|

Report from

Europe

Imports of tropical wood rebound in the UK but lose

share in a rising market

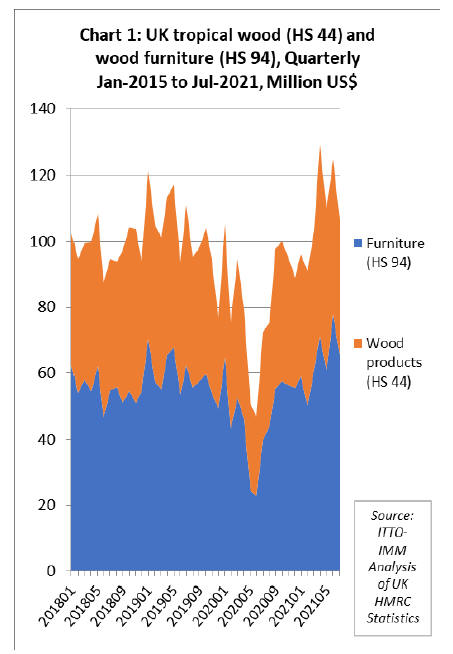

The UK imported tropical wood and wood furniture

products with a total value of USD760 million in the first

seven months of 2021, a 36% increase compared to the

same period in 2020.

Following the sharp increase in April, when import value

was at the highest monthly level since before the financial

crises of 2008-2009, imports declined only slightly from

this peak between May and July (Chart 1).

While UK import value of tropical and wood furniture was

strong compared to the first seven months last year, which

was severely affected by COVID lockdowns, import value

was marginally down compared to USD762 million in the

same period of 2019.

This is disappointing at a time when import prices are

inflated by a dramatic rise in freight rates, particularly

from Southeast Asia and other tropical supply regions, and

overall demand for timber products in the UK is at

unprecedented levels.

This year, the UK is experiencing a very robust rise in

construction sector activity and in timber trade and

consumption. There has been a welcome rebound from the

lows of last year in the value of wood product imports

from tropical countries into the UK, and importers are

benefiting from strong sales, high prices and larger

margins. However, much bigger gains are being made in

this market by wood products suppliers outside the tropics.

The latest UK Construction Products Association (CPA)

Trade Survey shows construction remained in expansion

mode during the second quarter of this year, with private

housing and repairs, maintenance and improvement

leading the industry. Much of the activity in these sectors

has been sustained by government housing policies, an

increase in the disposable income across households in the

UK, and a homeworking trend that has been driving

demand for greater or improved outdoor and office space.

According to the Building Merchants Building Index

(BMBI), in the three months between May and July this

year, UK sales of timber were at record levels and

performing better than all other building material

categories. During the three month period, total UK

builders' merchant sales were 35% up on a COVIDaffected

period last year, while sales of timber and joinery

products increased 65%. Total sales in May to July were

9% higher than in February to April, while timber and

joinery products sales were up 19%.

Sales were also exceptionally strong compared to 2019,

before the pandemic. Total builder's merchant sales in

May to July 2021 were 17% higher than in May to July

2019, while timber and joinery product sales were 44%

higher.

A statement by the UK Timber Trade Federation issued

earlier in September suggests that longer term prospects

for timber demand in the UK are good, but short term

logistical issues are putting severe strain on supply.

¡°The supply chain has been working hard to satisfy this

additional demand, which is expected to continue in the

short to medium term according to industry forecasts.

While some of this demand may ease as pandemic

restrictions subside, the demand for timber is likely to

remain strong amidst a construction industry seeking to

rapidly decarbonise.

By choosing to build with responsibly sourced timber,

architects, engineers and house builders are helping to turn

our built environment into a form of carbon capture and

storage. There is a significant opportunity for the timber

sector to grow into a pillar of the UK¡¯s low-carbon

economy".

The TTF go on to note that ¡°The main brake on this

growth will come from other factors, particularly labour

shortages in areas across the supply chain from logistics to

skilled on-site labour, with the CBI [Confederation of

British Industry] warning this could take at least two years

to settle down.¡±

The latest IHS Markit/CIPS UK Construction Purchase

Managers Index (PMI) for August suggests that these

factors are beginning to act as a drag on the rate of market

growth. The PMI dropped to 55.2 in August 2021, from

58.7 in the previous month and below market expectations

of 56.9. Although any figure over 50 indicates continuing

growth in the UK construction sector, the latest reading

points to the softest pace of expansion since February.

Commenting on the slowing growth in August, IHS

Markit/CIPS note that "given the amount of stimulus and

relatively early stage in the recovery, to be slowing so

close to the long-term trend is disappointing. Part of the

slowdown can be linked to weaker growth of new orders

for construction work, with the survey's New Orders Index

slowing for a third consecutive month to register a further

cooling of demand growth from May's record high.

"The slowdown can also be partly attributed to ongoing

and near-record shortages of raw materials, as measured

by suppliers' delivery times, which have in turn led to

unprecedented price hikes for building materials in recent

months¡ in August 68% of construction companies

reported even longer delivery times for materials

compared to July. A combination of ongoing covid

restrictions, Brexit delays and shipping hold-ups were

responsible as builders were unable to complete some of

the pipelines of work knocking on their door".

However, IHS Markit/CIPS end on a positive note,

¡°optimism improved on last month as more than half of

building firms believe that output will continue to rise in

the year ahead.¡±

UK tropical furniture imports recover ground lost

during the pandemic

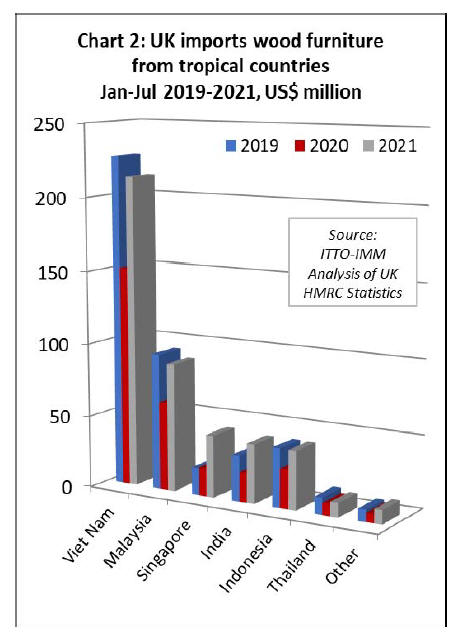

Overall the UK imported USD445 million of tropical

wood furniture products in the first seven months of this

year, 52% more than the same period in 2020, but just 3%

more than the same period in 2019. After a slow first

quarter this year, when lockdowns once again disrupted

trade, imports strengthened considerably in the second

quarter to reach monthly highs not seen for over a decade.

Overall during the first seven months of 2021 compared to

the same period last year, UK wood furniture imports were

up from all four of the leading tropical supply countries to

this market; Vietnam (+41% to USD214 million),

Malaysia (+44% to USD88 million), Singapore (+123% to

USD43 million), India (+103% to USD41 million),

Indonesia (+50% to USD40 million) and Thailand (+19%

to USD10 million).

While gains were made across the board when compared

to the depressed levels of 2020, wood furniture import

value was still trailing the pre-pandemic 2019 level from

Vietnam (-6%), Malaysia (-6%), Indonesia (-1%), and

Thailand (-15%).

In contrast the pre-pandemic rise from India has resumed,

with import value from the country 30% higher this year

than in 2019. Import value from Singapore, which has

become more important as a supply hub due to logistical

problems elsewhere during the pandemic, is 130% higher

than in 2019 (Chart 2).

UK tropical wood imports still down on pre-pandemic

level

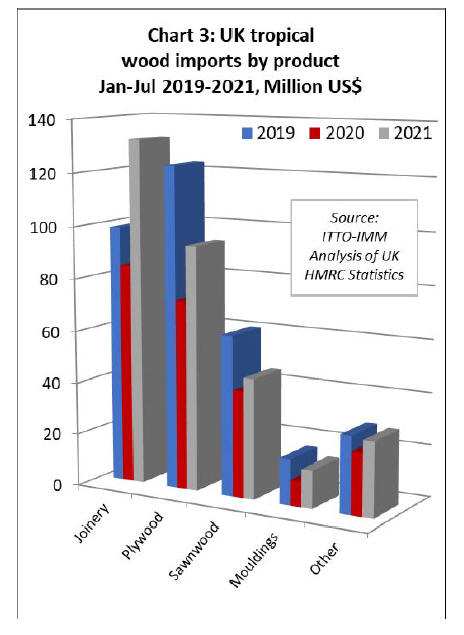

UK import value of all tropical wood products in Chapter

44 of the Harmonised System (HS) of product codes was

USD315 million in the first seven months of 2021, 36%

more than the same period last year but 5% less than the

same period in 2019.

Comparing UK import value in the first seven months of

2021 with the same period in 2020, tropical joinery was up

57% at USD132 million, tropical plywood was up 29% at

USD94 million, tropical sawnwood was up 12% at USD46

million, and tropical mouldings/decking was up 47% at

USD8 million.

While import value of tropical joinery in the first seven

months of this year was also up 34% on pre-pandemic

level in 2019, UK import value of all other HS 44 tropical

wood products was significantly behind the 2019 level

including plywood (-24%), sawnwood (-25%), and

mouldings/decking (-17%) (Chart 3).

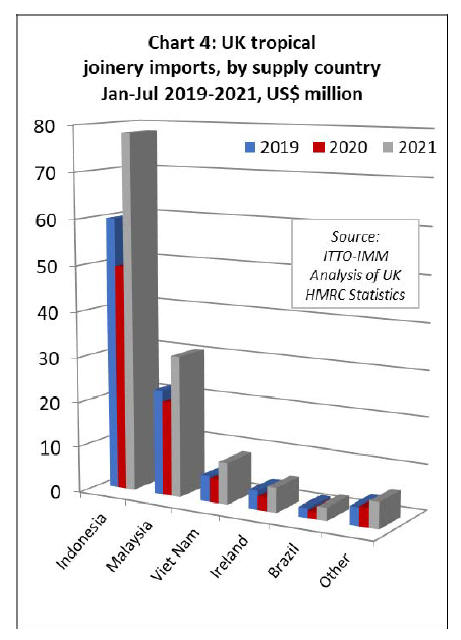

After the sharp dip in UK imports of tropical joinery

products during the first lockdown period in Q2 2020,

imports gradually built momentum until March this year

and then surged in the second quarter. Imports from

Indonesia, mainly consisting of doors, were USD78

million in the first seven months of 2021, 58% more than

the same period last year and 31% up on the same period

in 2019.

UK imports of joinery products from Malaysia and

Vietnam (mainly laminated products for kitchen and

window applications) also made strong gains in the first

seven months of 2021. Imports from Malaysia were

USD31 million between January and July this year, 50%

more than the same period in 2020 and 35% up on the

same period in 2019. Imports of USD9 million from

Vietnam were 76% more than in the same period in 2020

and 60% more than the same period in 2019 (Chart 4).

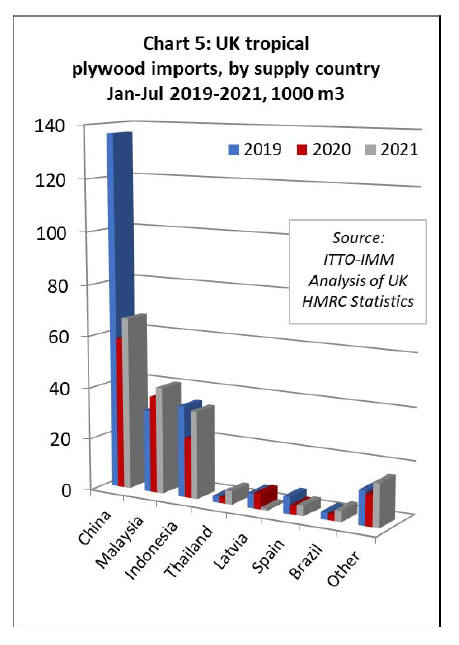

In contrast to joinery products, UK imports of tropical

hardwood plywood have remained at relatively low levels

this year. In the first seven months of 2021, the UK

imported 172,400 cu.m of tropical hardwood plywood,

which is 20% more than the same period in 2020 but still

down 26% compared to the same period in 2019.

Imports from the UK¡¯s three largest suppliers of tropical

hardwood plywood ¨C China, Indonesia and Malaysia ¨C

have followed very different trajectories this year (Chart

5). The UK imported 66,700 cu.m of tropical hardwood

faced plywood from China in the first seven months of this

year, 15% more than the same period in 2020 but down

over 50% compared to the same period in 2019.

In contrast, Malaysian plywood has made gains in the UK

market this year, imports of 41,100 cu.m in the first seven

months being 11% more than the same period in 2020 and

30% up on the same period in 2020. But it should be said

these gains are being made against historically very low

levels after a long period of decline in UK imports of

Malaysia plywood in the years before 2019.

So far this year, UK imports of plywood from Indonesia

have rebounded from the lows of 2020 but are still below

the relatively modest levels of 2019. Imports of 33,600

cu.m in the first seven months of this year are 48% more

than the same period in 2020 but 4% less than in 2019.

As with other hardwood product groups, UK demand for

tropical hardwood plywood has been strong this year,

driven by high levels of construction activity and

shortages of competing materials. The main market

challenges have been on the supply side, notably the

considerable escalation in freight rates on Asian routes to

the UK.

A 40ft container from Malaysia or Indonesia as late as last

autumn cost US$1,500 -2,000. By Q2 2021 importers were

being quoted US$15,000-20,000 and rates have stayed

there.

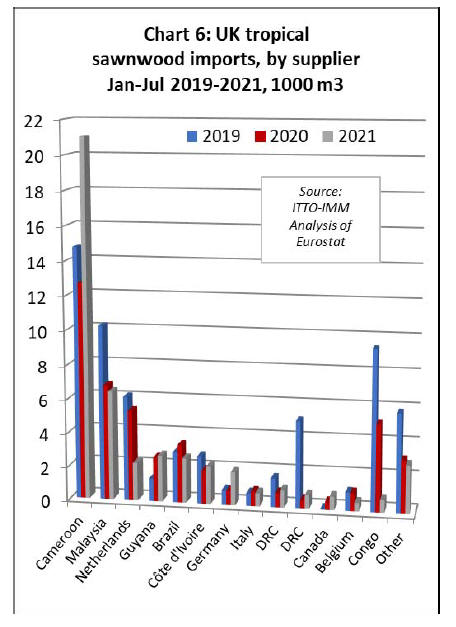

After falling sharply in May and June last year, UK

imports of tropical sawnwood have gradually

strengthened, but the strength of the rebound has been

impaired by significant logistical problems on the supply

side. UK imports were 46,700 cu.m in the first seven

months of 2021, just 3% more than the same period in

2020 and 26% less than the same period in 2019.

Although imports from Cameroon, now by far the leading

supplier of tropical sawnwood to the UK, were up 66% on

2020 and 43% on 2019 during the seven month period,

imports from nearly all other leading tropical sawnwood

supply countries have remained weak this year (Chart 6).

The large increase in imports of sawnwood from

Cameroon was due to the long lead time in shipment of

contracts placed back in 2020. UK importers now report

that supply for hardwoods from Cameroon and other

African supply countries is very limited.

Global demand for species such as sapele, sipo and iroko,

accompanied by production delays and logistical

difficulties, have been such that many African mills placed

a moratorium on taking new orders in late March and

throughout April this year.

UK imports of tropical sawnwood from Côte d'Ivoire were

just 2200 cu.m in the first seven months of this year, 13%

more than the same period in 2020 but still down 20% on

the same period in 2019.

The UK was previously a significant buyer of framire

from Côte d'Ivoire but UK importers report that this

species is proving increasingly difficult to source, both due

to a lack of raw material in the forest and the challenges of

obtaining assurances of legality that satisfy UK Timber

Regulation requirements.

Meanwhile, UK imports of tropical sawnwood from both

the Republic of Congo and DRC have fallen to a trickle

since the start of the pandemic.

Imports from the Republic of Congo were just 700 cu.m

in the first seven months of the year, down 86% and 92%

compared to the same period in 2020 and 2019

respectively. Imports from DRC were 800 cu.m, which is

62% more than the negligible amount imported last year,

but 84% less than the same period in 2019.

After an extremely slow start to the year, brought on by

pandemic induced production problems and extreme

shortages of containers, UK imports of tropical sawnwood

from Malaysia picked up a little in the second quarter with

the arrival in May of the first breakbulk shipments of

Asian meranti and keruing lumber into the UK for nearly

30 years.

UK imports of Malaysian sawnwood were 6,400 cu.m in

the first seven months of 2021. That is still 6% less than

the same period last year and 37% down on the same

period in 2019.

With shortages in supply from other sources, UK

importers were turning more to South America in the

opening months of this year. Imports from Brazil were

quite good in the first quarter but ground to a halt in the

second quarter. By the end of the first seven months, total

UK imports of tropical sawnwood from Brazil were 2,600

cu.m, 23% less than the same period last year and 13%

down on 2020.

Imports from Guyana on the other hand have continued to

rise, at 2,700 cu.m in the first seven months this year, a

gain of 4% on the same period in 2020 and double the

volume imported in the same period in 2019.

Indirect UK imports of tropical sawnwood from other EU

countries have fallen dramatically this year. Total UK

imports from EU countries were 6,900 cu.m in the first

seven months of 2021, 25% less than the same period last

year and 46% down on the same period in 2019.

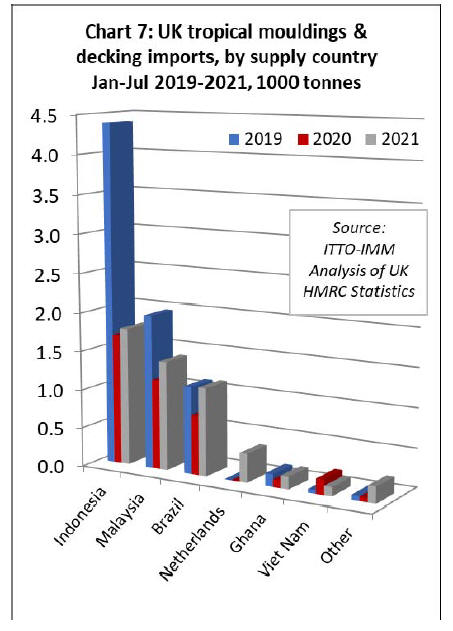

The UK imported 5,200 tonnes of tropical hardwood

mouldings/decking in the first seven months of 2021, 31%

more than the same period in 2020 but still 33% less than

the same period in 2019. The arrival of the first breakbulk

shipments into the UK this year boosted imports a little

from Indonesia, which at 1,800 tonnes in the first seven

months were 6% more than the same period in 2020, but

still down 60% compared to 2019.

Similarly, imports from Malaysia, at 1,400 tonnes, were

21% more than the same period in 2020 but 29% less than

in 2019. Imports from Brazil have also picked up a little,

at 1,100 tonnes in the first seven months, 49% more than

the same period last year 1% more than in 2019 (Chart 7).

The UK market is currently suffering from severe lack of

availability of tropical hardwood decking, due both to the

freight hikes and also to suppliers preferring to sell the

limited stocks they have available to other markets.

This has forced more UK importers to purchase more

tropical decking from importers in the Netherlands. The

UK imported 400 tonnes of tropical hardwood decking

from the Netherlands in the first seven months of this year

when previously very little was sourced indirectly from

there.

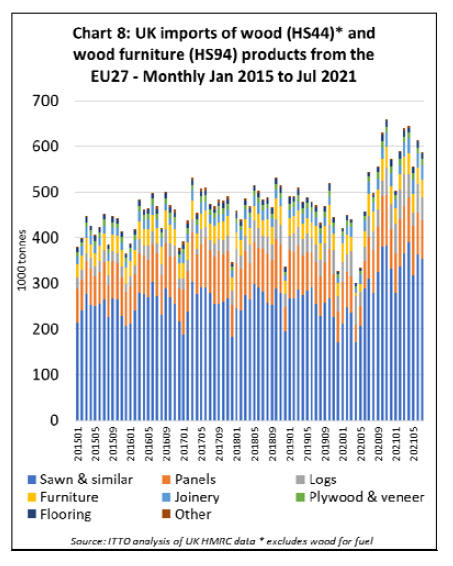

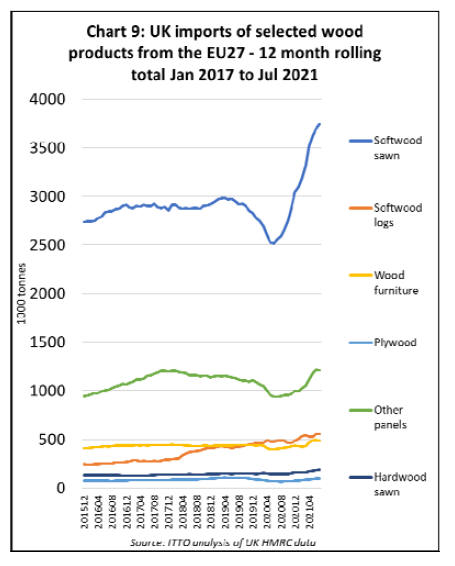

Big increase in UK timber imports from the EU despite

Brexit

An impact of the UK¡¯s departure from the EU single

market and customs union on 1st January this year was

meant to be a decline in the quantity of UK timber imports

from the EU.

This forecast followed expectations of logistical problems

as new controls were introduced at the UK border,

increased scrutiny of the plant health and legal status of

EU wood products imported into the UK, and sluggish

economic activity in the UK due to post Brexit

uncertainty.

However, not only did UK imports from the EU fail to

decline in the first half of 2021, but they were at record

levels. Chart 8 shows the quantity of UK imports of all

wood and wood furniture products from the EU (excluding

wood for fuel) on a monthly basis since the start of 2017.

In total, the UK imported 4.13 million tonnes of wood

products from the EU27 in the first seven months of 2021,

40% more than the previous year, which of course was

COVID-affected, but also 21% more than in 2019, the last

¡°normal¡± year.

Most of this growth was concentrated in softwood

sawnwood and logs and panel products, which dominate

UK imports from the EU27 (at least in tonnage terms).

However, imports of furniture and hardwood products

which compete more directly with imports from the

tropics also grew strongly from the EU in the opening

months of this year.

Of course it is early days for the UK outside the EU single

market, and the UK timber market is currently

experiencing unprecedented conditions due to the COVID

pandemic. The combination of very high levels of

consumption in the UK construction and DIY sectors and

severe disruption of supplies from sources further afield -

in China, Southeast Asia, North and South America, and

Africa - has fed a significant upturn in UK demand and

prices for timber imports from the EU.

Importers and distributors have had a strong incentive to

overcome the new logistical and bureaucratic challenges

of sourcing from the EU.

The main question now is whether this situation will be

maintained for the long term, and whether there is any

genuine potential for the UK to pivot away from the EU as

logistical problems ease in other parts of the world.

The market signals are still mixed in relation to this

question. The UK's exit from the EU has contributed to a

significant fall in indirect imports of tropical sawnwood

and plywood from the European continent during 2021.

But this has yet to be compensated by any significant rise

in direct imports of these same products from tropical

countries.

However, the uptick this year in UK imports of wooden

doors from Indonesia and of other joinery products from

Malaysia to levels exceeding those pre-pandemic, despite

very high freight rates, is some grounds for optimism.

|