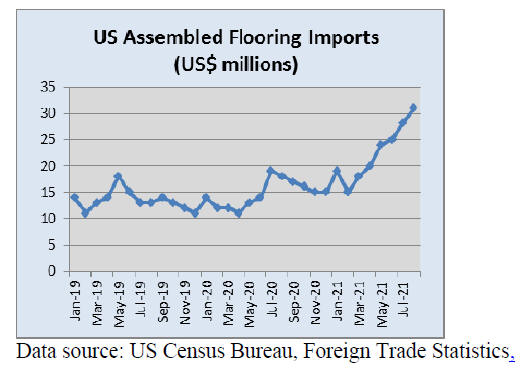

Hardwood flooring imports hit post-pandemic high

Imports of hardwood flooring rebounded in August, rising

26% to reach their highest level since 2019. Imports from

Brazil rose 39% in August to a level more than 50%

higher that the previous August and are up 116% year to

date. Imports from China and Indonesia, which have been

off for most of the year, both saw strong gains in August,

up 46% and 84%, respectively.

Imports from Malaysia fell 40% in August but were still

more than 15% better that the previous August and remain

ahead 36% year to date. Total U.S. imports of hardwood

flooring are ahead 40% year to date over 2020.

Imports of assembled flooring panels continued to expand,

rising 9% in August for a sixth straight month of growth.

Despite the growth, imports from Canada have remained

flat, rising only 2% in August and are down 1% year to

date. Imports from China and Indonesia have fueled much

of the expansion this year, but both fell in August: China

down 21% and Indonesia down 31%.

Regardless, imports from Indonesia remain up 73% year to

date while imports from China are up 34% year to date.

Imports from Vietnam were up 64% in August and are

ahead 66% year to date. Overall imports are ahead of last

year by 61% through August.

However, all year-to-date numbers should be viewed as

inflated as the USDA added two additional categories to

the Assembled Flooring Panels category in May.

Moulding imports also reach post-pandemic high

U.S. imports of hardwood moulding also hit a postpandemic

high in August, rising 9% to their highest level

since December 2018. Imports from China were

responsible for the gain, rising 71% in August for their

strongest month since imports took a nosedive in August

2020.

However, imports from China are still well below historic

levels and are down 55% year to date. While August

imports fell from Malaysia (down 29%) and Canada

(down 4%), year-to-date totals are up from both countries

by more than 40%. Overall U.S. imports of hardwood

moulding are ahead by 19% over 2020 totals so far this

year.

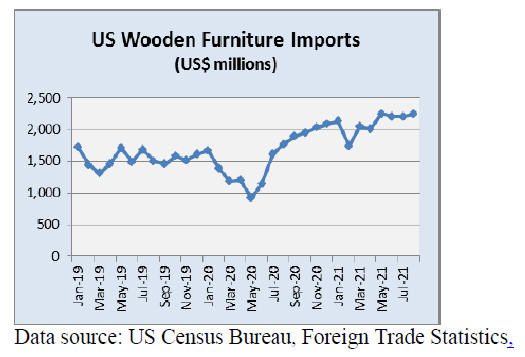

Wooden furniture imports up slightly

Imports of wooden furniture rose by 2% in August,

remaining at a historically high level. At more than

US$2.24 billion in August, imports were at a level more

than 26% higher than the previous July and at a year-todate

pace 54% above 2020.

See:https://www.woodworkingnetwork.com/news/almanacmarket-data/despite-july-drop-residential-furniture-orders-upyear-date

Imports from most countries were fairly flat, with nearly

all not raising or falling more than 5% for the month.

However, imports from Malaysia fell 32% in August while

imports from India rose 14%.

Meanwhile, new orders for residential furniture dropped

11% in July compared to a year ago, an impact of the

continuing COVID issues facing the nation, reported

Smith Leonard in the latest issue of Furniture Insights.

It marks the first time since June 2020 that new orders

were down from the same month in the previous year.

New orders were up 39% year to date through July.

Cabinet sales retreat in July

Kitchen cabinet and vanity manufacturers saw sales retreat

in July according to the latest monthly survey by the

Kitchen Cabinet Manufacturers Association (KCMA). The

KCMA¡¯s latest ¡°Trend of Business Survey¡± saw overall

sales decrease 11.5% in July compared with June. Custom

sales were down 15.1%, semi-custom sales were down

17.2%, and stock sales decreased 6.6%.

However, sales remain strong in comparison with last

year. Domestic kitchen cabinet and vanity manufacturers

enjoyed a year-to-date sales increase of 18.3% through

July, compared to the same seven-month period in 2020.

Custom cabinet sales through the first seven months were

reported up 21.5% over the same period last year, while

semi-custom sales rose 17.6% and sales of stock cabinets

gained 18.1%, KCMA said.

July sales were up 7.2% compared to the same month last

year, the association added.

See:

https://www.kcma.org/news/pressreleases/July_2021_trend_of_busines_press_release

US and Vietnam reach agreement on timber sourcing

United States Trade Representative Katherine Tai said an

agreement has been reached with Vietnam that addresses

concerns regarding the use of illegally harvested timber in

products such as furniture. Thus, the U.S. will not impose

any trade-related tariffs on Vietnam relating to this issue at

this time.

|