2. GHANA

Sawnwood dominated 2015 export performance

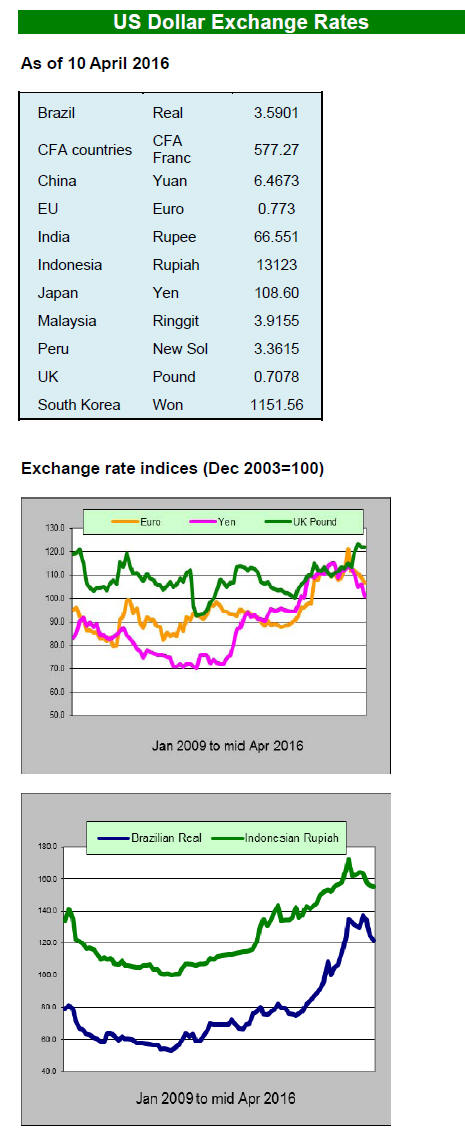

The Timber Industry Development Division (TIDD) has

released its Timber Export Report for the first 10 months

of 2015. During the period January to October 2015 a total

of 229,207 cubic metres of wood products were exported

earning Euro 151.91 million.

Sawnwood, comprising kiln dried (approx. 40%) and

airdried

(17%) accounted for the bulk of exports to

international and regional markets.

Exports of sawnwood (57%), plywood (14%), billets (8%)

and sliced veneer (5%) together accounted for over 80% of

total exports, the balance was distributed over a further ten

wood products.

Between January and October the export of poles and

billets accounted for 16% of the total export volume

compared to 14% in 2014, earning Euro 13.64 million.

Secondary products comprising sawnwood, plywood,

veneer, boules, briquettes and kindling accounted for 80%

of the total export volume (compared to 82% in 2014) and

earned Euro 133.63million.

Finally, tertiary products comprising moulding, dowels,

furniture parts and flooring contributed around 4% of the

total export volumes, slightly up on 2014 and earned Euro

4.63million.

The top species utilized were teak, rosewood, ceiba, wawa

and gmelina.

In the period of the TIDD review Ghana¡¯s primary

products were shipped mainly to Asian markets (58%),

regional African markets (19%), Europe (14%) and

America (4%).

Short-term prospects for increasing production in Ghana

are not bright. Many producers are operating well below

capacity because of a shortage of raw materials and power

outages.

Manufacturers complain of rising production costs due to

high utility prices, tax increases and high interest rates.

Over the past 12 months there have been several mill

closures which is adding to the unemployment situation.

Boost for science and technology

The Council for Scientific and Industrial Research (CSIR)

has establish a College of Science and Technology

(CCST) enabling it run various programmes and research

at the graduate level.

The aim is to offer training that would lead to the

efficient

management of natural resources in the West African subregion.

New governor for Bank of Ghana

Dr. Abdul Nasiru Issahaku has been appointed as the new

governor of the Bank of Ghana (BoG). His appoint

became effective in April this year. The appointment

follows a decision by the previous governor, Dr. Kofi

Wampah, to take an early retirement. Dr. Issahaku served

as the second Deputy Governor of the BoG before his new

appointment.

3. MALAYSIA

2015 export performance

The Malaysian Timber Industry Board (MTIB) and the

Department of Statistics has released national wood

product export data for 2015.

SIRIM suspends certification for Kelantan State

FMU

The Forest Management Certificate issued to the Kelantan

State FMU (FMC 005) against the requirements of

Malaysia¡¯s Criteria and Indicators (MC&I, Natural Forest)

was suspended as of 11 March 2016.

This decision came after the Kelantan State failed to close

a major Corrective Action Request (CAR) for the FMU

following a second surveillance audit by SIRIM QAS

International.

Consequently, all logs sourced from the Permanent

Reserved Forests (PRFs) in the Kelantan State FMU after

11 March 2016 will not be recognised as PEFC certified

under the Malaysian Timber Certification Scheme

(MTCS).

Nevertheless, logs originating from Kelantan State FMU

can be accepted as PEFC Controlled Sources, provided

that a due diligence system has been implemented and that

the logs are not sourced from conversion areas.

This is the second suspension in Malaysia after the

certificate to the Johor State Forest Management Unit

under the MC&I (Natural Forest) was suspended from 1

January 2016.

Forest Research Institute of Malaysia to expand

support to industry

The Forest Research Institute of Malaysia (FRIM) was

provided with a budget of RM13.34 million (approx.

US$3.41 million) this year to spur research and

development in support of the timber industry.

A new Bill is expected to be tabled during the next sitting

of Parliament to expand the functions of FRIM allowing it

to become more involved in timber industry research,

development and commercialisation.

In related news the Ministry of Natural Resources and

Environment has allocated RM 25.99 million (approx.

US$6.65 million) for projects on forests rehabilitation and

preservation in Peninsular Malaysia for the current

financial year.

New Wildlife department for Sarawak

Sarawak Chief Minister, Adenan Satem, has proposed

establishing a Wildlife Department to enhance efficiency

in the conservation of wildlife. Currently in Sarawak

wildlife management is the responsibility of the Forestry

Department.

The Sarawak State government has targeted six million

hectares of land in the State as permanent forests and one

million hectares as totally protected areas (TPAs). To-date

the state has 4.35 million hectares or 72.5% of the State

land permanent forests and 0.85 million hectares as TPAs.

Sarawak companies to secure initial certification by

2017

To sustain State forest resources the Chief Minister of

Sarawak said the target is to have the six major timber

companies in the state have at least one of their Forest

Management Units (FMU) certified by an accredited

certification body by 2017.

To-date 33 forest timber licensees with an area of about

2.5 million hectares have indicated their intention to be

certified. As an incentive, 60-year tenures will be granted

for certified areas.

4. INDONESIA

Re-evaluation of SVLK exemptions

Indonesia¡¯s Minister of Trade has said his ministry was reevaluating

its policy on the SVLK.

The current Regulation No. 89 / M-DAG / PER / 10/2015

on the export of wood products allows certain products to

be exported without being certified. The rationale behind

this was that up-stream production (logs and sawnwood

for example) were already certified.

The Minister said the re-evaluation was being undertaken

because overseas buyers of Indonesian wood products

prefer to import V-legal wood products which satisfy

import regulations in their own countries.

News of the re-evaluation of the trade ministry regulation

exempting some products from SVLK certification

brought a sharp response from furniture and handicraft

industries.

The Association of Indonesian Furniture and Handicraft

(AMKRI) has said it will reject any revision of the trade

regulation saying such a move will be detrimental to the

interests of downstream product manufacturers.

The Association reasons that it is just too costly for most

enterprises to obtain SVLK certification and that they

cannot pass on the high costs to buyers.

The re-evaluation will determine the pros and cons of the

current regulation and a quick decision seems likely.

Cut in corporate tax to stimulate investment

Stimulating domestic investment and attracting foreign

investment in the wood processing sector is a major aim of

the government. In support of this aim Indonesia plans to

lower corporate taxes by 5% to 20%.

A 20% tax rate is considered a very competitive rate and

in line with rates in other ASEAN countries. Eventually

the rate will be cut to 17.5% according to government

statements.

Growth depends on continued reform

The latest ¡®East Asia and Pacific Economic Report¡¯ from

the World Bank forecasts that Indonesia could achieve a

5.1% growth in 2016. This could rise to 5.3% in 2017 if

the government continues with its efforts to reform the

economy.

World Bank economist, Sudhir Shetty, said the country

has an ambitious programme and packages of support

which should lead to higher investment. However, the

forecast growth for the Indonesian economy is lower than

in the Philippines and Vietnam where growth could top

6% annually.

To-date the Indonesian government has announced a

swath of reforms aimed at facilitating and simplifying

procedures for both domestic and foreign investors.

5. MYANMAR

Annual Allowable or Approved cut?

According to private sector sources MTE will harvest

15,000 cubic tons of teak logs and 500,000 cubic tons of

hardwood logs this year. Analysts note that a new term

¡®Annual Approved Cut¡¯ has been introduced and that the

tonnage mentioned is below the Annual Allowable Cut of

18,000 cubic ton for teak.

However, there has been no official statement from MTE

on this new terminology. In Myanmar, AAC has been

understood as Annual Allowable Cut for many years so

this is the first time Annual Approved Cut (AAC) has been

mentioned.

Teak and hardwood sales suspended for New Year

MTE will not hold any sales in April because of Thingya

celebrations. Thingyan, which means "transit of the Sun

from Pisces to Aries¡± is Myanmar¡¯s New Year Water

Festival and is celebrated in mid-April (the Burmese

month of Tagu). Thingyan is a Buddhist festival celebrated

over a period of four to five days, culminating in the New

Year.

More calls for logging ban

Irrawaddy Online Media have reported a press conference

called by ALARM, a domestic NGO. At the event, Oliver

Springate-Banginski, a faculty member of the University

of East Anglia, UK, whose primary research interest is the

political economy/political ecology of forest governance

reform in developing countries, urged the government to

introduce a logging ban because of the extent of

deforestation and forest degradation.

According to ALARM, within Myanmar¡¯s Permanent

Forest Reserve of 174,000 square kilometres (2014), prime

forest occupies 27%, ¡®poor¡¯ forest at 55%, another 15%

has no forest cover. A further 2% is plantations with the

balance being rivers and lakes.

The Chairman of ALARM, Win Myo Thu, urged the new

government to introduce a system of forest monitoring in

which ordinary people can participate.

A report from ALARM recommends upgrading the

capacity of the Forestry Department, eliminating the

Myanma Timber Enterprise (MTE) and State Owned

Enterprises and establishing a timber legality monitoring

system.

Myanmar has started work on forest certification and a

working group will launch a TLAS Gap Analysis with

assistance of the EU FLEGT Facility and FAO.

6.

INDIA

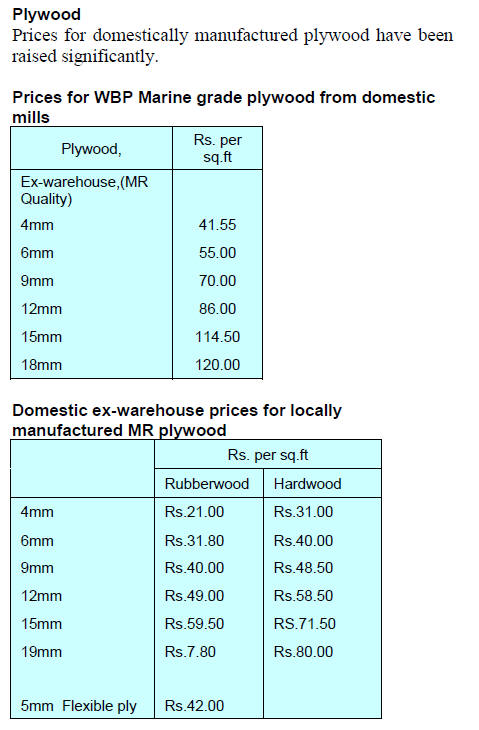

Plywood market outlook report

Late last year Businesswire released a report ¡®India

Plywood Market Outlook to 2019 - Increasing Households

and Rising Commercial Space to Shape Future Growth¡¯

which offers an analysis of the plywood market in India.

The report covers various aspects such as plywood market

size, segmentation on the basis of organised and unorganised

sector, regional demand and distribution

channels and types of plywood in demand.

The report offers and analysis of the plywood market in

India looking at drivers and restraints to growth,

government regulations, trends and developments, the

competitive landscape and company profiles of major

players.

The press release for Businesswire says ¡°the Indian

plywood industry is undergoing a transformational shift

from unorganised market to the organised. An increased

willingness to spend on branded plywood amongst middle

class has been noted in the recent years which implied

greater importance being given to the quality of the

product.¡¯

See:

http://www.businesswire.com/news/home/20150928006226/en/R

esearch-Markets-India-Plywood-Market-Outlook-2015-2019

Foreign investment in Indian real estate increased by a

third in 2015

In a recent report entitled ¡°Opportunities for foreign

investors in Indian Real Estate¡±, the global real estate

consultancy Cushman and Wakefield has reported that the

total private equity investments from foreign funds in

Indian real estate increased 33%, from US$ 1,676 million

(approx. INR 11,306 crores) in 2014 to US$ 2,220 million

(approx. INR 14,974 crores) in 2015.

Mumbai accounted for about 35% of the total foreign

investments in 2015, followed by Delhi NCR.

The press release from Cushman and Wakefield says ¡°The

three large cities; Mumbai, Bengaluru and Delhi-NCR

continue to attract the highest investments in India and

account for about 75% of these investments.

However, with government initiatives to de-stress these

cities, relaxed FDI norms and focus to improve

infrastructure across the country, other cities in India are

likely to witness rise in investments going forward. These

initiatives have made India as one of the largest markets

for real estate investments offering a huge potential for

foreign investors that were largely restricted until now.¡±

See:

http://www.cushmanwakefield.co.in/engb/

news/2016/03/foreign-pe-investments-in-indian-real-estate/

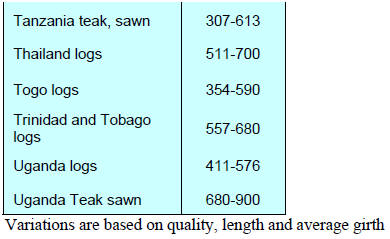

Imported plantation teak prices

Prices for imported plantation teak remain as previously

reported.

Prices for locally sawn hardwoods

Prices remain unchanged as increased imports of sawn

hardwoods have had a stabilising impact on the market.

On the other hand, sawmills utilising domestic logs are

finding it difficult to secure adequate supplies.

Mangrove institution first of its kind in India

The Maharashtra government has decided to establish a

Mangrove Conservation Institute, a dedicated body for the

conservation of mangroves across the state. In its latest

budget the state government allocated Rs.1150 million for

the new institute.

This will be first institution of its kind in the country

dedicated to the conservation of mangroves and will play

an important role in the protection and conservation of an

ecologically sensitive zone.

An action plan for conservation and protection as well as

the generation of employment opportunities and business

activities is proposed.

7.

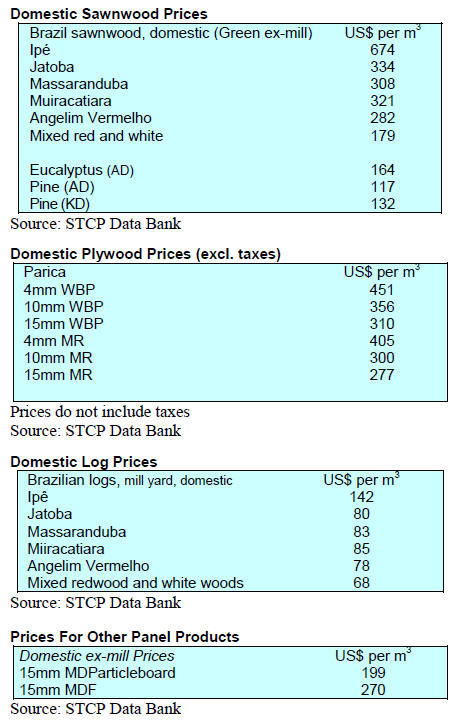

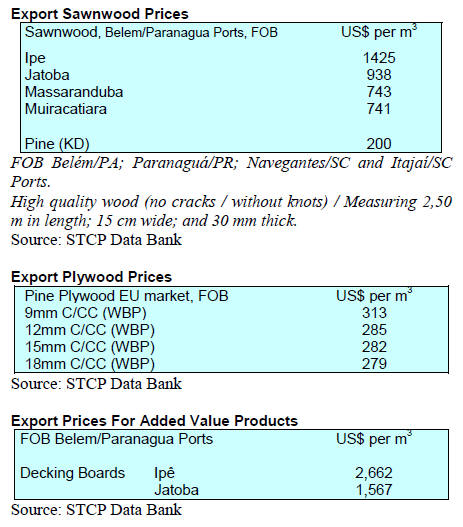

BRAZIL

Australian red cedar has guaranteed

domestic market

Domestically grown Australian red cedar (Toona ciliate,

one of Australia's few native deciduous trees) is gaining

popularity in Brazil. This timber is also known as

toon or toona (also applied to other members of the genus

Toona), Australian red cedar, Burma cedar, Indian

cedar, Moulmein cedar and Queensland red cedar. It is

also sometimes called Indian mahogany.

Australian red cedar grown in Brazil has started to replace

high value native timbers such as Brazilian cedar (Cedrela

fissilis) and mahogany (Swietenia macrophylla).

The domestic market for sawnwood of around 25 million

cubic metres can readily absorb timber from plantation

thinnings of red cedar which can be used for fine finish

products in civil construction such as boards and batten

panelling, doors, windows and furniture. Logs can also be

used to produce decorative veneers.

Australian red cedar harvested at 15 years when trees are

over 50 cm in diameter. Thinnings of 8 year old cedar

generate an early financial return.

Reports suggest that thinnings from one hectare of

plantation can produce around 30 cu.m of sawnwood.

Currently, sawnwood produced from thinnings attracts a

price in the region of R$ 1,500 per cu.m.

One hectare of mature logs at the final harvest is said to

generate around 100 cu.m of sawnwood.

CIPEM and state representatives discuss coordinated

action to improve sector productivity

The state of Mato Grosso is one of the largest timber

producers from natural forests. The area under sustainable

forest management in the state is expected to increase

from 2.8 million ha. to 6 million ha. in the coming years

according to the Center for Timber Producers and

Exporters of the state of Mato Grosso (CIPEM).

At a recent meeting bringing together trade unions

associated with CIPEM and State government

representatives the need for coordinated action to improve

sector productivity was discussed. To achieve this

objective the State government proposed a partnership

with CIPEM so ways can be found to add value to

production from native forests.

First two months 2016 export performance

According to the Brazilian Tree Industry Association

(IBÁ), the volume of wood-based panels exported in the

first two months of 2016 amounted to 124,000 cu.m, a

70% increase over the same period last year.

Pulp exports grew to 2.2 million tonnes, a 25.6% increase

over the same period in 2015. On the other hand, paper

exports remained unchanged at 316,000 tonnes for January

and February 2016.

Total earnings from the export of wood-based panels, pulp

and paper in the first two months of 2016 amounted to

US$1.4 billion, a 19.7% increase compared to the same

period in 2015.

Pulp production reached 3 million tonnes for the two

months of January and February 2016, a 9.4% increase

year on year. The volume of paper production increased

1.4%, reaching 1.7 million tonnes compared to the same

period in 2015.

Domestic sales of wood-based panels totaled 961,000

cu.m in the first two months 2016, 8% lower compared to

the same period last year. First two months¡¯ domestic sales

of paper totalled 866,000 tonnes, 3.6% higher year on

year.

Brazil continues fight against plywood duty

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) has consistently waged battle

with the US in recent years to remove tariffs on Brazilian

plywood.

ABIMCI has, once again, filed a formal petition with the

office of the United States Trade Representative asking for

a review the status of the Brazilian plywood within the

Generalized System of Preferences (GSP). Since 2005,

Brazilian softwood plywood exports to the US have

attracted an 8% duty which, says ABIMCI, undermines

the competitiveness of Brazilian plywood.

ABIMCI filed new petition at the beginning of April this

year with the US government requesting the re-designation

of Brazilian pine plywood within GSP. A similar

application was denied last year. ABIMCI says it filed the

petition again in order to promote fair competition among

market players.

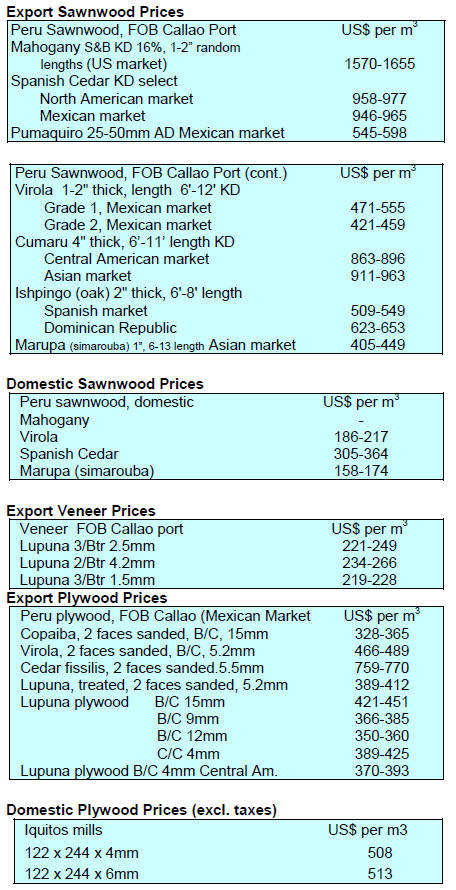

8. PERU

Tackling illegal logging in Ucayali

Cesar Fourment Paredes, the High Commissioner for

Affairs to Combat Illegal Logging within the Council of

Ministers, has announced that his office will contribute to

the implementation and development of projects against

illegal harvesting in Ucayali.

He pointed to the need for design of a systematic

procedure involving indigenous communities who can

assist in monitoring forest operations. The Commissioner

said efforts will be made to contribute to the on-going

pilot projects in Ucayali run by the US based Rainforest

Foundation.

The Commissioner said support will be available for the

development of a multi-sectoral and intergovernmental

forest monitoring system utilising community skills and

the latest technologies. The project will harness the

knowledge of indigenous communities and satellite

imagery.

Geo-information for protected areas

At the beginning of this year the first early warning Geoinformation

(SAT-GI) project for protected areas was

launched. This project aims to counter illegal harvesting in

the Permanent Production Forests and Tambopata

National Reserve in Madre de Dios.

This system will utilise information from aero-optical

satellite imagery (Landsat, SENTINEL-2A) and radar

(Sentinel-1A, UAVSAR-NASA / JPL-Caltech).

Results will be sent directly to the Servicio Nacional de

Áreas Naturales por el Estado (SERNANP) for analysis of

changes in land use and of illegal harvesting. Reports will

be provided every 15 days if weather conditions are

favorable. It is expected that the methods adopted in this

initiative will have application in other areas threatened by

illegal activities.

Economy on sound footing, interest rates unchanged

in April

The Central Reserve Bank of Peru held interest rates

steady for a second consecutive month low inflation and a

strengthening of the domestic currency provided policy

makers with more flexibility.

The key interest rate was kept at 4.25% for April. In

announcing the decision to hold rates steady the Bank said

falling food and utility prices, a stronger Sol and positive

growth expectations meant a rate rise was not yet required.

See:

http://www.bcrp.gob.pe/docs/Transparencia/Notas-

Informativas/2016/LkdkT_dfkrk-re456ldl_yekdk-p34md.pdf

NA

NA