Japan

Wood Products Prices

Dollar Exchange Rates of 10th

December

2018

Japan Yen 113.34

Reports From Japan

¡¡

GDP likely to be lower than

forecast

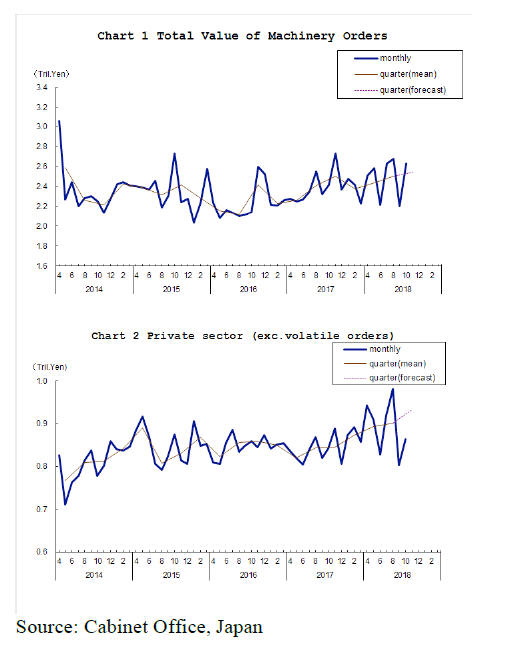

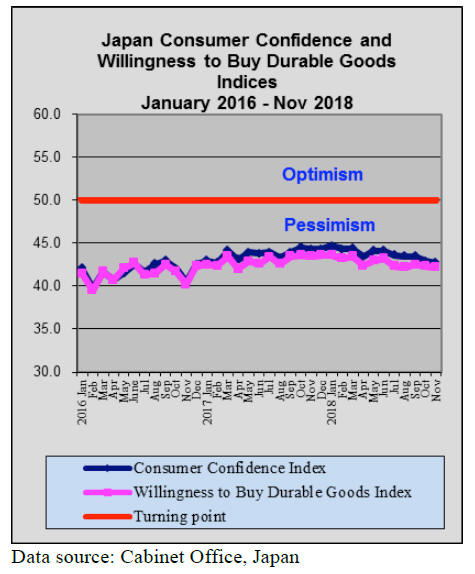

The latest data on manufacturing activity is showing that

in November the pace of expansion was at its slowest for

the past 12 months suggesting fourth quarter GDP may be

lower than forecast. In related news, corporate spending,

while still expanding, is showing signs of tapering off.

See:

https://www.esri.cao.go.jp/en/stat/di/di-e.html

While corporate investment by large and medium sized

companies continued to rise in the October-December

quarter according to the Cabinet Office a recent Reuters

poll is showing that most Japanese firms expect weaker

domestic growth next year amid concerns over the impact

of the US/China trade dispute and the government¡¯s plan

to raise the consumption tax.

See: https://www.reuters.com/article/us-japan-companies/japanfirms-

see-trade-war-sales-tax-pressuring-economy-in-2019-

idUSKBN1O52MN

Dark clouds on the horizon

Revised data shows that Japan's economic growth declined

at an annualized 2.5% in the third quarter 2018 the biggest

drop since the third quarter of 2009. Companies have been

cutting back on investment in anticipation of a tough year

ahead.

As the Japanese economy is very sensitive to export

performance, companies are seeing dark clouds on the

horizon in the form of escalating trade friction between the

US and China.

An alternative view is provided by Robert Carnell, Chief

Economist and Head of Research at ING based on data

provided in the recent Tankan survey from the Bank of

Japan.

The fourth quarter Tankan depicts a brighter picture of

steady economic activity in sharp contrast to the weak

third quarter GDP figures. This is interpreted as indicating

an underlying strength of the Japanese economy.

See: https://think.ing.com/articles/japan-tankan-survey-not-bad/

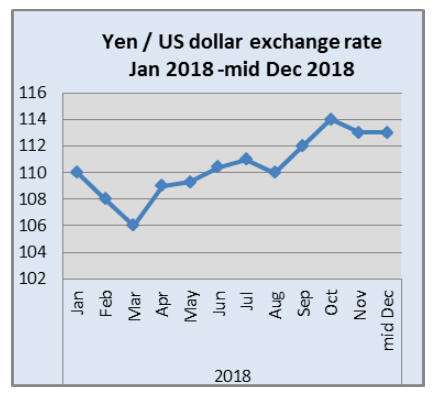

Importers alert - Stronger yen likely in

2019

The Japanese yen/US dollar exchange rate has remained

rather stable for the most of 2018 largely because the Bank

of Japan (BoJ) has successfully held off any appreciation

and because the US dollar has been steadily strengthening

due interest rate increases in the US.

Many observers are now anticipating a change to a

stronger yen driven by changes in policies at the BoJ

which is slowly stepping back from its easy monetary

policy to bring it more in line with the policies of other

central banks.

Such a change will inevitably lead to a stronger yen and

several analysts are now forecasting that, in the medium

term, the yen could strengthen to as much as yen 105 to

the dollar from the current yen 112-3 to the dollar.

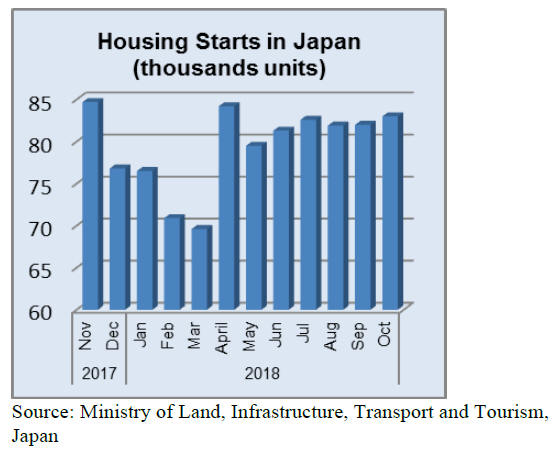

Abandoned homes - even in urban areas

In previous reports mention has been made of the millions

of unoccupied houses across Japan especially in rural

areas. Recent reports have pointed out that, even while

house prices in the cities may be rising here also, there is

also a problem with abandoned homes.

This situation, according to an article in the Japan Times,

has become so acute that some local authorities have

decided to offer subsidies to owners to tear down the old

maybe derelict home and build anew.

Furniture imports

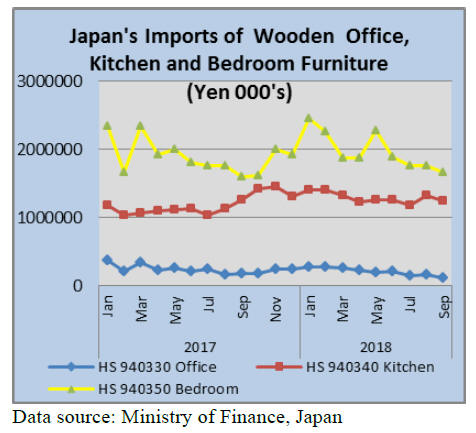

The third quarter of a year traditionally marks a turning

point for Japan¡¯s imports of wooden furniture.

In every year since data has been provided in this report

wooden furniture imports to Japan dip in the first two

quarters of the year and reverse direction in the middle of

the second quarter and an upward trend is generally

recorded into the final quarter of the year. This trend is

already emerging for 2018.

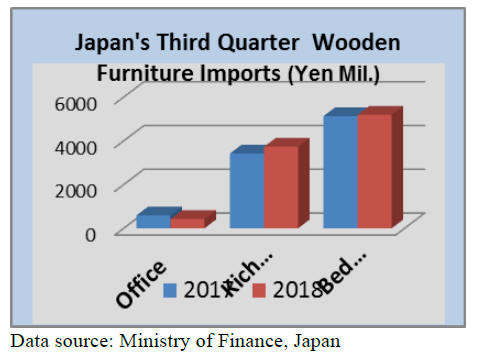

Third quarter wooden furniture imports

Year on year, third quarter 2018 imports of wooden office,

kitchen and bedroom furniture are little changed. For the

third quarter of 2018 the value of wooden office furniture

imports accounted for around 7% of the total for the three

categories in the graphic below.

Wooden kitchen furniture was the second highest in terms

of import values accounting for a further 37% while

wooden bedroom furniture accounted for over half of all

imports.

In the third quarter 2018 imports of wooden office

furniture were down 28% year on year, wooden kitchen

furniture imports were up 8% while the value of third

quarter 2018 wooden bedroom furniture imports were little

changed from a year earlier.

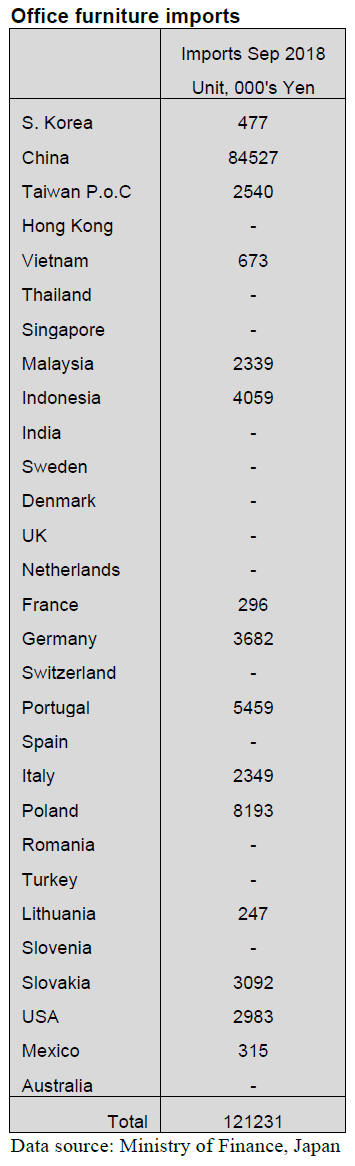

Office furniture imports (HS 940330)

Japan¡¯s September 2018 imports of wooden office

furniture (HS 940330) declined a massive 30% year on

year and were also down 23% from a month earlier. This

trend mirrors the level of imports in the same period in

2017.

The top three shippers of wooden office furniture

(HS940330) to Japan in September were China (70% of all

September imports) followed by Poland (7%) and Portugal

(5%) which translates into the top three shippers providing

82% of all wooden office furniture imports in September.

Shipments from China were up 20% in September and

Indonesia saw a quadrupling of the value of exports to

Japan. The losers in September in terms of shipment

values were Italy where exports to Japan were halved and

the US where there was a significant drop in the value of

shipments.

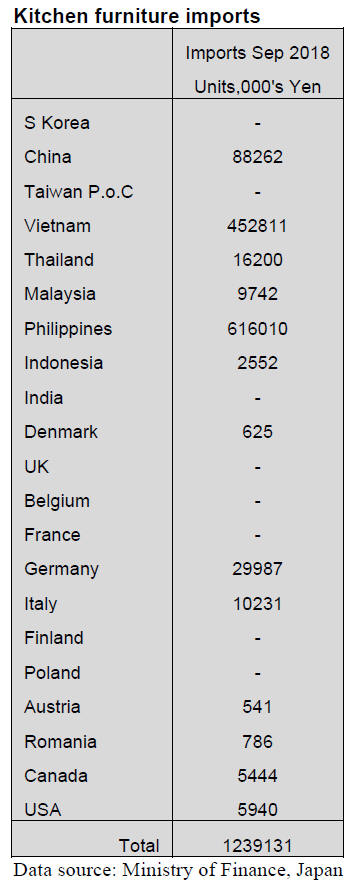

Kitchen furniture imports (HS 940340)

For almost the whole year to September 2018 two shippers

have dominated Japan¡¯s imports of wooden kitchen

furniture, the Philippines and Vietnam.

Shippers in the Philippines accounted for half of Japan¡¯s

imports of wooden kitchen furniture in September 2018

with shippers in Vietnam providing another 37%. The

third largest shipper China could only secure a 7% share

of imports in September.

Year on year, September 2018 imports of wooden kitchen

furniture were flat but month on month there was a decline

in the value of imports with all major shippers

experiencing a downturn. Shipments from China dropped

27%, shippers in Malaysia saw a 17% decline and both

German and Italian shippers experienced a roughly 25%

drop.

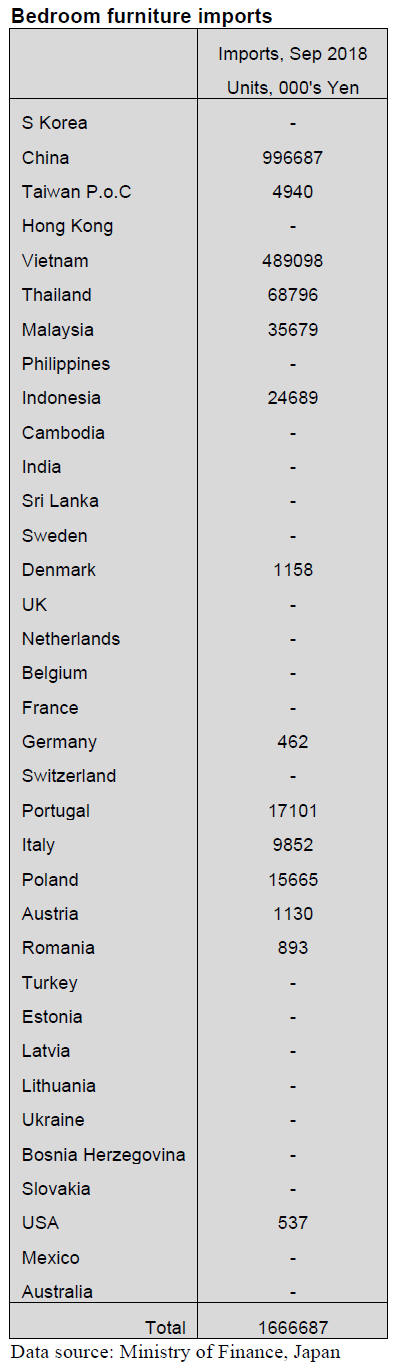

Bedroom furniture imports (HS 940350)

Contrary to the expectation that Japan¡¯s imports of

wooden bedroom furniture had bottomed out in July there

was a continuation of the downturn in imports in August

and also into September 2018. Looking at the trend in

past years wooden bedroom furniture imports are set to

rise significantly in the final quarter of the year.

In September year on year imports of wooden bedroom

furniture were little changed but September import values

were down 5% from levels in August. As in previous

months China and Vietnam dominate Japan¡¯s import

sources for wooden bedroom furniture.

Together these shippers in these two countries accounted

for 90% of Japan¡¯s wooden bedroom furniture in

September.The value of September shipments from

exporters in China was higher than in August but there

was a slight drop in the value of shipments from Vietnam.

The big winners in September were exporters in Indonesia

whose exports of wooden bedroom furniture rose over

30% in September. Arrivals of wooden bedroom furniture

from Portugal were also higher than in recent months as

they were from Indonesia. The losers in September were

shippers in Poland (a 50% drop) and Lithuania.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Utilisation of domestic large diameter logs

Plantation of domestic forest of Japan started after the war

and trees have kept growing and now average diameter of

harvested logs get larger.

Utilisation started to deal with small thinning at first then

next step was to deal with logs with top diameter of 16-18

cm then 24-28 cm to recover post and stud. Sawing has

been based on cutting small logs to recover one piece of

post so it is ¡®chip and saw¡¯ type machines. Main log sizes

sawmills are cutting have been 24-28 cm of top diameter

and logs over 30 cm have to be sawn by head rig on

carriage then slabs go to edger or gang saw to recover

smaller lumber.

After 50 years after plantation started, trees get bigger and

log size is larger so sawing needs to change to deal with

larger diameter logs. Particularly in Southern part of Japan

like Kyushu where growth is faster.

In Miyazaki prefecture in Kyushu, clear cutting has been

standard while other regions had selective harvest and

according to the Forestry Agency, total harvest of

Miyazaki in 2017 was 1,964,000 cbms of which cedar was

1,810,000 cbms. The prefectural institute reveals that

assuming annual harvest of cedar continues with

2,000,000 cbms, more than half of logs would be over 60

years old.

Trees in fast growing regions are soft with coarse grain so

it is hard to recover valuable grade of lumber so together

with sawing larger logs, it is necessary to find market of

lumber recovered from large logs. Advantage of larger

logs is to recover large size lumber like beam but warping

and bending then dimensional stability by drying remain

as problem.

In Northern Japan, trees grow slower so that grain is tight

and quality lumber without knots and heart center can be

recovered from slabs but fast growing cedar is different.

2x4 lumber may be possible and crating lumber to replace

high priced radiate pine logs then purlin and girder to

replace high priced North American softwood lumber may

be other options.

Plywood is another possibility. For plywood mills, peeling

one large log is more efficient than peeling two small logs

but again warping by drying veneer is problem to solve.

At present, log export market is the only market to

appreciate large diameter logs. China market uses cedar

logs for non -construction like crating, lamina for interior

use and public works so strength is not necessary.

It sounds ridiculous but actually prices of larger logs are

lower than smaller logs now. In Southern Kyushu market,

prices of 3 meter cedar logs with diameter of 24-28 cm are

13,100 yen then 36-38 cm are 11,500 yen, 1,600 yen

down. 4 meter log prices are the same.

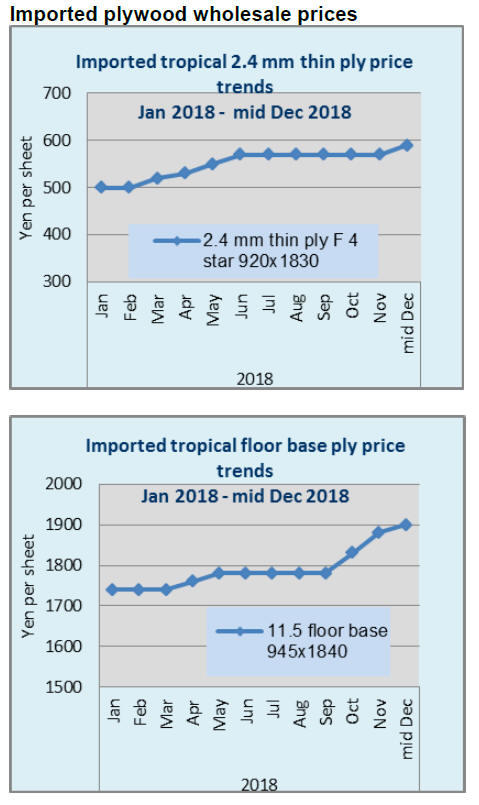

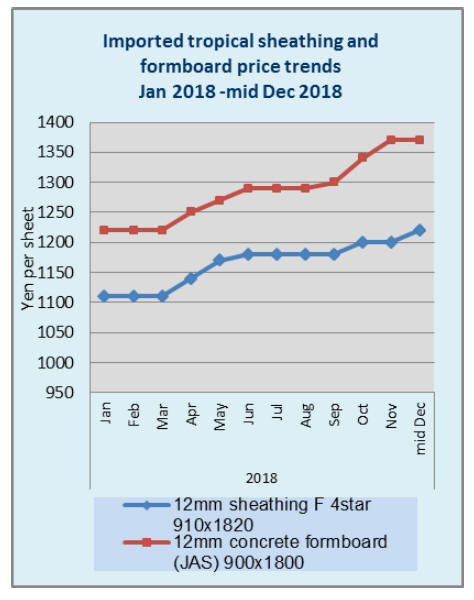

South Sea (tropical) logs

After Sabah, Malaysia banned log export since last May,

South Sea log supply was expected to drop but import

from PNG increased so that total year log supply would be

the same as last year. For the first nine month, log supply

from PNG is 48,000 cbms, 37,000 cbms from Sabah and

25,000 cbms from Sarawak so PNG is the top supply

source now.

However, main species in PNG is mersawa, which is

higher in price than Malaysian logs and freight is higher so

plywood mills in Japan face tough choice. They wish to

buy Sarawak logs but it is a pipe dream because even local

plywood mills in Malaysia cannot have enough logs to

produce export plywood.

US and China trade war on wood products

Since September 24, U.S. imposed 10% duty on Chinese

wood products while China imposed 5 or 10% duty on

American wood products except for 25% on Southern

Yellow Pine. For China, wood products supply from the

U.S. is about 10% and can substitute from other sources.

Meantime, Chinese furniture manufacturers suffer higher

cost of hardwood lumber from the U.S.A.

For U.S. side, logs and lumber export for China increased

considerably in last three years so decline of export may

influence forest products suppliers. What kind of influence

would this cause to Japan market is various. Since China

became large wood importing country, China needs to

look for substituting sources.

China is large importing country of southern yellow pine

logs. If this declines, China would buy more New Zealand

radiate pine logs, Russian logs or Japanese cedar logs to

replace. Next concern is if the U.S. would increase duty to

25% since 2019.

Total trade amount in 2017 from China to the U.S. US$

506.5 billion (14.3% of total trade amount of China) and

from the U.S. to China is US$130.8 billion (16.3% of total

trade amount of the U.S.A.). This tells bullishness of the

U.S.A.

In wood products trade, import of China is 55,400,000

cbms of logs, 37,390,000 cbms of lumber. This is

130,000,000 cbms in log basis. There is almost no log

import to the U.S. and lumber import mainly from Canada

is 29,800,000 cbms. Plywood import by the U.S.A. is the

largest in the world with 12,880,000 cbms.

China has practically no export of logs and lumber but

plywood export is the largest in the world with 14,760,000

cbms in 2016.

With domestic plywood production being 170,000,000

cbms, export volume is less than 10% of production. Also

export of furniture by China is the largest in the world.

U.S. has very little plywood export main exporting items

are 11,470,000 cbms of industrial logs and 6,750,000

cbms of lumber.

In wood products trade, the amount of wood products

trade from the U.S. to China is about US$3.2 billion and

that from China to the U.S. is about US$3.9 billion.

Noticeable change is that the amount from the U.S. to

China has kept climbing year after year during 2015 and

2017. US$2.0 billion in 2015.US$ 2.5 billion in 2016 and

US$3.2 billion in 2017. Both logs and lumber increased.

Amount lumber increased from US$1.1 billion to US1.7

billion and logs increased fromUS$ 900 million to

US$1.4 billion in three years.

Amount of items exported from China to the U.S. is

almost all finished products like furniture, which takes

about half then plywood, particleboard and wooden board

take about one third. According to the announcement by

China, total export amount of wood products in 2017 is

US$36,250 million dollars so US$3.9 billion is about 10%

for the U.S. export.

Main export item from the U.S. to China is softwood logs

of 4,840,000 cbms, 6.9% more than 2016. By species,

hemlock is 1,200,000 cbms, southern yellow pine is

870,000 cbms, Douglas fir is 670,000 cbms, spruce is

580,000 cbms and cedar is 3,000 cbms.

In these hemlock is flat and Douglas fir is declining but

southern yellow pine sharply increased in last three years.

It was only 200,000 cbms in 2015 then 870,000 cbms in

2017, four times more than 2015. This may be the reason

that the duty rate is 25% on southern yellow pine only

while others are 10%.

In lumber export of 3,250,000 cbms, softwood lumber is

only 850,000 cbms so balance is all hardwood lumber for

furniture and flooring manufacturing. In softwood lumber,

southern yellow pine lumber is 413,527 cbms, almost half

of softwood lumber. Main species of hardwood lumber are

oak and ash.

Furniture export is main item for China. Both U.S. and

China target hardwood and furniture as higher duty items.

China imposes 10% duty on both hardwood logs and

lumber but initially China suggested 25% on oak, 20% on

cherry and ash so the rate may be raised to this level since

2019. U.S. imposes 10% duty on Chinese furniture but if

things do not improve, it will be raised to 25%.

In log import, volume of hemlock and spruce for China is

more than Japan. Hemlock logs for China in 2017 was

1,204,785 cbms, 13.1% less than 2016 and spruce was

581,525 cbms, 11.7% less. China volume of hemlock is

75.0% in total hemlock export and of spruce is 35.3%. If

demand in China declines, U.S. hemlock log suppliers

may have a hard time to find low grade log market.

Plywood export from China to the U.S.A. has been

increasing by about 10% every year. About 1,680,000

cbms in 2014. About 1,840,000 cbms in 2015 and about

2,050,000 cbms in 2016. The volume is more than three

times compared to the volume from China to Japan. U.S.

plywood industry complained that subsidy by the Chinese

government is the reason of increase and by this sharp

increase of import, U.S. domestic plywood mills¡¯

operation dropped by about half.

The Department of Commerce admits that it is unfair

dumping by China and ITC supports this so that since

December 2017, maximum of 183.36% of anti-dumping

duty plus 22.98-194.9% of countervailing duty for subsidy

are imposed.

The volume from China sharply dropped after this.

Chinese plywood manufacturers are shifting to supply

base to South East Asian countries now.

|