Japan

Wood Products Prices

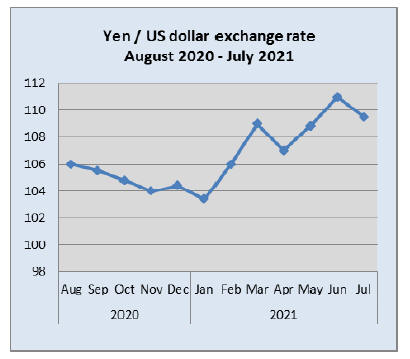

Dollar Exchange Rates of 25th

Jul

2021

Japan Yen 110.55

Reports From Japan

Optimism abounds ¨C economic

recovery this year says

government

In its July assessment of economic trends the Cabinet

Office emphasised that Japan¡¯s economy has seen

increased weakness in some sectors as measures to control

the spread of the corona virus have disrupted businesses.

However, the Cabinet Office, quoting the quarterly Bank

of Japan Tankan survey, upgraded its view on corporate

business sentiment.

The government has forecast the economy will return to

pre-pandemic levels in the latter part of this year driven by

accelerated vaccine rollouts and the steady recovery of the

global economy. The Cabinet Office forecast the nation¡¯s

real gross domestic product to grow 3.7% in fiscal 2021

from the previous year. Tokyo is currently under a fourth

state of emergency and this has been extended to Chiba,

Saitama and Kanagawa which border Tokyo.

The Chief Economist at the International Monetary Fund

said, when meeting the press, that the Tokyo Olympics,

even held without spectators at most venues, will not have

a significant impact on the Fund¡¯s projections for the

Japanese economy.

This was because spending on infrastructure in advance of

the games was the biggest outlay and that has long past. In

compiling its most recent economic outlook for Japan the

Fund did not take into account the fourth state of

emergency so warned there is a further downside risk to

Japan's economic growth coming from the latest state of

emergency.

See:

https://www.imf.org/en/News/Articles/2021/07/27/tr072721-transcript-of-the-world-economic-outlook-update-press-briefing

One of the most expensive Olympics

Hosting an Olympic Games is one of the most expensive

events any country can take on and the Tokyo Games is no

exception with estimates of the total cost put at a

staggering US$20 billion by the Japanese government

auditors. This is around three times the forecast of US$7

billion when Tokyo bid for the event.

In a recent article, Kiyoteru Tsutsui, Professor and

Director of the Japan Program at the Walter H.

Shorenstein Asia-Pacific Research Center, part of the

Freeman Spogli Institute for International Studies at

Stanford University, says Japanese public sentiment can

be summed up in a single phrase ¡°Why are we doing this

now?¡±

In an Asahi newspaper survey in Japan reported over 80%

said the Games should be postponed again or scrapped.

Professor Tsutsui continued ¡°The road to the Tokyo

Olympics has been a long and winding one complicated by

COVID-19, first and foremost and various scandals. The

Japanese public has been fed up with the COVID-19

related emergency declarations and other restrictions, as

well as the slower pace of vaccination compared to other

developed countries. The perception, right or wrong, is

that the government decisions were based on whether they

help in hosting the Olympics successfully, when the focus

should be on public health and economic rescue in the

COVID environment¡±.

See:https://news.stanford.edu/2021/07/22/long-winding-road-2020-tokyo-games/

and

https://www.asahi.com/ajw/articles/14351670

Export data suggest a recovery taking shape

In June exports from Japan rose almost 50% year on year,

the fourth month of expansion. The increases have been

exaggerated by the sharp drop in exports last year due to

the pandemic however, the data does suggest a recovery

was taking shape. The problem is now by how much will

the measures adopted to slow the rate of infections in the

fourth wave impact manufacturing output.

Slight appreciation of yen against US dollar

The US dollar fell to new weekly lows against most major

currencies in late July as economic indicators came in

weaker than expected. Second quarter GDP showed the

economy grew at an annualised 6.5%, below the 8% plus

forecast.

Also, unemployment data was worse than expected. As a

result of the unexpected dollar weakness the yen

appreciated to over 109 to the dollar.

Seeds of recovery

Year on year, June housing starts rose 7% after an almost

10% year on year rise in May. There has been a steady

upward trend in the number of housing starts from the

very low level in January this year. However, looking at

the starts over the past five years it is clear there is a long

way to go before the numbers get close to levels in the

years before 2020.

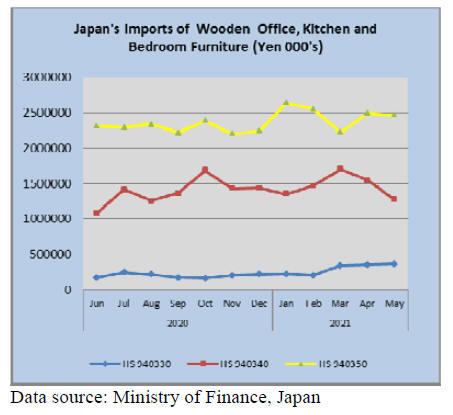

Import update

Furniture imports

As is the case in most other advanced economies

consumer spending on furniture recovered quickly after

the downturn in the first quarter of 2020 when it became

apparent that the corona virus outbreak was becoming a

pandemic. In Japan imports of wooden furniture got back

on track in the second half of 2020 and since have

performed as in pre-pandemic years.

Japan suffered a serious third wave of infections which

dented consumer sentiment and the July fourth wave of

infections and associated lockdowns along with the

general disillusionment with the Olympics are having a

negative effect on consumption.

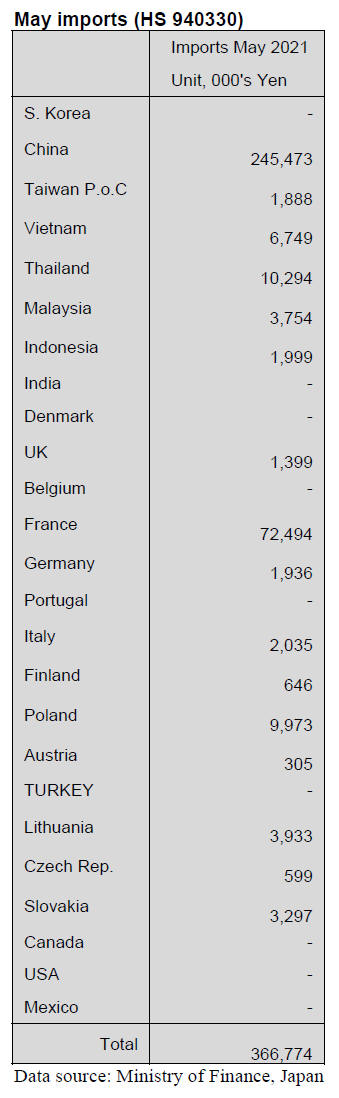

Office furniture imports (HS 940330)

Imports of wooden office furniture picked up in March

this year and the rise was sustained for two additional

months to May 2021. Year on year, May 2021 wooden

office furniture imports were up 70% and compared to

May 2019, pre-pandemic, there was a 65% rise in May

2021.

The top three shippers of wooden office furniture in May

this year were China, France and Thailand. Shippers in

France and Thailand have been steadily gaining market

share in Japan. On the other hand Poland and Italy, once

significant shippers have lost market share.

Exporters of wooden office furniture in China accounted

for over 65% of Japan¡¯s imports of wooden office

furniture followed by France (34%) and Thailand (3%).

The top three shippers saw shipments rise in May

compared to a month earlier.

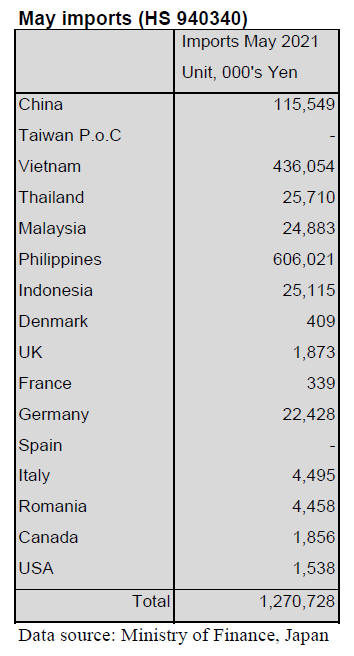

Kitchen furniture imports (HS 940340)

The slowdown in wooden kitchen furniture imports

recorded in April extended into May. Given the much

lower level of the value of imports in May 2020 it is not

surprising that year on year the value of May 2021 imports

were almost 50% up on May 2020. In comparison to prepandemic

May 2019 Japan¡¯s imports of wooden kitchen

furniture were down around 10%.

All three of the main suppliers, the Philippines, Vietnam

and China saw May imports drop below levels reported for

April. The Philippines was the top shipper, accounting for

48% of May 2021 arrivals followed by Vietnam (34%)

and China (9%). Of note was the sharp rise in the value of

wooden kitchen furniture from Germay and Malaysia.

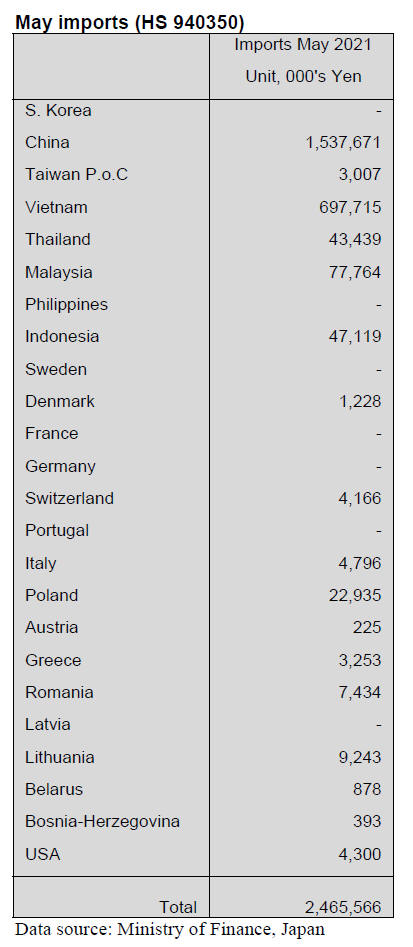

Bedroom furniture imports (HS 940350)

The value of May 2021 imports of wooden bedroom

furniture was little changed from that a month earlier and

for the year to May is running at average levels seen over

the past 2 years. Year on year, the value of May 2021

imports of wooden bedroom furniture were up 27% and

caompared to May 2019 there was an almost 15%

increase.

The top three shippers accounted for over 90% of May

shipments of wooden bedroom furniture to Japan.

Shippers in China accounted for 62% of May imports (up

from a month earlier), Vietnam 28% (down from a month

earlier) and Malaysia 3% (down slightly from a month

earlier). While shipments of wooden bedroom furniture

from Indonesia are still small there was a significant rise

in the value of May imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Price increase of domestic softwood plywood

Supply of structural softwood plywood is getting tight by

active demand of precutting plants and wholesalers. The

manufacturers¡¯ inventory is trending low. The

manufacturers are not able to increase the production

because of manpower shortage. Log prices climbed to

supplement shortage of imported materials so the

production cost is climbing. The manufacturers have

started proposing 1,050 yen per sheet (12 mm thick/3x6)

since 1 July.

Recutting plants have been restricting taking orders

because of shortage of building materials but orders for

structural plywood has not decreased. Wholesalers say that

sales are active so that there is very little time to store the

inventory at warehouses.

Non-structural plywood demand is also vigorous by

declining supply of South Sea hardwood plywood.

Floor manufacturers demand more supply to replace

imported hardwood plywood and sales of softwood

concrete forming panel for DIY stores are increasing.

Domestic softwood plywood manufacturers are running

fully but the production has not increased because of

restriction of overtime works by law and competition to

acquire material logs is getting fierce. Demand of cedar

logs increased and sawmills buy suitable logs for plywood

then cedar logs are now shipped for China so sudden

increase of demand for cedar logs so log purchase by

plywood mills is not easy.

Particularly in the Western Japan, demand for lumber and

export is very active so that plywood mills are not able to

buy enough locally so that they buy logs from far places

like Hokkaido and the North East Japan.

At the end of April, the manufacturers¡¯ inventory was

92,300 cbms, 10,300 cbms less than March. May has

many holidays so further decline of inventory is certain so

the manufacturers ship out produced plywood right after it

is made.

Presently market prices of structural softwood plywood

(12 mm/3x6) are 980-1,000 yen per sheet and in the

Western Japan, the supply is tighter so that the prices are

over 1,000 yen. Now the manufacturers are proposing 50-

70 yen higher prices.

Overheating market of cypress logs

Supply shortage of imported wood products triggered

demand shift to domestic logs and lumber and the prices

have been soaring sharply.

Cedar log market is now pausing before rainy season but

cypress log prices continue climbing in the Western Japan,

where there are many cypress cutting sawmills.

Despite rainy season, high prices stimulate cypress log

production. Volume of cypress is much smaller than cedar

so sawmills try to buy as much as possible before log

production slows down.

Cypress lumber prices are about 62,000-65,000 yen all

over Japan up until early March on both KD 105 mm post

and sill then the prices soared to 120,000-130,000 yen in

Kanto market by early June. Sawmills have flood of orders

and with high lumber prices, they keep paying high prices

for logs so the log prices skyrocketed all over Japan after

April.

Particularly in Western Japan and Kyushu, the prices are

extraordinary high. A number of cypress cutting sawmills

and plywood mills increased but the log supply is limited

so it has been chronic of tight supply of cypress logs then

the demand expanded all of a sudden so the prices keep

climbing.

Cypress log prices were about 20,000-22,000 yen in late

May on 4 metre sill cutting logs, which moved up to

25,000-28,000 yen in late May. The prices further climbed

to 30,000 yen or higher in June. In late June, at auction

market in Shikoku, cypress log prices marked 40,000 yen.

In this market, the prices were about 23,000 yen in last

April and May. The prices advanced to 27,000 yen in early

June and jumped up to 35,000 yen in middle of June and

finally reached 40,000 yen in late June.

After rainy season is over, log production should increase

but the supply will not be enough to satisfy booming

demand. In Hita, Kyushu, auction prices for sill cutting

cypress logs reached 40,000 yen and in Kumamoto,

Kyushu, cypress log prices are 39,000 yen.

Some sawmill owner bought cypress logs ate 40,000 yen

and said that manufacturing KD 105 mm lumber with

40,000 yen logs means lumber price should be about

140,000 yen with 50% recovery, KD cost and

transportation cost. Cypress sawmills need to increase the

sales prices of lumber in July to cover high log prices.

This is extraordinary market that cypress log prices

skyrocketed and doubled in two months.

Plywood

Both domestic and import plywood are tight in supply.

Movement of domestic softwood plywood continues

active despite slowdown of precutting companies¡¯

operations. In wholesale channel, inquiries on softwood

plywood are strong. Main orders are to fill in declining

inventory but there is some demand as substituting

materials.

Domestic plywood manufacturers increase the sales prices

because of higher log cost. Supply tightness of imported

plywood remains unsolved. Manufacturing plywood mills

in Malaysia and Indonesia struggle to secure logs but

shipment of contracts made after July will be shipped after

October so considering rainy season in the fourth quarter,

any sizable supply increase is unlikely.

Log supply in Indonesia is improving but because of

robust demand of other markets, Japan volume is very

limited. In Japan, distributors are chasing necessary items

in low inventory but fortunately construction activities are

slow so there is no impact to construction activities.

Domestic logs and lumber

Short supply of imported wood products and climbing

prices continue so substituting demand for domestic wood

also continues. There are very active orders of lumber but

production cannot increase in short time so short supply

and high prices continue.

The market in Western Japan started climbing since

early

May and speed of price increase got faster in June and

July. Particularly cypress log prices jump up by 10,000

yen every month and finally the prices reached 40,000

yen. There has not been any such high price on standard

grade cypress logs before. Meantime, in Kanto market,

where the prices started climbing since last April, the

market simmered down in June and the high prices

stopped climbing.

Normally in rainy season, log production declines but this

year, high prices stimulate log production even in rainy

season. There are more rainy days in July so log

production is slowing down and some sawmills with

minimum inventory are concerned to log supply.

Meantime, Kanto market, which led price increase of

domestic logs and lumber, upward momentum is easing in

June. 3 metre KD cedar 105 mm post prices were 52,000-

53,000 yen per cbm until last March are now 110,000-

120,000 yen. 4 metre KD cypress 105 mm sill square

prices were 62,000-63,000 yen in March are now 120,000-

130,000 yen. The prices doubled in two months then

leveling off in July.

Sawmills and dealers wish that high prices should stay

since all the imported materials are over 100,000 yen.

Wood procurement policy by Daiwa House

Daiwa House (Osaka) drew up wood procurement policy

on June 16. Purpose is to stop destruction of the forest as a

result of procuring wood to build houses. Purchase of

wood must be made through suppliers whose policy is

zero forest destruction. Also the suppliers must consider

safety and right of native workers of producing countries.

Daiwa House has started purchasing wood with policy of

no destruction of forest since 2010 and made survey of

suppliers since January 2011 and evaluate each supplier

with ranking. They are classified with four ranking, S,A,B

and C. Wood purchase from S rank, which is least risky

suppliers, was about 87% in 2015 then moved up by about

94%. A is 3.9% and B is 1.2% then C is 0.8%.

S rank is certified either by FSC or PEFC, Sustainable

Green ecosystem Council (SGEC) or sustainable supply

and legality is certified suppliers.

Daiwa House has long term environmental vision

¡®Challenge zero 2055¡¯. It is aiming zero environmental

load and one of themes is to achieve zero forest

destruction which is caused by purchase of wood for

construction of houses.

Initially it applied to purchase of structural materials, floor

panel, wall panel and furring strips but now concrete

forming plywood, interior fittings and wall cloth are

covered now.

Active log exports to China

The price of logs to China has been US$170-US$180

(C&F, cubic metres). It continues good business to export

logs to China and estimated prices may be US$190 (C&F,

cubic metre) in this month, the exporting companies say. It

is difficult to get profit because of increasing freight and

competition at a market even though yen exchange is

stable around ¥110 for US$1.Cedar logs, 4¡Á8 cm for

fences, to China and the U.S.A is very popular recently so

that causes high prices trading.

The price of radiata pine logs for China from New

Zealand, as an indicator, is nearly US$200(C&F, cubic

metres). Due to COVID-19, there are many ships

remained idle at Changshu harbor in China and it takes a

lot of time to unload.

Usually the FOB prices of Japanese logs at shipping ports

are around US$11,000 but it may increase up to ¥14,000-

¥15,000 when several exporting companies compete at a

market.

In recent few months, since there are a lot of demands for

housing in overseas, it is difficult to buy logs around

¥10,000 any longer. That makes some traders worried.

The prices of logs in Japan are ¥10,000-¥11,000 at loading

ports. If you buy logs at open market, the price might be

expensive because of competition by many companies. So

that is why the profit of exporting companies is not good

enough. On the other hand, log suppliers are happy with a

high price for even low quality logs, which are used for

biomass fuel.

People who involved with biomass energy of wood chips

are concerned about there will be not enough wood chips

if exporting logs to China keeps going since there are new

operation of biomass energy facilities which consume

wood chips.

|