Japan

Wood Products Prices

Dollar Exchange Rates of 25th

July

2020

Japan Yen 104.92

Reports From Japan

Lockdown lifted but weak global

demand hammers

growth prospects

Japan¡¯s economy is expected to have contracted almost

24% on an annualised basis in the second quarter of 2020

driven down by falling exports and the impact of the state

of emergency which encouraged work from home and

businesses to close. Preliminary second quarter GDP data

will be available mid-August.

The Bank of Japan said it expects the Japanese economy

to shrink 4.7% and the consumer price index to fall 0.5%

in fiscal 2020 ending March 2021.

Japan's industrial activity contracted for the 15th

consecutive month in July suggesting the economic

damage from the pandemic will linger as there is little

hope for a quick recovery in global demand. The lifting of

most lockdown restrictions gave a boost to the domestic

economy but it is still negatively affected by weak

international trade. Japan¡¯s exports crashed in June, the

fourth month of declines.

Subsidised relocation of manufacturing from China

The Ministry of Economy, Trade and Industry has released

the names of the first group of Japanese companies being

subsidised to relocate manufacturing out of China. The

first 87 companies will benefit from the yen 70 billion

fund to move production lines. The Japanese

government¡¯s aim is to reduce reliance on China and build

diversified supply chains. The Ministry said 30 of the 87

companies will shift production to Southeast Asia.

The government has allocated yen 220 billion in the fiscal

2020 supplementary budget to create this subsidy

programme to encourage companies to move. Of the total,

yen 23.5 billion is for those shifting to Southeast Asia.

See:

https://asia.nikkei.com/Economy/Japan-reveals-87-projectseligible-for-China-exit-subsidies

¡®Go to¡¯ tourism boost off to a rocky start

In an effort to boost domestic tourism the government

launched what has been called the ¡®Go To¡¯ subsidised

travel campaign but there are growing concerns on

whether encouraging travel at this point of time as a

second wave of infections is expanding.

This yen 1.35 trillion campaign was originally designed to

promote domestic travel by anyone to any destination with

discounts via deals and vouchers but after a rise in

coronavirus cases, particularly in Tokyo, the government

announced travel to and from Tokyo is not included.

The recent nationwide surge in infections has promoted

suggestions that the government may re-impose a state of

emergency as there is a risk the health care system could

be overwhelmed.

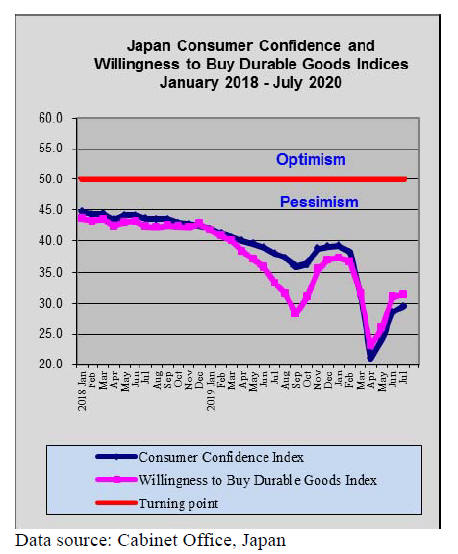

Consumer confidence

Japan¡¯s consumer confidence index rose slightly in July,

improving for a third consecutive month. While the overall

index rose that for ¡®willingness to purchase durable goods¡¯

was flat.

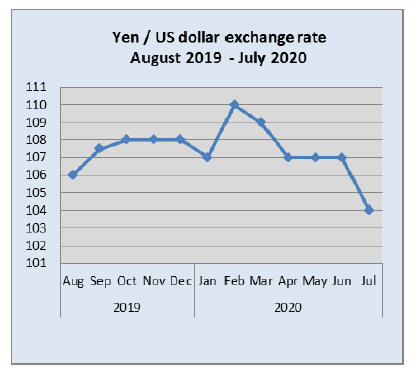

Yen may continue to strengthen against the

dollar

Two issues affected the dollar yen exchange rate at the end

of July, US/China tensions and the rise in infections in the

United States.

The ¡®safe-haven¡¯ yen recently strengthened to its highest

against the US dollar in more than four-months due to a

host of negative news including the rise in coronavirus

cases in the US, a delay in the US stimulus package bill

and the rapidly deteriorating US/China relationship.

The Japanese yen was well below the 107 mark to the

dollar in late July dipping to yen 104 to the dollar. Some

commentators have suggested the yen may rise to 102 if

tensions between the US and China worsen and that this

will be the point at which the Bank of Japan will be

viewing its options.

Working from home opens opportunities to

move out

from city

As employees are being encouraged to work from home to

help stem the virus spread many young people are seizing

the opportunity to move to the suburbs where rents are

lower, homes tend to be bigger and the environment more

appealing.

The proportion of those working remotely dropped to 20%

after the state of emergency was lifted dropping down

from 31% in the earlier period. This seems to indicate that

the idea of flexible working faded but now, as a second

wave of infection is on the rise home work has risen.

Interestingly, the survey conducted on working from home

found respondents reporting their work efficiency had

improved.

See:

https://www.japantimes.co.jp/opinion/2020/03/05/editorials/usecoronavirus-crisis-promote-teleworking/#.XyajHbozbIU

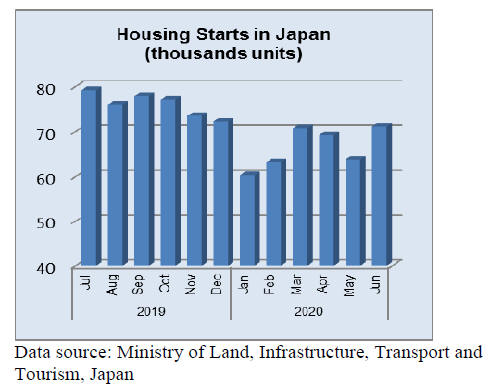

Housing starts

June housing starts were better than expected. Compared

to a month earlier June starts were up 12% but year on

year there was a 13% decline which, given the tough

economic situation, was not so bad.

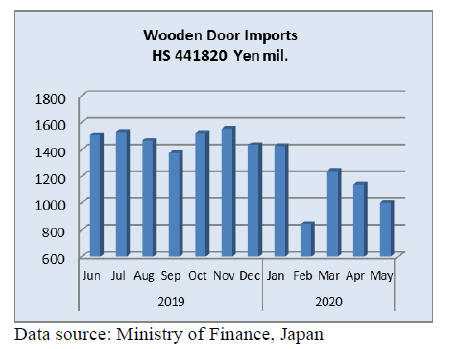

Import update

Wooden door imports

The value of Japan¡¯s imports of wooden doors

(HS441820) has fallen for three consective months up to

May 2020. From March to May there was an almost 20%

drop in the value of wooden door imports.

Year on year, the value of wooden door imports in May

declined 30% adding to the year on year declines seen in

March and April. Of the other shippers, only the US and

Malaysia featured significantly in May imports of doors.

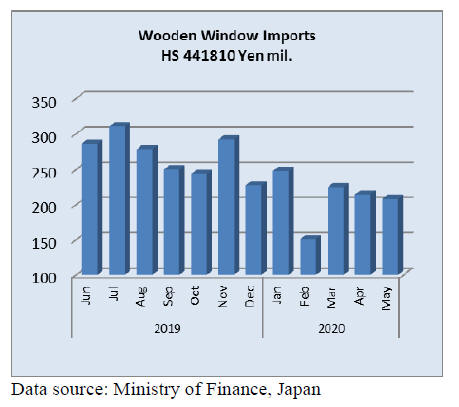

Wooden window imports

The pattern of imports of wooden windows (HS441810)

mirrors that of door imports. Wooden window imports in

May were down 24% year on year but compared to April

there was only a small dip in the value of imports.

Japan¡¯s May wooden window imports in terms of source

were split between shipments from China (44% of the

total) and shipments from the US (almost 30% of the

total). Shippers in Sweden and Malaysia each accounted

for around 8% of the value of imports of wooden

windows.

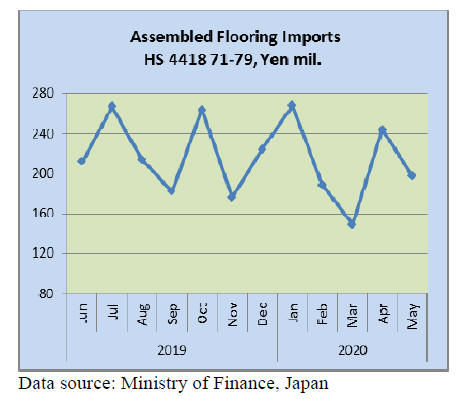

Assembled wooden flooring imports

Over the past 12 months the value of wooden assembled

flooring imports have see-sawed every 2 months but from

the graphic below an overall downward appears to be

emerging which would fit with the trend in import values

of other woodwork items such as doors and windows.

Year on year the value of May imports of assembled

flooring dropped 30% and month on month imports were

down 19%.

Two categories of imports HS441875 and HS441879

accounted for most of Japan¡¯s flooring imports. The

largest category in May, as in other months, was

HS441875 (71% of imports) followed by HS441879 (22%

of imports).

Manufacturers in China accounted for most (60%) of the

HS441875 followed by Vietnam (28%). Imports of

HS441879 in May were fairly even split between

Indonesia and Thailand.

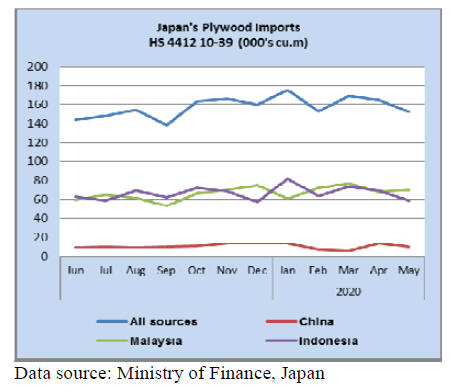

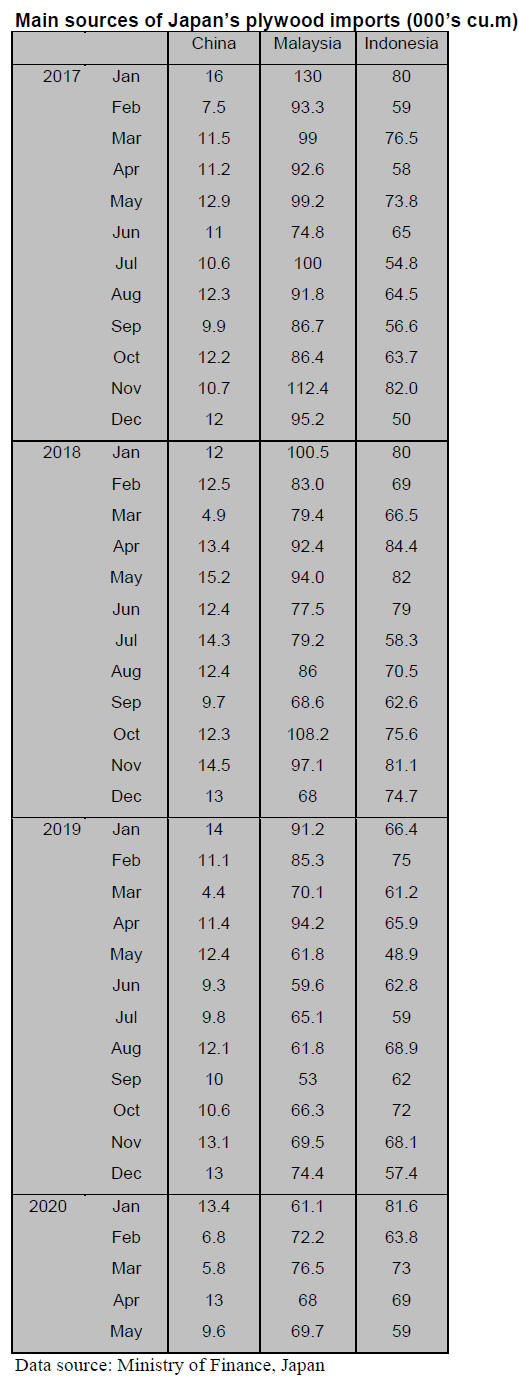

Plywood imports

Up to March this year there was a slight increase in

Japan¡¯s imports of plywood from the top three shippers,

Indonesia, Malaysia and China. However, first in April

and then again in May import volumes trended lower.

Plywood imports from China in May were over 20% down

year on year.

Indonesia and Malaysia are the top shippers of plywood to

Japan accounting for over 80% of all plywood imports. In

May arrivals from Malaysia were up 13% year on year and

imports from Indonesia were up 21% year on year.

Despite the better year on year performance, overall,

import volumes have started to decline.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/Softwood

plywood manufacturers continue

curtailment

program

Major plywood manufacturers in Japan tie-up and

collaborate to maintain the market by production

curtailment and are determined not to follow down trend

of the market. In the past, to reduce production cost, the

manufacturers over produced and drop the sales prices to

dispose of surplus inventory.

They know that reducing the sales prices does not generate

any new demand and after one reduces the prices, others

steal a march and drop the prices one notch further and

vicious circle continues without any end. This time for the

first time, they communicate with each other and control

the supply volume. They produce only for what the market

needs and wait for recovery of the market.

Seihoku group has been reducing the production by 20%

since last April and some plants curtail more than 20% in

June. Nisshin group plans to expand degree of reduction to

30% in August. Hayashi Plywood has no idea of reducing

the sales prices to promote sales.

Construction works stagnated for three month during April

and June and they will start activating probably in fall

after corona virus problem settles down somewhat and

once things gets moving, man power and distribution

works may get tight toward end of this year.

Sales activities stagnated for almost three months since

last March and dealers¡¯ marketing activities are back in

June and they are trying to catch up short fall of sales but

buyers buy small volume only by uncertain future market.

Precutting plants also face the same uncertain future so

that they try to reduce the inventory as much as possible

and buy on spot basis.

Present market prices of 12 mm 3x6 panel in Tokyo

market are 950 yen per sheet, 40 yen lower than last

month.

National forest plan for 2020

The plan for 2020 is publicised on June 12. Sales plan of

timber and logs is 4,602,000 cbms, 2% more than 2019 but

the demand is likely to decline this year by corona virus

epidemic.

Size of business of national forest depends on the budget.

Initial budget for 2020 is 75.8 billion yen, 1.4 billion yen

less than 2019 but supplementary budget is 1.6 billion yen

so it is about the same as 2019.

Based on the budget, the harvest plan is 7,112,000 cbms of

main cut, 4% more and thinning is 6,958,000 cbms, 1%

more. Sales plan is 2,770,000 cbms of logs, 2% more and

1,832,000 cbms of timber, 2% more.

Both are more than 2019 but by impact of wide spread

corona virus infection, actual management will be flexible.

Particularly as to timber sales, Kyushu regional office held

supply adjustment meeting in May and it decided to hold

some of timber sales.

Hokkaido regional office held the same meeting in May

and decided to postpone time of public auction for timber.

Seven regional offices have decided to extend expiry time

of timber sale by one year without any penalty. It is

unusual that all the regional offices take the same measure

to reduce the supply uniformly.

Time of harvest depends on timber purchaser but there are

request for extension from the purchasers as log prices

keep dropping and some lumber and plywood mills

stopped accepting logs.

New experimental deal is to sell much larger lot of timber

for longer harvesting period. It will designate about ten

locations in Japan in three years from 2020 and each has

200-300 hectares with ten years¡¯ time limit.

It will investigate demand in various regions to see where

the most suitable location is but log supply will increase

all of a sudden by this and likely to collapse balance of

supply and demand so it will keep watching the market

before actual plan is made.

Plywood

Movement of both domestic and imported plywood is

getting stagnating. Domestic manufacturers have been

curtailing the production and are determined to hold the

prices but the market prices are weakening as buyers buy

minimum volume only because of uncertain future market.

Precutting plants also limit the purchase volume by

unpredictable future market. Regular orders are now less

and spot base purchase is increasing.

Imported plywood market continues suffering inactive

movement.

In Tokyo market, large construction works were estimated

to postpone until the summer Olympic Games are over and

they would start up in September but by corona virus

outbreak makes future demand much obscure now so the

importers hesitate to place orders to the suppliers in South

Sea countries.

In middle of March after Malaysia restricted movements

to stop corona virus infection, some placed orders in fear

of total disruption of the supply but the supply actually

continued.

Contracted volume is in Japan now and they are up for

sale but in demand slow market, it is pushing the market

prices down.

Marutama curtails the plywood production

Marutama Industry Co., (Hokkaido), plywood

manufacturer, decided to make every Friday as holiday at

the Tsubetsu plant from June to September so the

operation is four days a week to adjust supply volume.

Marutama¡¯s sales in first half of June was about 5% less

than normal pace and the decrease seems to keep widening

month after month so it decided to quit prospect

production and manufacture by orders only. Curtailment

program will continue for four months through September.

Marutama says it takes two days from accepting order to

actual production. Delivery would take seven days. With

five to six days to spare, the inventory would be reduced

down to two weeks. Log inventories are about two months

so it started to restrict accepting logs now.

The plant produces about 8,000 cbms of both structural

and non-structural plywood but it is preparing to have

lower sales like 20% compared to last year. June¡¯s

working days are 22 so production should drop by 13%.

Closing account of wood building materials

manufacturers

Earnings performance of seven major wood building

materials manufacturers for the term ended March 2020

shows sales are almost unchanged from previous term and

some marked record high sales. Majority enjoyed rush-in

demand before the consumption tax hike in October 2019

then suffered plunged market on the rebound.

Demand of building materials was active in the first half

then dropped sharply in the second half as housing starts

declined.

On profit, there is difference among companies. While

cost of raw materials and transportation continue to

increase, some succeeded to pass higher cost onto sales

prices and rationalization of manufacturing cost and others

failed.

Daiken Corporation registered the highest profit. Sales of

interior materials like flooring was active for not only

residential but for public and commercial buildings.

Then in June 2019, two of subsidiary companies in the

U.S.A. and Teio Flooring in October participated as

consolidation group, which contributed high profit.

Nihon Flush Company marked higher sales and profit for

three straight terms. It expanded the business in China and

started dealing with seventeen new developers in China.

Noda Corporation marked higher sales and higher profit. It

switched floor base material from imported South Sea

hardwood plywood to domestic softwood plywood and

now share of domestic flor base is more than 50%, which

contributed to reduce impact of high cost of imported

plywood. Nankai Plywood enjoyed busy sales of cabinet

and marked higher sales and profit for four consecutive

terms.

Wood One Co. Ltd. pushed price hike of the products so

marked higher sales after three terms. Also by reduction of

sales and general administrative expenses, ordinary profit

and operating profit recovered.

Eidai Co. Ltd. suffered damages by typhoons in 2018 then

closed particleboard plant in Yamaguchi so sales dropped

in two terms and loss but with all-out effort to improve the

performance, loss amount is less than previous term.

Asahi Woodtech Corporation had firm sales in the first

half then dropped some in the second half. Marketing cost

increased after it expanded showrooms and increase of

transportation and ware house so the profit was lower than

previous term.

|