3.

MALAYSIA

Plantation expansion in Sabah to get

Federal help

Primary Industries Minister, Teresa Kok, said the Federal

government will assist Sabah in its reforestation efforts.

She said her ministry and the Sabah Forestry Department

have identified a site in the east coast for part of the

reforestation programme.

In advance, the two agencies will undertake a wildlife

survey in the area proposed for plantation development.

She also referred to the Federal government’s decision to

limit further oil palm cultivation and to ban the conversion

of forest land for oil palm cultivation as well as a ban on

planting oil palm on peatland.

Revised Pahang tax levels to stay say Chief Minister

The Pahang Chief Minister, Wan Rosdy Wan Ismail, said

Pahang state has no intention of lowering its timber tax

which was raised in June last year.

The Chief Minister said the latest increase was the first for

31 years and was considered reasonable and is lower than

in some other states. Perak, Terengganu and Kelantan

have raised their tax rates three or four times over the

same period. The tax increase will raise State income from

timber to around RM200 million from RM100 million.

Timber sector wants to be included in foreign worker

regularisation programme

The Sabah Timber Industries Association (STIA) has

indicated it hopes that the state government will consider

applying the ‘Regularisation Programme’ for illegal

foreign workers in the plantation and agricultural sectors

to all sectors in Sabah, particularly wood-based

manufacturing.

STIA President, Chua Yeong Perng, said the conditions of

the new regulation should be applied to all so that

employers in other sectors have the same benefits as

plantation and agriculture sectors. STIA welcomed the

decision of the Government to require the Immigration

Department to introduce the new rules. Chua said local

manufacturers in the wood-based sector cannot attract

local workers and that the level of automation in the

industry is still very low.

Tallest tropical tree

Scientists in the UK and Malaysia reported they have

discovered the world's tallest tropical tree measuring more

than 100m (328ft) high. The yellow meranti was found in

Sabah by a team from the University of Nottingham last

year.

https://www.nationalgeographic.com/environment/2019/04/worl

ds-tallest-tropical-tree-discovered-climbed-borneo/

Sarawak timber sector suffering reduced margins

Sarawak timber companies are seeing margins decline

because of higher production costs of logging and the

introduction of new tax structures in the timber sector.

According to the Sarawak Timber Association (STA) the

increase in hill timber rehabilitation and development cess

(tax), at RM55 per cu m has pushed up operating costs

significantly.

In addition, rising wages, reduced harvest levels and

implementation of forest management certification scheme

had contributed to the current high cost of production.

By 2022, the Sarawak Forest Department wants all longterm

forest timber licensees to achieve forest management

certification to ensure sustainable management. Against

this background the STA said the state forest industry is

going through a period of transformation and a change

from raw material supply from natural forests to supply

from planted forests.

Bintulu Port expansion planned

Bintulu Port plans to expand capacity at its Bintulu

International Container Terminal (BICT) to cope with

rising demand. There has been a double-digit growth in

container throughput for three consecutive years.

The BICT handled 349,792 TEUs (twenty-foot equivalent

unit) last year, representing a 13% growth over 2017 and

the highest ever traffic according to Mohammad Medan

Abdullah the Bintulu Port chief executive. A feasibility

study on the expansion is currently under way.

4.

INDONESIA

Indonesia and UK discuss

trade agreement

anticipating Brexit

Indonesia and the UK are beginning discussions on

bilateral cooperation in anticipation of the UK leaving the

European Union. Dino Kusnadi, Director (Europe) in

Indonesian Ministry of Foreign Affairs said that one of the

trade agreements being explored was for timber traded

under the FLEGT-VPA between the EU and Indonesia.

Soewarni, the Chairman Indonesia Sawmill and Wood

Working Association (ISWA), welcomed the

government's move to expand timber and wood products

trade with UK as this could boost exports of wood

products.

See:

https://ekonomi.bisnis.com/read/20190401/99/906829/asosiasikayu-

olahan-siap-optimalkan-pasar-inggris

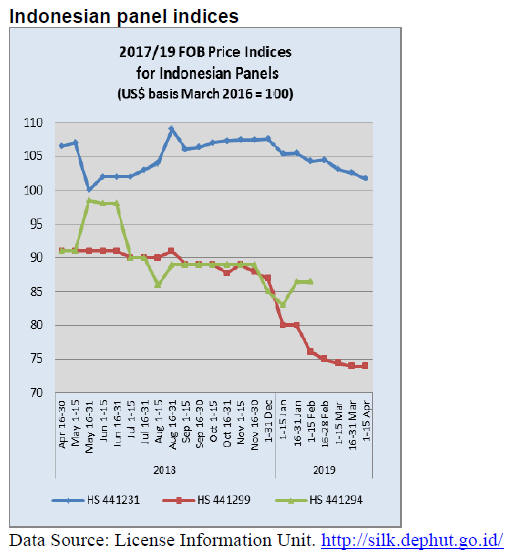

APKINDO seeks unified tariffs for meranti/seraya

plywood

The plywood industry has complained that import duties

for Indonesian and Malayasian wood products in the EU

should be unified.

Gunawan Salim, Marketing and International Relations

Executive in the Indonesian Wood Panel Association

(Apkindo) said the issue of import duty differences

between meranti plywood from Indonesia and seraya

plywood from Malaysia to the EU needs to be addressed

as Indonesian exporters are at a disadvantage.

He stated that the import duty on meranti plywood from

Indonesia is 7%, while the import duty on seraya plywood

from Malaysia is 3.5%. Gunawan explained that these two

names are commercial names for the same timber.

See: https://ekonomi.bisnis.com/read/20190401/99/906911/flegtvpa-

lebih-efektif-bila-bea-masuk-sama

Furniture industry – please relax regulations

Indonesian furniture entrepreneurs have asked the

government to relax a number of rules affecting

production of processed wood saying the Ministry of

Trade Regulation No. 110/2018 concerning imports

without a Limited Prohibition (Lartas) license and SVLK

implementation are some rules that need to be revised.

Trade Ministry Regulation 110/2018 regulates imports and

this is a problem say manufacturers. If the regulation was

removed, furniture entrepreneurs could more easily obtain

production materials and would not have to wait for

permits to be approved for the import of accessories used

in furniture production.

In addition, the implementation of SVLK to downstream

industries hampers the performance of furniture sector.

The certificate should only be applied to the upstream

industry as it is intended to prevent illegal logging.

China’s domestic furniture consumption an

opportunity for Indonesia

Abdul Sobur, Secretary General of the Indonesian

Furniture and Handicraft Industry Association (HIMKI),

has projected that furniture consumption in China could

reach US$225 billion annually and this represents an

opportunity for Indonesian exporters if they are smart.

He said a product that can be immediately promoted for

the Chinese consumer is rattan furniture, a segment where

Indonesia has an advantage. In addition to exporting to

China the furniture industry should also seek cooperation

with Chinese enterprises to invest in the country.

See:

https://ekonomi.bisnis.com/read/20190408/257/909172/chinajadi-

pasar-mebel-terbesar-dunia#

5.

MYANMAR

Anti-Corruption measures

highlighted

In 2018, the Myanmar parliament enacted a tough forest

law that threatens violators with up to 15 years in prison in

a bid to conserve the country’s fast-dwindling forest

resources.

Under the new law, which was enacted on September 20

2018, forestry staff can also be punished for accepting

bribes or for being involved in the extraction, transfer or

possession of illegally harvested logs or forest products.

U Nyi Nyi Kyaw, Director General of the Forest

Department under the Ministry of Natural Resources and

Environmental Conservation, said an education campaign

would be conducted to inform the public on the new law.

Union Minister for Natural Resources and Environmental

Conservation U Ohn Win called for greater efforts to

eliminate corruption in the country’s forestry sector.

FDI on the rise after 2 year slump

According to Myanmar Investment Commission (MIC)

the flow of foreign investment into Myanmar has started to

rise after declining for the past two years. Between

October 2018 and March 2019, Myanmar received US$1.9

billion in approved FDI. During the period October 2017

to March 2018 the equivalent number was US$1.3 billion

for over 80 projects.

Singapore has overtaken China as the major investor in

Myanmar. In February last year, Singapore invested

US$20.88 million for 302 projects and China invested

$20.41 million for 314 projects, according to DICA

figures.

Myanmar is attracting more investment spurred by the

new Myanmar Investment Promotion Plan and

establishing a new ministry, the Ministry of Investment

and Foreign Economic Relations with the objective of

raising local and foreign investments and creating

opportunities for entrepreneurs.

A UN-mandated Fact-finding Mission on Myanmar

(UNFFM) recommended that all business enterprises

active in Myanmar, trading with or investing in businesses

in Myanmar should demonstrably ensure that their

operations are compliant with the United Nations Guiding

Principles on Business and Human Rights (UNGPs).

6. INDIA

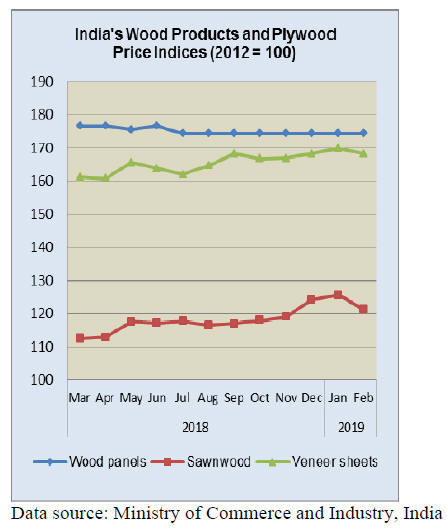

Higher particleboard prices lifts

price index

The official Wholesale Price Index for ‘All Commodities’

(Base: 2011-12=100) for the month of February, 2019 rose

to 119.5 from 119.2 for the previous month. The index for

manufactured wood and cork products rose due to higher

prices for particleboard. However, prices for sawnwood

dropped pushing down the index.

The annual rate of inflation based on monthly WPI in

February 2019 stood at 2.93% compared to 2.76% for

January.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

India not a DIY country - IKEA changes

business

format

The online retailer IKEA is changing its business model to

suit the market as India is not a DIY market but rather a

serviced market. IKEA will open mall style retail outlets

and will address servicing by teaming up with Indian

companies. The Swedish retail firm has been clear that it

sees India as a long-term market and has made significant

investments in the country.

The Indian retail industry is expected to grow to US$1.1

trillion by 2020 according to a report by Deloitte and the

Retailers Association of India.

Gloomy prospects for home prices

According to a recent report by Liases Foras, a Mumbaibased

housing research company, because home sales are

unlikely to improve in the short term, construction

companies are finding it difficult to escape the debt trap

they are in as they cannot service their debt obligations

because of low sales and high inventory.

https://www.liasesforas.com/

In recent years access to credit and funding has become a

major problem for builders as the advances on homes from

buyers and financing from investors is insufficient to

service loans.

This problem has been made worse since the Reserve

Bank of India (RBI) changed its guidelines to banks on the

risks associated with loans to builders which resulted in

banks offering less support to the sector.

According to a report from Liases Fores there is a housing

inventory of about 41 months in the top eight cities in

India and this has created a crisis for developers.

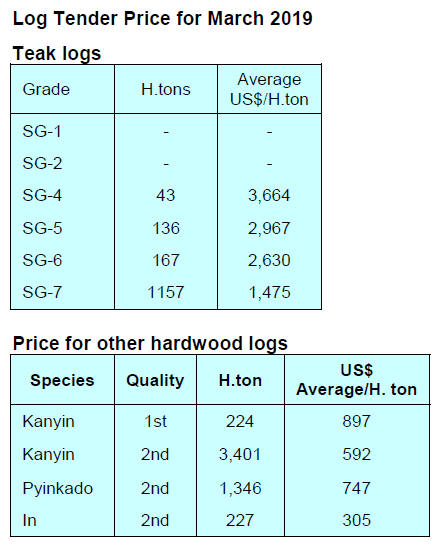

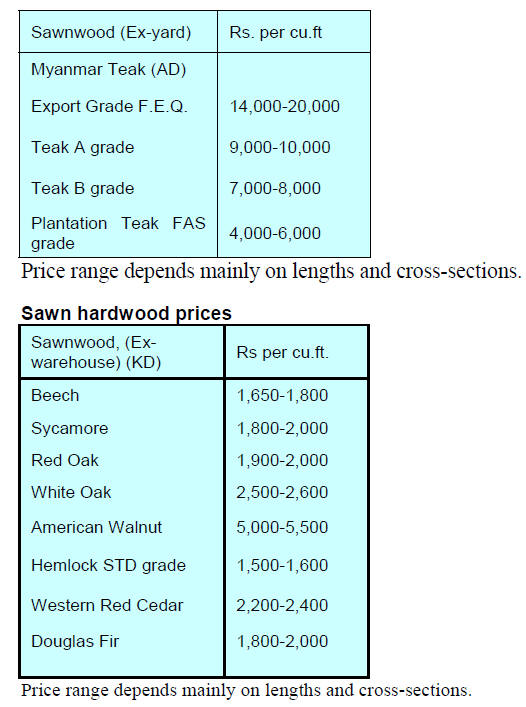

Plantation teak prices

The Rupee continues to firm against the dollar bringing

cheer to importers. Traders still anticipate further

strengthening of the Rupee.

Analysts report that demand for imported plantation teak

is firm and recent delivers have been of good quality

especially those from South American and African

shippers.

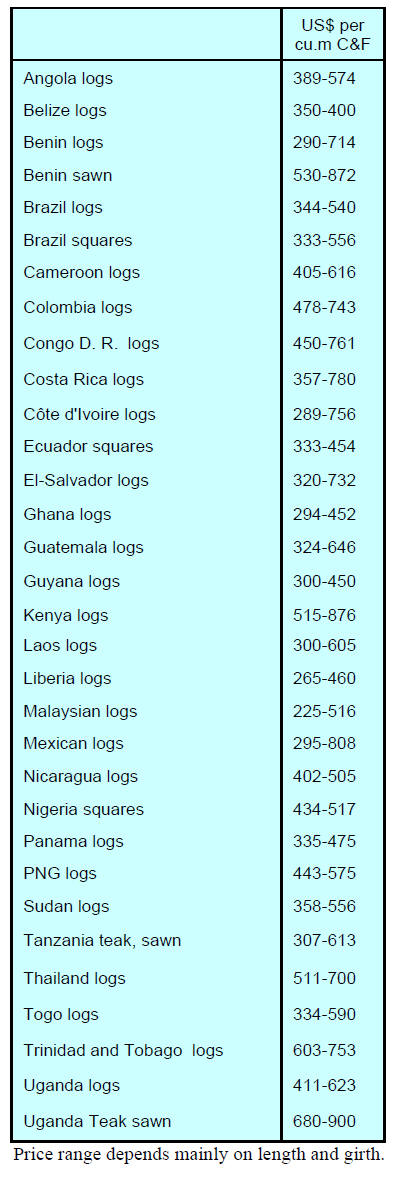

C&F prices for plantation teak landed at Indian ports are

within the same range as shown in the previous report.

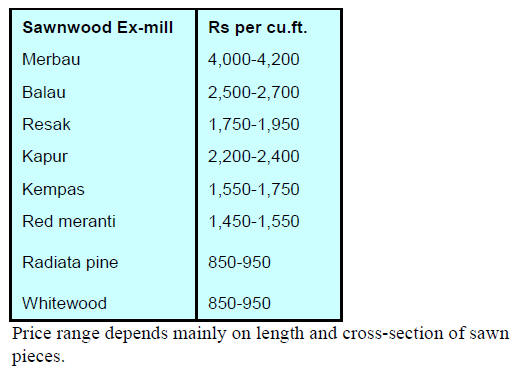

Locally sawn hardwood prices

Prices for imported sawn hardwoods remain unchanged.

Myanmar teak prices

The pace of import growth from Myanmar is being

sustained but demand is getting ahead of supply say

analysts. The importers in India are appealing for greater

output and exports from Myanmar.

Middle East demand for teak products from India is

weakening as importers there have switched to iroko as a

good substitute for Myanmar teak.

Prices continue as previously reported.

Indian importers are showing more and more interest

in

hardwoods from the US, Canada and some European

countries such as Finland and Sweden.

This is helping to stimulate demand as buyers have wider

range of timbers to choose from. Indicative prices for

some imported timbers are shown above.

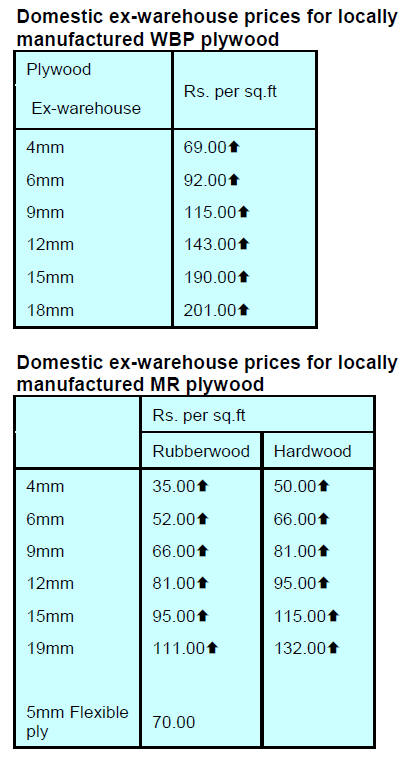

Increased capacity pushing up plywood log prices

Situation in the plywood sector is unsettled at the moment.

Many new manufacturing licenses have been offered in

various states such that production capacity has risen

significantly without a corresponding increase in demand.

There has been a rise in the log raw material price and

mills seek logs to sustain output and this, along with a

shortage of labour and supervisory staff is testing the

profitability of manufacturers which has resulted in

plywood prices being increased. But whether the new

prices can be sustained is questionable as demand is not

expanding. Manufacturers have raised prices by about

10%.

Plants in Gabon continue to ship veneer to India.

Production is increasing as more Indian companies invest

in veneer production in Gabon.

7. BRAZIL

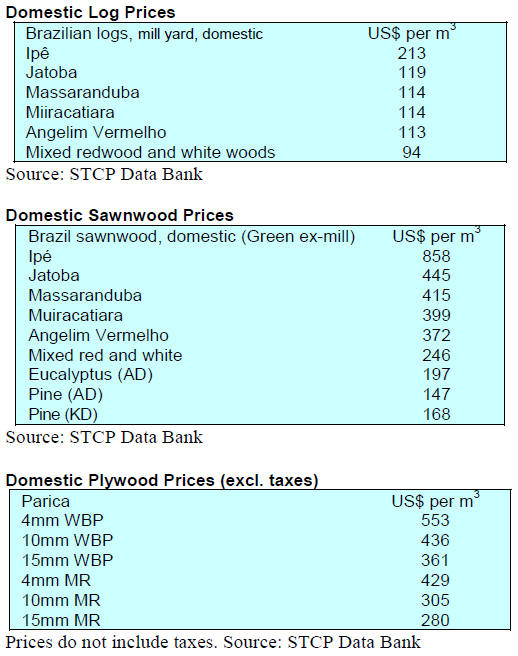

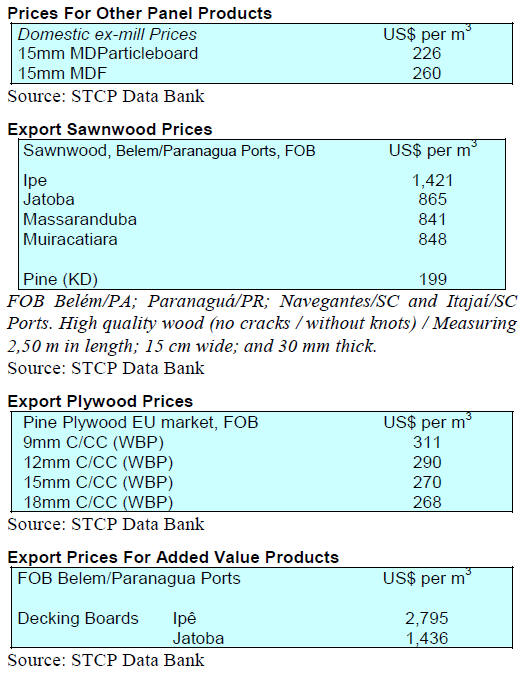

Rising log demand for export production

Against the background theme of "Forests and Log

Market", a workshop, arranged by the Brazilian

Agricultural Research Corporation (EMBRAPA) and the

Paraná State Forest Based Companies Association

(APRE), concluded that there has been a sustained rise in

demand for logs for domestic processing.

Demand for roundwood is high despite the low level of

domestic economic growth and this is because more

companies are exporting. Log consumption is estimated at

around 14 million cu.m annually.

Most log consumers are vertically integrated but also

purchase between 30% and 40% from the open market.

Participants at the workshop reported some problems with

supply as logs have become of smaller diameter and

transport distance are rising.

Paraná and Santa Catarina states have expanded

eucalyptus plantations by 190,000 hectares because of

demand from forestry companies that prefer eucalyptus

which offers shorter rotations and increased yields

comaperd to pine.

Increasing planted forests areas

The National Forest Development Plan prepared by the

Brazilian Agricultural Research Corporation (Embrapa

Florestas) aims at a 20% increase in the area of planted

forest to achieve a national target of 20 million hectares of

commercial forests by 2030.

Currently, according to the Brazilian Tree Industry (IBA),

the planted forest area is 7.8 million hectares of mainly

eucalyptus, pine and acacia. The area with planted forests

occupies only 1% of the national territory but accounts for

91% of all wood produced for industrial purposes. The

planted forest productivity averages of 35.7 cu.m/ha./year.

New measures from the Brazilian Forest Service and the

National Plan for Development of Planted Forests (known

as PlantarFlorestas) were discussed at a recent meeting of

the Production Chain of Planted Forests at the Ministry of

Agriculture, Livestock and Food Supply (MAPA).

One issue raised was the need to preserve and protect

natural vegetation in some 5.6 million hectares of natural

forests under private ownership.

2019 Furniture Fair BtoB events yield results

An “International Buyer Project” has been developed by

the Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (APEX - Brazil) and this was

introduced at the 2019 Furniture Fair (Movelpar) arranged

with the support of the Union of Furniture Industries of

Arapongas (SIMA) and EXPOARA.

Movelpar brought together 60 Brazilian industries and 30

importers from 11 countries including North America and

the Middle East to build business and commercial

partnerships.

According to ABIMÓVEL, 740 business rounds were held

of which 60% were new commercial contacts between

Brazilians and international buyers. The projections are of

orders for US$13.6 million of Brazilian products.

So far this year two events under the International Buyer

Project have already been carried out by ABIMÓVEL and

APEX-BRASIL.

Exports increase from in São Bento do Sul

In 2018 a furniture industrial center in São Bento do Sul

municipality, in Santa Catarina State, one of the main

furniture export regions, registered an increase in exports.

2018 export revenues from industries in São Bento do Sul,

Campo Alegre and Rio Negrinho region reached US$165

million, up 30% compared to 2017. São Bento do Sul is a

top Brazilian municipality for furniture exports with a

16% share of national exports.

Export revenues in the region represented 58% of the total

furniture exports from Santa Catarina State and 23% of the

national total. The country's furniture industries exported

US$723 million, up 9.9% over the previous year and Santa

Catarina state US$283 million, up 19.5.

According to the Union of Construction and Furniture

Industries of São Bento do Sul (SINDUSMOBIL) export

growth was mainly driven by two factors; the exchange

rate has been favourable to exports and over the last few

years more companies started to export because of weak

domestic market.

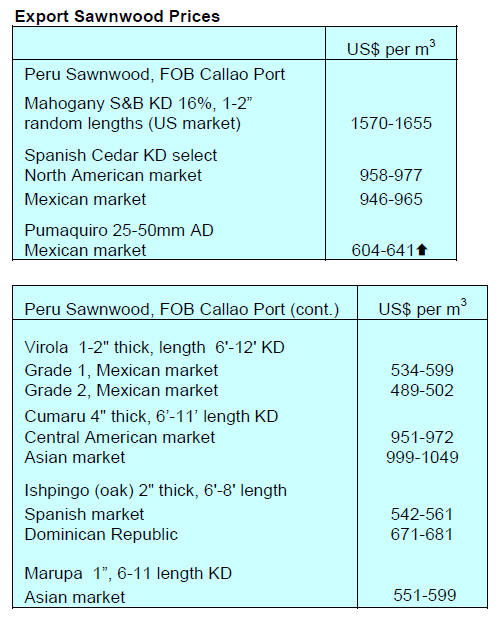

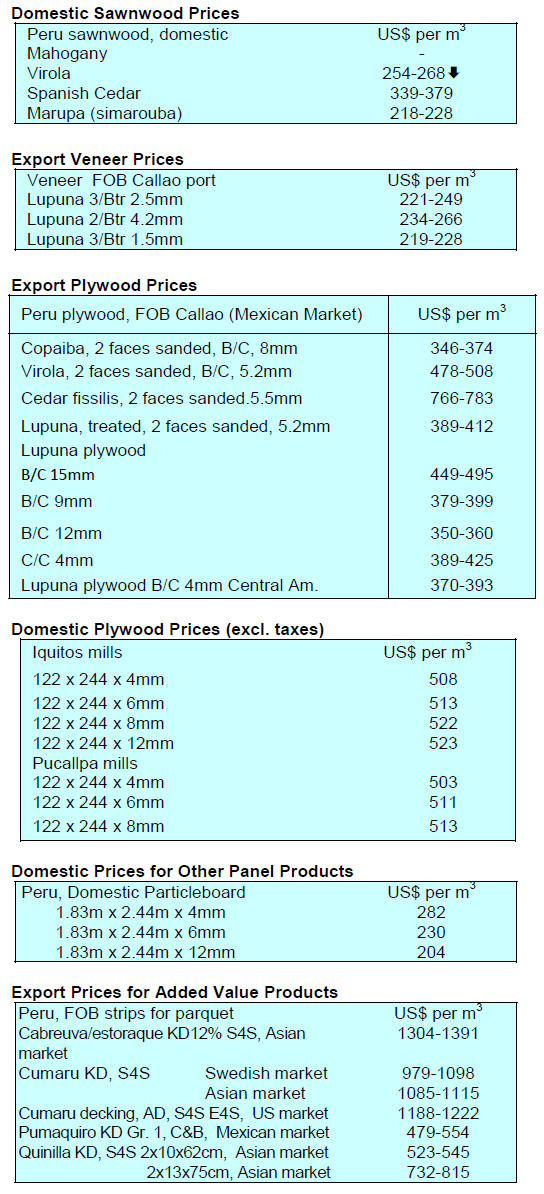

8. PERU

Responsible utilisation the key to

sustainability

During a recent Spain/Peru Business Meeting, Erik

Fischer, Vice president of the Association of Exporters

(ADEX), emphasised the economic strengths of the

country and the Government's commitment to further

development of the forestry and timber sectors as a new

driver of growth.

Fischer commented that the development of forest

plantations and the responsible and sustainable use of

Peru’s extensive natural forests can be effectively

managed through closely monitored forest concession

models.

Fischer pointed out that it has been observed by several

agencies that most of the deforestation in Peru is due to

shifting agricultue which is not sustainable.

January exports at new high

According to ADEX, January 2019 exports of Peruvian

wood products totalled US$11 million FOB. This

compares to the US$7.1 million exports in January 2018.

Of the US$11 million exported in January 2019, China

was the main destination with a 34% share but demand in

China has fallen sharply (-60%) compared to 2018. France

was the second placed market with 15% share.

Sawnwood exports in January this year were US$1.9

million FOB, up 4.3% on the previous year.

The main destination for export sawnwood was the

Dominican Republic with a 32.4% share; second was

Mexico followed by China.

SERFOR and WWF cooperation in promoting SFM

The National Forestry and Wildlife Service (SERFOR) of

the Ministry of Agriculture and Irrigation and WWF Peru

have signed an agreement for cooperation in promoting

mechanisms for sustainable management of forests and

wildlife in Peru.

This cooperation will strengthen coordination of work

between both institutions with the aim of contributing to

scientific research, promoting the restoration of degraded

landscapes, supporting the development of local capacities

and promoting the management and sustainable use of

flora and fauna resources, through alliances with our

indigenous people and other stakeholders.

Transport control system improved

In order to improve the supervision and control of the

Forest Transport Guides (GTF) the National Forestry and

Wildlife Service (SERFOR) has introduced a computer

application that will improve the tracking of wood from its

origin to mill gate.

The tool is called the ‘Application for the Issuance and

Registration of GTF’ and the system is compatible with

cell phones and tablets and has been tested in the

departments of Madre de Dios, Puno, Arequipa and Lima

(Pucusana) whose Regional Forestry and Wildlife

Authorities (ARFFS) and Technical Forestry and Wildlife

Administrations (ATFFS) have been trained.

With this system, it will be possible to track the transport

of the wood in real-time and recover data on the type of

product, the volumes, the species, the destination and

transport used and the point extraction.