Japan

Wood Products Prices

Dollar Exchange Rates of 25th

September

2020

Japan Yen 105.58

Reports From Japan

Open to travel but

quarantine necessary

Japan is considering opening the country to all travelers

beginning in October. Currently only business travel is

allowed. Those entering the country will still be required

to complete a two-week quarantine period before being

allowed to join the general public and inbound traffic will

be limited to 1,000 people per day.

However, the Japanese government has suggested that

travelers who obtain a negative PCR test within 72 hours

of arrival and agree to have another test done upon arrival

may be able to avoid the 14-day quarantine. This has not

yet been confirmed.

Consumer price index dips

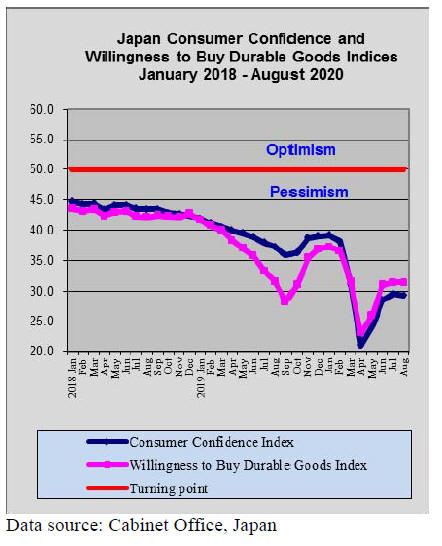

Cabinet Office data is showing consumer confidence fell

in August for the first time in four months, dragged down

by concerns about the rise in virus infections. In other

news, the Ministry of Internal Affairs has reported a

decline in the August consumer price index. This was the

first drop in three months and is likely the result of the

government¡¯s subsidised travel programme which brought

down the cost of hotel accommodation. The pace of

decline in prices was the fastest in almost four years.

The Bank of Japan Governor, Haruhiko Kuroda, has

indicated the Bank is watching the trends in consumer

prices and unemployment and is ready to increase stimulus

measures if job losses heighten the risk of deflation.

Yen hits seven-week high against the dollar

Government data shows that around 30% of Japanese are

65 and above with only 12% being under 15. This puts a

lot of people at risk from the corona virus.

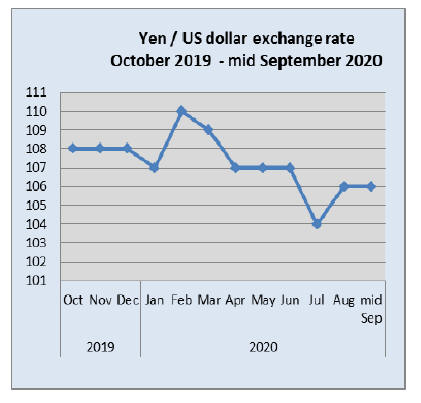

Despite these risks and the crushed economy the foreign

exchange market currently likes the Japanese yen which

hit a seven-week high against the US dollar in September

rising to 105.30. The yen also strengthened against the

Australian dollar, the British pound and the euro. That is

clearly yen strength and not just US dollar weakness.

Land prices drop, the first decline in 4

years

The average land price in Japan fell this year, the first

decline in three years as the coronavirus pandemic caused

a drop in demand for building sites by commercial

property builders.

This is in stark contrast to the March 2020 survey by the

government which report that the average price of all types

of land across Japan had risen for a fourth straight year

and that the price of residential land in some rural areas

had increased for the first time in 27 years. Behind the

early 2020 price increase was aggressive buying by

overseas investors.

Uncertain prospects for a recovery of economic activities

are impacting real estate investment. Unless economic

conditions show improvement in the coming months more

areas will see land price fall. In areas outside the three

metropolitan areas the average price of commercial land

was down 0.6% and residential land prices dropped almost

1%.

Among the surveyed sites, the island city of Miyakojima,

Okinawa Prefecture, recorded the highest land price rise

with commercial and residential land prices jumping

around 38% year on year boosted by resort hotel

development.

Import update

Wooden door imports

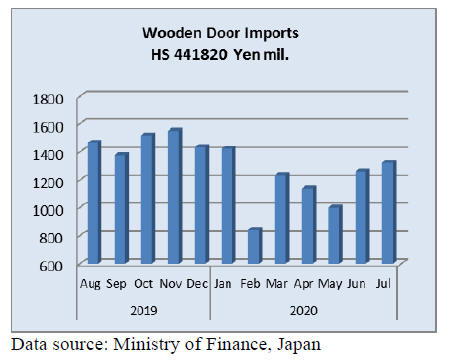

Japan¡¯s July imports of wooden doors (HS441820)

increased, building on the rise seen in June. July wooden

door imports were up 5% month on month but were down

14% year on year.

In July the main shippers of wooden doors to Japan were

China (47% of June imports)but this was down

significantly from the 68% share of imports in June. Other

shippers in July were the Philippines (23%), Indonesia

(6%) and a new-comer, South Korea (4%).

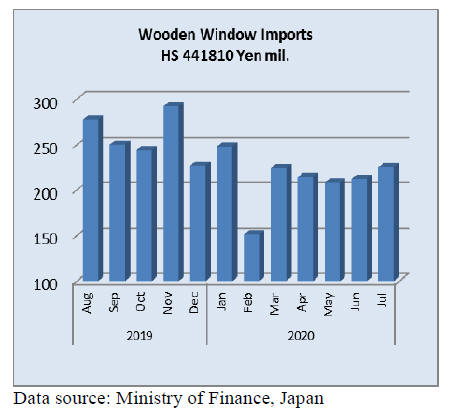

Wooden window imports

Japan¡¯s imports of wooden windows (HS441810), while

small, have been consistent since March. In June there was

a slight increase in the value of imports and this continued

in July when a 5% month on month rise was evident. A

year on year comparison is however less positive as the

was a 28% decline in July 2020 imports compared to

August 2019.

Two shippers China and the US accounted for almost 80%

of the value of July imports of wooden windows. The only

other shipper was the Philippines which contributed a

further 17% to the value of imports.

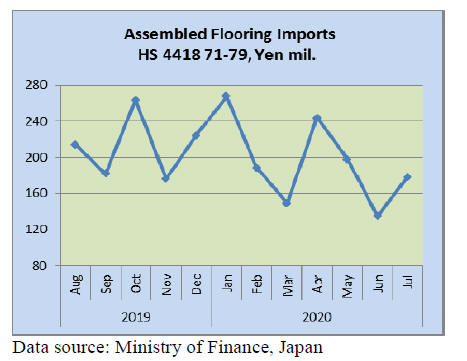

Assembled wooden flooring imports

The pattern of two consecutive declines in the value of

assembled flooring imports first seen at the beginning of the year

repeated itself in May and June.

While April imports drove imports back up to around the

monthly average the rise in July was insufficient to repeat this

thus underlining the steady decline in the value of imports this

year. Compared to June, the value of imports in July were around

30% higher but year on year July imports were 34% down.

Of the various categories of flooring imported HS 441875

accounted for 67% of July imports as it has done in past months

and was supplied mainly by shippers in China and Vietnam.

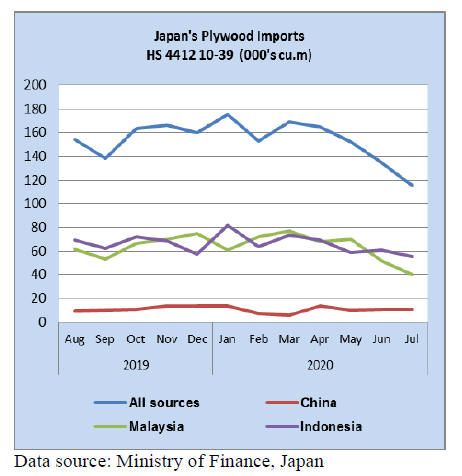

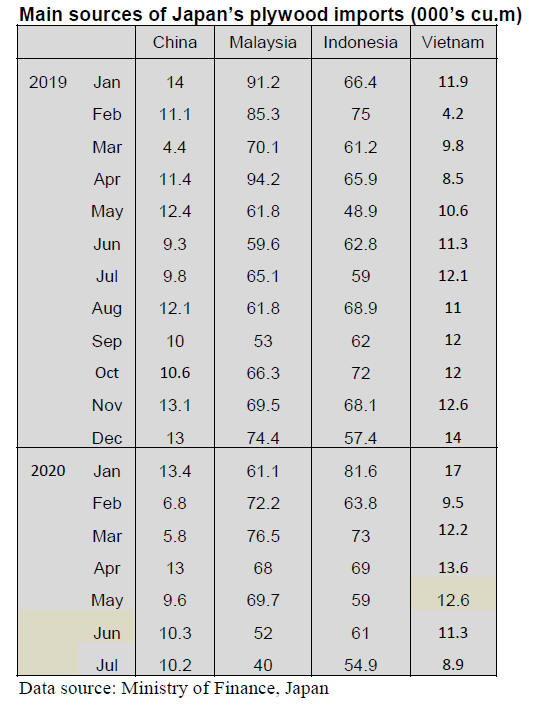

Plywood imports

It has been only shippers in China which have managed to

maintain their level of exports (albeit small) of plywood to

Japan, the other main shippers, Indonesia and Malaysia

have seen a steady decline in the volumes imported.

In July, the volume of shipments from Malaysia was down

24% year on year and shipments from Indonesia were

down 10% year on year. Vietnam has been a steady

supplier of plywood to Japan for several years but has seen

shipments decline over the past few months.

Year on year, July plywood imports (HS441210-39) were

down 22% and month on month there was a 15% drop in

the volume of imports. Of the various categories reported

HS441231 accounted for over 80% of imports with a

further 5% each being of HS441233 and HS441234.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Road map to expand large wooden structures

announced

The Ministry of land, infrastructure and transport tied up

with the Forestry Agency made up the road map to expand

large scale wooden buildings market scale to one trillion

yen by 2030. This is publicized on the website in late

August.

Large scale wooden building means to exclude low

buildings of three stories or less and the market scale as of

2018 is 500 billion yen and the target is to double this to

one trillion yen by 2030.

To materialize the target, there are problems and necessary

activities as large buildings in urban areas require high fire

resistance and as they becomes higher, stronger materials

are needed so future activities require to develop high fire

proof and high durable wooden materials.

Todays¡¯ technology and products are not good enough to

permeate in terms of versatility and cost. Sample of design

should be made to make it easier by considering safety of

high rise architecture.

Durability of outer shell of wooden building should be

considered and the standard should be made up. At the

same time, training is necessary to secure necessary

personnel who are in charge of designing and actual

construction works. It is necessary to have stable supply of

wood to materialize the target so road map is made up to

improve productivity and safety of forestry by promoting

smart forestry as a set of the above road map.

As concrete activities, forestry cloud and ICT production

system will be introduced nationwide with unified

standard and develop function of automation, remote

control of logging machines.

Plan to extend life of wooden buildings

The wooden home builders association of Japan is

developing high durable wooden house with 35 building

materials companies. The plan is to extend life of wooden

house from about 30 years to 85-90 years.

To make durable outer skin of house, manufacturers of

high quality, durable roof and exterior wall are selected

and design and construction with such materials will be

discussed.

To give longer life to wooden built houses has been

general demand for many years but about 30 years¡¯ life of

wooden house has been tacit understanding in housing

society.

Actually majority of building materials manufacturers

think that it is general standard of 30 year¡¯s life of the

materials they make.

The Association came up with hypothesis that outer skin

of the house like roof and exterior wall may be reason of

short life and formed development project then 35

companies joined and discussions continued until last

August with 23 companies to make durable outer skin of

wooden building.

Present assumption is that if 40-45 years life roof material

is used, only one time reroofing makes life of 80 -90 years.

Compared to 30 year¡¯s life roof materials, initial cost is

higher for longer life materials by about 200,000-300,000

yen. Reroofing cost of 30 years life materials would be

1.2-1.5 million yen but longer life materials¡¯ reroofing

cost would be 50-60% lower so life cycle cost would drop.

In short, house buyers have option to choose short life

house or long life house.

Wood pellet production in 2019

The Forestry Agency disclosed wood pellet production in

2019. The production increased by 12% from 2018 but

supply of imported pellet has been sharply increasing so

that self-sufficiency rate remains low at 8.4%. Selfsufficiency

rate of wood pellet in 2014 was about 57%

then it has been dropping year after year.

Production of wood pellet in 2019 is 147,321 ton, 12.1%

more than 2018. Use of wood pellet is 142,454 ton for

fuel, 12.9% more so it is 97% of total wood pellet. Main

use is power generation and utilization of heat.

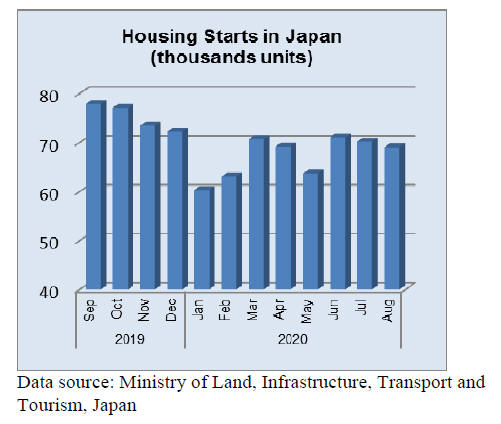

Large house builders¡¯ increasing orders

Eight major house builders report that the orders¡¯ amount

exceeded that of the same month of last year after one year

and four months. Bottom is about 65% in April and May

then the orders have kept recovering month after month.

Since last July, event of sales campaign at the house

exhibit locations reopened so the sales resulted in order

amount. However, large builders comment that the

demand is moving to low cost builders because of

uncertain income in future and demand to reduce the

prices is increasing. Negotiations now take more time than

before.

It is first recovery since April 2019. April 2019 was the

last month of rush-in orders before the consumption tax

hike and the starts had kept sliding down month after

month so the tax hike reaction finally ended after sixteen

months together with influence of various measures to

stop corona virus epidemic.

The amount compared to the same month a year earlier in

August 2019 was 91% then August 2020 is 108% so the

demand has recovered to April 2019. Ordered amount of

three companies among eight majors exceeded since last

July. Then in August, they increased to five companies.

Low cost and unit built for sale builders draw more buyers

so that their recovery is more than the majors.

Eight majors are Sekisui House, Daiwa House, Sekisui

Chemical, Panasonic Homes, Misawa Homes, Asahi Kasei

Homes, Mitsui Home and Sumitomo Forestry. Low cost

builders are Tama Home, Yamada Home, Hinokiya Group

and two others.

South Sea(tropical) logs and lumber

Log import is more than 10% less than last year but users

have enough inventory. Sarawak, Malaysia could go into

rainy season in any day but the users in Japan feel

confident that PNG supply should satisfy their needs.

Indonesian mercusii pine laminated free board prices

dropped in late July in Indonesia but with limited volume

in distribution channels, the prices are settling down.

Chinese South Sea lumber has started moving after August

but demand for renovation of stores continues slow due to

coronavirus restrictions.

|