|

Report from

Europe

EU tropical sawn hardwood imports fall to all-time

low

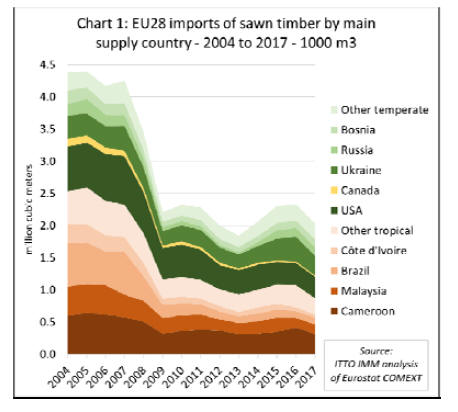

The EU imported 2.04 million cu.m of sawn hardwood

from outside the region in 2017, 13% less than the

previous year. (Chart 1).

EU imports of tropical sawn hardwood were 875,000 cu.m

in 2017, 18% less than the previous year. Imports of

tropical sawn hardwood last year were the lowest ever

recorded by the EU, below the previous low of 930,000

cu.m in 2013 during the euro-zone crises and only around

a third of the level prevailing before the global financial

crises.

The value of EU imports of tropical sawn timber

decreased by 16% to €653 million in 2017. The average

unit value of tropical sawn hardwood imports into the EU

in 2017 was €746 per cubic meter, up from €728 per cubic

meter the previous year.

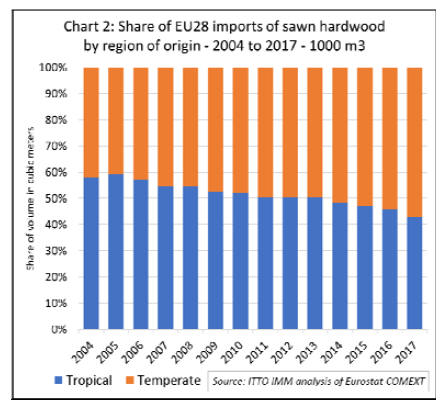

In 2017, EU imports of temperate sawn hardwood fell by

8% to 1.16 million cu.m. The more rapid pace of decline

in imports from the tropics meant that the share of tropical

in total EU sawn hardwood imports fell from 46% in 2016

to 43% in 2017, an acceleration in the long term

downward trend (Chart 2).

Sharp fall in EU imports of African sawn wood

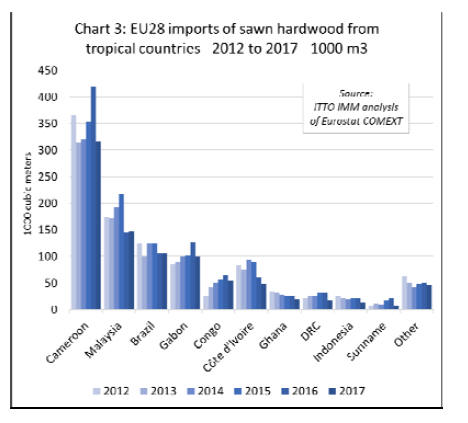

The most notable trend in the supply of sawn hardwood to

the EU in 2017 was the sharp fall in imports from Africa,

particularly from Cameroon, but also Gabon, Congo, Cote

d¡¯Ivoire, Ghana and DRC. Imports from Malaysia and

Brazil were more stable (Chart 3).

Following a surge in 2016, EU imports from countries in

the Congo region declined sharply in 2017. Imports

decreased by 24% from Cameroon to 316,000 cu.m, by

22% from Gabon to 99,000 cu.m, by 17% from Congo to

54,000 cu.m, and by 51% from DRC to 16,000 cu.m.

Last year, there was also a continuation of the long-term

decline in EU imports of sawn hardwood from West

Africa. Imports fell by 21% to 48,000 cu.m from Côte

d'Ivoire, and by 23% to 20,000 cu.m from Ghana.

EU imports from Brazil and Malaysia were more stable in

2017, although only a shadow of earlier levels having

already declined significantly in previous years. Last year

the EU imported 148,000 cu.m of sawn hardwood imports

from Malaysia 2% more than the previous year, and

105,000 cu.m from Brazil, 1% less than in 2016.

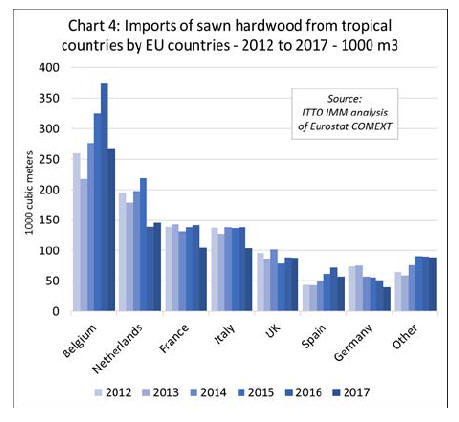

The decline in imports of tropical sawn hardwood during

2017 was particularly notable in Belgium (down 29% to

266,000 cu.m), France (down 26% to 105,000 cu.m), Italy

(down 25% to 103,000 cu.m), Spain (down 22% to 56,000

cu.m) and Germany (down 21% to 40,000 cu.m).

Imports increased 5% to 145,000 cu.m in the Netherlands,

after a sharp decline the previous year. Imports in the UK

declined only 1% to 88,000 cu.m. (Chart 4).

Increasing concentration of trade in the hands of a small

number of large companies close to EU ports, and their

role to distribute tropical sawn timber throughout the EU,

mean it is becoming more difficult to relate import trends

with changes in consumption at national level in the EU.

Fall in EU imports driven mainly by supply-side issues

In practice, the recent decline in tropical imports into the

EU is better seen as a region-wide phenomenon driven

mainly by supply side trends. In 2017, a range of factors

conspired to result in extremely low tropical sawn

hardwood imports across the EU. These include:

On-going serious problems and delays with On-going serious problems and delays with

shipping out of Douala Port in Cameroon.

Overstocking in the EU at the end of 2016 Overstocking in the EU at the end of 2016

following arrival all at once of a large volume of

delayed shipments from Africa.

Diminishing commercial availability of

tropical Diminishing commercial availability of

tropical

hardwood species of interest to European buyers.

The problem of delayed payment of VAT

refunds The problem of delayed payment of VAT

refunds

by African governments, partly linked to low oil

prices, which is creating additional financial

challenges for operators in the region.

Good demand and willingness to pay higher Good demand and willingness to pay higher

prices for tropical hardwood in other regions

including Asia, the Middle East, and North

America.

Reduced focus on supply of sawn timber to

the Reduced focus on supply of sawn timber to

the

EU by many tropical suppliers, particularly

encouraged in Africa by strong demand for logs

from China, and in South East Asia by on-going

efforts to move into higher value products such as

furniture.

Continued substitution of tropical

hardwoods for Continued substitution of tropical

hardwoods for

a range of modified temperate wood species and

alternative non-wood products.

Fashion changes, particularly the strong

trend Fashion changes, particularly the strong

trend

towards the oak look in EU and the fact that there

is now very little demand for redwood finishes in

the EU interiors sector.

The on-going trend towards prefabrication

in The on-going trend towards prefabrication

in

construction, is increasingly favouring tightly

specified engineered wood products which are

more readily accessible from domestic

manufacturers than from the tropics.

Intensifying enforcement of EUTR across

the EU Intensifying enforcement of EUTR across

the EU

and the challenges and expense of legality due

diligence in some tropical countries.

Loss of share for tropical veneer in EU market during

2017

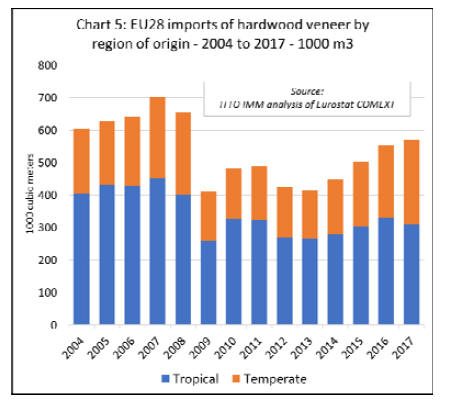

Many of the same factors contributing to the downturn in

EU imports of tropical sawn timber are also now

impacting trade in tropical veneer. Following three years

of recovery, EU imports of hardwood veneer from the

tropics declined 6% to 310,000 cu.m in 2017.

The decline in EU imports of tropical veneer contrasts

with a significant rise in imports of veneer from temperate

countries which increased 17% to 262,000 cu.m last year.

Imports from Ukraine, the EU¡¯s largest external supplier

of temperate hardwood veneer, increased 9% to 89,000

cu.m in 2017, while imports from Russia, the second

largest supplier, increased 35% to 57,000 cu.m.

These increases in veneer imports from Eastern European

countries during 2017 were driven partly by very weak

exchange rates in the region, which has increased export

competitiveness, and partly by policy measures to limit log

exports and increase wood processing capacity in these

countries.

In total, the EU imported 572,000 cu.m of hardwood

veneer in 2017, 3% more than in 2016. The share of

tropical veneer in total EU veneer import volume fell from

60% in 2016 to 54% last year. (Chart 5).

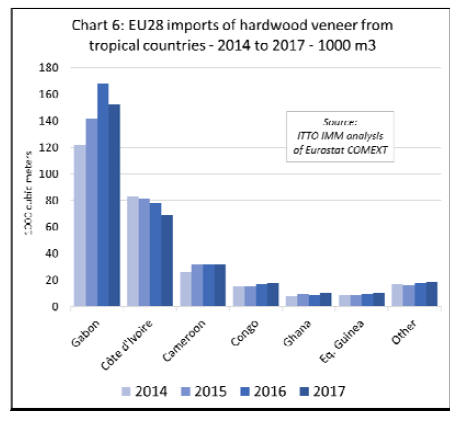

EU imports of hardwood veneer from Gabon, the leading

tropical supplier, ended the year 9% down compared to

2016 at 152,000 cu.m. EU veneer imports also declined

from Côte d'Ivoire in 2017, by 12% to 69,000 cu.m.

Imports from Cameroon were stable at 32,000 cu.m in

2017, but increased 3% to 18,000 cu.m from Congo, 9% to

10,000 cu.m from Ghana, and 11% to 11,000 cu.m from

Equatorial Guinea (Chart 6).

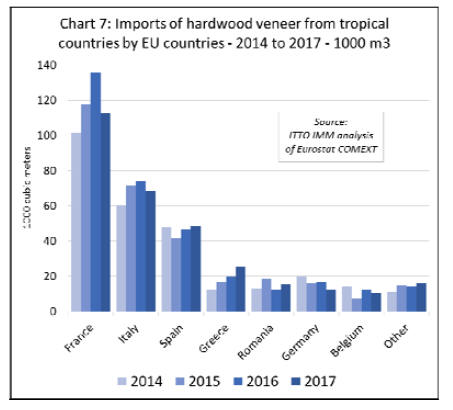

The downturn in EU imports of tropical veneer during

2017 was concentrated in France, Italy and Germany.

Imports fell 17% to 113,000 cu.m in France, 7% to 69,000

cu.m in Italy, and 26% to 12,000 cu.m in Germany. These

falls were partially offset by rising imports in Spain (+4%

to 49,000 cu.m), Greece (+27% to 25,000 cu.m), and

Romania (+28% to 16,000 cu.m).

|