|

Report from

North America

High value plywood from Vietnam and Cambodia

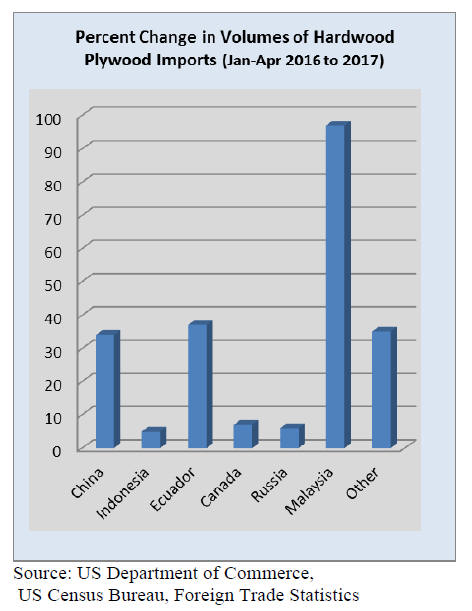

Hardwood plywood imports grew 2% in April to 291,317

cu.m. The value of imports (US$157.8 million) was

unchanged from March. Year-to-date import volumes

were 27% higher than in April 2016.

Plywood imports from China declined for the third

consecutive month in April. China still accounted for half

of total hardwood plywood imports and year-to-date

imports from China were one third above April 2016.

Imports from Indonesia recovered from last month¡¯s

decline to 35,444 cu.m. in April. The value of year-to-date

imports is slightly down from April last year.

Malaysian shipments to the US fell in April but year-todate

imports from Malaysia doubled compared to April

2016. Among the smaller suppliers imports from both

Brazil and Cambodia were over 5,000 cu.m. in April.

The highest average unit landed price of imports was for

plywood from Vietnam (US$1,380 per cu.m.) and

Cambodia (US$1,160 per cu.m.).

More tropical veneer from Ghana and Cote d¡¯Ivoire

Tropical hardwood veneer imports grew again in April,

but year-to-date veneer imports were only a fraction of

April 2016.

April 2017 imports were worth US$2.4 million. Veneer

imports from Ghana and Cote d¡¯Ivoire increased in April

while imports from Italy declined from the previous

month.

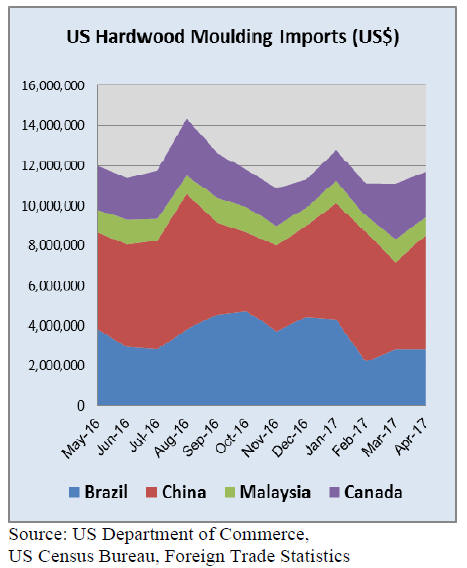

China expands share in US moulding imports

Hardwood moulding imports grew 9% in April to US$15.4

million. Year-to-date imports were almost the same as in

April last year.

The growth in imports came almost entirely from China.

Moulding imports from China were worth US$5.7 million

in April and accounted for over one third of total imports.

Hardwood moulding imports from Brazil were unchanged

from March at US$2.8 million. Imports from Malaysia fell

one quarter in April.

Europe expands flooring shipments to US

Hardwood flooring imports declined 5% in April to

US$2.5 million but imports of assembled flooring panels

increased 4% to US$10.4 million. Imports of both types of

wood flooring were up year-to-date imports compared to

April 2016.

Hardwood flooring imports from most suppliers, except

Canada, declined in April. Imports from Indonesia fell one

third in April to US$588,798. Normally a small hardwood

flooring supplier to the US market, Denmark shipped

US$315,044 worth of flooring in April.

Imports of assembled flooring panels (including

engineered hardwood flooring) from China, Canada and

Europe increased in April, while imports from Indonesia,

Thailand and Brazil declined. At US$2.7 million, Europe

was the third-largest supplier in April after Canada and

China.

Wooden furniture imports growing again

Following a decline in wooden furniture imports in March,

US imports grew 18% in April to US$1.47 billion. Yearto-

date imports were 9% higher than in April 2016.

Imports from China, Vietnam, Canada and Europe

increased in April, while Mexico, Malaysia, Indonesia and

India exported less furniture to the US. Year-to-date

imports from all were higher than in April last year.

China had a 45% import share in April with US$662

million¡¯s worth of wooden furniture shipped to the US.

Imports of all types of wooden furniture grew in April.

Imports of kitchen furniture increased the most, followed

by office furniture.

Business expansion reported by US furniture

manufacturers

GDP growth slowed to 1.2% in the first quarter of 2017,

according to the second estimate by the US Department of

Commerce. This is up from the first estimate of 0.7%. In

the fourth quarter, real GDP increased 2.1%. Investment in

non-residential construction and personal consumption

were larger in the first quarter than previously estimated.

The unemployment rate was almost unchanged at 4.3% in

May. The rate has declined 0.5 percentage points since

January.

Economic activity in the manufacturing sector expanded in

May, according to the latest survey by the Institute for

Supply Management. Furniture manufacturing reported

the second-highest output growth in May of all

manufacturing industries. Raw material prices increased

for furniture producers. Both furniture and wood products

manufacturers reported higher new export orders in May.

Consumer confidence in the economy declined

significantly in June, according to the University of

Michigan¡¯s survey of consumers. The loss in confidence

was larger for Republican voters than for Democrats

mainly because Republicans believe proposed economic

policies are less likely to be passed.

Overall consumers are less optimistic about the future of

the US economy despite higher household incomes and a

strong job market. Personal consumption expenditures are

still expected to grow 2.3% in 2017.

Harvard report - home renovation and remodeling the

growth market fueled by baby-boomer spending

The Joint Center of Housing Studies of Harvard

University has released the latest State of the Nation¡¯s

Housing report.

The recovery of the housing market in recent years has

helped grow US wood product imports and domestic

production, both of which collapsed with the Great

Recession in the late 2000s.

The national housing market has on the whole returned to

normal, but the supply of homes for sale and rent is

extremely tight. Even after seven consecutive years of

growth, new residential construction in 2016 was well

below the annual average rates of the 1980s and 1990s.

In 2016 1.17 million new housing units were built,

compared 1.4 to 1.5 million in the 1980s and 1990s. The

low rate of construction shows in the lack of inventory of

homes for sale. Inventory was at an 11-year low with

homes for sale representing only 3.6 months of supply.

The rental market is also extremely tight despite higherthan-

average construction of multi-family homes.

Several factors contribute to the relatively low

construction rate, according to the National Association of

Home Builders. Labour shortages, strict financing

requirements and limited building lot supply are the main

factors that raise the cost of home development and

construction. Moderately priced homes, such as small

houses, townhomes, and affordable rental apartments, are

in extremely short supply.

The number of new households increased from just over

half a million per year during the recession to 1.2 million

by 2015. But the share of adults under 34 living with their

parents was still at an all-time high in 2015. The Joint

Center for Housing Studies projects household growth to

reach 13.6 million between 2015 and 2025. After 2025

household growth is expected to slow.

These forecasts depend not only on US economic growth,

but also on immigration policies. If immigration is

curtailed, growth in housing construction would be lower

in the near-term. More certain is the center¡¯s projection

about spending by baby-boomers on home renovation and

remodeling.

In the coming years the baby-boom generation will modify

their homes, driving more investment growth in

renovation and remodeling.

|