|

Report from

Europe

EU tropical sawn hardwood imports rose 9% in 2015

In 2015, EU imports of tropical sawn hardwood were 1.05

million cu.m, 9% more than previous year. The value of

EU imports increased by 15% to Euro772 million.

The average unit value of tropical sawn hardwood imports

into the EU in 2015 was Euro732 per cubic meter, up from

Euro670 per cubic meter the previous year, the increase

due to the euro being on average 20% weaker against the

US$ in 2015 compared to 2014.

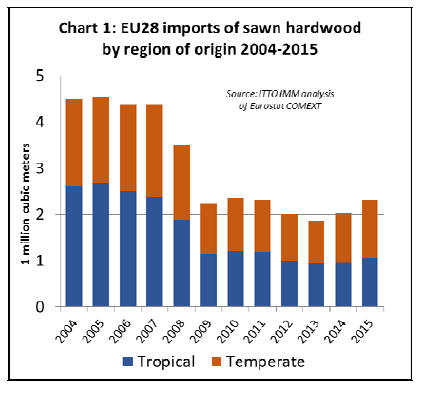

While the rise in EU imports of tropical sawn hardwood in

2015 is encouraging, the volume of imports remains at

historically very low levels. Import volume in 2015 was

only 40% of the level prevailing before the global

financial crises and fell short even of the level between

2009 and 2011 in the immediate aftermath of the crises

(Chart 1).

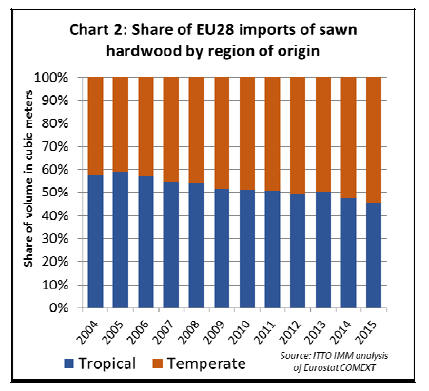

The pace of increase in import volume in 2015 was also

slower than for temperate sawn hardwoods which jumped

19% to 1.26 million cu.m. The share of tropical in total

EU sawn hardwood imports fell from 48% in 2014 to 46%

in 2015, continuing a long term trend (Chart 2).

On the other hand, the loss of tropical wood*s share in EU

sawn hardwood imports is less obvious in euro value

terms; tropical wood*s share was 57% in 2015, the same as

the previous year and not too far short of the level of 62%

that prevailed before the global financial crises.

Main tropical producer countries extend their market

dominance

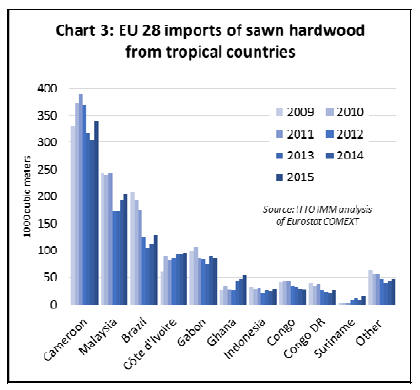

Cameroon, Malaysia, and Brazil, Europe*s top three

suppliers of sawn tropical hardwood, each recorded

significant growth in deliveries to the EU last year (Chart

3).

Cameroon was by far the largest single supplier of tropical

sawn hardwood to the EU in 2015, accounting for almost

one-third of all imports. EU imports from Cameroon were

339,000 cu.m last year, 12% more than in 2014.

There was solid growth in sales of Cameroon sawn

hardwood to several EU markets in 2015 including France,

Belgium, Spain, and Italy. These gains were sufficient to

offset a decline in sales to the Netherlands, Germany and

the UK.

EU imports from Malaysia were up 7% to 206,000cu.m in

2015, the rise being entirely due to much higher imports

by the Netherlands (although the data here is highly

uncertain 每 see next section). Most other EU countries

recorded low or declining sawn hardwood imports from

Malaysia last year.

European imports of sawn tropical wood from Brazil

increased 14% to 128,000 cu.m in 2015. The main driving

forces behind this increase were France, Belgium and, to a

lesser extent, Germany.

Of other significant producer countries, there was doubledigit

growth in tropical sawn hardwood imports into the

EU in 2015 from Ghana (+15% to 55,000 cu.m), Indonesia

(+22% to 29,000 cu.m), and the Democratic Republic of

the Congo (+27% to 26,000 cu.m). However EU imports

from Gabon fell 5% to 85,000 cu.m and imports from

Congo declined 4% to 28,000cu.m.

Tropical wood imports recover in France and Benelux

countries

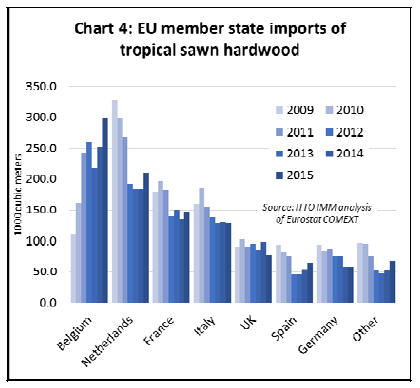

The rise in EU tropical sawn hardwood imports was owing

to recovery of demand in the three largest importing

markets: Belgium (+19% to 299,100 cu.m), Netherlands

(+14% to 210,700 cu.m) and France (+10% to

147,800cu.m). Together these three markets accounted for

62% of the EU*s tropical sawn hardwood imports in 2015

(Chart 4).

By far Belgium*s largest supplier of tropical sawn

hardwood is Cameroon, from where the country imported

124,500 cu.m last year, 22% more than in 2014 and 304%

more than in the crisis year of 2009.

Belgian imports from Gabon have also grown dramatically

in the last six years, from just 3,800 cu.m in 2009 to

53,800 cu.m in 2015. As early as 2011, Gabon ousted

Malaysia as Belgium*s second most important supplier of

tropical sawn hardwood. Malaysia is the only one among

the seven top suppliers to have delivered less sawn timber

to Belgium in 2015 than in 2009.

Data on sawn hardwood volume imports provided by the

Netherlands authorities to Eurostat is inconsistent and

difficult to interpret. The data shown here has been heavily

amended, based on (simplistic) assumptions that import

value recorded by the Dutch authorities is accurate and

unit values are likely to have remained reasonably

consistent. The adjusted Netherlands data suggests a rise

in tropical sawn hardwood imports in 2015, largely driven

by increased trade with Malaysia.

There are reasons to believe that there might have been an

increase in Netherlands imports from Malaysia in 2015.

After several very depressed years, the Dutch construction

sector is growing again. Meanwhile the Dutch government

in 2014 finally recognised the Malaysian Timber

Certification System (MTCS) as meeting their criteria for

sustainable timber after many years of effort by the MTCS

and Malaysian Timber Council.

This at a time when the Netherlands timber trade has made

very far-reaching commitments to procurement of only

certified timber products in recent years, claiming that

74% of all wood imported into the country is certified. The

Dutch EUTR enforcement regime also appears to be

relatively more rigorous than in some other EU countries.

In short, all these factors may have encouraged Dutch

importers to buy more Malaysian timber at the expense of

imports from other tropical countries less capable of

delivering certified product.

It*s notable that the recent apparent rise in Dutch imports

of Malaysian sawn timber has been matched by a decline

in imports from Cameroon.

However these comments in relation to the Netherlands

are still speculative. The Malaysian export data, which

seems more consistent than the Dutch import data,

recorded no increase in exports of sawn hardwood to the

Netherlands in 2015.

Imports of tropical sawn hardwood into France increased

9.7% to 147,800 cu.m in 2015. As in the Netherlands,

there were signs of improving economic performance in

France in 2015. Important market players in the French

tropical timber sector, such as the tropical sawn hardwood,

logs and plywood producer Rougier, reported improving

demand, although still in a very competitive environment.

Cameroon and Brazil were the primary beneficiaries of the

rise in French imports of sawn tropical hardwood last year.

Imports from Cameroon jumped 48.9% to 46,100 cu.m,,

cementing the country*s position as France*s leading

supplier. French imports from Brazil increased 29.1% to

36,400 cu.m but are still far below the volume of 61,100

cu.m delivered by Brazil in 2009.

The Italian market for tropical sawn hardwood is still in

the doldrums. Italian wood importers had started to be a

little more optimistic again in 2014, but this trend did not

last.

After a 2% rise in 2014, the first increase since 2010,

imports fell back again last year by 1% to 129,000cu.m.

The share of tropical in Italy*s total imports of sawn

hardwood fell from 21% to 18%. This was mainly due a

significant rise in Italian imports from other EU countries,

a development partly due to the fashion for oak in

furniture production. Also, due to the weakness of the

euro, beech and other pale European hardwoods are likely

being used for mouldings in place of tropical wood and

American tulipwood (imports of which also declined in

2015).

Italy*s imports of tropical sawn hardwood increased from

both leading supply countries in 2015. Imports were up

9.5% from Cameroon to 61,200 cu.m and 6.2% from Côte

d*Ivoire to 26,500 cu.m. However these gains were offset

by a sharp fall in imports from Gabon, the third most

important supplier, down 29% at 23,200cu.m.

After rising in 2014, UK imports of tropical sawn

hardwood fell 23% to 76,500 cu.m in 2015. Total UK

imports of sawn hardwood, both temperate and tropical,

declined 7.6% to 428,000cu.m in 2015. The share of

tropical countries in total UK sawn hardwood imports fell

from 22% in 2014 to 18% in 2015. Cameroon replaced

Malaysia as the UK*s largest supplier of tropical sawn

hardwood in 2010 and maintained this position until 2014.

However, last year imports from Cameroon fell by 41.4%

to 20,800 cu.m. In 2015, Malaysia overtook Cameroon to

become the largest tropical sawn hardwood supplier to the

UK despite a 17.5% decline in imports to 20,900cu.m.

The rebound in Spain*s imports of tropical sawn hardwood

continued last year, with imports rising 19% to 64,400

cu.m. This follows a similar gain in imports in 2014 and

suggests the recovery in Spain*s crisis-stricken market is

becoming more sustainable.

Tropical wood also seems to be maintaining market share

in Spain: in 2015 sawn hardwood from tropical countries

accounted for 40% of total sawn hardwood imports up

from 39% in 2009. Spain imports tropical timber primarily

from Cameroon and Brazil, both of which showed growth

last year, by 25.2% to 38,400cu.m and 26.9% to

10,700cu.m, respectively.

USA, the largest sawn hardwood supplier to the EU

The USA remained the single largest external supplier of

sawn hardwood into the EU in 2015, but deliveries fell by

6% to 366,000 cu.m. At the same time, the EU*s sawn

hardwood imports from Canada fell by 23% to 24,000

cu.m.

Data compiled by the American Hardwood Export Council

(AHEC) indicates that exports of U.S. sawn hardwood to

the EU fell 11% in volume and 10% in dollar value last

year. While exports of white oak and red oak increased

slightly, there was a significant fall in exports of other

U.S. hardwood species, particularly tulipwood and ash.

According to AHEC, ※these declines occurred at a time

when European currencies weakened sharply against the

dollar and there was only slow post-recession growth in

key economic sectors, like construction and furniture§.

AHEC also note that concerns about future supplies of ash

due to the Emerald Ash Borer, combined with uncertainty

over EU rules for phytosanitary certification of American

ash may have encouraged manufacturers to build up stock

during 2014.

This combined with the weakening euro led to the sharp

fall in exports of ash during 2015. American ash is now

subject to very stringent phyto-sanitary requirements in the

EU (AHEC argues too stringent) which is severely

limiting opportunities for export of this species.

Increased EU imports of lower value Eastern European

hardwood

A key trend in the EU sawn hardwood trade in recent

years has been increased dependence on imports of lower

value product from Eastern Europe, notably Ukraine,

Belarus, Russia, Bosnia and Serbia.

In 2015 there were higher deliveries from the Ukraine

(+37% to 350,000cu.m), Belarus (+63% to 128,000cu.m),

Russia (+117% to 125,000cu.m), Bosnia (+17% to

112,000 cu.m) and Serbia (+3% to 77,000 cu.m).

Growth in import volumes was significantly higher in each

case than the rise in euro-based import value, as all three

countries* currencies fell dramatically against the euro in

2015. This is likely to have a decisive factor for the sharp

rise in volumes from this region last year.

Much of the product arriving from Ukraine, Bosnia and

Serbia is oak which remains very fashionable in the EU

flooring and furniture sectors. Material from Belarus and

Russia is mainly lighter lower grade hardwoods such as

birch and aspen used for packaging and other industrial

uses.

To some extent the rise in imports from these Eastern

European countries is an inevitable result of the EU*s

manufacturing centre of gravity shifting from higher cost

countries in the west to lower cost countries in the east.

The latter are more inclined to source hardwood from

neighbouring non-EU countries than from tropical

countries or North America.

Regulatory changes may have been an additional factor in

the case of the Ukraine. In April 2015, the Ukrainian

government banned exports of logs for 10 years effective

from 1 November 2015. The log export ban affects logs

and poles as well as sawn wood with thickness exceeding

70 mm and over 22% moisture content. In addition to the

log export ban, Ukraine added oak to the list of ※rare and

valuable§ timber species for which controls are imposed

on a wider range of secondary and tertiary processed

products.

These various new regulations contributed to a significant

shift in the make-up of hardwood imports into the EU

from Ukraine during 2015. Ukrainian oak log deliveries to

the EU plummeted to 29,000 cu.m last year, down from

82,000 cu.m in 2014. Meanwhile EU imports of Ukrainian

sawn oak rose dramatically, probably a short-lived trend as

importers purchased additional supplies before November

2015 to beat the extra controls on oak which are now in

force.

Challenges remain despite rising tropical timber

imports

While imports have been rising and some key sectors of

the European economy, such as construction, furniture and

flooring, are now growing slowly, these remain

challenging times for the European hardwood industry.

Use of all hardwood in traditional applications in Europe,

but particularly for mass-produced goods like doors and

flooring, continues to come under pressure. Many

consumers are still cash-strapped and, while they want the

look of hardwood, they often won*t pay the price for what

is perceived to be a luxury product. Share continues to be

lost to alternative materials perceived to be cheaper and

easier to maintain. Alternatives include panel products like

MDF, softwood 每 sometimes chemically or thermally

modified or engineered - as well as laminates and plastics.

Challenges are particularly pronounced for tropical

hardwood. There is a persistent ※image problem§, while

the EU Timber Regulation together with uncertainty over

the legality of product seems to be limiting EU

procurement of tropical timber to a narrower range of

companies, both on the importing and exporting side.

Importers also continue to mention lack of supply

continuity, transport problems and long lead times as

factors impeding increased use of tropical timber in the

EU.

Tropical wood LCA performance beats other materials

Sustainably sourced tropical timber species out-performed

competitor materials in a demanding life cycle analysis

project backed by the European STTC. Eric de Munck of

Netherlands每based timber research body Centrum Hout

led the trials, which pitted tropical timbers against key

market rivals in the manufacture of marine application pile

planking and window frames.

The pile planking life cycle analysis (LCA) project was

proposed to the STTC by the Netherlands Timber Trade

Association (NTTA) and other industry players due to the

fact that tropical timber faces increasingly strong

competition in this market from steel, PVC, plus other

varieties of wood. The research team also said that

existing environmental data for the species used in this

application was out-dated and unreliable.

The study, undertaken in association with the FSC

Netherlands, has already generated impressive figures in

favour of tropical timber in terms of cradle to grave

environmental cost per square metre.

The species used were sustainably sourced African azob谷

and okan and South American angelim vermelho. They

were evaluated against two types of PVC planking 每 one

comprising all virgin raw material, the other recycled 每

and steel.

The researchers chose a popular form of pile planking and

applied equivalent LCA methods to all materials types.

Preliminary results showed that, over a 30-year lifespan,

the environmental performance of tropical timber planking

is 24 times better than virgin-material PVC and 21 times

better than recycled. Compared to steel it*s 133 times

better.

The final LCA data from the research will be added to the

Dutch Environmental Database and international data

resources Ecoinvent and ILCD (the International

Reference Life Cycle database). The results will also be

publicised via the trade media, presentations to industry

events and direct to tropical timber end users and

specifiers.

The window frame LCA, which is being undertaken in

association with the Netherlands Woodworking Industry

Association, is using sustainably sourced African, Asian

and South American reference wood species.

The competitor materials in this case are softwood,

modified softwood and PVC and initial results are

expected by the end of next March. Both studies will be

completed and implemented by the end of next June, with

the outcomes widely publicised.

STTC gains momentum and puts money on the table

But the news is not all bad. There is a growing coalition of

companies and other organisations in the EU committed to

making the case for a long-term trade in tropical

hardwoods in the EU 每 although with the important

qualification that all tropical wood promoted for use in the

EU should be either third party certified or, at minimum,

subject to independent legality verification. That of course

raises questions, still not satisfactorily addressed, about

equitable market access, particularly for community and

other non-industrial forest operators.

The FLEGT Action Plan and associated work through

Voluntary Partnership Agreements (VPAs) with most of

the leading tropical wood suppliers to the EU is beginning

to encourage the development of more enlightened policy

environment and positive image for tropical wood

products in the EU.

Meanwhile there are signs that the European Sustainable

Tropical Timber Coalition (STTC), which started in 2013,

is gaining momentum. The STTC brings together

companies in timber sector, retail, and end-use industries,

with government officials and NGOs in the interests of

promoting increased use of certified tropical timber in the

EU. STTC has established a target to increase EU sales of

certified tropical timber by 50% over 2013 levels by 2020.

In March STTC launched a new phase of development

involving a closer strategic partnership with the European

Timber Trade Federation (ETTF), re-energised

communications and membership drives and, critically, a

funding initiative to back private and public sector Action

Plans and projects.

Timber businesses can now receive match-funding for

activities in the framework of an STTC Action Plan for up

to 30% of the cost, or Euro15,000. Federations are eligible

for grants of up to Euro30,000 for developing sustainable

sourcing policies. In addition, STTC partners and

participants can submit project proposals with a requested

STTC contribution up to Euro50,000 if it contributes to

STTC objectives.

A new website (www.europeansttc.com) lays out STTC

goals and the all-round case for using sustainable tropical

timber. It provides technical data, tropical timber

application case studies, lists STTC partners and members

and explains how to join and apply for funding.

ATIBT, PEFC and STTC link up to promote tropical

timber

Also in March, STTC acquired two influential new

partners with potentially important implications for the

future scope, direction and level of support for STTC

activities. One new STTC partner is the International

Tropical Timber Technical Association (ATIBT), which

supports development of international trade in tropical

timber, both as a viable business, and a means of helping

maintain the tropical forest and the habitats and

biodiversity it supports.

On announcing the partnership, ATIBT President Robert

Hunink emphasised the important role of STTC to

encourage introduction and promotion of so-called &lesser

used species*, noting that ※successful promotion of these

species is especially crucial for the economic viability of

operators in the Congo Basin and to maintain a balanced

species composition in the forest.§

PEFC is the other new STTC member and is already in

discussion with STTC about a project which aims to

increase European imports of certified tropical timber

from Asia, now one of PEFC*s principal focus areas. The

specific objective of the joint project is to create improved

linkages between growing certified Asian timber output

and the EU market and to address critical bottlenecks in

supply of certified wood products from the region.

|