Japan

Wood Products Prices

Dollar Exchange Rates of 09th

December 2016

Japan Yen 115.36

Reports From Japan

Capital investment growth rebounds in

October

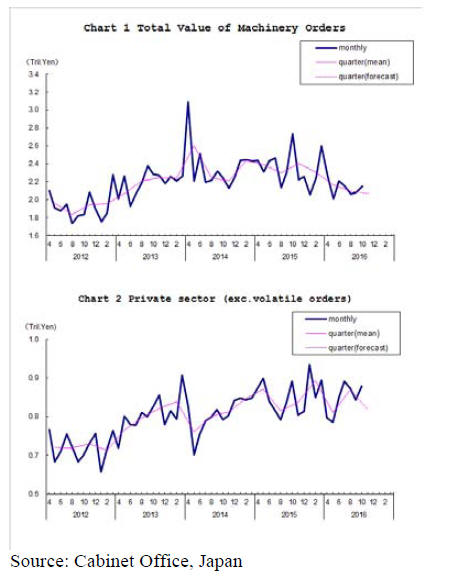

Japan’s Cabinet Office has released details of the value of

manufacturing machinery orders received by companies

operating in Japan. The October figure is up 3.3% from

September on a seasonally adjusted basis. Private-sector

machinery orders, excluding those for ships and power

generation, increased a seasonally adjusted by 4% in

October.

Private sector capital spending is just one indicator, and a

rather volatile one, of the direction of the economy.

The government is hoping that capital spending will

support sustainable growth.Capital investments fell in the July-September

quarter for

the first time in nearly four years and in the third quarter

the Japanese economy grew much slower than initially

estimated driven lower by global economic uncertainty.

See:

http://www.esri.cao.go.jp/en/stat/juchu/1610juchu-e.html

OECD pessimistic on growth prospects in 2017/18

Japan’s GDP is forecast to expand by just 1% in 2017 and

then slow in 2018 says the latest assessment from the

OECD. The brake put on reforms required to spur growth

has slowed fiscal consolidation but has helped the country

weather the mid-year yen appreciation. The OECD again

reiterated that structural reforms are essential to boost

productivity and to get more women back to work.

The OECD writes “This would enhance social cohesion

and reduce Japan's high relative poverty rate. Faster

growth is critical to stopping and reversing the run-up in

public debt, which is projected to reach 240% of GDP by

2018.”

See: https://www.oecd.org/economy/japan-economic-forecastsummary.

htm

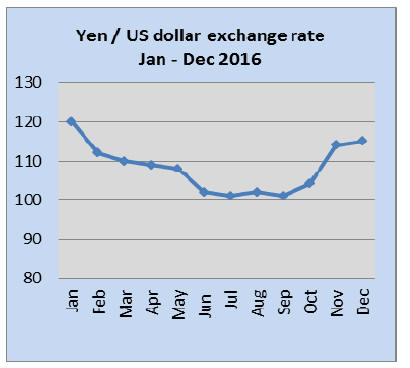

All eyes on the US Federal Reserve

The Yen fell mid-December marking the fifth-consecutive

weekly drop against the US Dollar. As of 10 December the

Yen was at its weakest in almost two years. The midmonth

US Federal Reserve meeting has determine the

direction of the yen and a further decline seems inevitable.

Interest rates in the US are on the way up. At the last

meeting of the Federal Reserve the benchmark interest

was moved from the current 0.25-0.50% to a range of 0.50

and 0.75%

US employment has been improving as have wages. The

head of the Federal Reserve said she expects rates to be

raised three times in 2017.

Japanese investors chase returns in housing

sector

Financial agencies in Japan are keeping a close eye on the

condominium and apartment block loan portfolios of

commercial banks so as to be sure the banks are properly

assessing the risks associated with such loans.

This concern stems from data showing loans for apartment

building has expanded rapidly against a backdrop of an

increase in vacancy rates especially in Tokyo. With

interest rates at zero, investors have turned to the property

market looking for returns. The Bank of Japan says loans

for condo and apartment buildings have grown at twice the

rate of overall lending.

Another factor stoking concern amongst the financial

watchdogs is that demand for housing could fall well

below the rapidly rising supply even in the main cities as

the population in Japan is on a steady downward trend and

this is likely to spill over to Tokyo by 2020.

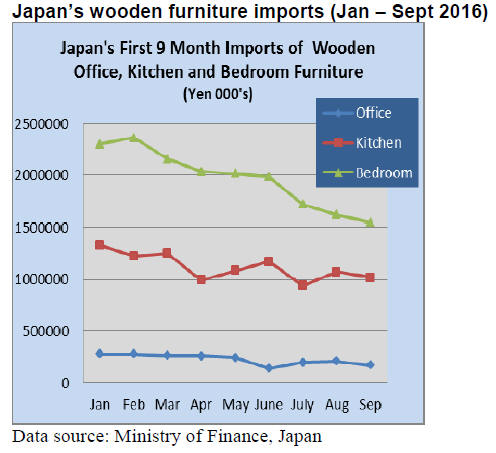

Japan’s furniture imports

January 2016 marked the high point for wooden kitchen

and bedroom furniture imports but since then there has

been a steady decline in the value of imports of both

categories of furniture. However, year on year figures are

more encouraging with kitchen furniture imports steady at

2015 levels in the first 9 months and bedroom furniture

imports showing just a 1% decline year on year.

Wooden bedroom furniture imports display cyclical

demand but this is less pronounced for wooden kitchen

furniture imports. Of the three categories of wooden

furniture imports being tracked, only office furniture

imports are showing a downward trend for the first 9

months of this year.

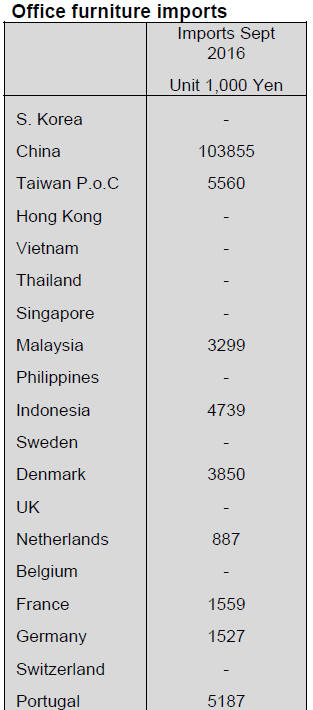

Office furniture imports (HS 940330)

September year on year imports of wooden office furniture

were down 8% and month on month imports dropped a

huge 17.5%.While shippers in China dominate the trade in

office furniture with Japan (60% of the total) the second

and third ranked suppliers alternate between suppliers in

the EU.

In September the second ranked supplier was Italy (18%

of Japan’s total imports) followed by Poland. In

September China’s share of total wooden office furniture

imports dropped 25% while the two EU suppliers marked

gains.

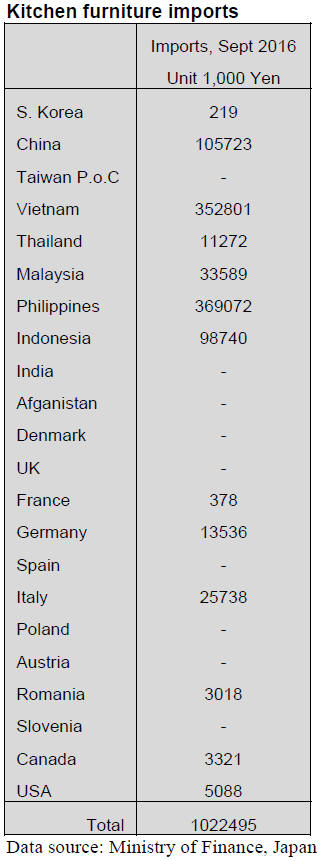

Kitchen furniture imports (HS 940340)

For the year to September 2016 there was an 1% year on

year drop in wooden kitchen furniture imports into Japan

and compared to August, September imports were down

around 5%.

The same four shippers dominated September imports

of

wooden kitchen furniture: Vietnam, the Philippines, China

and Indonesia. From the beginning of this year Vietnam

has been the main supplier but in September shipments

from the Philippines just topped those from Vietnam.

Together, the Philippines and Vietnam account for around

70% of all Japan’s imports of wooden kitchen furniture

with each accounting for around 35%.

The third ranked supplier is China which in September

accounted for a further 10% of Japan’s kitchen furniture

imports.

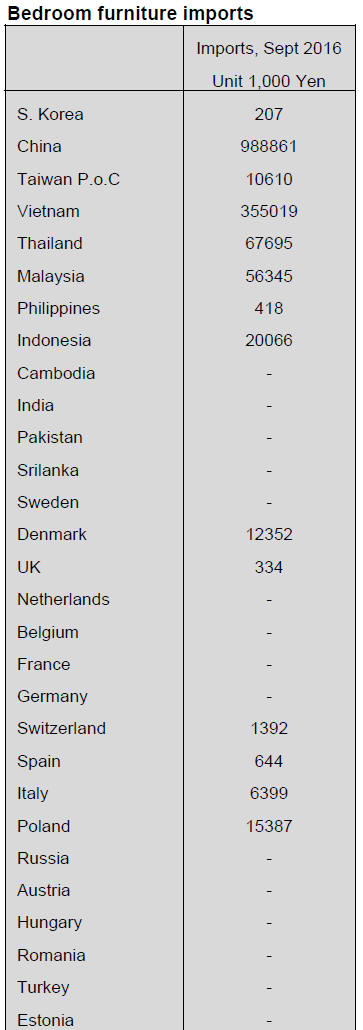

Bedroom furniture imports (HS 940350)

Bedroom imports by Japan are exhibiting the typical

cyclical trend seen in previous years. For the first 9

months of 2016 imports have fallen mirroring the trend in

2015. It remains to be seen if imports will increase in the

final quarter on the back of the healthy increase in new

home building starts.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Joint action plan by five groups

Demand promotion of domestic logs has been busy but

replantation after the harvest is now the question. Five

groups made joint declaration to warn sustainability of

domestic forests.

Japan Forestry Association, Japan Federation of Wood

Industry Association, Japan Federation of Forest

Association, Forest management Association of Japan and

Japan Federation of Logging Association signed action

plan to establish sustainable forest management and five

groups declared to realize fundamental policy for

promotion of utilization of wood and sustainability of the

forest.

In 2015, joint action plan was made for reconstruction of

forest in Japan. As one of concrete plans, in April 2016,

the law to use wood for public buildings should be

extended to private buildings so that it is necessary to have

a new law of wood use promotion law. It is requested to

the Forestry Agency.

This year’s action plan includes having system to have

sustainable forest by cooperation from economic society

and general public. It is necessary to establish fundamental

measures of utilization of wood including revision of the

wood use for public buildings through every level of

government system. It is also necessary to share the

information of forest and forest owners then to create

understanding of this move through general public as

national move.

The groups commented that even if the demand of wood

increases, it is doubtful to replant after the harvest based

on current return to forest owners, unless cycle of harvest

and replant is established soon, future planted forest

resources would be gone, timber harvest got busy in

Kyushu by exporting logs, increased consumption by

biomass power generation and building large new

sawmills but replantation is not progressing and this will

be the common national issue eventually.

Another comment is that recent increasing demand of

domestic wood is mainly for lower grade used for biomass

power generation like B & C class logs but demand for A

class logs, which is high grade logs to recover clear

lumber with higher prices. Unless demand for such higher

grade logs increases, return to the forest owners remain

low so that expenses for replanting are hard to generate.

After all, demand promotion is fine but it is imminent

issue to establish cycle of harvest then replant.

Japan Wood Station in Vietnam

The Japan Wood Products Export Promotion Council

opened ‘Japan Wood Station’ in Ho Chi Ming in Vietnam

to display Japanese wood products with subsidiary of

Forestry Agency to promote exporting wood products.

The station has floor space of 133 square meters.

Displayed items are square, beam and decorative girder,

structural laminated lumber, panel, laminated lumber for

interior finish and siding board. Also special items used

for the Japanese style room and Japanese style room.

In late October, representatives of Forestry Agency and

other groups visited the room and discussed schedule of

opening ceremony and also discussion with the

Vietnamese wood products users

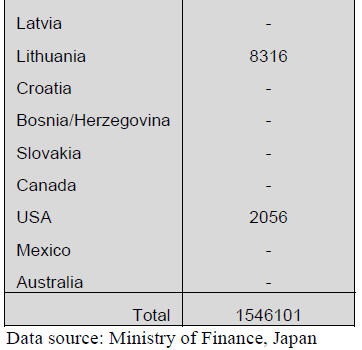

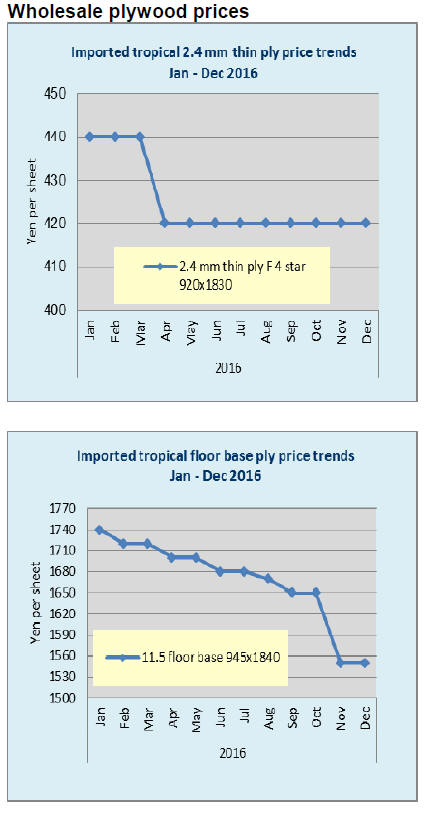

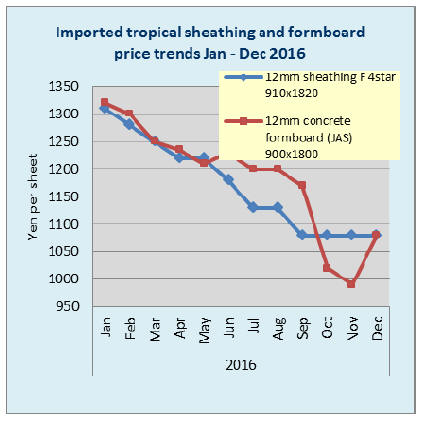

Imported South Sea (tropical) hardwood plywood

The market of 12 mm panel has been declining little by

little for over a year but now after the importers and major

wholesalers finished interim book closing in September,

the inventory adjustment completed.

Level of inventory gets low and order files are low for

future arrivals. Major plywood manufacturers in Sarawak,

Malaysia announced $20 price increase.

In this situation, the extreme low price offers are totally

gone from the market but price increase is difficult due to

depressed demand so it will take more time until the prices

climb. 12 mm 3x6 JAS concrete forming for coating

panel prices dropped down to 1,050 yen per sheet

delivered and green 3x6 concrete forming panel to 960-

970 yen in late September, which were extremely low.

Then in October, the yen got weaker down to 104-105 yen

per dollar so tide of strong yen is changed then in middle

of October, the largest Sarawak plywood supplier

proposed $20 per cbm higher FOB prices because of high

material log prices and other suppliers follow suit.

If these prices are accepted, FOB prices are $450-460 on

3x6 JAS concreter forming panel and $520 on 3x6 JAS

coated concrete forming panel.

Then in November, some wholesalers started

purchasing

in declining inventory because of higher cost in future.

The importing trading firms started proposing higher

prices to get out of loss business. Some importer says to

bring the prices of 3x6 concrete forming panel for coating

up to 1,150-1,200 yen is a target as the first step.

The importers have started committing future cargoes of

tight items so higher FOB offers are gradually accepted.

However, demand for concrete forming panel will slow

down in winter time until March next year so the buyers’

desire to purchase is dull. Increase of market prices will

take time and be slow. The move would start from upper

stream of distribution channels then gradually spread

downstream.

South Sea (tropical) logs

In Malaysia, there are more rainy days in November so it

is arrival of rainy season. There are more rain falls in

Bintulu, Sibu and Sabah so log production will be affected

by weather factor now.

Log suppliers in Sarawak try to harvest regular grade logs

to have higher return affected by reduced log export quota

set by Sarawak government but this move could be

temporary since number of regular grade log buyers is

limited.

The Japanese log buyers have hard time to buy small and

super small logs now. Some go to Sabah by limited supply

in Sarawak.

Log buyers from India are not able to buy enough logs in

Sarawak with high prices so they are now in PNG and

Solomon Islands where China is the main buyer but

because of depressed market in China, they reduced a

number of ships to the area so India sneaked in while

China is absent.

India does not concern to quality of logs so much and they

can use low grade logs with large hole so as long as the

prices are low and the volume is available, source does not

have to be Sarawak.

With rainy season coming, log supply will decline and the

prices would go up higher but for Japan, the yen is getting

weaker and the demand is stagnant, the importers are not

able to accept higher log prices. Presently Sarawak log

prices stay up high at US$275-278 per cbm FOB on

meranti regular, US$255-258 on meranti small and

US$245-250 on super small.

Itochu Kenzai concentrates on legal products

Itochu Kenzai Corporation (Tokyo) decided to start

handling legal products only starting April 2018. This

includes all the imported products and shipments. On any

suspicious products, it will visit supply sources and

confirm legality. It will visit some European company to

which environmental groups expressed some doubtful

comment. This move is to deal with the Clean Wood law,

starting in 2017.

Its business policy is to make effort of stable

supply of

only products the customers’ needs and it considers

environmental protection important by expanding in

handling of legally certified products the Clean Wood law

stipulates.

In particular, in wood products trading department, four

points are important, consideration to environment,

proposal business, unique supply sources and non-housing

business.

Handling of legal products has been increasing so since

April 2018, all the products will be legally certified. In

2015, share of certified products (lumber and laminated

products) were 79% then it increased to 84% during April

and August 2016.

The employees and customers’ members visit suppliers to

see if the products are conforming to conditions of

environmental protection. It will send some to the

European suppliers shortly.

It has its own house brand of Chikyuugi (Earth Tree),

which includes Canadian WFP certified KD hemlock. It

will supply of this products steadily by having inventory

on both sides of the Pacific.

Also, as an agent of Metsa Wood, it handles Metsa

products consistently then it will increase handling of

redwood laminated lumber supplied by Schweighofer.

Since 2017, it plans to handle legally proved Russian red

pine lumber. It will consider forming processing system of

domestic logs.

Arauco plans eight ships in 2017

Arauco, the largest Chilean radiate pine lumber supplier,

announced 2017 plan of bulk ships for green lumber for

Japan. It plans eight ships in 2017, the same as 2016 with

the volume of 144,000 cbms. It has two additional ships as

option in case the demand picks up.

Actual arrivals of total Chilean lumber during January and

August in 2016 are 134,200 cbms, 8.2% less than the same

period of last year so total year volume is expected to be

about 200 M cbms. Arauco’s supply volume for Japan in

2016 is estimated about 140 M cbms (loading base).

The last ship of the year will depart Chilean port in late

December and arrive Japan in early February of 2017.

Therefore, the first ship of 2017 will be loading in early

February. Arauco figures about 18,000 cbms for Japan per

every ship and plans shipment in every 45 days. Ships’

loading volume is 30,000-50,000 cbms per ship chartered

from three shipping companies, NYK, WBC and DAM.

The volume includes markets of China and Korea. Chilean

lumber suppliers revised joint shipment and

individual supplier negotiates with shipping lines of yearly

necessary ships. Since shipments include other markets

volume, ships’ rotation is flexible so that inventory

management is much more difficult than before after

regular 45 days rotation is disrupted.

|