US Dollar Exchange Rates of

25th

Sep

2021

China Yuan 6.4667

Report from China

Real estate development and sales growth slows

National investment in real estate development was CNY

9806 billion between January and August 2021, a year-onyear

increase of 10.9% and 15.9% higher than in the same

period in 2019; thus, average growth over the last two

years has been 7.7%. Within this, residential investment

was CNY 7397 billion, an increase of 13%.

The area of land acquisitions by real estate

development

enterprises was 107.3 million m2 in January每August 2021,

a year-on-year decrease of 10.2%; the land transaction

price was CNY 664.7 billion, down by 6.2%, year-onyear.

The sales area of commercial housing was 1142

million

sq.m in January每August, a year-on-year increase of 16%

and 12% higher than in the corresponding period in 2019,

with an average growth of 5.9% over the two-year period.

See:

http://www.stats.gov.cn/english/PressRelease/202109/t20210916_1822206.html

Risk to China*s real estate market from Evergrande

problems

Until this year, Chinese property was booming. Demand

for real estate in the megacities of Beijing, Shanghai,

Shenzhen and Guangzhou drove prices to among the most

expensive in the world. Until this year, Evergrande,

China*s second-largest property developer by sales,

invested heavily.

But then came falling property prices in smaller cities and

a series of government measures aimed at cracking down

on excessive borrowing in the real estate sector.

Economists say the potential collapse of Evergrande

could ※be the biggest test that China*s financial system has

faced in years§.

See:

https://www.abc.net.au/news/2021-09-21/china-propertybust-evergrande/100472190

More background:

https://www.japantimes.co.jp/news/2021/09/17/business/corporate-business/china-evergrande-scenarios/

Tariff exemption extended for US hardwood imports

The Customs Tariff Commission of China*s State Council

has extended the exclusion period for additional tariffs

imposed on certain commodities imported from the US,

which was due to end on 16 September 2021. Among the

commodities excluded from the additional tariffs are

anticorrosive wood (44039100), North American

hardwood logs (44039960), cherry sawnwood (44079400),

ash sawnwood (44079500) and other North American

hardwood sawnwood (44079930). China will now exempt

these US products from additional tariffs until 16 April

2022.

See:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202109/t20210916_3753336.htm

First wood-fumigation enterprise starts up in Henan

The first enterprise for fumigating wood packaging for

export was established recently in San Men Xia in Henan

province.

Demand for wood packaging has risen in San Men Xia in

recent years in line with the city*s increasing commodity

exports. There is a growing need to fumigate wood

packaging for export, and the new company will help fill

the gap.

First timber train arrives from Russian Federation in

Xinxiang

The China每Europe Express arrived recently in Xinxiang

from the Russian Federation, carrying about 2500 m3 of

timber worth RMB 3 million. This is the first timber train

from the Russian Federation to Xinxiang, a city in Henan

province, and it marks the beginning of regular timber

shipments on the Xinxiang China每Russian Federation line.

The trip takes about ten days, shaving at least two-thirds

off the previous travel time.

See:

http://www.henan.gov.cn/2021/09-08/2309347.html

Production line for reed-based formaldehyde-free

wood panels set for Yueyang

The first production line of formaldehyde-free wood

panels using reed fibre will be built in Yueyang, Hunan

province, according to the local government there. The

project will use abundant reed resources in the Dongting

Lake District of Yueyang city, opening up a new way to

boost the income of reed farmers, promote local economic

development, help rural revitalization, and develop a

※green§ industry.

See:

http://www.yiyang.gov.cn/yyslyj/1822/1823/content_1443455.html

China每Japan wood seminar held in Nanning

A China每Japan wood seminar was held recently in

Nanning, Guangxi Zhuang Autonomous Region,

sponsored jointly by the China Timber and Wood Products

Distribution Association and the Japan External Trade

Organization.

The aims of the seminar were to increase knowledge

among China*s wood industrial enterprises of Japanese

timber resources and the prospects for Japanese wood in

China; lay a foundation for increasing timber trade

between China and Japan and thus deepen relationships

among industrial wood enterprises in the two countries;

and jointly plan an improved timber trade.

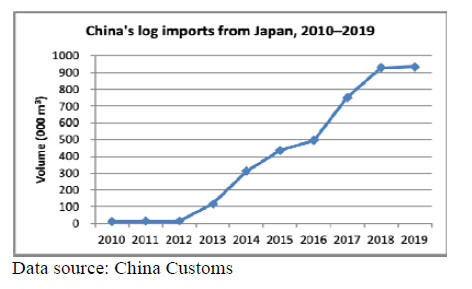

Japan*s wood exports to China are booming, jumping from

about ¥1 billion in 2001 to ¥17 billion in 2020. China*s

log imports from Japan surged from about 15 000 cu.m3 in

2012 to more than 900 000cu.mm3 in 2019.

China imported 671,000 cu.m of logs from Japan in

the

first half of 2021, at a value of US$101 million, a year-onyear

increase of 36% in volume and 68% in value.

The CIF price rose by 23%, year-on-year. Almost all

China*s log imports from Japan are softwood.

China*s log imports from Japan have increased due to

active Japanese promotion of timber exports and in-depth

exchanges between Japanese producers, the Chinese

government and Chinese enterprises.

Concern on COVID-19 variants triggers decline in

exporter confidence in Hong Kong

The HKTDC (Hong Kong Trade Development Council)

Export Index dropped by 9.7 points in the third quarter of

2021, to 39.0, indicating that market uncertainties in light

of COVID-19 variants could be undermining the near-term

confidence of Hong Kong exporters. Two-thirds of

exporters indicated that they had been adversely affected

in the past three months, a 9.7% increase on the previous

quarter. Reductions in order sizes (cited by about 60% of

exporters) were the most common downside.

See:

https://research.hktdc.com/en/article/ODQ2ODEyMjg1?utm_source=weky_edm&utm_campaign=edm_promo_upd&utm_medium=edm&DCSext.dept=12&WT.mc_id=6251901

New ※international hub§ in development in Yangtze

River Delta

Shanghai, the leading city in the Yangtze River Delta

(YRD) region, is home to China*s first pilot free trade

zone, the host city for the China International Import

Expo, and an important window for expanding imports

and helping businesses venture into the mainland market.

Central authorities have given the city the strategic task of

promoting cross-border trade, with the State

Council approving an overall plan in February 2021 for

the construction of the Hongqiao international hub.

High-level planning has been carried out for the

construction of the hub to promote the deepening of

reform and the coordinated opening up of the YRD. The

goal is to complete construction by 2035, with a functional

layout of ※one core and two belts§.

See:

https://research.hktdc.com/en/article/ODQ3NjE1MTY1?utm_source=weky_edm&utm_campaign=edm_promo_upd&utm_medium=edm&DCSext.dept=12&WT.mc_id=6251906

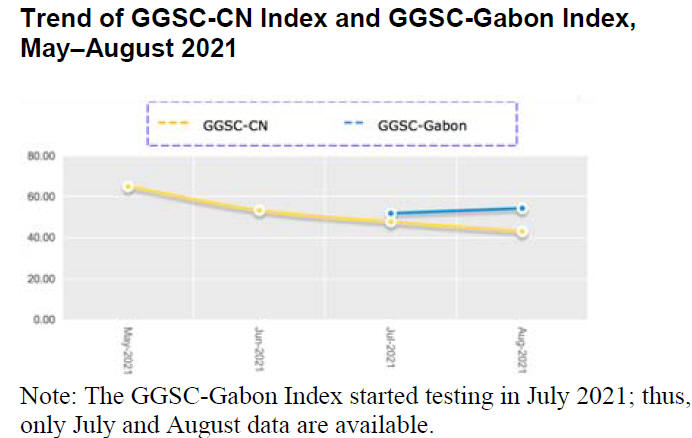

GGSC-CN Index Report, August 2021

China*s PMI index declined to 50.1% in August 2021, a

decrease of 0.5 percentage points from the previous

month, indicating that, although the economy continued to

pick up, the rate of growth slowed. The wood production

and manufacturing industry was in its traditional offseason

in August. Domestic and international market

demand dropped and manufacturing continued to be tight.

The price of raw materials is still rising, the inventory of

raw materials has continued to decline, and the cost

pressure on the industry has increased.

The GGSC-CN comprehensive index for August was at

43.0% (compared with 47.1% in August 2020 and 42.1%

in August 2019), a decrease of 4.7 percentage points from

July (Figure below). It has been below the critical value of

50% for two months, showing that the operations of the

superior forest product enterprises represented by the

GGSC-CN index have been declining.

Challenges

Labour shortage.

It is difficult to purchase wood, and the supply of

imported raw materials is unstable.

There are few solid wood raw materials to meet

demand.

The price of raw materials is rising, and this

situation is becoming the norm.

The price of ebony and pine core board has

increased significantly.

Products in short supply

Diperyx, merbau, teak, zingana, chemical raw

materials, paint.

Commodities for which prices increased

South American materials such as diperyx and

tauari.

Merbau, teak, oak veneer, formaldehyde,

fibreboard, paper, paraffin, waterproofing agents,

melamine.

Commodities for which prices decreased

Chinese fir logs, pine core board, urea.

Four of five sub-indexes of the GGSC-CN fell

in August 2021 and one increased.

The production index was at 40.9%, down

by 5.2 percentage points compared with July; it has been

below 50% for two months now and shows that the

production of superior forest product enterprises

represented by the GGSC-CN has been falling.

The new-order index was at 40.9%, down

by 9.1 percentage points over July, indicating that the

ability of enterprises to obtain orders worsened in the last

month.

The new-export-order index, which reflects international

trade, was at 22.7% in August, down by 0.4 percentage

points from July, showing that orders from abroad

decreased in the last month.

The main-raw-material-inventory index was at 45.5%

in

August, up by 0.7 percentage points from July, indicating

that raw-material inventories of superior forest product

enterprises have been decreasing.

The employment index was at 45.5% in August, down

by 8.4 percentage points from July, showing that the

employment provided by forest product enterprises was

significantly down compared with July.

The supplier-delivery-time index was at 45.5%, up

by 7.0 percentage points from the previous month,

showing that supply times by raw-material suppliers to

forest product enterprises were more drawn out than in

July.

See:

http://www.itto-ggsc.org/site/article_detail/id/224

GGSC-Gabon Index Report, August 2021

The GGSC-Gabon index was at 54.3% in August (the

testing period for the index), an increase of 2.5 percentage

points over July.

It has been above the critical value of 50% for two

consecutive months, indicating that the overall operating

situation of key timber companies in Gabon is expanding.

Specifically, on the supply side, the manufacturing of key

enterprises decreased slightly; on the demand side, there

was rising momentum for enterprise orders. Export orders

rose slightly and enterprise orders on hand also increased

compared with the previous month. At the same time, the

price of raw materials increased significantly.

According to feedback from enterprises, inventories of

raw materials and finished products generally increased in

August, highlighting problems such as high export

logistics and transportation costs and a shortage of

containers.

The Figure below compares GGSC-Gabon and GGSCCN.

August is the traditional off-season for the forest

product manufacturing industry in China. The GGSC-CN

comprehensive index in August 2021 was at 43.0%

(compared with 47.1% in August 2020 and 42.1% in

August 2019), a decrease of 4.7 percentage points

compared with July; it has been below the critical value of

50% for two consecutive months, showing that the

operations of the forest product enterprises represented in

the GGSC-CN index shrank over the period.

The GGSC-Gabon sub-indices are as follows:

The production index was at 44.4% in August

2021, down by 13.9 percentage points from July

and below the critical value of 50%. It shows

that the production of key companies with forest

concessions in Gabon decreased compared with

July.

The new-order index was at 66.7% in August, up

by 16.7 percentage points from the previous

month, reflecting the ability of key companies

with forest concessions to obtain more orders

than in July.

The main-raw-material-inventory index was

at 57.1% in August, down by 2.9 percentage

points from the previous month (but still above

the critical value of 50%), showing that the rawmaterial

inventory of key companies with forest

concessions increased compared with July.

The employment index was at 50.0%, showing

that there was basically no change in

employment numbers for key companies with

forest concessions.

The supplier-delivery-time index was

at 41.7%, an increase of 8.3 percentage points

compared with the previous month, indicating

that the supply time of raw-material suppliers for

key companies with forest concessions was

significantly slower than in July.

See:

http://www.itto-ggsc.org/site/article_detail/id/225

|