|

Report from

North America

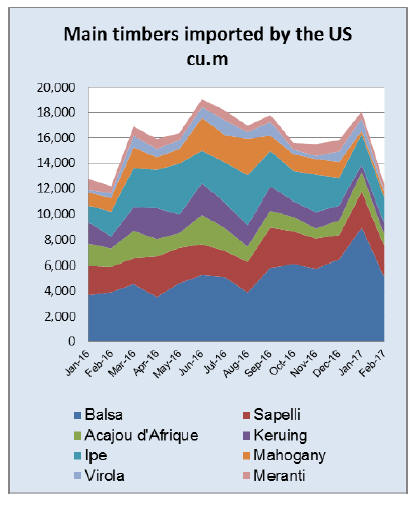

Drop in balsa imports

US imports of all sawn hardwood fell 24% in February

from the previous month. 53,345 cu.m. of sawn hardwood

worth US$31 million were imported in February. The

steepest drop was in imports of several temperate species,

but tropical imports also declined.

The volume and value of tropical sawnwood imports fell

by almost one third in February. A total of 16,107 cu.m.

was imported, valued at US$15.5 million. Despite the

decline, year-to-date tropical imports were 27% higher

than in February 2016.

The largest drop was in imports of balsa sawnwood from

Ecuador. Imports fell 43% to 5,088 cu.m. in February.

Sapelli and ipe imports were also down from the previous

month but remained at relatively high levels (2,446 cu.m.

and 1,953 cu.m., respectively).

Imports from Cameroon declined to 1,910 cu.m. in

February due to lower volumes of sapelli (1,334 cu.m.)

and acajou d¡¯Afrique (408 cu.m.). Ghana on the other

hand increased shipments of both species to the US in

February.

Malaysia also grew exports to the US in February from the

previous month, but year-to-date volumes remained below

February 2016. Malaysia shipped 779 cu.m. of keruing

and 269 cu.m. of red meranti to the US market in

February.

Italy supplied over 1,000 cu.m. of tropical sawnwood to

the US market in both January and February.

Canadian tropical imports up in February

Canadian imports of tropical sawnwood were worth

USUS$1.87 million in February, up 13% from January.

The value of year-to-date imports was unchanged from

February 2016. Imports of virola, imbuia and balsa

(combined) increased to USUS$646,233 in February.

Year-to-date imports of the three species were up 68%

from February last year.

Sapelli imports were almost unchanged from January at

US$380,644, down 27% year-to-date compared to

February 2016. Cameroon was again Canada¡¯s main

source of imports at US$547,083 in February, but year-todate

imports were down from the same time last year.

Imports from Brazil grew substantially in February and

were worth US$184,539. The majority was likely ipe

sawnwood, which is not classified separately in Canadian

trade data. Among the smaller suppliers Thailand, Gabon

and Guyana increased sawn hardwood exports to Canada

in February.

Weak start of the year for furniture industry

New furniture orders were flat in January compared to the

same time last year according to the Smith Leonhard

industry survey of residential furniture manufacturers and

distributors. In November and December new orders were

up 8% and 11%, respectively. Just over half of all survey

participants reported order were down.

January furniture shipments increased 2% from January

2016. Inventory levels at distributors and manufacturers

were slightly up from December.

January retail sales at furniture stores were unchanged

from January 2016 according to US Census Bureau data.

This was despite strong consumer confidence in the

economy and higher personal income.

Overall retail sales were up 5% from January last year

with strong growth in building materials and garden stores,

home furnishings (but not furniture) and car sales.

With interest rates still low furniture retail sales are

expected to pick up this year. Despite pre-election

promises by President Trump on trade policy there has

been no real change and few developments are expected

for much of 2017. Wooden furniture imports were at

record high levels in January.

First DLT manufacturing plant in North America

The first manufacturing plant for dowel laminated timber

(DLT) is being built in Canada near Vancouver. DLT

panels are engineered wood products similar to cross

laminated timber (CLT), nail laminated and glue

laminated timber.

Unlike in CLT wood fibres are all in the same direction in

DLT. Instead of nails or glue, DLT uses hardwood dowels

that expand and lock the softwood into a structural panel.

The panels are made entirely of wood without the use of

plastic, metal or glue.

DLT panels can be used for building floor, wall and roof

structures. Of the approximately twenty existing DLT

plants most are in Austria, Germany and Switzerland,

according to the Journal of Commerce. The technology

was invented in Switzerland.

Mass timber panels like DLT and CLT are prefabricated

and quick to erect at the building site. A disadvantage of

DLT compared to CLT is the lower stability when the

panels are exposed to rain during construction.

The 50,000 sq.ft. DLT production facility is being built

from mass timber and is scheduled to open in January

2018.

Timber Innovation Act to promote timber construction

in the US

The Timber Innovation Act is a new bipartisan legislation

put forward to the US Congress to advance the design and

construction of tall timber buildings. The Act would create

a research and development program for tall wood

structures.

The US has fallen behind other countries in mass timber

technology and its application in construction of tall

buildings, according to the Binational Softwood Council,

whose mandate includes expanding the market for

softwood in the US and Canada.

The Senate and the House introduced the bill in March to

the support of almost 100 organizations and companies.

More information about the Timber Innovation Act is

available at:

http://www.timberinnovation.org/index.html

The first tall wooden building in the US will be built in

Portland, Oregon later this year. The 12-storey building

will be made with CLT for the floors and the exterior and

have glulam beams and columns.

The tallest wood buildings is currently in Vancouver,

British Columbia, with 17 wooden stories on a concrete

foundation.

|