4.

INDONESIA

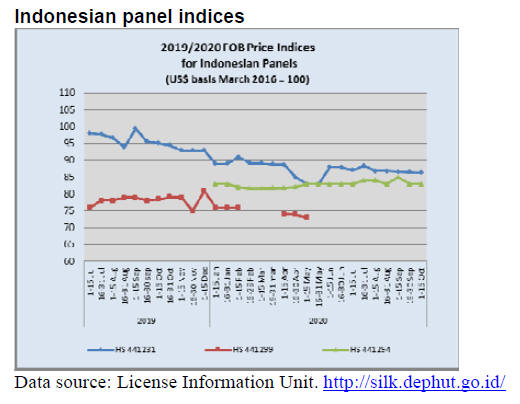

Better than expected exports

The value of Indonesia’s wood product exports in the first

8 months of 2020 amounted to around US$7.2 billion.

This was almost 7% down compared to the same period

last year when exports earned over US$7.7 billion.

In spite of the ongoing global pandemic wood product

exports for the first three quarters of the year jumped to

US$8.3 billion, only just below the US$8.5 billion earned

in the same period in 2019.

The Ministry of Environment and Forestry (KLHK) has

congratulated the private sector on this performance

achieved in the face of great difficulties. The Minister said

the government will continue to implement measures to

support the sector so it can avoid a downturn.

FORESTHINTS.NEWS quotes the Ministry Secretary

General, Bambang Hendroyono, as saying "The

improvement in export performance means that we remain

in alignment with our efforts to avoid lay-offs, as much as

possible, in the forestry business sector. This is among our

minister's top priorities.”

See:

https://foresthints.news/real-time-data-shows-impressiverebound-level-of-indonesias-forestry-exports/

No new harvesting permits in 66 million ha. of forest

In a press conference the Director of Inventory and

Monitoring of Forest Resources (IPSDH) of the

Directorate General of Forestry Planning and

Environmental Management (PKTL), Belinda Arunarwati

Margono, announced that the Ministry of Environment

and Forestry (KLHK) will not allocate harvesting permits

in an area of 66 million hectares of natural forest and

peatland.

This decision is contained in a ministerial decree number

SK. 4945 / MENLHK-PKTL / IPSDH / PLA.1 / 8/2020

“Determination of Indicative Map of the Termination of

Issuing New Permits (PIPPIB) period II for Primary

Natural Forest and Peat Land in 2020.”

Ms. Belinda said the Directive has taken into account

changes in spatial planning, input from the community,

updating of licensing data, as well as the results of a field

survey of physical conditions.

See:

https://nasional.kontan.co.id/news/klhk-hentikanpemberian-izin-baru-di-6627-juta-ha-hutan?page=2

South Korea's biggest investor in Indonesia’s forestry

The Minister of Forestry of the Republic of South Korea,

Park Chong-ho, has reported that 15 Korean companies

have invested in creating almost 170,000 ha. of plantations

in Indonesia and that this exceeds Korean forestry

investment in other countries thus making Indonesia an

important partner for the Korean forestry sector.

This news was announced at the recent Indonesia-Korea

Forest Cooperative Committee (IKFCC) where the two

countries signed several agreements including a

Cooperation Framework for Forestry Priority

Programmes, an agreement for the revitalisation of the

Korea-Indonesia Forest Center and the signing of an

agreement for the rehabilitation of burned peatlands.

The Indonesian Minister of Environment and Forestry, Siti

Nurbaya, expressed her appreciation for the South Korean

government's support for Indonesia.

See:

https://www.antaranews.com/berita/1749745/indonesia-jadinegara-investasi-kehutanan-terbesar-bagi-korsel

Government asked to review raw material regulations

On behalf of the national furniture industry, Tbk, Halim

Rusli President Director of PT Integra Indo Cabinet, has

requested a review of current regulations to support the

survival of the sector. He said he urges the government to

review regulations, particularly raw material import

regulations which are a handicap to the sector.

He argued that domestic suppliers do not have the capacity

or capability to supply the materials needed by the

furniture and craft industry. The impact of this he said that

export growth is hampered.

The Director of PT Multi Manao Indonesia, Budianto, also

mentioned that the SVLK regulation is a disincentive for

many because it has increased the cost of doing business.

At the same time he acknowledged that the SVLK has

opened new opportunities and helped remove the stigma

suffered by the timber industry it is just too expensive to

apply.

The government has been asked to simplify licensing

procedures and remove the legality requirements for

Timber Administration (TUK) permits and also ease the

requirements for raw material imports.

See:

https://www.liputan6.com/bisnis/read/4373811/selamatkanindustri-mebel-pemerintah-diminta-tinjau-regulasi-bahan-baku

Job creation Bill raises concern

The government recently passed the controversial

legislation on job creation which is intended to deliver a

radical change the labour market and in natural resources

management by improving bureaucratic efficiency and

cutting ‘red tape’ especially for business permits and

decisions on investment. This change has not been well

received and thousands have demonstrated saying the law

is too pro-business and will undermine worker rights.

See:

https://www.thejakartapost.com/news/2020/10/06/indonesiapasses-jobs-bill-as-recession-looms.html

Concerns have been raised that the new law eliminate a

requirement that Indonesian provinces have a forest cover

of 30%. This, say commentators, could increase forest

land clearance and escalate conflicts over land and

indigenous rights.

In commenting on the revisions KLHK Minister, Siti

Nurbaya Bakar, said the purpose of the new laws is to

simplify licensing procedures and overcoming barriers to

job creation for the new workforce. She said "The Job

Creation Law is also important in resolving chronic

problems related to forest area conflict”.

See:

https://www.tribunnews.com/nasional/2020/10/09/menterilhk-uu-cipta-kerja-untuk-penciptaan-lapangan-kerja-danpenyelesaian-konflik-kehutanan?page=3

Global investors have warned that the revisions to the law

puts jobs and forests at risk. Reuters has reported many

international investors expressed concern on the law

revisions saying they have concerns about the negative

impact of certain environmental protection measures

affected by the Omnibus Bill on Job Creation.

In an open letter to the Indonesian government, Peter van

der Werf, Senior Engagement specialist at Robeco, said

“While the proposed regulatory changes aim to increase

foreign investment they risk contravening international

best practice standards intended to prevent unintended

harmful consequences from business activities that could

deter investors from Indonesian markets.”

See:

https://www.robeco.com/en/media/news-item/2020/openletter-to-the-indonesian-government-on-the-omnibus-bill-on-jobcreation.html

5.

MYANMAR

No timber processing

Yangon is still under a strict lockdown and the quarantine

facilities are being expanded to cope with a recent surge in

infections. All production at wood processing mills has

stopped and the lockdown has been extended to 21

October.

However, the so-called CMP factories (Cut Manufacturing

Production factories such as garment factories) can resume

if they meet the Class A Anti-Covid Measures. The

government instruction is not so clear for non-CMP

factories.

As of early October the country has reported around

10,000 infections and over 200 fatalities linked to the

virus. The lockdown is having a serious impact on the

livelihoods of residents, especially the poor. The local

media reports around 6,000 people are quarantined in the

city.

Domestic travel out of Yangon is forbidden and the ban on

international commercial flights has been extended until

the end of October.

MTE launches teak production map

The Myanma Timber Enterprise (MTE) is responsible for

the traceability and legality of timber harvested and in a

move to increase transparency the MTE has made

available a map showing teak production by area in 2019-

2020.

The map can be found at:

http://www.mte.com.mm/index.php/en/annoucements/1359-8-10-2020-3

MTE explains that by clicking on a location information

such as type of forest, compartment number, geographic

and administrative location, number of trees harvested and

the tonnage and Forest Department hammer marks and

Extraction Agency hammer marks can be found.

In addition, MTE has launched a trial QR Code system to

improve access to tracking information. The Myanmar

timber sector has welcomed the MTE effort to develop ITassisted

transparency in support of traceability.

Assistance from Japan

The Japanese Embassy in Myanmar has provide some

details of a bilateral agreement set to deliver emergency

loans to Myanmar. The Embassy says Japan is helping

with economic projects concerning the COVID-19 disease

and COVID-19 Economic Relief Plan. The loans will be

low-interest and a grace period including suspension

period will be 40 years.

Export earnings

While timber exports earned just US$138 million between

October 2019 and August 2020 the agricultural sector

earned more than US$3 billion. Myanmar exports

agricultural products, animal products, fishery products,

forest products, finished industrial goods and timbers.

Union Minister for Commerce, Dr. Than Myint, said total

trade value in the current financial year was expected to

reach US$34 billion including US$18 billion in export

earnings.

World Bank Survey

The World Bank surveyed Myanmar private enterprises in

May, July and August covering the services, retail,

wholesale, manufacturing and agricultural sectors. It said

35% of firms were micro-businesses and 40% were small.

Medium-sized firms made up 19% of the study and large

firms constituted 6%.

The Bank found that 81% of the firms were affected

negatively by COVID-19 in May and 79% in July. It said

86% of manufacturing firms faced negative impacts in

May, 80% in July and 76% in August.

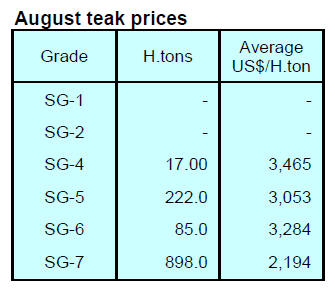

Teak log tender postponed

Because of the corona virus second wave the September

tender sale was postponed. The suspension of the Forest

Department control measures for timber exports continues.

6. INDIA

September rise in

exports the first for 7 months

By mid-October India had over 6.6 million recorded

corona infection cases, second only to the US but, despite

to continual spread of the virus, efforts are being made to

revive the economy and these are bearing fruit as a few

economic activity indicators are showing improvement as

people get back to work.

In the first days of October there was a 14% rise in power

consumption, the pace of decline in diesel fuel sales

slowed considerably, fees from road tolls are rising, rail

freight volumes were up 15% in September and exports in

September were up over 5% year on year.

The September rise in exports was the first for seven

months. At the same time imports continued to decline,

albeit at a slower pace.

Together with a rise in goods and services tax collection, a

rise in the purchasing managers’ index (PMI) and rising

auto sales there are signs of economic recovery after GDP

fell 24% in the first quarter of fiscal 2020.

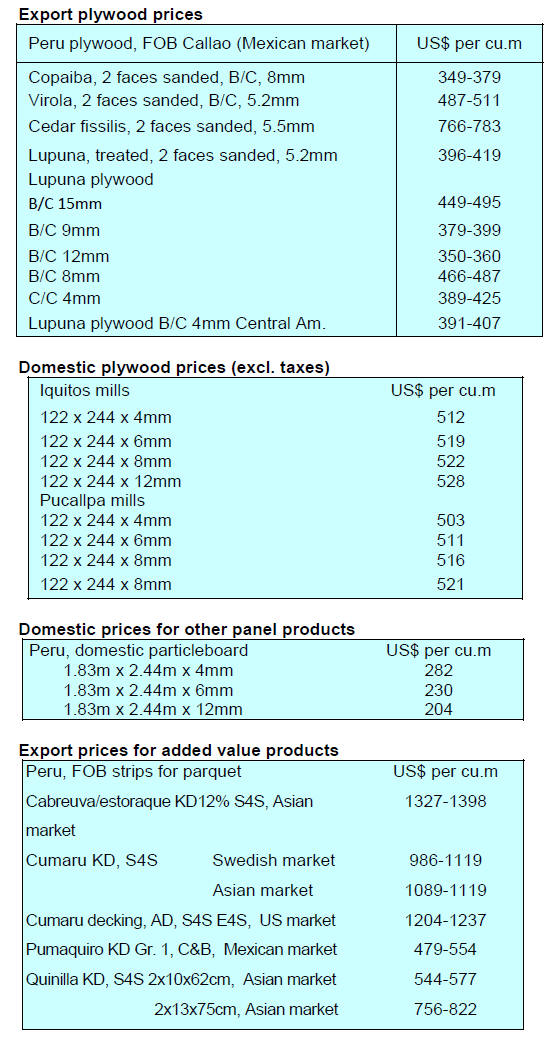

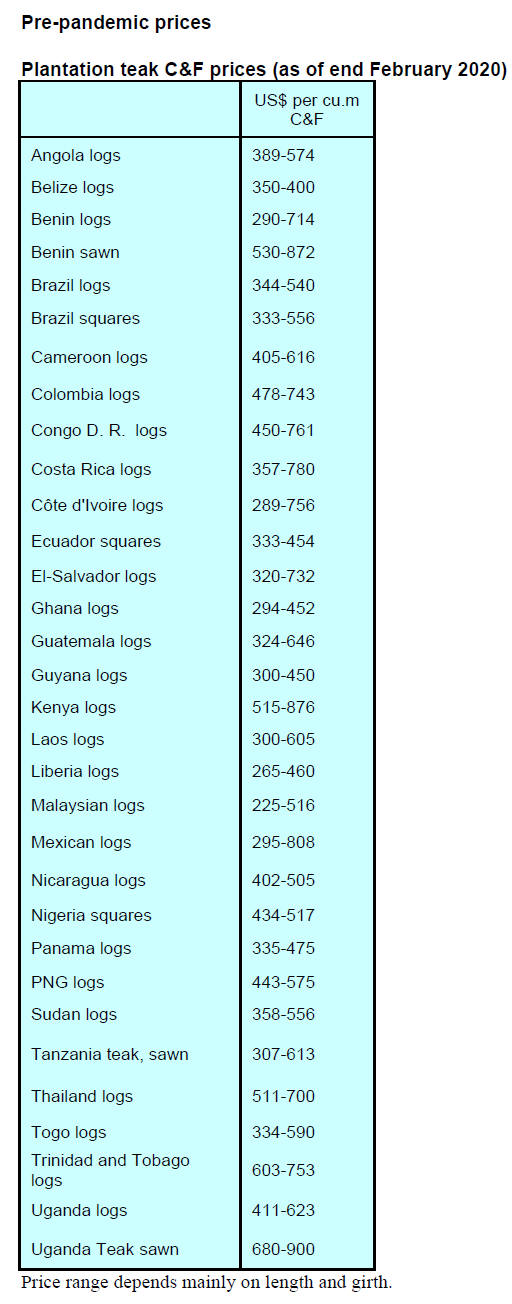

Plantation teak

Freight rates continue to be volatile due to uneven

import/export volumes which have been made worse by a

shortage of container boxes. It will take time for trade

flows to return to normal, only then will importers have an

opportunity to decide on price increases.

Under present circumstances it is difficult to provide a

clear picture of plantation teak C&F prices. The price

indications below do not reflect the changing freight rates.

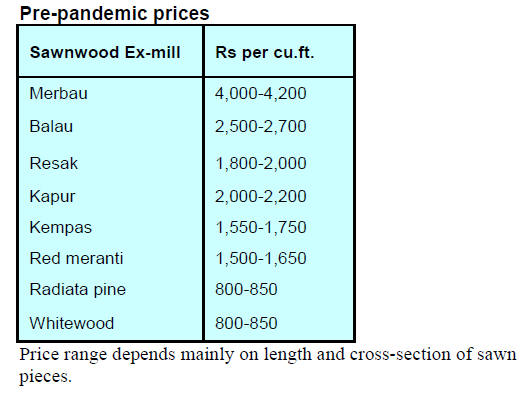

Locally milled sawnwood

Traders report sustained demand in the moffusil (rural)

markets while demand in the cities is almost zero as

timber markets are closed because of recent surges in

infection rates.

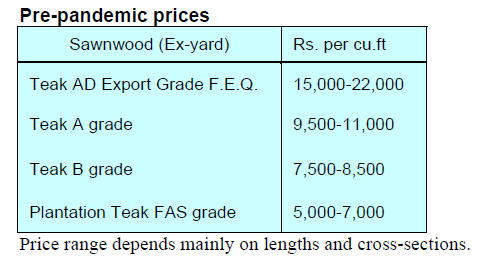

Myanmar teak

There have been no new teak shipments from Myanmar.

The prices below are only indicative of the time before the

pandemic. When Indian importers begin to negotiate

shipments it be possible to report on the impact of price

increases expected for Myanmar teak.

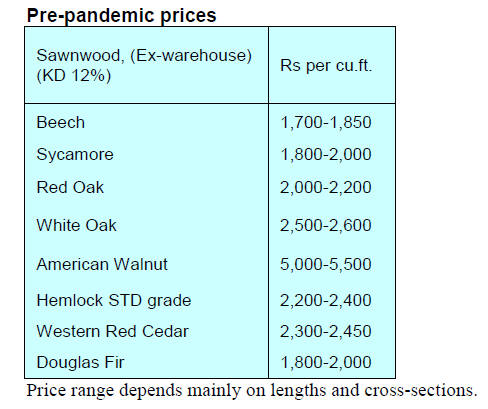

Sawn hardwood prices

Much of the imported hardwoods are used for export

furniture manufacture. As international trade is expanding

this has resulted in a revival of demand for hardwoods in

India.

Trade news

During these difficult times many of the usual sources of

trade news have suffered disruption. The alternative news

sources are now webinars which provide some industry

updates and these continue to focus on self-sufficiency and

how post-corona demand may develop.

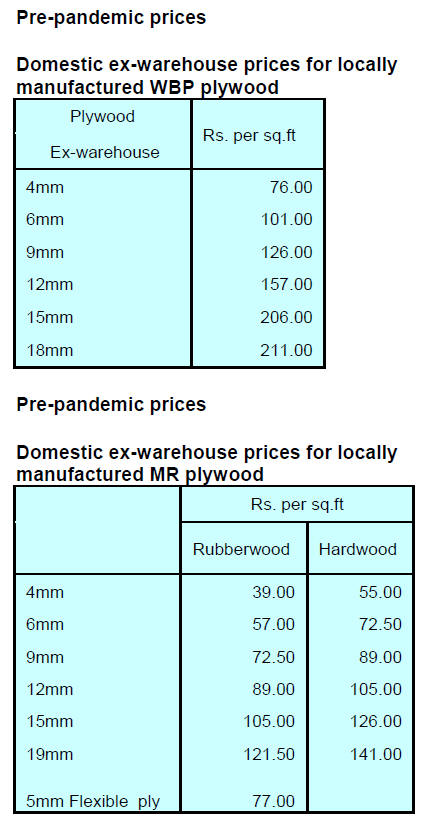

Plywood

Production and sales of plywood are improving but

because prices for imported plywood are easing domestic

manufacturers have no opportunity to raise panel prices.

Mills are steadily ramping up production as workers have

returned.

7.

VIETNAM

US initiates

investigation of log imports and

intervention in currency practices

The US Trade Representative (USTR) is initiating an

investigation of two issues with respect to Vietnam,

Vietnam’s acts, policies and practices related to the import

and use of timber and practices that may contribute to the

undervaluation of its currency.

US Trade Representative, Robert Lighthizer said,

“President Trump is firmly committed to combatting

unfair trade practices that harm America’s workers,

businesses, farmers and ranchers.

Using illegal timber in wood products exported to the US

market harms the environment and is unfair to US workers

and businesses which follow the rules by using legally

harvested timber.

In addition, unfair currency practices can harm US

workers and businesses that compete with Vietnamese

products that may be artificially lower-priced because of

currency undervaluation. We will carefully review the

results of the investigation and determine what, if any,

actions it may be appropriate to take, he said.”

See:

https://ustr.gov/about-us/policy-offices/press-office/pressreleases/2020/october/ustr-initiates-vietnam-section-301-investigation

and

https://ustr.gov/about-us/policy-offices/press-office/pressreleases/2020/october/ustr-initiates-vietnam-section-301-investigation

The USTR has released two notices and requests for

comments concerning the investigation under Section 301

of the Trade Act of 1974 regarding certain of Vietnam’s

acts, policies and practices.

The first notice announces that the USTR is initiating an

investigation of Vietnam’s import and use of timber that is

illegally harvested or traded. The USTR seeks comments

regarding the investigation due by November 12, 2020.

The USTR notice says:

Exports of wooden furniture to the US exceeded US$3.7

billion in 2019 and Vietnam is one of the largest global

exporters of wood products.

It appears that most timber exported from Cambodia

to Vietnam crosses the border in violation of

Cambodia’s log export ban.

Aspects of the importation and processing of this

timber also may violate Vietnam’s domestic law and

be inconsistent with the Convention on International

Trade in Endangered Species of Wild Fauna and Flora

(CITES).

The USTR is investigating whether Vietnam’s

practices related to the import and use of illegal

timber are unreasonable or discriminatory and burden

or restrict US commerce.

Comments are requested to address the following:

The extent to which illegal timber is imported

into Vietnam

The extent to which Vietnamese producers,

including producers of wooden furniture, use

illegal timber

The extent to which products of Vietnam made

from illegal timber, including wooden furniture,

are imported into the United States.

Vietnam’s acts, policies or practices relating to

the import and use of illegal timber

The nature and level of the burden or restriction

on US commerce caused by Vietnam’s import

and use of illegal timber

The determinations required under section 304 of

the Trade Act of 1974, including what action, if

any, must be taken

See:

https://public-inspection.federalregister.gov/2020-22270.pdf

Valuation of Vietnamese currency

The second notice announces that the USTR is initiating

an investigation of Vietnam’s acts, policies and practices

related to the valuation of its currency. Written comments

must be received by November 12, 2020.

The USTR notice says:

Analysis indicates the Vietnamese dong, which is closely

tied to the US dollar may have been undervalued by 7% -

8.4% in 2017 and 2018. Evidence indicates that the

Vietnamese government actively intervenes in the

exchange market.

The investigation will focus on whether Vietnam’s

interventions through the State Bank of Vietnam (SBV) in

exchange markets and other related actions that contribute

to the undervaluation of Vietnam’s currency are

unreasonable or discriminatory and burden or restrict US

commerce.

Comments are requested to address the following:

Whether Vietnam’s currency is undervalued

and the level of the undervaluation

Vietnam’s acts, policies or practices that

contribute to undervaluation of its currency

The extent to which Vietnam’s acts, policies

or practices contribute to the undervaluation

Whether Vietnam’s acts, policies and

practices are unreasonable or discriminatory

The nature and level of burden or restriction

on US commerce caused by the

undervaluation of Vietnam’s currency

The determinations required under section

304 of the Trade Act of 1974, including what

action, if any, must be taken

See:

https://www.federalregister.gov/documents/2020/10/08/2020-22271/initiation-of-section-301-investigation-vietnams-actspolicies-and-practices-related-to-currency

and

https://home.kpmg/us/en/home/insights/2020/10/tnf-ustrrequests-comments-section-301-investigations-vietnam.html

8. BRAZIL

‘Amazônia Viva’ Inspection operation

results

The ‘Amazônia Viva’ operation, which is part of the

Command and Control strategy of the ‘Amazônia Agora’

(Amazon Now) in Para State plan has already resulted in

the seizure of over 3,000 cu.m of wood and stopped forest

operations in an area of around 100,000 hectares.

‘Amazônia Agora’ is the main strategy adopted to prevent

illegal harvesting and forest fires which, in turn,

contributes to lowering emission of greenhouse gases. The

Operation covers 15 municipalities and the location of

deforestation is mapped from satellite data provided by the

National Institute for Space Research (INPE).

The State implementing team comprises the State Force to

Combat Deforestation and inspectors from the State

Secretariat of Environment and Sustainability (SEMA).

The team recently shut down a clandestine sawmill, seized

tractors, trucks, chainsaws and timber. In August, the third

phase of the ‘Amazônia Viva’ operation had already

resulted in a 60% decline in deforestation in state forests

compared to the same period of 2019.

According to SEMA the ‘Amazônia Viva’ operation is

from previous efforts in that is an on-gong operation and is

slowly changing the culture of deforestation in Pará State.

Furniture prices increased

A Brazilian Institute of Geography and Statistics (IBGE)

survey has determined that furniture prices in the first 8

months of 2020 increased around 7% as manufacturers

passed on the higher production costs due to higher prices

for raw materials. Ex-factory furniture prices in August

increased by 3%, twice as much as in the previous month

and wholesale furniture prices are expected to keep rising.

Brazilian furniture export overview

Exports by the furniture sector earned US$361.6 million in

the first eight months of this year according to the

Brazilian Association of Furniture Industries (Abimóvel).

This represents a decline of 12% year on year.

Of the total, furniture exports to the United States

accounted for 40% of total exports and were up 3%

compared to the same period in 2019. The increase in

exports to the US was driven by firm American retails

sales of furniture. The second largest market was the UK

with a 9% share of exports but in this market there was a

decline of over 20% in export earnings. Uruguay was the

third placed market at 7% and exports were down 13% as

of August.

The main exporting states were the three states in the

South Region. Together, the states of Santa Catarina

(42%), Rio Grande do Sul (27%) and Paraná (14%)

accounted for over 80% of Brazil’s furniture exports in the

first eight months of the year. All experienced a drop in

the value of furniture exports compared to last year.

Brazil furniture imports were valued at US$107 million in

the first eight months of the year, a 19% decline compared

to the same period of last year. China was the main source

of imports (76%) followed by Italy (5%) and the United

States (3%). Most imports were destined for São Paulo

followed by Santa Catarina and Rio de Janeiro.

Programme to export carbon credits

The Ministry of the Environment has published guidelines

for the first government programme for a carbon credit

market. The project entitled ‘Floresta+ Carbono’ aims to

promote a regulatory environment favourable to the

carbon credit market.

The initiative seeks to encourage the generation of credits

for the preservation of natural forests. The federal

government will not invest money in the sector but will

help ensure the credits recognised.

According to the Ministry, Brazil will be an exporter of

carbon credits. The expectation is that the “Forest+

Carbon” programme could involve a trade worth R$1

billion a year. The biggest beneficiaries will be owners of

unexploited natural forests. The owners of these forests

can sell credits to companies that want to offset carbon

emissions.

In the past few months several companies have committed

to become carbon neutral and to achieve this they will

need to buy credits.

9. PERU

Financing programme

for plantations

Thousands of small forest producers can now access the

Direct Financing Programme for Forest Plantations, an

initiative that offers loans for the development and

commercialization of forest plantations.

The National Forest and Wildlife Service (SERFOR) has

reported that the programme has available over US$14

million and they hope it will be applied to create around

16,500 hectares of forest plantations which could generate

about 35,000 direct and indirect jobs. The programme will

be implemented up to December 2023.

Ministries join forces to promote timber consumption

SERFOR, the Ministry of Housing and Construction and

Sanitation and the Ministry of Production, through

CITEmadera, have mounted a joint effort to promote

demand for wood products and boost the economy of

micro and small entrepreneurs in the forestry sector.

During a discussionthemed "Sustainable Timber Business

in the Housing Sector", the Vice Minister of Development

and Agrarian Infrastructure and Irrigation, Carlos Ynga,

and the Executive Director of SERFOR expressed the

view that to contribute to economic revival it is necessary

to promote policies to bring life back to the forest sector.

The various ministries will conduct regional events in

areas badly affected by the corona control measures.

Remote monitoring project for forest supervisions

The control measures introduced to address the corona

pandemic have made it difficult to monitor forest activities

while complying with the necessary provisions of social

distancing.

For this reason, beginning in March, FOREST, a

USAID/US Forest Service programme has provided

technical assistance to OSINFOR for the design and

implementation of techniques for remote forest

monitoring. This work began in Madre de Dios and will be

replicated in the Loreto and Ucayali regions.

SIGO advances to provide better information to the

sector

September was an important month for SIGOsfc,

OSINFOR's management information system. Use of this

system has increased over the years as it can provide alerts

to authorities, statistical reports and information that

defines the risk level in forest management plans.

As part of the SIGO 3.0 project, which aims to improve

current services and offer new tools for decision-making,

OSINFOR received new servers that will improve the

support and availability of data.

The SIGO 3.0 project has the technical support of the

alliance between the US Forest Service and USAID. The

ongoing project seeks to strengthen supervision and

oversight efforts to improve the legality of the sector.

Among the expected changes are: first, a better integration

and inter-operability of SIGO with other public

information systems which will allow better coordination

and joint efforts to guarantee the legal trade in wood. The

first phase of the SIGO 3.0 system is expected to be

completed in December.