2. GHANA

First African Development Bank funds for

PPP forestry

project

The African Development Bank (AfDB) is joining with

private sector investors for a project to restore degraded

forest reserves and double the area of sustainable forest

plantations.

A press release from the AfDB says ¡°This agreement is a

first-of-its-kind Public-Private Partnership (PPP) in its

forest sector and is backed by a US$10 million

concessional loan from the Climate Investment Funds'

Forest Investment Program (CIF FIP). It is also

supplemented by US$14 million in co-financing from the

AfDB.

The press release quotes the AfDB Director for Private

Sector Department, Kodeidja Diallo, as saying ¡°This

project is the Bank¡¯s first direct intervention in forestry

through a private sector window and will serve as a pilot

in setting the pace for engaging the private sector in

sustainable forest plantation management.

The concept is replicable and demonstrates how a close

collaboration between the public and private sectors can

contribute in transforming the future outlook for private

sector participation in forestry.

Reacting to the Board Approval and on behalf of the

project sponsors, Paul Hol, Executive Director of Form

International, stated that ¡°this is a breakthrough for private

investments in forestry on the continent.

I believe that this project and collaboration between AfDB

and Form Ghana Ltd can be a very important step to

enable the expansion of large scale reforestation and

landscape restoration projects in Africa. In this way it can

be an important front running project for the African

Forest Landscape Restoration Initiative (AFR100) from

the World Resources Institute (WRI) and NEPAD which

aims at restoring 100 million ha of land in Africa by the

year 2030¡±.

The Form Ghana reforestation project will establish a

forest plantation in areas that used to be productive semideciduous

forest reserves but that have been severely

degraded.

See http://www.afdb.org/en/news-and-events/article/afdbapproves-

usd-14-million-for-its-first-private-sector-directinvestment-

in-restoration-of-degraded-forests-throughsustainable-

forest-plantations-in-ghana-15955/

See also:

http://www.forminternational.nl/portfolio-item/formghana/

Stakeholders urged to help protect forest resources

The Minister of Lands and Natural Resources, Mr. Nii

Osah Mills, has called on stakeholders in the industry to

help protect the Forest and Wildlife resources of the

country.

At a press conference the minister said the natural

resources of the country are under intense pressure from

farming, illegal mining and illegal chainsaw felling.

The Minister reported on the success of the Rapid

Response Unit (RRU) within the Forestry Commission

(FC), which operates to deal with illegal activities in the

forest. The RRU was established to augment the Military

and Police Task forces to check, monitor and destroy all

unscrupulous practices which are key threats to closed and

open forests across the country.

Mr. Mills said his ministry was well aware of the many

challenges confronting the forestry sector such as

inadequate financing sources, the continuous depletion of

both natural and plantation resources and inadequate

logistics.

3.

SOUTH AFRICA

Truss makers threaten to turn to

steel

The South African magazine Sawmilling South Africa

reports that September sales of structural timber sales are

still strong and this can be judged from stock levels at

most mills.

It is reported that some mills are down to just a few days

stock and this, although good on the one hand, is not good

on the other as merchants and fabricators are experiencing

frustration as they cannot get the required dimensions for

their roof truss plants.

Some end-users are even talking about turn to steel if the

situation does not improve.

While this was an empty threat years ago, now with the

development of light roles steel components, the

competition from alternatives is a serious threat to our

industry.

The editor of the magazine writes ¡°Sawmillers need to sit

up and take note of the situation and try to address these

shortages. Light weight steel is already making serious

inroads in to the truss market and we must not let this

continue under our noses.¡±

Timber engineered product awards

The Institute for Timber Construction (ITC-SA) recently

showcased and rewarded top class workmanship in the

fields of decking, timber frame construction and roofing.

Sawmilling South Africa reports; ¡°Four entries were

received in the Alterations and Additions category ranging

from economical extensions to full-scale remodelling.

The Structures Smaller than120 sq.m. category saw four

entries varying from a ¡®granny flat¡¯ to a beautiful starter

home all of which clearly demonstrated a high standard of

skills and finishes.

Five entries were received for the Structures Larger than

120 sq.m, but below 220 sq.m. These projects ranged from

beach homes to those built on particularly sensitive sites,

showcasing the versatility and gentle approach to

construction made possible with timber frame.

The Structures Larger than 220 sq.m category saw three

entries, which all illustrated a variety of styles and quality

finishes capable of satisfying the most discerning taste.

Eight entries were received for the new Roofing category,

which encompasses commercial and residential roofs as

well as exposed trusses. All entries demonstrated the

inherent versatility timber lends to the design, fabrication

and erection of roofs across a broad spectrum of building

styles.¡±

For more see: http://www.timber.co.za/

4.

MALAYSIA

Increased first half 2016 wood product

exports

The Malaysian Timber Industry Board (MTIB) has

released export statistics for the first half of 2016.

Between January and June Malaysian exports of wood

products were valued at RM10.923 billion up 4.4% year

on year.

First half 2016 export values

Furniture RM3.603 billion

Plywood RM2.243 billion

Sawnwood RM 1.633 billion

Logs RM 888.4 million

MDF RM 615.9 million

Builders' carpentry and joinery RM 579.1 million

Mouldings RM 423.9 million

Particle/chipboard RM 174.7 million

Veneer RM 167.8 million

Others RM 593.6 million

Guidelines for Frontline Customs Officers

A National Workshop on Developing Timber Trade

Guidelines for Frontline Customs Officers was held in

Putrajaya, Malaysia.

This was jointly organised by the Ministry of Plantation

Industries and Commodities, the Malaysian Timber

Industry Board and The Wildlife Trade Monitoring

Network (TRAFFIC) in collaboration with the World

Customs Organization (WCO) and ITTO.

The WCO and ITTO recognise there is a lack of specific

guidelines and reference material on wood products for

frontline customs and other border officials so this

workshop aimed to to the first step in developing Timber

Trade Guidelines for customs officers.

The WCO signed a Memorandum of Understanding

(MOU) with TRAFFIC to assist in developing draft

Timber Trade Guidelines and funding was provided by

ITTO.

The purpose of the guidelines is to assist customs officers

validate and verify the classification and legality of wood

products and is part of a phased approach by WCO

towards enhancing the capacity of frontline customs

officers in their daily operational work.

Participants were informed that the guidelines will utilise

Malaysia¡¯s legislation, systems and procedures in term of

the legality of timber trade as a pilot project.

Occupational Safety and Health (OSH)

An OSH information campaign was recently organised by

the Sarawak Timber Industry Development Corporation

(STIDC) to cater for the wood based industry in Sarawak.

The campaign served as a platform to promote OSH in the

workplace. Besides increasing the understanding of the

Occupational Safety and Health Act 1994, the workshop

aimed to instill a safe and healthy work culture amongst

managers and workers.

As a follow up to the campaign OSH audits were

conducted in logging camps to assess OSH practices..

STIDC General Manager, M Sarudu Hoklai, has said that

the safety and health of employees are prerequisites for

forest certification.

India marketing mission report

In August this year the Malaysian Timber Council (MTC)

mounted a marketing mission to Chennai and Bengaluru.

The rational for this mission, says the MTC, hinged on the

assessment that the Indian market offers many advantages

to Malaysian exporters as India traditionally prefers

tropical hardwoods and the proximity between the two

countries is advantageous in terms of transportation cost.

In a press release the MTC reported the seminars as well

as business to business (B2B) sessions were held in

Chennai and Bengaluru. The B2B meeting in Chennai

attracted 41 buyers from 37 companies; while 106 buyers

from 80 companies attended the B2B sessions in

Bengaluru.

Buyers in Bengaluru came from 10 states and 16 cities in

India, namely; North (Delhi, Uttar Pradesh, Haryana),

South (Karnataka, Kerala, Telengana and Tamil Nadu),

West (Maharashtra, Gujarat) and East (West Bengal). The

presence of these buyers indicates how keen they are to

see what Malaysia has to offer.

For more see: http://mtc.com.my/releases/

5. INDONESIA

Interest rate cut to boost credit growth

Bank Indonesia lowered interest rates at its last meeting

saying the stable domestic economy has allowed the Bank

to adopt a loser monetary policy which will pump money

into the market and should provide for accelerated

economic growth despite the uncertain global economic

outlook.

This lower interest rate is expected to boost credit growth

in the private sector. Rising credit growth as a result of

business expansion and higher household consumption

should boost overall economic growth.

Community forest management target on track

The success of Indonesia¡¯s community managed forests

was showcased recently in Jakarta. This comes a year after

the launch of the government¡¯s target of allocating 12.5

million hectares of forests to be managed by communities

through social forestry schemes.

The community management target is part of the five year

plan (2015-2019) which aims at providing for 2.5 million

hectares annually of forests to be under community

management. Expectations are high for this scheme as it is

seen as providing for better management, solving tenure

issues and tackling rural poverty.

Post-Brexit trade to be boosted

Indonesian Ambassador to the UK, Rizal Sukma, is

working with small and medium sized companies in the

UK which are showing interest in a wide range of

products, including wooden items, produced by SMEs in

Indonesia. SMEs play a vital role in the Indonesian

economy contributing close to 58% of Indonesia's GDP.

Trade between Indonesia and the UK is rather small with

Indonesia¡¯s exports to the UK amounting to about US$1.5

billion, a fraction of Indonesia¡¯s total exports of over

US$160 billion. On the other hand Indonesian imports

from the UK were only US$800 million last year.

To support the initiative by the Ambassador the

Indonesian Chamber of Commerce and Industry is putting

together a plan for ¡°business to business¡± matching as the

first step to expanding commercial contacts.

Renminbi to be promoted for trade and investment

The Bank of China (BOC) has said it is ready to broaden

the usage of renminbi (RMB) in its trade and investment

activities in Indonesia in line with Beijing¡¯s efforts to

internationalise the Chinese currency.

Speaking recently the Bank of China Jakarta manager,

Zhang Min, indicated that the Bank is ready to broaden the

use of the renminbi (RMB) in its trade and investment

activities in Indonesia. A wider use of the RMB in trade

and investments, said Zhang, would reduce the risk of

losses from exchange rate fluctuations.

6. MYANMAR

Help at hand for VPA negotiations

Myanmar¡¯s State Counsellor, Daw Aung San Suu Kyi,

recently met the UK Prime Minister and discussed her

plans for rehabilitating the forests in Myanmar.

The UK offered assistance to Myanmar with VPA

negotiations and the Palladium Group will be contracted to

help prepare for and conduct negotiation. Dr. Kerstin

Duell will be the chief facilitator and the assistance from

the UK will not be affected by the UK decision to exit the

EU.

Call to streamline export procedures

Myanmar¡¯s Minister for Commerce has said the country is

facing difficulties in promoting exports because of

burdensome red tape, excessive regulation and poor

coordination between the many departments that are

involved in processing documents for export. The minister

said if the trade deficit is to be reduced then the efficiency

of export processing must be improved.

More police to guard Forest Rangers against attack

The Myanmar Police Force has announced that an

additional 215 officers will be assigned to protect forest

rangers from assault by illegal loggers. Attacks on forest

rangers were common in the past but the number of

incidents has fallen over the past month. In recent week

some 800 tons of illegal timber was confiscated along the

Myanmar/China border.

Revamped investment law should boost investor

confidence

As hopes rise for the removal of international sanctions

Myanmar is preparing to restructure the laws covering

investment. The plan is to merge the Foreign Investment

law and the Myanmar National Investment Law which

should provide more protection for overseas investors.

The Minister of National Planning and Finance has

reported that the pace inward finance has slowed as

potential investors await the outcome of the law revision.

Over the past five months under the new Government FDI

amounted to around US$2 billion.

7.

INDIA

CenturyPly cancel plans for MDF production

in

Vietnam

The July announcement from the Indian government that

an anti-dumping duty will be imposed on MDF imported

from Vietnam has caused CenturyPly India to reassess its

plans for investment in Vietnam.

The duty is said to amount to over US$60 per cubic metre,

roughly equivalent to 25 percent of the CIF price. At this

level production in Vietnam for the Indian market would

not be profitable according to CenturyPly so a decision has

been taken to divest its stake in the Singapore subsidiary,

Innovation Pacific, and exit from its MDF production plan

in Vietnam.

On the domestic front in India plans have been drawn up

for a new MDF plant in Hoshiarpur, Punjab which, itis

said, will be the largest plant in India.

CenturyPly has investment heavily in facilities in

Myanmar and Laos. In Myanmar they manufacture veneer

and in Laos the company has a local partner to also

produced veneer.

A spokesperson from CenturyPly said they are very

eagerly waiting for the implementation of the new goods

and service tax as this could boost market opportunities

and should lift profits.

Importers complain log fumigation regulations out of

step with international standards

Timber associations across India have petitioned the

government regarding saying that the recent plant

quarantine regulations have become major problem for

Indian importers.

The current regulation stipulates that logs need to be

fumigated with methyl bromide prior to export from the

country of origin but international bodies such as the

International Plant Protection Convention, the United

Nations Environment Programme and the Montreal

Protocol classify methyl bromide as hazardous for health.

The petition says as many countries prohibit the use of this

chemical as such they are unable to fulfill the requirement

of Indian plant quarantine regulations and that alternative

and internationally accepted treatments must be adopted.

India imports a huge quantity of logs to meet the domestic

requirements and until recently were importing from

Myanmar, Laos, Vietnam, Malaysia, Thailand etc., but

since these countries have reduced or banned log exports

India relies more heavily on log imports from the EU, the

US, Latin America and Africa where the use of methyl

bromide is restricted.

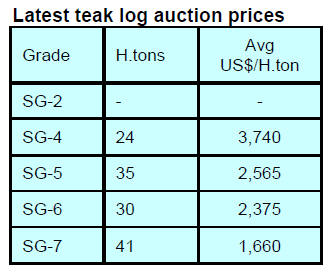

Plantation teak prices

Demand for teak has improved and some shippers have

changed the prices for small size logs.

Prices from the three new plantation teak log

suppliers

remain unchanged at: Taiwan P.o.C (US$1036 to 2126 per

cu.m C and F), China (US$855 to 1118 per cu.m C and F)

and Honduras (US$471 to US$539 per cu.m C and F).

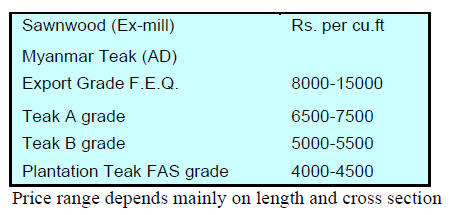

Myanmar teak flitches resawn in India

Domestic demand continues to firm but has not yet

impacted pricing.

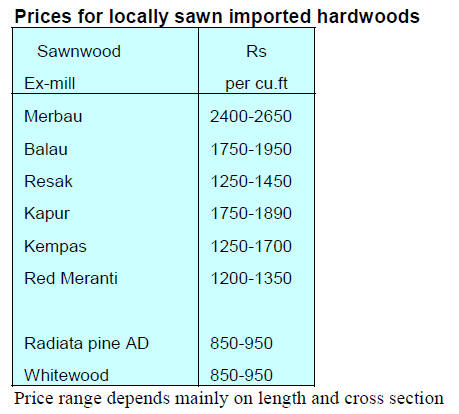

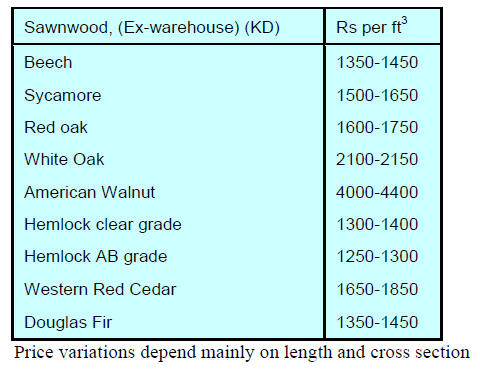

Prices for imported sawnwood

Demand for imported sawnwood remain weak such that

there are no opportunities for price increases.

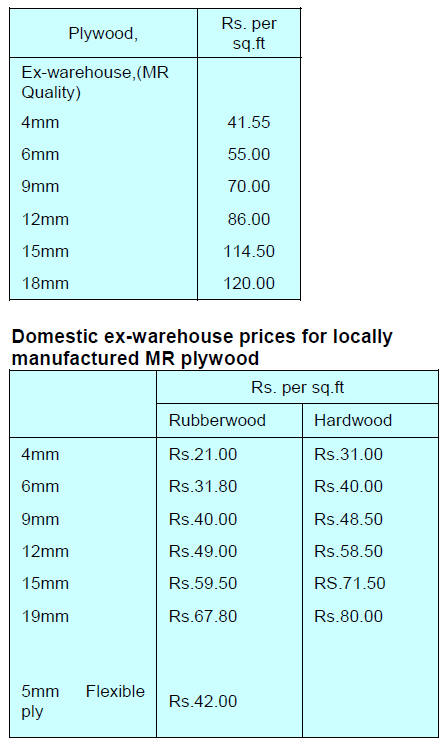

Prices for WBP Marine grade plywood from domestic

mills

Increased investment in plywood production has created a

situation of over-supply which is impacting sales volumes,

pricing and the bottom-line of manufacturers.

The building and construction sectors are active but the

glut of standard panels offers no opportunity for

manufacturers to achieve better prices which are long over

due.

8.

BRAZIL

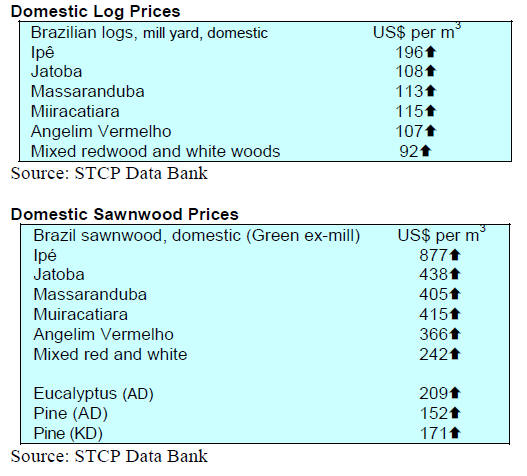

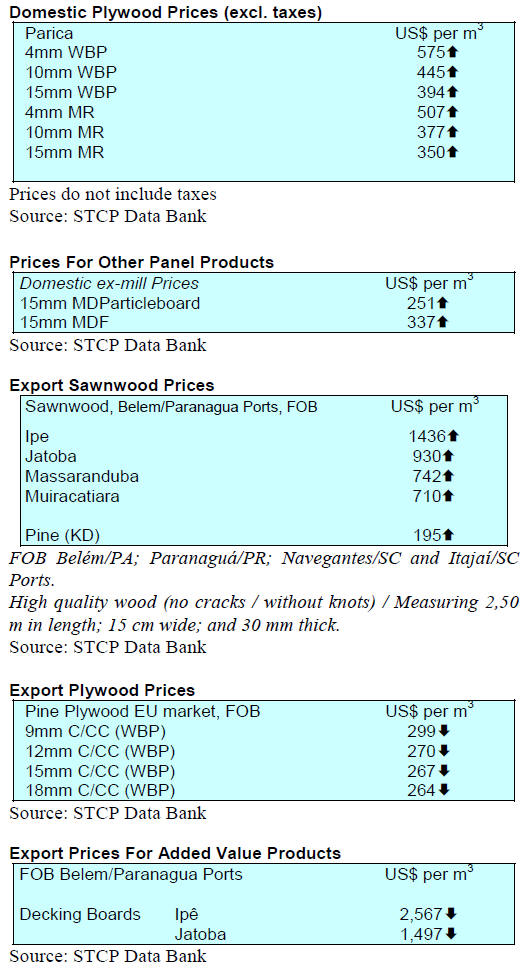

August export up-date

In August 2016, Brazilian exports of wood products

(except pulp and paper) increased 21% in value compared

to August 2015, from US$216.0 million to US$262.0

million.

Sawnwood export volumes and value rise in August

August pine sawnwood exports rose 36.0% year on year

from US$26.1 million in August 2015 to US$35.5 million

this year. The volume of pine sawnwood exports rose by

around 50% over the same period, from 118,700 cu.m to

178,500 cu.m.

Tropical sawnwood exports also jumped in August rising

33% from 23,200 cu.m in August 2015 to 30,900 cu.m. At

the same time the value of exports increased 32% from

US$11.4 million last August to US$15.0 million in August

this year.

Mixed performance from plywood exporters

The value of August 2016 pine plywood exports dropped

compared to August 2015 from US$38.9 million to

US$33.1 million but the volume of exports jumped 42%,

from 103,900 cu.m to 148,000 cu.m, over the same period.

However, exports of tropical plywood increased by almost

91% in August this year from 7,500 cu.m in August 2015

to 14,300 cu.m this year. At the same time the value of

exports rose around 56%.

First half 2016 tough for furniture makers

While August furniture exports increased by around 13%,

this year has been tough for furniture manufacturers. The

contraction of the Brazilian economy has impacted all

sectors and the furniture industries are no exception.

According to a report from the Market Intelligence

Institute (IEMI), between January and June this year

Brazilian furniture production, in terms of number of

pieces produced, was down almost 15% compared to the

first half of 2015.

Over the same period furniture imports dropped around

13%. Perhaps of most concern is the indication from IEMI

that productivity in the furniture manufacturing sector

worsened.

To address the challenge of weak demand the Furniture

Industry Association of Rio Grande do Sul (MOVERGS)

says the solution is to maintain investment in advanced

technologies and pay more attention to product design and

market diversification.

Strategic export markets identified by furniture sector

panel

The Brazilian Furniture Industry Association

(ABIMÓVEL) organized a panel discussion focused on

the challenges in the furniture manufacturing sector at its

recent Furniture National Congress.

One major concern voiced was the trend in demand level

in the US and China and the impact of this on the global

economy.

The panel attempted to identify strategic export markets

after analysing the potential in various countries. The

panel concluded that for Chile and Mexico efforts should

be focused on resuming trade, for Colombia, the United

States and Panama the panel suggested there is a need to

strengthen trade relationships.

For the United Arab Emirates and the United Kingdom the

panel concluded these markets were beginning to be aware

of Brazilian furniture.

The Brazilian Agency for Industrial Development (ABDI)

contributed to the panel discussion and said the agency has

a great interest in the furniture industry and would

encourage the adoption of advanced manufacturing and

management technologies to secure greater market access.

Export ¡°Brazilian-ness¡± to increase international

market share

In the ten years since 2005 Brazilian timber exports have

almost halved (-44%) while imports have increased

dramatically. This, and the fact that Brazil slipped from

the 12th to 32nd place in the ranking among exporting

countries, has been reported by IEMI.

Prospects for a short term recovery in furniture sales are

not good but IEMI is forecasting that global and domestic

demand should begin a recovery towards year end but it is

unlikely that the furniture sector will see production rise to

the 476 million pieces produced in 2013. IEMI has

forecast that it could be until 2022 that such output could

be once again attained.

In offering a solution for increasing exports IEMI suggests

the furniture industries could focus on innovation and

characteristics that differentiate Brazilian products from

those from other countries, i.e. increase the ¡°Brazilianness¡±

of products.

This could involve using the wide-range of native timbers

along with innovative designs to gain competitive

advantage in the international market.

Forestry sector has a role in the Paris carbon

emissions agreement

Brazil ratified the Paris Agreement on climate change

establishing the country's commitment to reduce carbon

emission and according to the Brazilian Tree Industry

(IBA), the Brazilian plantation sector has a role in meeting

Brazil´s goals.

As a totally renewable resource it is estimated by IBA that

the 7.8 million hectares of forest plantation areas in Brazil

are responsible for stock of approximately 1.7 billion

tonnes carbon equivalent.

In addition to carbon removal and carbon stocks in tree

plantations the sector, according to IBA generates and

maintains carbon reserves of approximately 2.48 billion

tonnes of CO2eq in protected areas.

IBA has suggested that policies that recognize biomass as

carbon neutral when secured through sustainable

management should be adopted and that these should

recognise the positive contribution made by all forms of

forest.

9. PERU

Imports of composite boards increase

In the first eight months of 2016 Peruvian imports of

particleboard/MDF totalled US$49.2 million, an increase

of 6.9% compared to the same period in 2015.

The main importer was Novopan Peru at US$20.8 million

(2015: USD 19.3 million) and a 42% share of total imports

of panels. The second main importer was Arauco Peru

with imports of US$10 million (2015: 10.0 million) and a

market share of 21% (2015: 22%).

Ecuador remained the largest supplier with a market share

in the first eight months of 44% of total composite

imports, followed by Chile with 35% and Spain with 12%.

Brazil ships composite panels to Peru and in the first eight

months had an almost 9% market share.

New forest development programme launched

The Minister of Agriculture and Irrigation (Minagri), Jose

Manuel Hernandez, announced that its work will include a

programme of aggressive forest development to reforest

areas in the highlands of Peru.

The minister said it is unacceptable that the country loses

around 150,000 hectares of forest every year through

deforestation. He said that Minagri is signing agreements

with six national universities which have agricultural

activity programmes to launch a ¡®Young Agro

programme¡¯. This will provide an opportunity for students

of these universities conduct fieldwork with Minagri and

at the same time earn study credits.