Japan

Wood Products Prices

Dollar Exchange Rates of 10th

July

2020

Japan Yen 106.92

Reports From Japan

Thousands laid-off

The Ministry of Labour has reported that only 32,000

workers, so far, have been fired by their employers due to

the impact of the coronavirus pandemic adding that about

232,500 businesses are eligible for subsidies allowing

them to keep their workers on the payroll. The Ministry

reports having paid out over US$1.5 billion to companies.

The number of identified infections has been rising in

tandem with the increase in the rate of testing. Tokyo has

the highest number of cases and this has surged since

movement restrictions and restrictions on businesses were

eased.

Tokyo's cumulative infections reached 7,927, accounting

for nearly a third of the around 22,600 confirmed cases in

the country. None of those recently infected were in a

serious condition as most are in their 30s or younger.

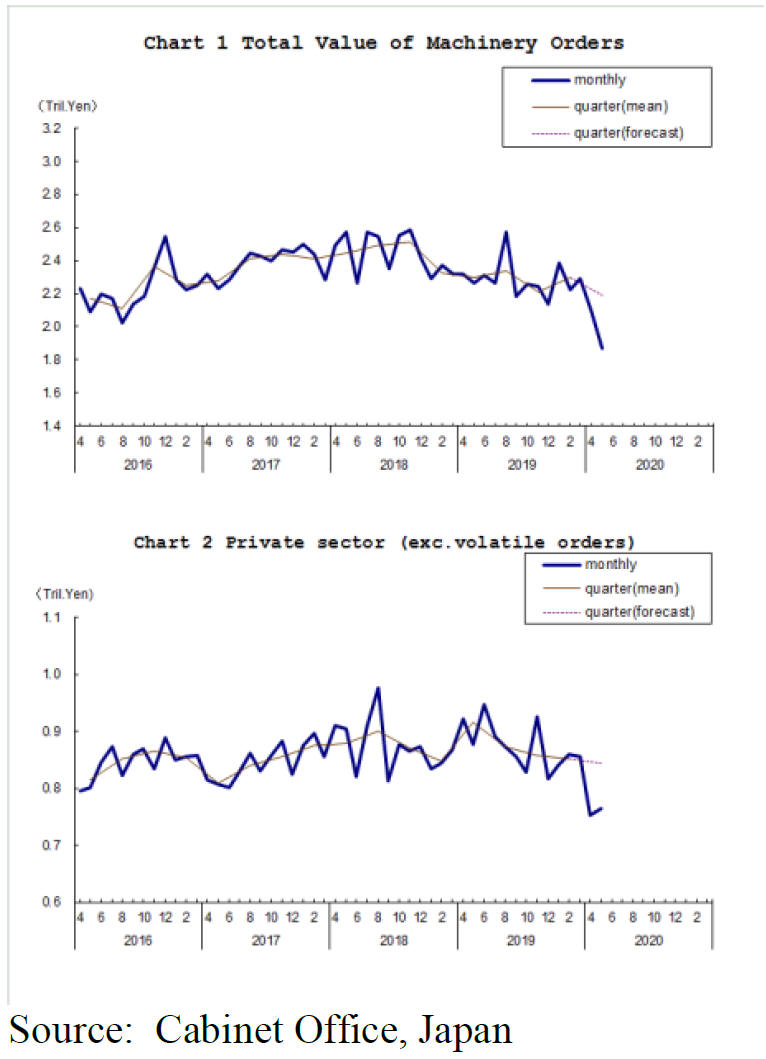

Pace of decline in machinery orders slows

A survey of the value of machinery orders received by

manufacturers operating in Japan reveals there was a more

than 10% decline in May from the previous month. But,

says the report, private-sector machinery orders, excluding

for ships and those from electric power companies,

increased slightly in May.

The Chief Economist at Norinchukin Research Institute is

reported by the Japan Times as saying ¡°Japan¡¯s economy

may have hit the bottom in May but capital expenditure

likely won¡¯t turn for the better, as weak demand and the

risk of a second wave of infection discourage

manufacturers from boosting non-urgent spending.¡±

See: https://www.esri.cao.go.jp/en/stat/juchu/2020/2005juchue.html

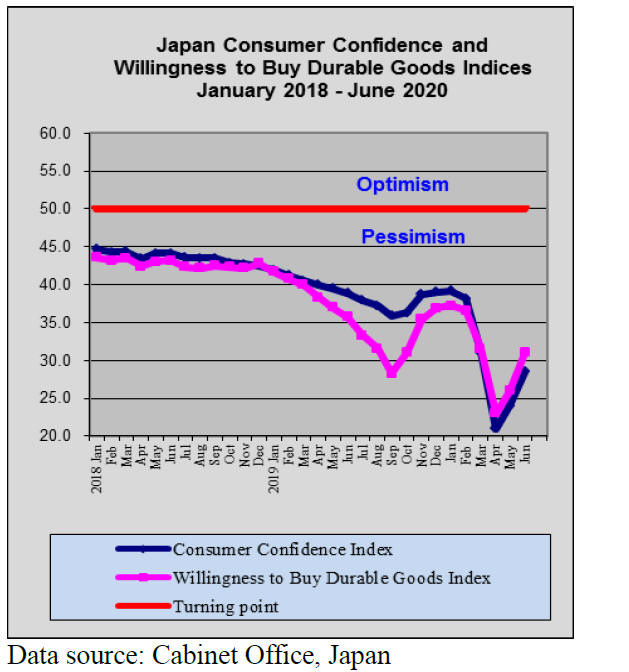

Consumer sentiment clawing back

Cabinet Office data shows that in June, for a second

consecutive month, Japan's consumer confidence index

rose but still remained well below pre-pandemic levels

despite the end of a nationwide state of emergency.

The index of sentiment among households for their

economic expectations for the coming six months jumped

marking the biggest reversal since the recent survey

method was introduced (see below).

The index for willingness to purchase durable goods rose

however, it should be remembered that a reading below 50

suggests pessimism.

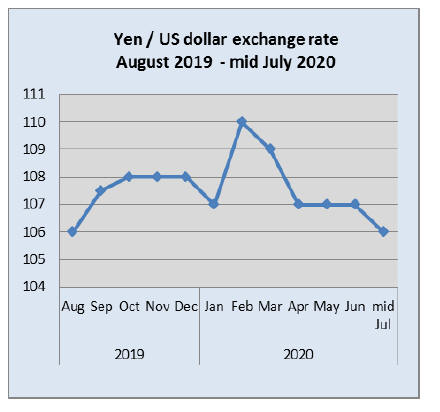

Yen more susceptible to global trends than

domestic

economy

The US dollar remains weak as infections in the US and

around the world continue to increase which has raised

uncertainty about the prospects for a recovery in trade and

investment.

In Japan, the economic fundamentals are steady and it

seems that the yen/dollar exchange rate has more to do

with the pandemic impact around the world than the

performance of the domestic economy.

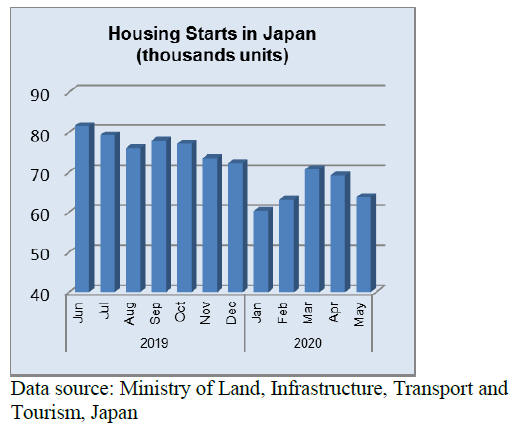

Housing starts forecast to 2030

Year on year, May housing starts were down 12% and

compared to April starts fell by more than 5%. May

marked the second consecutive decline in starts and for the

first 5 months of this year housing starts are off by 11%

which, given the impact of the pandemic control measures

and reduced business activity is better than expected.

However, according to a recent Nomura Research Institute

report, there is likely to be a significant drop in new

housing starts across Japan by 2030. Housing starts are

forecast to drop from 950,000 units in 2018 to 730,000

units in 2025. In 2030, total housing starts are forecast to

be only 630,000 units.

If this forecast is correct it will result in marked changes in

the structure of the domestic wood products sector as well

as in imports.

Import update

Furniture imports

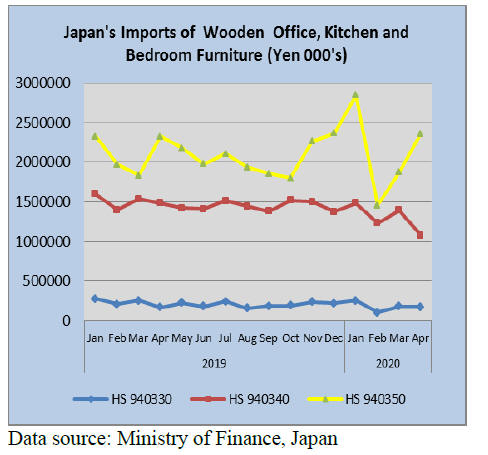

Japan¡¯s April furniture import data present a mixed

picture. Wooden bedroom furniture imports continued the

upward trend advancing on the value of March imports, on

the other hand wooden kitchen furniture imports dipped.

Since the end of 2019 wooden kitchen furniture imports

have been on a downward path.

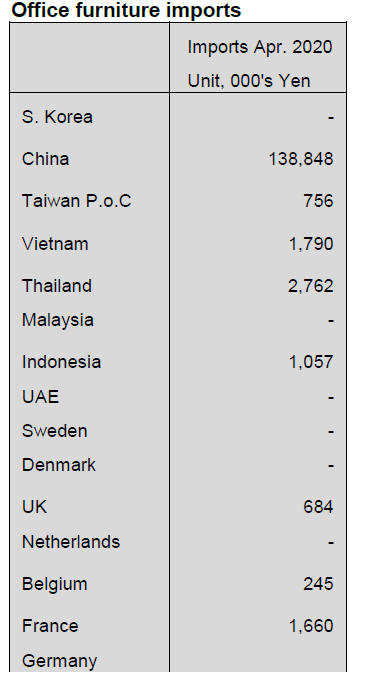

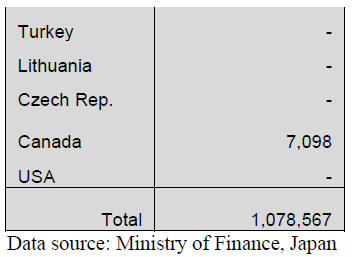

Office furniture imports (HS 940330)

The value of April imports of wooden office furniture

(HS940330) were around the same level as in March and

year on year the value of April imports were little

changed. At almost 80% of all April wooden office

furniture imports producers in China dominate the trade.

The other traditional shippers, Poland and Italy slipped

back, with each shipping around 3% of April¡¯s imports.

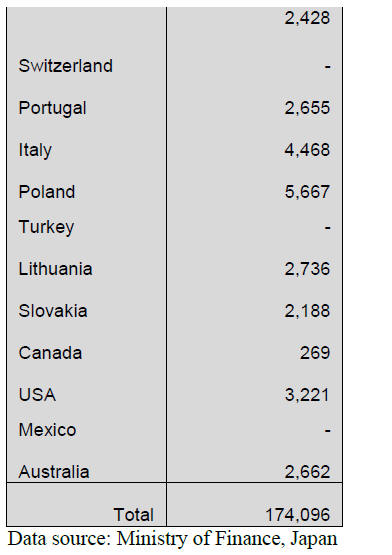

Kitchen furniture imports (HS 940340)

Japan¡¯s imports of wooden kitchen furniture slumped in

April. Year on year, the value of April imports was down

29% and compared to the value of March imports there

was a 22% decline in April.

The most notable change month on month was in the value

of shipments of wooden kitchen furniture from China

which jumped more than three fold. In April the main

shippers were, in order of value rank, Vietnam (49%) the

Philippines (23%) and China (17%). China¡¯s shipments in

March accounted for just 3% of imports.

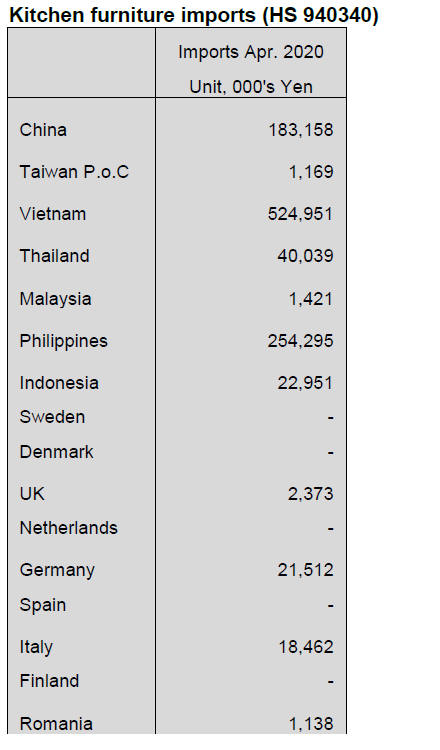

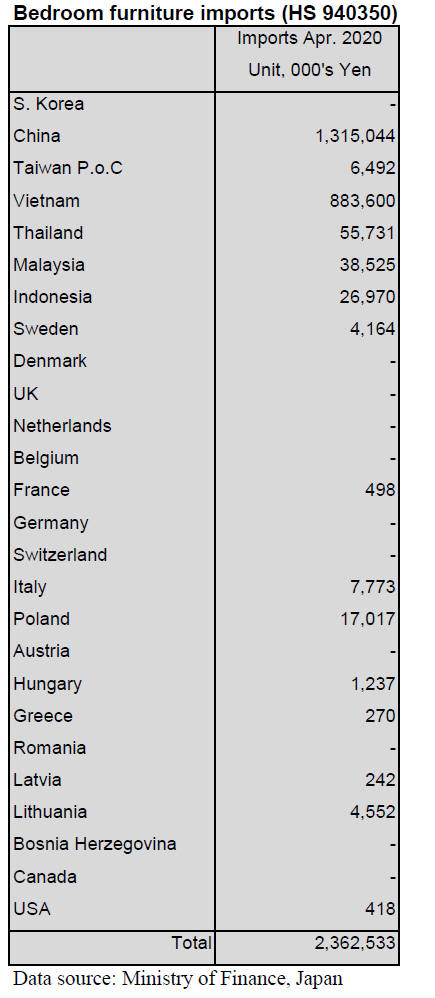

Bedroom furniture imports (HS 940350)

The additional rebound in the value of April imports of

wooden bedroom furniture (+26%), coming as it did after

the almost 30% month on month rise in March only

brought April imports level with those in April a year

earlier.

Exporters in two countries, China and Vietnam dominated

April imports of wooden bedroom furniture (HS940350).

Shippers in China accounted for just over half of all

arrivals in April followed by Vietnam at 37%. The other

main shippers, Thailand, Malaysia and Indonesia together

accounted for just 3% of Japan¡¯s imports of wooden

bedroom furniture.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Performance of building materials trading firms

For the term ended March 31, performance of four major

building materials trading firms and Sumitomo Forestry is

disclosed.

Corona virus incident is nothing to do with the

performance but imported plywood business did not

contribute by slump market in Japan. Consumption tax

hike in October last year generated rush-in purchase of

building materials and house appliances, which

contributed performance.

Four companies are Itochu Kenzai Corporation, SMB

Kenzai Co., Ltd., Sojitz Building Materials Corporation.

Building materials division of Sumitomo Forestry Co., Ltd

does not publicize current profit as the division.

Total sales of five companies maintained 1,200 billion yen

but profit decreased. In sales, imported plywood sales

decreased by 25.1 billion yen. Generally processed

building materials and house appliances were good but

plywood and lumber did not have any strength. While

imported plywood keeps losing ground, domestic

softwood plywood gained strength.

Housing starts for the period were 880,000 units plus,

7.8% less than previous period. This is first time that the

starts dropped less than 900,000 units after five years.

There are last minutes purchases before consumption tax

hike so building materials and some renovation works

moved rather actively.

Meantime, imported plywood and some commodity items

lost supply and demand balance and became money loser.

Itochu Kenzai is the only company registered increased

sales and profit. Others had decreased sales and profit.

Itochu Kenzai had record high sales and current profit and

ordinary profit was fourth highest. Consolidated sales are

the top in the past and ordinary profit is second high.

Sumitomo Forestry¡¯s sales increased by 9.8 billion yen by

sales of building materials but decreased by 16 billion yen

by lumber and plywood. Ordinary profit exceeded last

term except for profit of transfer of New Zealand

plantation business, which is registered as non-operating

income.

SMB Kenzai reduced the profit by 37% after loss by

business transfer and withdrawal of joint venture in

Australia is appropriated as special loss.

Sojitz Kenzai¡¯s sales have been over 160 billion yen

but

the profit has kept falling for three straight terms since

2017. Major factor of sales drop is decrease of imported

plywood sales.

Toyo Materia suffered decreased sales and profit. For the

first time, sales of domestic plywood exceeded imported

plywood.Material sales to subsidiary precutting company

decreased after the company quit. For the company,

plywood sales had been the top but now it is replaced by

building materials sales.

After all, imported plywood business had been core

business for all major trading firms but not any more.

Daishin Plywood to quit

Daishin Plywood Co., Ltd. (Niigata prefecture) announced

that it will quit manufacturing plywood at the end of

March 2021 and dissolve the company. It has been

manufacturing South Sea hardwood plywood but

availability of logs from South Sea countries gets tougher

without any hope of recovery with climbing prices.

This is the largest hardwood plywood manufacturer in

Japan. It consumes about 6,300 cbms of logs a month to

produce 3,800 cbms of plywood.

Logs are 75-80 % of mersawa from PNG and 20% of

meranti from Sarawak, Malaysia.

Products are 1,250 cbms of three layered thin panel and

1,350 cbms of medium thick panel. These take about two

third of products and a balance is thick panel. Majority is

base panel of decorative plywood so secondary processors

are major customers.

It manufactured composite plywood with local cedar but

basically it manufactures products secondary processors

want, for which import plywood cannot deal with. The

annual sales are about five billion yen.

Up until 2018, combination of logs was 50% of Sabah,

Malaysia, 20% of Sarawak, Malaysia and 30% of PNG

then Sabah government banned log export in 2018 so the

combination failed and share of PNG increased. Then

PNG government increased log export duty with possible

export ban in future.

Log size got smaller so that recovery dropped. There is no

other source to replace PNG. Then came corona virus

pandemic and future demand of building materials looks

gloomy and profitability continues to drop so it finally

decided to give up.

The company started in 1957 in Tokyo then moved to

Niigata in 1965. Oshika Corporation, adhesive

manufacturer, became the owner in 2015.

South Sea log and lumber

Tropical hardwood log supply from PNG and Sarawak,

Malaysia has been steady although the volume is very

limited.

Log supply in both countries is tight. In PNG, log harvest

is decreasing after increase of export duty and dwindling

export to China.

In Sarawak, Malaysia log supply has been tight and local

plywood mills struggle to secure the necessary volume. In

Japan, Daishin Plywood, the largest tropical hardwood

plywood manufacturer announced to quit the business in

March next year. Tropical hardwood log demand will

further drop.

Japan Kenzai markets 100% domestic wood long

plywood

Japan Kenzai Co., Ltd. (Tokyo) has started marketing

100% domestic wood long length plywood since May.

Thickness is 9 mm and 12 mm. Veneer for 9 mm plywood

is pine core with cedar face and back and for 12 mm is all

cedar. This is first product of all cedar long length

plywood.

Sizes are 910x2,730 mm, 910x3,030 mm and 1,000x3,030

mm for both 9 and 12 mm. Manufacturer is Nisshin group

in Tottori prefecture.

Japan Kenzai submit sample to Japan Plywood Inspection

Corp. and tested JAS structural bending and cleared the

standard.

All domestic cedar structural plywood is now normal for

standard 3x6 plywood but for long plywood, imported

species like North American Douglas fir and Russian larch

are used for face and back in view of strength. Now by

selecting cedar veneer severely, all cedar long length

plywood is approved. It tries to make 100% cedar 9 mm

long panel.

Recovering Japan¡¯s log (and lumber) export

Japan¡¯s log export for the first four months is 367,411

cbms, 6.8% less than the same period of last year.Lumber

export is 46,159 cbms, 6.9% less.

Log export to China in March was down by 47.2% so total

decreased. Then export to China recovered in April so

total increased by 20%. Also log export to Taiwan and

Vietnam increased significantly. Lumber export to China

also increased in April. Lumber export to the U.S.A. has

been increasing steadily from January. Large drop of log

export to China in March is result of corona virus outbreak

in China.

Cedar log export to China in January was 10.1% less than

2019, February was 22.6% less. March was 44.9% less

then April was 20.5% more. Drop of small diameter logs

with top diameter of 15 cm or less was large but small log

export recovered in April. Log export to Korea in 2019

decreased but it increased by 16.7% for the first four

months then Taiwan was flat last year but it increased by

30% this year. Log export to Vietnam, which is new

market, increased by three times of 2019 although the

volume is small yet with 6,105 cbms. This is promising

market after corona virus problem is over.

As to cedar lumber export, export to China and

Philippines, two major market, decreased for the first three

months then China increased by 56.8% so total four

months is 3.4% more. Philippines continues weak in April.

Lumber export to the U.S.A. has been increasing steadily.

January was 44.5% more. February was 20.8% more.

March was 29.1% more and April was 48.0% more. There

is no impact of corona virus pandemic in the U.S.A. as to

cedar lumber market.

|