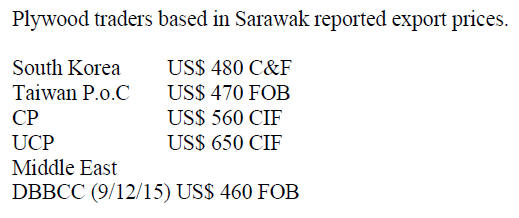

WTK Holdings has indicated it will adjust plywood output

in response to weak demand in the Japanese market. In

2020 around 70% of the group’s plywood was exported to

Japan and 29% to Taiwan P.o.C. WTK said Japan

imported plywood faces tough competition from Japanese

domestic plywood.

4.

INDONESIA

Furniture industry

continues to grow

Indonesia’s Minister of Industry, Agus Gumiwang

Kartasasmita, said the performance of the furniture sector

is very encouraging and as a result it will get more support

from the government.

Furniture exports in 2020 increased by around 8% from

2019 and were worth close to US$2.0 billion. Another

product that is doing well is wooden doors as Indonesia is

among the top producers after China, Canada, Poland,

Brazil and Germany.

He pointed out that in 2020 Indonesia was among the top

six door exporters to the UK, United States, Netherlands,

Australia and South Africa. The pandemic undermined

growth in the wood products sector in 2020 but now the

sector is recovering.

See:

https://jatim.antaranews.com/berita/487606/menperinindustri-furnitur-terus-menggeliat-di-tengahpandemi

MDF manufacturer optimistic on 2021 prospects

In 2020 PT Indonesia Fiberboard Industry achieved a 7%

increase in export sales over 2019 supported by increased

sales to Middle East countries where demand expanded

over 30% year on year. Company sales in 2020 were

distributed between Japan (IDR 248 billion), Middle East

(IDR 228 billion) and domestic sale (IDR1421 billion).

The company continues to be optimistic on prospect for

2021 especially as, according to a company spokesperson,

some other countries find it difficult to offer MDF from

mixed light hardwoods a common raw material for MDF

production.

Strengthen climate partnership with US

Indonesia has expressed support for strengthening a new

bilateral climate partnership with the US. The Minister of

Environment and Forestry, Siti Nurbaya, conveyed this in

writing in response to a letter from the US Presidential

Envoy for Climate, John F. Kerry.

The Minister noted that building a new climate partnership

with the US is among Indonesia's bilateral climate

priorities.

See:

https://foresthints.news/indonesia-making-efforts-tostrengthen-new-climate-partnership-with-us/

Number of fire ‘hotspots’ falls

The number of haze-casing fires during the period January

to mid-May this year has dropped. The Minister of

Environment and Forestry reported that there were 232

fire ‘hotspots’ during the period which was over 60% less

than in 2020. The Minister said fire-fighting efforts

continued despite the challenges posed by pandemic.

Trade Balance Surplus

The Minister of Trade Muhammad reported the April 2021

trade balance was a surplus of US$2.19 billion and that

this builds on the monthly surpluses reported since May

2020. The surplus in April 2021 was mainly from non-oil

and gas sectors.

See:

https://www.republika.co.id/berita/qtlsah383/neracadagang-surplus-lutfi-pemulihan-ekonom-menguat

5.

MYANMAR

Myanmar reports 96 new

COVID-19 confirmed patients

Myanmar’s Ministry of Health and Sports reported

additional COVID-19 patients on 27 May bringing the

total number of confirmed cases to 143,414.

It has been reported that China has donated 500,000

Sinopharm Covid vaccine does to Myanmar which will be

administered first in badly affected areas. The ministry is

trying to make sure all health workers receive vaccine

shots. Currently, Myanmar is using Covishield and as of

the end of April over 1.5 million people have received

their first shot.

See:

https://elevenmyanmar.com/news/myanmar-to-use-chinadonated-sinopharm-covid-vaccine)

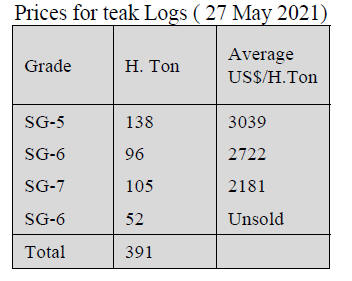

MTE Tender sales resume

The Myanmar Timber Enterprise (MTE) sold teak and

hardwood logs on 27 May 2021. This was the first sale

conducted under the new administration, the military

government. Out of 391 tons on the tender list, 340 tons

were sold for about US$900,000. The conditions of sale

specified that only finished products could be exported.

Sales were conditional on production of finished products

only if for export. As a result of this the average price

offered was lower than if mills could export sawnwood.

Since the first week of April sawnwood export licenses

were suspended.

It is understood that sawmillers and representatives of the

Ministry of Natural Resources and Environmental

Conservation met to discuss the preparation of new export

regulations. No new regulations had been released as of

the end of May.

The local media (The Irrawaddy) reported that the value of

tender sale (all logs) totalled around US$1.8 million for

390 tons of teak logs, 4,030 tons of other hardwood logs

and sawnwood.

Business suspend payments to joint venture state

enterprises

The international media has reported Total of France and

Chevron of the US announced they have suspended some

payments to their joint venture with a state-owned

company.

Democracy advocates are repeatedly pressuring businesses

companies to suspend ties with the military regime and

have urged that oil and gas payments be put in a trust or

protected account until Myanmar has an elected

government.

The oil-and-gas sector is Myanmar’s largest source of

foreign exchange, earning at least US$1.5 billion annually.

See:

https://www.telegraphindia.com/world/myanmar-fossil-giantstotal-and-chevron-stop-junta-payments/cid/1816959

EU statement on recent developments

On 23 may 2021 the EU released a Statement by the

Spokesperson on the latest developments in Myanmar.

This states:

“We have heard the statement of U Thein Soe, the juntaappointed

chairman of the Union Election Commission,

according to which the Commission may dissolve the

National League for Democracy, which overwhelmingly

won the last general elections in November.

If the Commission were to proceed with this proposal, it

would show yet again the junta’s blatant disregard for the

will of Myanmar’s people and for due legal process.

The EU reiterates that the elections in November faithfully

represented the will of Myanmar’s people. This was

confirmed by all independent domestic and international

observers.

No arbitrary decision by the military junta and

their illegally-appointed members of the Electoral

Commission can cancel that.

The EU will continue to denounce all attempts to overturn

the will of the Myanmar people and to alter the outcome of

the last general elections. No repression or

unfounded pseudo-legal proceedings can grant legitimacy

to the junta’s illegal takeover of power.

Only respecting the will of the people can bring Myanmar

back onto its democratic path and deliver stabilityand

nd sustainable development.

See:

https://eeas.europa.eu/delegations/myanmarburma/98878/myanmar-statement-spokesperson-latestdevelopments_en

6. INDIA

Decisions on forests and

wildlife to be made by

Central government

Power to monitor state infrastructure projects is being

centralised to limit state government's decision-making in

issues related to forest and wildlife conservation. The

Ministry of Environment, Forest and Climate Change has

issued instructions that restrict State governments from

imposing environmental or conservation requirements for

infrastructure projects in forest areas other than what has

already been stipulated by the central government.

The Ministry has indicated that for a project to be

implemented under the Forest (Conservation) Act the

Central and State government will consult so that a

proposal can be examined and that due diligence has been

exercised.

See:

https://www.hindustantimes.com/india-news/centre-limitsstates-role-in-forest-matters-101616955823571.html

India plans heavy duties on fibreboard imports

The Directorate General Of Anti-Dumping and Allied

Duties in the Ministry of Commerce and industry has

proposed the introduction of duties on fibreboard imports

from Indonesia, Malaysia, Sri Lanka, Thailand and

Vietnam in order to effect import substitution and aid

domestic manufacturers. If approved by the Ministry of

Finance the duties will be valid for five years.

The aim of the recommended duty structure is to eliminate

the price difference between domestic and imported thick

MDF (around 70% of the MDF market) and narrow the

difference for thin boards.

Analysts comment this would help domestic fibreboard

producers replace imports which are currently estimated at

25-30% of the MDF market in India.

See:

https://economictimes.indiatimes.com/markets/stocks/news/fibreboard-import-levies-to-boost-centurygreenpanel/articleshow/82422994.cms?from=mdr

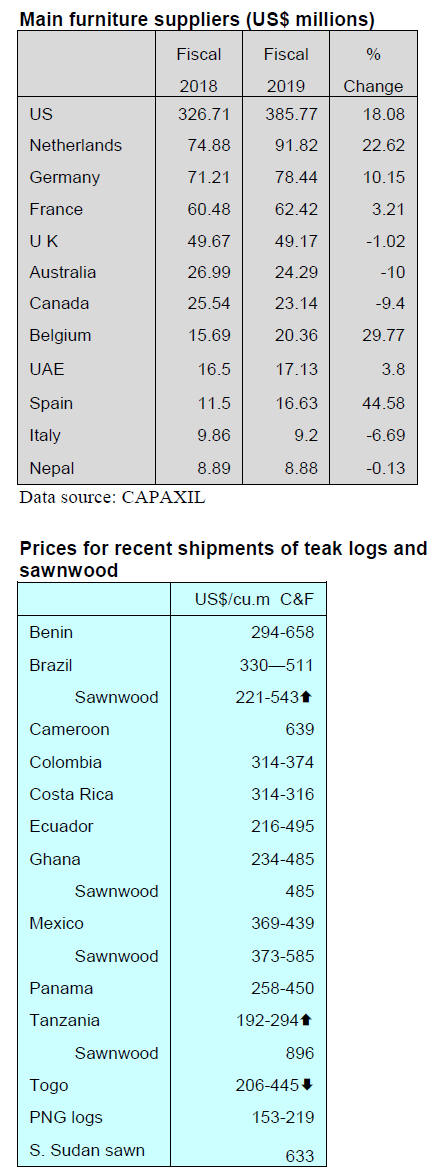

Main shippers of wooden furniture to India

Of the thirty main shippers of wooden furniture to India in

fiscal 2019, just 12 accounted for 92% of the US$850

million imported. Of the others Shippers in Vietnam saw

exports of wooden furniture to India triple in 2019 from a

year earlier.

Both China and Malaysia saw 2019 exports of wooden

furniture to India decline.

7.

VIETNAM

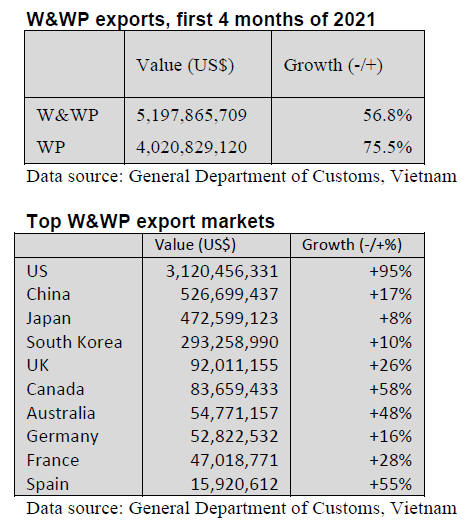

Impressive export growth in the first 4 months of 2021

In spite of the pandemic Vietnam’s wood and wood

product (W&WP) exports in the first 4 months of 2021

grew over 50%. At the current rate of growth W&WP

exports for 2021 could be as high as US$5 billion.

Duties on upholstered furniture

Upholstered seats originating from Vietnam are set to be

subject to an anti-dumping tax rate of 101.5% in Canada.

The move comes following the Canadian International

Trade Tribunal (CITT) preliminary investigation into

dumping.

The CITT found “reasonable indications” that dumping

and subsidised upholstered seating made in China and

Vietnam has or is threating to damage Canada’s domestic

furniture manufacturing industry. The CITT will continue

its inquiry and expects to issue its ultimate finding by 2

September. A letter from the Canada Border Services

Agency (CBSA) notified importers that provisional duties

will be collected as of 5 May.

According to details posted by the CBSA, numerous

products will be subject to anti-dumping and subsidy

duties including those with HS code 9401.40.00.00,

9401.61.10.10, 9401.61.10.90, 9401.71.10.10, and

9401.71.10.90.

Most notably, upholstered furniture originating from both

China and Vietnam will be subject to a tax rate of 295.5%

and 101.5% respectively in the Canadian market. In total,

28 Chinese manufacturers are expected to face antidumping

duties ranging from 20.65% to 226.45% while 7

Vietnamese manufacturers will be subject to duties

between 17.44% and 89.77%.

This follows the CBSA initiating an investigation in

December 2020, based on Palliser Furniture's complaint

with support from other manufacturers such as Canadian

Elran Furniture Ltd., Jaymar Furniture Corp., EQ3 Ltd.

and Fornirama Inc.

The move looks to limit the penetration of motion

upholstery and leather stationary furniture from China and

Vietnam into Canada.

Since 2017, Vietnam has maintained its position as the

largest trade partner with Canada of ASEAN members

with bilateral trade hitting US$5.1 billion in 2020.

See:

https://vietnamtimes.org.vn/canada-imposes-anti-dumpingduties-on-vietnams-upholstered-seats-31425.html

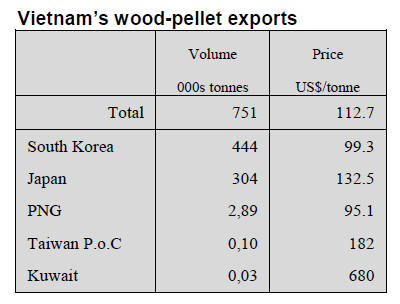

Vietnam’s wood-pellet export growing fast

Vietnam’s wood-pellet exports in the first 3 months of

2021 reached 751,000 tonnes worth US$84.6 million,

9.7% up in volume and 15% up in value over the same

period of 2020. The export price of wood pellet in the first

3 months of 2021 stood at US$112.7 per tonne, up 4.8%

over the same period in 2020.

According to Vietnam’s Ministry of Industry and Trade in

the period 2016–2020 the world wood pellet trade

expanded rapidly with an average growth rate of 14% per

year.

In 2020, global wood pellet imports are estimated at

US$4.55 billion, up 3.8% compared to 2019 and up 65.6%

compared to 2016.

In 2020 the UK was the largest consumer of wood pellets

with an import value accounting for around 38% total

world trade in pellets. Other major consumers were

Denmark, Italy, Korea and Japan.

In 2020 Vietnam's wood-pellet exports accounted for 7%

of the total world trade value of wood pellets.

In the first 3 months of 2021 almost all wood pellets

(99.6%) produced in Vietnam were exported to South

Korea and Japan. Exports to South Korea reached 444,000

tonnes worth US$44.09 million, up 2.6% in volume and

7.1% in value against the same period in 2020.

However, exports to South Korea have declined due to a

shortage of containers.

The Japanese market consumed 304,000 tonnes worth

US$40.2 million in the first 3 months of 2021, up 21% in

volume and 24.4% in value over the same period.

Refence log imports from Nigeria

Documents with Vietnam Customs show2020 log shipments

from Nigeria. The origin of the logs is unknown.

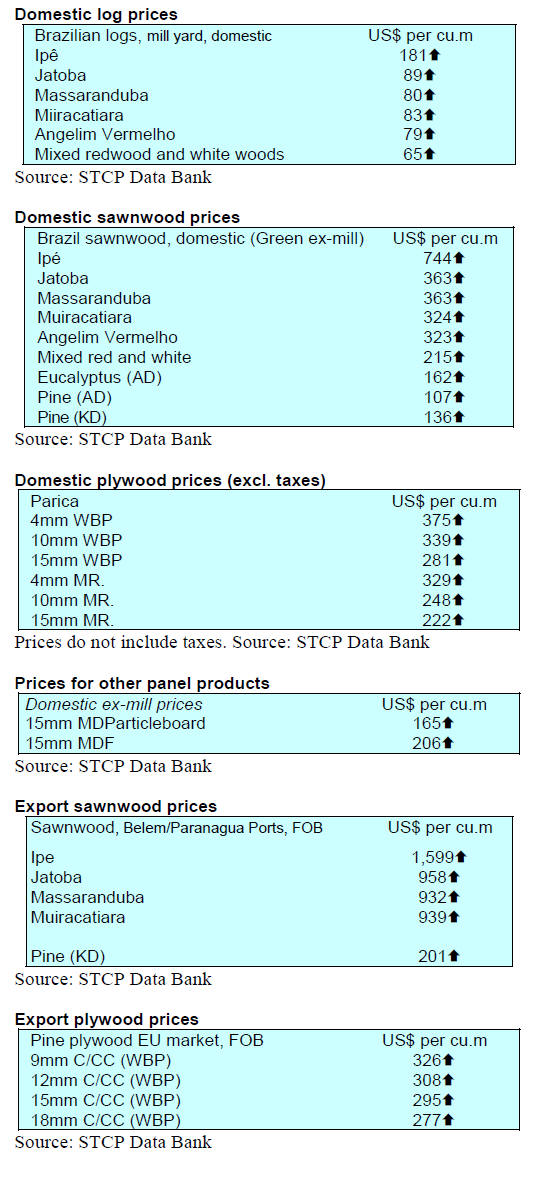

8. BRAZIL

Rise in inflation,

interest rates hiked

Inflation, as measured by the Extended National

Consumer Price Index (IPCA), was 0.31% in April, 0.62%

below the March rate (0.93%). The Central Bank of Brazil

(BCB) decided in April 2021 to increase the basic interest

rate (Selic) by 0.75% to 3.5% per year, the second

consecutive monthly rate increase aimed at containing

inflation.

Performance of the furniture industry

According to the Brazilian Furniture Industry Association

(ABIMÓVEL) and the Market Intelligence Institute

(IEMI) furniture production in January 2021 was 1.9%

lower than in December 2020. January export revenues for

the sector were R$7.4 billion. In January there was an

increase in domestic consumption which resulted in

manufacturers being able to raise prices. Employment

generated by the furniture industry remains at around the

same level as at the height of the pandemic.

While prospects are improving the high level of

uncertainty on the economy has resulted in fluctuating

business confidence according to the Brazilian National

Confederation of Industry and confidence in the industry

was below the historical average in February 2021.

New Standard to boost wooden frame buildings

It is anticipated that a Technical Standard (ABNT NBR

16.936, Brazilian Association of Technical Standards) on

buildings utilising ‘light’ wood frames should be

published this year. The draft text was prepared by the

Brazilian Committee of Civil Construction (ABNT/CB-

02) together with the Brazilian Wood Committee

(ABNT/CB-31) and provides guidelines for design and

execution of construction systems for ‘light’ wood frames.

The Standard establishes various requirements one of

which is that only wood products from plantation forests

or natural forests whose legal origin can be verified can be

used and applies to two story detached or semi-detached

buildings. The Standard includes reference to materials,

structural engineering design and fire protection systems

among others.

In preparing the Standard more than forty Brazilian

standards were consulted as well as international

references related to wooden frame/structures such as

Eurocode 5, ISO standards (European and American) and

the Sinat Directive 005. As result of the publication of the

standard it is expected there will be an increase in

domestic consumption of wood products.

According to the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI) the standard will

help promote the use of wooden frame construction as a

sustainable construction method. In addition, expanding

building of wooden frame homes can contribute to

reducing the Brazilian housing deficit.

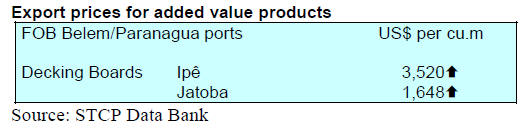

Export update

In April 2021 Brazilian exports of wood products (except

pulp and paper) increased 57.5% in value compared to

April 2020, from US$238.9 million to US$376.4 million.

Pine sawnwood exports grew 31% in value between April

2020 (US$45.6 million) and April 2021 (US$59.7

million). Export volumes increased 16% over the same

period, from 245,600 cu.m to 285,500 cu.m.

Tropical sawnwood exports increased 11.5% in volume,

from 31,400 cu.m in April 2020 to 35,000 cu.m in April

2021. The value of exports in the same period rose 14%

from US$12.6 million to US$14.4 million.

The value of pine plywood exports surged over 100% in

April 2021 in comparison with April 2020, from

US$49.19 million to US$100.9 million. Export volumes

also rose jumping 20% over the same period, from

200,900 cu.m to 241,200 cu.m.

As for tropical plywood exports increased in volume

(28%) and in value (39%), from 6,100 cu.m (US$2.6

million) in April 2020 to 7,800 cu.m (US$3.6 million) in

April 2021.

Wooden furniture export earnings increased from US$25.7

million in April 2020 to US$72.2 million in April 2021, a

181% growth in the total exports of the product during the

period.

Furniture exports jump in first quarter

The Brazilian Trade and Investment Promotion Agency

(APEX-BRAZIL) in collaboration with the Brazilian

Furniture Industry Association (ABIMÓVEL) publishes a

monthly report “Monitoring of Furniture Exports” in April

this year it was reported that Brazilian exports of furniture

grew by 34.5% in the first quarter 2021.

In March 2021 wooden furniture exports grew by 37%

compared to the previous month. The main destination

was the United States where exports jumped 32% in the

first quarter of 2021.

Brazil's trade ties with Chile have grown and Brazilian

furniture exporters have benefitted as there was an over

180% rise in furniture exports in the first quarter 2021.

Two other South American countries have also

strengthened trade relations with Brazil, Uruguay and

Peru. Furniture exports to both countries are growing.

9. PERU

Five year sustainable

management programme

The ‘Program for the Promotion and Sustainable

Management for Forest Production’ will be implemented

over around 5 million ha. in nine regions of the country

over the next five years. It is anticipated the programme

will generate over 50,000 direct and indirect jobs in

Ancash, Cajamarca, Huánuco, Junín, Loreto, Madre de

Dios, Pasco, San Martín and Ucayali.

The Ministry of Economy and Finance has received a

financial contribution from the German Development

Bank, Kreditanstalt für Wiederaufbau (KfW) for a sum of

euro 6 million to partially finance the investment

programme. The programme will be executed by the

National Forest and Wildlife Service (Serfor).

This programme is expected to generate as much as

US$500 million in private investment. The Ministry of

Agriculture envisions that through this programme around

70 million ha. of the country will be zoned for planning

purposes.

Boost for the forestry sector

In order to develop and implement a communication

strategy for the forestry sector a meeting was held between

the Association of Exporters (ADEX), the Commission for

the Promotion of Peru for Exports and Tourism

(PromPerú) and WWF. The meeting discussed issues such

as the need to communicate good forestry practices

implemented in the timber sector emphasising industries

are core stakeholder in the sustainability and conservation

of Peruvian forests.

Forest products movement regulation from Serfor

The National Forest and Wildlife Service (Serfor)

approved regulations for the Control of Timber Forest in

Land Transportation in order to strengthen measures

against illegal logging and the illegal timber trade in Peru.

The document standardises the means to control the

movement of forest products. It is envisioned that the

Regional Forestry Authorities will man checkpoints.

The regulations are mandatory across the national territory

and define the activities related to the verification and

presentation of the required documentation such as the

requirement to the carrier of the Forest Transport Guide

(GTF) and other documents that support the movement

mobilization and prove the legal origin of forest products.

This measure seeks to further promote the legal trade in

the wood products in the national and international

markets to ensure the sustainable use of the country's

natural resources.

Composite panel imports surge in the first

quarter

Peruvian imports of composite panels (PB/MDF) reached

US$37.5 million in the first quarter of 2021 versus

US$24.4 million in the first quarter of 2020, a record level

for the first quarter of a year.

Ecuador was once again the main supplier of PB/MDF to

Peru in the first quarter of 2021 with shipments worth

US$14.5 million a 37% year on year increase. Spain

ranked second with US$10.4 million, an increase of 152%

compared to the US$4.2 million shipped in the first

quarter of last year.

Brazil, with a notable growth of 127%, was the third

supplier country in the first quarter of this year at US$6.1

million, versus US$3.1 million in the first quarter of last

year. Chile followed with US$3.0 million a drop of over

50% year on year.