Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2019

Japan Yen 109.3

Reports From Japan

¡¡

Decline in imports tilts up GDP

growth

In the first quarter 019 Japan¡¯s economy grew at an

annualised rate of 2.1% according to Cabinet Office data,

an acceleration of growth compared to the previous

quarter. The better than expected numbers were due

largely to a sharp decline in imports, interpreted as a sign

of underlying weakness in demand. While exports rose 2%

in the first quarter the trend in consumer spending and

private sector capital investment continued to disappoint.

The weakening global economy, especially slower growth

in China, Japan¡¯s biggest market, has undermined

corporate confidence and driven down business

investment, a cornerstone of recent economic growth in

the country.

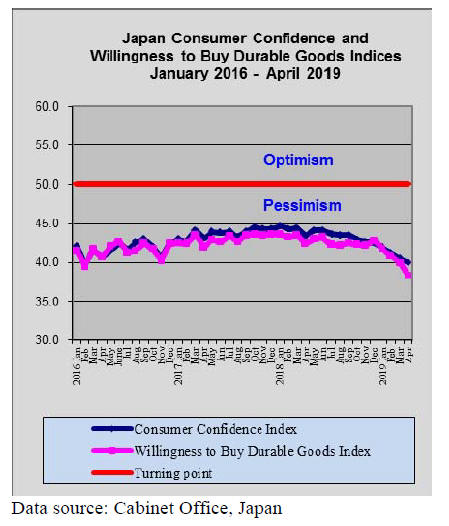

The continued down trend in consumer confidence is

reflected in weak domestic demand, something that will

weigh on the minds of policymakers as they debate

whether or not to raise the consumption tax in October.

Vital that tax be raised in October says OECD

At a press conference to launch the OECD¡¯s ¡®Economic

Survey¡¯ report on Japan, OECD Secretary-General, Angel

Gurria, said the increase in consumption tax scheduled for

October this year along with constrained spending is vital

if the government wishes to stabilise its budget. Japanese

government debt topped 225% of GDP in 2018, the

highest amongst members of the OECD and far exceeding

that of Greece and the United States.

The OECD¡¯s report on Japan says the impact of the 2%

rise in consumption tax ¡°would be less intense than the

2014 3% rise because the government has plans for

offsetting fiscal support specifically aimed at supporting

domestic consumption.

The OECD also recommended that the government speed

up economic reforms to address the aging population and

women in the workplace. The OECD report supports

Japan¡¯s plan to make it easier and more attractive for

foreign workers, a major step to deal with the growing

labour shortages in Japan.

https://www.oecd.org/economy/surveys/japan-economicsnapshot/

First quarter machinery orders down 10%

The total value of orders received by top machinery

manufacturers in Japan fell just over 4% in March

compared to February. First quarter 2019 data show that

orders fell by 10.4% compared with the previous quarter.

Private-sector machinery orders, excluding those for ships

and those from electric power companies, increased a

seasonally adjusted by 3.8% in March but were also down

quarter on quarter. Manufacturers surveyed by the Cabinet

Office forecast core orders could rise over 15% in the

second quarter.

See data at: https://www.esri.cao.go.jp/en/stat/juchu/1903juchue.

html

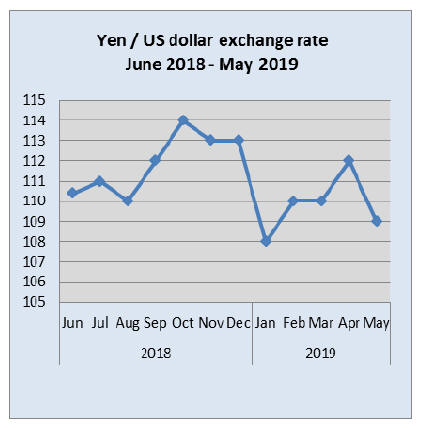

Yen strength defies Bank of Japan efforts

As the US/China trade war intensifies investors are

moving assets to safe currencies such as the yen.

In the past two weeks the yen has strengthened by almost

2% against the US dollar. The perception is that yen

strength may continue even though the Bank of Japan

maintains its current monetary policy.

However, a stronger yen undermines export prospects

while, at the same time, making imports that much

cheaper.

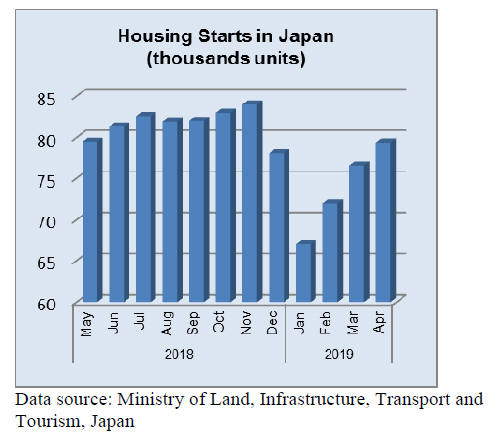

Three month of rising housing starts

April data shows a third straight monthly (4%) rise in

housing starts but year on year there was a 6% decline.

Panasonic/Toyota expand diversification in housing

sector

In a press release Panasonic, the Japanese electronics firm,

announced it will form a joint venture with Toyota and the

two will merge their respective housing businesses. The

joint venture brings together the companies' housing

subsidiaries Toyota Housing and Panasonic Homes Co. as

well as Misawa Homes Co.

The press release says globally, urban communities will

increasingly desire ¡®connected¡¯ life styles and homes

which are energy efficient systems and that this will be the

focus of the joint venture.

See:

https://news.panasonic.com/global/press/data/2019/05/en190509-

2/en190509-2-1.pdf

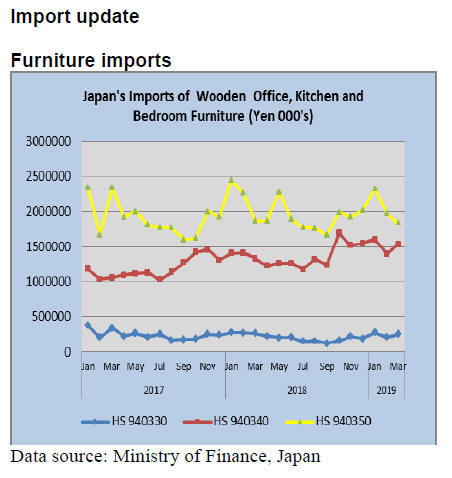

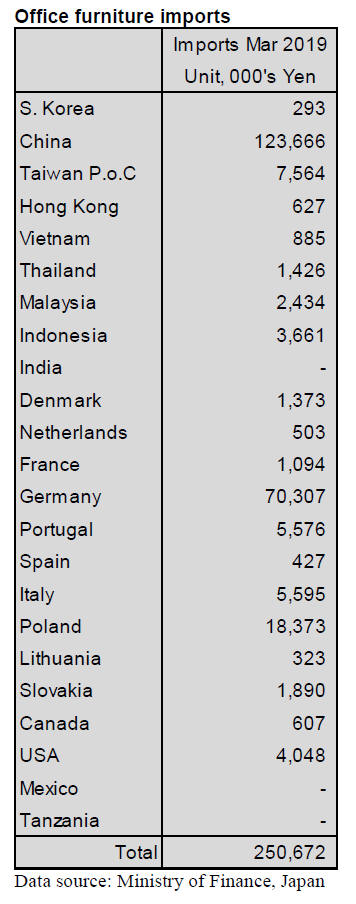

Office furniture imports (HS 940330)

First quarter 2019 wooden office furniture imports were

down around 10% compared to the first quarter 2018, this

despite a 22% rise in the value of imports in March 2019.

Two shippers dominated March imports, China which

accounted for 49% of Japan¡¯s imports of wooden office

furniture and Germany which contributed a further 27%. If

shipments from Poland are added to those from the two

main shippers then over 80% of imports are accounted for.

Shippers seeing a significant decline in March deliveries

to Japan include Viet Nam, Indonesia and Portugal.

Shipments of office furniture from Germany surged in

March coming in some 25 times higher than a month

earlier. The month on month value of March imports from

China was flat. Overall, year on year imports of wooden

office furniture dipped 5% in March 2019.

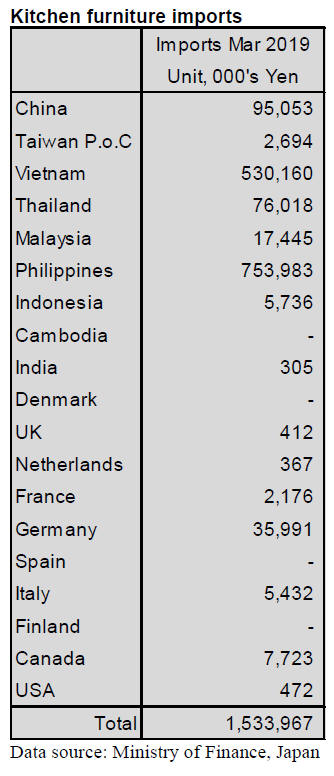

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s first quarter 2019 imports of wooden

kitchen furniture rose 9% compared to the same period in

2018. As usual, the main shippers of wooden kitchen

furniture to Japan in March were the Philippines (49% of

all wooden kitchen furniture imports) and Viet Nam

(36%).

China is not a big supplier of kitchen furniture to

Japan

and in March shipments dropped sharply. As was the case

with office furniture, shipments of wooden kitchen

furniture from Germany jumped in March.

Year on year the value of March 2019 imports of wooden

kitchen furniture rose 15% and there was a 10% increase

compared to the value of February imports.

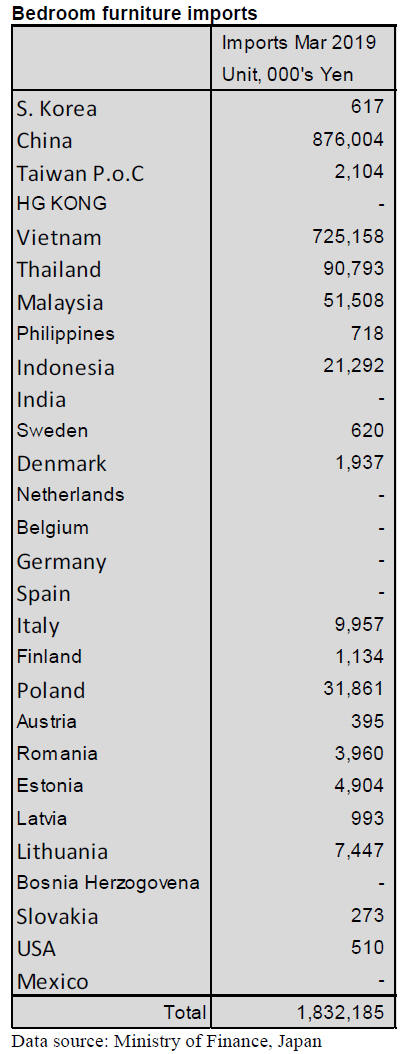

Bedroom furniture imports (HS 940350)

The decline in Japan¡¯s imports of wooden bedroom

furniture first noted in February continued into March

when there was a furthet 7% month on month decline.

This marks two months of decline mirroring the pattern of

imports seen in previous years, a rise in imports should

kick in mid-year.

The combined value of imports of wooden bedroom

furniture from the top two shippers, China and Viet Nam,

accounted for almost 90% of March 2019 imports. The

third largest sipper, Thailand, contributed only an extra

5% to imports.

In March this year imports from China fell around 25%

compared to a month earlier and imports from Viet Nam

were at around the same level as in February. Almost all

of the other shippers saw March deliveries rise.

Year on year the value of March 2019 imports of wooden

bedroom furniture was little changed from March 2018

and there was a 7% decline compared to the value of

February imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood supply statistics in 2018

The Ministry of Agriculture, Forestry and Fisheries

disclosed wood supply statistics of 2018. Total wood

supply for lumber, plywood and wood chip in 2018 was

26,545,000 cbms, 0.3% more than 2017.Supply of

imported logs was 4,905,000 cbms, 3% less. North

American logs, New Zealand logs and South Sea logs

decreased.

By use, supply for plywood was 5,287,000 cbms, 5.7%

more than 2017 in which domestic wood increased by

9.0% to 4,492,000 cbms. Plywood mills operated

smoothly without much trouble in 2018 then Nisshin

started new plywood mill.

By species, cedar was 2,851,000 cbms, 9.2% more then

cypress was360,000 cbms, 18.8% more. In 2019, Shinyei

Plywood¡¯s Ohita plant and Keytec¡¯s Yamanashi plant will

start up so supply of domestic wood will increase further,

getting close to 5,000,000 cbms.

Total of imported wood for plywood was 795,000 cbms,

9.9% less. Russian logs increased by 9.4% but North

American logs decreased by 12.1% and South Sea logs

also decreased by 1.5%. The largest decrease was New

Zealand logs by 45.5%. Russian logs covered shortage of

North American logs (Canadian Douglas fir logs), which

prices soared and the supply was tight in competition with

booming North American demand.

Wood supply for lumber was 16,672,000 cbms, 0.8% less.

Domestic wood was 12,563,000 cbms, 0.5% less while

import wood was 4,109,000 cbms, 1.5% less. Import of

lumber in 2018 was 5,968,000 cbms, 5.6% less. Shipment

of domestic lumber was 9,202,000 cbms, 2.7% less.

Since KD lumber shipment was 3,930,000 cbms,

unchanged from 2017 so green lumber for construction

was the main decrease. Green lumber supply for public

works and crating increased. Number of sawmill was

4,582 in 2018, 232 down from 2017. Small sawmills

continue quitting while large mills get larger. 73% of log

consumption was by large mills with power output.

Domestic lumber production of laminated Lumber

The Ministry of Agriculture, Forestry and Fisheries

disclosed domestic production of structural laminated

lumber in 2018. It was 1,852,000 cbms, 0.3% less than

2017. By size, large size decreased by about half. Medium

size decreased by about 10% then small size increased

more than 50%.

Imported structural laminated lumber in 2018 was 813,215

cbms, 6.3% less than 2017 so total supply of structural

laminated lumber in 2018 was 2,665,215 cbms, 2.2% less.

Production of CLT was 14,000 cbms.

In domestic production, large size was 27,000 cbms,

50.9% less than 2017. Medium size was 784,000 cbms,

9.4% less. Small size was 1,041,000 cbms, 11.0% more.

Others like interior finishing and decorative lumber was

71,000 cbms, 37.2% less so total production of laminated

lumber was 1,923,000 cbms, 2.4% less.

Consumption of lamina was 2,691,000 cbms, 2.3% less.

By source, domestic was 1,051,000 cbms, 15.7% more and

the import was 1,640,000 cbms, 11.2% less. Domestic

share increased to 39.1% from 33.0% in 2017. Obviously

domestic cedar lumber increased.

Total supply by size including imports is 27,804 cbms of

large size, 50.6% less, 1,138,956 cbms of medium size,

7.7% less and 1,498,445 cbms of small size, 4.4% more.

Domestic production of small size increased but imports

decreased by 7.9%.

The market of structural laminated lumber in 2018 was

inactive through whole year so despite high imported

lamina cost, market prices did not climb to cover the high

cost.

Whitewood laminated post supply increased since 2017

then by reduced imported post, the market recovered in

late 2018 and the market prices were up some after

inventory adjustment was made but the market prices are

not high enough to cover high cost.

Redwood laminated beam market was bullish in early

2018 then the supply increased and the market skidded in

spring. Inventory of imported redwood laminated beam

increased in the second half of the year so the prices

dropped. Number of laminated lumber manufacturing

plant was unchanged from 2017 at 165 then CLT

manufacturing plant was nine, two more then 2017.

Plywood

Movement of both domestic and imported products has

been stagnating. Large precutting plants¡¯ operations were

active in April so market recovery was expected but

lengthy holidays started before market got active so

trading firms are worried about downside of the market in

May with lower prices and the manufacturers try to tighten

the market while the market prices are softening.

March plywood production was 275,000 cbms, 0.5% less

then March last year and 4.3% more than February.

Softwood production was 263,200 cbms, 1.3% less and

r.1% more.

Shipment of in March was 256,200 cbms, 1.8% more and

1.4% more. March end inventories were 124,100 cbms,

7,000 cbms more than end of February.

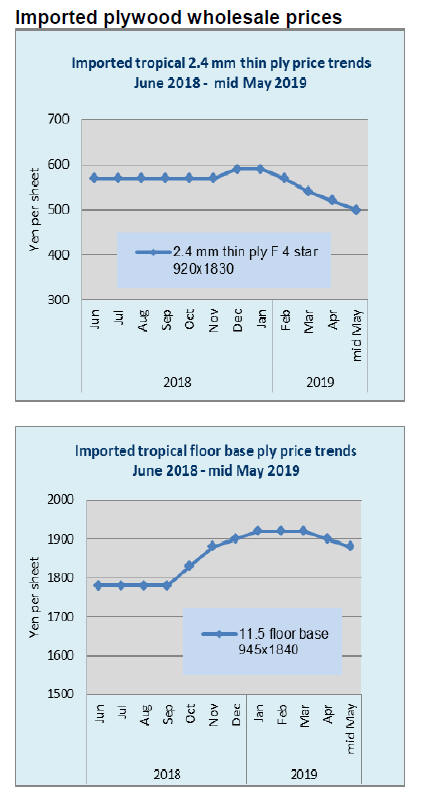

Movement of imported plywood is stagnating and the

prices are weakening after some trading firms

offered low prices of 12 mm panels to reduce on-hand

inventories in March for book closing.

The inventory of distributing dealers is increasing due to

confusion of warehouse management by increased

container shipments and uneven mixture of imported

items. 12 mm panel is not particularly heavy in inventory

but 12 mm is easy to market so low price of 12 mm is

confusing the market. The importers try to restructure the

market since April but it is not easy when the demand is

weak.

Tokyo Metropolitan government allocates

larger

budget for wood use

For 2019 budget, the Tokyo metropolitan government

intensifies utilization of local wood and allocates total of

1,620 million yen, 5.6 times more than 2018 budget. It has

started subsidising to put up wooden fence when concrete

wall of public schools and private residence are removed.

It also promotes using wood fence made by locally

produced wood when concrete block wall of public

facilities is removed.

It allocated 170 million yen for wooden table, bulletin

board and outdoor bench in public facilities including

2020¡¯s Tokyo Olympic facilities. It encourages to use

wood produced in Tama area of Tokyo.

550 million yen is allocated for exterior wall and other

exterior use, which needs to use 30% or more of Tama

wood. It also gives financial support if public schools use

wood for any part of the facilities.

Issue of domestic wood supply

Stock of timber in Japan has been increasing year after

year and recent investigation reveals is 5.2 billion cubic

meters. In this planted timber is 3.3 billion cbms, almost

doubled in 30 years. The administration says resources

have matured. 85% of planted timber is more than forty

years and well matured for harvest. However, log demand

in 2017 was 29,520,000 cbms, only 0.9% of total stock.

Therefore, expansion of log demand is urgent issue so the

administrations have been supporting capital investment of

wood processing facilities and development of demand.

Now in some areas where new sawmills and plywood are

built, log supply shortage is occurring so the voices are

saying there is enough capital investment and no need to

stimulate log demand but expansion of log supply is

necessary.

Ideal plan is that log and lumber prices climb by

increasing demand, which stimulate log supply then

number of workers for log harvest and log processing

facilities increase, which vitalize local economy.

Since 2017, many lumber mills, plywood mills, laminated

lumber mills and biomass power generation facilities have

started up one after another so log prices climbed but log

supply did not increase to satisfy expanded demand and

log supply shortage escalated in many areas. Log shortage

will get worse since there are more new log consuming

facilities after this year.

The largest reason of supply shortage is labor shortage.

Many forest workers are aged and have been retiring while

young workers are not enough to fill the gap of retired

workers. High performance forest harvesting machines

have been introduced and logging road system has been

developing but shortage of absolute numbers of workers

make it hard to utilize such machines efficiently. Such

machines attract young workers so this is one of effective

measures to draw young workers for forest business.

Workers engaged in forest harvest in 2015 were 20,910,

2,241 increase in ten years but it is less than half of 1985.

Workers engaged in replantation in 2015 were 19,400,

75% less than 1985 and less than half of 2000. If clear

cutting system continues, replantation would be way

behind cutting.

Another reason is recent trend of increasing clear cutting,

which requires replanting and clearing under bush. This

takes workers from harvesting works.

Increasing number of biomass power generation plants

impacts supply of low grade logs for sawmills. For fuel, C

class small logs are used. This used to be used for wood

chip for paper manufacturing plants and some selected

logs are sent to sawmills to produce low priced disposable

type lumber like crating and lumber supporting concrete

forming panels.

This type of lumber has demand all the time so log

suppliers made such sorting as long as the prices are

higher than wood chip. Now biomass plants use large

volume of logs for fuel and log suppliers prefer to send all

type of low grade logs direct to biomass plants rather than

sorting for sawmills.

Now low grade lumber manufacturing sawmills suffer log

shortage critically. If this trend continues, such sawmills

are forced to quit and low grade, low priced lumber supply

would stop so log supply shortage is likely to cause

shrinkage of wood demand.

Large users of domestic wood are categorized into three.

First is lumber mills. Second is plywood mills and LVL

plants. Third is wood biomass power generation plants.

In last several years, large sawmills, which consume more

than 100,000 cbms annually, have been built one after

another.

Large sawmills need large amount of logs but log supply

is not even all through a year and it fluctuate by the

season. Since log quality is inferior during summer months

so log supply decreases in summer months and the log

prices tend to climb. Thus, unlike plywood and biomass

business, lumber business suffers periodical log shortage

by season.

Plywood mills have established stable log supply structure

with local forest unions. Softwood plywood made by cedar

has been main material for structural panel then in recent

years, new demand like floor base, and concrete forming

has been increasing. For these, various different species

are required such as cypress, fir and larch.Fir is mainly

produced in Hokkaido.

This is highly demand for floor base but he supply is

limited and ships to transport logs to main-island are hard

to come by. Larch also grows in limited area and demand

for lumber is very strong so it is chronically short in

supply. Cypress is easy to obtain during harvest season but

it becomes hard to find during rainy season of June and

July because log suppliers reduce the harvest when logs

are easy to deteriorate.

Problem of biomass is utilization of unused fiber left in the

woods such as branches, roots and chunks. These are

original idea of biomass fuel when FIT started but it takes

a lot of labor to get them out so it is costly as fuel so the

plants tend to use thinning, low grade small logs, imported

wood chip and PKS, which are more economical than

fiber left in the woods. Future issue is how leftover fiber

can be removed and distributed economically.

In total stock of planted timber of 3.3 billion cbms, cedar

is 1.9 billion cbms, 57.6% in total. Cypress is 738,980 M

cbms, one fourth of cedar and larch is 223,580 M cbms.

Assuming all of 3.3 billion cbms is harvested at any

desired time, can log demand be satisfied ? First is prices.

Prices are not always agreed with timber owners then type

of logs users demand is not always same by species and

size of logs.

With new demand like biomass power generation and log

export, any type logs can be sold at 6,000-8,000 yen per

cbm but once the prices exceed 8,000 yen, type of logs to

meet this high price is limited.

Like cedar logs with more than 30 centimeters in diameter,

it is hard to market while timber keeps growing so

percentage of large diameter logs is increasing.

In stock of cedar of 1.9 billion cbms, 46-65 age class is

1.173 billion cbms, 60% of total. Therefore, it is urgent

issue to find market of larger diameter cedar logs.

Plywood mills can use larger logs now but the prices may

be same as small cedar logs so this may not be the solution

unless log suppliers are willing to accept low prices.

|