4.

INDONESIA

Association calls for more efforts

to expand exports to

the EU

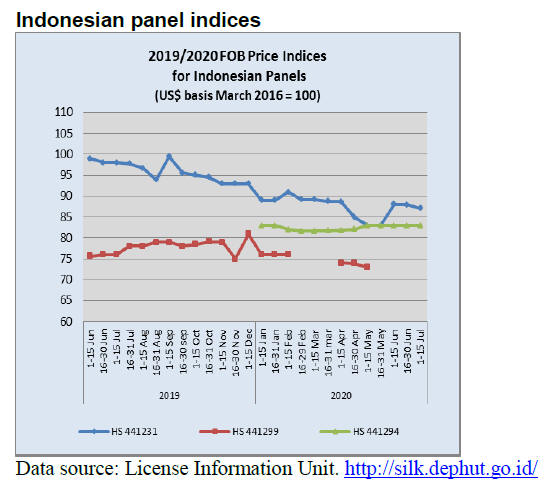

Chairman of the Association of Indonesian Forest

Concessionaires (APHI), Indroyono Soesilo, has called for

more efforts by the Indonesian embassies in Europe to

identify market opportunities for wood products.

He pointed out that the European Union is the fourth

largest export destination for Indonesian forest products

after China, Japan and the United States. In 2019,

Indonesian forest product exports to the European Union

earned more than US$1 billion.

Indroyono said the pandemic had dented exports of

Indonesian forest products to Europe. In the first 5 months

of 2020 there was a 17% year on year decline in the value

of exports.

The Indonesian Ambassador for Belgium, Luxembourg

and the European Union, Yuri Thamrin, reported that

demand for forest product in the EU member states is over

US$150 billion annually but Indonesia’s share of the

market is very low. Yuri suggested it would help if

Indonesia had warehousing facilities for Indonesian wood

products at one of the main ports to raise efficiency and

lower the logistics costs.

See:

https://industri.kontan.co.id/news/wah-potensi-ekspor-produkkehutanan-ke-uni-eropa-capai-us-152-miliar-per-tahun

In related news, Indroyono said APHI is optimistic about

the market penetration in some countries such as South

Korea where exports in 2019 topped reached US$700

million. Even during the first 5 months of this year exports

continued to rise. He suggested that South Korea should

consider adjusting import tariffs to encourage more

imports from Indonesia.

Association - Indonesia yet to become a global player

in furniture market

Setyo Wisnu Broto, Secretary General of the Indonesian

Light Wood Association (ILWA) in Sukoharjo, Central

Java considers that Indonesia has a long way to go before

it can take its place as a force in the global wood and

furniture business.

See:

https://republika.co.id/berita/qd3yst349/ilwaindonesia-tertinggal-dalam-bisnis-kayu-dan-mebel-dunia

While proudly reporting export revenue this, in the past,

has not been presented alongside the global value of

furniture exports. If it had, he said, it would show

Indonesia lags far behind other countries.

He expressed concern that the furniture sector suffers

because the government issues regulations that are not

pro-business and counterproductive.

In addition, the timber and furniture industries have failed

to modernize processing and management skills. He also

pointed out that the banking sector is not well informed of

the potential for furniture exports which is behind its

reluctance to support the industry with competitive loans.

Reduce dependence on imports

The Ministry of industry is looking for way to boost the

role of domestic small and medium enterprises in

supplying inputs for larger companies in order to reduce

reliance on imported goods.

Gati Wibawaningsih, Director General of Small and

Medium Enterprises in the ministry said they have

initiated a programme to help a group of SMEs with brand

registration, packaging advice as well as with information

on National Industrial Standards (SNI).

This programme is part of the government’s efforts to

increase the role of small businesses which contributed

over nearly 60% to the country’s economy. The ministry

has set itself a target of slashing Indonesia’s raw material

imports by up to 35% by 2022.

https://www.thejakartapost.com/news/2020/07/01/ministry-wants-to-increase-smes-role-in-big-business-supplychains.html

1 million mandays of job opportunities created

The government continues to expand the Forest and Land

Rehabilitation (RHL) programme which generates over 1

million mandays of day work opportunities in Java. The

Minister of Environment and Forestry (LHK), Siti

Nurbaya Bakar, asked the staff to increase the activities

under the programme.

Multi-business model for forestry

The Secretary General of the Ministry of Forestry, who is

also the Acting Director of the Ministry of Environment

and Forestry's Sustainable Production Forest Management

(PHPL) activitie,s said that the utilisation of the

production forest area needs to be optimised. The focus

should be on the total resource not only wood products

and should involve utilisation of as non-wood forest

products and environmental services.

In this regard the Ministry recently issued a innovative

policy of through Regulation P.01/2020 covering

‘Procedures for Application, Assignment and

Implementation of the Multi-business Model of Forestry

for Forest Concession Holders in Production Forests’.

This, said Bambang, is the first step in development of a

multi-business model for forestry and integrates the

utilisation of wood products with non-timber wood

products from agroforestry or silvo-pastural activities.

https://www.beritasatu.com/nasional/653261-klhkoptimalkan-pengusahaan-hutan-untuk-atasi-krisis-pangan

Norway announces first payment for reduced

deforestation in Indonesia

The Norwegian government has approved the first resultsbased

payment to Indonesia for reduced emissions from

deforestation and reduced forest degradation in the country

covering the period 2016-17. This is the first time Norway

has paid Indonesia's for achieving results in emission

reductions according to the domestic press.

The first payment from Norway for Indonesia's success in

reducing deforestation and forest degradation went

through an international standard verification process

carried out by an independent third party appointed by

Norway.

5.

MYANMAR

Resumption of MTE tenders sales

eagerly awaited

The Myanma Timber Enterprise (MTE) will resume tender

sales on 27 July. Sales have been suspended for four

consecutive months from March. However, there has been

no announcement by MTE as yet. Some of the local mills

are now running low on log stocks and there are reports of

resale of logs from earlier tenders.

Bago Region Minister acts on illegal logging

The Regional Minister of Forestry (Bago Region) has

stated there has been an increase in illegal logging in the

Bago Yoma Range where the 10-year logging ban has

been in place since 2016-17.The Bago Yoma Range has

more than a million hectares of rich natural forest land. In

response the Minister proposed activating an existing

regulation which restricts entry into the forest.

In related news, the Forest Department recently seized a

container packed with undocumented padauk. The

contents of the container were declared as non-wood

products in an attempt to avoid submitting the required

documents verifying the shipment was legal.

According to the current regulations exporters are obliged

to present documentation showing the raw material for the

wood products being shipped was purchased from the

MTE. This is a prerequisite to securing the official export

permit.

Covid-19 Relief Fund

The government has announced that around 70% of the

initial Covid-19 Relief Fund to support the economy has

been distributed to SMEs, mostly in the garment

manufacturing, hotel and tourism sectors since April this

year.

In addition the government has provided loans totalling

Kyats 101 billion to over 3,000 businesses impacted by the

pandemic. The Government set aside funds amounting to

5% of GDP for its Covid-19 Economic Relief Plan.

Deferral of interest payments offered by EU member

states

In a letter sent to the Union Minister of Planning, Finance

and Industry U Soe Win, EU member states Austria,

Finland, France, Germany, the Netherlands and Poland

announced the deferral of interest and capital payments

representing US$ 98 million [134.5 billion MMK] or

approximately 20% of Myanmar’s overall scheduled debt

service for that period.

“Today’s announcement from Team Europe is part of our

coordinated global response to the COVID-19 crisis,” said

EU Ambassador Kristian Schmidt, who signed the letter

together with the ambassadors from the six EU Member

States.

EU member states have granted Myanmar debt relief in

the past. Austria, Finland, France, Germany, the

Netherlands and Poland are currently the only EU

countries to which payment are due this year.

See:

https://eeas.europa.eu/delegations/myanmarburma/81921/eu-announces-usd-98-million-1345-billion-mmkdebt-suspension-myanmar_en

Overseas worker remittances are huge

According to the Central Bank of Myanmar, remittance

from Myanmar migrant workers exceeded US$1 billion

for the period April 2019 to March 2020.

Remittance from Malaysia were the highest at US$258

million from 578,000 Myanmar citizens working there

followed by Singapore US$170 million, US$11 million

from workers in Thailand with the balance from workers

in a host of other countries.

6. INDIA

June exports held up well in June

The Indian Minister of Commerce and Industry has

reported that the value of India's exports in June is forecast

to be only around 10-12% lower than in the same period

last year. This is in contrast to the 60% decline in April

export values.

The minister emphasised that the focus of the government

is on sustainable growth and partnership with the private

sector.

Rural demand recovers, a good first step

Favorable monsoon weather which boosted harvests plus

government support for rural communities has resulted in

a modest recovery of demand in rural areas. Trends in

some so-called ‘high-frequency’ indicators such as sales of

tractors and fertilisers suggest many rural communities are

recovering faster than the urban areas.

The government pumped almost US$20 billion into the

rural economy after March through various welfare

programmes and state-sponsored buying of crops,

according to a report by CitiBank.

The Center for Monitoring Indian Economy says the rural

unemployment rate has fallen from a peak of 26% in the

first week of May to around 7.3% in the week ending 21

June, almost back to pre-lockdown levels. Unemployment

in the major cities is still above pre-lockdown levels.

See:

https://www.cmie.com/kommon/bin/sr.php?kall=warticle&dt=2020-06-16%2010:02:45&msec=733

Importing logs and sawnwood into India

The Directorate of Plant Protection, Quarantine and

Storage (DPPQS) under the Ministry of Agriculture,

Cooperation and Farmers Welfare (MOA) regulates the

import of logs into India.

Species that are listed under VI and VII of the Plant

Quarantine (PQ) order 2003 may be imported into India

provided the requirements in these schedules and also the

general import requirements listed under Section 9

(Requirement of Import of Wood and Timber), Chapter II

(General conditions for import) of the PQ order are

followed.

Under the current Plant Quarantine Order 2003, updated as

of 18 December 2018, the import of wood and wood

products requires fumigation/heat treatment/kiln dried to

be noted on the phytosanitary certificate issued in the

supplier country.

According to the PQ Order timber/wood with or without

bark shall be fumigated prior to export with methyl

bromide (MBR) at 48 g/cu.m for 24 hours at 21 degrees

Celsius or above, or an equivalent thereof, or any other

treatment approved by the Plant Protection Adviser,

Government of India.

The treatment method shall be noted on the Phytosanitary

Certificate issued by the supplier country.

Imports of sawnwood are also regulated by the DPPQS,

Ministry of Agriculture, Cooperation and Farmers

Welfare.

Shipment of sawn or sized wood with or without bark

must be either fumigated with methyl bromide at 48

g/cu.m for 24 hours at 21 degrees Celsius or above, or an

equivalent thereof, or kiln dried at 56℃ for 30 minutes

(core temperature of wood) or heat treated at 56℃ for 30

minutes (core temperature of wood) prior to shipment. The

treatment shall be noted on the Phytosanitary Certificate

issued at the supplier country.

The Indian domestic timber sector has proposed phasing

out the requirement for methyl bromide fumigation as it is

toxic and classified as a class 1 ozone depleting substance.

Alternative treatments are said to be under consideration.

Pomoting bamboo and sandalwood plantations

The Khadi and Village Industries Commission (KVIC) is

exploring the potential for investment in sandalwood and

bamboo plantations.

A sandalwood tree matures in 10 to 15 years and can be

sold for Rs10-12 lakh. A variety of bamboo, Bambusa

Tulda, used for making Agarbatti (incense) sticks could

provide a regular income says the Commission.

Consideration is being given to planting sandalwood and

bamboo on vacant land.

See:

https://www.deccanherald.com/national/west/kvicpromotes-bamboo-sandalwood-plantation-854020.html

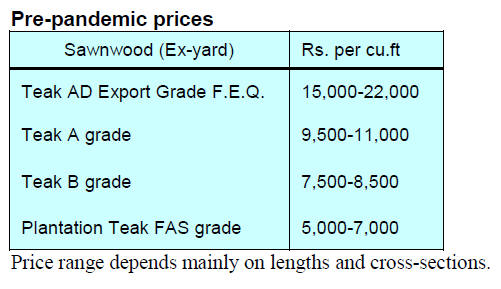

Plantation teak

Traders report some plantation teak shipments have started

to arrive and are being transported to end-users. At

present there are no reported changes in the price range for

logs. C&F rates for Indian ports from various other

sources continue within the same range as given earlier.

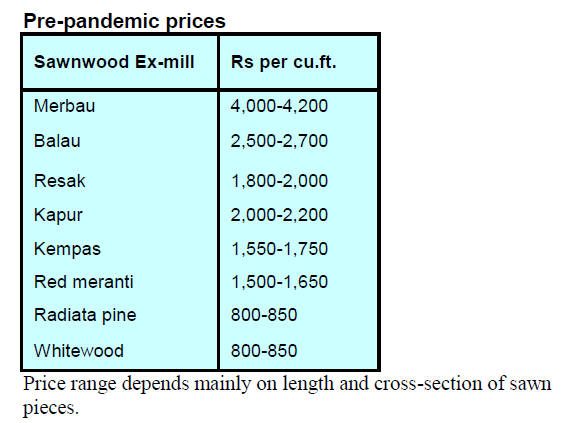

Locally sawn hardwood prices

As most of the sawnwood markets are yet to reopen there

has not been any change in prices.

Myanmar teak prices

For the time being trade in imported Myanmar teak has

stopped.

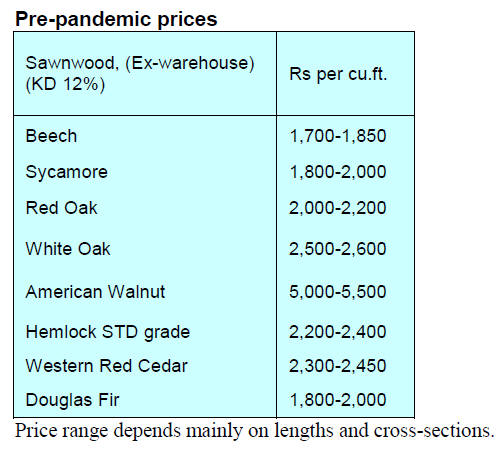

Sawn hardwood prices

Production at most manufacturing units has not resumed

and sales are virtually non-existent.

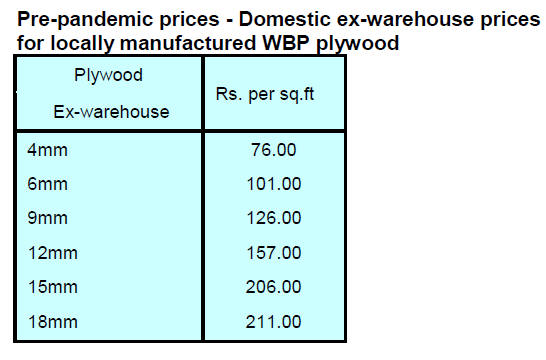

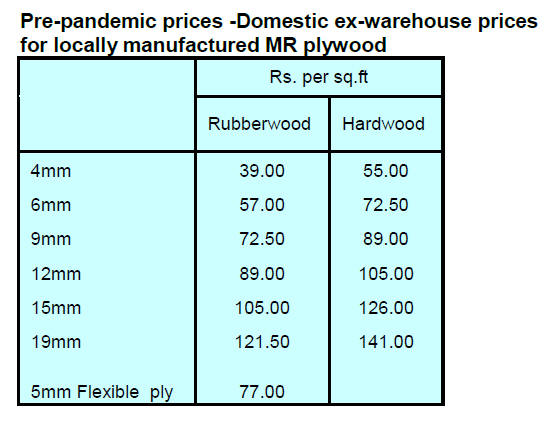

Plywood

Plywood production and sales of plywood have resumed

in many places as India adopts its ‘Phase-1 of Mission

Begin‘. Where production has resumed, sales are reported

to be about 40% of pre-pandemic levels. While demand

has started to rise analysts report the biggest problem

facing manufactures is finding workers.

As raw material costs are starting to rise manufacturers are

talking about a possible 5- 7% price increase but, under

the current weak market conditions, have decided to wait.

7.

VIETNAM

Woodchip prices

crash – weak demand in Japan blamed

Woodchip producers in many provinces of Vietnam are

suffering from rapidly declining prices. Last year the

average price of woodchips exported from Vietnam was

around US$128/BDT while in the first half of 2020 this had

dropped to between US$116 – 120/BDT.

The main reasons for the slump in price are said to be weak

demand in the Japanese market as the pulp and paper

industry in Japan has cut production due to lower falling

domestic demand and the actions of Chinese importers who

have grasped the opportunity to force down prices.

Japan and China together account for around 90% of

woodchip exports from Vietnam.

In response, some Vietnamese enterprises are restructuring

their business to produce wood-based panels (laminated

boards/MDF) or furniture making. Last year Vietnam

exported about 13 million BDT of woodchips and earned

US$1.7 billion.

See:

https://zingnews.vn/dam-go-e-am-chat-cao-nhu-nuipost1086257.html

Foreign investors pump millions into plywood sector

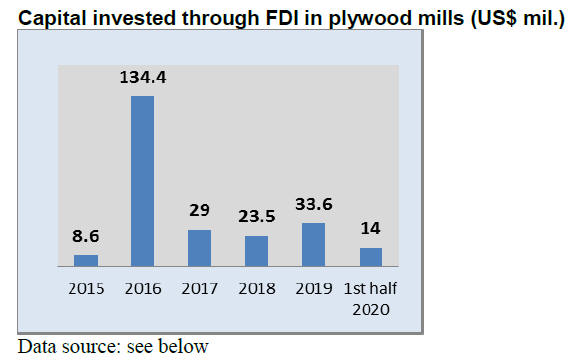

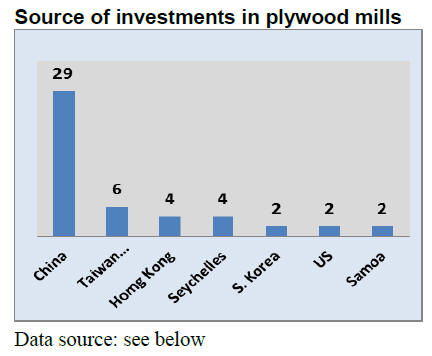

According to the General Department of Foreign Investment

in the years between 2015 and the first half of 2020 Vietnam

approved investment from 11 countries in 53 plywood

projects worth US$243 million.

Data source: VIFOREST, FOREST TREND, HAWA, BIFA,

FPA Binh Dinh, DOWA: Vietnam’s plywood industry - Current

status and countermeasures to mitigate risks and strengthen

sustainable development

In 2019 Vietnam exported 2.03 million cubic metres of

plywood and earned US$685.4 million equivalent to 7% of

all wood and wood product exports. In spite of the

pandemic, in the first six months of this year Vietnam has

exported 0.90 million cubic metres of plywood earning

US$287 million, an increase of 14% year on year.

Plantation target steadily achieving

During the first 6 months of 2020, Vietnam planted

106,300 ha. of commercial tree plantations which was

around 48% of the plantation target for the year. The total

re-afforested area planned for 2020 is 220,000 ha.

Suspicions that Chinese components used in ‘Made in

Vietnam’ wood products

The United States Department of Commerce has launched

an investigation into whether certain hardwood plywood

products completed in Vietnam are using components

sourced in China.

See:

https://www.federalregister.gov/documents/2020/06/17/2020-13075/certain-hardwood-plywood-products-from-the-peoplesrepublic-of-china-initiation-of

The investigation is looking into whether components

from China such as assembled cores, multi-ply core panels

or individual core veneers are being combined in Vietnam

with other components such as face and/or back veneers

produced in Vietnam or a third country to circumventing

antidumping and countervailing duty orders on plywood

from China.

A Notice by the International Trade Administration on 17

June 2020 says: “In response to allegations of

circumvention from the Coalition for Fair Trade in

Hardwood Plywood (the petitioner), the Department of

Commerce (Commerce) is initiating country-wide anticircumvention

inquiries to determine whether certain

hardwood plywood products (plywood) completed in

Vietnam using plywood components (face veneer, back

veneer, and/or either an assembled core or individual core

veneers) manufactured in the People's Republic of China

(China), or Chinese components (assembled cores, multi9

ply core panels, or individual core veneers) combined in

Vietnam with other components (face and/or back

veneers) manufactured in Vietnam or third countries, are

circumventing the antidumping duty (AD) and

countervailing duty (CVD) orders on plywood from

China.”

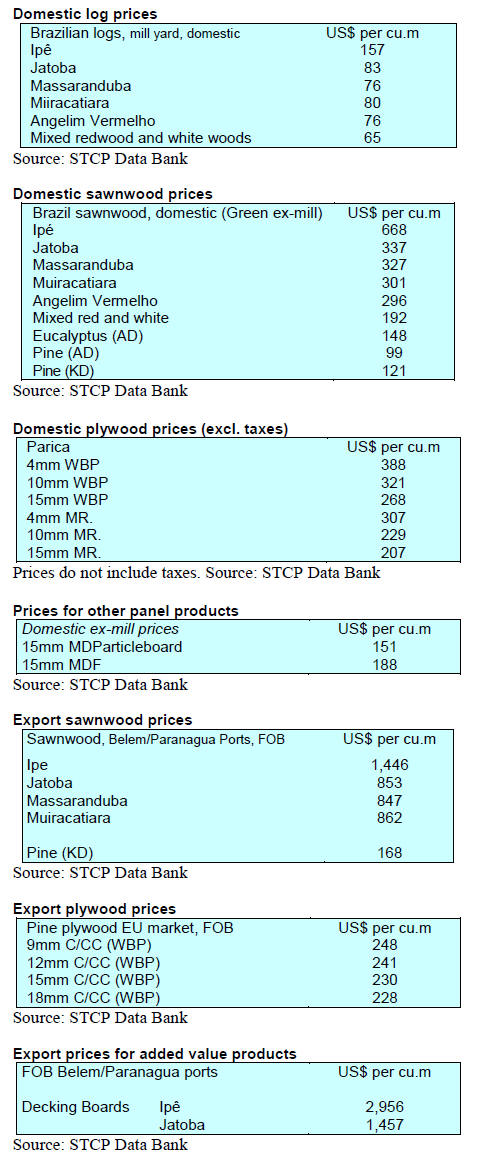

8. BRAZIL

Floresta+ Programme encourages preservation

of native forests

On 3 July this year the Ministry of the Environment

(MMA) adopted the ‘Forest+ Program’ (Programa

Floresta+) through an Administrative Ordinance n°

288/20. This ordinance aims to strengthen the preservation

of the Brazilian natural forest.

The initial project activities will be carried out in the Legal

Amazon covering all nine states in the Amazon basin.

Around R$500 million from the Green Climate Fund will

be earmarked for activities that improve, conserve and

recover natural forests.

The programme is aimed at supporting individuals, legal

entities, community groups and others who conduct

environmental service activities in areas of natural

vegetation or support natural forest recovery. According to

the MMA this is the largest programme of payments for

environmental services in the world.

The Administrative Ordinance says that monitoring,

surveillance, firefighting, research, tree planting,

environmental inventory and agroforestry systems are

considered environmental services that bring effective and

relevant results for the improvement, conservation and

protection of natural vegetation.

The next steps in the ‘Forest+ Program’ involve the

definition of methodology, valuation and verification of

environmental services, the creation of the National

Register of Environmental Services and regulations

governing payment for environmental services.

May furniture output reverses much of earlier losses

In May 2020 industrial production of furniture expanded

7% compared to April, reversing two consecutive months

of declines (-9% in March and -19% in April). In contrast

overall industrial production in May fell over 20%, the

second highest drop since records were kept.

The May result, however, was not enough to overcome the

accumulated decline in furniture production for the year

to-date, which went from -18% to -22% from April to

May.

Possible impact of new NAFTA

On 1 July 2020 the new agreement between the US,

Mexico and Canada (USMCA) came into force replacing

the North American Free Trade Agreement (NAFTA). The

Brazilian Business Coalition (Coalizão Empresarial

Brasileira - CEB), has published a report on the new

agreement.

According to the Coalition, the USMCA signatories

account for 17% (US$225.4 billion) of Brazilian exports

and 21% (US$177.3 billion) of Brazilian imports.

The Coalition underlined some of the possible impacts for

Brazil:

-- as free trade was maintained, Brazilian

companies with operations in Mexico or in the

US will not suffer increased costs with any new

tariffs;

--rules of origin have become less flexible,

reinforcing verification and certification of

origin;

--Expanded rules for sanitary and phytosanitary

measures based on science;

--and uncertainties regarding the potential of the

Brazil-Mexico trade given that the US

government said that Mexico is committed to

buying US agricultural

Among the main changes in the agricultural and

environmental sectors the CEB report highlights the

following:

-- maintenance of zero tariffs for agricultural goods;

-- reducing export subsidies and increasing

transparency in this area

-- increasing the effectiveness of customs

inspections checking wild flora at ports of entry

--creation of robust and modern mechanisms for

public participation and environmental

cooperation

--support for sustainable forest management

US, the top export market for Bento Gonçalves

furniture cluster

Data from the Special Secretariat for Foreign Trade and

International Affairs analysed by the Furniture Industry

Association of Bento Gonçalves (Sindmóveis) shows that

in the first half of 2020 the furniture cluster of Bento

Gonçalves, Brazil's main furniture cluster, saw a 10%

decline in exports to US$19 million.

Exports from Rio Grande do Sul fell by 22% and for all of

Brazil the drop was 17% between January and June 2020.

However, among exports to the other main markets by the

Bento Gonçalves furniture cluster there was growth in

exports to Colombia, Peru and the United Kingdom.

According to Sindmóveis, companies operating through ecommerce

were the least affected by the pandemic and

some earned more than in the same period of last year.

For the domestic and foreign markets furniture sales by the

furniture cluster of Bento Gonçalves dropped 9.5% and by

11% for manufacturers in Rio Grande do Sul. Sindmóveis

anticipates there will be significant declines reported in the

coming months but by the end of the year business should

be improving.

9. PERU

Lockdown lifted

On 16 March Peru implemented a lockdown at a time

when there were less than 100 coronavirus cases in the

country. Despite the quick action by the government, Peru

now has the third-highest number of cases in the

Americas, after the US and Brazil.

On 30 June the government revised the lockdown

switching to what it calls”Phase 3” of its economic

recovery. Now Stores can open with 50% customer

capacity, restaurants but not bars can open with 40%

customer capacity and hotels and travel agencies are

allowed to operate. Before reopening, businesses must

present their public health plan to the Peruvian authorities

and await approval.

In related news, the president of the Association of

Exporters (ADEX), Erik Fischer Llanos, welcomed the

decision of the government allowing full resumption of

external trade activities as this will help revive the

economy.

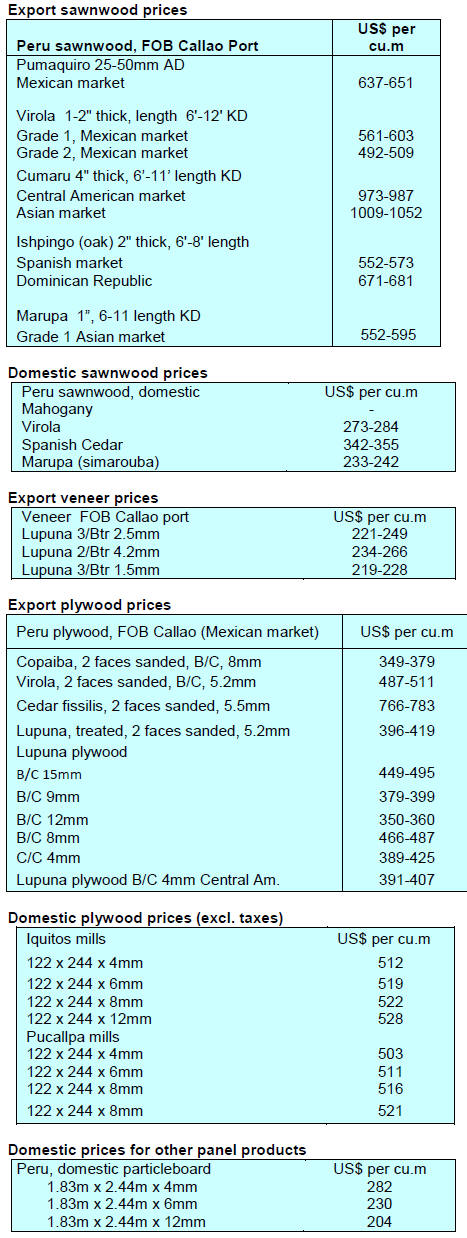

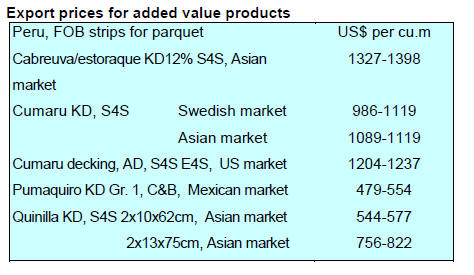

Export update

The Exporters Association (ADEX) has reported that

between January and April, wood product exports were

down around 35% to US$26.5 million FOB. In the same

period last year exports were worth US$41 million.

In the same 4 month period exports of semi-manufactured

products accounted for over half of all export but saw a

45% decline year on year.

Sawnwood exports accounted for over 30% of export

earnings and surprisingly 2020 earnings were over 20%

higher than in 2019. In contrast, export earnings from

veneer and plywood dropped over 25%.

Of the US$26.5 million exported in the first 4 months of

this year China continued to be the main market

accounting for around 40% of all wood product exports

(mainly sawnwood). But, the value of earnings from China

in 2020 was down over 20% compared to the same period

in 2019.

Mexico was the second largest market at 11% of exports

but here the value of exports dropped over 30%. France

and the United States are in third and fourth placed

markets and in both the decline in export sales was well

over 50%.

Deforestation in Peruvian Amazon slowed during

lockdown

During the period of mandatory social isolation decreed by

the government as a preventive measure to COVID-19 the

Ministry of the Environment, quoting the Early

Deforestation Alerts (ATD) of the National Forest

Conservation Programme, has reported that deforestation

in the Amazon forests in the country dropped year on year

by almost 30%.

It is reported that in the period from the start of the

lockdown up to May, 7,000 hectares of forest loss was

identified. The Ucayali region had the greatest loss, says

the Ministry.