|

Report from

North America

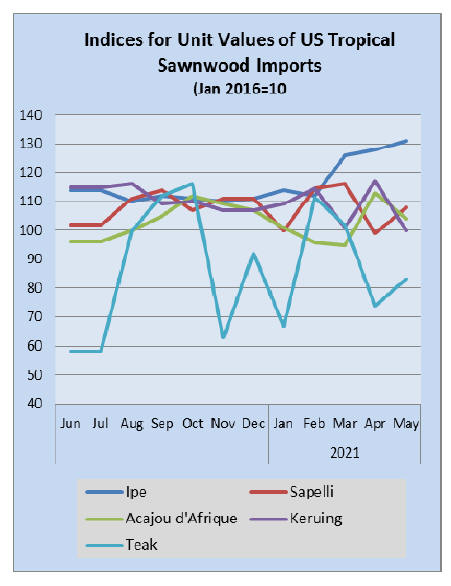

Sawn tropical hardwood imports rise

Imports of sawn tropical hardwood rose by 5% by volume

in May. The 9,931 cubic metres imported in May was the

highest monthly volume so far this year. The rise was

fueled by a 22% increase in imports from Ecuador, a 29%

increase in imports from Malaysia, and a 258% increase in

imports from Congo (Brazzaville).

Imports of sapelli and acajou d¡¯Afrique both rose around

50% over the previous months to levels more than double

that of May 2020. Imports of mahogany fell 89% from

their strongest month in 5 years. Despite the drop,

mahogany imports were still about even with May 2020

volume and are still up 77% year to date through May.

Imports of ipe and jotoba, no longer included in the overall

reported totals, were both up handily. Jotoba imports

gained 58% in May and are up 10% year to date while ipe

imports rose 29% in May and are up 17% year to date.

Total tropical hardwood import volume (including ipe and

jatoba) is up 9% year to date.

Canadian imports of sawn tropical hardwood cooled in

May after a strong April, falling by 8%. Imports of iroko,

mahogany and balsa all fell sharply.

Hardwood plywood imports soar

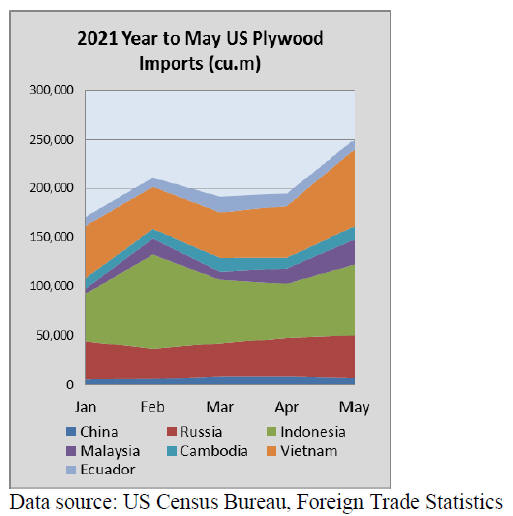

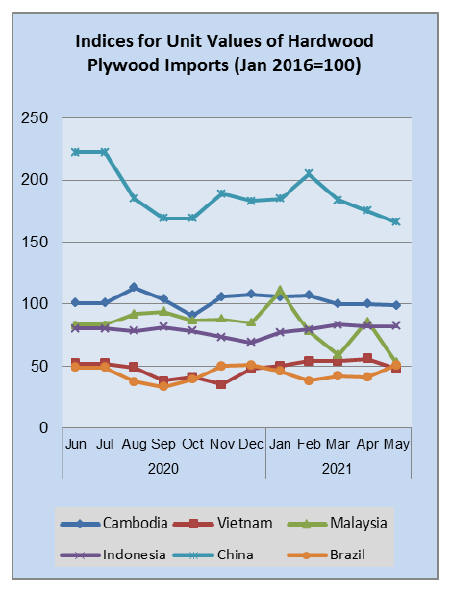

Imports of hardwood plywood jumped 24% by volume in

May to the highest volume in more than 4 years. At

306,116 cubic metres, volume was more than 20% higher

than the previous May and the highest since February

2017.

Imports from Vietnam rose 51%, while imports from

Malaysia rose 65%, imports from Indonesia rose 31%, and

imports from Cambodia rose 21%. Year-to-date imports

are up by 20% overall with imports from Indonesia and

Cambodia both up more than 40%. Imports from China

fell by 16% in May and are down 7% year to date.

Veneer imports surge again

Imports of tropical hardwood veneer surged again in May,

rising 41% by volume as imports continue to recover from

a weak winter. Imports from Italy and India were the

reason. Imports from Italy rose by 33% while imports

from India nearly tripled. This more than offset a 98%

drop in imports from China.

Total imports for the month were nearly double that of the

previous May, yet year-to-date imports are still 11%

behind 2020 through May.

Hardwood flooring imports rebound

Imports of hardwood flooring grew by 16% by volume in

May, gaining back most of April¡¯s loss. Imports from

Indonesia and China, which have been down considerably

so far this year, both made strong gains in May with

imports from China rising 31% and imports from

Indonesia up 41%.

Imports from Brazil were up 24% In May and are ahead

172% year to date. Overall hardwood flooring imports are

up 35% year to date through May.

Moulding imports gain

Imports of hardwood mouldings rose 14% by volume in

April as imports from Brazil and other key suppliers

returned to more traditional levels. Imports from Brazil

rebounded from an uncharacteristically bad April, rising

643% to return to its March level.

Imports also rose sharply from China (72%), Malaysia

(31%) and Canada (15%). Overall imports are up 14%

year to date.

Wooden furniture imports advance again

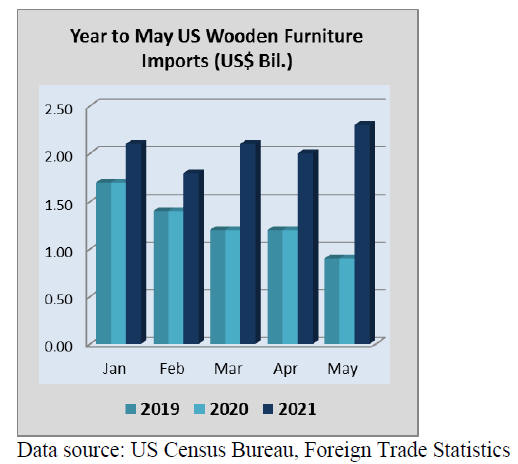

Imports of wooden furniture grew by 12% in May,

producing another record month. May¡¯s more than

US$2.25 billion in imports is a new high month, well over

twice that of last May and surpassing the all-time high set

in January.

Imports from Vietnam rose 20% in May and are up 73%

year to date. Imports from China grew 10% in May and

are up 57% year to date. Overall imports are up 60% year

to date.

Meanwhile, the overall US furniture market remains

sturdy. New orders for furniture remained strong in April,

up 239% from the same month last year, and a healthy

30% ahead of a more meaningful comparison with April

2019.

According to the latest Furniture Insights survey of

residential furniture manufacturers and distributors, yearto-

date orders are up 73% compared with 2020¡¯s first four

months ¨C and up 36% compared with January-April 2019.

Ken Smith, partner at accounting and consulting firm

Smith Leonard, which produces the monthly Furniture

Insights report, called that performance ¡°really

impressive.¡±

Cabinet sales hold steady

According to the Kitchen Cabinet Manufacturers

Association¡¯s monthly Trend of Business Survey,

participating cabinet manufacturers reported net sales near

level in May. Overall sales increased 0.8% in May

compared to April. Custom sales were down 2.0%, semicustom

sales up 2.1%, and stock sales increased 0.5%.

Sales are vastly better than in 2020, with an increase in

overall cabinet sales of 32.9% for May 2021 compared to

the same month in 2020. Custom sales are up 26.9%,

semi-custom increased 32.6%, and stock sales increased

34.4%. These numbers reflect the continued recovery from

the height of the pandemic lockdown.

Overall, year-to-date cabinet sales are up 21.6% over

2020. Custom sales up 23.5%, semi-custom sales

increased 21.3% and stock sales increased 21.4%.

See:

https://www.kcma.org/news/pressreleases/May_2021_trend_of_busines_press_release

Lumber prices retreat but analyst says they¡¯ll head

back up

The softwood lumber bubble has finally popped due to

eased demand and growing supplies in June. Lumber

futures tanked by more than 40% in June, the biggest

monthly drop in data kept since 1978, according to CNBC.

Lumber futures fell for six straight weeks, with the price

ending June at about US$710 per thousand board feet.

This comes after prices hit an all-time high closing price

of US$1,670.50 on May 7.

John Duncanson, Executive VP of Corton Capital and

timber analyst on the Corton Global Timber Fund, who

forecasted the rise and the subsequent crash, says right

now we are seeing the lowest prices we will get this year.

Duncanson told Yahoo Finance that the lower prices will

bring demand back up while harsh wildfires in the US and

Canada will squeeze supply. He predicts a price over

US$1,000 by September.

See:

https://therealdeal.com/2021/07/01/lumber-pricesare-splintering/

|