|

Report from

North America

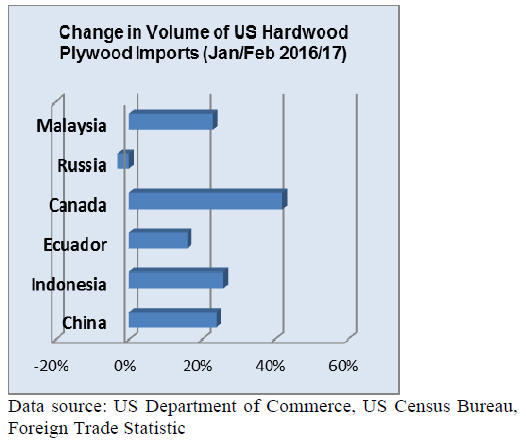

Plywood imports from Malaysia triple from 2016

Hardwood plywood imports declined in February after two

consecutive months of growth. February imports

decreased 9% to 313,168 cu.m. worth US$168.7 million.

However, year-to-date plywood imports were 24% higher

than in February 2016. Year-to-date imports from

Malaysia almost tripled compared to the same time last

year.

The US imported 192,057 cu.m. of hardwood plywood

from China in February, followed by Indonesia with

34,598 cu.m. Cambodia has become a significant source of

US hardwood plywood imports. In February Cambodia

shipped 4,457 cu.m. of plywood to the US.

The unit value of imported plywood was highest in

February for plywood from Indonesia and Malaysia, and

lowest for imports from Russia.

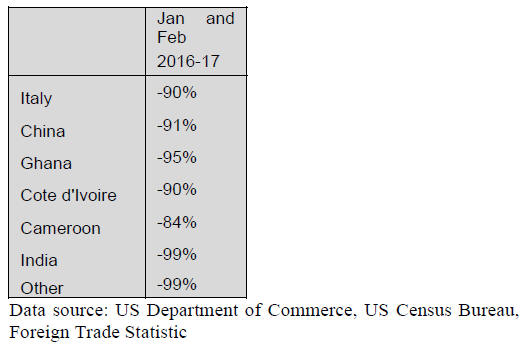

Decline in tropical veneer imports

Tropical hardwood veneer imports decreased in February

for the second consecutive month. Imports were worth

$1.5 million, down 43% from January.

Veneer imports from China and Ghana grew in February

despite the overall decline. The largest drop was in

imports of spliced and other veneer from Italy.

Imports from Italy were only worth US$180,111 in Italy,

compared to US$437,644 from China. Indonesia exported

US$99,418 worth of meranti veneer to the US in February.

China expands share of hardwood moulding imports

Hardwood moulding imports decreased 16% in February

to US$14.0 million. Year-to-date imports were also down

from February 2016.

The largest month-over-month decline was in imports

from Brazil, which fell by almost half to US$2.2 million.

Imports from Malaysia declined to under $1 million.

Moulding imports from China increased 11% in February

to US$6.5 million. China¡¯s share in total US hardwood

moulding imports year-to-date was 40%.

More hardwood flooring from Indonesia in early 2017

Hardwood flooring imports increased 11% from the

previous month and were worth US$4.3 million in

February. Imports of assembled flooring panels (including

engineered hardwood flooring) were US$9.2 million.

Year-to-date imports of both types of wood flooring were

significantly up from February last year.

Hardwood flooring imports from Indonesia grew

substantially in February to US$792,066. Year-to-date

imports from Indonesia were 30% higher than in February

2016. Hardwood flooring imports from China were

US$1.26 million in February, up 43% year-to-date from

February 2016.

Imports of assembled flooring panels declined from the

previous month to US$9.2 million in February, but yearto-

date imports were up from last year. China and Canada

accounted together for over 60% of all imports of wood

flooring panels.

Year-to-date flooring panel imports from Indonesia were

one third higher than at the same time last year. Vietnam

surpassed Thailand in flooring panel shipments to the US

in 2017 with over US$1 million exported year-to-date.

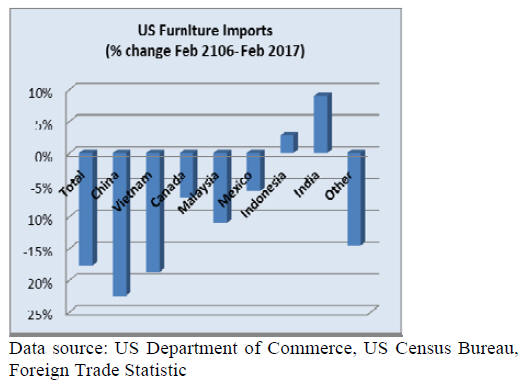

Sharp drop in furniture imports from China and

Vietnam

The value of wooden furniture imports declined to

US$1.30 billion in February, but year-to-date imports were

3% higher than in February 2016.

The month-over-month decline was mainly in imports

from the US¡¯ two largest suppliers China (-22%) and

Vietnam (-19%).

However, year-to-date imports from China and Vietnam

remained higher than in February last year. Wooden

furniture imports from Malaysia decreased 11% from

January toUS $52.5 million.

Indonesia grew furniture exports to the US market by 3%

in February to US$47.2 million. The strongest growth

year-to-date compared to 2016 was in imports from

Mexico.

Imports of all types of wooden furniture were down in

February with the largest decline in upholstered seating

furniture.

Furniture manufacturing output picks up

The US economy grew in March and economic activity in

the manufacturing expanded, according to the latest survey

by the Institute for Supply Management.

Furniture manufacturing reported higher output in March,

following three months of decline. All industries reported

higher activity compared to February, including wood

product manufacturing.

Consumer sentiment rose in April and was 10% higher

than in April 2016, according to the University of

Michigan consumer confidence index. Views were

positive about current economic conditions, but Democrat

and Republican voters had very different views on

economic expectations.

Many households expect fundamental changes in the

economy, which may result in variable spending and

different trends by market and product.

Housing market strong despite March decline in starts

Housing starts decreased 7% in March to a seasonally

adjusted annual rate of 1,288,000, according to the US

Department of Housing and Urban Development and the

Commerce Department. Starts were 9% above the March

2016 rate. Both single-family and multi-family

construction declined in March.

The number of building permits issues, which indicates

future building activity, increased 4% in March from the

previous month at a seasonally adjusted annual rate. Multifamily

permits grew, while single-family authorizations

declined.

Builders¡¯ confidence in the market for new single-family

homes declined slightly in April but remained high. The

National Home Builder Association considered confidence

in March unusually high. The builder sentiment in April

reflects strong demand from home buyers but also cost

challenges for builders.

Sales of existing homes sales increased in March to the

highest rate in over ten years, according to the National

Association of Realtors. Demand exceeded the supply of

homes on the market and the median price for existing

homes was 7% higher than in March last year.

Low mortgage rates contribute to the growth in home

sales, although rates are higher than a year ago. In April

mortgage rates declined, despite the March hike in interest

rates by the Federal Reserve.

US imposes countervailing duties on Canadian

softwood

The US Commerce Department announced preliminary

countervailing duties on Canadian sawn and laminated

softwood effective May 1. The duties range from 3% to

24% on five large producers and close to 20% for all other

Canadian sawmills and manufacturers.

The Canadian dollar declined after the announcement and

large job losses in forestry are expected. Small

independently owned mills and manufacturers are

particularly vulnerable because they have fewer financing

resources for the duties. Shares in publicly traded

Canadian softwood producers rose because the

countervailing duties were lower than some analysts

expected.

The National Association of Home Builders in the US

denounced the countervailing duty decision as it would

increase costs for businesses and home buyers.

Since the previous Softwood Lumber Agreement between

the US and Canada expired in 2015, Canada has been

looking to increase exports to other markets. Chinese and

Canadian officials met in late April to discuss a potential

free trade agreement between the two countries.

Canadian government and forestry leaders are also

promoting the use of softwood in home construction and

other markets in China.

President Trump announced the US will renegotiate the

North American Free Trade Agreement (NAFTA) with

Canada and Mexico. Previously the president had pledged

to pull out of the agreement.

While softwood is not part of NAFTA, furniture trade

between the three countries has greatly increased under

NAFTA. US furniture companies invested in Mexico and

Mexican exports of wooden furniture to the US increased

nearly 50% in the last ten years, compared to a 17%

growth in total US imports of wooden furniture.

|