2. GHANA

Furniture testing centre to improve competitiveness

To improve the quality and add more value to locally

made furniture a testing facility has been established by

the Timber Inspection Development Division (TIDD)

near Kumasi, a centre for wood product manufacturers.

The centre has modern equipment for testing furniture,

plywood and wood-based panels and was made possible

by technical support from UNIDO.

Funding of the project was provided by the Government of

Switzerland under tits Trade Capacity Building

Programme. This centre, say analysts, is the first of its

kind in the West Africa.

The centre is expected to stimulate growth in

Ghana’s

added value wood product sectors. The Minster for Trade

and Industry, Alan Kwadwo Kyeremanteng, has said the

government will do all it can to support growth in the

wood products sector to lift Ghana’s productivity and

competitiveness locally and internationally.

Praise for efforts to reclaim degraded forests

The Forestry Commission has engaged local firms to help

with the reclamation of forest reserves degraded by illegal

mining. Over the next 12 months the work will be carried

out in the worst affected areas in the Ashanti, Eastern and

Western regions.

The Chief Executive of the Forestry Commission,

Kwadwo Owusu Afriyie, announced these plans during a

tour of affected areas by Commission officials and the

Chairman of the Parliamentary Select Committee on

Lands and Natural Resources.

The Commission has indicated it will recruit an additional

15,000 personnel, half of which will be trained as forest

guards to strengthen measures against illegal activities in

forest reserves.

In the State of the Nation address, the President, Nana

Addo Dankwa Akufo-Addo, praised the efforts of the Inter

Ministerial Team on galamsey (illegal mining).

Ghana to host international trade fair

In conjunction with the Ghana International Trade Fair

scheduled from 28 February to 2 March in Accra, BVRio

will hold an event dedicated to promoting the trade of

100% legal and certified timber dubbed ‘The Responsible

Timber Trade Fair’.

The BVRio website says the event will provide an

opportunity to meet with potential trading partners in the

region. Leading experts will provide an overview of trends

in West African timber trade, the regulatory framework

involved and progress in eliminating illegal timber from

the international timber trade.

BVRio is an electronic marketplace where timber

producers and traders have the possibility to promote

timber products.

For more see: http://tradefairgh.com/

and

https://bvriotradefairs.org/

3.

MALAYSIA

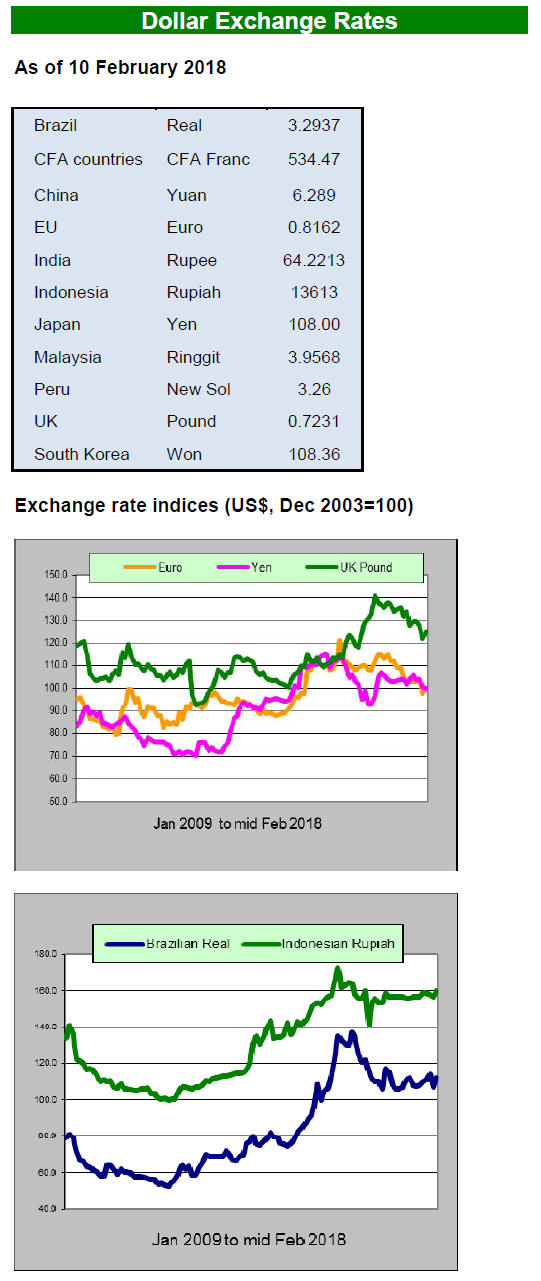

Malaysia’s exports and the

strengthening ringgit

Malaysia’s exports rose almost 19% in 2017 compared to

a year earlier, the fastest pace of expansion since 2005.

For the ninth consecutive year, China was again

Malaysia’s main trading partner. Last year Malaysia’s

exports to China rose by almost a third while imports

jumped 15%.

Of concern to exporters is the pace at which the ringgit is

appreciating, especially against the US dollar. Furniture

exporters have voiced concern saying their

competitiveness will inevitably be undermined by the

stronger ringgit.

Analysts write that few of Malaysia’s furniture exporters

use hedging to minimise currency fluctuation risks. In

addition to the impact of a strong local currency,

manufacturers are facing rising production cost as wages

rise.

Gaharu wood worth millions seized

Forestry officials in Sabah have seized a huge quantity of

illegally harvested gaharu wood (known in international

markets as agarwood or aloeswood) a fragrant dark wood

used in incense, perfume and carvings.

Sam Mannan, the Director of Forestry in Sabah,

announced that the timber was stolen from protected forest

areas including the Maliau Basin. During a survey in 2004

it was estimated that there were around 3 million karas

trees (the source of gaharu wood) in the state but illegal

cutting has halved that number.

Commercial arm of the Forest Research Institute

launched

Malaysia’s Deputy Prime Minister recently officially

launched FRIM Inc., the commercial arm of the Forest

Research Institute (FRIM), a statutory agency of

the Government of Malaysia. FRIM Inc. was established

last year as a FRIM’s subsidiary to transform and

commercialise research and development findings as well

as deliver FRIM’s technical services.

FRIM Inc. will conduct marketing and sales activities for

FRIM R&D products, expertise and skills services,

intellectual property (IP) protection services, technical

services in the form of technology transfer and training as

well as commercialisation of IP in open markets. From

December 2017 to January 2018, the company has secured

business worth around RM1 million.

https://www.frim.gov.my/en/tpm-lancar-frim-inc/?wppaoccur=

1&wppa-cover=0&wppa-album=462&wppa-photo=2278

4.

INDONESIA

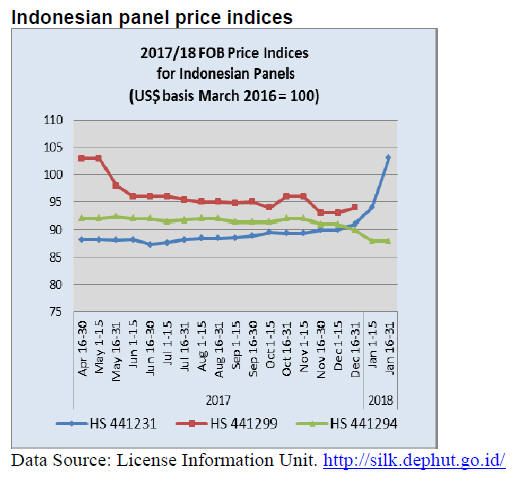

Success in slowing

deforestation

Indonesia has reported a significant decline in

deforestation over the past years. In a recent statement to

the press, the Minister of Environment and Forestry, Siti

Nurbaya, said total deforested area between 2016 and

2017 was recorded at just over 496,000 hectares a 20%

decline compared to the 630,000 hectares in the period

2015-2016.

Siti said strengthened forest management, hard work by

the country’s forestry staff and the moratorium on clearing

for palm oil plantations had brought down the pace of

deforestation.

http://nasional.republika.co.id/berita/nasional/jabodetabeknasional/

18/01/29/p3b5la284-klhk-angka-deforestasimenurun

In related news, the Minister said plans are being made to

take back unused land which had been allocated but not

cleared for palm oil plantations. She hinted that if the land

in question has a recoverable forest then it will be secured

as natural forest.

Plantation production can underpin export growth

The Secretary General in the Ministry of Environment and

Forestry, Bambang Hendroyono, said Indonesia will

export wood products worth around US$12 billion this

year. In support of this the Chairman of the Indonesian

Forest Entrepreneurs Association (APHI), Indroyono

Soesilo, said Indonesia export potential is yet to be fully

realised. But, as plantation log production expands

investment in export oriented production will follow.

In 2015 planation log production was 32 million cubic

metres which expanded to 33 million in 2016 and then 39

million in 2017.

However, to achieve export growth the government must

act to encourage investment said Indroyono Soesilo,

Chairman of APHI.

Indroyono suggested that business activities need to be

diversified into area such agroforestry, ecotourism,

environmental services and bioenergy.

APHI offered suggestion to the government on ways to

expand exports from the forestry sector including speeding

up work to demarcate concession boundaries, expanding

market promotion and addressing deregulation.

Industry calls for allowing semi-finished rattan exports

Julius Hoesanoesan, Vice Chairman of Indonesian Rattan

Entrepreneurs (APRI), has indicated that association

members want the Ministry of Commerce to allow exports

of semi-finished rattan this year. This, they say, will allow

the industry to recover and become a profitable sector

once more.

Their argument is that domestic demand has dropped and

many enterprises that produced semi-finished rattan have

stopped operation. In response, the Director General of

Foreign Trade in the Ministry of Trade, Oke Nurwan, has

said the Ministry is still gathering data on the demand in

the domestic rattan industry so that it can determine a

suitable policy on rattan exports.

5.

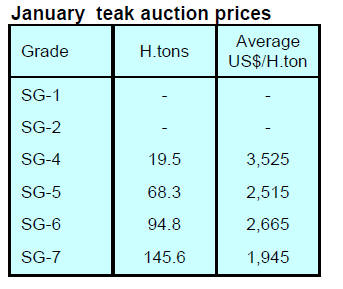

MYANMAR

Royalty rates to be raised

The domestic media (Daily Eleven) has quoted a Forest

Department spokesperson as saying the Department is

revising the royalty on Myanmar’s natural forest timber

species. Reports say teak, padauk and tamalan will now

attract a 30,000 Kyats per ton, Pyinkado and Inn-Kanyin

20,000 per ton and between 6-10,000 Kyats per ton for

others species depending on their commercially value.

However, if the timbers come from the forest conversion

areas or are confiscated timbers a different rate will apply

namely 150,000 Kyat per ton for teak logs, 300,000 Kyats

per cu.m for teak sawnwood and 150, 000 Kyats per ton

for padauk and tamalan logs. Anlaysts write “it is

understood that the revenue is to be paid by the Myanma

Timber Enterprise to the Forest Department”.

No harvesting in Kayah State

In the another development, harvesting in Kayah State for

2018-19 will be postponed despite the fact that the Forest

Department estimated the annual allowable cut for the

State to be 10,000 tons for hardwoods.

The Regional Government and the Civil Society have

welcomed this. It is noted that it will be third consecutive

year of logging suspension in Kayah State.

Hot-line opens for public to report illegal logging

The Forest Department has introduced a ‘Community

Monitoring and Reporting System’ through which anyone

can contribute to combat illegal logging. The Forest

Department has announced ‘Hot Line’ telephone numbers

for people to call in and report illegal logging.

Further action against illegal forest activities has been

discussed in parliament and news laws and regulation to

protect the natural resources, to reduce the dependency on

the raw materials and to encourage value-added

production are being considered.

Private sector wants interest rate cut

A debate between members of parliament, the business

community and the banks on the need to reduce interest

rates has become very heated. Currently, Myanmar banks

offer 8% on saving but charge 13% on loans. One member

of parliament proposed a 1% drop in interest on savings

and a 2% cut in loan rates. The private sector has been

pointing out that the current interest rates and the

unfavorable tax regime do not encourage investment and

trade.

On a brighter note it has been hinted that the revenue

department will eliminate the 2% withholding tax which is

also called the retention tax.

Currently, all exporters have to pay 2% on the value of the

exports prior to shipment. In response to the complaints

from the private sector the Ministry of Planning and

Finance made it clear through the local media that

Myanmar has the lowest tax rate amongst ASEAN

members.

6. INDIA

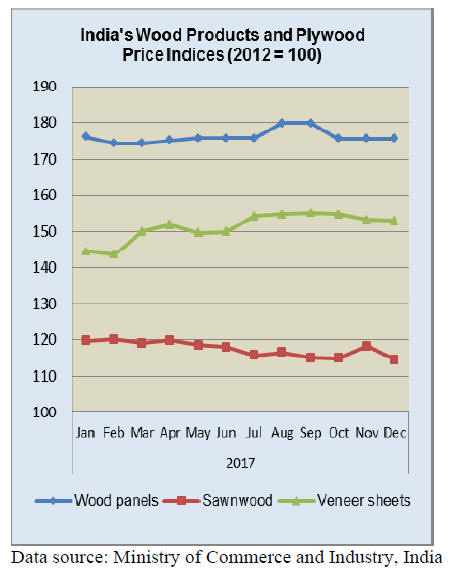

Wood product price index slides

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for December 2017 released by the

Office of the Economic Adviser to the government (OEA)

declined to 115.7 from 116.3 from the previous month.

The annual rate of inflation, based on monthly WPI, in the

financial year so far was 2.21%.

The overall price index for wood and cork products

declined 130.3 from 131.6 in the previous month due to

due to lower price of sawnwood and wooden boxes/crates.

However, the price of plywood and blockboard moved up.

The press release from the Ministry of Commerce and Industry

can be found at: http://eaindustry.nic.in/cmonthly.pdf

PEFC lauds Indian certification system

In a press release after the official launch, Sarah Price,

Head of Projects and Development at PEFC International,

said that given the size of India and the diversity of its

forests, the development of a national certification system

is to be applauded.

Shri Siddhanta Das, Director General of Forests and

Special Secretary, Government of India, added that India

has practiced scientific management of forests since 1864,

built upon the principles of sustainability.

Early forest management was predominantly focused on

timber extraction but now there has been a shift to achieve

sustainable ecosystems as well as the sustained livelihoods

forest communities.

PEFC worked with the Indian Network for Certification

and Conservation of Forests (NCCF) headed by Mr. Vijai

Sharma. NCCF was responsible for developing the Indian

national system, a task that began in 2015.

“To achieve our commitments for mitigation and

adaptation to climate change, we have to take forestry

beyond forests, through agroforestry, urban plantations,

plantations by corporations, companies, communities and

voluntary organizations,” said Mr. Sharma.

See: https://www.pefc.org/news-a-media/general-sfmnews/

2490-india-launches-its-national-forest-certification-system

Expansion of bamboo resources supported in

government budget

In the 2018 budget the government has allocated Rs 12.9

billion to promote the bamboo sector. The aim, say

analysts, is to expand India’s ‘green cover’ and at the same

time create a resource base for the panel, furniture and

joinery sectors.

Currently most of India’s bamboo resources are in the

North East Region and is vital to local industries

especially the rural poor.

Opportunities await at Delhiwood 2019

In readiness for DelhiWood 2019 the organisers have

produced a useful overview of the Indian wood processing

sector and market prospects for wood products.

The Delhiwood press release says the Indian woodworking

and furniture manufacturing industry is worth around

US$20 billion annually (and growing) and employs over 3

million in the so-called organised sector which contributes

less than half to total output from the sectors.

Further Delhiwood says the Indian furniture industry is

expanding in line with increasing income levels and that

this is also influencing consumer purchasing trends. The

company makes the point that these trends provide an

opportunity for suppliers to the furniture manufacturing

sector.

The press release says “while wooden home furniture is

the biggest segment, the fastest growth is seen in the

modular furniture and the kitchen segment. The industry

has seen a compounded annual growth of 30%.”

For more see:

http://www.delhi-wood.com/market_scenario.html

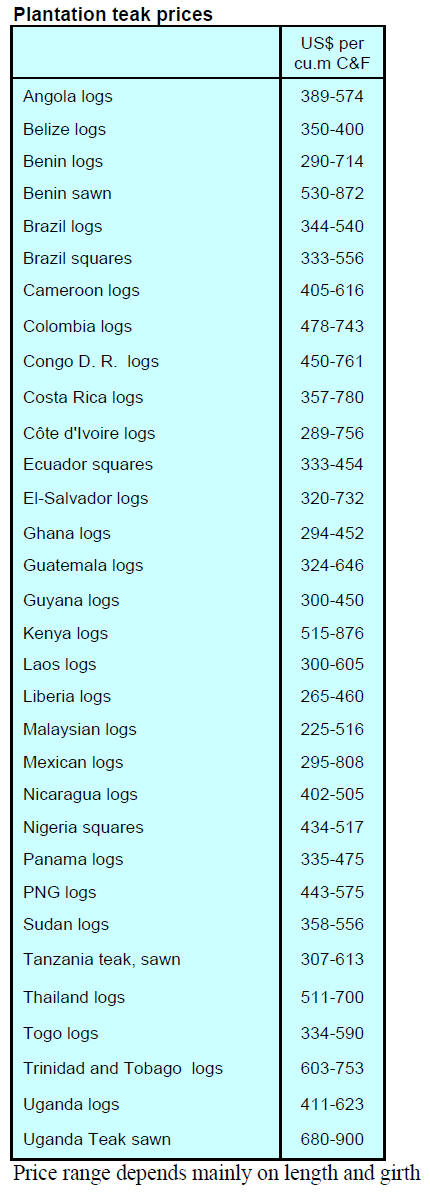

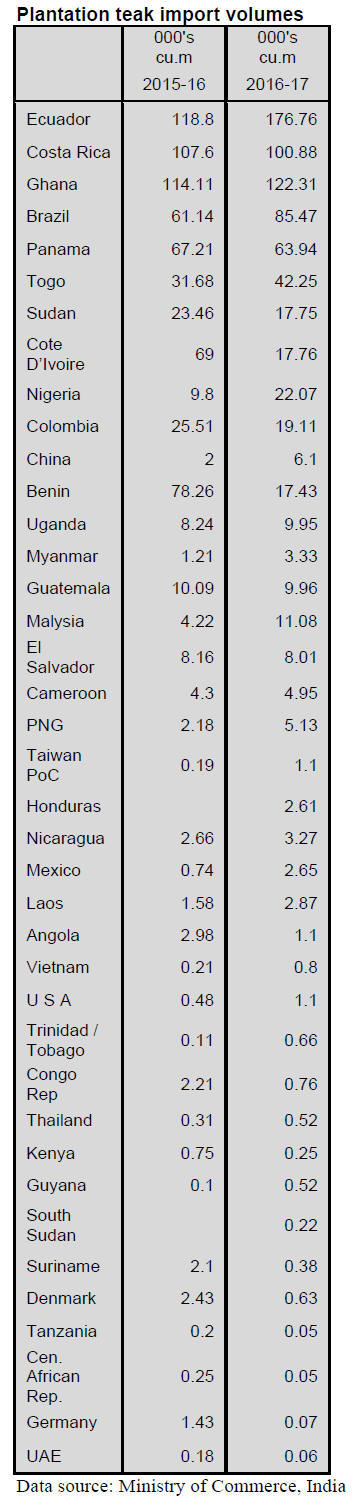

Imported plantation teak

Reduced freight rates, along with the weaker US dollar, on

top of a plentiful supply have worked to keep import costs

in check.

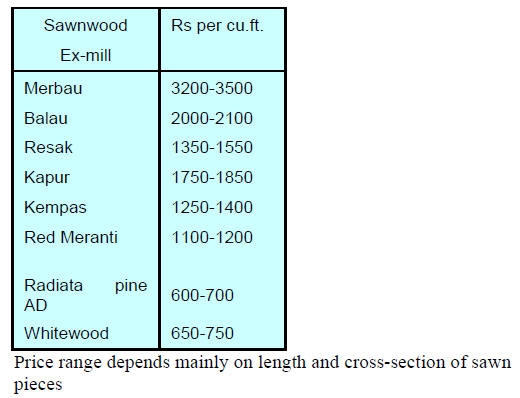

Locally sawn hardwood prices

Prices for imported hardwoods and pine remain

unchanged. Analysts report that demand is picking up as

housing projects get underway, especially in the low and

medium cost sectors. However, with the current stiff

competition in the retail market importers have little

opportunity to raise prices.

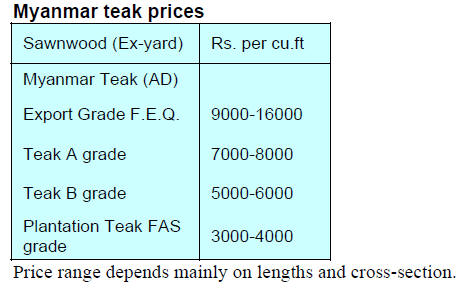

Imported sawn Myanmar teak

Imports of Myanmar teak are flat and traders report sales

are also flat as the competition with alternative timbers

heats up.

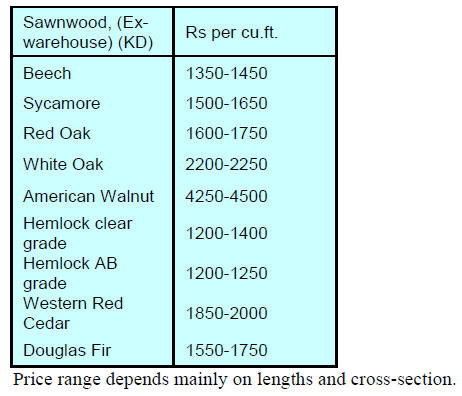

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

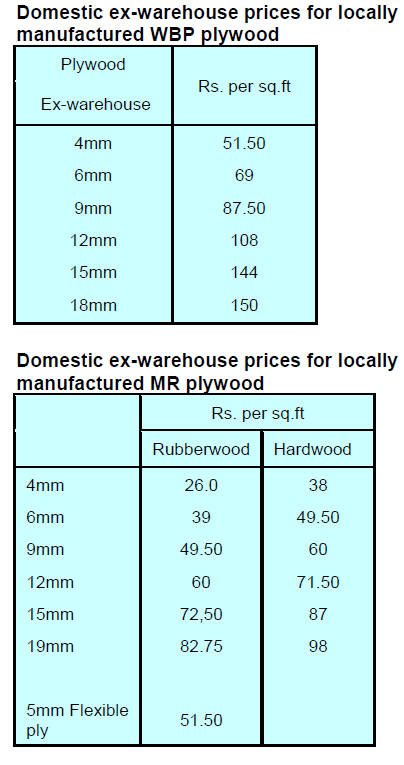

Domestic plywood prices

Plywood production capacity in India has expanded and

this is putting pressure on log prices but manufacturers are

still maintaining the same prices as in January.

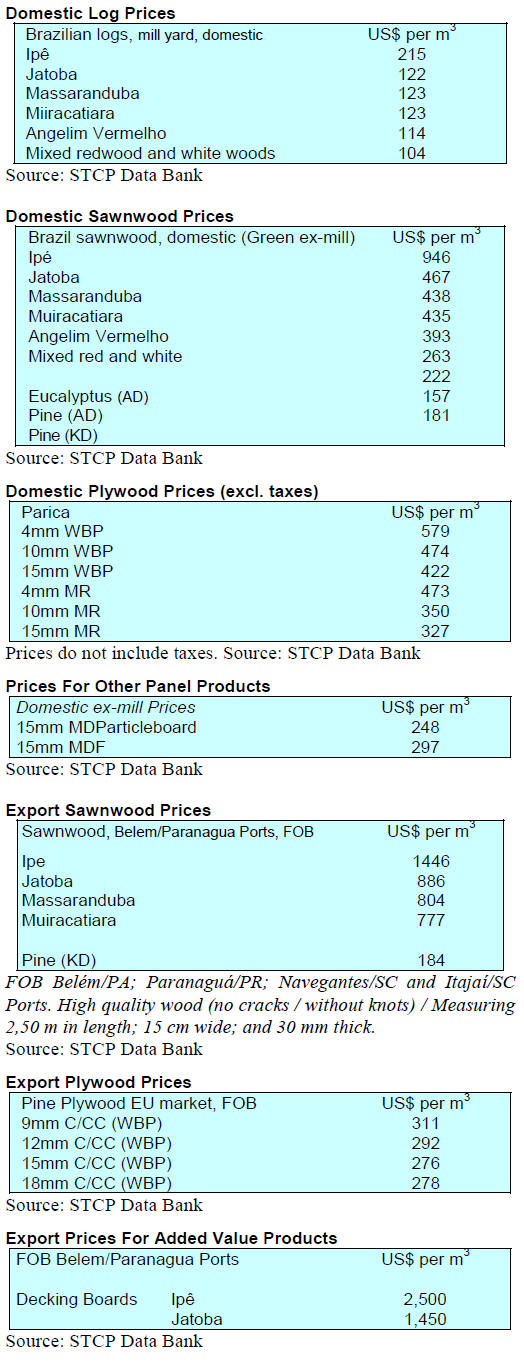

7. BRAZIL

Stellar export performance by

plantation sector

Brazil’s 2017 pulp exports increased 14% to US$6.4

billion. Paper exports were up marginally to US$1.9

billion and woodbased panel exports jumped 16% to

US$289 million. Overall, 2017 was positive for the woodbased

industry which saw a 13% increase in the trade

balance.

In terms of volume, international trade in 2017 was good

with the pulp industries seeing a 2.3% rise in export

volumes to 13.2 million tonnes. The woodbased panel

sector did exceptionally well seing a 21% increase in

export volumes to 1.3 million cubic metres.

China remained the main buyer of Brazilian pulp in 2017

increasing its consumption by 19% over the previous year

to US$2.6 billion. The other major market was Europe

where demand was up 7.5% to US$2 billion.

Latin America was the main market for wood panels and

paper and the region accounted for just over 52% of total

panel exports or US$151 million, an increase of 11%

compared to 2016.

However, growth in demand from the Asia/Oceania region

topped that at 74% for wood-based panels. In contrast, the

domestic market for wood panels registered a 4.0%

increase rising to 6.5 million cubic metres.

Furniture production increases in December

Furniture production in Brazil during December 2017

increased almost 3% month on month, the highest rise

since June 2013. Year on year, December 2017 production

increased 4.3%, the eighth consecutive rise. As result, of

the steady increase furniture sector output expanded

almost 5% in the fourth quarter of 2017.

Companies expecting tough trading conditions in

2018

Despite the growth in export volumes in 2017 revenue

continues to be below expectations, prompting the timber

industry not to be too optimistic for the coming year, at

time when there are likely to be political and economic

changes in the country.

According to the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI) many companies

are expecting tough trading conditions in 2018 because of

the strengthening currency and because of the risk of

turmoil as a result of the presidential election dispute.

Several wood product sectors did well in 2017 but export

volumes were modest and profit margins were low, mainly

because of increased production costs and weakening

prices because production had got ahead of demand.

Brazil’s export of pine plywood in 2017 increased 19%

year on year and the monthly average shipment was

172,000 cubic metres, an expansion of around 27,000

cubic metres from a year earlier. Among the main markets

for pine plywood in 2017 were the United States (30%),

the United Kingdom (13%) and Germany (8%).

Exporters losing money because of bureaucratic

mix-up

Eleven timber exporting companies in Rond˘nia state have

to absorb a daily loss of about R$75,000 because there

shipments have been held up at the port of Manaus due to

a bureaucratic mix up. It has been reported that over 100

containers of wood products have been held for over 45

days even though there are no suggestions of irregularities

with the shipments which were inspected by IBAMA.

The problem arose because authorities in Manaus did not

recognise the inspection done in Porto Velho (capital of

Rondonia) which has federal customs officers who

inspected and sealed the containers. Unfortunately the

containers were opened at Manaus Port which broke the

chain of custody.

For the past three years shipments of wood products

through Porto Velho have been authorised as they are

covered by the Document of Forest Origin (DOF) an

obligatory license for transportation and storage of forest

products from natural forests. This license explicitly says

once inspected and sealed the container cannot be opened

until it reaches its final destination.

The Rond˘nia government has expressed concern that

shipments are being delayed because of misunderstandings

among the federal institutions.

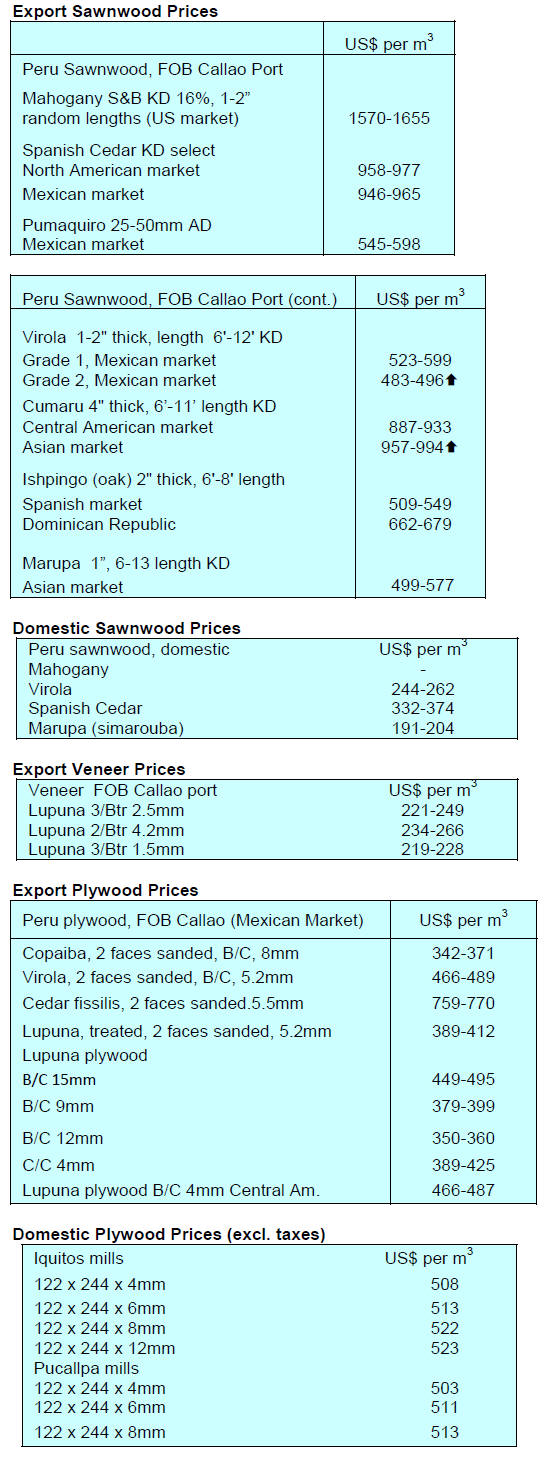

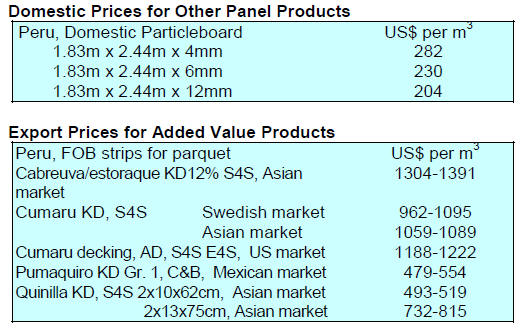

8. PERU

Composite panel imports

continue to expand

In 2017 Peruvian imports of particleboard (PB) and MDF

were worth almost US$84 million, an increase of 11%

compared to 2016. Ecuador was the main supplier in 2017

taking about a 40% share of total imports equal to US$33

million followed by Chile with a 33% share (US$28

million), Spain 14% and Brazil 13%.

The main importer in 2017 was once again Novopan Peru

with a US$31 million slice of total imports of PB and

MDF. The second ranked importer was Arauco Peru

(US$16 million). In third place came Grupo Martin which

accounted for around 14% of imports.

SERFOR penalises forestry consultants for

manipulating data

Under new powers it has been granted SERFOR has

initiated proceedings against more than 90 forestry

consultants for providing false information in management

plans prepared on behalf of clients.

Amongst this group are those who participated in the

preparation of management plans for an area from which

timber on board the MV Yacu Kallpa was seized in the

port of Tampico, Mexico after leaving Loreto carrying

what was suspected illegal wood products.

When the revised Forestry and Wildlife Law came into

force last October forestry, consultants ( now termed forest

regents) became responsible for the accuracy of data in

management plans and also, with their clients, for its

implementation. Those consultants sanctioned will no

longer be able to operate.

Statistical data base to aid policy and management

decisions

The General Directorates of SERFOR, the thirteen

Technical Forestry and Wildlife Administrations, the

Regional Governments and the National Superintendent of

Customs and Tax Administration (SUNAT) have joined

forces to compile an extensive statistical data base.

This, say analyst, contains statistical reports on forest

product exports and imports, data on vehicle inspections

from the control posts of the Forestry and Wildlife

Technical Administration, details of concessions and also

price bulletins. This says SERFOR will make it possible to

promote competitive businesses at a national and

international level.

This new consultative tool is interactive and easy to

access. Users can filter the information according to their

needs and share information easily.