Japan

Wood Products Prices

Dollar Exchange Rates of 25th

August 2016

Japan Yen 100.53

Reports From Japan

Confidence slips - government spending to

boost

growth in the second half of year

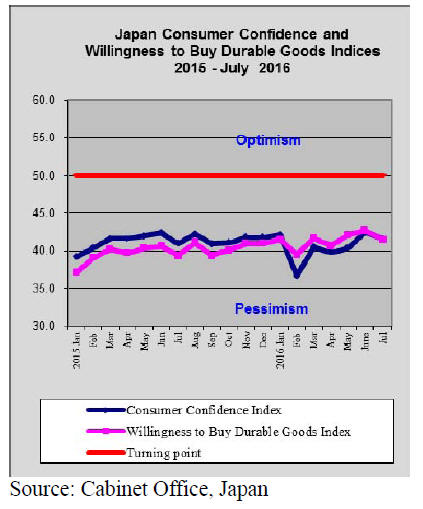

Japan’s consumer confidence index fell to 41.3 in July

from the five month high in June. The consensus amongst

analysts was that the figure would rise in July.

Among the various indicators used to compile the overall

index willingness to buy durable goods (of significance to

the furniture sector) worsened and the employment

prospect index also weakened. The impact of the two

declines brought down the overall confidence level.

Japan’s economy nearly stalled in the second quarter

amid

falling exports and weak corporate investment, showing

the nation is still largely dependent on government

stimulus for growth.

Japan’s economy grew at an annualised 0.2% in the

second quarter of 2016 well below the 2% achieved in the

first quarter. Analysts were quick to point out that the

number would have been in negative territory were it not

for the second quarter rise in public investment.

In early August the government approved a massive

stimulus package so government spending should boost

growth in the second half of this year. It came as a

disappointment to the government that private sector

investment continues to decline and exports fell.

Consumer spending makes up roughly 60% of Japan’s

gross domestic product and boosting spending is a must if

the economy is to be turned around but consumers are

holding back as they are unsure of prospects and because

few see any real prospect of growth in wages. The greatest

challenge is to reverse the continuing decline in consumer

prices.

BoJ hints at weakening the yen

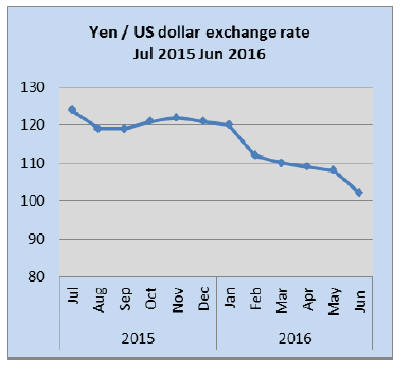

Immediately after the result of the UK referendum the yen

surged against the US dollar and has remained persistently

strong. The strength of the yen has undermined the

profitability of exporters and has seriously dented retail

sales.

These two factors, especially if the yen dollar rate goes to

95, are behind the current thinking that the Bank of Japan

is likely to intervene to weaken the currency.

Up to July this year department store sales dropped by

almost 20% year on year and this was despite record high

tourist arrivals.

That the BoJ could announce further rate cuts is

considered the most likely option as the Bank Governor

indicated the negative interest rate approach had not been

fully exploited.

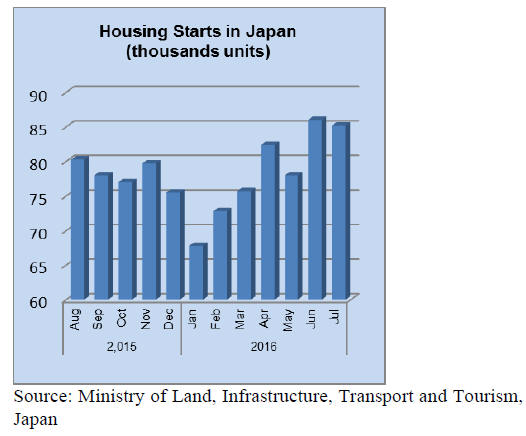

Mortgage refinancing applications at record highs

While the Bank of Japan(BoJ) is criticised for not

achieving its inflation target, in one sector action by the

Bank has been a success – home loans.

Since the negative-interest-rate policy was adopted at the

beginning of the year mortgage rates in Japan have

dropped to record lows and the number of applications for

mortgage refinancing up to July this year is almost twice

that for the same period last year. On top of this

applications for home loans have risen over 40%.

Housing starts in Japan increased almost 9% in July

compared to levels in July 2015 reversing the year on year

decline noted in June. However, in response to the

government’s regular survey construction companies

reported weaker order books.

The negative-rate policy was introduced to encourage

lending and stimulate growth but on this score it has been

less successful. It was anticipated that the savings made by

those refinancing their home loans would mean more

money in their pockets and increased spending but, so far,

there is little evidence of that as retail sales and consumer

spending remain weak.

Import round up

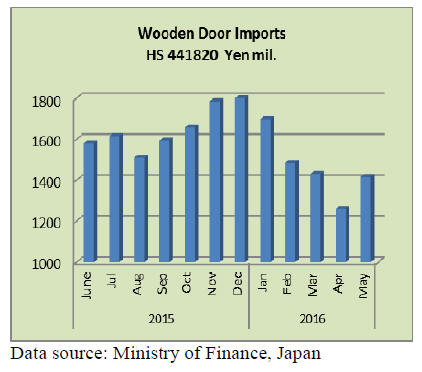

Doors

Japan’s wooden door imports in April marked a new

record low having fallen for 4 consecutive months.

However, May 2016 imports rose around 12% from April

but year on year May 2016 wooden door imports were

some 5% below that in May 2015.

China, Philippines and Indonesia continue as the main

suppliers in that order of rank in terms of the value of

imports. These 3 countries accounted for over 80% of

Japan’s wooden door imports in May 2016, with another

7% being shipped from Malaysia.

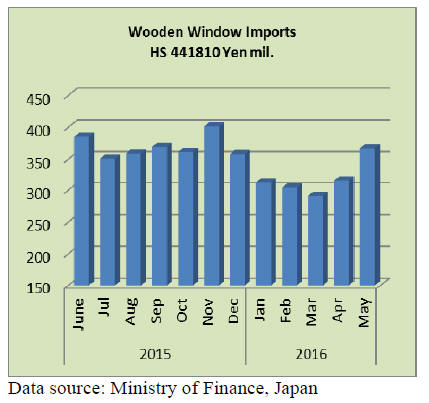

Windows

The pattern of Japan’s wooden window imports closely

mirror that for wooden doors except that there was a slight

rise in the value of imports in April and this extended into

May 2016.

Year on year May 2016 wooden window imports were

down 5% but the increase seen in May this year lifted the

value of imports close to the peak seen in November 2015.

The value of May 2016 imports of wooden windows were

close to 17% higher than in April.

The Philippines, China and the US, in that ranking, were

the main suppliers of wooden windows to Japan in May

this year and these th ree countries accounted for 83% of

all Japan’s imports of wooden windows for the month.

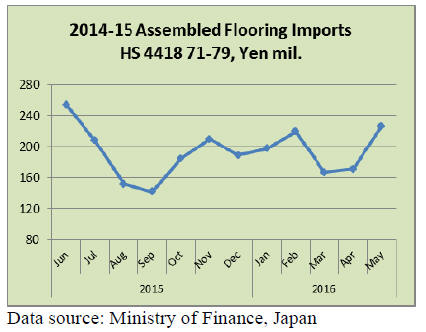

Assembled flooring

Assembled flooring imports continue to struggle to regain

the highs of early 2015. March 2016 was the low point for

assembled flooring imports into Japan but since then there

has been a rebound. May 2016 imports were up 33% on

the value of April imports. However, year on year, May

imports were around 8% down.

Two categories of assembled flooring dominate Japan’s

imports, HS 441872 and HS 441879. China is the main

supplier of the third category (HS 44187) while Indonesia

ships both HS 441872 and 79 and is the second ranked

supplier followed by Thailand which ships mainly HS

441879.

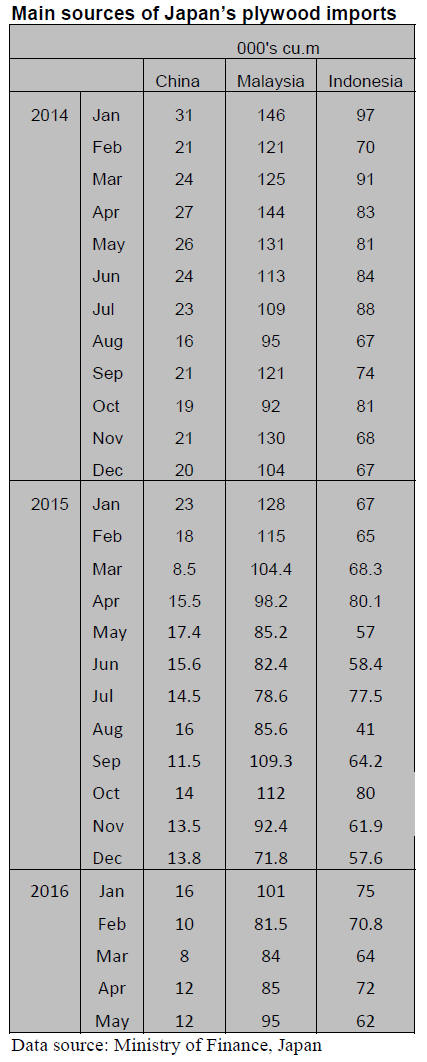

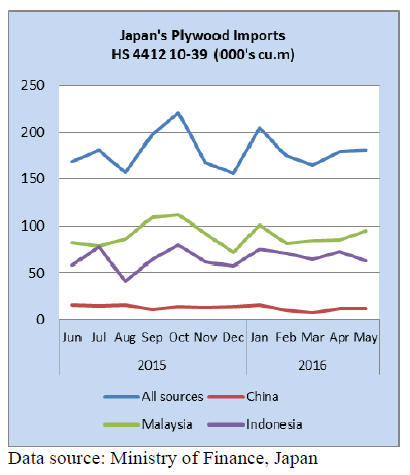

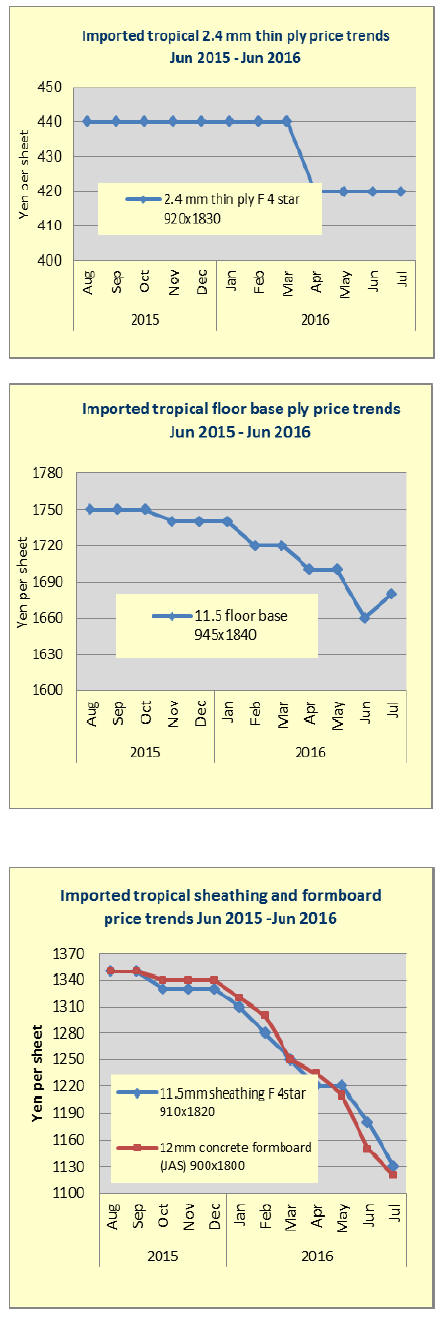

Plywood

Trends in total plywood imports into Japan over the past

12 months are illustrated below. Malaysia and Indonesia

continue to be the main suppliers followed by China. The

three main suppliers account for over 90% of monthly

plywood imports to Japan.

May 2016 plywood imports were almost 6% higher than in

May 2015 and were marginally higher than in April this

year. In 2014 and early 2015 monthly plywood imports

were almost 70% higer than during 2016. This year

imports peaked in January and then fell for two months

before the recent increasing trend.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Woodframe model houses for China

The Japan Wood Products Export Promotion Council has

made up four model of wood house based on the Chinese

wood building standard. They are corresponding to the

Chinese needs with exposed use of wood of Japanese

species like cedar, cypress and larch to differentiate from

2x4construction. The Association hopes to promote sales

of domestic wood products and wood house to China.

The Association has been asking to add Japanese species

of cedar, cypress and larch to the Chinese wood structure

standard. There are four model plans. M1 type is two

stories with floor space of 170-300 square meters and M2

type is two to three stories with floor space of 170– 300

square meters. M1and M2 are both medium grade

specifications. J1 type is two stories with floor space of

200-300 square meters and J2 type is two stories with

floor space of more than 300 square meters. 1 and J2 are

both high grade specification.

They are different from Japanese houses with much higher

height of ceiling like 3-4 meters on first floor and 2.4-2.5

meters on the second floor.

The Chinese wood construction standard allows to build

up to three stories and the committee is now discussing for

higher wood multilayer building and they are interested in

wood multilayer buildings in North America and Europe

including use of CLT. China has CLT manufacturing

plants.

COC acquisition increases among laminated lumber

manufacturers

The Japan Laminated Wood Products Association sent out

questionnaires to the 88 members to find out how many

members have acquired COC certificate by forest

certification system by FSC, PEFC and SGEC.

63 companies responded with response rate of 72%.

Three companies have COC certificates by three forest

certification systems of FSC, PEFC and SGEC. Three

companies have two from FSC and PEFC. Two have

certificates from FSC and SGEC. Two have certificates

from both PEFC and SGEC. Then 24 companies have

certificate by either one of three authorization systems.

Demand for certified wood will increase for the Tokyo

Olympic Games in 2020 and construction of public

buildings so all the manufacturers are anxious to have the

certificate.

South Sea (tropical) logs

Weather in Sarawak, Malaysia is recovering and rainy

season seems to be over now but control on illegal harvest

continues then the Sarawak government decided to reduce

export log volume from 40% to 30% so the log supply

from Sarawak will further decline. It looks like weather is

nothing to do with log supply now.

Sabah’s log production has not increased much even after

the weather improved. In this tight supply situation, the

log suppliers’ bullish attitude has not changed a bit.

When the yen advanced to 102 yen per dollar in late June,

log’s yen cost would be down but strong FOB prices

supported by bullish Indian buyers, such hope of lower log

cost faded. Present FOB prices of Sarawak logs for Japan

are all firming at about $275 per cbm on meranti regular,

$255 on small and $240 on super small.

After Sarawak log prices continue strong and the quality

is dropping, other log buying countries like China and

India are shifting to other sources like PNG and Solomon

Islands much more than before.

Hida Sangyo markets domestic cedar tables and chairs

in Europe

Hida Sangyo Co., Ltd. (Gifu prefecture) plans to market

cedar table and chair in Europe. Hida uses compressed

straight grain cedar for furniture. It started relationship

with Swiss design office of ‘Aterior Oi’ by introduction of

the prefecture office then Atelier Oi introduced Hida

Italian furniture manufacturer, Danese.

Now Hida will market its products through Danese’s

shops in Europe. Hida uses brand name of Gifoi. Atelier

Oi designs, Hida manufactures and Danese markets with

Hida’s brand name of Gifoi. Hida has been marketing the

products in Taiwan, Hongkong and China but has no

shops under direct management and sales amount by

overseas sales have been small.

It has own device of making compressed wood so it

intends to develop overseas market more. It ties with

English architect office and design office in Swiss and

sold the products on spot basis in the past. It also

participated Italian international furniture fair’

Milanosalone’ for four straight years.

It is studying if assembly of furniture can be done in Italy.

In September, the Chinese sales agent will open showroom

in Shanghai and display Hida’s products.

|