US Dollar Exchange Rates of 25th

May 2017

China Yuan 6.8555

Report from China

Real estate development in the first four months of

2017

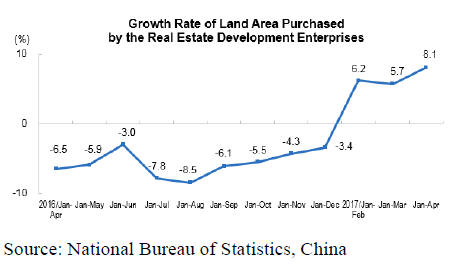

In a press release the National Bureau of Statistics in

China reported national real estate sales for the first four

months of 210 increased by just over 9% year on year.

Investment in residential buildings was up by10.6% down

slightly from a month earlier. However, April sales rose at

the slowest rate for several months after more

municipalities introduced regulations to slow demand for

residential properties.

The crackdown on speculative housing investment was

strongest in the provinces close to Beijing because a new

city plan has sparked excitement of investors looking for

quick buy and sell profits.

Despite the attempts to reigning the housing market, in the

first four months there was an increase in the area of land

purchased by real estate developers.

See:

http://www.stats.gov.cn/english/PressRelease/201705/t20170517

_1495113.html

No more fees for entry-exit inspection and quarantine

As of 1 April China¡¯s Ministry of Finance and National

Development and Reform Committee removed the need

for traders to pay the inspection and quarantine entry and

exit fees for all import and export commodities. The aim

of this measure is to mitigate burden on enterprises.

While the fees have been eliminated enterprises must

follow the previous formalities.

Call for abolition of consumption tax on wooden

flooring

Recently, a large group of companies called for the

abolition of the consumption tax on solid composite

flooring as the industry is facing tough market conditions.

A 5% of consumption tax has been paid on solid

composite flooring for 10 years but this has eaten into the

profitability of many wood flooring producers, some of

which are said to be on the verge of bankruptcy. The tax

burden has undermined demand and this, along with rising

labour and raw material costs have created a serious

situation for manufacturers.

Output from redwood enterprises falls

It is estimated that there were 15,000 Chinese redwood

enterprises in 2016 with annual output value of RMB90

billion. However in 2016 the value of output fell 10%

from the previous year.

The Chinese redwood industry is mainly centered on

Beijing, Shanghai, Hebei, Shandong, Jiangsu, Zhejiang,

Fujian, Yunnan, Guangdong, Guangxi and Jiangxi

provinces.

Surge in timber imports through Zhangjiagang port

According to the Zhangjiagang Entry-Exit Inspection and

Quarantine Bureau in Jiangsu province, in the first quarter

of 2017, containerised timber (logs and sawnwood)

imports through Zhangjiagang port surged over 60% year

on year to 130,000 cubic metres accounting for 37% of the

total imports volume through the port in 2016.

The imported timbers were mainly from Gabon,

Cameroon, Mozambique and Zambia Zambia (mainly

Pterocarpus tinctorlus, a rosewood look-a-like).

Rubber production in Hainan province

Hainan Natural Rubber Industry Group has a national

largest natural rubber production base with 250,000

hectares of rubber plantations.The annual output of latex is

230,000 tonnes.

The Group has 12 rubberwood processing factories

producing around 300,000 cubic metres of sawn

rubberwood, 30,000 cubic metres of laminated timber,

8,000 door sets and about 5,000 cabinet furniture items.

Rise in wood furniture exports from Huizhou City

According to Entry-Exit Inspection and Quarantine

Bureau, furniture exports from Huizhou City in

Guangdong province rose 17% to US$133 million in 2016.

Wooden furniture exports from Huizhou City have

increased every year for the past 7 years.

There are about 180 wooden furniture enterprises in

Huizhou City. The main products are wooden tables and

chairs, wood frames for sofas, wooden kitchenware and

wooden crafts. The main markets are the USA, European

Union, Japan, Australia, UAE and Malaysia.

As trade expands under China¡¯s ¡®Belt and Road¡¯ strategy,

Huizhou wooden furniture makers have diversified exports

reaching out to, for example, Cameroon, Mongolia,

Kuwait and Qatar. Furniture exports to Southeast Asia, the

Middle East and Africa continued to increase.

According to the available statistics, the export value of

wooden furniture manufactured in Huizhou City in 2016

almost doubled to US$580 million between 2010 to 2016.

First imported timber port in West China

A signing ceremony was recently held to launch the

RMB30 bllion western timber trade centre in Banan

District, Chongqing City. Chongqing is situated between

the Qinghai-Tibet Plateau and the plain at the middle and

lower reaches of the Yangtze River.

It has been reported that wood consumption by

manufacturers in Chongqing City has grown steadily for

several years. Timber consumption by wood processing

enterprises in the western provinces account for around

40% of total consumption. It is anticipated that timber

consumption in the western provinces could reach 20

million cubic metres by 2020.

The establishment of a new timber import port and

distribution centre for imported wood products will attract

wood processing enterprises from the coastal regions. It is

expected that timber industry clusters will be created in the

future.

Shanghai manufacturers began to relocate

Traders report that activity in the Shanghai timber markets

is very quiet. Analysts say one reason is that many wood

processing plants have relocated.

As early as March this year wood processing enterprises in

Shanghai without environment impact assessment

certificates were asked to stop production. Also many

wood processing factories began to move to Zhangjiagang

and Taicang Ports due to the increase in rent and labour

costs in Shanghai.

It is estimated that about 1,000 furniture makers have

moved out. As this trend continues the timber markets at

Taicang and Zhangjiagang will play a greater role in

distribution.

|