|

Report from

North America

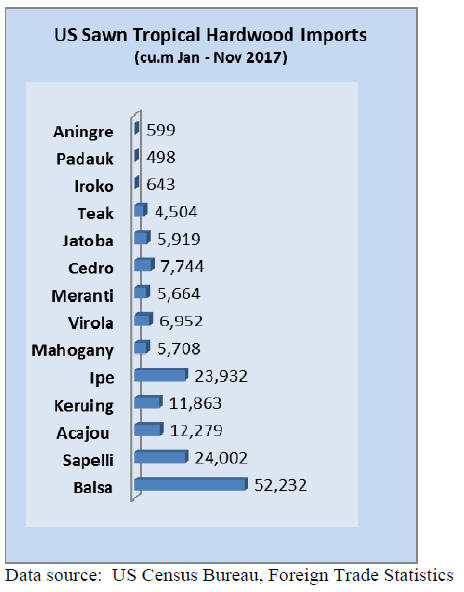

Decline in balsa imports

US imports of temperate and tropical sawn hardwood

declined 8% in November to 65,272 cu.m. The value of

sawn hardwood imports declined 9% from the previous

month to US$38 million.

Import volumes of tropical species fell 19% in November

to 17,936 cu.m., while the value of imports was down 9%

from October.

The significant decline in volumes in November was

mainly due to lower balsa and sapelli imports. Balsa

imports from Ecuador fell 38% to 3,292 cu.m. Imports of

sapelli sawnwood were only1,862 cu.m. in November,

down 54% from the previous month. Year-to-date imports

of sapelli remain higher, however, than at the same time

last year.

Sawnwood imports from Brazil increased 30% in

November because of higher ipe imports. Ipe imports from

Brazil grew to 2,868 cu.m. However, the year-to-date

import volumes of ipe were down 7% in November

compared to the same time last year.

Keruing imports from Malaysia increased in November,

but the overall value of sawnwood imports from Malaysia

was down from October due to lower meranti shipments to

the US.

Steep decline in Canadian tropical sawnwood imports

in November

Canadian imports of tropical sawnwood fell 40% in

November to less than US$1 million (US dollars). Yearto-

date Canadian imports were 4% lower than in

November 2016.

Imports of most major species including sapelli declined

in November, but sapelli sawnwood imports from

Cameroon increased to US$154,995. Balsa imports from

Ecuador also grew in November after record low imports

in October.

Canada launches wide-ranging trade complaint against

US

Canada has filed a WTO complaint over US antidumping

and countervailing duty proceedings. In its complaint

Canada says the US procedures are against international

trade rules in six different aspects, including WTO¡¯s Anti-

Dumping Agreement, the Agreement on Subsidies and

Countervailing Measures, the General Agreement on

Tariffs and Trade and the Understanding on Rules and

Procedures Governing the Settlement of Disputes.

The US Department of Commerce under the Trump

administration launched more than eighty anti-dumping

and countervailing trade investigations in 2017, almost

50% more than in 2016.

Canada¡¯s complaint cites almost 200 examples dating back

to 1996, with many involving countries other than Canada,

including China, India and Brazil.

The US has 60 days to try to settle the complaint, or

Canada could ask the WTO to adjudicate. The process

could take years. The US has lost cases in the WTO before

over its punitive duties system.

The Canadian Foreign Minister said the legal action was

part of a broader litigation to defend forestry jobs in

Canada.

In November 2017 Canada filed a complaint with the

WTO regarding US antidumping and countervailing duties

on Canadian sawn softwood. The US imposed preliminary

countervailing duties on Canadian newsprint in January.

The filing comes shortly before the next round of

negotiations between the US, Canada and Mexico for the

North American Free Trade Agreement (NAFTA). The

complaint might help Canada protect itself if the US

withdraws from NAFTA. Canada¡¯s complaint is available

on the WTO website.

Court hearing on formaldehyde rule compliance

deadline postponed

Last October two environmental groups challenged the US

Environmental Protection Agency¡¯s (EPA) authority to

extend the compliance deadlines for the formaldehyde

emissions rule.

The extension gives manufacturers and importers an

additional year before having to comply with the

Formaldehyde Emission Standards for Composite Wood

Products. The original compliance deadline was December

12, 2017.

Several US industry associations have filed briefs with the

court in support of the deadline extension, including the

Composite Panel Association and the International Wood

Products Association who represent importers. The federal

district court hearing on the case has been postponed until

the end of January.

|