4.

INDONESIA

SVLK centre for forest farmers,

traders and SMEs

The Secretary of the Directorate General of Sustainable

Production Forest Management (PHPL) in the Ministry of

Environment and Forestry, Misran, has emphasised the

importance of ensuring that timber coming onto the

market must come from legal sources.

To ensure this the government has strengthened the

capacity of the private sector through application of the

Timber Legality Verification System (SVLK) and the

Community Based Forest Enterprises. This, said Misran,

was achieved through the Multi-stakeholder Forestry

Programme Phase 4 (MFP4).

To further encourage the growth of legally processed

wood the Ministry together with MFP4, Javlec (Java

Learning Center / NGO) and industry associations built a

SVLK clinic to serve community forest farmers, traders

and SMEs needing advice on SVLK implementation and

procedures.

See:

https://lenterasultra.com/blog/2021/05/04/indonesia-dorongpenguatan-kapasitas-pelaku-usaha-hutan-melalui-svlk/

Indonesian teak furniture a favourite in India

The Head of the Indonesian Trade Promotion Center in

Chennai, Kumara Jati, has reported that there is demand in

India for some products such as household furniture, home

décor items and handicraft made by Indonesian SMEs. He

added that sales of these products increased over the past

year despite the pandemic and the preference was for teak

furniture.

See:

https://money.kompas.com/read/2021/05/03/160022426/produkfurnitur-hingga-handycraft-buatan-umkm-indonesia-diminati-diindia

Indonesian furniture exports up but far behind

Vietnam’s

The Chairman of the Indonesian Furniture and Craft

Industry Association (HIMKI), Abdul Sobur, commented

on Indonesia’s 5-6% increase in furniture exports during

the pandemic helped, he pointed out, by the trade friction

between the US and China. But, said Sobur, the 5-6%

increase was nothing compared to what was achieved by

Vietnam where exports were four times higher than those

by Indonesia. According to Sobur, Indonesia has a chance

to expand exports especially to the US.

In related news, Sobur said the Association encourages

furniture makers to expand sales in the domestic market

but admitted that the current export market is much more

attractive than the domestic market. However, he urged

manufacturers not to underestimate the domestic market

and to diversify sales. He reported that in 2020, total

furniture imports were in the region of IDR10 trillion

indicating the growth potential in the local market.

See:

https://ekbis.sindonews.com/read/414408/34/eksporfurnitur-ri-naik-5-imbas-perang-dagang-tapi-kalah-jauh-darivietnam-1619795094

Structural reforms to boost economic growth: Finance

Minister

The Finance Minister, Sri Mulyani Indrawati, has said the

structural reforms being carried out by the government

will boost growth of by over 6% in 2025. The reforms

cover five strategic policies; human resource development,

infrastructure development, bureaucratic reform,

simplification of regulations and economic transformation.

The main impact will be on expanded investment and

exports.

See:

https://www.thejakartapost.com/news/2021/04/29/srimulyani-sets-sights-on-6-gdp-growth-by-2023-throughreform.html

Multi-business forestry model for climate change

mitigation

Environmental services in a multi-business forestry model

could, according to Siti Nurbaya, Minister of Environment

and Forestry, be part of climate change mitigation action

by the forestry sector. The contribution to climate change

mitigation efforts by enterprises could be through

activities that can reduce emissions and/or increase carbon

sequestration.

The Minister said the government encourages forestry

entrepreneurs to adopt a multi-purpose business model so

they can contribute to strengthening and supporting

climate change mitigation. This will be the challenge for

forestry entrepreneurs in the future.

This theme was taken up by the chairman of the

Association of Indonesian Forest Concessionaires (APHI),

Indroyono Soesilo, who said adaptation and mitigation

activities in climate change are important factors in efforts

to achieve Indonesia's Nationally Determined Contribution

(NDC) target and that businesses and other non-state

stakeholders are also an important part of this process.

The ability to calculate potential emission reduction is

crucial for businesses to determine their contribution to

adaptation and mitigation and earn Carbon Economic

Value (NEK) credits through both Results Based Payment

and carbon trading schemes.

He estimates the potential for emission reduction from

natural forests, plantation forests and ecosystem

restoration would make a huge contribution in fulfilling

Indonesia's NDC goals.

He said incentives absorption of carbon emissions in

natural forest areas and plantation forests can be obtained

through conservation and management of peatlands, the

application of Reduced Impact Logging (RIL) and

extension of planting and harvesting time in industrial

plantations along with reducing the area logged in natural

forests.

See:

https://investor.id/business/aphi-pelaku-usaha-harus-terlibatdalam-penghitungan-potensi-penurunan-emisi

5.

MYANMAR

Forest resource policy of military

administration

The Foretry Minister, Khin Maung Yi, was quoted by the

state-owned newspaper “The New Light of Myanmar” as

saying the priority of the administration regarding timber

extraction will be forest protection, only the minimum

harvest to meet demand will be permitted. He added that

the export of logs has been banned since 2014 and logging

in Bago Yoma has been suspended for ten years. It was

earlier announced that logging during the financial year

2021-2022 will be suspended.

With regard to the development of the wood-based

industry in the country the Minister said the focus will be

on value-added wood products and the Forest Department

and the private sector should work together to achieve this

and expand export markets. However, some NGOs are

urging a boycott of timber from Myanmar since the

income derived from exports will support the military.

Regarding the one-year logging ban for 2021-2022 the

website of Myanma Timber Enterprise (MTE) uploaded

the official notification from the Ministry dated 27 April

2021. Initially, MTE had targeted to harvest 6,000 tons of

teak logs and 220,000 tons of other hardwood logs.

The frequent suspension of monthly log tender sales as

result of anti-covid19 preventive measures and the decline

in milling has resulted in a build-up of log stocks.

According to exporters the suspension of export licenses

for sawnwood has not yet been revoked and they are

waiting for their licenses.

However, even if the licenses are issued the challenge now

for exporters is the availability of containers. The cost of a

20ft container for the route to Europe has surged to around

US$6,000. Last year the cost was just US$1,800 per

container.

See:

https://www.gnlm.com.mm/coordination-meeting-discussesenvironmental-forest-and-mining-sectors/#article-title

100 days of military administration – the impact

Tthe online Irrawaddy News published a review of the

economic impact of the coup and resistance. The

following are highlights from the Irrawaddy article:

Foreign investors suspended more than US$6

billion (9.4 trillion kyats) worth of projects.

Work on a US$1 billion industrial hub backed by

the Amata Corporation, Thailand’s largest

industrial real estate developer, was suspended.

A major Japanese car market has delayed opening

its US$52.6 million vehicle plant in the Thilawa

Special Economic Zone.

A Singaporean conglomerate halted plans to

develop an industrial park in Yangon’s Hlegu

Township.

The French energy company, Électricité de

France, has suspended a hydropower project,

worth more than US$1.5 billion in Shan State.

Myanmar’s banking system has been paralysed

since the coup with branches closed for nearly

three months, cash shortages and limited access

to social welfare payments and international

remittances for hard-pressed families.

All sea trade has ceased as banks are unable to

issue documents needed to import and export

goods.

Companies are struggling to pay salaries as banks

are not able to process payrolls.

Since mid-February businesses have suffered

from a cash shortages.

Most private banks started to reopen in late April

amid repeated threats of penalties and orders to

blacklist staff who refuse to return to work.

The kyat has tumbled in value as confidence and

trade fell, losing more than 20% since the coup.

Exports have fallen by around 45% and imports

are down by 65%.

The garment sector has been paralysed as out of

fear workers to returned to their hometowns.

The trade unions said over 300,000 garment

workers have lost their jobs.

The Construction Workers Union said around

300,000 to 400,000 construction jobs have gone

as all major infrastructure projects are halted in

Yangon.

Professional jobs are also being lost. Job agencies

said hundreds of staff working for foreign

companies are losing their jobs.

See:

https://www.irrawaddy.com/news/burma/100-days-sincemyanmars-coup-looming-economic-collapse-poverty-andhunger.html

Significant risk of economic collapse - UN

A United Nations Development Programme report

concludes that Myanmar’s economy is facing significant

risks of collapse and the level of poverty is as bad as in

2005.

Over the past 10 years, Myanmar’s average economic

growth has exceeded 6%. However, the World Bank has

now projected growth to contract by 10% this year

because of the coup, by far the biggest contraction in Asia

which is already reeling from the impact of coronavirus.

The United Nations World Food Program (WFP) warned

that up to 3.4 million citizens could go hungry this year

amid rising food prices and the loss of manufacturing,

construction and services jobs. The WFP estimated that

food insecurity is rising sharply in Myanmar alongside

food prices and joblessness. It said COVID-19 concerns

are also accelerating the economic deterioration and

humanitarian crisis.

The UNDP estimated that the impact of military rule and

the COVID-19 pandemic could force nearly half of

Myanmar’s population into poverty by 2022.

See:

https://news.un.org/en/story/2021/04/1091002

6. INDIA

Domestic demand

collapsed due to pandemic

In April production for India’s domestic market slowed to

an eight-month low as the early signs of the second wave

of corona infections dampened consumer sentiment,

however, there was an upturn in international orders

which, in April, rose again for the eighth consecutive

month.

India’s exports surged a record to US$30 billion in April

2021. Exports had contracted by over 60% in April 2020

due to the nationwide lockdown and this led to a halt in

the manufacturing sector.

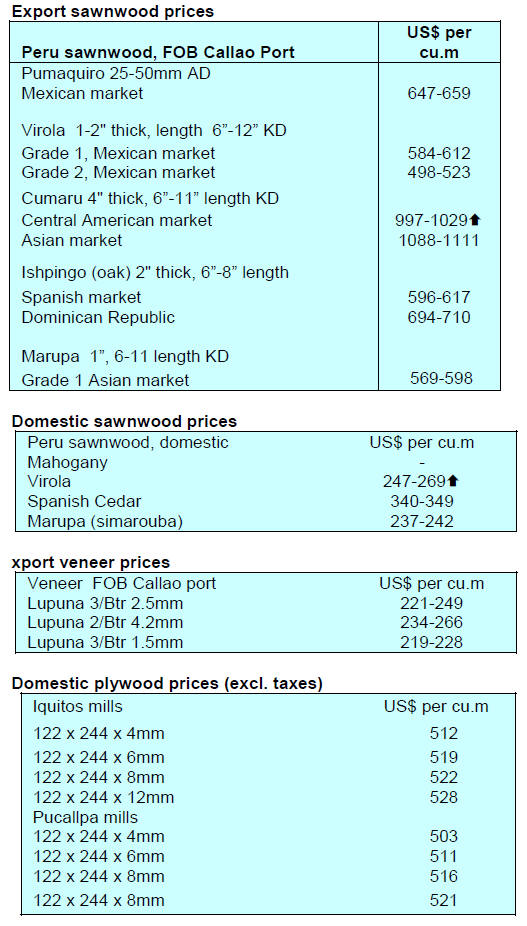

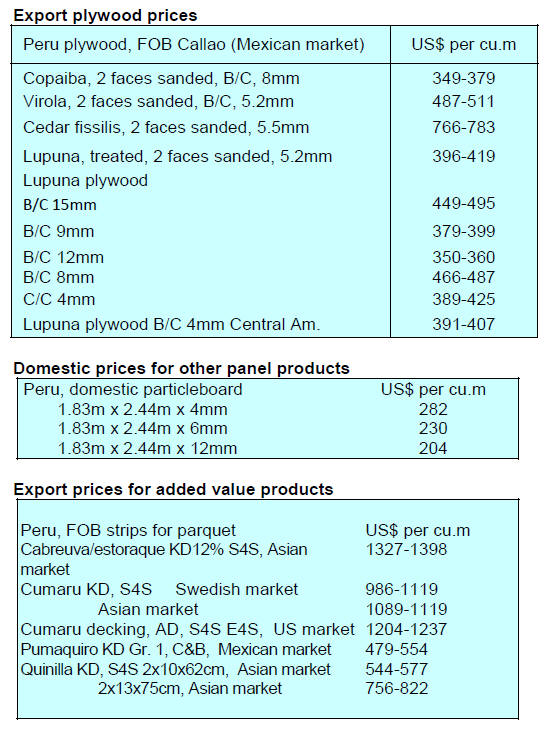

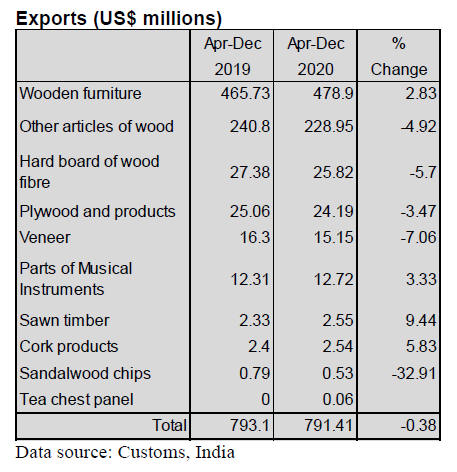

The latest wood product export data for the period

April to

December 2020 reveals a slight decline compared to the

same period in 2019. From March 2020 exports dropped

due to the pandemic and sluggish global demand.

In April the IHS Markit India Manufacturing Purchasing

Managers’ Index (PMI) rose to 55.5 after falling to a

seven-month low in March as new export orders grew the

fastest since October.

See:

https://www.business-standard.com/article/economypolicy/manufacturing-pmi-up-marginally-growth-of-domesticorders-production-slow-121050400043_1.html

Second wave a set back to housing market

The economies in many states have now begun to suffer

from the consequences of the second and serious wave of

corona virus infections and the real estate sector is one that

has been affected. The housing market started to recover

after the 2020 pandemic but this second wave has come as

a shock and home sales have fallen sharply and project

launches have been delayed.

Potential homebuyers have become very cautious in view

of the current virus situation and a number of transactions

have been put on hold as consumers cut back on outlays as

they are uncertain how long it will take to overcome the

current disaster. A recent Anarock Property Consultants

report suggests that the current virus outbreak, along with

the expiry of the free stamp duty period, impacted growth

in the housing market.

See:

https://www.financialexpress.com/money/a-year-since-thepandemic-mapping-real-estate-sectors-growth-journey/2241136/

Printed homes

Part of the solution to India’s acute shortage of affordable

homes could be in 3-D printed structures. A roughly 60

sq.m home was recently created by Tvasta Manufacturing

Solutions in Chennai in collaboration with the NGO

Habitat for Humanity’s Terwilliger Center for Innovation

in Shelter.

The concrete used in this 3D printing is specially

formulated for faster drying times, allowing Tvasta to

build these homes more quickly and efficiently than

traditional construction. Adithya Jain, the Tvata CEO said

a home can be built in under a week .

See:

https://www.habitat.org/stories/investing-innovation-india

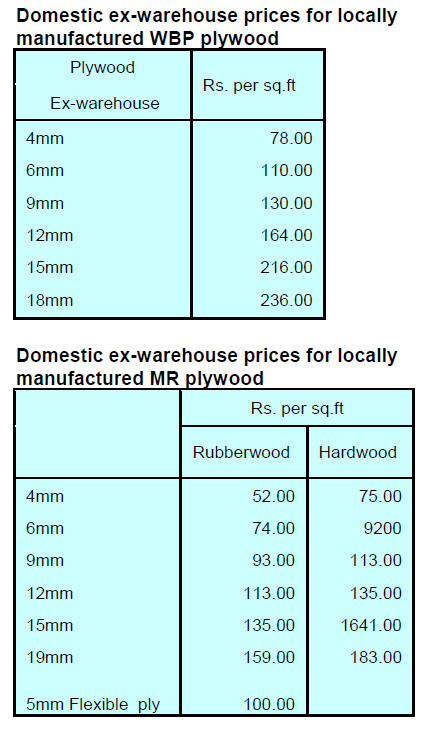

Plywood

The Indian trade magazine Plyreporter has highlighted the

current plight of Kerala based plywood mills that now face

an acute shortage of workers which is disrupting

production.

The problem is that Kerala plywood mills rely heavily on

migrant laborers mostly from Assam and West Bengal.

These workers, it seems, have returned home to participate

in assembly elections and because this is the marriage

season in both states.

Revising the Forestry Act revisited

On 8 April this year the Ministry of Environment, Forest

and Climate Change called for ‘Expression of Interest’ for

shortlisting consultancy companies that could prepare a

draft comprehensive amendment to the Indian Forest Act

1927 created in pre-independent India.

The objective of this latest exercise is to prepare a “draft

of the comprehensive amendment of Indian Forest Act,

1927” in consultation with state governments and union

territories, central government ministries and other

stakeholders according to the Ministry.

See:

http://moef.gov.in/wp-content/uploads/2021/04/MoEFCCinviting-EOI-for-draft-amendments-to-IFA.pdf

and

https://science.thewire.in/environment/unbent-indiangovernment-trying-to-amend-the-indian-forest-act-1927-again/

7.

VIETNAM

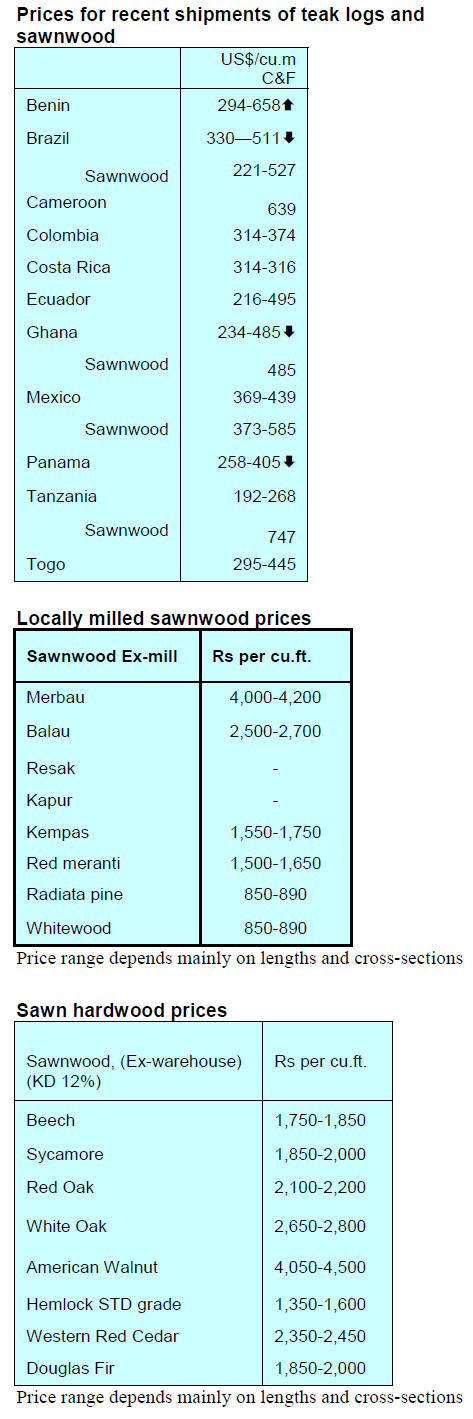

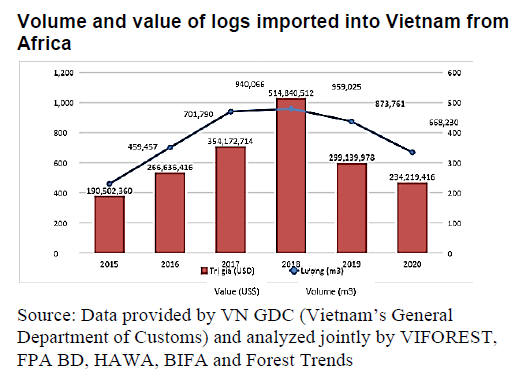

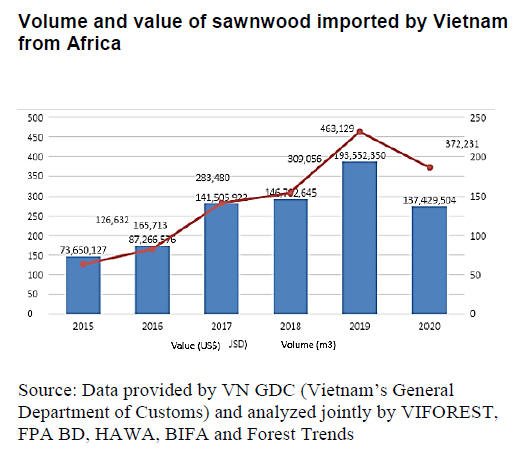

Vietnam's import of tropical timber from Africa

Volume and value of tropical timber imported from all

sources

Vietnam imports tropical timber from Africa, South

America, SE Asia and PNG to meet the demand of local

consumers who still prefer the hardness and durability of

tropical timber.

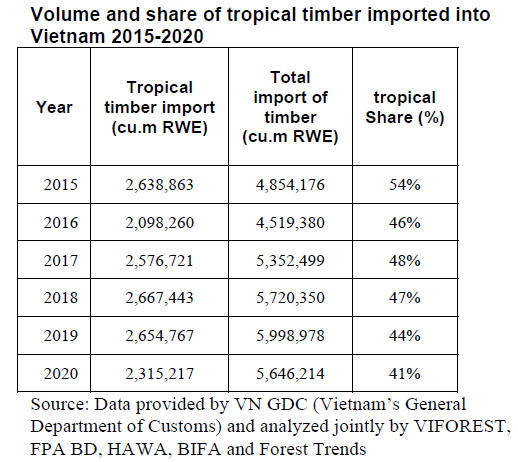

In 2020, the volume of tropical timber imported into

Vietnam from all tropical areas totalled 2.7 million cubic

metres, accounting for 41% of total log and sawnwood

imports from all sources.

The share of tropical timber against the total

volume of

timber imported into Vietnam has been declining. In 2015,

tropical log and sawnwood accounted for 54% of total

imports from all sources. By 2020, this share dropped

down to 41%.

However, this does not mean that the volume of tropical

timber has decreased as the total imports have been

increasing rapidly. The growth of non-tropical timber

import has been much higher than that of timber imported

from the tropics.

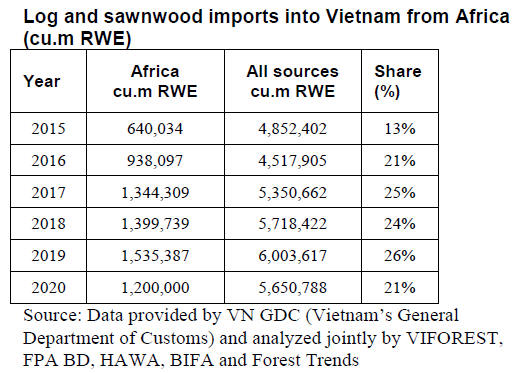

Tropical timber imported from Africa into Vietnam

African countries are the main suppliers of tropical timber

to Vietnam with some 20 countries selling annually about

1.3 cu.m of tropical timber to Vietnam.

The volume of tropical timber imported from Africa into

Vietnam accounts for about a quarter of the total log and

sawnwood that Vietnam has been importing in recent

years (see Table below).

African countries are the top supplier of tropical

logs to

Vietnam. Due to Covid-19 pandemic, the African supply

of tropical timber has slightly reduced. However, Africa

remains the most important supplier of tropical timber for

Vietnam.

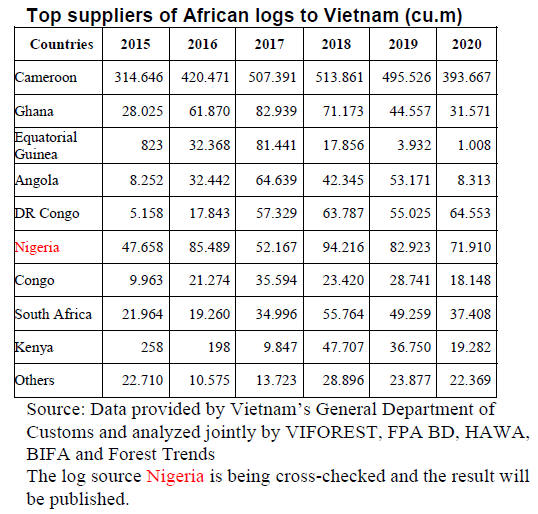

Log suppliers

At present, there are some 20 African countries selling

logs to Vietnam and contributing 33% of the total volume

of logs imported into Vietnam. The top 5 suppliers are

Cameron, Ghana, Democratic Republic of the Congo,

Nigeria and Congo. These 5 countries account for 86% of

the total volume of tropical logs Vietnam imports from

Africa in 2020.

On average, Vietnam annually imports over 400,000 cu.m

of logs from Cameroon. This is the largest tropical log

supplier contributing nearly 60% of the total log Vietnam

imports from Africa and over 21% of the log imported into

Vietnam from all sources.

The major woody species are tali/iron-wood (67%), sapele

(12%) and mahogany (6%).

Ghana is the second largest supplier of African logs to

Vietnam with an annual supply of over 50,000 cu.m,

corresponding to over 7% of the total import from Africa.

In 2020 imports declined to 31,570 cu.m. Mahogany tops

the imports (69%) followed by tali/iron-wood (34%) and

padouk (5.5%).

Nigeria is also amongst the major suppliers of tropical logs

for the Vietnamese market with shipments of 71,000 cu.m

in 2020 accounting for between 6-12% of the total log

imports from Africa. In 2018, Nigeria exported to Vietnam

94,210 cu.m of log, while in 2020 the export volume

dropped to 71,910 cu.m. Species imported from Nigeria

include mahogany (50%), padouk (46%) and tali (2.5%).

In 2015, the DRC shipped 5,150 cu.m of logs to Vietnam

equal to 1% of logs imported from Africa. However, in

2020, DRC exported 64,550 cu.m, accounting for 10% of

logs Vietnam imported from Africa. The main species

imported are tali/iron-wood (35%), sapele (20%) and

padouk (10%).

On average, Congo annually supplies over 20,000 cu.m of

log to Vietnam, accounting for 2-4% of the total log

volumes Vietnam imports from Africa. In 2020, the import

from Congo decreased to 18,140 cu.m. The main imported

species are tali, padouk, rose-wood and mahogany.

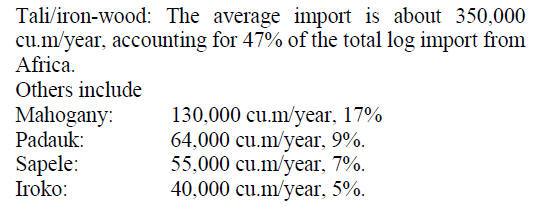

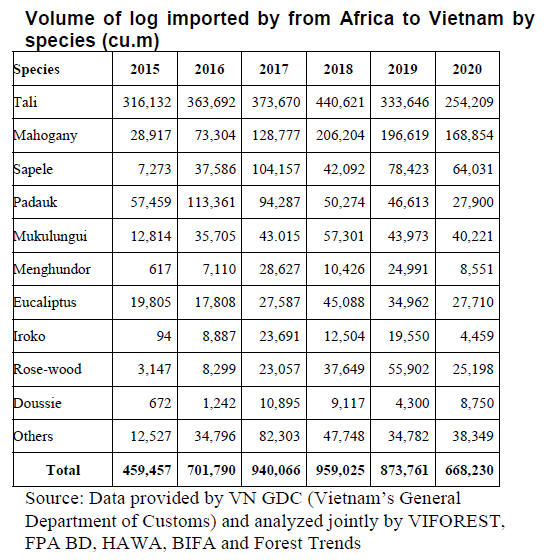

Log species imported

Vietnam has been importing about 90-100 species in log

form from Africa. Among them, 10 species are imported

in large volume, including tali/iron-wood, mahogany,

sapele, padouk, iroko, eucaliptus, iroko, rose-wood, and

dossie. These are the common timber species of Africa.

They contribute over 90% of the total supply. The volume

and value of top species imported are as follows:

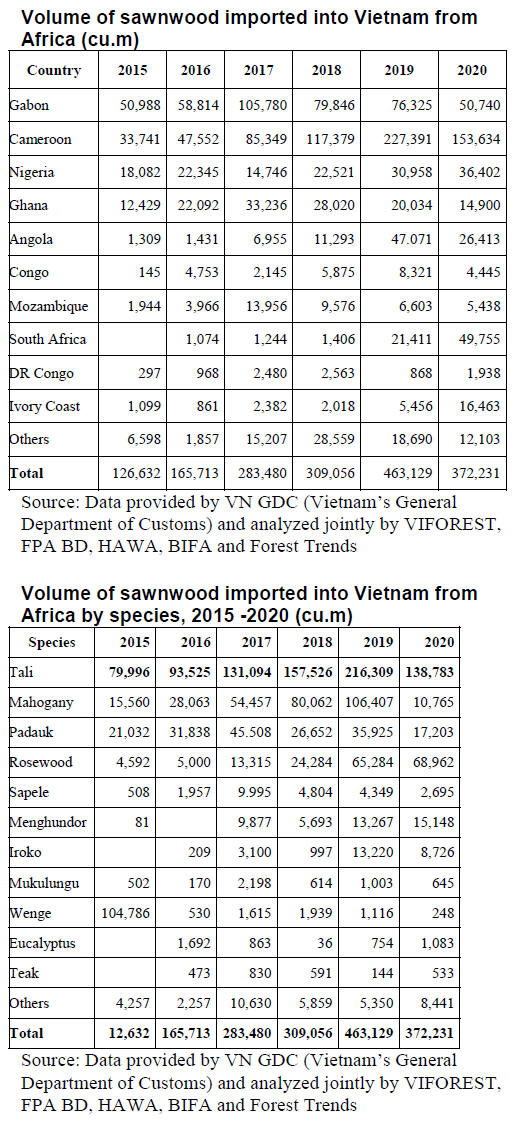

Sawnwood imports from Africa

African countries are the main suppliers of tropical

sawnwood to Vietnam. The volume of sawnwood

imported from African countries in 2020 was reported at

372,000 cu.m corresponding to 15% of the total volume of

sawnwood imported from all countries.

Sawnwood suppliers

Among some 20 countries supplying sawnwood to

Vietnam, Gabon, Cameroon, Nigeria, Ghana, Angola and

South Africa are the 6 main supply countries accounting

for around 90% of the total sawnwood imports from

Africa.

Cameroon leads the supply with fast growing export

volumes. On average, each year this country supplies over

100,000 cubic metres of sawnwood to Vietnam.

In 2015 sawnwood imported from Cameroon accounted

for 27% of the total import from Africa.

This figure increased to 41% by 2020. In 2020 imports

declined but still remained at quite a substantial volume

(153,630 cu.m).

The main species are tali, mahogany, padauk and sapele

with Tali topping imports at 60% of the total volume of

sawnwood imported from Cameroon, followed by doussie

(22%), padauk (9%) and sapele (1.5%).

Following Cameroon, Gabon is the next supplier of sawn

timber, exporting over 70,000 cubic metres per year to

Vietnam.

In 2015, Gabon exported 50,980 cu.m, accounting for 40%

of the total import from Africa. In 2020, due to the

pandemic, imports fell to 50,740 cu.m, equal to 14% of the

total import of sawnwood from Africa. The main imported

species from Gabon are tali (77%), menghundor (7%),

padauk (7%) and rose-wood (4%).

Nigeria supplies nearly 24,000 cubic metres of sawnwood

to Vietnam annually accounting for 7-14% of total

sawnwood imports from Africa. In 2020, Nigeria provided

36,400 cu.m, showing an increase of 18% compared to

2019. The main timber species imported from Nigeria

include Mahogany (51%), padauk (32%) and tali (15%).

Ghana exports over 20,000 cubic metres of sawnwood to

Vietnam each year. In 2020, Vietnam imported about

14,900 cu.m of sawnwood from Ghana, a decline of 24%

compared to 2019. The imported species are mahogany

(58%) and tali (34%).

Angola supplies over 10,000 cubic metres of sawnwood to

Vietnam sharing about 3-4% of the total import from

Africa. In 2020, 26,410 cu.m were exported to Vietnam.

The main export species are rose-wood, padauk and sapele

with rose-wood accounting for 63% of the total export,

followed by padauk (4.5%) and sapele (4%).

South Africa appears as a more and more important source

of sawnwood for Vietnam with rapid growth. In 2016, the

import from South Africa was about 1,000 cu.m. In 2020,

the import volume increased to nearly 50,000 cu.m,

accounting for 13% of the total volume of sawnwood

imported from Africa.

The main species of sawnwood imported from South

Africa into Vietnam are rose-wood, eucalyptus and

doussie, with rose-wood accounting for 95% of total

sawnwood imports from this country.

Similar to log imports, over 100 species of sawnwood

are

currently imported from Africa to Vietnam. However,

there only 5 species accounting for 90% of the total

import, including tali, mahogany, padauk, rose-wood and

sapele. Of these 5 species, tali is top with yearly import

volumes of over 130,000 cu.m accounting for nearly half

of the total timber import of tropical sawnwood from

Africa into Vietnam.

VNTLAS with new requirements on timber import

In Vietnam, Decree 102 issued by the Government to

operate VNTLAS became effective from 31 October,

2020. Following this Decree, overseas suppliers of timber

for Vietnam have been classified into countries of active

geographic areas and non-active geographic areas.

With this classification in place out of over 100 countries

having timber export to Vietnam, there are 51 countries

attributed to active geographical areas. At present, out of

all African countries which are exporting tropical timber

to Vietnam, South Africa alone is listed as the country of

active geographic areas.

To tighten the control over the legality of timber imports

Decree 102 also classified import species into risk and low

risk groups. Risk species encompass those that are either

imported into Vietnam for the first time or listed by

CITES or are endangered species.

In addition to currently applicable documents including

Sale Contract, Packing List, Bill of Lading, Quarantine

Certificate and Certificate of Origin, with the newly issued

Decree to operate VNTLAS before clearing customs

formalities importers may be asked to provide additional

evidence to prove timber legality such as logging license

(if applicable in sourcing countries), SFM certificate,

timber processing/transportation license etc.

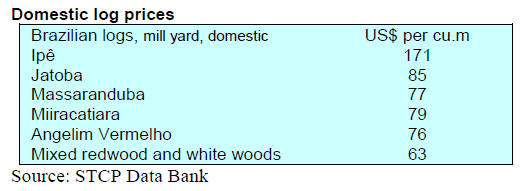

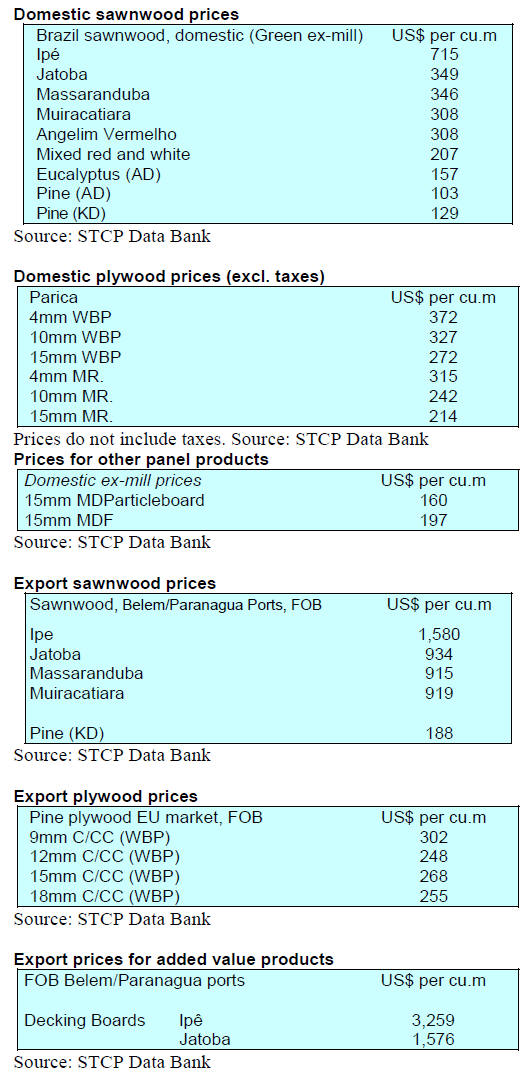

8. BRAZIL

Using technology to detect illegal

timber

The Federal Police (PF) recently used two technologies

that have been found very effective in the fight against

illegal logging:

a new satellite monitoring system, called

‘Planet Lab’

a tool that identifies the DNA of the tree

The technologies were used in two of the largest

operations to combat illegal logging, the Archimedes

Operation and the Handroanthus GLO Operation. The

operation was named Handroanthus GLO because it is the

scientific name of golden trumpet tree (ipê) the most

targeted tree by smugglers in the Amazon.

Using DNA methods the police can check the exact

location from where the timber originated. ‘Planet Lab’

utilises high resolution satellite images can allow for cross

referencing of field harvesting against the forest

management plan.

Partnerships in furniture development in Mato Grosso

The Center for Timber Producers and Exporters of Mato

Grosso State (CIPEM) recently met with the Federation of

Industries of Mato Grosso State (FIEMT), the Union of

Timber Industries of Mid-North Region of Mato Grosso

(SINDINORTE) and the Furniture Industry Union of Mato

Grosso State (SINDIMÓVEL/MT) to discuss the issue of

ensuring furniture manufacturers to have access to timber

raw material supplies.

One of the concerns discussed was the source of timber

used by the furniture sector as the state of Mato Grosso

has a range of timber species of excellent quality and

suitable for furniture manufacturing.

Representatives of SINDIMÓVEL/ MT stated that its

main suppliers are from other states despite there being

high quality raw material available within the state.

Among the challenges identified to limit the need to use

timber from other states was quality, reliability,

dimensioning of parts and continuous supplies.

Closer collaboration between the timber industry unions

and furniture industry unions will boost confidence

between the buyer and seller and together they can address

the issue of quality improvement.

It was decided that FIEMT will carry out a study to

identify how best to bring the primary producers and

furniture industries together so as to strengthen the state

economy.

Roundwood among main Brazilian agribusiness

exports

Exports of roundwood are among the top agribusiness

exports when comparing the percentage of the main

commodity exports according to the Secretariat of Foreign

Trade (Secex).

In the first four months of 2021 export shipments of

roundwood were almost double that of the same period in

2020 totalling US$ 66 million. By way of comparison

soybean exports (17.4 million tonnes) were worth US$7.2

billion, a record for the country.

Exports in the first quarter 2021

The Brazilian Association for Mechanically Processed

Timber (ABIMCI) has reported that in the first quarter of

this year timber exports have increased compared to Q1

2020.

Tropical plywood exports increased with the United States

being the main market. Tropical sawnwood exports in the

first quarter also increased with Vietnam being a major

buyer.

Wooden flooring exports increased by around 30% with

the US responsible for 64% of the all exports. Exports of

wooden doors grew 7% year on year in the first quarter

with over 80% being shipped to the US. Exports of pellets

declined year on year in the first quarter of 2021 but it has

been noticed that pellet exports fluctuate more widely than

has been seen for other wood products.

Brazil’s exports of pine veneer fell 5% year on year in the

first quarter while tropical veneer exports dropped 12% in

the same period. Malaysia is a major buyer of both

products accounting for a share of around 30% for pine

veneer and 50% for tropical veneer.

9. PERU

Modernising Peru’s forestry sector

Andina, the Peruvian news agency has reported

the Governments’ of Peru and the United States have

agreed a Memorandum of Understanding that will enable

the development of joint action for the modernisation of

the Peruvian forestry sector through sustainable, inclusive,

responsible and profitable economic growth.

See:

https://andina.pe/agencia/noticia-peru-us-agree-to-joinefforts-for-modernization-of-forestry-sector-842193.aspx

Semi-manufactured wood product exports begin to

recover

The Exporters Association (ADEX) has reported that

exports of semi-manufactured wood products in the first

two months of this year were worth US$10.6 million, up

8% compared to the same period in 2020 (US$9.8

million).

ADEX says most of the recovery was due to major

purchases by French importers who bought wood products

valued at US$3.1 million compared to the US$1.6 million

in the same period in 2020.

The other major markets in the first two months of this

year were China (US$4.2 million, down 6%) followed by

Denmark (-34.6%), Belgium (30%), USA (46%), New

Zealand (-55%), Netherlands (544%), Germany (11.6%),

Australia (22.5%) and Mexico (-70.3%).

The main export items were tropical wood moldings

(except ipé) US$4.3 million, slats and friezes for

unassembled parquet (US$2.4 million) and other profiled

(US$2.1million). These three products accounted for 82%

of the total.

Exports of semi-manufactured products topped exports of

sawnwood in the first two months of 2021 and overtook

exports of construction products, furniture and parts and

veneers and plywood.

Forest Account shows contribution to the economy

The National Forest and Wildlife Service (Serfor) and the

National Institute of Statistics and Informatics (INEI)

presented details of the ‘Forest Account for Peru’ which

show that the forestry sector contributed 1.04% to GDP in

2020.

In 2019, INEI estimates only considered the value of

forestry (wood) as a contribution from the forestry sector

and concluded a modest 0.15%.

The Forest Account is a key tool for policy decisions in

the forestry and wildlife sector as it enhances available

statistics and indicators related to the sector and

demonstrates the value of the services provided by forests.

During the discussion of the Forest Account the Vice

Minister of Agricultural Development and Irrigation stated

that “through these indicators it will be shown, in

monetary terms, to what extent the forests located on the

coast, mountains and jungle of the country are part of the

livelihood of the population, industries, tourism, regional

economies and our country in general".

New programme for SFM forest production

Through an agreement between the Peruvian and German

governments the Ministry of Agrarian Development and

Irrigation will implement a programme for ‘Promotion and

Sustainable Management of Forest Production’. A sum of

around US$138 million will be allocted to benefit 2.7

million rural inhabitants of nine regions of the country

over the next five years.

The Minister said this is one of the largest forestry sector

investment programmes in the history of the country

aimed at reactivating productive forest economic activity

through sustainable management.

The programme will directly benefit nine regions: Ancash,

Cajamarca, Huánuco, Junín, Loreto, Madre de Dios,

Pasco, San Martín and Ucayali. The executing agency will

be the National Forest and Wildlife Service (Serfor).

Improving productivity of Amazon forest plantations

The Center for Research in Silviculture and Forest

Improvement (CESILMEF) of the National Agrarian

University La Molina (UNALM) and the National Institute

of Agrarian Innovation (INIA) with the support of the

National Fund for Scientific, Technological Development

and Technological Innovation have been executing a

research project called "Maderas 3".

The project seeks to obtain data on wood quality of eight

commercial species from native and exotic forest

plantations in the Amazon in order to construct growth and

productivity indicators as well as determining their

technological properties.