|

Report from

Europe

European market for tropical wood slows again

Although overall economic conditions are improving in

Europe, growth in key countries and sectors for the

tropical hardwood sector is subdued and weakening in

some cases.

The European Commission currently forecasts GDP

growth in the EU to remain level at 1.9% in both 2017 and

2018. However, private consumption, the main growth

driver in recent years which expanded at its fastest pace in

10 years in 2016, is set to moderate this year as inflation

partly erodes gains in the purchasing power of households.

Investment is expected to expand fairly steadily in the EU

but remains hampered by the modest growth outlook.

Unemployment continues its downward trend, but it

remains high in many European countries. In the euro

area, it is expected to fall to 9.4% in 2017 and 8.9% in

2018.

Meanwhile the European market for tropical wood which,

after a long period of decline, stabilised at a low level

between 2014 and 2016, has generally slowed again this

year.

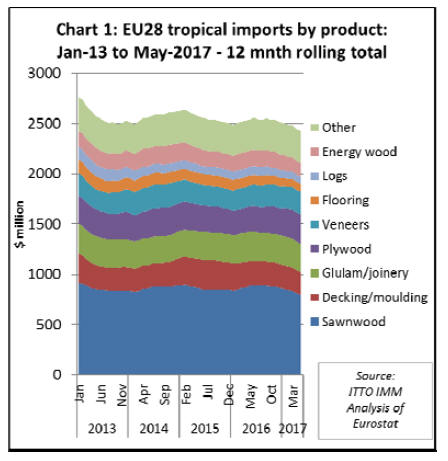

Charts 1 to 4 show the monthly trend in imports of tropical

wood products into the EU to May 2017 using 12 month

rolling totals. This is calculated for each month as the total

import of the previous 12 months. The data removes shortterm

fluctuations due to seasonal changes in supply and

shipping schedules and provides a clear indication of the

underlying trade trend.

Trade value is reported in US dollars, rather than in Euro,

to provide a clearer indication of demand from the

perspective of exporters into Europe. Because the Euro

and other European currencies depreciated sharply against

the US dollar between June 2014 and June 2016, the

switch to reporting in US dollars has a significant impact

on the trade trend.

40-month stasis in dollar value of EU tropical wood

imports

While the euro value of tropical wood product imports into

the EU increased 20% between mid-2014 and mid-2016,

the value reported in US dollars remained almost static.

Chart 1 shows the US dollar value of EU imports value of

all wood products listed in Chapter 44 of the HS codes

sourced from tropical countries. It highlights that the 12-

month rolling total remained consistent at around US$2.5

billion for a 40-month period between the middle of 2013

and end of 2016.

Chart 1 also highlights that the US dollar value of EU

tropical wood products imports was declining in the first

five months of 2017. Much of this decline is attributable to

sawn wood, for which the 12-month rolling total fell from

US$865 million in December 2016 to US$795 million in

May 2017.

This year has seen a significant slowdown in the volume

of sawnwood trade between Cameroon and Belgium,

which in 2016 overshadowed all other tropical sawnwood

trade flows into the EU. In the first five months of 2017,

Belgium¡¯s imports of tropical sawnwood were US$88

million, down 22% compared to the same period in 2016.

The tropical sawnwood trade in the Netherlands also

declined in the first five months of 2017, by 18% to

US$57 million. However, after a very slow start to the

year, trade was beginning to pick up in the second quarter.

Imports from Malaysia were strengthening during this

period, responding to the Dutch government¡¯s decision in

January to recognise MTCS certified wood as conformant

to national procurement criteria for ¡°sustainable¡± timber.

Elsewhere in Europe, the US dollar value of direct imports

of tropical sawnwood in the first five months of 2017

declined in the UK (-8% to US$32 million), France (-21%

to US$31 million), Italy (-33% to US$29 million),

Germany (-2% to US$22 million), and Spain (-17% to

US$19 million).

Changing product mix in EU tropical wood trade

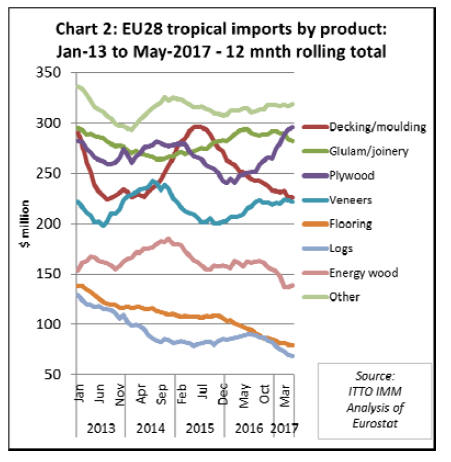

Chart 2 shows the US dollar value trend in EU imports of

tropical wood products other than sawnwood. It highlights

that, while there has been relative stability in the total

value of imports, there is considerable flux in the product

mix.

EU imports of tropical decking have been particularly

volatile in the last three years, rising sharply in 2015 and

declining in 2016 and the first half of 2017. The recent

decline is mainly due to intensifying competition from

alternatives, notably wood plastic composites and

modified temperate wood species.

In contrast, imports of tropical hardwood plywood have

been rising rapidly and continuously since the start of

2016. All the gains have been in imports of tropical

hardwood plywood from Indonesia and China, with a

rising proportion destined for the UK and Belgium.

The EU plywood market has been an early target for

EUTR regulatory checks. As a result, Indonesian product

is now receiving a boost from the ¡°green lane¡± through

EUTR provided by FLEGT licenses. There is also greater

focus on ensuring that plywood imported from China

contains only wood material of known species and origin,

so that more is now positively identified as faced with

tropical hardwood.

EU imports of tropical veneers were rising in 2016, but the

pace of increase has slowed in 2017. Roughly half the

tropical veneer imported into the EU is rotary okoume

veneer from Gabon to supply plywood manufacturers,

mainly in France, and the remainder is decorative veneer,

mainly from Ivory Coast and Cameroon and mostly

destined for Italy. Meanwhile EU imports of other tropical

wood products, including energy wood, flooring and logs

have been sliding in 2017.

Indonesia increases share in declining EU market

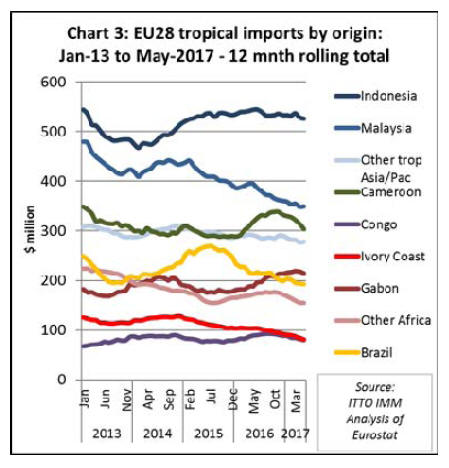

Chart 3 shows how the fortunes of the various tropical

supply countries are changing in the EU market. Indonesia

has become more firmly established as the leading tropical

supply country into the EU this year. While the dollar

value of EU imports from Indonesia has remained static

since the start of 2016, import value from most other

leading supply countries has been declining.

This provides context for those concerned about the

apparent lack of market growth for Indonesian wood

products in the EU since issue of the first FLEGT licenses

in November 2016. While total imports from Indonesia are

not rising, they are stable in a market which is generally

declining and Indonesia is increasing share compared to

other tropical supply countries.

The dollar value of EU imports of tropical wood products

from Malaysia fell almost continuously in the two years up

to March 2017, with a notable decline in Dutch and

German imports of sawnwood and UK imports of

Malaysian plywood. However, there were some early

signs of EU imports of Malaysian products picking up

again in April and May this year.

EU imports from Cameroon, mainly sawnwood and

mostly imported into Belgium, spiked in the second half of

2016 and subsided rapidly in the first five months of 2017.

EU imports from Congo and Gabon have also slowed in

2017 after a strong performance in the second half of

2016. Meanwhile the long-term decline in EU imports

from Ivory Coast has continued in 2017. Imports from

Brazil have also declined consistently in the last two years.

Rising uncertainty in the UK market

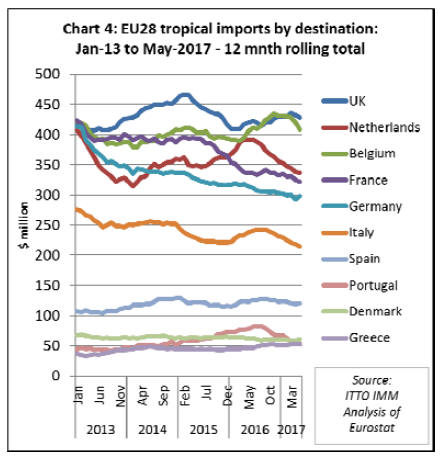

Chart 4 shows that over the last 4 years, the UK has been

the largest single destination for tropical wood imports

into the EU. The focus on direct imports also

underestimates the influence of the UK since a proportion

of sawnwood imported by Belgium and the Netherlands

from Africa is also sold into the UK after kiln drying on

the continent.

The UK market for tropical hardwood remained more

resilient than many expected in the second half of 2016,

despite the uncertainty caused by the Brexit vote in June

2016 which led a 15% fall in the value of the British

pound against the dollar in the third quarter of the year.

However, concerns are now mounting about economic

conditions in the UK. The UK economy was the worst

performer in the EU in the opening months of 2017 as the

Brexit vote at last began to take its toll. With economic

growth of just 0.2% in the first three months of this year,

the UK was well behind its European neighbours (growth

for the whole of the EU was 0.6% in the first quarter).

The latest British Woodworking Federation survey of

joinery activity in the U.K. reinforces this picture of

subdued demand. The survey shows slowing growth and

tightening margins in this sector during the first quarter of

2017. The weakness of the British pound and associated

rising inflation are identified as dampening factors. While

stair manufacturers had a good quarter, manufacturers of

internal and external doors had more mixed results.

Recent business surveys suggest the UK economy picked

up some momentum in the second quarter after its slow

start to 2017. But with higher inflation weighing on

consumer spending, most forecasters expect growth to be

lackluster during the rest of 2017. The snap election called

for June 2017, which led unexpectedly to a hung

parliament and undermined the authority of the current

Conservative government, has only served to increase the

uncertainty.

Positive indications in Benelux

Imports of tropical wood products into Belgium and the

Netherlands were mirror images of each other in the

second half of 2016, rising very rapidly into the former

while declining in the latter.

Given that both countries are important centres for

distribution of tropical wood to other parts of Europe,

these trends are more likely associated with short-term

logistical factors favouring transit via ports in Belgium

over those in the Netherlands, than with changes in

internal demand in the two countries.

In fact, underlying market conditions in each country

appear to be reasonably good. There was robust growth in

construction output in both the Netherlands and Belgium

in 2016, and this trend continued into the first quarter of

2017.

The Belgian economy expanded 0.64% in the first quarter

of 2017 compared to the quarter, the highest quarterly

growth rate since 2011, driven by an uptick in private

consumption. In the Netherlands, a buoyant labour market

together with rising wages and house prices and upbeat

consumer sentiment are fuelling household spending.

There is also optimism that the Dutch government¡¯s

decision to recognise MTCS as ¡°sustainable¡± will boost

prospects for Malaysian timber in the Netherlands in the

next few years, particularly as both the government and

the Netherlands Timber Trade Association share a

commitment to ensure that at least 90% of tropical timber

imports derive from sustainable sources by 2020.

French economy boosted by election results

France has been a weakening market for tropical wood in

recent times, both due to sluggish economic growth and to

substitution by alternative materials, including European

timbers and non-wood products.

However, there is now better news on the economic side.

France¡¯s economy grew by 0.4% in the first three months

of the year, stronger than the 0.3% initially estimated by

statisticians. That suggests the economy is moving in the

direction indicated by surveys which show business

activity growing at the fastest pace for seven years.

French consumer confidence has climbed this year to its

highest level for a decade, according to the national

statistics agency INSEE. The EC¡¯s sentiment data for

France is also at a six-year high and shows improvements

across all the sectors it monitors - industry, services, retail,

consumer and construction.

Economic sentiment was given another boost by the

outcome of the French elections in June, which delivered a

new centrist President at the head of a party with an

absolute Parliamentary majority. The new government¡¯s

election manifesto emphasised the need to reduce the

budget deficit and increase confidence in the business

environment. The new government now forecasts GDP

growth of 1.6% this year and 1.7% in 2018.

However, the new government will have to walk a fine

line to deliver on its promises. It is committed both to

reducing the budget deficit to below 3% in line with eurozone

rules, and to a big cut in taxes on individuals and

businesses of around 11 billion euros next year.

To achieve this, it intends to reign in public spending and

to liberate France¡¯s rigid labour market laws, measures

that will likely meet ferocious opposition from unions and

labour groups.

Economic growth in Germany not benefitting tropical

suppliers

The German economy got off to a strong start this year,

according to official GDP figures released by the German

Statistics Institute in May. GDP growth accelerated and

was well balanced, with all main categories accelerating.

The positive momentum seems to have carried over to the

second quarter, with confidence indicators reaching alltime

highs and signs of particularly strong growth in the

German construction sector.

Some hardwood product sectors are benefitting from this

growth. For example, the European wood flooring

association FEP reports that parquet sales in the first

quarter of the current year remained stable building good

performance recorded in 2017.

Despite the underlying strength of the economy, Chart 4

highlights that German imports of tropical wood have

been in continuous decline in the last five years. This is a

clear indication of the mounting pressure on tropical wood

from substitute products in Germany. EUTR regulatory

concerns have also deterred German importers concerned

about the legality risks associated with buying tropical

timbers

Italy lags further behind

Italy is another market where tropical wood imports have

been in almost continuous decline in recent times. In this

instance, the trend is more readily explained by poor

underlying economic conditions.

Italy¡¯s economy is lagging further behind its European

peers. Recently released data shows that GDP expanded

just 0.2% from the previous quarter in the first quarter of

2017, less than half the 0.5% growth recorded in the Euro

area. Private consumption, which was the main driver of

growth last year, is gradually weakening, restrained by

rising inflation, a stubbornly high unemployment rate and

feeble wage increases - a consequence of stagnant

productivity.

However there are some more positive signs emerging.

According to Euroconstruct, residential renovation and

new non-residential buildings are increasing in Italy and

only new residential construction is still declining.

Spanish economy improves but tropical wood demand

still flat

Imports of tropical wood into Spain have been static

overall at a low level in recent years. However, market

prospects are beginning to improve. The Spanish economy

continues to build momentum as stronger-than-expected

dynamics in the first quarter of 2017 have carried over into

second.

Households are now benefitting from higher real estate

prices and robust job creation. The residential housing

sector is improving. For the first time since the crisis, there

were more housing starts than completions in 2016.

Other leading data points to a better-performing economy

in Spain this year, with both the services and

manufacturing purchasing managers indices accelerating

markedly in April and exports expanding at the fastest

pace on record in the first quarter. Spain¡¯s economy is

expected to grow 2.7% in 2017.

|