|

Report from

North America

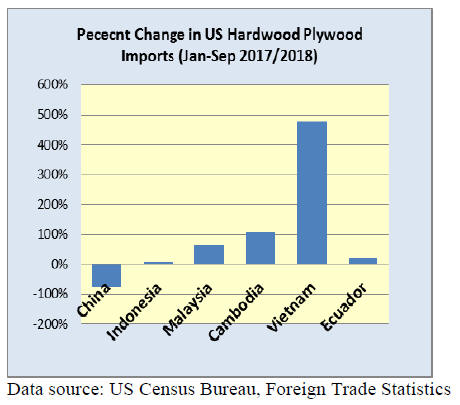

China regains share of US plywood market

US imports of hardwood plywood fell by 9% in September

with an across-the-board decline in both volume and

value, the exception was China. Import volumes from

China increased 29% in September, slowing a prolonged

slide. Yet, hardwood plywood imports from China still

trail 2017 imports by more than 75% year-to-date.

Meanwhile, imports from Indonesia, Vietnam and

Malaysia all fell in September, yet those countries are all

well ahead in for the year as they capitalise on the lost

trade from China.

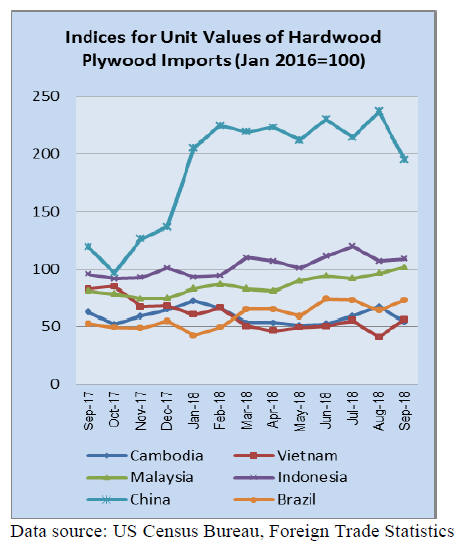

Due to rising prices, the value of plywood imports are up

by 6% at US$1.4 billion year-to-date even though the

volume of hardwood plywood imported is down by 13%.

Veneer imports continue to advance despite

September dip

US Census Bureau, Foreign Trade Statistics show that

while monthly US imports of tropical hardwood veneer

plunged by over one-third in September, they were still

more than 40% higher than those of September 2017.

Year-to-date imports are outpacing 2017 by 42%.

The September drop was fueled by the yearly seasonal

decline in imports from Italy, which is the largest supplier

of hardwood veneer for the US. Despite the monthly drop,

Italian imports remain up 28% for the year. Chinese

imports are up by 66% even after a somewhat smaller

September decline.

Flooring and moulding imports cool after a ¡®hot¡¯

summer

Hardwood flooring imports dropped 15% in September

from August, ending a long period of expansion that has

seen total imports rise by nearly 40% for the year so far.

The decline was mostly due to a 78% month-to-month

drop in imports from Brazil and a drop of 24% from China

as the two countries came down from exceptionally strong

August totals.

Imports from Malaysia rose by 18% in September with

2018 numbers nearly doubling those of 2017 year-to-date.

Imports from Indonesia declined in September and are

now down more than one-third from last year.

Assembled flooring also declined in September after

showing nice growth mid-year Declining imports from

Brazil were the cause of the drop in this category as well.

Overall, imports in this area are up 7% year-to-date.

Imports from China and Canada, which account for over

half of the market, were both down slightly in September

but remain ahead of 2017 year-to-date.

US hardwood moulding imports typically decline from

August to September, but a drop of 23% led to the worst

month in more than 5 years at just under US$13 million.

Imports from Brazil, China and Malaysia were all down

for the month, yet they are all modestly ahead of 2017

year-to-date.

Imports from Canada have been lagging by nearly a

quarter this year but were helped by a 30% rise from

August to September. Total US imports are now down 3%

for the year after being ahead of the 2017 pace for most of

the year.

Wooden Furniture Imports Fall in August

US imports of wooden furniture fell by 4% in September

from August, yet outpaced September 2017 figures by

nearly 5%. The US$1.57 billion total for the month kept

US imports at about 6% above the 2017 year-to-date.

Imports from the largest suppliers, China and Vietnam, are

both up 6% year-to-date despite falling slightly in

September. Imports from Canada, which have lagged all

year, increased by 9% in September.

US economy continues to add jobs in construction and

manufacturing

The latest data from US Bureau of Labor Statistics shows

total nonfarm payroll employment in the US rose by

250,000 in October, and the unemployment rate was

unchanged at 3.7 percent. Job gains occurred in health

care, manufacturing, construction, and transportation and

warehousing.

Construction employment rose by 30,000 in October, with

nearly half of the gain occurring among residential

specialty trade contractors (+14,000). So far in 2018

construction has added 330,000 jobs.

In October, employment in manufacturing increased by

32,000. Most of the increase occurred in durable goods

manufacturing, with a gain in transportation equipment

(+10,000). Manufacturing has added 296,000 jobs in 2018,

largely in durable goods industries.

Economic activity in the manufacturing sector expanded in

October, and the overall economy grew for the 114th

consecutive month, say the nation¡¯s supply executives in

the latest Manufacturing ISM Report on Business.

However, consumption has softened, with production and

employment continuing to expand, but at lower levels

compared with September. Demand remains moderately

strong, however, the New Orders Index eased below 60

percent for the first time since April 2017.

Cabinet Sales Soften

According to a press release from the Kitchen Cabinet

Manufacturers Association on its monthly Trend of

Business Survey, participating cabinet manufacturers

reported an increase in cabinet sales of 2.3% for

September 2018 compared to the same month in 2017.

Stock sales increased 9.4%; semi-custom sales decreased

5.6%; and custom sales increased 5.2% compared to

September 2017.

However, the numbers tell a different story compared to

the previous month (August 2018), sales are down 1.9%.

Stock sales decreased 4.4% and semi-custom decreased

1% compared to August. Custom sales saw the only

growth in September with an increase of 4.9%.

Year to date cabinetry sales through September 2018 are

up 1.9% according to participating manufacturers. Stock

sales are up 4.1%; semi-custom sales continue to decrease

with a downturn of 1.1%; and custom sales are up 4.3%.

See: https://www.kcma.org/news/press-releases/september-2018-

trend-business-press-release

New Furniture Orders Rise

New furniture orders in August 2018 increased 9% over

new orders reported in August 2017, according to the most

recent Smith Leonard survey of residential manufacturers

and distributors. The 9% increase in August followed three

consecutive months of 5% increases reported.

Approximately 70% of the participants reported increased

orders in August.

Year to date, new orders remained 6% over the same

period a year ago. August 2017 year-to-date orders were

also 6% ahead of the same 2016 period so the comparisons

are tshowing onsistently improving numbers. Some 71%

of the participants reported increased year-to-date orders.

See: https://www.kcma.org/news/press-releases/september-2018-

trend-business-press-release

US businesses paying 50% more in tariffs

A recent study found that US businesses paid US$4.4

billion in tariffs in September, up more than 50% from the

same month the previous year. Former Congressman

Charles Boustany, who serves as a spokesman for the

Tariffs Hurt the Heartland Campaign, the group that

sponsored the study, said that "the historic rise in costs for

American businesses, farmers and consumers is only the

beginning...Instead of doubling down on tariffs that this

data shows are clearly hurting Americans, it is time for

meaningful negotiations to take place."

https://www.cnbc.com/2018/11/05/tariff-payments-up-50percentin-

september-on-trump-trade-war-industry-group.html

In related news many US trade associations representing

thousands of businesses have come together to form

¡®Americans for Free Trade¡¯ (AFT) aimed at opposing

tariffs and highlighting the benefits of international trade

to the U.S. economy.

It has been reported that the AFT will cooperate closely

within the ¡®Farmers for Free Trade¡¯ which is supported by

major agricultural produces who launched the ¡®Tariffs

Hurt the Heartland¡¯ campaign.

|