US Dollar Exchange Rates of

25th October

2020

China Yuan 6.7122

Report from China

New transport channel in eastern

China improves

timber import efficiency

The first ¡°timber train¡± from Zhangjiagang (Jiangsu

province) to the Ganzhou International Dry Port arrived on

29 September. The train was loaded with 40 containers, all

of which contained wood imported through Zhangjiagang

by Linsentai Furniture Ltd and other local furniture

companies in Nankang. The goods were shipped using a

new water¨Crail combination transport channel: from

Zhangjiagang to Jiujiang Port by river, and then to the

Ganzhou International Dry Port by train.

Zhangjiagang is a traditional port for imports of African

and other timbers and one of the most important timbersupply

bases for the furniture industry in Nankang, a

district situated in Ganzhou city, Jiangxi province. The

new transportation channel has increased the ease of

shipping African timber and marks a further transition

from road transport to rail for timber imported via

Zhangjiagang. The new channel will reduce costs and

increase efficiency for furniture companies; increase the

supply of imported wood; and assist the development of

the Ganzhou Dry Port International Timber Trading

Center.

Ganzhou International Dry Port is promoting the

development of a national trading and distribution centre

for imported timber, and it held the Imported Timber Expo

in October. Cooperation among ports such as Shenzhen,

Guangzhou, Xiamen, Ningbo and Zhangjiagang is

expected to open up further logistics channels for the

importation and distribution of timber in China and help

create a hub for timber import and trade businesses close

to the port, with benefits for a wide range of woodconsuming

sectors.

Per capita income rises but spending drops

Per capita disposable income reached nearly RMB 23,800

in China in the first three quarters of 2020, a nominal

increase of 3.9% over the same period in 2019 and a real

increase of 0.6%. The median per capita disposable

income of Chinese households was RMB 20,500, up by

3.2%, year-on-year.

As disposable income rose, however, household

consumption expenditure declined by 3.5% in nominal

terms and by 6.6% in real terms, to RMB 14,923.

Although expenditure rose on food, tobacco and alcohol

over the period, it fell for all other categories, including on

housing.

See:

http://www.stats.gov.cn/english/PressRelease/202010/t20201020_1794986.html

China¡¯s real estate market heating up again

Meanwhile, however, overall national investment in real

estate development was RMB 10,300 billion in the first

three quarters of 2020, an increase of 5.6%, year-on-year.

This amount comprised RMB 7,660 billion in residential

buildings, RMB 437 billion in office buildings and RMB

955 billion in buildings for commercial businesses. The

total floorspace under construction was 8,600 million

square metres.

See:

http://www.stats.gov.cn/english/PressRelease/202010/t20201020_1794943.html

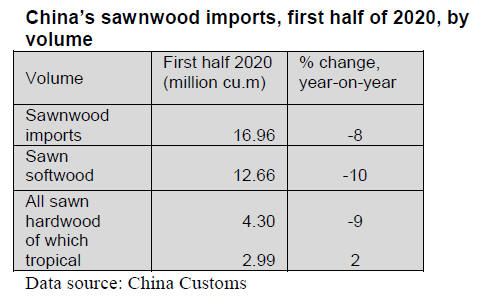

Sawnwood imports drop in first half

According to China Customs data, China imported 17

million cubic metres of sawnwood in the first half of 2020,

a decline of 8% compared with the same period in 2019, at

a value of US$3.7 billion (a drop of 17%, year-on-year).

The average price of imported sawnwood was US$217 per

cubic metre, down by 7% over the same period in 2019.

Sawn softwood imports fell by 10% in the first six months

of 2020, to 12.7 million cubic metres, which was 75% of

the total volume of imported sawnwood. The average price

of imported sawn softwood was US$171 per cubic metre,

down by 6% over the same period in 2019.

Sawn hardwood imports fell by 9% to 4.3 million cubic

metres in the same period, with volumes falling from

Thailand by 7%, from the United States by 15% and from

the Russian Federation by 34%. The average price of

imported sawn hardwoods in the first half of 2020 was

US$358 per cubic metre, down by 9% over the same

period in 2019.

Russian Federation the major sawn softwood

supplier

to China

The Russian Federation was the main sawn softwood

supplier to China in the first half of 2020, despite a fall in

volume of 12%, to 7.63 million cubic metres, which was

60% of the national total.

Meanwhile, China¡¯s sawn softwood imports surged from

Belarus (up by 147%), Sweden (+50%), Germany (+47%)

and Ukraine (25%).

Average prices dropped for almost all sawn softwood

suppliers in the first six months of 2020 ¨C including by

28% from the United States, by 22% from Canada and by

20% from Sweden. In contrast, average prices for

imported sawn softwood rose by 2% from the Russian

Federation.

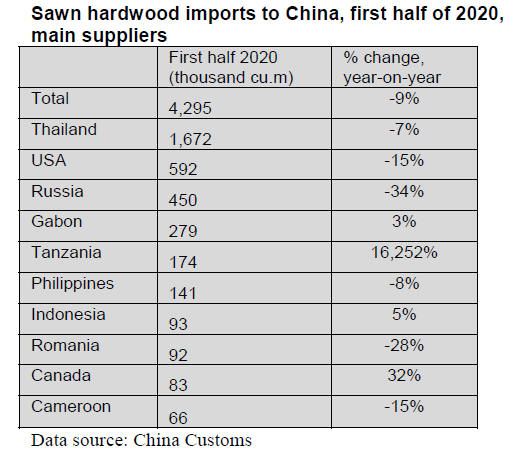

China¡¯s sawn hardwood imports increase from

Tanzania

China¡¯s sawn hardwood imports from the United Republic

of Tanzania surged to 174,000 cubic metres in the first

half of 2020, from just over 1,000 cubic metres in the first

half of 2019; this was the result of a dramatic plunge (-

77%) in the average price of hardwood exports from this

country. China¡¯s sawn hardwood imports also rose

significantly from Canada (+32% by volume).

In contrast, China¡¯s sawn hardwood imports from Viet

Nam fell away in the first half of 2020 because most of the

production was consumed by Chinese furniture factories in

Viet Nam. Some Chinese furniture factories have

transferred to Viet Nam due to China¡¯s stricter

environmental controls and increasing tariffs on Chinese

products in the United States.

Average prices for China¡¯s imported sawn hardwood

declined in all markets in the first six months of 2020.

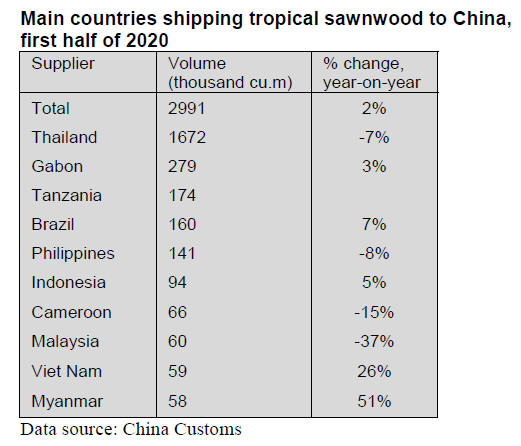

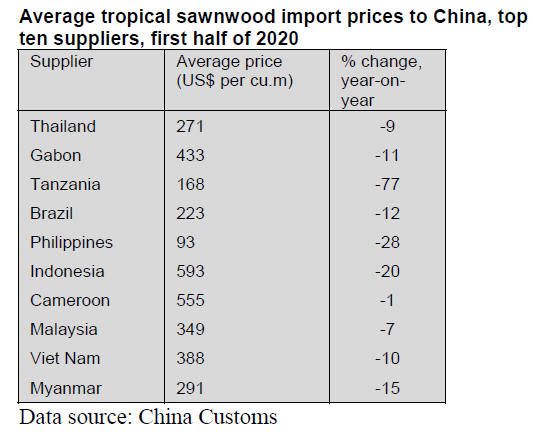

Slight rise in China¡¯s tropical sawnwood import

volume

Of total sawn hardwood imports, tropical sawnwood

imports accounted for 2.99 million cubic metres (18% of

all sawn hardwood imports) in the first half of 2020, up by

2% compared with the same period in 2019. The value of

these imports was US$942 million, down by 11%, yearon-

year.

The average price of imported tropical sawnwood was

US$315 per cubic metre, down by 13% over the same

period in 2019.

Thailand was the main supplier of China¡¯s tropical

sawnwood imports in the first half of 2020, at 1.67 million

cubic metres, down by 7%, year-on-year. This volume was

worth US$453 million, down by 15%.

The top ten suppliers of tropical sawnwood to China in the

first half of 2020 were Thailand (56% of the total volume),

Gabon (9%), the United Republic of Tanzania (6%),

Brazil (5.3%), the Philippines (4.7%), Indonesia (3.1%),

Cameroon (2.2%), Malaysia (2.0%), Viet Nam (1.98%)

and Myanmar (1.94%).

Correction

In the early October Market Report it was stated:

The latest efforts to clean the air will impact wood product

manufacturers and it has been reported that 39 companies

have been ordered to stop production and some furniture

and wood-based panel enterprises are included.

The text should have said: companies in 39 industrial

sectors, including furniture and wood-based panel

enterprises, will stop production.

|