Japan

Wood Products Prices

Dollar Exchange Rates of 25th

September 2017

Japan Yen 111.73

Reports From Japan

Good second quarter results

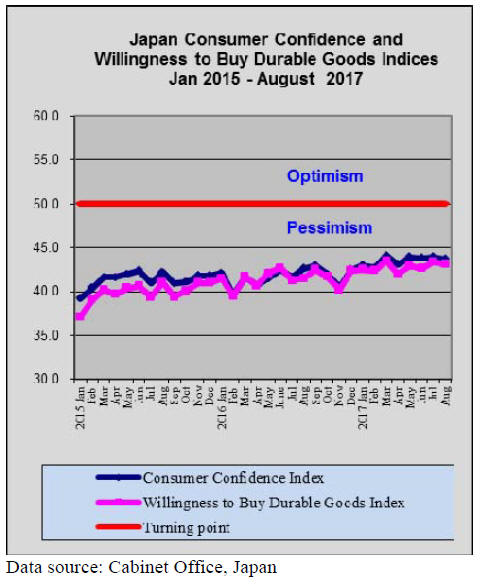

In the second quarter of this year Japan¡¯s economy

expanded at the fastest pace in more than two years driven

by higher consumer spending and corporate investments.

But it will require a steady increase in prices and in wages

if this is to be sustained. Overall, growth remains weak

because companies are not passing on part of their profits

as higher earnings for employees.

It appears that manufacturer¡¯s assessment of the

prospects

for the economy is such that they do not want to risk

raising sales prices for fear of undermining what little

growth has been recorded.

All eyes are now on the Tankan survey results due to

be

released 2 October. The consensus is that confidence

levels in the largest Japanese manufacturers should move

higher on the back of improved global demand however,

further growth will depend on defusing tensions between

the US and North Korea.

Yen weakens on plans for new stimulus

package

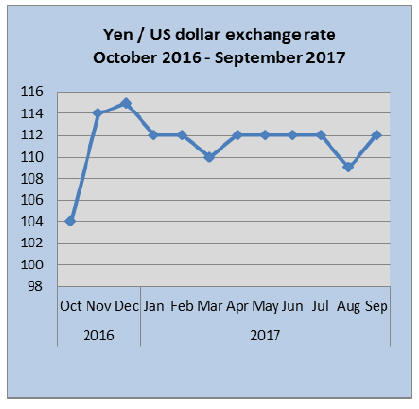

Two issues affected the yen/dollar exchange rate in the

second half of September, the growing tension between

the US and North Korea and the package of stimulus

measures proposed by the ruling party in Japan as it heads

into a surprise general election.

As is usual when regional tensions increase there is

Yen

buying however, the decision for a massive Yen 2 trillion

stimulus weakened the yen. Immediately the stimulus

package was unveiled the yen fell to around 112 to the US

dollar.

The Prime Minister of Japan said he intends to use the

income raised from the planned consumption tax increase

in 2019 to subsidise education, child-care costs and on

boosting corporate investments to improve productivity.

The earlier plan was to use the extra income to pay down

some of the national debt and expand social services.

Residential land prices at 26 year low

The latest data from the Ministry of Land, Infrastructure,

Transport and Tourism show the average price of

commercial land across Japan, as of 1 July 2017, rose

0.5% from a year earlier. This extends the gains noted in

the 2016 survey when data showed commercial land prices

bottomed out for the first time in nine years.

Commercial land prices, as of July this year in the

three

major cities, rose 3.5% year on year, the fourth

consecutive annual. Prices in four regional cities surged

almost 8% with Sendai, a city in central Japan leading the

charge.

However, residential land prices moved in the

opposite

direction falling almost 1% across the country, the 26th

year of decline.

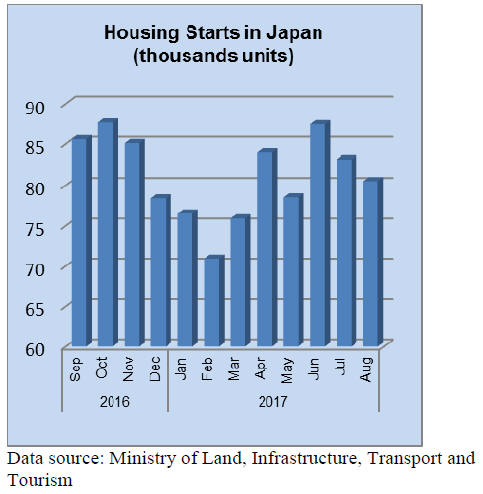

August housing starts

Japan's August housing starts were expected to be higher

than in July but instead they dropped unexpectedly

marking two straight months of decline. Year on year

starts were down around 2% in August, a month that saw

extended holidays in the construction sector.

Other data from the Ministry shows orders received

by

construction companies fell around 10% in August in

contrast to the rise in July.

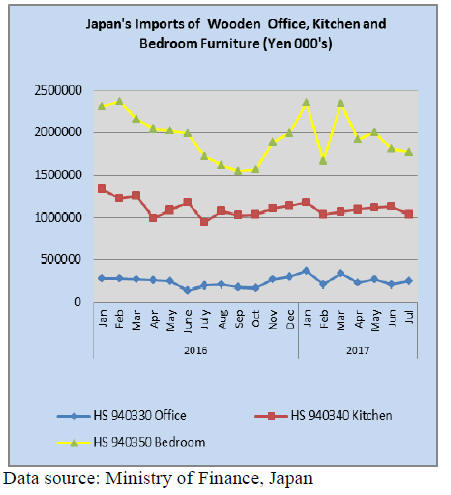

Japan¡¯s wooden furniture imports

The overall trend in Japan¡¯s July imports of wooden

furniture reinforces the steady decline observed since the

beginning of this year. Bedroom furniture imports, the

largest by value of the three categories tracked, have been

falling as have imports of wooden kitchen furniture.

Wooden office furniture imports are a fraction of

the value

of bedroom and kitchen furniture and have remained fairly

steady since the end of the first quarter 2017 but picked up

in July.

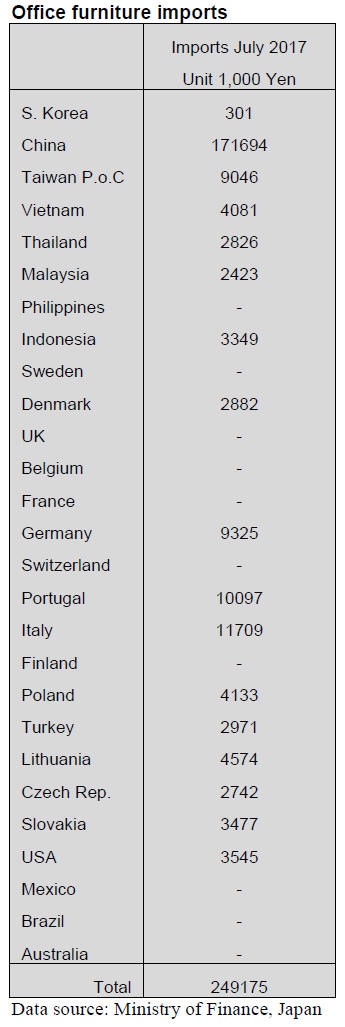

Office furniture imports (HS 940330)

Year on year, Japan¡¯s imports of wooden office furniture

rose 26% and compared to a month earlier July imports

rose 18%.

Exporters in China and Italy are successful in the

Japanese

wooden office furniture market and always feature in the

top 3-4 shippers.

Third placed shippers tend to be either Portugal or Poland

and in July the third raked supplier was Portugal. The top

three shippers accounted for around 80% of July

shipments of wooden office furniture to Japan with China

dominating imports at 69%.

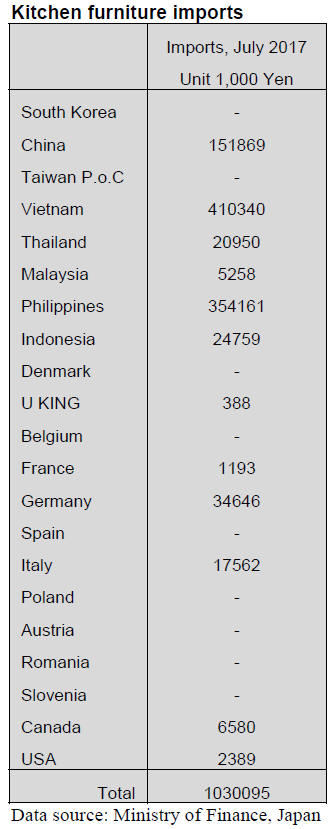

Kitchen furniture imports (HS 940340)

Japan¡¯s imports of wooden kitchen furniture increased every

month for the past 4 months but July saw a correction with

month on month imports falling 8.5%. However, year on year

imports are up 9%.

Imports of wooden kitchen furniture from Vietnam and

the

Philippines dominate the market for imported kitchen furniture as

together shippers in the two countries account for over 70% of all

wooden kitchen furniture imports. The third place supplier over

the past months has been China.

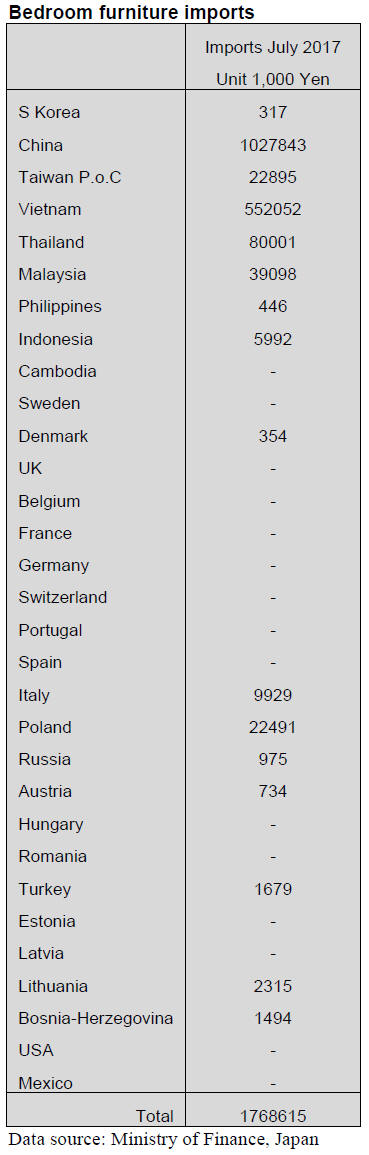

Bedroom furniture imports (HS 940350)

Japan¡¯s imports of wooden bedroom furniture increased

steadily in the second half of 2016 only to fall back in

2017.

First quarter 2017 import values were very volatile

but a

steady downward trend in the value of imports emerged in

the second quarter of this year and has been reinforced by

the flat to slight decline reported for July.

Manufacturers in China account for around 60% of

Japan¡¯s imports of wooden bedroom furniture with another

30% originating in Vietnam. In July, only the only

significant shipments from EU member states came from

Poland and Italy.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood product exports from Japan

Wood products export this year is increasing. During

January and June this year, log export volume was

479,141 cbms, 51.2% more than the same period of last

year and lumber export was 62,557 cbms, 58.6% more.

China is the largest buyer of Japanese logs and Philippines

becomes one of major lumber buyers.

The Ministry of Agriculture, Forestry and Fisheries

has set

a target of one trillion yen of export of farm, marine and

forest products by 2020. For forest products export, a

target is 25 billion yen but 2016¡¯s export was 27.4 billion

yen, which is more than the target. Next target is to

increase export of value added products like plywood and

lumber from logs but for this, development of new

markets is necessary.

The Ministry allocated some budget to develop new

markets and main targets are China, Korea, Taiwan and

Vietnam. In particular, it has been working to add

Japanese wood species for Chinese wooden building

standards to increase Japanese style wooden buildings.

The Japan Wood Products Export Promotion Council is

promoting activities of construction of model houses,

displaying wooden interior materials of condominiums

and participation to exhibitions and holding seminars.

Export has started of kiln dries wood products, which have

durability and dimensional stability and precut laminated

lumber for temple construction.

On September 16, it opened model room of 65 square

meters, which displays Japanese tea room with wellknown

high grade lumber of cedar from Yoshino and

Akita. There is demand for Japanese style relaxing room

but in China, price is always priority matter so it is

questionable if high priced Japanese products are selected

easily.

Japanese cypress is very popular in Korea as it is

believed

to have sterilizing power so cypress furniture and interior

materials are in high demand. Antenna shop was opened in

last August in Seoul, where cypress bed and interior

materials are displayed and sold. Export of Japanese style

house to Korea is more than China and export of precut

materials by Japanese builders is increasing.

Taiwan shows interest to Japanese wood products like

plywood, LVL and CLT. Vietnam market is unknown yet

but there are many furniture manufacturers exporting

finished products to Europe so demand of furniture

materials may be one of major business. For the U.S.A.,

Japanese cedar lumber is exported to substitute short

supplied Western red cedar for fencing.

Price hike proposed on softwood plywood

Supply of domestic softwood plywood is getting tighter

again with increasing orders for the fourth quarter

deliveries. Delay of deliveries about two weeks started

again for wholesale business.

With prospect of tight supply for coming months,

some

plywood manufacturers have started proposing price

increase due to climbing production cost.

Large precutting companies have kept ample orders

through the summer then small and medium precutting

companies are now having future orders and they have

started procuring plywood for busy fall demand. Supply of

thick panels was short last year so users are placing orders

before things change.

Normally small precutting companies carry minimum

volume but now they are building inventories to deal with

possible tight supply in fall. Building materials trading

firms are having more orders but allocated volume by

plywood manufacturers is firmly set so they are not able to

deal with spotty orders. They give priority to regular

customers like large precutting plants so there is no delay

of deliveries now.

Stabilising plywood industry

Plywood used to be typical un-stabilizing and market

sensitive commodity with frequent price fluctuations by

unbalance of supply and demand. Imported plywood used

to take more than 50% share of the market. Then supply of

raw materials relied on imported logs like South Sea

hardwood and Russian larch logs for many years.

Up until 2015, it was considered depressed industry

by

over supply then plywood manufacturers tried desperately

to restore the market by production curtailment. Then the

market stabilized and at the same time, the demand

recovered so for last two years, it has been sellers¡¯ market

and the manufacturers enjoyed profitable business.

Plywood production of South East Asian countries has

been declining mainly by difficulty of acquiring raw

material logs due to declining resources and environmental

protection.

Large production of South Sea hardwood plywood is

now

becoming history. The prices of imported plywood have

been steadily climbing. Now share of imported plywood is

less than half. Indonesian plywood has been used for floor

base and Malaysian plywood is used for concrete forming

panel. Since steady supply in future is diminishing,

Japanese industries, which relied on import plywood, are

now trying to switch to domestic softwood plywood.

Now main raw material of domestic plywood is

domestic

species of cedar, cypress and larch, which is available

consistently and the prices are stable without being

influenced by fluctuation of exchange rate.

Shipments of domestic softwood plywood for the first half

of this year were 1,447,000 cbms, 2.2% more than the

same period of last year. Use of plywood for a unit of

newly build houses is 3.12 cubic meters, which was 2.83

cbms in 2014, 10.2% more. Not only plywood but other

panel products such as structural particleboard, MDF and

gypsum board for bearing wall expand market by easy

workability and high wall strength factor. This is the first

time that plywood market has stabilised for long time.

South Sea (tropical) lumber and logs

Demand for South Sea lumber such as laminated free

board is firm but the supply is tight by log shortage in

South East Asian countries. With log harvest restrictions

and related tax increase, future cost will be climbing.

An immediate concerned matter is severe

environmental

restrictions by the Chinese government on red pine

laminated freeboard lumber manufacturing plants. Many

small plant are quitting without any money for capital

investment and orders are concentrating to large

manufacturers so the prices are climbing.

|