|

Report from

Europe

EU tropical imports sliding again

While there are clear signs that the EU economy is picking

up EU trade in tropical timber continues to slide. Market

demand within in producer countries and other non-EU

consuming markets are now probably more important

drivers of trade volumes into the EU than the current and

potential level consumption in the region.

With tropical wood supplies constrained globally and

strong demand elsewhere, particularly in China, and the

additional challenge of satisfying EUTR due diligence

requirements in the EU, tropical suppliers seem more

inclined to focus on other markets.

The total value of EU imports of tropical timber products

was euro1.65 billion in the first nine months of 2017, 5%

less than the same period in 2016. In quantity terms,

imports into the EU between January and September 2017

were 1.53 million metric tonnes (MT), nearly 9% down on

the previous year.

The unit value of EU tropical timber imports has increased

slightly this year, from euro1039/MT to euro1080/MT,

mainly because imports of higher value products like

plywood, glulam, veneer and decking have declined less

than imports of unprocessed logs and sawnwood.

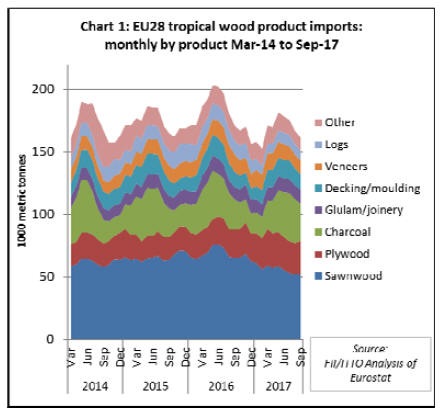

Although there was the usual seasonal rise in EU tropical

timber imports in the first half of 2017, this was subdued

compared to 2016 and imports declined sharply in the

third quarter (Chart 1).

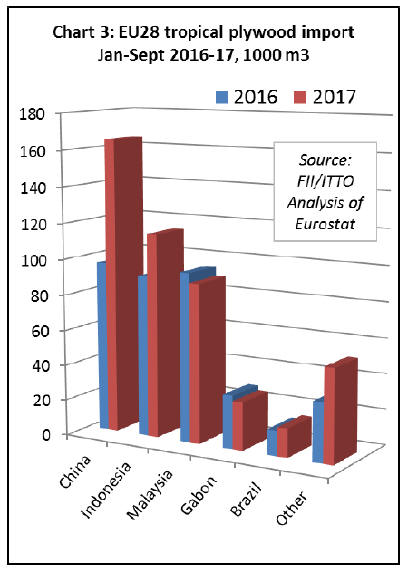

A large part of the decline in EU tropical timber imports in

the first nine months of 2017 was concentrated in

sawnwood, which in tonnage terms were down 20%

compared to the same period in 2016.

During this period there was also a fall in import tonnage

of tropical charcoal (declining 2% to 266,000 MT),

decking/mouldings (declining 5% to 122,000 MT), veneer

(declining 6.3% to 110,000 MT), logs (declining 31% to

76,000 MT) and flooring (declining 3% to 28,000 MT)

(Chart 2).

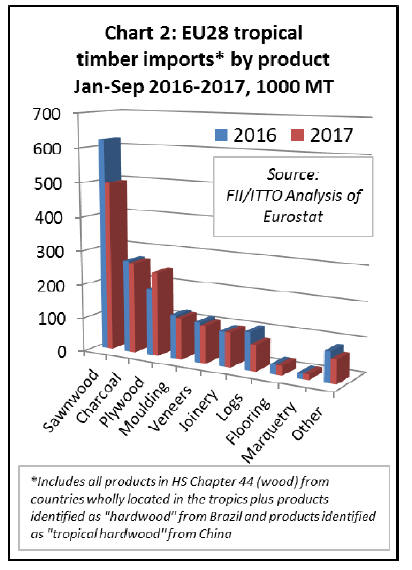

Tropical plywood apparently bucked this trend, with EU

imports rising 30% to 464,000 cu.m in the first nine

months of 2017.

However much of this gain comprised tropical hardwood

plywood manufactured in China, rather than direct imports

from the tropics, and may well be due to the increased

range of hardwood types specifically identified as

¡°tropical¡± rather than ¡°other¡± in the HS product definition

since the start of this year. (Chart 3).

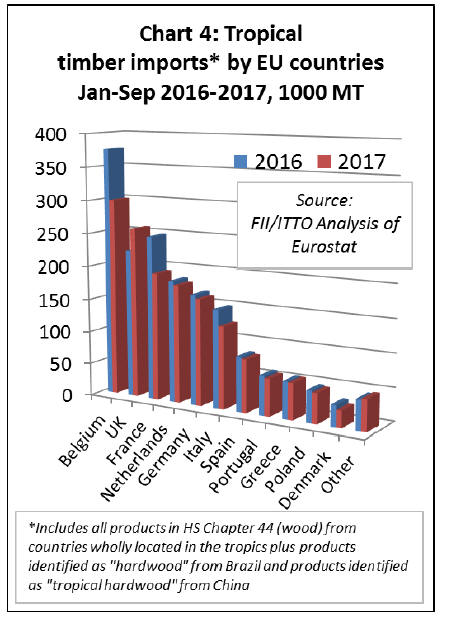

The downturn in EU imports of tropical timber products

during the first nine months 2017 was concentrated in

Belgium (declining 20% to 300,000 MT), France

(declining 22% to 194,000 MT), and Italy (declining 16%

to 125,000 MT).

The only market apparently recording significant growth

in tropical timber imports during this period was the UK,

rising 15% to 258,000 MT. (Chart 4).

The apparent rise in tropical imports in the UK is

misleading because this is by far the largest European

destination for tropical hardwood plywood from China.

Direct imports of tropical timber products into the UK

have not posted significant gains this year.

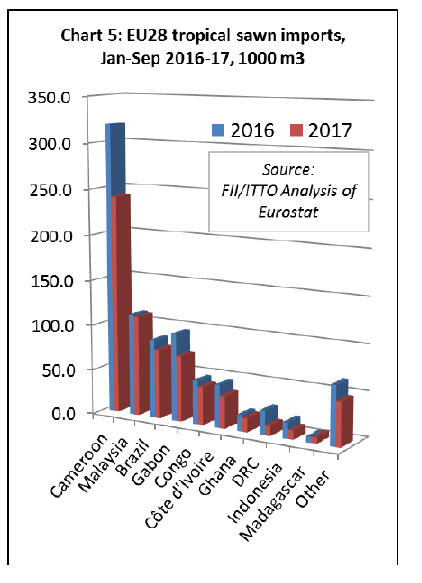

EU sawn timber imports fall 21%

In volume terms, EU imports of tropical sawnwood were

670,500 cu.m in the first nine months of 2017, 21% less

than the same period in 2016. Although a large share of

the decline was due to a 25% fall in imports from

Cameroon (to 241,000 cu.m), there was a fall in trade with

nearly all the main supply countries.

EU tropical sawnwood imports fell sharply from Brazil

(declining 12% to 76,600 cu.m), Gabon (declining 25% to

72,500 cu.m), Congo (declining 13% to 42,100 cu.m),

Cote d¡¯Ivoire (declining 24% to 36,000 cu.m).

Ghana (declining 14% to15,500 cu.m) and DRC (declining

57% to 11,300 cu.m). Of major suppliers, only Malaysia

maintained a level (110,000 cu.m) close to that of the

previous year. (Chart 4).

In the first nine months of 2017, imports of tropical

sawnwood declined into all the main EU markets, with the

single exception of the UK.

Imports were down 29% in Belgium (202,600 cu.m), 6%

in the Netherlands (103,100 cu.m), 26% in France (80,200

cu.m), 35% in Italy (73,100 cu.m), 21% in Spain (45,200

cu.m), 14% in Germany (31,700 cu.m), and 10% in

Portugal (22,200 cu.m). Imports in the UK increased, but

by only 2% to 67,600 cu.m.

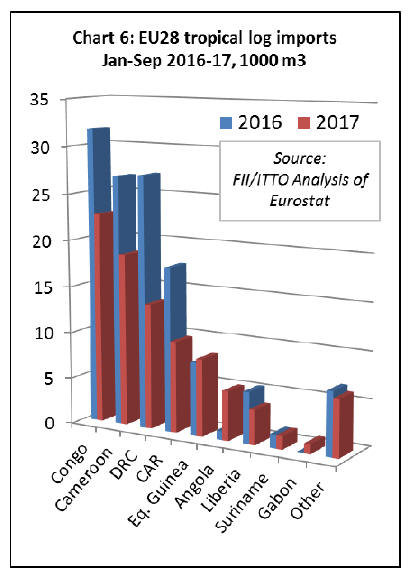

EU log imports fall from all leading tropical suppliers

The EU trade in tropical logs followed a similar downward

path. Imports in the first nine months of 2017 totalled just

90,400 cu.m, 28% less than the same period in 2016, and

fell 29% to 22,700 cu.m from Congo, 31% to 18,500 cu.m

from Cameroon, 50% to 13,500 cu.m from DRC, and 44%

to 9,800 cu.m from CAR.

However, there were gains in imports from some smaller

suppliers, notably Angola (to 5,300 cu.m from a negligible

level in 2016). (Chart 5).

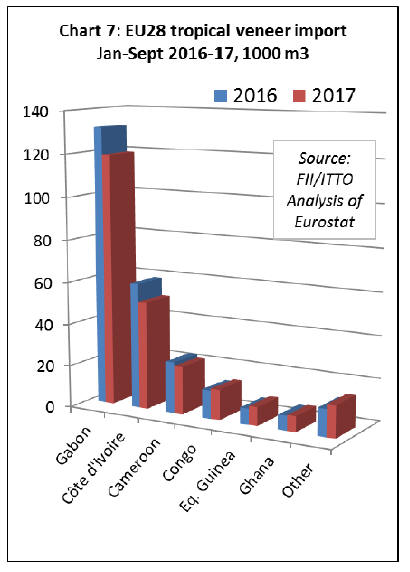

EU imports of tropical veneer declined 7% to 238,400

cu.m in the first nine months of 2017, mainly due to a 10%

fall in imports from Gabon to 119,000 cu.m. There was

also a 14% fall in imports from Cote d¡¯Ivoire to 51,100

cu.m, and a 7% fall in imports from Cameroon to 22,700

cu.m. However, imports increased from some smaller

suppliers including Congo (rising 7% to 14,400 cu.m),

Equatorial Guinea (rising 17% to 8,800 cu.m) and Ghana

(rising 6% to 7,300 cu.m). (Chart 7).

Most of the decline in EU imports of tropical veneer was

concentrated in the two largest EU markets; France and

Italy. Tropical veneer imports increased in Spain, Greece

and Romania during the nine-month period.

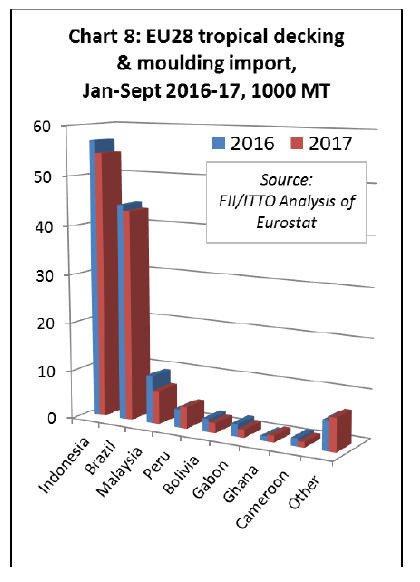

EU imports of moulding/decking were more stable than

for other tropical products in the first nine months of 2017,

falling only 5% to 121,000 cu.m.

Imports declined 4% from Indonesia to 54,300 cu.m, 3%

from Brazil to 43,100 cu.m, and 30% from Malaysia to

6,900 cu.m. There was a 17% gain in imports of

mouldings/decking from Peru, but from a small base to

4,400 cu.m. (Chart 8).

Tropical glulam, mainly laminated window scantlings and

kitchen, was one of the few tropical wood products to

record an increase in EU trade in the first nine months of

2017, with imports rising 9% to 43,800 MT. Imports from

Malaysia increased 31% to 19,800 MT but declined 2%

from Indonesia to 16,500 MT and 1% from Vietnam to

4,600 MT.

Imports decline despite economic growth

As noted in previous MIS reports, the downturn in imports

is more disappointing because it is occurring at a time

when there are clear signs that the EU is at last returning

to economic health. In their autumn statement issued in

November, the European Commission said that the latest

GDP statistics show that the EU "is on track to grow at its

fastest pace in a decade this year."

The EC forecast that the eurozone economy will grow by

2.2% this year and 2.1% next year, a significant

improvement on their previous forecast in May (1.9% in

both 2017 and 2018). For the whole EU, including noneurozone

countries, growth is expected to be a "robust"

2.3% this year and 1.9% next year - compared to 1.9% for

both years that was expected in May.

The EC noted that for the first time in a decade all EU

countries will grow this year. This was due, according to

the EC, to ¡°resilient private consumption, stronger growth

around the world, and falling unemployment".

Investment in the EU is also "picking up" and confidence

in the economy has "considerably brightened", encouraged

partly by the European Central Bank policy of low interest

rates and massive bond buying.

The EC noted downside trends, notably " sluggish wage

growth¡± which ¡°partly reflects low productivity growth

and persistent slack in the labour market." But for the first

time, risks surrounding the economic outlook are

considered by the EC to be "broadly balanced" instead of

"tilted to the down side".

|