Japan

Wood Products Prices

Dollar Exchange Rates of 10th

October

2017

Japan Yen 112.45

Reports From Japan

Business confidence at 10 year

high

The Bank of Japan survey of business confidence, the

basis of its Tankan Survey Report has risen to its highest

level in around 10 years. The results of the survey reflect

how companies perceive prospects in the medium term.

The September survey marks the fourth in a row showing

companies intend to increase capital spending.

The optimistic survey highlights the improvement in

Japan¡¯s economic prospects underpinned by strong exports

and investments linked to the Tokyo 2020 Olympics.

Faster growth driven by global demand

forecast

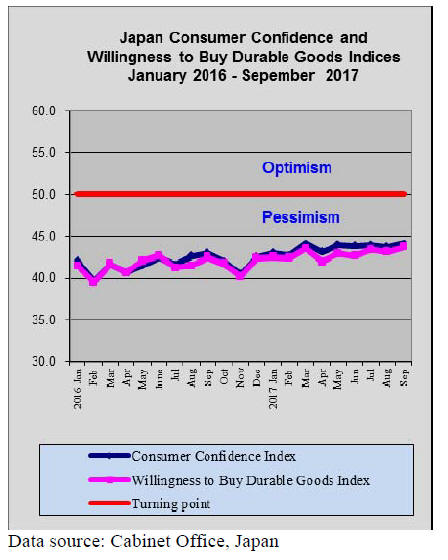

Along with the good news on corporate capital spending

the latest consumer confidence survey also delivered

positive news. The consumer sentiment index rose in

August, the latest for which data is available. The index

for overall livelihood also rose as did the income growth

index.

Of particular interest to wood product manufacturers was

the rise in the index assessing willingness to buy durable

goods.

In assessing recent economic trends the International

Monetary Fund has forecast Japan¡¯s economy will grow

1.5% this year, a figure slightly higher than forests three

months ago. This is because the global economic recovery

is moving at a faster pace than predicted driven by a strong

recovery in Europe, China, the United States and emerging

Asia.

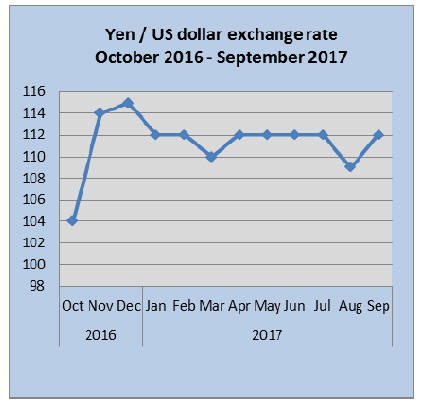

Yen exchange could be impacted by election

result

The uncertainty surrounding the outcome of Japan's

general election set for October 22 is impacting currency

markets.

In past elections the policies of the main political parties

were such that continuity was almost certain but in this

election things could be different.

A new party, Hope, led by the Tokyo Governor Yuriko

Koike, looks set to at least chip away some of the power of

the coalition that, except for a brief spell, has ruled Japan

for decades.

Under the current government the yen has been held in

check which has boosted exports, but if the new party

gains enough support to trim the ruling party¡¯s majority

then the basis for the yen's weakness may change.

Experts see need for 1 million temporary

homes after

mega-quake

Next month the government¡¯s Central Disaster

Management Council will issue new guidelines for

alerting people of the expected Nankai Trough earthquake

that could claim hundreds of thousands of lives and

destroy thousands of buildings along a 700 km stretch of

Japan¡¯s southern and eastern coast including Tokyo.

A panel of experts has said that in the event of a Nankai

Trough earthquake up to 840,000 temporary housing units

would be required. Securing emergency accommodation

would be a major challenge in the event of a catastrophic

Nankai Trough quake.

Import round up

Doors

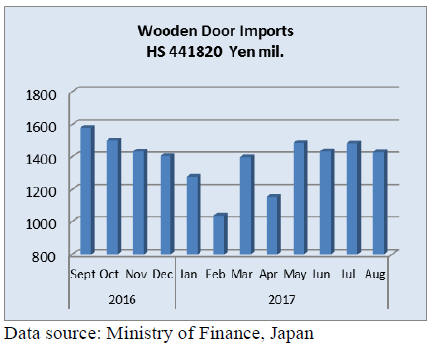

The value of Japan¡¯s July imports of wooden doors (HS

441820) was little changed from the previous month and

data for August shows a 10% decline year on year with a

month on month fall of 18%.

In August the three main shippers, China, the Philippines

and Indonesia accounted for 86% of all imports of wooden

doors with China alone accounting for 56% of Japan¡¯s

total wooden door imports.

Windows

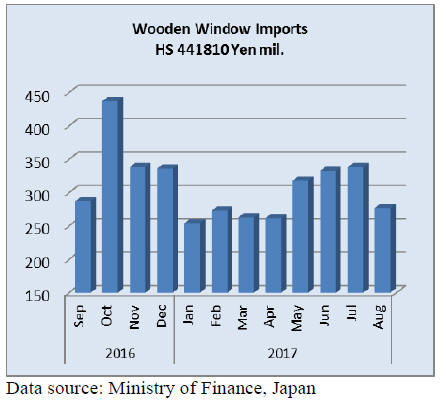

The steady decline in year on ear imports of wooden

windows into Japan continued into August. Year on year

August 2017 imports of HS441810 were down 27% and

compared to a month earlier August imports were down

18%.

As has been the trend over the year 3 countries dominate

Japan¡¯s imports of wooden windows, China (36%), the

Philippines (23%) and the US (30%). This leaves little

market share for other shippers mainly in Europe.

Assembled flooring

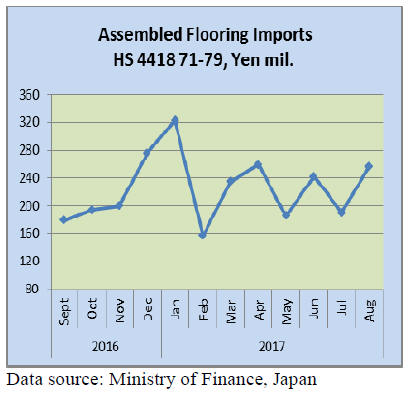

Once more the volatility in imports of assembled wooden

flooring (HS441871-79) observed this year continued into

August. Year on year, August imports were up over 60%

and compared to levels in July there was a 35% surge in

August imports.

The bulk of Japan¡¯s imports of assembled flooring fall

within HS 441875 which, in August, represented over

70% of imports.

Other major categories include HS 441879 (25%) shipped

mainly from China and Indonesia. Imports of HS 441873

and 79 are small (around 2% of August imports).

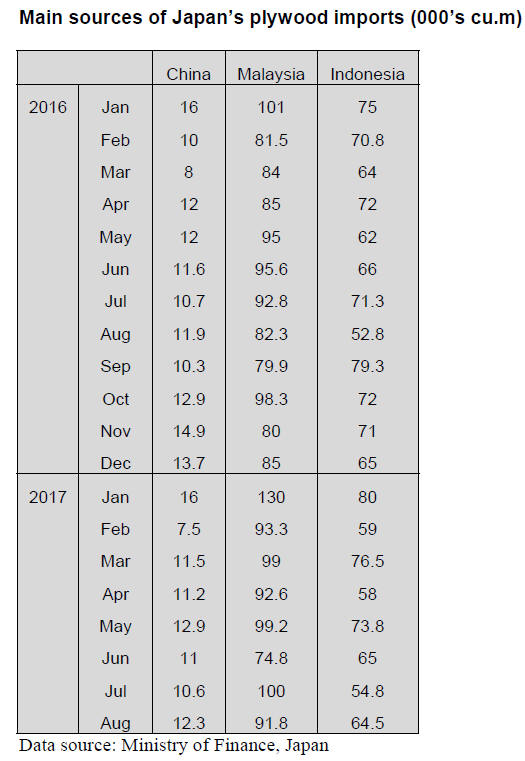

Plywood

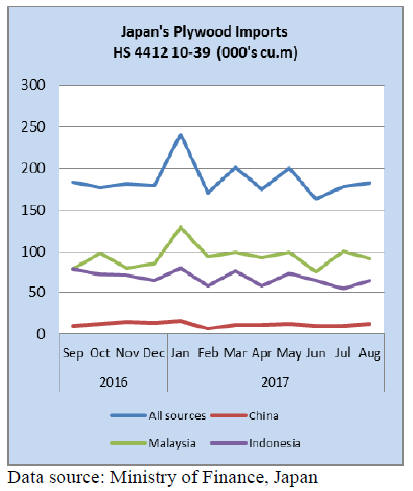

Japan¡¯s August imports of plywood rose 11% year on year

but compared to a month earlier August import volumes

were flat.

Over the past 12 months shippers in Malaysia, mainly

Sarawak have provided the largest volume of plywood to

Japan. The second ranked shipper is Indonesia followed by

China. The three account for most of Japan¡¯s imported

plywood.

Shipments from Malaysia are mostly of HS 441231 (97%)

with small quantities of HS 4412 33 and 34. Shipments

from Indonesia follow a similar pattern with 87% being S

441231 but more HS 441234 is shipped (12%). In contrast

plywood shipments from China are more varied with HS

441231 accounting for 48%, HS441233 (31%), HS 4412

34 (8%) and HS441239 (12%).

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

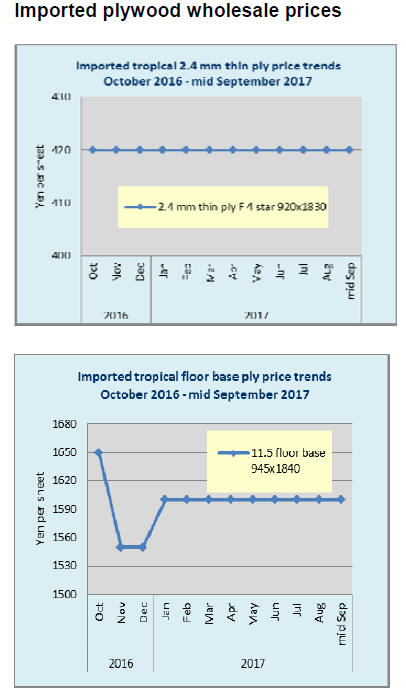

Tight supply of South Sea (Tropical) plywood

Shipments of ordered plywood of South Sea hardwood

have been largely delayed by log supply shortage.

Even after the rainy season was over, weather has not

improved in producing regions of Indonesia and Malaysia,

which hampers hauling of harvested logs to coast where

plywood mills are. Plywood mills operate with very little

log inventories. Also quality logs are hard to come by

now.

To produce thin plywood and floor base plywood, log

quality is important but the mills are not able to have

enough quality logs, which delayed production of ordered

volume. Delay of shipments is about three to four months

now and port inventories are way down in Japan while the

demand continues strong.

Because of supply shortage, the export prices are

climbing. Indonesian 2.4 mm thin plywood (second

class/F4 star) prices are US$800-820 per cbm C&F.

With supply shortage of imported plywood, demand of

thin plywood has been shifting to other materials such as

MDF and this move seems to accelerate.

Floor base plywood demand has been shifting to domestic

softwood plywood. Delayed shipments will continue as

the producing regions will be in rainy season again after

late October. Reduced supply volume and higher export

prices will continue.

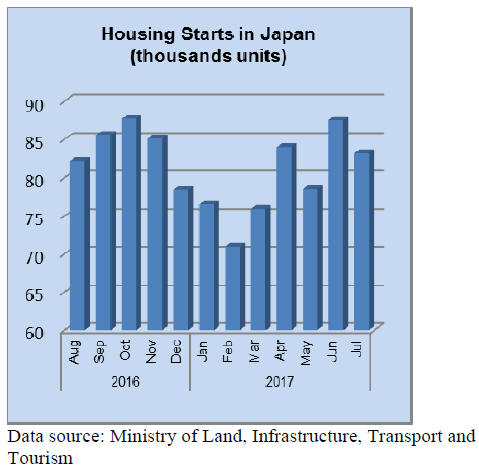

Wood demand in 2016

Total demand for wood in 2016 was 78,077,000 cbms,

3.9% more than 2015. Housing starts were 6.4% more

than 2015, which stimulated wood demand for lumber and

plywood then with start-up of new biomass power

generation plants, demand of wood for fuel was additional.

The degree of self-sufficiency in wood increased by 1.6

points to 34.8% but for lumber, imports were more so that

the degree dropped by 0.7 points. The degree of wood for

fuel increased by 6.0 points with increased domestic

supply.

Domestic wood production for total demand was

27,141,000 cbms, 8.9% more then imports were

50,936,000 cbms, 1.4% more. Majority of domestic

increase was wood for fuel, which took 58.9% while wood

for lumber and plywood increased only by 2.6%.Domestic

wood for fuel was 4,458,000 cbms, which is more than

3,876,000 cbms for plywood and it is getting close to

5,266,000 cbms for pulp and wood chip.

Since there are more start-ups of biomass power

generation facilities in 2017, demand for wood for fuel

would be the second largest behind wood for lumber.

Domestic wood demand for plywood continues increasing

close to 4,000,000 cbms in 2017 since demand of domestic

plywood to replace floor base of South Sea hardwood

plywood.

Plywood

Demand for softwood plywood is brisk mainly by large

precutting plants while wholesale channels are getting

quiet after they have built up enough inventories. Medium

and small precutting plants maintain regular purchase

volume in fear of supply shortage they experienced a year

ago.

August softwood plywood production was high at

254,700 cbms, 10.8% more than August last year and

2.6% less than July despite fewer working days with the

Bon holidays.

The shipment in August was 249,900 cbms, 4.6% more

and 4.7% less. The inventories were 110,100 cbms, 7,300

cbms more than July.

Besides main product of structural plywood, plywood

mills now need to produce floor base panels for domestic

building manufacturers.

Trading firms are not able to respond to spotty orders

since volume allocation by plywood manufacturers is

unchanged. They are now trying to correct price gap

between direct buyers of precutting plans and wholesalers.

After plywood manufacturers increased the sales prices in

September, they are pushing the prices up step by step.

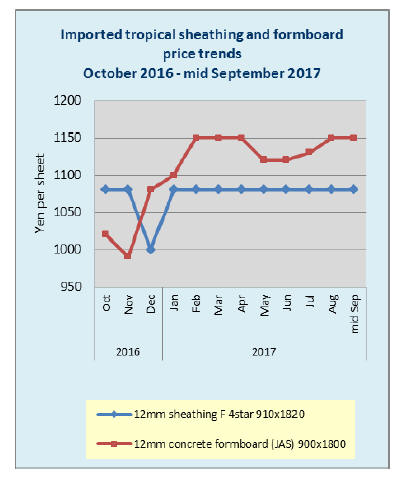

Imported 12 mm 2x6 coated concrete forming panel

supply is tight. The suppliers suffer log supply shortage to

manufacture veneer. Importers have enough inventory of

3x6 but 2x6 inventory is down with busy shipment.

Plywood conference by three countries

Plywood manufacturers and dealers from Indonesia,

Malaysia and Japan had conference at Jakarta, Indonesia

to exchange market information and trend of plywood

market.

The most recent issues are restriction of log harvest and

demand structure.

In Indonesia and Malaysia, harvest of natural growth

timber has reduced by various restrictions while

production of planted timber is increasing. In Indonesia,

40% of total harvest is now planted timber and in

Sarawak, Malaysia, share of planted timber in total harvest

will be more than 50%in five years.

In Sarawak, Malaysia, log production in the first half of

this year was 3,746,000 cbms out of which 2,937,000

cbms were naturally grown timber and 808,000 cbms were

planted timber, 21% in total harvest. Total year harvest of

planted timber this year will be 1,600,000 cbms, 300,000

cbms more than 2016.

Raw materials of various products are shifting from virgin

timber to planted timber.

In Indonesia, utilization of recyclable resources is

progressing and various products have been developed by

cooperation with the Japanese building materials

manufacturers.

To the question by Indonesia of present status of plywood

manufacturing in Japan with domestic wood resources, the

Japan Plywood Manufacturers Association answered that

the government has set target of six million cbms of

domestic logs for plywood manufacturing by 2025 and

eight million cbms for biomass power generation but it is

uncertain if this target is materialized.

It is the fact that domestic plywood is now more than

imported plywood in Japan but imported plywood is

absolutely necessary product for Japan but in coming

years, the market would not accept any product without

traceability or forest certificate.

Increasing consumption of CLT

Meeting by the governmental offices to promote use of

CLT was held recently and it reported that consumption of

CLT in 2017 would be about 20,000 cbms, four times

more than 2016 but gap between producing capacity of

about 60,000 cbms and actual consumption remains so

further promotion to use CLT is necessary.

In 2016, use of CLT was only 5,000 cbms to the

production of 50,000 cbms so the demand was only one

tenth of the production then in 2017, the production

increases to 60,000 cbms and the consumption increases to

20,000 cbms.

To promote use of CLT, the central and local governments

give subsidy so majority of CLT construction is based on

the subsidy. The government plans to increase the

production of CLT to 100,000 cbms by 2020 so further

demand promotion is immediate issue.

In 2017, total construction by CLT is 112, which exceeds

total CLT construction of 93 in the past so speed of

increase is remarkable but not enough to catch up the

production.

Since there are many buildings with subsidy, type of

buildings is public hall and community center by local

governments. Others are office, public housing,

companies¡¯ dormitory, stores and warehouse.

By the government¡¯s road map to stimulate use of CLT,

each local government has to build at least one CLT

building by 2018.

|