US Dollar Exchange Rates of

10th

Aug

2021

China Yuan 6.4792

Report from China

Substantial rise in log imports ¨C but not tropical logs

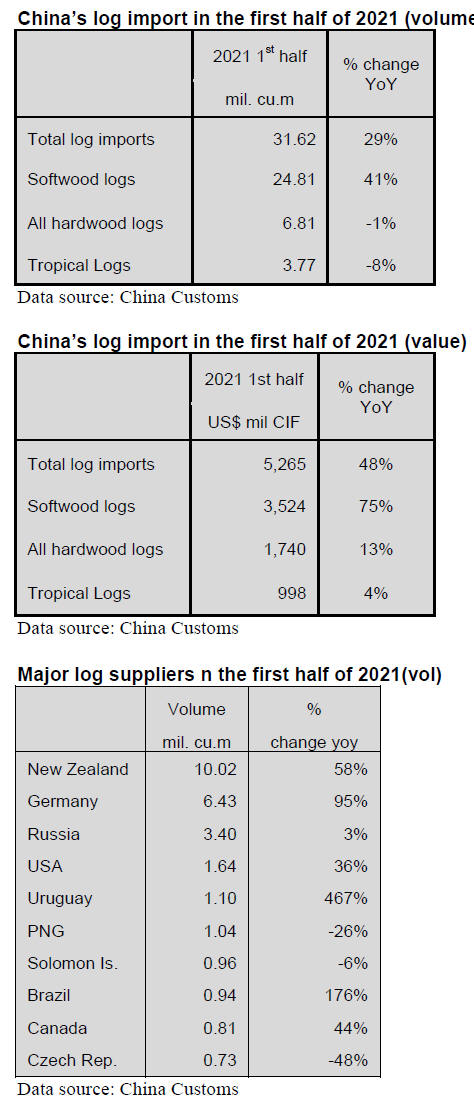

According to China Customs, log imports in the first half

of 2021 totalled 31.26 million cubic metres valued at

US$5.265 billion (CIF), up 29% in volume and 48% in

value. The average price for imported logs was US$167

(CIF) per cubic metre, up 15% from the same period of

2020.

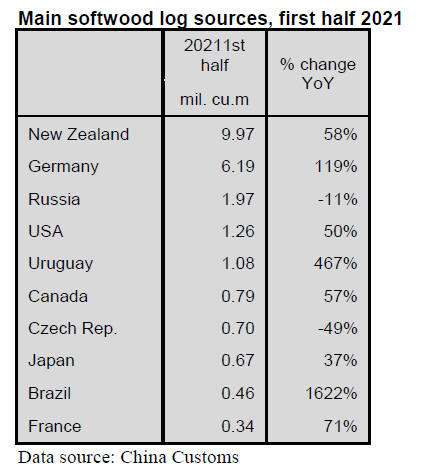

Of total log imports, softwood log imports surged 41% to

24.81 million cubic metres, accounting for 78% of the

national total. The average price for imported softwood

logs was US$142 (CIF) per cubic metre, up 24% from the

same period of 2020.

According to local experts, the main reason for the

increase in the volume of softwood logs imports was that a

large quantity was imported from European countries in

the first half of 2021. It has been estimated that about 500

million cubic metres of damaged European spruce will

have to be harvested up to 2024 and much of this will be

imported by China via the China-Europe Railway Express.

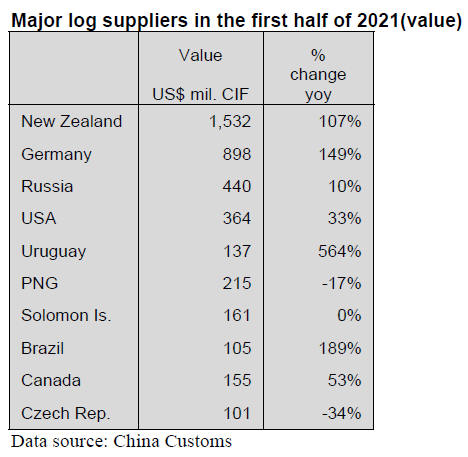

Germany, the second largest log supplier

The volume of log imports from most countries soared in

the first half of 2021 and Germany became the second

largest supplier of logs to China. Log imports from

Germany rose 95% to 6.43 million cubic metres in the first

half of 2021. China¡¯s log imports from Uruguay and

Brazil surged to 1.10 million cubic metres and 0.94

million cubic metres respectively which contributed to the

increase in overall log imports.

New Zealand was the top log supplier to China in the

first

half of 2021 accounting for 32% of total log imports. Log

imports from New Zealand totalled 10.02 million cubic

metres in the first half of 2021, up 58% from the same

period of 2020.

Russia ranked third in terms of log exports to China

at

3.40 million cubic metres in the first half of 2021, up 3%,

and accounting for 11% of total log imports in the first

half of 2021.

Australia no longer a major log supplier to China

China¡¯s log imports from Australia plummeted to 628,855

cubic metres in the first half of 2021 from 2.09 million

cubic metres in the first half of 2020.

China¡¯s log imports from Australia plunged because of a

ban on imports as the quarantine service in China once

again detected pests in a log shipment. Since the beginning

of 2020 the quarantine service has repeatedly detected live

pests such as the long horn beetle, Cerambycidae and

jewel beetles, Buprestidae in logs imported from Australia.

In accordance with national quarantine laws and

regulations the infected logs have been treated and the

exporters notified of the non-conformance with

international standards and required to investigate the

causes and take improvement measures to avoid a

recurrence.

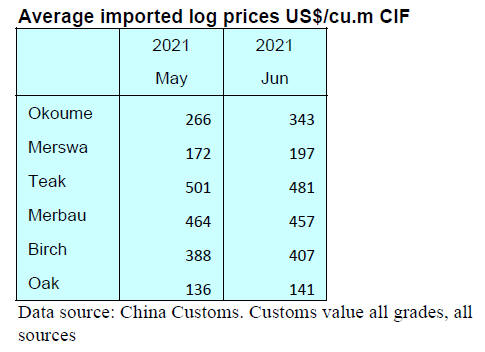

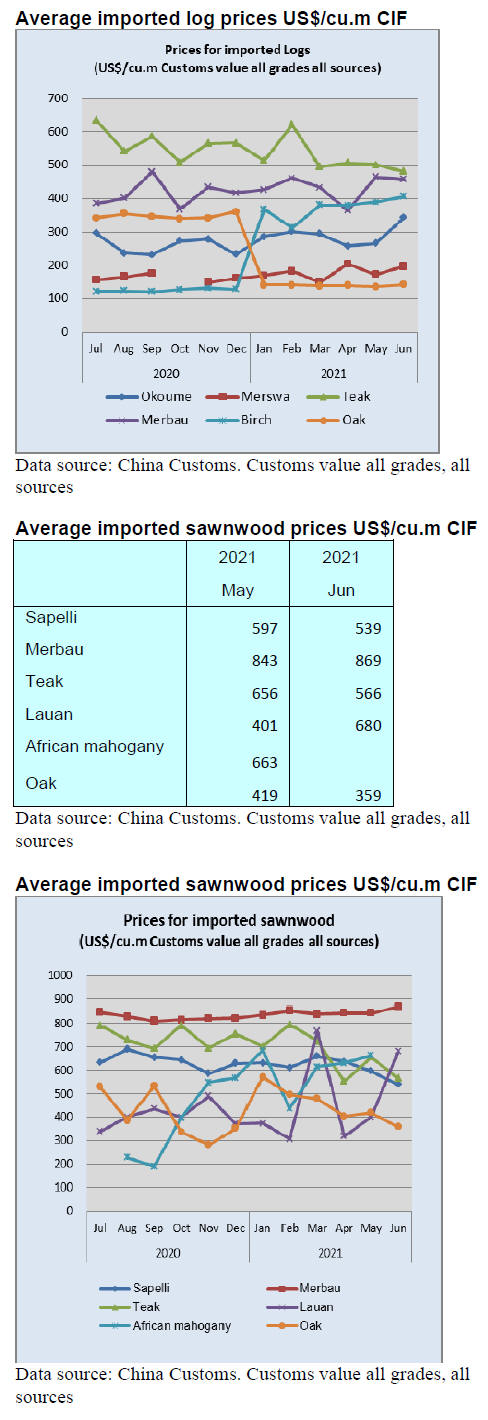

Slight decline in hardwood log imports

China¡¯s hardwood log imports in the first half of 2021 fell

1% to 6.81 million cubic metres (22% of the national total

log imports). The average price for imported hardwood

logs in the first half of 2021 was US$256 (CIF) per cubic

metre, up 14% from the same period of 2020.

Of total hardwood log imports, tropical log imports were

3.77 million cubic metres valued at US$9.98 billion CIF,

down 8% in volume but up 4% in value from the same

period of 2021 and accounted for 12% of the national total

log import volume.

The average price for imported tropical logs was US$265

CIF per cubic metre, up 14% from the same period of

2020.

Before its log export ban Myanmar was a major source of

tropical logs for China. However, China¡¯s log imports

from Myanmar have been declining for many years.

This trend reversed in the first half of 2021when China¡¯s

log imports from Myanmar soared 391% to 6,410 cubic

metres in volume and were valued at US$8.1 million. The

average price for imported logs from Myanmar rose 14%

to US$1,264 (CIF) per cubic metre in the first half of

2021.

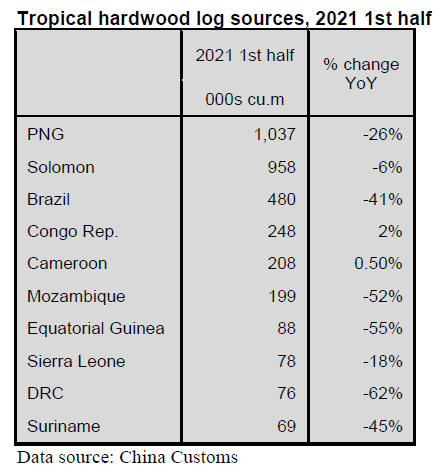

Decline in tropical log imports in the first half of 2021

China imported tropical logs mainly from Papua New

Guinea (27%), Solomon Islands (25%), Brazil (13%),

Republic of Congo (7%) and Cameroon (6%). Just 10

countries supplied 91% (3.442 million cubic metres) of

China¡¯s tropical log requirements in the first half of 2021.

China¡¯s tropical log imports from the first and second

largest suppliers, PNG and Solomon Is., fell 26% and 6%

to 1.037 million and 958, 000 cubic metres respectively.

It was this decline that drove down total tropical log

imports in the first half of 2021.

In the meantime, China¡¯s tropical log imports from

Equatorial Guinea and Suriname dropped 55% and 45% to

88,000 cubic metres and 69,000 cubic metres respectively.

Similarly, China¡¯s tropical log imports from the

Democratic Republic of Congo, Mozambique, Brazil and

Sierra Leone declined.

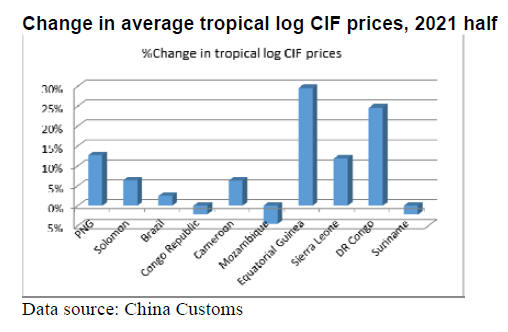

Average tropical log CIF prices

First half 2021 CIF prices for most of China¡¯s tropical log

imports rose. However, CIF prices for tropical log imports

from Mozambique, Suriname and the Republic of Congo

declined.

Change in China¡¯s HS code for wood products

Tariff codes for some commodities have been adjusted.

The following HS codes for wood products have been

deleted as of 1 January 2021.

The following HS codes on wood products have been

added as of 1 January 2021.

See:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202012/t20201223_3636573.htm

GGSC-CN Index Report (July 2021)

In July 2021, China's PMI index declined to 50.4%, a

slight drop from the previous month. However, it

remained above 50%, indicating that the economy

continued to pick up even as the growth rate slowed. In

July the wood production and manufacturing industry has

entered the traditional off-season period and while

domestic demand remains stable export orders have

declined significantly, the price of raw materials is still at

a high level, the inventory of raw materials has continued

to decline and the cost pressure of the industry has

increased.

The GGSC-CN comprehensive index

for July registered 47.7% (56.9% for July last year and

44.3% for July 2019), a decrease of 5.6% from the

previous month andit dropped below the critical value of

50% for the first time since March. From this it is

concluded that the operations of the forest products

enterprises represented in GGSC-CN index shrank from

last month.

Challenges reported

The price of fiberboard increased and the supply

of raw materials is tight.

The supply of raw materials such as base material

and ebony is tight so it is difficult to secure wood.

Efforts needed to reduce the procurement costs.

Products in short supply

Ebony, oak, black walnut, cumaru, oak above

1.8m, fibreboard, Base material.

Commodities for which the price has increased

Cumaru, pometia pinnata rosewood above 1.8m

£¬Pterocarpus erinaceus Poir black walnut board,

yelow rose board,rubberwood, ash, plywood,

fibreboard, reinforced base material, solid wood

blank, base material, urea, melamine,

frmaldehyde, dcorative paper, epoxy acrylate

Commodities for which the price has decreased

Formaldehyde, Paper

Summary

In the GGSC-CN index for July 2021 three out of five subindexes

of fell and two increased.

The production index registered 46%, a decrease of 15%

from the previous month and below 50% for the first time

since March. It shows that the production of forest

products enterprises represented in the GGSC CN

is worse than last month.

The new order index registered 50%, a decrease of 5.5%

from the previous month reflecting the ability of

enterprises to obtain orders is almost same rate as last

month.

The new export order index, reflecting international trade,

registered 23%, a massive decline from the previous

month showing orders from abroad in

July decreased sharply July from last month.

The main raw material inventory index registered 46%, an

increase of 7% from the previous month.

The employment index registered 54%, an increase

of 3.9% from the previous month indicating the

employment situation is better than the previous month.

The supplier delivery time index was 38.5% indicating

that the supply time of raw material suppliers is much

more slowly than in June.

|