|

Report from

North America

Impact of pandemic to linger into 2021

There are projections that it could take up to three years

for the US economy to recover from the corona virus

pandemic according to a review of a McKinsey &

Company report by Matthew Pelkki, George Clippert

Endowed Chair of Forest Economics at the University of

Arkansas at Monticello¡¯s College of Forestry, Agriculture

and Natural Resources.

Pelkki highlights that the forest products industry is

heavily integrated with the greater economy through

housing, manufacturing, and consumer goods.

Some likely impacts over the next 2-3 years are:

1. Housing starts will fall off, slowing lumber demand and

production in the second half of 2020 and first three

quarters of 2021.

2. Tree planting and other silvicultural operations will be

severely curtailed as immigrant (H2B visa) workers are

restricted in number and those that are available for work

in the USA will be used for critically needed food

production.

3. A likely national and global recession will last at least

through 2020, and may last until the third quarter of 2021,

which will affect demand for consumer goods and

manufacturing of high value products so consumption of

pallets and ties will decline.

4. Home remodeling may actually rise in portions of 2020

and 2021 when stay at home orders are relaxed, thus

helping ease the decline in softwood and hardwood

consumption.

5. Global trade in wood products will likewise be curtailed

until at least mid-2021, with the most severe declines in

the second and third quarters of 2020 lasting through the

first quarter of 2021, and then possibly a slow recovery

that could take as long as 2 years.

See:

http://www.magnoliareporter.com/news_and_business/opinion/article_ddaa6cb8-7938-11ea-b2c5-532a415d891c.html

Survey: Woodworking industry faces challenges but is

optimistic

Most woodworking businesses face major impacts from

the corona virus outbreak but the vast majority are

optimistic about the future after the virus passes and many

are pitching in to help by donating supplies and repurposing

their manufacturing.

Those are some of the findings of a survey conducted by

the Woodworking Network at the end of March. The

survey attracted 562 responses and paints a vivid picture

of what woodworking businesses face and how they are

dealing with the crisis, including how they are helping

health workers to cope.

Nearly three-quarters of respondents to the survey say the

virus outbreak is already having a serious to major impact

on their operations. More than 36% say they are

experiencing a major impact on their business while

almost 36% say it is having a serious but not major

impact. About one-quarter of respondents (23.7%) said the

outbreak is having only a minor impact on their business.

Only 4.1% said the virus is having no impact at all.

Biggest impacts faced by these businesses include

disrupted schedules, loss of business, and disruptions in

supplies. Some 69% of respondents said the outbreak has

resulted in disrupted schedules. More than half (55.1%)

said they already face a loss of business.

Nearly half (46.8%) said they are dealing with disruptions

in their supply chain.

Other significant impacts reported included governmentmandated

shutdowns and canceled orders. Some 39% of

respondents said they are dealing with mandated

shutdowns. More than a third (34.5%) are seeing canceled

orders. Nearly 15% listed other impacts including cash

flow issues, employee hardships, and emotional stress.

Despite those issues, the industry generally has a positive

outlook. Almost two thirds say they see a significant

impact short term, but they expect to recover in the long

term. Fewer than 30% see major negative impacts and

report they are uncertain about long-term prospects. Some

8% said they see no impact at all.

For more see:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/survey-woodworking-industry-faces-majorimpacts-still-optimistic

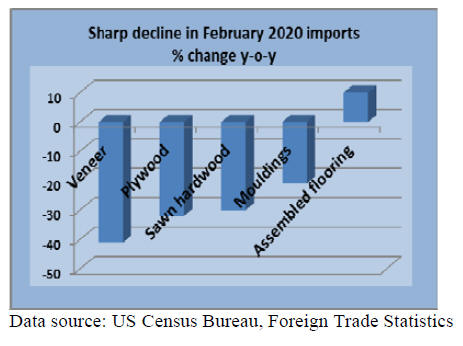

All heading lower - February data shows early impact

of pandemic

Import statistics from the US government are shedding

light on the extent to which the global pandemic is having

on the US imports of wood products. February data show

considerable across-the-board declines in imports of

tropical hardwood and hardwood products.

Other data reveals almost 7 million people claimed

unemployment benefits in the second week of April. This

bring the total claims to around 17 million, about 10% of

the labour force. The unemployment rate jumped to 4.4%

in March.

Most economists and industry analysts expect much larger

declines in the future as more states are calling for nonessential

businesses to shut down and individuals to stay

home to contain the spread of the coronavirus.

Tropical hardwood imports

US imports of sawn tropical hardwood fell by 30% in

February to the lowest level in more than 10 years. The

10,116 cubic metres imported was less than half the

amount of February of last year. Imports from Brazil and

Malaysia were both down by 48% in February.

The economic slowdown forced by COVID-19 affected

imports across the board with the volume of most types of

wood dropping between 25% and 55%. Imports of Balsa

rose by 28%, but that came off a January that was the

lowest for Balsa in more than a decade.

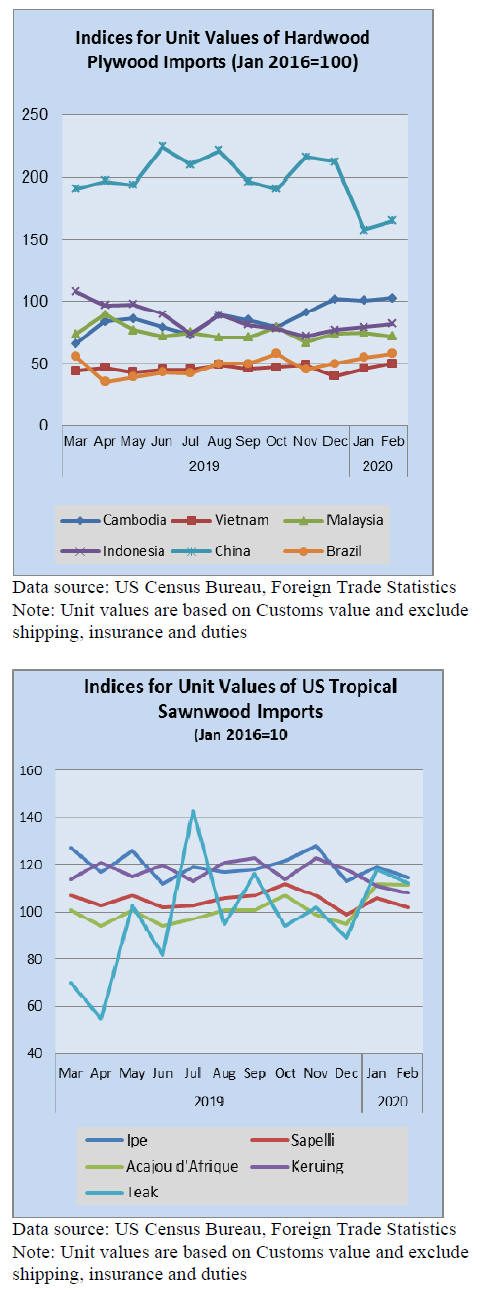

Hardwood plywood imports

US imports of hardwood plywood dropped by 32% in

February. The import volume of 160,042 cubic metres was

the lowest in eight years. Imports were down from all

major trading partners with imports from Indonesia falling

by 57%, Malaysia down 49%, and China down 46%.

Tropical veneer imports

US Imports of tropical hardwood veneer saw its slowest

month since September 2016 as imports fell by 41% in

February. Imports from Italy fell by 65%, while imports

from Cameroon and India declined by 60% and 57%

respectively. Year-to-date imports are down by 32%.

Moulding imports

US imports of hardwood moulding fell by 21% in

February and are down 9% from 2019 year-to-date.

Imports from Brazil plunged 82% in February to under

US$160,000 which is by far the weakest level in more

than a decade.

But, assembled flooring imports not affected in

February

US imports of assembled flooring panels fell by 14% in

February yet were still 10% higher than imports of

February 2019. A 29% gain in imports from Canada kept

totals from seeing the declines COVID-19 is bringing to

imports of most other products, at least for now. Year-todate

totals are 3% ahead of 2019.

Imports of hardwood flooring were down by 12% in

February and are behind 2019 year-to-date totals by 25%.

Imports from Brazil fell by 41% and from Indonesia by

20%. Imports from Malaysia and China were up slightly

for the month but are both down more than 50% year-todate.

Planned expansion of Lacey Act

The US Department of Agriculture's Animal and Plant

Health Inspection Service (USDA-APHIS) has announced

that a sixth round of products will be added to the Lacey

Act enforcement schedule and therefore will require a

Lacey Act declaration upon importation.

Within Chapter 44 of the Harmonised Tariff Schedule of

the United States which covers wood products, Phase VI

includes Oriented Strand Board (441012) as well as cases,

boxes, crates, drums, containers, pallets, box-pallets, etc.

(4415). Additionally, Phase VI includes several Essential

Oils, Trunks and Suitcases, and Musical

Instruments. Phase VI is scheduled to go into effect

October 1, 2020.

See:

https://www.federalregister.gov/documents/2020/03/31/2020-06695/implementation-of-revised-lacey-act-provisions

|