Japan

Wood Products Prices

Dollar Exchange Rates of 10th

February

2019

Japan Yen 110.47

Reports From Japan

¡¡

Annual wage negotiations focus on

small company

issues

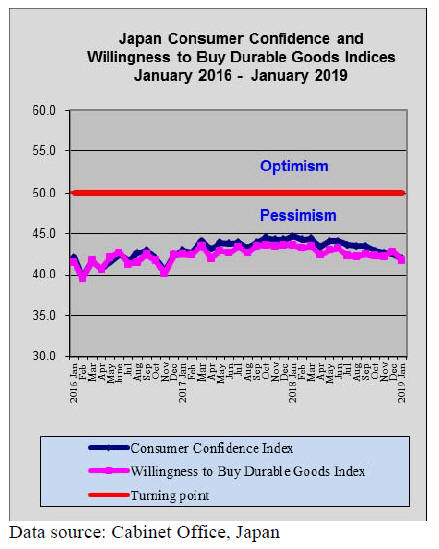

Japan's largest labour and business organizations, Rengo

and Keidanren (the Japan Business Federation) have

agreed in advance of the annual wage negotiations that

workers pay should be raised but have yet to decide on

what basis discussion on raises should be.

However, both agreed that workers income has a direct

bearing on the economy as consumer spending looms

large in the direction of economic growth.

The point made in advance of the wage negotiations by the

leader of Rengo was that most Japanese are employed by

small and medium sized companies who complain they

have not seen any improvement in sales and profit over the

past year.

Continuing saga of inaccurate economic data

In another twist in the saga of Japan¡¯s misrepresented

statistics it has been revealed that there is a serious

divergence between official GDP data and an alternative

series calculated by the Bank of Japan. This follows on

from the revelation that wage growth data was incorrectly

collected.

Japanese commentators say the problem is partly because

there is no central statistics bureau in Japan which means

each Japanese government ministry has its own statistical

department and decides how the data will be collected and

compiled.

Rise in domestic consumption compensates for drop

in exports

Japan's gross domestic product grew in the third quarter

2018 reversing the sharp decline in the previous quarter.

The positive numbers were mainly the result of a rise in

domestic consumption and business investment which

combined to offset weak exports.

Seasonally adjusted GDP rose at an annualised 1.4% in the

fourth quarter according to data released by Japan¡¯s

Cabinet Office.

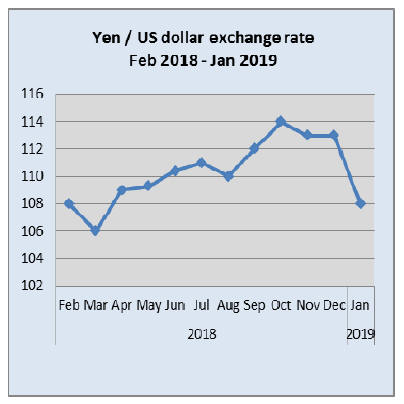

Beginning of US/China trade talks boosted US

dollar

In early February the US dollar strengthened against the

yen on the news that initial talks between Chinese and US

officials on the trade dispute have started. However, the

rise was quickly eaten away after weaker than expected

data on US retail sales was released.

US retail in January dipped below levels seen in 2009 a

clear signal that consumer spending, which accounts for

around two-thirds of the US economy, is weakening.

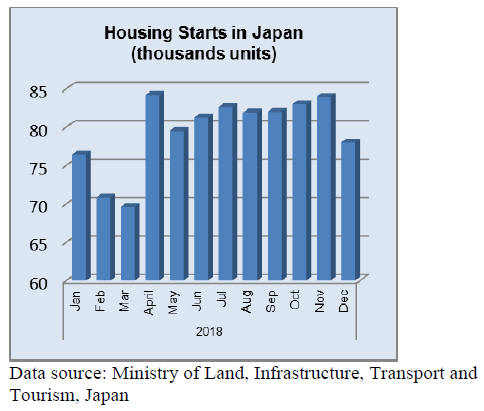

Second consecutive yearly decline in housing

starts

2018 housing starts fell just over 2% year on year marking

the second consecutive decline. Homes in the ¡®for rent¡¯

sector saw a 5.5% drop, the first in 7 months and there was

a slight drop in custom-built homes and other owner

occupied housing. Regionally, starts for housing for sale

rose in both Osaka and Aichi Prefectures but dropped

almost 15% in Tokyo.

Analysts continue to point out there are no signs of

housing starts sky-rocketing in advance of the planned

October consumption tax rise.

Doors

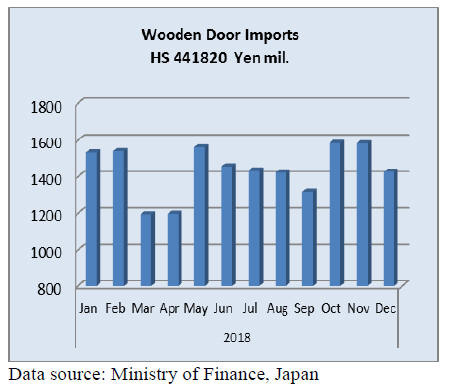

2018 wooden door imports

Japan¡¯s 2018 imports of wooden doors (HS 441820) are

shown below. Year on year there was little change in the

value of wooden door imports. China was the major

supplier accounting for around 60% of all wooden door

imports. Other suppliers included the Philippines 20%,

Indonesia 7%, Malaysia 6% and Sweden 2%. These top 5

suppliers accounted for over 90% of 2018 wooden door

shipments to Japan.

Windows

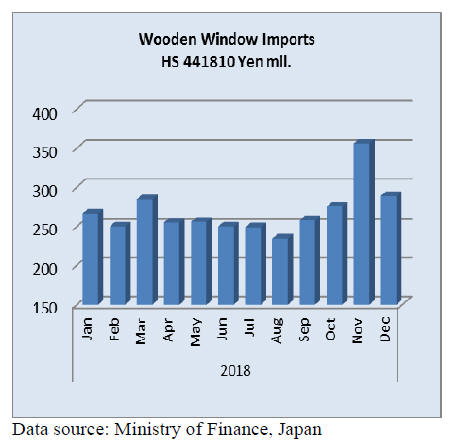

2018 wooden window imports

In contrast to the imports of doors, 2018 wooden window

imports into Japan rose 8% from a year earlier. As in

previous years there was a noticeable rise in second half

year imports with the first quarter of the year being much

quieter.

The top 5 shippers of wooden windows (HS 441810) in

2018 were China 35%, USA 27%, the Philippines 22%

Sweden almost 9% and Italy.

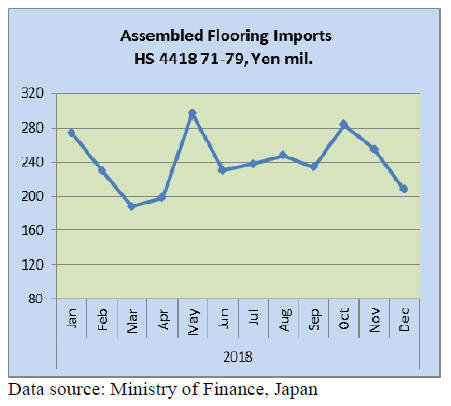

2018 assembled wooden flooring imports

The value of Japan¡¯s 2018 imports of assembled wooden

flooring (HS 441871-79) was unchanged from a year

earlier. As was normal imports dipped early in the year

mainly because of the impact of winter weather on

construction activity.

Wooden flooring in HS441875 accounted for around 80%

of all assembled wooden flooring imports with China,

Thailand and Indonesia providing most of the supply.

HS441879 accounted for 18% of 2018 imports of

assembled wooden flooring being shipped from China

(57%), Indonesia (14%) and Malaysia (9%). The value of

Japan¡¯s imports of HS 441873 and HS441874 is small.

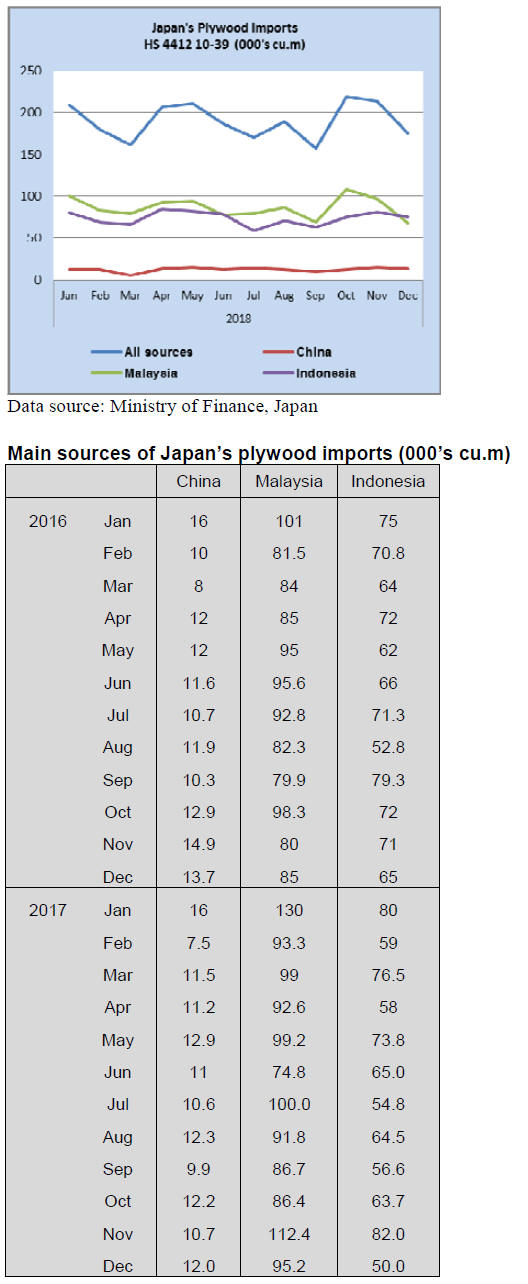

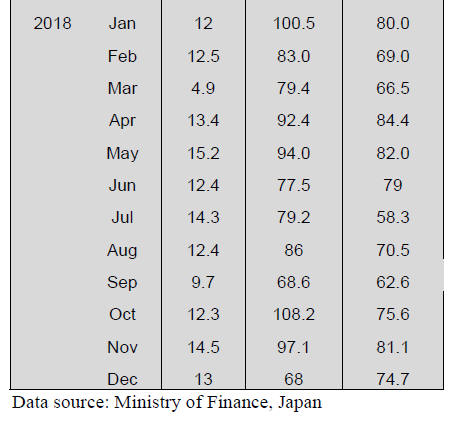

2018 plywood imports

Three supply countries account for over 85% of Japan¡¯s

imports of plywood, Malaysia, Indonesia and China. In

recent years shipments from Vietnam have been

increasing.

In 2018 shipments of plywood (HS 441210-39) accounted

for 45% of all plywood arrivals followed by Indonesia

(39%) and China 6.5%).

There are major changes being seen in Japan¡¯s production

and imports of plywood as supplies from manufacturers in

Sarawak have been forced to reduce production due to

stricter log harvesting regulations.

It is unlikely that any shortfall from Malaysia can be made

up quickly by either Indonesia or Vietnam which is putting

pressure on Japanese plywood makers to source logs from

domestic forest resources, a move that is being actively

encouraged by the government.

¡®Clean Wood¡¯ seminar to report on ITTO study

The Japanese Forestry Agency is developing a website to

provide information to the timber industry on the Japanese

¡®Clean Wood¡¯ Act, laws and regulations.

ITTO has compiled information on five tropical countries

to be included in the ¡®Clean Wood¡¯ website and will

organise a seminar to report on the research undertaken in

the Philippines,Thailand, Brazil, Ecuador and Lao PDR.

Japan¡¯s ¡®Clean Wood¡¯ Act is in support of the promotion

and distribution of legally-harvested wood products.

This Seminar will take place in Tokyo on Friday, 8 March.

For more see:

https://www.itto.int/events/event/id=5925

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Demand projection of imported wood

Five groups of imported wood products such as Japan

lumber Importers Association came up with demand

projection for 2019 by source.

Total of logs and lumber would decline for three straight

years. Lumber would stay the same but imported logs

would decrease. Not only by declining demand for wood

products by dropping new housing starts but also by

withdrawal of wood processing businesses due to high

cost of imported materials.

Log import would be below three million cubic meters,

which is the main factor of dropping imported wood

demand.

Forecast of new housing starts in 2019 is 920,000-930,000

units, slight decline from 2018 so there would not be any

sizable decline of total wood demand.

Consumption tax will be raised from 8% to 10% in

October 2019 but last minutes rush demand surge before

rate increase is not expected.

Forecast of log import is 2,981,000 cbms, about 260,000

cbms less than 2018. The largest decrease of North

American logs by 220,000 cbms to 2,350,000 cbms is the

main factor of decline of log import. The reason is

withdrawal of Toa Ringyo, which is the second largest

Douglas fir lumber manufacturer.

Other Douglas fir lumber manufacturers would try to

cover up shortfall of Toa¡¯s supply volume but 100%

coverage is impossible.

Supply of South sea hardwood logs would continue

declining because of export ban in Sabah and decreasing

supply from Sarawak.

Russian log import would further decline by increase of

log export duty by the Russian government.

New Zealand log cost would continue climbing by

massive purchase by China and sawmills in Japan are

shifting to use domestic species.

Lumber import from North America, South Sea and

Russia would decrease some but from Europe, New

Zealand and Chile would increase so total would be the

same as 2018 with 6,220,000 cbms.

Lumber prices from North America in 2018 climbed

sharply in the first half then dropped in the second half but

basic demand is unchanged in Japan. Cost of European

lumber would continue high particularly of lamina so the

manufacturers in Japan have been struggling.

Demand for North American and European lumber has

been shifting to domestic wood.

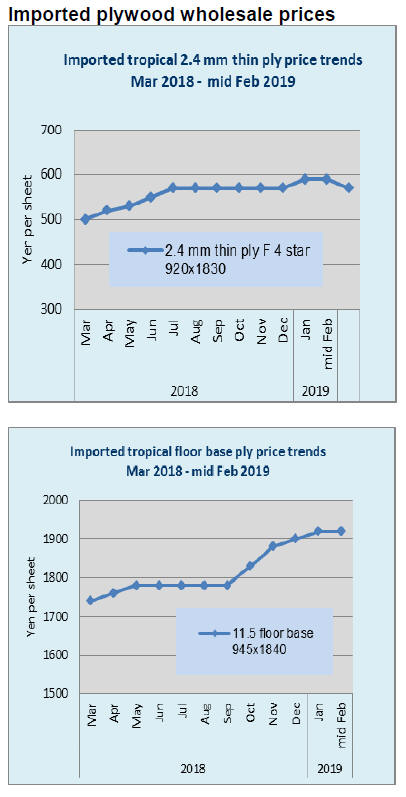

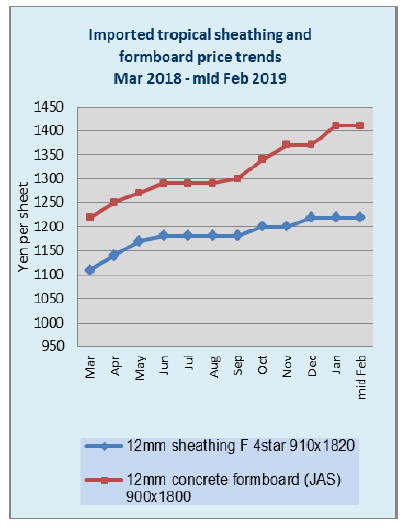

Plywood

Movement of plywood is steady. Orders for domestic

softwood plywood by precutting plants are busy. Some

items of imported plywood are getting tight since future

purchase is inactive because of gap between suppliers¡¯

prices and market prices in Japan. Tight supply would

continue in this situation and dealers, which carry

inventories are marketing cautiously.

Production of domestic plywood in November was

272,600 cbms, 3.6% less than November last year and

1.0% less than October. In this, softwood plywood was

260,500 cbms, 4.0% less and 1.1% less.

The shipment of domestic plywood was 295,900 cbms,

4.9% more and 0.7% more, out of which softwood was

283,100 cbms, 5.4% more and 1.2% more. This is the

record high monthly shipment and first time that the

volumeexceeded 280,000 cbms. Shipment of both

structural and non-structural was active.

The inventories are 140,600 cbms, 22,500 cbms less than

a month ago. Orders in December was active from both

direct route like precutting plants and wholesale channels

and some plywood manufacturers sold out January

production.

As future offer prices of imported plywood continue

climbing by the suppliers, market in Japan show some

signs of tightening. In the second half of last year,

importers reduced purchase volume by climbing export

prices and dull demand in Japan so future arrivals would

continue low.

Inventory of green concrete forming panel and structural

panel is low without any hope of recovery.

South Sea (Tropical) logs and lumber

South Sea hardwood log prices continue climbing after

Malaysia raised minimum wages since January 1,

2019 and Sarawak government increased timber harvest

tax.

Present meranti regular log prices in Sarawak soared to

nearly US$320 per cbm FOB, which

h is almost unacceptable level for users in Japan.

However, log market prices in Japan are holding steady.

Supply source of South Sea logs for Japan has shifted to

PNG and PNG log prices are lower than Sarawak as a

result of slowdown of Chinese log purchase by economic

recession of Chinese economy. Trend of yen¡¯s

appreciation since early this year helps reduce log cost.

Demand for South Sea lumber including lumber from

China continues depressed so that the inventories have not

dropped.

Prices of mercusii pine free board are weak so that the

dealers are not able to place new orders to the suppliers.

Movement of poplar LVL and falcate laminated free board

for DIY stores is firm.

Russia increases log export duty

Export duty on three species (larch, spruce and fir) in Far

East Russia is raised by 15 points to 40% since January

2019.

This will be increased to 80% in 2021, which practically

stops log export. However, if more than 25% of export

sales amount by log exporting companies is processed

products such as lumber, veneer and wood chip for last

three years, log export duty is held at 6.5% for 2019 for

such companies.

Purpose of higher log export duty is to promote

industrialization of Far East forest industry but there are

only limited companies, which already have wood

processing facilities so log export will be more difficult.

For Russian log users in Japan such as lumber and

plywood mills, increasing log export duty means higher

log cost so they have been switching to domestic species

and end users of lumber are buying Russian made lumber

or genban for reprocessing.

Malaysia increases minimum wage

The Malaysian government increases the minimum wage

to 1,050 Ringgit since January 1, 2019. Minimum wage

was set differently in peninsula Malaysia and Sabah and

Sarawak in Borneo before but the government decided to

make one uniform rate in all Malaysia since this year.

The new wage rate is 1,050 Rgt and this is 14.1% increase

in Sabah and Sarawak.It was 1,000 Rgt in Peninsula

Malaysia and 920 Rgt in Sabah and Sarawak.

New Mahatir regime plans to increase the minimum wage

to 1,500 Rgt in five years so the rate will continue to

climb. Furthermore, Sarawak government increases timber

harvest tax. Present rate is 0.6 Rgt (0.14 dollar), which is

raised to 5 Rgt ($1.2) since January 1, 2019. This is to

promote replantation and industrialization of forest

industry in Sarawak.

By increased minimum wage and timber harvest tax,

production cost of plywood would climb by $15 per cbm.

Plywood manufacturers in Sarawak need to increase

export prices by cost push so further price hike is

inevitable.

Present prices are $580-590 per cbm on 3x6 JAS uncoated

concrete forming panel and $680-690 on concrete forming

panel for coating.

|