|

Report from

North America

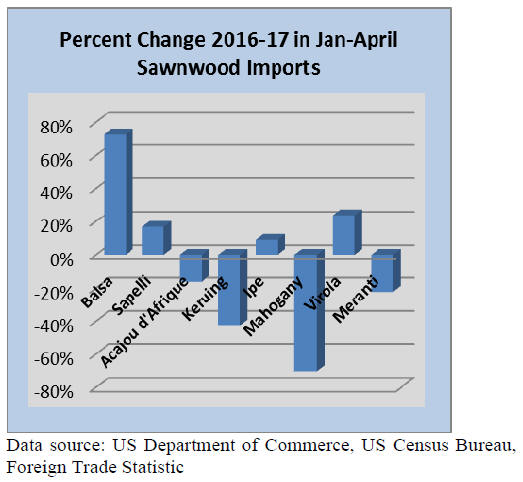

Ipe leads US tropical imports

US imports of all sawn hardwood increased 9% in April to

82,091 cu.m. The growth in tropical sawnwood imports

was greater than for temperate species.

Tropical sawnwood imports increased for the second

consecutive month in April to 22,279 cu.m. Year-to-date

imports were up 17% from April 2016. The value of

imports grew 18% from March to US$24.7 million. Balsa,

keruing and virola imports were down month-over-month,

but imports of most other species increased in April.

Ipe sawnwood imports were 2,912 cu.m. in April, up 9%

year-to-date from April 2016. The value of ipe imports

was US$6.5 million, making ipe the highest value of all

tropical sawnwood imported and Brazil the largest

supplier to the US market based on value. Brazil

accounted for almost all ipe imports (2,707 cu.m.) valued

at over US$6 million.

Imports of sapelli sawnwood more than doubled from

March to 4,073 cu.m, Year-to-date imports increased 17%

from April 2016. Cameroon exported 2,363 cu.m. of

sapelli sawnwood to the US, significantly more than the

922 cu.m. in March.

Congo/Brazzaville also more than doubled sapelli

shipments (1,454 cu.m.) to the US in April.

Acajou d¡¯Afrique imports grew by nearly one third in

April to 1,764 cu.m., but year-to-date imports were lower

than in April 2016. Cameroon accounted for the majority

of acajou d¡¯Afrique (989 cu.m.), followed by Ghana (401

cu.m.), Congo/Kinshasa and Congo/Brazzaville.

Balsa dominates Canadian tropical imports

Canadian imports of tropical sawnwood were unchanged

in April at USUS$1.94 million. The value of year-to-date

imports was up 4% from April 2016.

While the overall value of imports was unchanged, virola,

imbuia and balsa (combined) and sapelli imports grew

from March. Imports of mahogany and other tropical

species fell in April.

Even more so than in the US market, balsa sawnwood

imports for industrial use dominate Canadian tropical

imports.

In April, balsa imports from Ecuador increased 39% to

just under USUS$0.6 million. More balsa sawnwood may

be imported via the US. Balsa is grouped with virola and

imbuia in the Canadian trade classification. Canada

imported USUS$351,502 worth of virola, imbuia and

balsa from the US in April.

Improving competitive environment for US wood

flooring manufacturers

Imported wood flooring (engineered and solid) lost US

market share in 2016 and the underlying reasons present

an opportunity for US flooring manufacturers, according

to Hardwood Floors, the magazine of the National Wood

Flooring Association.

US manufacturers accounted for 67% of total wood

flooring sales in 2016, and 56% of total square foot sales.

This is up from 67% and 52%, respectively, in 2015. US

production increased by an estimated 9% in 2016, while

imports declined by almost 5%. The decline was in both

solid and engineered wood flooring.

While the decline in imports is relatively small, compared

to annual imports growth rates in the previous eight years,

US wood flooring may increase its market share if US

manufacturers invest in new production capacity.

Several factors contributed to the slowdown in wood

flooring imports, according to the Hardwood Floors

magazine.

The main factor is probably rising prices of imported

wood flooring, while US flooring prices declined. At the

same time imported wood flooring had to comply with the

Lacey Act requirements, which made many US

distributors and retailers turn to domestic sources.

China lost US market share when the US imposed

antidumping duties and countervailing duties on

engineered wood flooring, but Vietnam, Cambodia and

other countries in Asia made up for the decline in imports

from China.

In 2007, average flooring import prices were only slightly

below US-made products. In 2015 the gap was more than

50%, according to Hardwood Floors. Moreover Asian

suppliers were able to provide more species and colours.

Between 2007 and 2015 wood flooring imports grew at

more than 20% annually.

In 2016 import prices increased by an average 9.6% but

prices of Chinese engineered wood flooring grew by over

13%. US-made flooring prices declined 8.2% in 2016.

China increasingly imports hardwood from the US to

manufacture flooring and other wood products to export

back to the US market, thereby ensuring legal sourcing

from US forests. Higher US sawnwood prices and rising

Chinese labour cost contributed to the higher than average

growth in Chinese-made flooring prices.

Despite these relatively favourable circumstances for US

flooring manufacturers, imports are unlikely to decline

significantly unless US manufacturers invest in new stateof-

the-art wood flooring production capacities.

In the last five years US wood flooring manufacturers

have increased capital spending by only 20%, which is

less than half of other flooring covering industries and a

moderate amount given the growth in the US housing and

remodeling markets.

The market outlook for imported wood flooring remains

positive if suppliers control costs and make it easy for US

importer to comply with the Lacey Act.

For more see:

https://hardwoodfloorsmag.com/2017/06/01/sourcing-woodflooring-

supply-u-s-manufacturers-ready-take-share-foreignsourced-

products/

12-storey CLT timber tower for Portland

A 12-storey building constructed of cross-laminated

timber (CLT) and glulam was approved for construction in

Portland, Oregon. The building will be the first all timber

tall building in the US. It will include retail space, offices

and apartments.

The CLT panels will be supplied by Portland manufacturer

D.R. Johnson who was the first company in the US to

receive certification according to the APA/ANSI standard

for CLT.

The proposed building design was also tested by two

universities for seismic, fire and acoustic performance.

Building code work is underway in Washington State and

Oregon to allow for tall wood buildings, which will

simplify the design and permitting process.

Twenty-seven tall wood buildings have been completed to

date in Europe and Canada, according to the Council on

Tall Buildings and Urban Habitat.

A hybrid timber and concrete building in Vancouver is

currently the highest building, but a 24-storey hybrid

timber and concrete tower is under construction in Vienna,

Austria.

The tallest proposed buildings are a 26-storey hybrid

timber and steel tower in Lagos, Nigeria and a 35-storey

tower also in timber and steel in Paris, France.

The proposed Abebe Court Tower in Lagos would be the

first tall all timber building in Africa and the first to

include open-air planted sky-gardens.

|