2.

GHANA

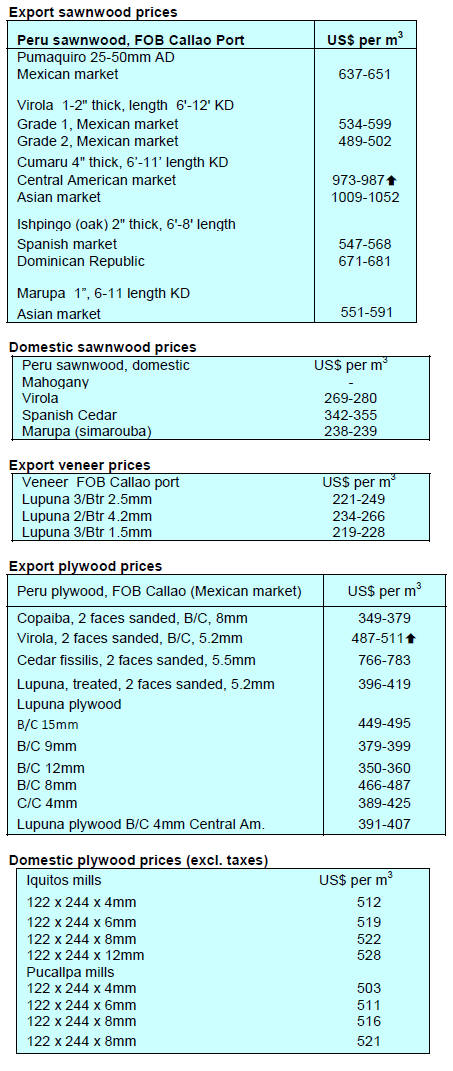

January to October export performance

Ghana exported a total of 266,015cu.m of wood products

in the first 10 months of 2019 earning euro 129.85 million.

Export volumes and values in the first 10 months of 2019

fell by 4% and 18% respectively when compared to the

same period in 2018.

The export of five products, air and kiln dry sawnwood,

plywood to regional markets, billet and sliced veneer

accounted for over 90% of the total export volume for the

period.

Products that saw significant increases included kiln dried

boules, sliced veneer plywood and kindling. However, the

overall average unit price for export product in the first 10

months of 2019 dropped to euro 488/cu.m from euro

570/cu.m in 2018.

Asia continued as the major market for country’s wood

product with a 69% growth in 2019, compared in 2018 but

the pace of growth in Asian markets has slowed. This was

followed by Europe which recorded a 15% year on year

increase. Regional African markets continued to perform

well. The leading species that went into the production of

export products were teak, wawa, ceiba, eucalyptus and

mahogany.

Economic growth forecast at almost 7% in 2020

The World Bank is projecting an economic growth of

6.8% for Ghana in t 2020 according to its January 2020

Global Economic Prospects report. This is lower than the

7.5% forecast by the International Monetary Fund for the

same year. The Bank’s report, however, said growth will

fall to 5.2% and 4.6% in 2021 and 2022, respectively.

See:

https://www.worldbank.org/en/news/feature/2020/01/08/january-2020-global-economic-prospects-slow-growth-policy-challenges

3.

Business outlook positive say Ghana’s business

leaders

In its annual survey of Ghana’s Chief Executive Officers

the Oxford Business Group reports that most CEOs are

highly positive about the country’s prospects and that this

positive view was driven by the likely opportunities when

the Africa Continental Free Trade Area (AfCFTA) whose

headquarters is in Ghana, becomes operational.

The Oxford Business Group said most respondents

described their expectations of local business conditions as

positive or very positive and most were of the view that

business transparency in the country was good relative to

the West Africa region.

Forest landscape restoration target exceeded

As part of its forest landscape restoration plan Ghana

planted a total of 26,865 ha. exceeding its annual target of

25,000 ha. In a statement to the press, the Chief Executive

of the Commission, Kwadwo Owusu Afriyie, said this was

the first time since the annual target has been exceeded.

Mr, Afriyie said the high level of planting was in part due

to the programme for the Youth in Afforestation and

Reforestation project. The species planted included teak,

cedrela, gmelina, ofram, emire, mahogany and rosewood,

3.

MALAYSIA

Costs beginning to outweigh benefits of fair

participation

Speaking after the December Malaysian Furniture &

Furnishing Fair 2019, furniture manufacturers reported

that 2019 was a tough year for sales especially in the

domestic market where the reintroduction of the sales and

service tax at a higher rate than the previous tax was one

of the factors behind the weaker domestic demand.

A Malaysian company executive said fierce competition

weighed on sales which called for strong efforts to

maintain market share, even at the cost of discounted

prices and higher promotional costs. While there is strong

interest in participating in fairs to raise brand awareness,

in the face of weak demand the costs are beginning to

outweigh the benefits. One manufacturer commented that

the company previously participated in some 40 fairs but

will now cut back.

For more see:

https://www.theedgemarkets.com/article/2019-tough-year-localsales-2020-likely-be-better

Sarawak association warns of consequences of minimum wage hike

The Sarawak Timber Association (STA) has issued a press

release on the recent decision to raise the minimum wage.

The press release, which can be found at:

http://sta.org.my/images/staweb/Press_Release/2019/Press Release

31122019.pdf

says the following:

“The recent increase in the minimum wage from RM1,100

to RM1,200 for 57 major cities and towns throughout

Malaysia from January 1, 2020 onwards is a major

concern, including for the plantation, forestry and timber

industries. This comes as the minimum wage increases

rapidly over the last three years from RM920 to RM1,200.

The general pushback against this hike, as claimed by

some employers, is the lack of a corresponding increase in

labour productivity. Also, the current weak international

economy is making it hard to absorb additional

production costs.

STA is deeply concerned about the latest decision by the

Government in raising minimum wages (MW) to RM1,200

in fifty-seven (57) major cities and towns effective from 1

January 2020. STA continues to support the Government’s

efforts and policies in spurring sustainable and equitable

economic growth. Nevertheless, STA is taken aback by the

seemingly hasty and ambiguous pattern of setting the MW.

In less than sixteen (16) months, the MW was revised

from RM1,000 for Peninsular Malaysia and RM920 for

Sabah & Sarawak to become RM1,100 nationwide

effective 1 January 2019, which was then again raised to

the recent RM1,200 effective 1 January 2020. Relevant

stakeholders, specifically employers and employees, have

been since thrown in a state of confusion and unease due

to the constant revisions of the MW by the Government.

STA is in the opinion that such move without considering

the current lethargic global economic condition and the

capacity of employers to continuously absorb rising

operation costs will indefinitely take its toll on the already

hard-hit industry.

The upward review of MW will inevitably lead to cost

increase in timber and timber products. For example,

plywood which is one of the main export products of

Sarawak, is currently seeing a cost increase of about

RM18 per cubic metre. Sarawak is already losing its

market shares to more competitive nations like Indonesia,

Viet Nam and other ASEAN countries, who are able to

offer their products at cheaper prices.

Even before the MW increase to RM1,200, our plywood

production cost has skyrocketed over the last few years

due to increase in costs for raw materials and labour. Log

cost has escalated by at least 22% since 2017 because of

increase in Hill Timber Premium from RM0.80/m3 to

RM50.00/m3 (hill timber species), Timber Premium

(Rehabilitation & Development) from RM0.60/m3 to

RM5.00/m3 ; glue cost has increased by 12%, and

administrative & distribution costs increased by 59% due

to significant reduction in production volume.

For our plywood export to Japan, it has dropped by 32%

over the corresponding period of January to November

2018 and 2019.”

Plans for bamboo industry development cluster

The Primary Industries Minister has announced that a

bamboo industry development cluster development will be

established this year in the Taman Industri Perabot Lahat,

in Ulu Kinta, Perak.

The Minister pointed out that, currently, the contribution

of the bamboo industry to the Malaysian economy was

low with exports of bamboo products earning just RM9.9

million in 2019. She pointed out that the global bamboo

market is worth around US$65 billion a year. The minister

said that bamboo plantations will be encouraged and

supported especially in Sabah which has vast areas of

suitable land.

News in Brief

A Japanese company is interested in investing in the pellet

wood industry in the Tanjong Manis timber industrial area

in Sarawak. This was expressed by Makoto Yokoshi, who

led a business delegation to visit the Minister of

International Trade and Industry, Industrial Terminal and

Entrepreneur Development.

https://www.theborneopost.com/2019/12/14/japanese-firm-eyesinvestment-

in-pellet-wood-industry-in-tanjong-manis/

The Sarawak State government has increased the premium

on swamp timber species effective 1 January. The Director

of Forests disclosed that the premium for swamp timber

species had not been reviewed for over three decades.

https://www.theborneopost.com/2020/01/04/swamp-timberpremium-

increases-three-to-six-folds/

The Chief Minister of Sarawak has set a target of RM10

bil. in exports of timber products by 2030. Of the target,

he wanted RM6 billion to come from the export of

furniture. He revealed that total earning from the export of

timber products from Sarawak in 2018 was RM5.4 bil. Of

the total, the export of furniture was only worth RM43

million.

https://cm.sarawak.gov.my/modules/web/pages.php?mod=news

&sub=news_view&menu_id=&sub_id=&nid=3752&m=12&y=2

019

Malaysia-China bilateral trade would hit another record

high in 2019, as it had already posted US$111bil. in the

first 11 months of the year, according to Chinese

Ambassador to Malaysia Bai Tian.

In 2018, bilateral trade between the two countries totalled

US$108.66 bil.

See:

https://www.thestar.com.my/business/businessnews/

2020/01/07/malaysia-china-trade-to-hit-new-high-in-2019-

envoy-says

4.

INDONESIA

Building opportunities for

community/private sector

investments

The Ministry of Environment and Forestry (KLHK) plans

to strengthen investment and production in the forestry

sector in support of Indonesia's National Medium-Term

Development Plan (RPJMN) for 2020-2024. The 2020-

2024 RPJMN, the macro development plan is targeting an

investment level increase of around 8 percent.

Secretary General of the KLHK, Bambang Hendroyono,

explained that one of the KLHK’s contribution to

increased investment will be through social forestry.

Communities have been given legal access to manage

forest land for non-timber commodities and abandoned

forest lands can be managed productively. Bambang hopes

that by simplifying regulations and bureaucracy in the

private sector joint investments will develop.

SMEs can boost exports due to ‘empty’ US market

says association

Regina Kindangen, the Deputy Chairman for Small and

Medium Industries in the Indonesian Furniture and Crafts

Industry Association (HIMKI) is optimistic that

association members will be able to take advantages of

market opportunities in the United States where they have

some competitive edge on rivals.

To support the SMEs to progress and develop, Kindangen

said that HIMKI has an annual trade exhibition for

furniture, craft, and homedecor in Jakarta which attracts

many overseas buyers.

Encouraging plantation forestry

The KLHK encourages industrial plantation to increase

national the production volumes. The government intends

to prioritise commercial tree plantations as the raw

material for industry. Acting Director General of KLHK's

Sustainable Production Forest Management, Bambang

Hendroyono, said that while the natural forest will

continue as a source of timber the emphasis on plantations

is to protect the natural forest where exploitation has now

been restricted.

In recent years the contribution of production forests to the

Indonesian economy has fallen. It is reported that in 2019,

the non-tax State Revenue from the production forest

sector dropped to 2.73 trillion rupiah from 2.86 trillion in

2018.

In addition, investment in the production forest sector has

also been falling said Bambang. In 2018 investment

reached 155.71 trillion rupiah but in 2019 it dropped to

128.14 trillion rupiah.

Bambang said the ministry wants the private sector to

invest in plantations across the country. A major concern

of government is that the supply chain for wood products

should be made more efficient and costs reduced and a

number of supporting policies are also being prepared.

In 2020-2024 the KLHK will focus on increasing

investment, productivity, added value and competitiveness

of production forests.

In related news, the Chairman of the Indonesian Forestry

Community Communication Forum (FKMPI), Indroyono

Soesilo, pointed out that plantation forests have increased

significantly. In 2018, planting totalled 196,000 hectares

while in 2019 this jumped to 297,000 ha.

Chinese enterprises deterred by investment climate

Over 50 Chinese wood processing companies are said to

be considering relocating some of their production

capacity to Indonesia. The Chairman of the Indonesian

Forestry Community Communication Forum said

investors from 53 companies had visited Indonesia and

met with business associations and the government.

However, the Chinese companies have not yet made a

decision to relocate citing the unattractive investment

climate.

There was still an opportunity to attract these investors as

the government had just issued a new policy that will

facilitate investment.

See:

https://www.republika.co.id/berita/q3miow370/asosiasi-53-industri-olahan-kayu-cina-lirik-indonesia

Indonesia International Furniture Expo

(IFEX) 2020

The Indonesia International Furniture Expo (IFEX) that

has been successful in introducing and promoting

Indonesian quality furniture to the global audience will be

held 12-15 March 2020.

The furniture industry is still regarded as important for the

Indonesian economy as it supports a huge labour force.

Data from the Ministry of Industry shows an increase in

furniture exports in 2019 to US$1.69 billion. On average,

the industry is experiencing a growth of 4% annually.

To realise further growth, the country's furniture industry

needs continuous innovations in terms of design,

technology, marketing and the after-sales service to ensure

a high level of customer satisfaction.

See:

https://markets.businessinsider.com/news/stocks/indonesiainternational-

furniture-expo-ifex-2020-pursuing-the-opportunityto-

increase-indonesia

5.

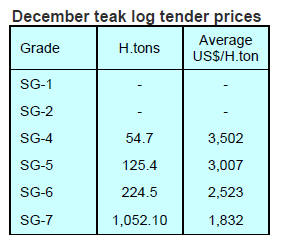

Myanmar

More harvests from mature teak plantations

The Myanma Timber Enterprise (MTE) harvesting plan

for 2019-20 provides for the production of about 5,000

tons of teak and 28,5000 tons of other hardwoods. Some

3,000 tons of teak will come from the Shah State with

most of the balance from the Sagaing Region, Chin State

and Magwe Division. In addition, teak will be harvested

from mature plantations (30 years and above).

It is understood that the mature teak plantations are

considered ‘natural forest’ as the quality of the timber is

considered equal to that from the natural forest. Myanmar

is believed to have exported about 80,000 tons of timber to

as many as forty countries in fiscal 2018-19 with teak

accounting for around 35% of the total.

According to Ministry of Commerce, earnings from the

forestry sector in fiscal 2018-19 were about US$175

million.

To maintain business activity at the same level as in

previous years, exporters need to be trading around 60,000

tons of teak annually. On the current harvest levels it is

clear the industry will face a shortage of teak logs in the

coming years. Myanmar has a problem with deforestation

and the switch to harvesting mature plantations will help

ease the pressure on the natural forest.

Forestry Minister, Own Win, recently attended a ceremony

marking 100 years of plantation forest in the Bago

Mountain Range. An area of 268 acres produced 7,356

teak trees out of which there were 5,665 tress with girths

above 4ft., according to MTE data.

Logging ban – but communities depend on the forest

for their livelihood

The Minister of Natural Resources and Environmental

Conservation has been quoted as saying during the

quarterly meeting of the Ministry that an indirect effect of

the logging ban has been a rise in illegal harvesting since

over 80% of the population depend on the forest for their

livelihood.

How to address domestic timber consumption needs is one

of the main issues as Myanmar addresses forestry sector

reforms. The Minister said that as long as there is a

logging ban there will be so-called ‘illegal logging’ (by

rural communities to support their lives) and he said the

legal export of logs can support the state income.

This remark by the Minister is interpreted by analysts that

Myanmar will continue harvesting to meet domestic

requirements and to support exports but that the volumes

will be strictly controlled.

Logging ban has impacted domestic availability of

sawnwood

In an article published by a local journal by a retired

general manager of the Myanma Timber Enterprise (MTE)

says that in the ten years from fiscal 2006-07 37,758 tons

of teak and 1,714,780 tons of other hardwood sawnwood

was milled.

Of this it was estimated that around 52% of the teak and

32% of the other hardwoods were for domestic

consumption. Analysts note that the logging ban has

seriously impacted the domestic availability of sawnwood

the distribution of which, before the ban, was undertaken

by the MTE.

Management of natural resources for peace building

report

Forest Trends has published a report “Natural resource

governance reform and the peace process in

Myanmar,” billed as a baseline study for efforts to

promote equitable and accountable management of natural

resources for peacebuilding.

The report calls for natural resources to be governed by

subnational and local government officials may help meet

ethnic political demands and steer the country towards a

federalist structure.

See:

https://www.forest-trends.org/publications/natural-resourcegovernance-

reform-and-the-peace-process-in-myanmar/

ADB project to fight rural poverty

The Asian Development Bank (ADB) has approved a

US$195 million financing package for a project that will

develop climate-resilient and market-oriented

infrastructure and livelihoods in 2,942 villages in

Myanmar’s Ayeyarwady, Chin, Sagaing and Tanintharyi

regions. This will help reduce rural poverty and strengthen

the villages' climate and disaster resilience, benefiting

around 1.8 million people, according to a statement.

See:

https://www.adb.org/sites/default/files/publication/156173/adbiwp318.pdf

Disclosure of owners of companies in

extractive sectors

The Office of the President has issued a notification that

requires the disclosure of owners of companies involved in

the extractive sector. This is to support Myanmar’s efforts

to become accredited to the Extractive Industries

Transparency Initiative (EITI).

The notification will result in greater transparency on the

158 companies and 5 state-owned enterprises operating in

Myanmar’s natural resource sector.

See:

https://www.mmtimes.com/news/knowing-who-ownsextractive-

companies-will-help-myanmar-thrive.html

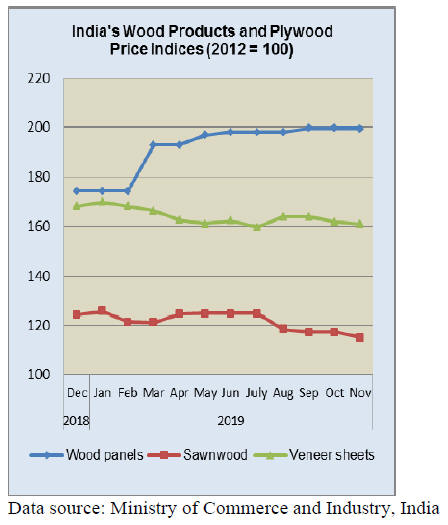

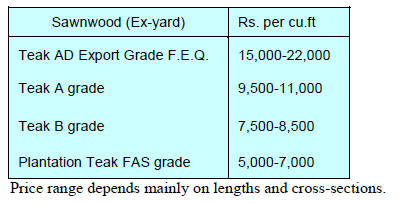

6. INDIA

Lower prices for sawnwood and veneer pushes

down

price indices

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for November 2019 rose slightly to

122.3 from 122.2 for the previous month. The index for

the group 'Manufactures of Wood and of Products of

Wood and Cork' declined to 133.7 from 134.4 for the

previous month due to lower prices of sawnwood and

veneer sheets.

The annual rate of inflation based on monthly WPI in

November 2019 stood at 0.58% compared to 4.47% in

November 2018.

The press release from the Ministry of Commerce and Industry

can be found at: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

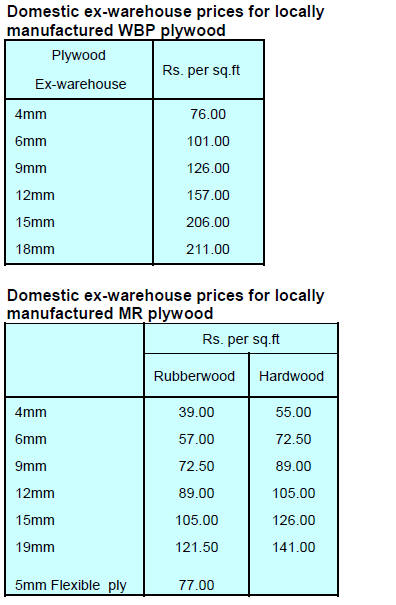

Plywood association comes out against trade deal

At the 3rd Regional Comprehensive Economic Partnership

(RCEP) summit held in Bangkok in November 2019 India

opted out fearing a surge of imports into India, particularly

from China. Some in India held the view that there would

also have a negative impact on farming communities and

small-scale industries.

More recently the Punjab Plywood Manufacturers

Association (PPMA), one of the largest associations in the

country, has urged the government to keep plywood and

allied products out of any agreement on trade. PPMA

chairperson, Ashok Juneja, has said “if trading of products

like plywood and allied items is allowed under RCEP, it

will be disastrous for the plywood industry”.

See:

http://timesofindia.indiatimes.com

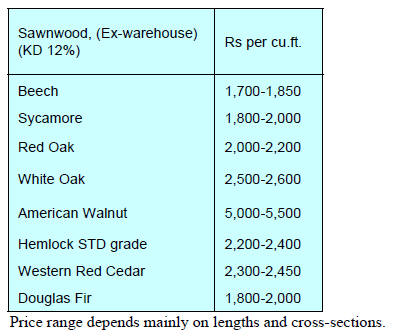

Growing interest in red oak says AHEC

The American Hardwood Export Council has released data

showing that total exports of US hardwood lumber to India

reached a value of US$1.822 million for a volume of

around 3,200 cubic metres during the first three quarters of

2019, with red oak sawnwood accounting for nearly a 25%

of all exports to India. The total value of American

hardwood lumber and veneer exports top USD 5.272

million in the first three quarters of 2019.

As the leading international trade association for the

American hardwood industry, the American Hardwood

Export Council (AHEC) has closely observed the Indian

market’s growing acceptance of hardwood, especially

American red oak.

India is known as an importer of logs primarily but

changes in the market structure and regulations has

encouraged a growing interest in sawnwood imports.

India’s imports of US hardwood logs for the first nine

months of 2019 fell by around 50%.

See: www.americanhardwood.org

Plantation teak prices

C&F prices for teak landed at Indian ports continue within

the same range as shown in December 2019 reflecting the

stable rupee/US dollar exchange rate which remains at

around Rs.71 to the US dollar.

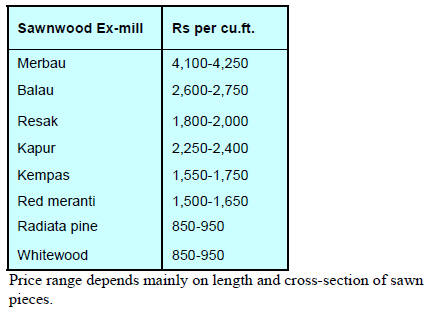

Locally sawn hardwood prices

Prices have been maintained as reported previously.

Domestic market demand and import volumes remain well

balanced say traders.

Myanmar teak prices

Much of the teak imported from Myanmar is used in India

for the manufacturing of entrance doors for private homes

and, as such, teak imports from Myanmar mirror activity

in the Indian housing market.

On prospects in the housing market analysts write

“conditions in the money market are improving and loans

and credit facilities are being slowly being granted by

banks. Also, the Central government is actively helping

boost the reality market which, along with easing interest

rates, should lead to firmer teak imports”.

Sawn hardwood prices

Prices remain unchanged. The AHEC website referred to

above specifically mentions Indian interest in red oak

saying “There has never been a better time to buy

American red oak.

That’s partly because it’s in plentiful supply and partly

because it’s eminently affordable, with the price

differential versus European oak as wide as it’s ever been.

Plywood price increases

Container freight rates continue to rise but plywood

manufacturers have maintained the price increased prices

reported in December 2019.

7.

VIETNAM

Forest product exports now one of three

commodities

with earnings over US$10 billion

At a meeting with the Vietnam Timber and Forest Product

Association and wood associations of Ho Chi Minh City,

Binh Duong, Dong Nai and Binh Dinh Provinces on 9

January the Minister of Agriculture, Nguyen Xuan Cuong,

said that having achieved exports of over US$11 million in

2019, an increase of 18% compared to 2018 he expects the

industry to achieve US$20 billion in export earnings by

2025.

Forest product exports are now one of three commodities

in Vietnam with annual earnings over $10 billion.

To achieve the 2025 export target the Minister noted that it

will be necessary to adopt the latest technologies, revamp

institutions and policies, build the value chains and

develop new market opportunities and new technology.

The most important thing he said, is to ensure that the are

dedicated and well trained engineers and administrators.

See :https://sggpnews.org.vn/business/forestry-industry-aims-atexports-of-20-billion-by-2025-85200.html

2019 – services sector the biggest employer

The Vietnamese formal workforce topped 55.8 million in

2019, an increase of 417,100 compared to 2018 according

to the General Statistics Office (GSO). Of the total, 19

million or around 35% were working in the agro-forestryfishery

sector, 16.1 million in the industrial and

construction sector (290%); and 19.6 million in the service

sector (36%).

The GSO Director General, Nguyễn Bích Lâm, said the

labour issue had seen positive developments last year with

the service sector just overtaking the agro-forestry-fishery

sector as the largest employer. The average pay of workers

increased 2.2% last year says the GSO.

Young workers aged 15-24 years accounted for most of

the unemployed at 44.4% which is a major challenge for

the government. To address this the government is actively

encouraging new enterprises and there were 138,100 new

enterprises established last year an increase of 5.2 per cent

compared to 2018.

See:

https://vietnamnews.vn/economy/570623/viet-nam-seespositive-labour-growth-in-2019.html

South Korea leads in investment

The Foreign Investment Agency (FIA) under the Ministry

of Planning and Investment has reported that foreign

investment pledges to Vietnam exceeded US$38 billion in

2019 marking a 10-year high and representing a year-onyear

increase of over 7%.

The FIA reports more than 3,500 new projects received

investment licenses during in 2019, up 27% from 2018.

Among the 125 countries and territories investing in

Vietnam last year, South Korea remained the leading

source of FDI with US$7.92 billion or 21% the total. Hong

Kong was next with almost 8 billion. Singapore ranked

third with US$4.5 billion, followed by Japan and China.

Investment from Hong Kong and mainland China

increased in 2019 mainly due to the impact of the

US/China trade dispute. FDI from China increased 1.65-

fold and from Hong Kong 2.4-fold, year-on-year. In 2019,

the foreign enterprise sector earned US$181 billion from

exports.

See:

https://vietnamnews.vn/economy/570419/viet-nams-fdicapital-hits-10-year-record-in-2019.html

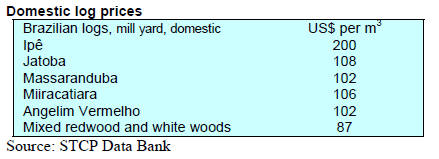

8. BRAZIL

Prospects for the domestic furniture sector

in 2020

The furniture sector has performed poorly in the domestic

market over the past five years because of economic

stagnation and manufacturers in the municipality of

Linhares, Espírito Santo, one of the main furniture

production centres in the country, have suffered. But in

2019 sales stabilised and, towards the end of 2019, there

was a modest expansion of sales in the domestic market.

Analysts write that prospects for 2020 will improve if the

reforms announced by the federal government, especially

the tax reforms, are enacted. Despite experiencing a period

of instability over the last few years furniture

entrepreneurs have strived to innovate and invest in

technology to raise productivity.

The regional association has maintained its policy of

strengthening partnerships with public and private

institutions in order to further develop the furniture sector.

Bringing innovation and sustainability to Amazon producers

The Brazilian Ministry of Agriculture, Livestock and Food

Supply (MAPA) has launched a project in the Amazon to

raise productivity in the agricultural and timber sectors.

The project, with the support of the German government,

will be implemented from 2020 to 2024 in five states of

the Amazon region: Amazonas, Mato Grosso, Pará,

Rondônia and Tocantins. MAPA will manage and monitor

the project and the Inter-American Institute for

Cooperation on Agriculture (IICA) will act as the financial

agent.

Some planned outcomes include alignment of production

with international agreements, traceability of supply

chains, opening new markets (internal and external) and

development of innovation.

For more see:

https://portal.datagro.com/en/207280

Exports of Tropical Plywood and Veneer in

2019

Exports volume of tropical plywood in 2019 totalled

89,120 cubic metres, an increase of over 45% compared to

2018. However, the monthly average of around 7,400

cu.m is very low compared to the past decades and minute

compared to the potential of the Brazilian tropical forest.

The top 5 markets for tropical plywood in 2019 were the

US, Ireland, the United Kingdom, Mexico and Canada

which together accounted for over 80% of all exports of

these products.

It has been difficult to expand markets for tropical veneer

says the Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) because of raw material

supply issues. However, despite this problem there was a

significant growth in export volumes in 2019, with

shipment of 25,848 cubic metres, a good recovery

compared to previous years.

The top 5 markets for Brazilian veneers in 2019 were

South Korea, the US, Malaysia, the Philippines and China

which together accounted for almost 70% of veneer

exports.

Timber production in international market in 2019

According to ABIMCI production of the main timber

products has been steadily expanding, driven mainly by

the rising production potential of the forests and export

demand.

Sawnwood, pallets, veneer sheets, plywood, wood frames,

doors and other components are some of the main products

produced for the domestic and export markets. Some

processed products such as furniture parts/frames for the

export market, especially in the US are competing directly

with the same product from Chile and China.”

Representatives of ABIMCI said in 2020 the international

wood products market will continue to experience some

market unpredictability as the US/China trade dispute will

linger on creating uncertainties and changes in the supply

chain for wood products in several countries.

The consumption of wood products is gaining importance

globally and there is a high expectation that as technical

standards for wood frame construction are developed there

will be major opportunities in the construction sector.

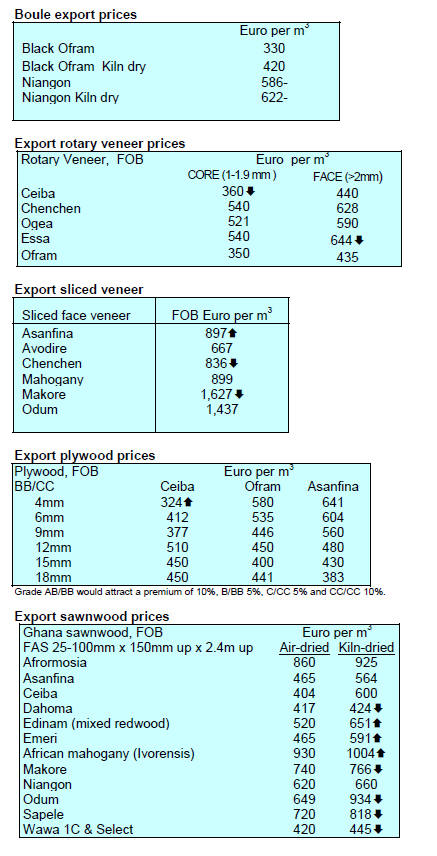

9. PERU

Millions of hectares of natural forest

exposed to

encroachment

Erik Fischer, president of ADEX, the exporters

association of Peru has said there are millions of hectares

of natural production forest that are unutilised and exposed

to encroachment and destruction.

According to Fischer, "95% of deforestation in Peru is due

to a change in land use for subsistence agriculture, illegal

mining and illegal cultivation of coca leaf”. Fischer

strongly recommended that the government implement

clear policies for the sustainable development of forests as

the only means to prevent informal and illegal activities.

He considered it essential to fully value the immense

potential of the forests in the country and boost private

investment in timber and non-timber production in order

to generate employment opportunities in remote areas.

Domestic construction sector set to grow

The expansion of public investment this year will bring a

boost for the construction sector which, according to the

Institute of Business Development and Economics

(IEDEP) of the Lima Chamber of Commerce (CCL), could

expand by over 6% this year.

In the first half of 2019 Peru’s construction sector

expanded by over 5%. The IEDEP indicated that it is

optimistic on growth prospects as mortgage lending has

been rising.

Information of the Superintendent of Banking and

Insurance shows that up to August 2019 loans granted by

financial institutions expanded almost 10% compared to a

year earlier. A healthy and expanding construction output

contributes greatly to the development of markets for

wood products.

New law extends tax benefits to forestry sector

An Emergency Decree, approved 28 December 2019 by

the Council of Ministers extends the validity of the

Agricultural Promotion Law until 2031 and incorporates

the forest and aquaculture sectors.

One of the benefits that will be retained is the lower

payment of tax now extended to the forestry and

aquaculture sectors, explained the Minister of

Development and Agricultural Infrastructure and

Irrigation, Jorge Montenegro. The Minister said the aim is

to boost investment in both sectors which will lead to

higher exports.

San Martín and Loreto progress forest zoning

San Martín was the first region to complete its technical

studies for its forest zoning exercise and has now

submitted its conclusions to the National Forest and

Wildlife Service (SERFOR) within the Ministry of

Agriculture and Irrigation which is responsible for

verifying the compliance with the provisions for the

zoning process.

The San Martín report has been reviewed favourably by

SERFOR and has been forwarded to the Ministry of

Environment which is responsible for issuing any

ministerial resolution formalising the approval of the

forest zoning exercise.

For its part, the Loreto completed the first stage of the

zoning process and this has earned a favourable response

from SERFOR but has not yet received notification from

the ministry. Meanwhile, in Loreto modules II and III of

the zoning process are advancing.

It should be noted that forest zoning is the planning tool

that provides information on the forest and wildlife

resources. The forest zoning exercise is carried out by

regional governments with technical assistance from

SERFOR throughout the process. To-date, 19 regional

governments are undertaking forest zoning.