US Dollar Exchange Rates of

25th January

2020

China Yuan 6.9367

Report from China

Rising disposable incomes despite uncertainties

In 2019 the per capita disposable income of Chinese

residents was RMB 30,733, an increase of 8.9% (nominal)

and 5.8% (real) compared to 2018. The per capita

disposable income of urban households increased 7.9%

and the per capita disposable income of rural households

increased over 9%.

See:

http://www.stats.gov.cn/english/PressRelease/202001/t20200119_1723719.html

Enterprises call for zero consumption tax on solid

wood flooring

Recently the Ministry of Finance and the State Taxation

Administration invited public comments on a draft

revision of the consumption tax. The new draft clarifies

that both companies and individuals are liable to pay a

consumption tax when they sell goods, process products or

purchase certain imported merchandise.

China started collecting a consumption tax on some

consumer goods in 1994.

In 2004, the country revised the consumption tax to adjust

the scope and rate of taxable items which added energyintensive,

highly polluting products and some high-end

consumer goods to the list.

In response to the recent call for comments the China

Timber and Wood Products Distribution Association

(CTWPDA) submitted a request for the elimination of the

tax on solid wood flooring as 90% of the raw materials for

wooden flooring manufacture are imported.

At the end of 2018 there were about 2,000 enterprises

making solid wood flooring and most of them are small

and micro private enterprises. According to a survey, 30%

of wooden flooring enterprises are close to ceasing

operations, 40% are struggling to maintain their business

and 30% are moderately profitable.

The consumption tax has increased the operating costs for

enterprises. The private sector argues this is not in line

with national policy on tax reduction and activation of

private enterprise development as it will undermine the

growth in consumption.

Wooden furniture exports through Huangpu

According to Huangpu Customs local enterprises exported

US$1.849 bil. of wooden furniture in the first eleven

months of 2019 through Huangpu Customs.

Dongguan city serves as a manufacturing base for wooden

furniture and more than 160 new companies have been

registered in 2020. There are more than 600 exportoriented

bamboo and wood products manufacturing

companies in the city.

Huangpu Customs has a sophisticated multi-link

integrated system to support Dongguan furniture exporters

compete in the global market.

The export of bamboo and straw products are traditional in

Huangpu these products are shipped to over 120 countries

and regions around the world. The main products are

cabinets, sofas, tables and chairs, wood brushes, wood

crafts, rattan and straw products. The export value of

wooden furniture accounts for 90% of total exports of

bamboo, wood and straw products.

The business environment in the Dongguan area is said to

be good with a comprehensive industrial chain creating the

environment convenient, fast and efficient trade.

First bonded timber warehouse

It has been reported that a private sector bonded

warehouse has become operational and is being managed

by Changzheng Bonded Logistics Co. Ltd. Dongyang

wood processing enterprises in Dongyang import from

around the world and managing stocks can be a problem.

The new bonded warehouse offers and alternative source

of raw material if the supply of imports is disrupted or

insufficient to meet production requirements.

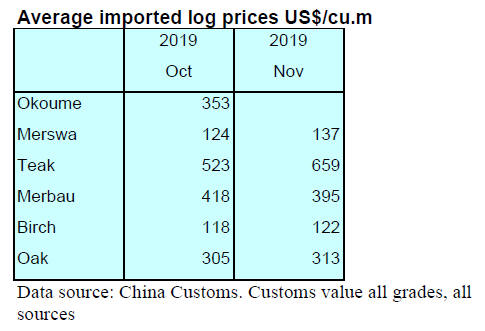

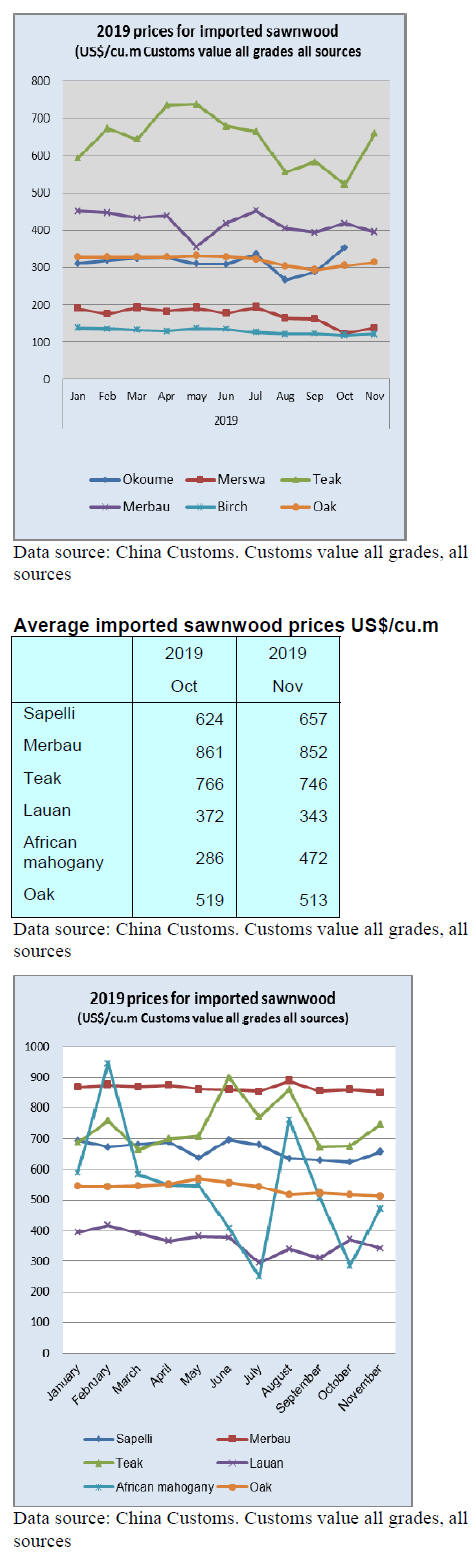

New imported price data series

In an effort to provide more transparency on imported

timber prices in China a new data set is provided below

showing average prices for some key timbers imported.

It should be noted that these average prices are derived

from the import volumes and values as reported by

China¡¯s Customs.

|