|

Report from

Europe

Subdued EU tropical timber imports in 2018

EU imports of tropical wood products have been subdued

so far in 2018 with little sign yet of any rebound from the

downturn in 2017.

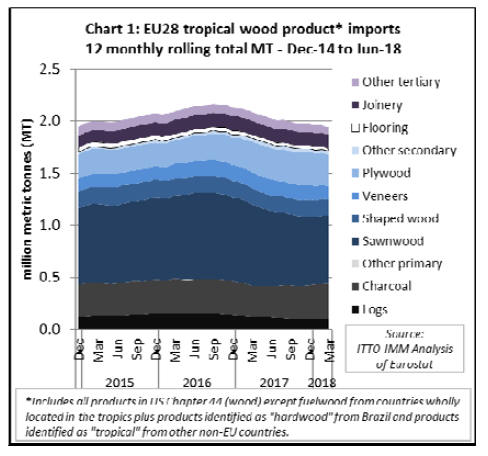

Chart 1 (above) shows twelve monthly rolling total

imports (to iron out seasonal fluctuations) into the EU of

all tropical wood products listed in HS Chapter 44

(excluding fuelwood, wood waste and chips).

It shows that imports peaked at an annualised level of 2.17

million metric tonnes (MT) in September 2016, slipped to

a low of 1.94 million MT in March this year and had

recovered only slightly, to 1.98 million MT by June.

In total, the EU imported 1.06 million MT of tropical

wood products in the first half of 2018, 1.6% more than

the same period in 2017. The total value of EU imports of

tropical wood products in the January to June 2018 period

was €1.10 billion, 3% less than the same period in 2017.

Although there have been gains in EU imports of tropical

sawnwood, charcoal, mouldings and joinery products this

year, these have been offset by a large decline in imports

of tropical veneers, flooring, and other tertiary products,

and a more moderate decline in imports of tropical

plywood.

Deteriorating economic conditions in the EU

Economic conditions in the EU have deteriorated since the

start of 2018 and are acting as a drag on hardwood

consumption. EU economic growth was slower than

expected in the first quarter of 2018.

At the time, policy makers were quick to dismiss this as a

temporary blip, mainly due to severe winter weather.

However, when economic activity in the second quarter

also fell below expectations, it became clear that more

persistent factors are impeding growth.

In Germany, domestic orders for manufactured goods are

currently running at 3% below a year ago and export

orders growth is close to a standstill.

The slowdown is made more worrying for occurring

before the planned withdrawal of the European Central

Bank (ECB) super-stimulus programme. In June, the ECB

confirmed that it intends to end this programme, which

involved bond-buying to the tune of €30bn every month,

in December. It¡¯s disappointing that growth has remained

sluggish in the euro-zone despite the mighty boost from

low interest rates and a cheap euro exchange rate.

Other storm clouds are gathering which may threaten

longer-term growth in the European economy. Several

large European banks are heavily exposed to the economic

turmoil in Turkey.

The Brexit negotiations have not progressed as well as

hoped and the odds are rising of Britain quitting the EU

with no deal, which will be costly for both sides.

In Italy, the new Eurosceptic government is threatening to

pass a budget in October that will put it on a collision

course with eurozone spending rules, with uncertain

economic and political consequences for the whole bloc.

These concerns are mirrored in the European

Commission¡¯s latest GDP growth forecasts published in

July. After expanding 2.2% in 2017, Germany¡¯s GDP

growth is forecast to slow to 1.9% this year and to grow at

the same rate in 2019.

France¡¯s economy will grow 1.7% this year and next,

much below the 2.2% growth from last year. The slowestgrowing

economy of the bloc will remain Italy, which is

expected to grow only 1.3% this year, down from 1.5% in

2017, and to further slow to 1.1% in 2019.

Only the UK is expected to match Italy in sluggishness of

growth among all the 28 states of the European Union. It

is expected to grow only 1.3% this year, a big drop from

the 1.7% GDP rise recorded last year.

EUTR impacts on tropical wood imports

The obligation placed on importers by the EU Timber

Regulation (EUTR) to gather data to demonstrate a

negligible risk of illegal harvest is acting as an extra drag

on EU trade in tropical timber.

Reports suggest regulatory actions are becoming more

frequent and vigorous, particularly in Belgium in recent

weeks. This is more significant given the important role

Belgian importers play in distributing tropical hardwood

products to other parts of the continent.

There appears to be a general trend in the EU for many

companies that formerly imported direct from the tropics

to avoid the need to implement EUTR due diligence

systems by procuring through other EU companies.

This is concentrating trade in the hands of a few of the

larger EU importers who, in turn, are limiting their

purchases to a smaller number of tropical suppliers

capable of providing the legality assurances required by

EUTR.

Overall, opportunities for tropical exporters to enter the

EU market are therefore becoming more restricted.

As the only country delivering products with FLEGT

licenses, which are not subject to any further EUTR risk

mitigation measures, unlike other non-EU countries

Indonesia may be expected to benefit from this more

active enforcement of EUTR.

There is some evidence for this. The EU¡¯s total imports of

tropical wood products from Indonesia increased 7% to

175,000 MT in the first 6 months of 2018, and Indonesia¡¯s

share of total EU tropical imports increased from 15.7% to

16.6% in the same period, mainly at the expense of

Cameroon and Gabon.

While EUTR may now be favouring Indonesia in the EU

market, other supply side factors are also playing a role.

As noted in the last market report, supplies of African

hardwood species of interest to the EU market are in long

term decline, while exports from African have been

seriously affected by logistical challenges at the port of

Douala in Cameroon and cash flow problems of large

European operators, issues brought to a head with the sale

of Rougier¡¯s subsidiaries in Cameroon and the Central

African Republic in July.

Supplies of both Malaysian and Indonesian products were

also restricted in the first half of 2018, largely attributed

by European importers to the long and severe wet season

and its impact on harvesting and log transport, with mills

consequently running short of logs. This fed through into

rising prices.

Plywood prices for both Malaysia and Indonesia in the EU

increased by 30% in the six months between October 2017

and March 2018.

Meanwhile a larger share of African supply is now being

exported to China, Vietnam and other emerging markets.

5% rise in EU imports of tropical sawnwood.

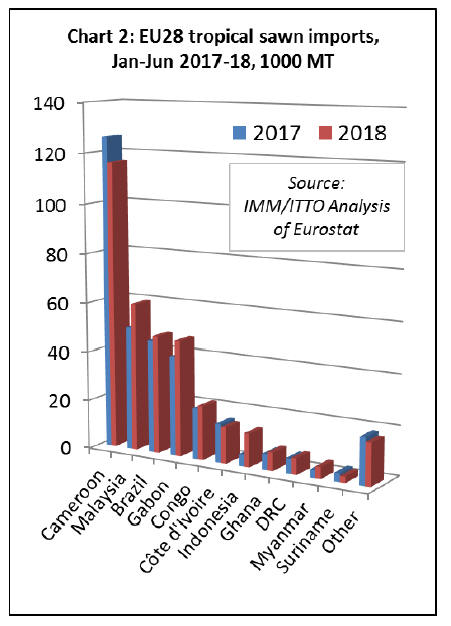

EU imports of tropical sawnwood increased 5% to

359,300 MT in the first half of 2018. Import value also

increased, by 7% to €366 million.

Although imports continued to slide from Cameroon (-8%

to 116,100 MT) and Côte d'Ivoire (-7% to 14,700 MT),

this trend was offset by rising imports from Malaysia

(+19% to 59,800 MT), Brazil (+4% to 47,700 MT), Gabon

(+16% to 47,000 MT), Congo (+6% to 21,900 MT),

Indonesia (+186% to 13,500 MT) and Ghana (+16% to

7,500 MT). (Chart 2).

The rise in imports from Indonesia, which only allows

exports of S4S lumber, may be partly due to alterations in

the HS codes used to record imports from Indonesia

following introduction of FLEGT licensing.

The rise in EU imports of sawnwood from Indonesia is

offset by a similar decline in imports of mouldings from

the country.

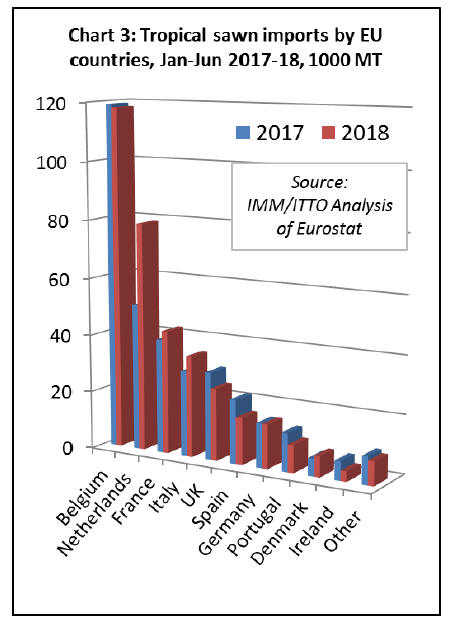

In the first half of 2018, tropical sawn hardwood imports

declined 1% to 118,000 MT in Belgium, 18% to 24,800

MT in the UK, 27% to 16,100 tonnes in Spain, and 27% to

9,600 MT in Portugal.

However, these losses were offset by a 56% rise to 78,900

MT in the Netherlands, an 8% rise to 42,600 MT in Italy

and an 18% rise to 34,900 MT in Italy. German imports

were level at 15,100 MT (Chart 3 above).

EU imports of tropical logs recover a little ground

After a downturn in 2017, the quantity of EU imports of

tropical logs recovered a little ground in the first half of

2018. Imports of 53,300 MT during the first half of the

year were 3% greater than the same period in 2017.

However, the value of tropical logs imported by the EU

fell 3% to €27 million.

EU imports of tropical logs decreased from Congo, the

leading supplier, falling 3% to 12,300 MT. There was also

a large fall in EU log imports from Angola, from 3,800

MT in the first half of 2017 to negligible levels in the

same period this year.

However, these losses were offset by rising imports from

CAR (+59% to 10,200 MT), DRC (+19% to 10,100 MT)

and Liberia (+20% to 3300 MT) (Chart 4).

Most of the gain in EU imports of tropical logs in the first

half of 2018 was concentrated in France (+21% to 20,700

MT) and Belgium (+23% to 13,200 MT). Imports of

tropical logs in Portugal fell 25% to 8000 MT during the

period.

Slight rise in EU tropical decking imports

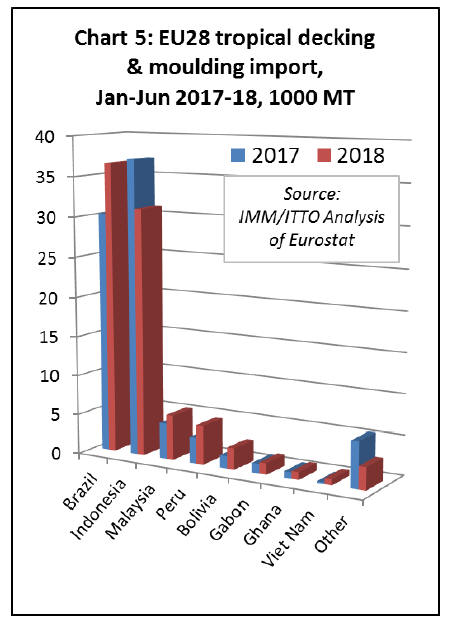

EU imports of tropical mouldings (which includes both

interior mouldings and exterior decking products)

increased slightly, by 3% to 86,700 MT in the first quarter

of 2018. Import value also increased by 3%, to €127

million.

A 21% rise in EU imports of mouldings from Brazil to

36,600 MT offset a 16% decline in imports from Indonesia

to 31,100 MT.

As noted earlier, the latter decline may be partly due to

alterations in the HS codes used to record imports from

Indonesia since introduction of FLEGT licensing.

EU imports of mouldings increased for some smaller

suppliers of this commodity in the first quarter of 2018

including Malaysia (+26% to 5,600 MT), Peru (+47% to

4,800 MT) and Bolivia (+71% to 2,700 MT) (Chart 5).

In the first half of 2018, imports of tropical decking

increased in France and Belgium but declined in Germany,

the Netherlands and the UK.

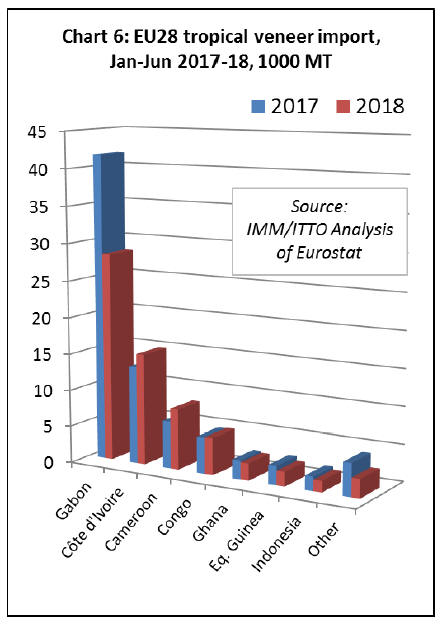

EU imports of tropical veneer down 17%

After a rise in trade in the previous two years, EU imports

of tropical hardwood veneer fell 17% to 65,100 MT in the

first 6 months of 2018. Import value fell by 17% to €84.2

million. The decline was mainly due to a 32% decrease in

imports from Gabon, to 28,300 MT.

This decline is likely related to the financial difficulties

experienced by Rougier this year. The decline in EU

imports from Gabon was partly offset by rising imports

from Cote d¡¯Ivoire (+14% to 15,100 MT) and Cameroon

(+29% to 8,200 MT). (Chart 6).

Imports of tropical veneer declined into the two largest EU

markets in the first half of 2018, falling 22% to 22,900 MT

in France and 8% to 15,400 MT in Italy. There was also a

sharp 53% decline in imports in Greece, to 3,600 MT.

Imports to Spain were level at 11,500 MT.

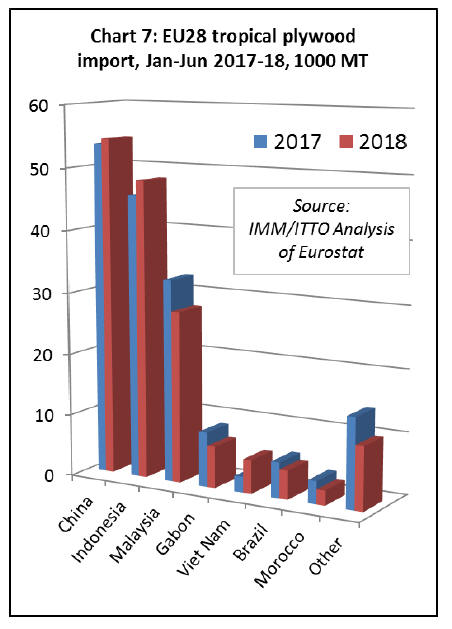

EU direct imports of plywood from the tropics decline

9%

In the first six months of 2018, EU imports of products

faced with tropical hardwood manufactured in China

increased 2% to 54,500 MT. This gain was achieved

despite reports of supply being disrupted by tough new

national environmental controls, which forced Chinese

mills to interrupt production to upgrade or replace

emission and waste treatment technology.

Direct EU imports of plywood from tropical countries

decreased 9% to 160,100 MT in the first half of 2018.

While imports from Indonesia increased 5% to 48,000

MT, imports from Malaysia fell 15% to 27,700 MT and

imports from Gabon fell 23% to 6,700 MT in the first half

of the year.

Although still only a minor supplier, there was a

significant 113% increase in EU imports of plywood from

Vietnam, to 5,400 MT, in the first half of 2018. (Chart 7).

Imports of tropical plywood in the UK were 80,500 MT in

the first half of 2018, the same as last year. A 31% decline

in imports in Belgium, to 20,800 MT, was partially offset

by rising imports in the Netherlands (+12% to 16,600

MT), Germany (+13% to 13,300 MT), and France (+2% to

10,400 MT).

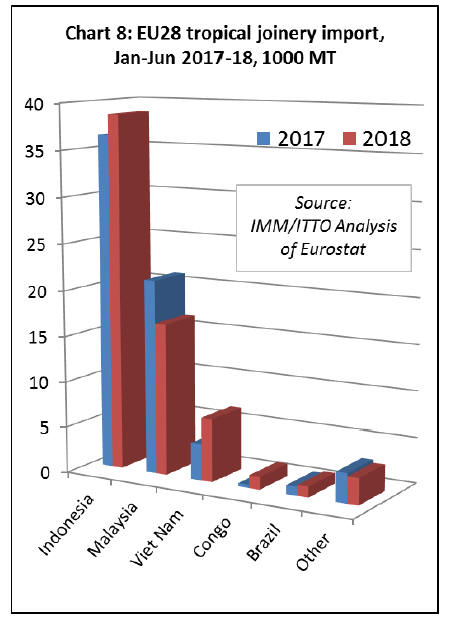

Indonesia boosts share of EU tropical joinery imports

EU imports of tropical joinery products (excluding

flooring) increased 2% to 67600 MT in the first half of

2018. However, import value decreased, by 7% to €126

million, which may imply some shift in the mix of

products involved.

In quantity terms, imports from Indonesia, by far the EU¡¯s

largest tropical supplier of joinery products, which consist

mainly of doors and laminated window scantlings and

kitchen tops, increased 6% to 38,700 MT.

There was also a 72% increase in EU imports of joinery

products from Vietnam, to 6800 MT, during the six-month

period. Imports from Congo increased from negligible

levels to 1400 MT. These gains offset a 22% decline in

imports from Malaysia to 16,600 MT. (Chart 8).

Imports of tropical joinery products in the UK, by far the

largest European destination for this product group,

increased 19% to 31,300 MT in the first six months of

2018. Imports increased by 37% to 9000 MT in Belgium

and by 60% to 7100 MT in France in the same period.

However, imports fell 36% to 12400 MT in the

Netherlands.

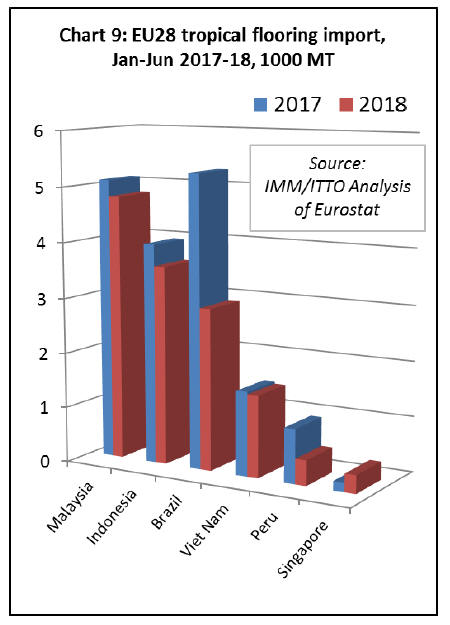

Another fall in EU imports of tropical flooring

EU imports of flooring products from tropical countries

fell a further 21% to, to 14,500 MT in the first half of

2018, continuing a long term decline in response to tough

competition from European and Chinese manufacturers

and non-wood alternatives, fashion trends favouring

temperate timbers, supply contraints, and challenges of

EUTR conformance. The value of EU imports of wood

flooring declined 18% to €32 million in the first half of

2018.

Most of the downturn in the first half of 2018 was due to a

45% fall in imports of hardwood flooring products from

Brazil, to 2900 MT. However imports also fell 6% from

Malaysia, to 4800 MT, 9% from Indonesia to 3,600 MT

and 53% from Peru to only 500 MT. (Chart 9).

In the first half of 2018, imports fell dramatically into the

two largest EU markets for tropical flooring, declining

49% to 3000 MT in France and 18% to 1800 MT in

Belgium.

However, this decline was partially offset by a 82%

increase in imports in Denmark, to 1700 MT, which was

the third largest EU destination for tropical flooring during

the six month period.

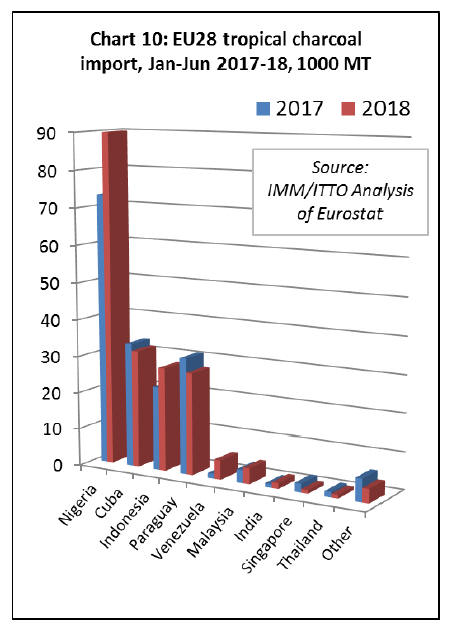

Gradual rise in EU imports of tropical charcoal

EU imports of charcoal from tropical countries has been

gradually rising since the start of 2017. Imports of

194,000 MT in the first six months of 2018 were 10%

more than the same period last year. The value of EU

imports increased 8% to €72.3 million in the same period.

EU imports of charcoal from Nigeria increased 23% to

89,900 MT, while imports from Indonesia were up 24% at

27,900 MT. Imports from Venezuela increased from

negligible levels to 5200 MT. These gains offset a 5%

decline in imports from Cuba to 31,700 MT. (Chart 10).

A wide range of EU countries now import wood charcoal

from tropical countries, the largest destinations (in

descending order this year) being Poland, Germany,

Greece, Belgium, Italy, UK, Portugal, and Spain.

In the first six months of this year, imports increased in

Poland (+31% to 35300 MT), Greece (+14% to 25,500

MT), Belgium (+43% to 23200 MT), Italy (+43% to

17500), and Portugal (+24% to 13000 MT). However

imports declined 17% to 31,500 MT in Germany, 4% to

14,600 MT in the UK, and 15% to 12600 MT in Spain.

|