4.

INDONESIA

Expanded stimulus to fight impact of

pandemic

The Indonesian government has expanded its financial

stimulus package by almost US$50 billion. The package is

set to strengthen the healthcare system, apply more

resources to social welfare and provide protection for

Indonesian businesses at risk from bankruptcy.

The Minister of Finance, Sri Mulyani Indrawati, said the

emphasis will be on countering the negative economic

impact of the pandemic on Indonesian society and

businesses and to keep economic growth pegged at zero.

Support for SMEs is particularly important. A recent

survey by the International Labor Organization (ILO) has

revealed that the majority of small and medium enterprises

(SMEs) in Indonesia had been forced to close their

businesses, either temporarily or permanently, due to the

impact of the pandemic on consumption.

In related news the Ministry of Manpower and

Transmigration has estimated that some 1.7 million

workers have either lost their jobs or been laid-off and this

will push the unemployment rate to 7%. Minister Ida

Fauziyah said this 1.7 million is already over 50% of the

2.9 million estimated to be without work.

The figures above are at a variance with the estimate 3

million laid-off made by the Deputy for Commerce and

Industry Coordination in the Ministry for Economy. The

National Development Planning Agency (Bappenas)

previously estimated that this year unemployment

could rise to 4.2 million.

See:

https://en.tempo.co/read/1351070/millions-laid-offdue-to-covid-19-pandemic-as-of-june

Jakarta lockdown eased

The Governor of Jakarta has said restrictions will soon be

gradually eased to allow economic activity to begin.

First restrictions on offices, restaurants and retail outlets

will be eased but enterprises must limit the number of

people attending as it is too early to fully lift social

distancing rules.

Measures put in place to counter the spread of the virus in

Jakarta and across the country have weighed heavily on

businesses and has contributing resulted in massive job

losses. The decision to ease restrictions in Jakarta comes

after a similar decision in the country’s most populous

province of West Java.

The central government has separately announced it plans

to reopen the country to foreign tourism as early as

September.

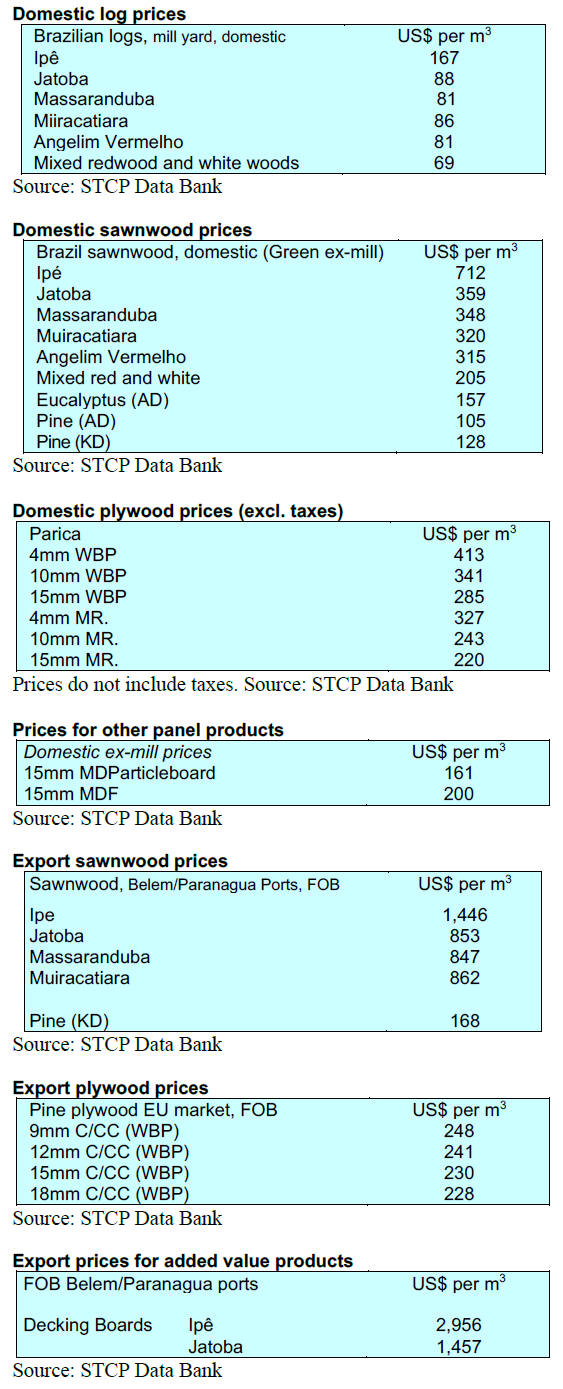

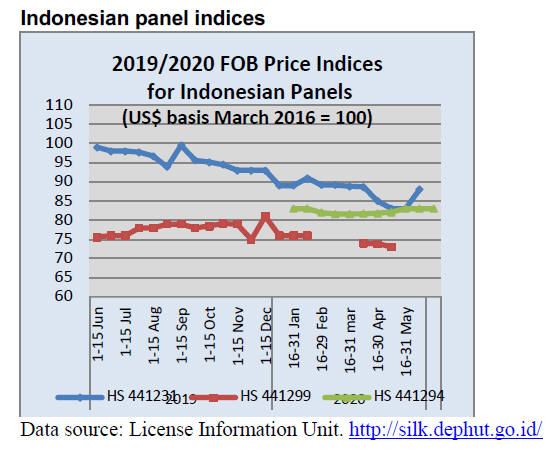

Plywood exports to US on the increases

Agus Suyono, Head of the Samarinda Agricultural

Quarantine Center has reported that plywood export to the

US during the first quarter of 2020 amounted to almost

600 tonnes worth around Rp5.56 billion. This first quarter

performance represents an 8% increase compared to a year

earlier.

He also reported exports to China, India, the Philippines,

Singapore and Thailand in the first 4 months of 2020

totalled 4,914 cubic metres earning Rp.49.89 billion.

According to Agus despite the pandemic plywood exports

to the US have continued largely unaffected and he puts

this down to Indonesia’s rigorous safety and health.

Furniture makers appreciate new orders from US

buyers

Some good news from furniture craftsmen in Solo, Central

Java, work has started on recently received orders from

buyers in the US. Irawan Mintorogo, Head of Marketing

for the Soloraya Furniture and Craft Industry Community

(Kimkas) in Solo said there had been a period when no

orders were arriving but that has now passed. He pointed

out that buyers in the US were the first to place orders

unlike buyers in the EU who are still hesitant.

See:

https://www.suara.com/bisnis/2020/06/03/154354/parapengrajin-mebel-di-solo-mulai-garap-pesanan-dari-as

Positive news as levels of forest loss

continue to drop

The World Resources Institute (WRI) says on its website

"In positive news, primary forest loss in Indonesia

decreased by 5% in 2019 compared to the year before,

marking the third year in a row of lower levels of loss.”

It should be borne in mind that primary forests defined by

the WRI refer to a 30% minimum tree cover density. This

WRI definition of primary forests is different from the one

used by the Indonesian government which defines primary

forests as undisturbed forests that have never been

exploited or disturbed by humans. Under this

definition, the Indonesian ministry of Environment and

Forestry stated from over the 2 years to the end of 2019

less than 100,000 hectares of primary forest were lost.

https://www.wri.org/blog/2020/06/global-tree-cover-loss-data-2019

Data from the and

https://www.dw.com/id/indonesia-berhasil-tekan-deforestasi/a-53676334

Forest Rehabilitation and Reclamation regulation

The Indonesian government has issued Regulation (PP)

No. 26 of 2020 concerning Forest Rehabilitation and

Reclamation. This regulation aims to ensure optimal

benefits from land and forests for the welfare of the people

of the country. The regulation also addresses the need to

restore, maintain, and improve the function of forests and

land in order to increase productive capacity to support

life.

See:

http://www.apbi-icma.org/en/regulation

5.

MYANMAR

‘New normal ’life begins in Yangon

The correspondent reports that life in the capital has begun

the ‘new normal’. Government offices are open but there

are still restrictions on when schools will reopen.

International flights in and out of Yangon International

Airport are still restricted and this will be reassessed at the

end of June. Many businesses, once having satisfied

government inspections for virus prevention measures, are

reopening.

Figures released by the Health and Sports Ministry show

the number of corona virus cases in Myanmar as of

13 June was 261, with six deaths. The country has tested a

total of 45,926 people in Myanmar for the coronavirus and

it has been found that most recent infections are among

quarantined workers returning from overseas.

See:

https://www.mmtimes.com/news/myanmar-extends-covid-19-control-measures-flight-restrictions.html

Myanmar responds to news reports on EIA

investigation

Kyaw Zaw, Deputy Permanent Secretary of Ministry of

Natural Resource and Environmental Conservation has

disputed the recent Environmental Investigation Agency

(EIA) report which he says suggests illegal teak from

Myanmar is being shipped to Europe. Kyaw Zaw said the

Ministry of Natural Resource and Environmental

Conservation will respond immediately to the misleading

news coverage of the EIA report.

Kyaw Zaw is quoted by the local media, Irrawaddy

Online, as saying, “I can accept if they (EIA) say we need

to make changes to meet their (EU) timber regulations.

But they said the exports are illegal, prompting us to

respond strongly. What they said is wrong. We oversee

timber production and export licenses are issued by the

Ministry of Commerce and the Customs Department is

responsible for collection of duties and clearance.”

For the full story see:

https://www.irrawaddy.com/news/burma/myanmar-condemnsreport-illegal-teak-exports-eu.html

The Irrawaddy article reports a manager of a Yangonbased

timber factory as saying, on condition of anonymity,

that the Myanmar Forest Department applies tough

measures to guard against the illegal export of teak and

other hardwoods.

When asked for comments, Barber Cho, Secretary of

Myanmar Forest Certification Committee, said the

authorities and timber industry in Myanmar understand

very well the EUTR which aims to prevent the arrival in

the EU of illegal wood products.

He said, “We have to respect the EUTR as this is the

regulation governing all wood products imported into the

EU, not only those from Myanmar.

In comments to Cho, Myanmar exporters said

international buyers of Myanmar timber were of the

opinion that, when it comes to teak imports into the EU,

Myanmar teak seems to attract more attention than imports

from other countries.

Kyaw Zaw was adamant that all consignments cited in this

investigation were shipped according to the rules and

regulation in Myanmar. These regulations requires the

reporting of details such as product type, species, quantity,

name of exporter and consignee in the EU and such

consignments from Myanmar can never be of illegal

timber. Whether documents for such shipments are

sufficient to satisfy the EUTR is another issue not related

to allegations of illegal transportation.

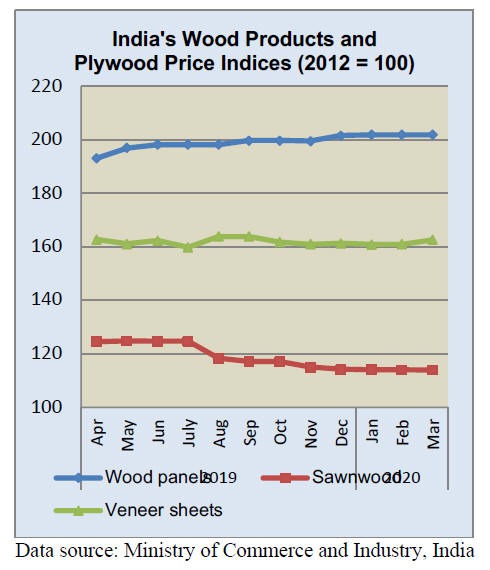

6. INDIA

No wholesale prices indices for

timber

The Office of Economic Adviser, Department for

Promotion of Industry and Internal Trade has advised that

in view of the limited transactions of products in the

wholesale market in April 2020 due to spread of Covid-19

pandemic, it has decided to release price movement for

selected product groups. Timber is not included.

The press release from the Ministry of Commerce and Industry

can be found at:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Workers returned to home states but no jobs

The Centre for Monitoring Indian Economy (CMIE) has

reported on the plight of migrant workers who, because of

the lockdown, had to leave their city jobs and had no

alternative to travel back to their home States. Having

returned home they have found there are few employment

opportunities.

CMIE cites some examples saying in Bihar State

unemployment went from 15% pre-pandemic to over 45%

between March and April. In Jharkhand in eastern India

unemployment went from 8% to 47%.

The government has rural employment schemes but there

are doubts that these schemes can absorb all the returnees.

Around 100,000 migrant workers have returned to

Jharkhand and a further 700,000 more are expected. In

Bihar some 650,000 migrant workers have returned and

the list continues. The Central government has estimated

that around 3 million migrant workers are trying to return

to their home states.

Analysts comment” the monsoon is expected to be normal

this year but on everyone’s mind is when will the

restrictions be lifted and when will shops, trade and offices

be back to normal? India has never experienced such a

calamity and now the call is for greater self-sufficiency”.

This has resulted in calls for the country to improve the

availability and distribution of locally produced items to

boost employment, reduce dependence on imports, save

foreign exchange and boost industrial activity.

The timber sector has called for a relaxation of the

regulations governing the establishment of wood

processing enterprises. In particular calls have been made

for the plantation sector to be expanded through both State

and Central government incentives.

Planting of fast growing species like melia dubia, poplar,

eucalyptus, acacia, rubberwood, teak, gmelina and

Casuarina along with bamboos’ and rattans should be

encouraged.

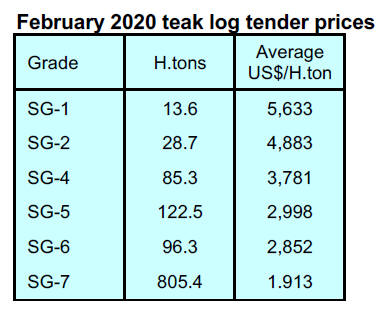

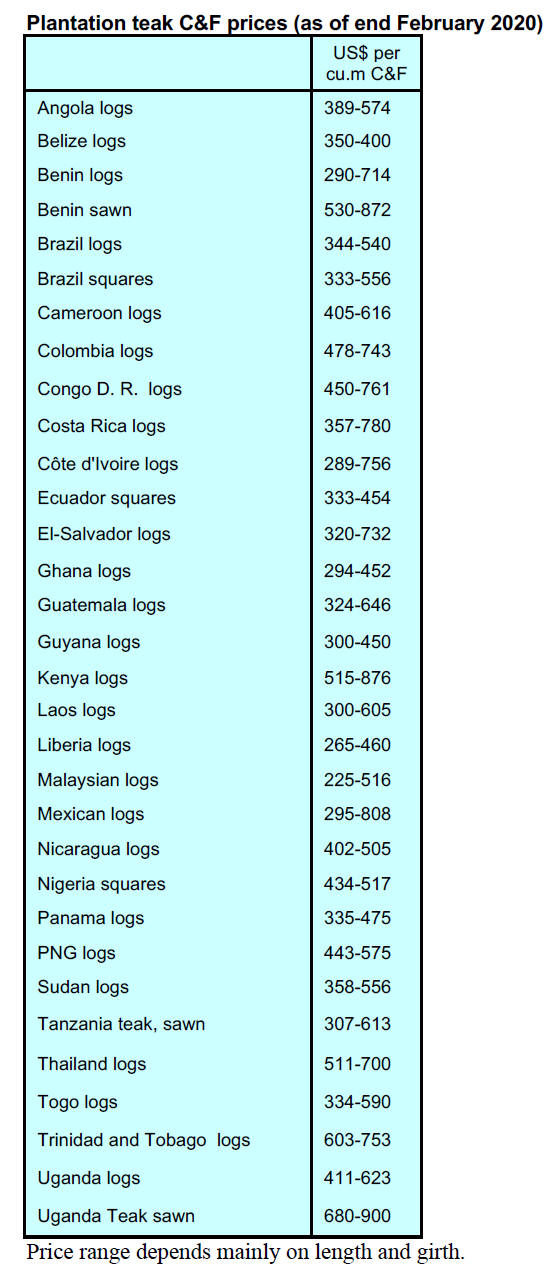

Plantation teak

Owing to current local and international situation there is

virtually no trade in plantation teak. Prices for the spring

of 2020 are shown below as a reference point.

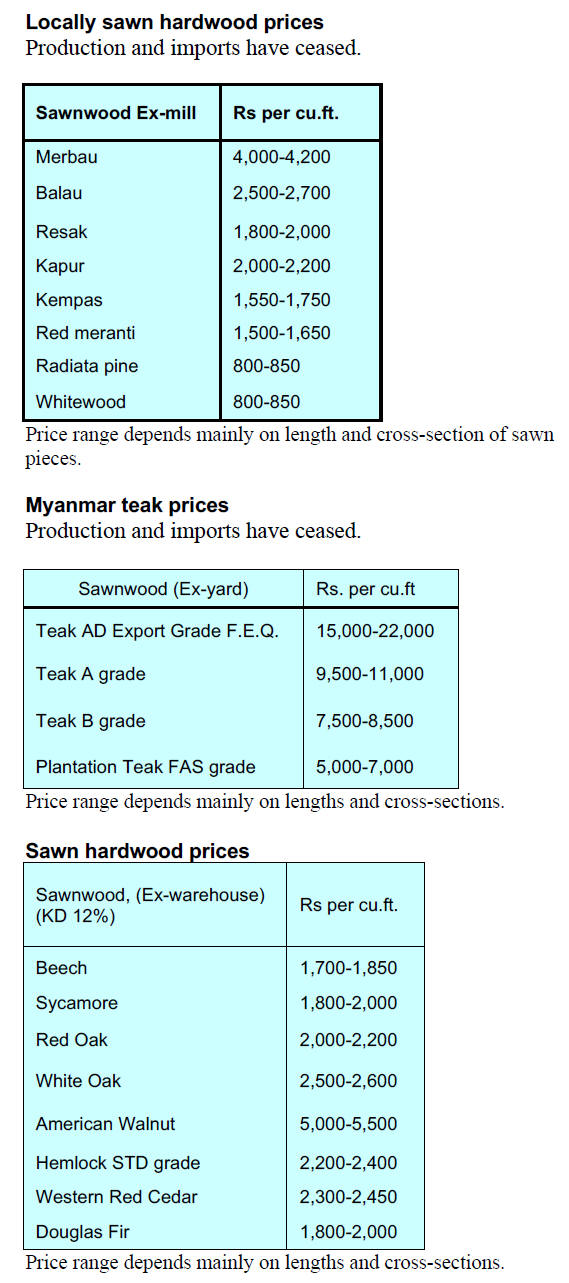

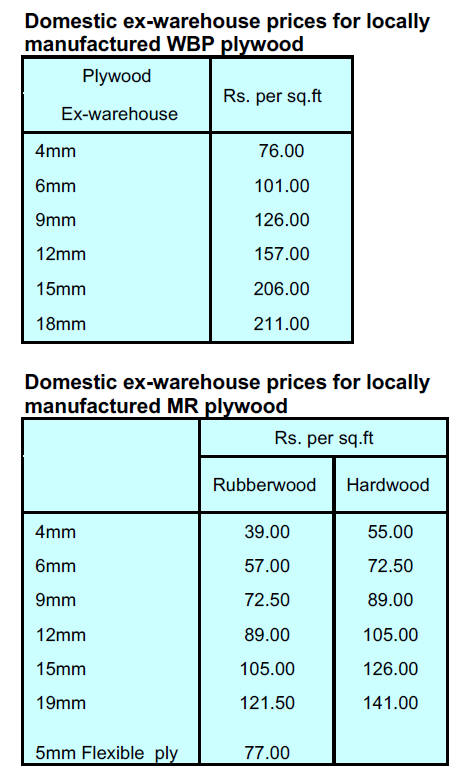

Plywood

Production and sales of plywood have resumed as

restrictions under the government’s ‘Phase-1 of Mission

begin’ have been eased. In those parts of the country

where the infection rates are low full production has

resumed.

The Karnataka and Kerala Plywood Manufacturers

Associations have jointly announced a price increase of

7% and 5% respectively. This, they point out, is to cover

increased cost of labour, timber and chemicals. Across the

country however prices remain unchanged as shown

below.

7.

VIETNAM

Wood product

exporters to benefit from Vietnam/EU

trade deal

The government in Vietnam has ratified the Vietnam/EU

trade deal which, it is hoped, will help boost the country’s

manufacturing sector and exports. The deal, when it takes

effect in July this year, means the EU will cut tariffs on

over 80% of Vietnamese goods, Vietnam will lift close to

50% of its import duties on EU exports and phase out the

rest over 10 years.

The EU-Vietnam Free Trade Agreement (EVFTA) is

expected to open the door wider for Vietnamese exports to

the EU and help the Vietnamese economy regain its

growth momentum following a difficult period due to the

coronavirus outbreak.

Bilateral trade in 2019 was around US$60 billion, of

which Vietnamese exports accounted for US$40 billion, a

modest figure given the EU is the world’s second largest

import market with an annual value of US$2,338 billion.

The EVFTA will create greater opportunities for Vietnam

to increase its exports especially of garments, footwear,

farming and wood products.

See:

https://www.vietnam-briefing.com/news/vietnam-eu-tradeevfta-ratified-vietnam-national-assembly.html/

Dismal April exports

Statistics from Vietnam Customs shows that exports of

wood and wood products (W&WP) during April 2020

were worth US$697 million, down by 29% compared to

March but 19% higher than in April 2019.

April wood product exports, in particular, fell sharply

dropping around 35% to US$434 million against previous

month and by 25% compared to April 2019. Despite the

declines in April W&WP exports remain in the top 6

groups of Vietnamese export commodities.

In the first four months of this year WP exports alone

amounted to US$2.272 billion, up by 2% compared to the

same period in 2019 and accounted for 69% of total

W&WP exports, down slightly year on year.

In previous years exports to the US, the top buyer of

Vietnam’s W&WP accounted for around 50% of total

exports but in the four months to April this dropped by

39%.

With the pandemic yet prevailing in US and several EU

countries and the global economy facing a severe crisis

exports of W&WP and NWFP will fail to reach the target

of over US$12 billion set for 2020 (in 2019, exports of

W&WP plus NTFP was reported at US$11.18 billion).

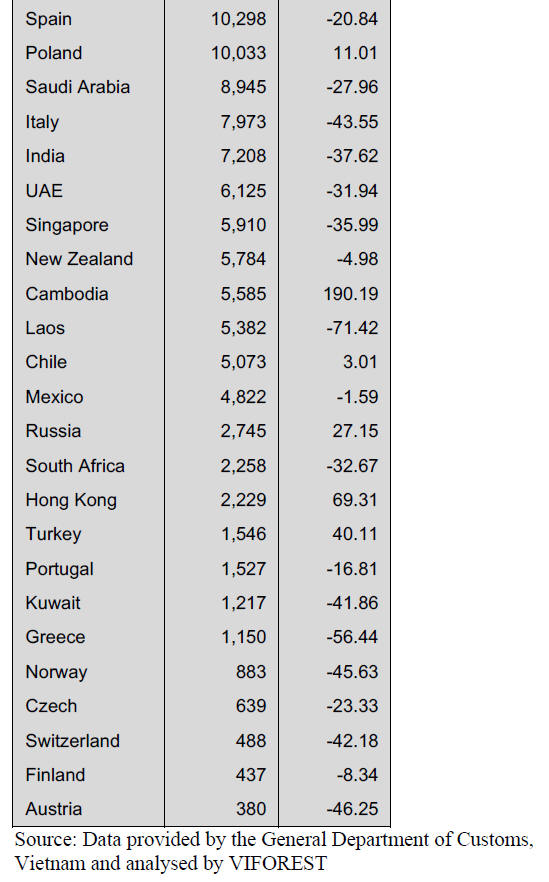

Export markets

Due to the impact of the pandemic on global trade April

2020 W&WP exports to the main markets dropped

compared to previous months. However, in the first four

months of 2020, W&WP exports to the EU and China

were still rising, by 13% in the case of the EU and by 23%

in the case of China. However, this growth is unlikely to

be sustainable.

April timber imports

W&WP imports into Vietnam in April 2020 fell after the

increase in March 2020. The accumulated W&WP imports

into Vietnam over the first four months of 2020 amounted

to US$731 million, down by 5.8% against the same period

of the last year.

Import sources

In April 2020, the value of W&WP imports from several

markets, including Thailand, Laos and Malaysia, increased

by 26.59%, 43.04% and 59.21% respectively compared to

March 2020. W&WP imports from the US and China

dropped slightly in April while imports from Brazil,

France, New Zealand, Russia and Germany fell sharply.

In the first four months of 2020, China was the largest

W&WP supplier to Vietnam at US$208 million, up by

41% over the same period of the last year and accounted

for 28% of total W&WP imported into Vietnam. The

second largest supplier was the US but here the value of

imports dropped almost 10%.

In contrast, W&WP imports into Vietnam from Thailand,

Chile and Brazil fell by 11%, 24% and 14% respectively

over the same period of 2019.

8. BRAZIL

Furniture production suffers record

fall

The Brazilian Institute of Geography and Statistics (IBGE)

has published industrial production indices since 1998

and, until April this year, the furniture sector has never

experienced a decline like the over 75% month on month

decline in April or as much as the year on year decline of

almost 60%.

The April figures resulted in the accumulated loss of

almost 18% in the first 4 months of this year.

The IBGE data was much worse than expected even taking

account of the massive suspension of business activities.

Timber producers seek extension of harvest deadline

Concession holders in Brazil have requested extension of

the harvesting deadline because the pandemic control

measures have delayed operations.

According to estimates by the National Forum for Forest-

Based Activities (FNBF) timber sales will drop by up to

60% this year such that it will be impossible to balance

production and sales in the 2020 harvest season which

began in May.

The peak of the harvest season is between June and

August when rainfall is lowest allowing safe harvesting

and transportation. However, with the drop in sales and

market uncertainties, many producers will either reduce

harvest volumes or suspend harvesting to avoid financial

losses that would be inevitable as accumulated stocks

could deteriorate if they accumulate beyond market

demand.

The FNBF has asked the Ministry of the Environment to

consider extending the harvesting period allowing

producers to harvest approved volumes during the next

harvest season. Producers are granted logging permits

(Timber Harvest Authorizations - Autex) by the competent

agencies to ensure harvests are sustainable and follow

management plans.

Paranaguá Container Terminal (TCP) expects rise in

wood product exports

TCP, the company that manages the Paranaguá Container

Terminal in the Port of Paranaguá, Paraná State in the

southern region of Brazil foresees an increase in timber

export shipments.

The Paranaguá Terminal has been handling around 2,600

containers per month this year and this is expected to grow

to 3,500 containers per month. Among the products

exported are plywood, sawnwood and veneers. The

outlook is for the resumption of full services after thirteen

years with regular weekly services that serve the East

Coast of the United States, one of the main destinations for

exports of wood products.

TCP's export warehouse covers 12,000 sq.m and is

designed to handle multiple products at any one time. The

warehouse is located close to the dock thus, simplifying

logistics and reducing costs.

Plantation sector achieves US$ 2 billion in first quarter

exports

According to the Brazilian Tree Industry (Ibá), in the first

quarter of 2020 exports by the plantation forest-based

industry reached US$2 billion. Pulp exports totalled

US$1.5 billion, while paper exports were worth US$451

million and wood-based panels US$68 million. The

sector's trade balance reached US$1.8 billion (-27.5%).

In the first quarter of this year, China continued as the

main Brazilian pulp market purchasing US$719 million.

Latin American countries are the major destination for

wood-based panels (US$38 million) and paper (US$262

million).

According to Ibá, sales of wood-based panels by Brazil

totalled 1.6 million cubic metres in the first quarter 2020.